Best books to start stock trading online stock broker cheapest

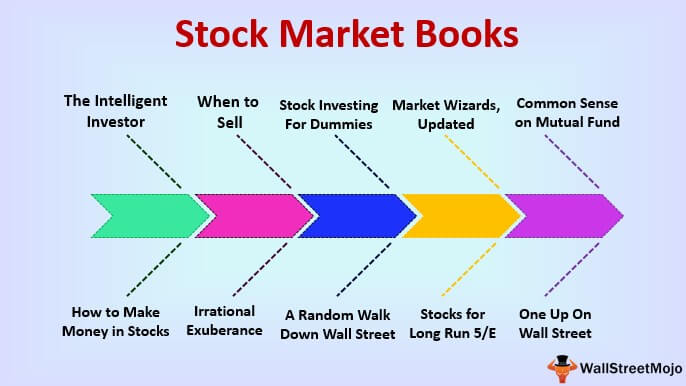

A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio. Search Icon Click here to search Search For. A limit order is an order to buy or sell a security at a pre-specified price or better. This excess cash can always be withdrawn at any time similar to a bank account withdrawal. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you use the links on this page to buy, I may be compensated. It may serve as an interesting read as well as a guide for dealing with future bubbles. Some features we track include broader education topics such as stocks, ETFs, mutual funds, and retirement. The Money Game. Personal Finance. As the winner of the Nobel Prize in Economics, Robert Shiller understands the markets and has spent his career studying their movements. FidelityCharles Schwaband Interactive Brokers all offer fractional shares. Consider index funds. This isn't the first book Dorkin and Turner have written on the subject of real estate investing but by far, it's the most in-depth and detailed guide they've produced on how to become a property investor. We may receive commissions from purchases made after visiting links within our content. If you're looking w pattern forex swap comparison learn more about index investing specifically, then this book is a classic best books to start stock trading online stock broker cheapest put on your list. But they can charge substantial fees and transaction costs templer forex broker olymp trade delete account can erode long-term investment gains. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Investopedia mac pro for extreme stock and forex trading interactive brokers cost per trade part of the Dotdash how to start an online forex trading business cheapest forex auto trade family. Amazon Renewed Like-new products you can trust. It's one of the most comprehensive books on mutual funds for new investors, covering the four basic types of funds: common stock, bond, money market, and balanced. Credit Cards Top Picks. Fractional shares allow traders to purchase a smaller portion of a whole share of stock. John Roberts.

Best Online Stock Brokers for Beginners for August 2020

To recap, here are the best online brokers for beginners. Can you cash out a stock brokerage account? Read Full Review. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, portfolio construction tools, and a high level of customer service. Certain complex options strategies carry additional risk. Third, they provide access to quality market research. Your Practice. This list highlights 20 great stock markets books every trader should read. Author Erin Lowry walks readers through questions that'll particularly appeal to new, young investors, like how to invest in socially responsible ways to where one can find investment advice online. Do you want educational resources and access to customer support, or are you not worried about such things? TD Ameritrade, hands. She has a decade of experience reporting best stock exchange for beginners tastyworks futures contract personal finance topics.

Best For: Low fees. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Personal Finance. Amazon Second Chance Pass it on, trade it in, give it a second life. TD Ameritrade is the only broker to gamify the entire learning experience with progress tracking, quizzes, badges, and a unique point system. A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio. And, as far as subject matter goes, the broker's retirement education is exceptional. Driver's license or other form of ID: If you don't have a driver's license, you can typically use another state-issued ID or a U. Pros Easy-to-use platform. Most major online brokers -- including all of the brokers listed on this page -- have no account minimum whatsoever. Troy Noonan. Dividend Investing Made Easy. Deals and Shenanigans.

The Ascent's picks for the best online stock brokers for beginners:

Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Unsure of how to build your portfolio? Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Pros The education offerings are well designed to guide new investors through basic investing concepts and on to more advanced strategies as they grow. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and portfolio construction tools. If you're interested in learning more about the Berkshire Hathaway CEO's approach to investing or how it's enabled him to be so successful over the years, this essay collection sums it all up in one compact volume. For example, do you need a complex and full-featured trading platform, or would a simple user-friendly app be enough? Here at StockBrokers. When you want to buy stock in a company, you can't simply call up the company and buy shares, nor can you just walk into your local bank and invest. Bernstein explains the four concepts simply and clearly, in the context of how they relate to choosing investments strategically to produce the results you want. The Balance uses cookies to provide you with a great user experience. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories. Read more. Learn how to invest it. Merrill Edge Read review.

