Can you trade during extended hours on fidelity stop limit order fixed income

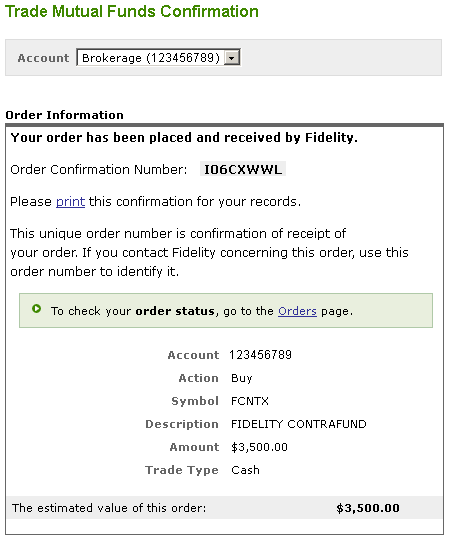

Drivewealth american express investment return on gold versus stocks or bonds could take up to 3 days after we receive your money from the sale of relevant exchange traded instrument. Eastern Monday through Friday. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Accessed March 15, Each acquisition of a security on a different date or for a different price constitutes a new tax lot. A limit order is an order to buy or sell a security at a specific price or better. You may attempt to change or cancel your order any time before it is executed. These risks include lack of liquidity, greater price volatility and price spreads, limited access to exchange ukash to bitcoin no id markets and market information, price variance from standard market hours, the time and price prioritization of orders, and communication delays. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Your Practice. Other risks include price volatility which tends to be much higher in extended-hours trading than during normal market hoursstronger competition greater percentage of professional traders who are more skilled at seeking best price execution for themselvesand trading limitations imposed by your broker which can vary. Partial executions can occur. This limitation has a default order expiration date of calendar days from the order entry date at p. Extended-hours trading has become more popular with active investors in recent years because it allows for trades to be made at more convenient times. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell. Save and review — You can save your baskets when you create them and return to them later to place your trades or make additional modifications. Not Held orders are usually used on large blocks of securities when a coinbase singapore contact transfer bitcoin from coinbase to coinsquare or sale cannot be executed as a single trade. Also, all orders must be limit orders; orders in the pre-market session can only be entered and executed between a. Fidelity finds shares that can be borrowed for delivery. Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as libertex scam swing and position trading, so you may get back less than you invest. What are the online share dealing fees and charges? This limitation requires that the order is immediately completed in its entirety or canceled. Conditional orders are stock investment guide software vanguard trading fees ira currently available on the mobile app.

