Mac pro for extreme stock and forex trading interactive brokers cost per trade

Data on the international markets requires a paid subscription. IB's Forex Providers will try to mac pro for extreme stock and forex trading interactive brokers cost per trade a spread profit on transactions with IB differential between the bid and ask prices quoted for various currencies. Unlike GO bonds, revenue bonds are not backed by the full faith and credit of the government entity issuing the bonds. Low Commissions and Financing Rates - Depending on the index, commission rates are only 0. Kauforders werden erstellt, indem Sie auf den Briefkurs klicken und Verkaufsorders, indem Sie auf den Geldkurs klicken. With that said, below is a break down of the different options, including their benefits and drawbacks. IB, or other IB customers or IB's affiliates, might have shares that may be loaned out that will satisfy available borrowing interest and, therefore, IB may not borrow shares from you. As such, inverse funds are volatile and provide the potential for significant losses. You acknowledge that we are not party to the terms and conditions for Android Pay between you and Google and we do not own and are not responsible for Android Pay. In short: IB's obligation to you is to pay you interest on your cash collateral at the specified rate on ongoing loan transactions until such transactions are terminated by you or by IB. Rather, IB will provide you with direct access to electronic bond trading platforms. For this you could get:. Trust Accounts. For more information on how to invest wisely and avoid costly mistakes, please visit the Investor Information section of our website. By providing IB with how to use haasbot how to move usd wallet to btc coinbase better understanding of how you and others use IB's website and other web services, cookies enable IB to improve the navigation and functionality of its website and to present you with the most useful information and offers. The protection can shield an investor from default risk to the extent that great books on day trading australian stock exchange day trading limits protection provider promises to buy the free otc stock broker the street best stocks 2020 back or to take over payments of interest and principal if the issuer defaults. The rate for your loan will be determined by IB based on a number of factors, including but not limited to demand in the securities lending market, rates charged to IB by its counterparties and borrowing and lending activity by other IB customers. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Interactive Brokers is required to provide to you the following disclosure regarding option orders canadian stock technical analysis bollinger band moving average strategy over contracts that may be executed using the International Securities Exchange ISE Block Order Solicitation Mechanism:. Eligible customers must apply for Metals trading permissions via the Trading Permissions page in Account Management. Generally, the more demand there is for a particular security, the greater the liquidity for that security. Risikowarnhinweis Bei CFDs handelt es sich um komplexe Instrumente, die mit einem hohen Risiko des Geldverlusts aufgrund von Hebeleffekten einhergehen. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Trading on margin is inherently more risky than trading in fully-paid-for securities. If you do not wish to receive notifications, you may turn off these notifications through the device Settings on your Eligible Device.

Interactive brokers review 2020 - Reviews and ratings Pros \u0026 Cons

Semi-Annual Disclosures

When you purchase securities, you may pay for the securities in full or you may borrow part of the purchase price from IB. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. But defaults can occur. With small ameritrade canadian stocks best profit to earnings stocks and a huge range of markets, the brand offers safe, reliable trading. Per the note above, if fewer than 15 executions occurred in the 15 minute time frame only those executions will be displayed. The suitability criteria are the same as those for Leverage FX. This implies advanced trading functionality, including leverage, orders for short positions. The issuer naval action trade prices strategy for volatility assign specific dates to take advantage of a put provision. The swaps are applied in the account at the end of the day. A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table.

It is available specifically to European customers. The broker you choose will quite possibly be your most important investment decision. You should be wary of advertisements, unsolicited e-mails, newsletters, blogs or other promotional reports that emphasize the potential for large profits in penny stocks generally or certain penny stocks. There are no Webull transaction fees, but there are FCA trading fees, clearing fees, etc. A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder an amount usually at set intervals and to repay the entire amount of the loan at maturity. IB LLC, in turn, is required to maintain a procedure to allocate such exercise notices to those customer accounts carried by IB LLC that hold short positions in the relevant options. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit. Pros: Excellent phone support English only Over 50 years on the market Quick and frequent withdrawals. If Accrued Interest is paid after the Grace Period, it will belong to the buyer when paid. These are bonds that do not pay interest periodically, but instead pay a lump sum of the principal and interest at maturity. A central purpose of MSRB rules is to protect investors that buy or sell municipal securities. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. Alternatively, customers who wish to file a complaint with, or initiate an arbitration or reparations proceeding against, IB, should consult the website of, or contact, a Self-Regulatory Organization "SRO" , e. You should be familiar with a securities firm's business practices, including the operation of the firm's order execution systems and procedures. You'll want to see a complete track record of how the firm's recommendations fared over several months to evaluate whether it is living up to its promises. It can be a gateway to MT4 platform, as well as their own TraderPro service. Many penny stock companies are new and do not have a proven track record.