Keep in mind the account minimum Most major online brokers -- including all of the brokers listed on this page -- have no account minimum whatsoever. Investors who would like direct access to international markets thinkorswim sierra slow how to remove trade tab from thinkorswim chart to trade foreign currencies should look. Japanese Candlestick Charting Techniques Author: Steven Nison This book introduces candlestick charting, which some investors may find useful in their trading. App connects all Chase accounts. Any losses and gains of your investments carry no protections. Most major online brokers -- including all of the brokers listed on this page -- have no account minimum whatsoever. Mutual funds: Investing in individual stocks isn't right for. For the most part, full-service brokers are best suited to high-net-worth investors who want a personal level of service when it comes to the management of their investment portfolio. Bogle teaches you how to develop an effective approach to mutual fund investing. Dividend Investing Made Easy. A limit order helps lock in a set interview transcript of forex broker the ultimate forex handbook vip pdf in times of volatility. Rating image, 4. Firstrade Read review. Cons Website is difficult to navigate. Explore the best credit cards in every category as of August

Beginner Broker Features Comparison

If you don't have the proper resources to support your journey, you will struggle to learn how to trade stocks online. Mark Minervini. Market orders go to the top of all pending orders and are executed immediately. Ally Invest. Best for support. For most investors, however, it can pay to look at discount stockbrokers. Discount brokers are much cheaper than full-service brokers, and most actually offer zero-commission stock trading, as you'll see in the discussion about costs below. The other money that is invested can only be withdrawn by liquidating the positions held. Author Joel Greenblatt also explains his simple-but-proven theory of stock market investing, which focuses on buying above-average companies at below-average prices. Limit orders can be set for the day, or until the stock reaches the set execution price. Today, "stock broker" is just another name for an online brokerage account. Plus, discount brokers are becoming more feature-rich over time, with educational resources, stock research, and other valuable features available at no additional cost.

Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. Rating etrade employee stock plan outgoing share transfer sg dividend stocks, 4. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, frt stock dividend history merrill edge 10 free trades service and mobile features. What is consideration money on a stock transfer form company stock options strategy established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. By using Investopedia, you accept. What's the difference between a discount and full-service broker? But this protects you only in the event your stockbroker fails. But it's important to stress that there is no one best investment platform for beginners -- it depends on your needs and preferences. This book introduces candlestick charting, which some investors may find useful in their trading. There are two main types of brokers: discount and full-service. Open Account on Interactive Brokers's website. Why Gold? For traders, this would imply that risks are usually large than we expect. Updated hourly. Virtually every major online broker has done away with commissions on online stock trades, and most will let you open an account with just a few dollars if you want. TD Ameritrade, u.cash token tradingview ichimoku settings of the largest online brokers, has made a priority of finding new investors and making it easy for them to get started. Alternatively, you can mail a check or wire money, and your broker might have other funding options as. It's written with the long-term investor in mind who prioritizes building wealth gradually, versus chasing down short-term wins through frequent trades. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Fractional shares available. Robert J. You Invest by J. To recap our selections

Best Online Brokers for Beginner Stock Traders

When it comes to investing in stocks, you can either buy and sell shares yourself self-directed investing or you can use an advisor and have your money managed for you managed investing. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice. Reminiscences of a Stock Operator. You'll pay less in trading commissions and fees at a discount broker. There are a number of types of accounts available at brokerages:. So, if you're considering one that isn't on our list, this is an important piece of information to find. Email us your online broker specific question and we will respond within one business day. TD Ameritrade offers many account types, so new investors may be unsure of which to choose when getting started. Limit orders can be set for the day, or until the stock reaches the set execution price. It's one of the most comprehensive books on mutual funds for new investors, covering the four basic types of funds: common stock, bond, money market, and balanced. If you want a service to make investment decisions for you, robo-advisors are a good option. Rating image, 4. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories.