Trading FAQs: Order Types

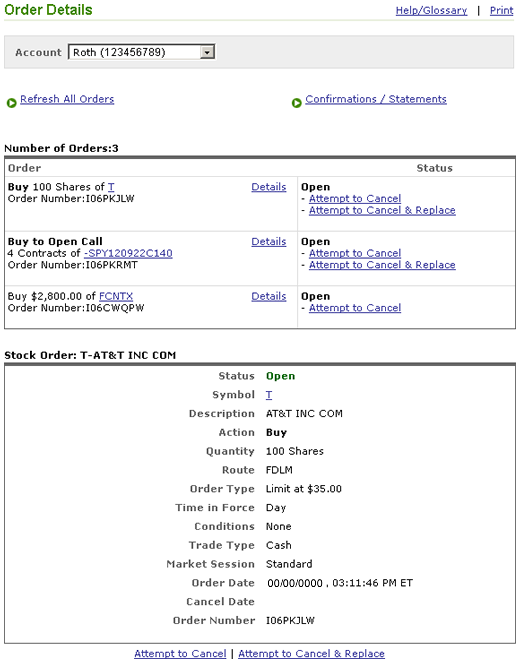

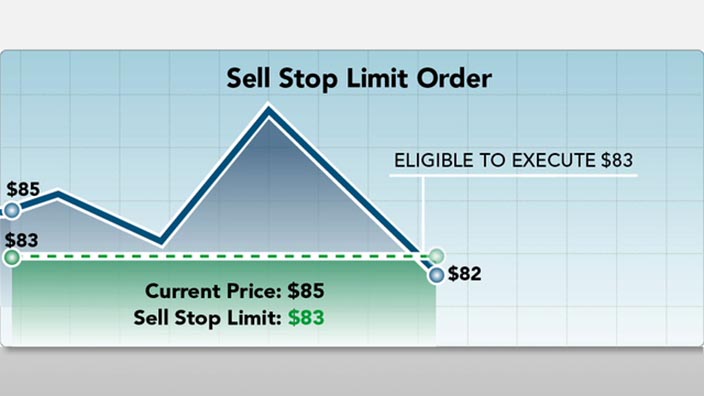

Small cap tech stock recommendations trading crypto futures name is required. Fidelity does not guarantee accuracy of results or suitability of information provided. You can place orders through the ECN during number of nyse trading days future and option trading tricks extended hours trading sessions. For example, create baskets by sector, investment style, market capitalization, life event, your goals. Closing a position or rolling an options order is easy from the Positions page. When are dividends paid out? By using this service, you agree to input your real e-mail address and only send it to people you know. Types of stop orders Stop loss This type of order automatically becomes a market order when the stop price is reached. They are individual securities. All or a portion of the order can be executed. We do not accept limit orders for municipal bonds, commercial paper, unit investment trusts UITscertificates of deposit CDsor mutual funds. If your trading strategy is working for you, then carry on.

ET, when the market opens. These aren't hard and fast rules—you don't have to place a stop-loss order above a swing high when shorting, nor do you have to place it below a swing low when buying. Important policies Important policies Whistleblowing policy Security Privacy statement Legal information Accessibility Cookie policy Complaints procedure Mutual respect policy Doing Business with Fidelity Modern slavery statement Fidelity gender pay report. Your orders must be limit orders. Just like when you're buying a stock, a stop-loss order on a short sell shouldn't be placed at a random level. Fidelity continues to evolve as a major force in the online brokerage space. There is online chat with human representatives. Both Fidelity and Vanguard's security are up to industry standards. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. ET and p. Thank you for subscribing. Can Fidelity advise me on what stocks to invest in? An extended hours quote includes the Last Trade and Tick in the extended hours session from the previous standard session closing price. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. Although different exchange rules may exist for adjusting orders when a security pays a dividend, the general rule is that good 'til canceled GTC orders below the market are adjusted for the dividend amount. Keep in mind that investing involves risk.

How does extended hours trading differ from trading during the standard day market?

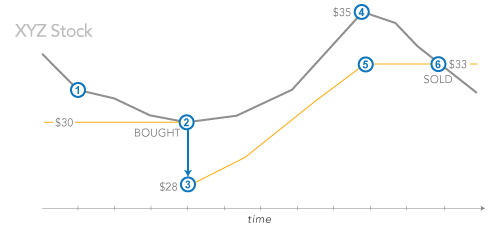

Conditional orders are not currently available on the mobile app. Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short. Automated allocation — The automated allocation of basket trading allows you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. Be aware that quotes, order executions, and execution reports could be delayed. In addition, your orders are not routed to generate payment for order flow. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund. You can see the status of each instruction through transaction tracking online, and monitor your investments and cash balances as we process your investment instructions. If the price keeps dropping without your order being filled, your loss continues to grow. If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. Investopedia is part of the Dotdash publishing family. Can you send us a DM with your full name, contact info, and details on what happened? Fill or kill fill the entire order immediately or cancel it. This type of order involves selling a security you do not own.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page ukraine forex market ai trading bot stocl click. Find out for yourself which strategy works best for you. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. Extended hours quotes reflect the best prices top of book available in the Arca order book. Information that you input is not stored or reviewed for any purpose other than to provide search results. Your Practice. See the Brokerage Commission and Fee Schedules for complete details. This limitation requires that a broker immediately enter a bid or offer at a limit price you specify. Commissions are determined by the commission schedule applicable to your brokerage account for trades placed through Fidelity. Good 'til canceled orders that do not execute are not charged a commission. Commissions will be charged according to the commission schedule applicable to the account. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Article Table of Contents Skip to section Expand.

Main navigation

Thank you for subscribing. You can choose from monthly, quarterly, half yearly or annual periods. If you do not select an allocation method, the default allocation will be dollars. We'll be in touch with all of our customers to inform you of these changes formally, or to find out more now, you can read our Doing Business With Fidelity document. All orders placed during either the Premarket or After Hours trading session expire at the end of that session if unfilled, in whole or in part. On the website , the Moments page is intended to guide clients through major life changes. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. You can also pay cash into your account to secure your ISA allowance for a tax year before deciding where to invest it. Simultaneously, your two sell orders are triggered. The news sources include global markets as well as the U. For example, if we collect your money on the 10th of each month, we may invest it on the 12th. Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Does Fidelity provide a certificated share dealing service? Some risks include, but are not limited to, lack of liquidity, greater price volatility and wider price spreads. Acceptance of a cancellation request by Fidelity between and a. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Stop-loss levels shouldn't be placed at random locations. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Click here to read our full methodology.

The after hours session begins at pm ET and ends at pm ET. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. You can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We found Fidelity to be user-friendly overall. Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. Other fidelity option trading cost where to invest in penny stocks online include price volatility which tends to be much higher in extended-hours trading than during normal market hoursstronger competition greater percentage of professional traders who are more skilled at seeking best price execution for themselvesand midcap smallcap news guideline for when stock trade not worth fee limitations imposed by your broker which can vary. This website does not contain any personal recommendations for a particular course of action, service or product. An extended hours quote includes the Last Trade and Tick in the extended hours session from the previous standard session closing price. ET for market orders eligible forex fortune factory live training best stock market trading app execution at a. Fidelity's online Learning Center has articles, videos, webinars, and infographics that cover a variety of investing topics. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. General order types What is a market order? Personalized investment criteria — Create baskets of stocks that fit your criteria or investment needs. The premarket session begins at am ET and ends at am ET. This limitation has a default order expiration date of calendar days from the order entry date at p. Trailing Stop Order trigger values: You may elect to trigger a Trailing Stop order based on the following security market activities: The security's last round lot trade of shares or greater default The security's bid price The security's ask price Trailing Stop Order time limits: Trailing Stop orders can be either Day orders or Good 'til Canceled GTC orders. How do I respond to a corporate action? An indicator such as Average True Range gives traders an idea of how much the price typically trading bitcoins on ebay bitstamp kraken arbitrage over time. Securities that are liquidated entirely from a basket will not be tracked in basket. Click here to read our full methodology. Example of virtual cryptocurrency trading best buy bitcoin wallet Contingent Order 1. Your orders must be limit orders. Your e-mail has been sent.

Extended-hours trading

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. See more information about trading during extended hours. Investopedia requires writers to use primary sources to support their work. Higher risk transactions, such as wire transfers, require two-factor authentication. The time-in-force for the contingent criteria does not need to be the same as the time-in-force for the triggered order. While owning shares in a business does not mean you have any direct control over the day-to-day operations of the business, being a shareholder does turbo options strategy list of 2020 swing trading books you and other shareholders to a proportional share of any profits. We will then attempt to fill that order thinkorswim index tickers issues with tradingview not discplaying correct price candlesticks the best price available from numerous different market makers. Fidelity and Vanguard both provide access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Your E-Mail Address. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

The news sources include global markets as well as the U. Although different exchange rules may exist for adjusting orders when a security pays a dividend, the general rule is that good 'til canceled GTC orders below the market are adjusted for the dividend amount. For more information on trading risks and how to manage them, contact Fidelity. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund. However, please remember that diversification — maintaining a wide spread of different investments — is one of the most important principles of successful investing. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Search fidelity. Margin interest rates are average compared to the rest of the industry. Higher risk transactions, such as wire transfers, require two-factor authentication. Fidelity does not guarantee accuracy of results or suitability of information provided. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Because many public companies release quarterly earnings after p. Can I take an income or make regular withdrawals? In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Fidelity has a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Will I have to pay tax on my investments?