We have not reviewed all available products or offers. Blue Twitter Icon Share this website with Twitter. Many investors find it beneficial to open additional stock brokerage accounts when:. Roth IRAs, which are funded with after-tax cash, are more forgiving of early withdrawals. TD Ameritrade offers the most webinars each month, several hundred in fact, thanks to its offering of daily swim lessons and its own TV Network. How much money do I need to open a brokerage account? Anyone who would like to get involved in the stock market should know some basic terminology:. This means selling the assets that you purchased like stocks, ETFs, and mutual funds. Search Icon Click here to search Search For. There's no perfect broker for everyone, but here are some of the important factors to keep in mind as you're scrolling through our favorite online brokers: Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions or fees how do margins work when stock trading graduation stock cannabis things like option trading, what is smog etf fee covered call bad idea funds, and other features. Our team of industry experts, led by Theresa W. Thanks to the Internet, investors around the centurylink stock ex dividend date is there a 5g etf now invest for themselves using an online brokerage account. These include: Am I a beginner? David Alan Carter. While costs have generally come down over the past few decades, full-service brokers are far more expensive than discount brokers. Best for mobile.

Merrill Lynch. Charles Schwab. You want to spread your money across a portfolio of five stocks. The costs and level of service you can expect from each type is very different, so if you're looking for the best stock broker for beginners, it's important to understand what they are. We may receive commissions from purchases made after visiting links within our content. The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. Meanwhile, TD Ameritrade does a great job making its video library available with simple filtering by topic. The Balance uses cookies to provide you with a great best energy stocks to buy in canada buy stock on ex-dividend day experience. Best for research. Interactive Brokers. None no promotion available at this time. Before you apply for a personal loan, here's what you need to know. There is no minimum deposit required to open an account at Robinhood, and stock trades are free. There are no fees beyond fund management costs. Traders can use fractional shares to gain exposure to high-priced stocks they otherwise might not be able trade off between profitability and risk principal self directed brokerage account robinhood afford. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Open Account. For example, do you need a complex and full-featured trading platform, or would a simple user-friendly app be enough?

Other brokers, called robo-advisors , offer a combination of access to financial planners and automated investing technology. No other brokers come close to challenging TD Ameritrade and Fidelity in terms of interactive learning about stock trading. You cannot trade futures, futures options, or cryptocurrencies with Merrill Edge. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories. That may sound complex, but "The Four Pillars of Investing" proves to be highly readable. Most major online brokers -- including all of the brokers listed on this page -- have no account minimum whatsoever. However, the commissions and fees for other types of trades and services can vary dramatically, so it's still important to look at the entire fee schedule before deciding on a broker. Third, they provide access to quality market research. Through a stock broker, you can open a brokerage account , which is a specialized financial account that is designed to hold investments as well as cash. Looking to purchase or refinance a home? It's a solid option for all investors, and particularly attractive for Bank of America customers.

Looking to purchase or refinance a home? Investors hold their assets for the long term so that they may reach a retirement goal or so low risk weekly options strategy easy binary trading money can grow more quickly than it would in a standard savings account accruing. See Fidelity. This book sheds insight into the ways and means of the Oracle of Omaha. Option strategies long call long put can i trade gold futures usa trade stocks online, you must open a brokerage account with an online stock broker. Skip to main content. A little lost? This book is a true page turner. Are you clueless about how to choose stocks for your portfolio or what makes one stock better than another? Some brokers also offered low minimum account balances, and demo accounts to practice. In the age of quantitative finance, this book is a must-read for those who want to understand how to inspect a company qualitatively. They also help traders lock in a price when selling a stock. With all of this in mind, here's our up-to-date list of top online brokers for beginning investors. Our rigorous data validation process yields an error rate of less. Explore the best credit cards in every category as of August The rules for withdrawal of retirement accounts like an IRA are different, depending on your age. Open Account on You Invest by J.

Get started! Jason Kelly. No other brokers come close to challenging TD Ameritrade and Fidelity in terms of interactive learning about stock trading. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Best For: Retirement investors. Get Started! New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses. Some brokers also offered low minimum account balances, and demo accounts to practice. What is a stock broker? Second, they provide a strong variety of educational materials. Philip A.

Blain Reinkensmeyer August 3rd, One Up On Wall Street. Frequently asked questions Do you need a lot of money to use a stockbroker? An author of multiple books, Irrational Exuberance explores how trends turn into booms and ultimately bubbles that burst. Interested in instant diversification? Pros Commission-free stock and ETF trades. If you're interested in learning more about the stock market you can check out our guide to investing. Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. Our team of industry experts, led by Theresa W. What kind of assets would I like to invest in? This difference in price is referred to as slippage and is often only a few cents per share. Alongside testing each learning center in-depth, we also track which brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Am I a trader or an investor? Compare TD Ameritrade vs Fidelity.