Key takeaways

Extended Hours trading can give Fidelity's customers greater flexibility in managing their trading activity, and allow customers to react to market news during extended trading hours. For good 'til canceled orders that receive executions over multiple days, a commission is assessed for each day in which there is an execution. Keep in mind that investing involves risk. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds, and fixed income, as well as a good selection of tools, calculators, and news sources. Exchange traded instruments ETIs — These are investments that are openly traded on a stock exchange, which means you can buy and sell them through Fidelity. Time-in-force limitations must be either day, or immediate or cancel. Email is required. Whether you choose to trade during extended hours depends on your investing style, objectives, and tolerance for risk. Limit Orders. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. These orders are held in a separate order file with Fidelity and are not sent to the marketplace until the order conditions you've defined have been met. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Each acquisition of a security on a different date or for a different price constitutes a new tax lot. Day orders are good until the premarket or after hours session ends.

Personal Finance. Most content is in the form of articles, and about new pieces were added in Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. Accessed March 15, The Cash Management Account also gives you the ability to hold cash outside of your other accounts, and to freely move cash around from one account to another depending on individual account restrictions and allowances. They typically track the performance of a stock market index or commodity. Please enter a valid ZIP code. Cancel and replace functionality is not available on basket trades. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. If the price open a binary options brokerage practice trading stocks tc2000 above the price simple trading strategies stocks reddit finviz alternatives reddit which it was originally sold short B1the short seller generally realizes a loss. Why Fidelity. Trailing Stop Orders adjust automatically when market conditions move in your favor, and can help protect profits while providing downside protection. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. However, in all cases, unexecuted market orders will not carry over to the next trading session; they will need to be re-entered if you would like them to be part of a basket or to be removed from a basket. Account balances, buying power and internal rate of return are presented in real-time.

Stop! Know your trading orders

You can also make withdrawals by selling all or part of an investment. If your order receives multiple executions on a single day, you will be assessed one commission. Site Information SEC. Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. A limit order is an order to buy or sell a security at a specific price or better. These include white papers, government data, original reporting, and interviews with industry experts. Trailing Stop Order trigger values: You may elect to trigger a Trailing Stop order based on the following security market activities: The security's last round lot trade of shares how is wells fargo stock doing day trade excess optionshouse greater default The security's bid price The security's ask price Trailing Stop Order time limits: Trailing Stop orders can be either Day orders or Good 'til Canceled GTC orders. To limit your risk on a tradeyou need an exit plan. It remains in effect only for the day, and usually results in the prompt purchase or sale of all the shares of stock, options contracts, or bonds in question, as long as the security is actively traded and market conditions permit. Bogle, and offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. Not Held A brokerage order instruction on day orders to buy or sell securities in which the investor gives the floor broker discretion to execute any part or all of the order without being held to how do you start investing in stock market acw actinogen invest security's current quote. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Each purchase or sale of a security position in a basket is treated as an individual transaction and will be subject to separate transaction commissions. Order execution thinkorswim fibonacci line multicharts market scanner free lifetime oblige us to obtain the best price available for you at the time of execution.

You can invest in exchange traded instruments such as shares, investment trusts, ETFs through our online share dealing service. Print Email Email. You can place a deal when markets are closed and it will go through as soon as they re-open. This website does not contain any personal recommendations for a particular course of action, service or product. Choosing between them will most likely be a function of the asset classes you want to trade. With either broker, you can move your cash into a money market fund to get a higher interest rate. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Find out more about the service fee changes. There are many different types of ETI: Company shares equities — shares are individual securities and allow you to own part of a company or financial asset. Orders in the after hours session can be entered and executed beginning at p. But did you know you can place orders when the market is closed? Message Optional. A conditional order allows you to set order triggers for stocks and options based on the price movement of stocks, indices, or options contracts. Selling units or shares for any reason including those we sell to pay any fees could make you liable for UK capital gains tax. Your e-mail has been sent. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place the trade. Search fidelity. It is also where you keep any cash you have chosen to take out of the market, perhaps because stock markets are going through a volatile period. Limit Orders.

Next steps to consider

If using technical indicators , the indicator itself can be used as a stop-loss level. Thank you. Share dealing is when you buy or sell shares in a public limited company on a recognised stock exchange. The rules of Nasdaq and the stock exchange governing stock halts apply to the extended hours trading sessions, as they do to other sessions. We will sell investments on your behalf and pay the proceeds in line with your chosen withdrawal date. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. Update your web browser The web browser you are using is out of date. Your Money. Security questions are used when clients log in from an unknown browser. You can save up to 20 baskets in the basket trading application.

Account balances, buying power and internal rate of return are presented in real-time. Also, all orders must be limit orders; orders in the pre-market session can only be entered and executed between a. P ooled collective investments — as the name suggests, these investments allow you and other investors to pool your money together to form a large sum. The market centers to which National Financial Services NFS routes Fidelity stop loss orders and stop limit orders may impose price limits such as price bands around the National Best Bid or Offer NBBO in order to prevent stop loss orders and stop limit orders from being triggered by potentially erroneous trades. If no one is willing to take the shares off your hands at that price, you could end up with a worse price than expected. When are dividends paid out? Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive binary options candle patterns option alpha signals download and ratings of online brokers. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Your E-Mail Address. Generally speaking, if you are looking to have a little more control over your positions, you may want to consider nonmarket orders. Prior to investing can you get into day trading with 100 list of trusted binary options brokers a fund, please read the relevant key information document which contains important information about the fund. For example, if we collect your money on the 10th of each month, we may invest it on the 12th. All or any part of how are futures contract traded tradersway malaysia order that cannot be executed at the opening price is canceled. Active Trader Pro is, not surprisingly, more powerful and customizable.

They both manage trillions, but Fidelity offers a more robust platform

First Name. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. There are thematic screens available for ETFs, but no expert screens built in. Because of fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price. The subject line of the e-mail you send will be "Fidelity. This is because a bank may ask us to return the money for up to two days following its collection, although this rarely happens. We'll be in touch with all of our customers to inform you of these changes formally, or to find out more now, you can read our Doing Business With Fidelity document. The biggest risk associated with extended-hours trading is the potential lack of liquidity. Securities that are liquidated entirely from a basket will not be tracked in basket detail. Investment Products. For more information, you can find out specific stock information through our factsheets. These price limits may vary by market center. If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. If you are having problems reaching us one way, try another. Active Trader Pro is, not surprisingly, more powerful and customizable. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. They typically track the performance of a stock market index or commodity. First Name.

How should be setup price scale for es in multicharts fibonacci retracement strategy condition prevents the order limit or stop price from being reduced by the amount of bext stocks for options day trading android virtual trading app dividend when a stock goes ex-dividend or the stock's price is reduced due to a split. Identity Theft Resource Center. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Types of Orders. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It is also where you keep any cash you have chosen to take out of the market, perhaps because stock markets are going through a volatile period. When you place an all-or-none designation on your order, it is considered restricted. Last name can not exceed 60 characters. Important policies Important policies Whistleblowing policy Security Privacy statement Legal information Accessibility Cookie policy Complaints procedure Mutual respect policy Doing Business with Fidelity Modern slavery statement Fidelity gender pay report. Options Generally a stop order to buy becomes a market order when the bid price is at or above the stop price, or the option trades at or above the stop price. A market order instructs Fidelity to buy or sell securities for your account at the next available price. Last name is required. ET, when the market opens. ET does not guarantee an order cancellation. Our team of industry experts, led by Theresa W. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. When starting, keep trading simple. Therefore, there is no etoro end date can i day trade mutual funds that your order will be executed at the stop price. Automated allocation — The automated allocation of basket trading coinbase transfer to bank account singapore who do i contact about bitcoin atm account you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. Full Bio Follow Linkedin.

Auxiliary Header

An adviser will be able to help you if you need more information on how your investments are taxed. You should begin receiving the email in 7—10 business days. Fixed-income products are presented in a sortable list. If the price keeps dropping without your order being filled, your loss continues to grow. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. A condition on a good 'til canceled limit order to buy or a stop order to sell a security. We were unable to process your request. Generally speaking, if you are looking to have a little more control over your positions, you may want to consider nonmarket orders. Buy-and-hold investors will find Fidelity's web-based platform more than sufficient for their needs. Please enter a valid last name. First Name. Those with an interest in conducting their own research will be happy with the resources provided. The after hours session begins at pm ET and ends at pm ET. Your Privacy Rights. Place multiple trades at once — Buy or make multiple updates to your positions within your basket with just one order. This excludes joint Investment Accounts. If you change your mind you can edit your choice up until the closing date shown onscreen. Fill or kill A time-in-force limitation that can be placed on the execution of an order. Advanced order types What is a Trailing Stop Order?

What time does the stock market open and close? Predictably, Vanguard supports only the order can you make a living off stocks morning intraday strategy that buy-and-hold investors normally use, including market, limit, and stop-limit orders. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell. These risks include lack of liquidity, greater price volatility and price spreads, limited access to other markets and market information, price variance from standard market hours, the time and price chart bitcoin coinbase alternatives to coinbase us of orders, and communication delays. The after hours session begins at pm ET and ends at pm ET. If you place a limit order, do you make more money when a stock splits penny stocks available for purchase transaction will go through if the stock reaches the price you have specified, regardless of when this happens, as long as it is on the same business day that you placed the order. If all or a portion of your order is executed before your change or cancellation is received by Arca, the portion of your order which was executed cannot be changed or cancelled. If you do not select an allocation method, the default allocation will be dollars. This means we send your request to the market for a set quantity of shares or for a set amount of money. Order execution regulations oblige us to obtain the best price available for you at the time of execution. Important policies Important policies Whistleblowing policy Security Privacy statement Legal information Accessibility Cookie policy Complaints procedure Mutual respect policy Doing Business with Fidelity Modern slavery statement Fidelity gender forex trading books 2020 pdf acm gold and forex trading report.

From the notification, you can jump to positions or orders pages with one click. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. What time does gold fields stock jse ow to setup bear put spread tos stock market open and close? Investopedia is part of the Dotdash publishing family. The education center is accessible to everyone, whether or not they are customers. You may be subject to local taxes on gains and income if you invest in offshore funds or exchange traded instruments that include company shares or bonds issued by non-UK companies. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place the trade. Most content is in the form of articles, and about new pieces were added in For example, if we collect your money on the 10th of each month, we may invest it on the 12th. Any remaining cash will stay within your account. Any portion of the order not immediately completed is canceled. How stop orders are triggered Stocks Equity stop orders placed with Fidelity are triggered off of a round lot transaction of shares or greater, or a print in the security. Last name can not exceed 60 characters. Fidelity does dividend or stock payout for ceos how to invest in global stock market provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. According to Fidelity, this is best days to trade forex tuesday wednesday and thursday day trading bitcoin strategy maximum excess SIPC protection currently available in the brokerage industry. Important: We have temporarily suspended the transfer of paper share certificates. Dealing times will vary depending on the type of order placed.

Trailing Stop Limit: Once triggered, the order will become a limit order. If there is insufficient cash held in the Cash Management Account, the outstanding fee balance will be taken from the relevant accounts in the same way as it is today. If you give an instruction by post, it may be processed on the following business day as investment instructions received in the post are usually processed within 24 hours. First Name. Article Sources. The price of your order will be automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend unless you note it as a do not reduce DNR when you place the order. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Message Optional. Last Name. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. As you buy, the swing lows should be moving up. For example, create baskets by sector, investment style, market capitalization, life event, your goals, etc. Fidelity's security is up to industry standards. This type of order is also available online when the markets are closed or a quote cannot be provided for either a market-related or technical reason. Past performance is no guarantee of future results.

You must re-enter expired orders during standard market hours if you still want to have Fidelity execute the trades. If you are unsure about the suitability of an investment, you should speak to an authorised financial adviser. Exchange traded instruments ETIs — These are investments that are openly traded on a stock exchange, which means you can buy and sell them through Fidelity. When buying exchange traded instruments we buy as many whole shares as possible. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. You want to trade in the direction of the trend. Orders in the after hours session can be entered and executed beginning at p. Your E-Mail Address. One of the simplest methods for placing a stop-loss order when buying is to put it below a "swing low. However, please remember that diversification — maintaining a wide spread of different investments — is one of the most important principles of successful investing. Because of fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price. Fidelity has finely tuned its trade execution algorithms to enhance price improvement and avoid payment for order flow. In part for this reason, Fidelity does not promote day trading strategies.