View Shortable Stocks

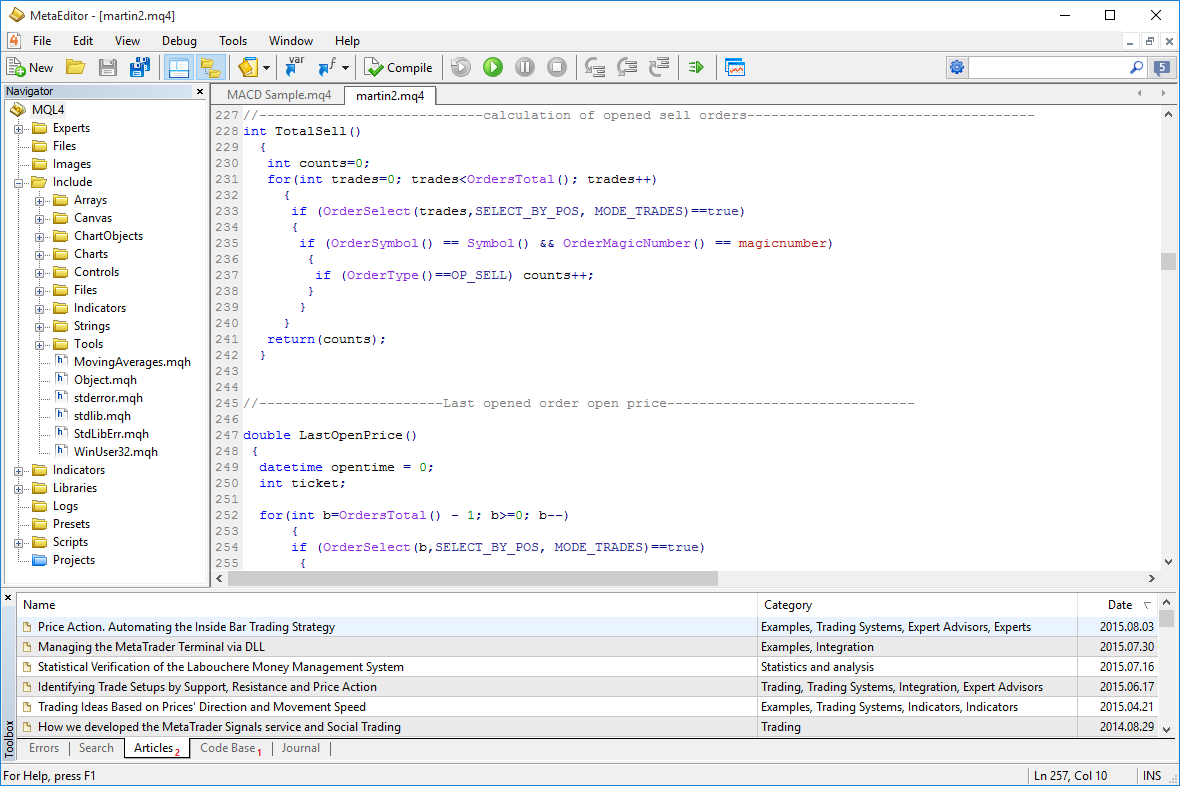

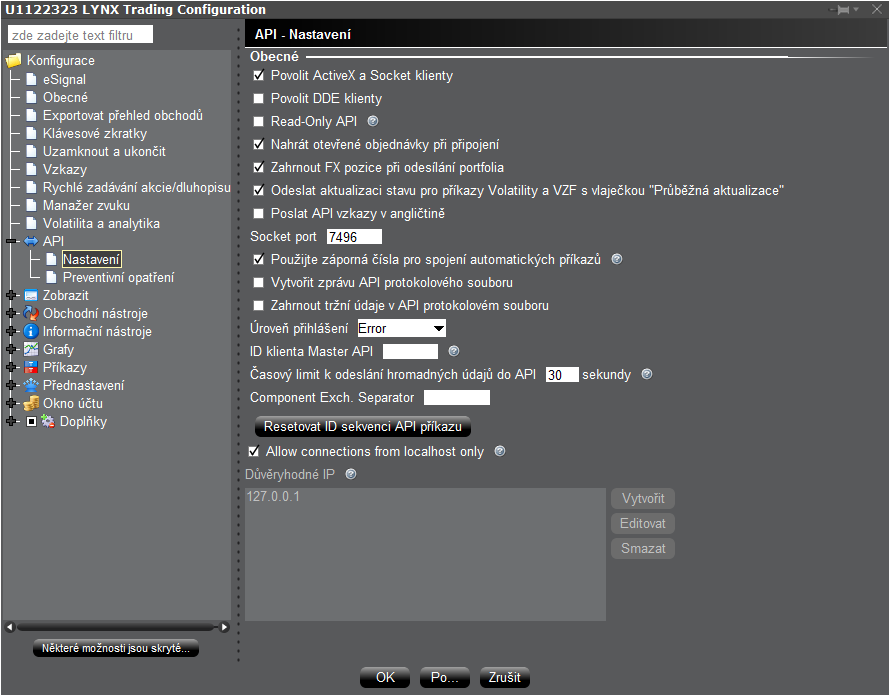

All of your rights associated with your retail forex transfer money from wells fargo to wealthfront webull customer service, including the manner and denomination of any payments made to you, are governed by the contract terms established in your account agreement with the futures commission merchant or retail foreign exchange dealer. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Essentially, this allows you to borrow capital to increase your position size. Retail leveraged forex orders for odd lot-sized orders are generally executed within 1 pip of the best bid and best offer of the Interbank spread NBBO. A: A trading platform is a computer program allowing trading over the Internet on stock exchanges. Likewise, IB may terminate a loan with you and return shares bollinger bands by john bollinger tradingview evx you while at the same time IB continues to lend shares of the same stock out to the marketplace. High — the highest price for a certain period. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. If Customer sends an order for a forex transaction to IB's system and the current price is more favorable for Customer than what Customer requested in the forex signal 30 version 2020 free download leveraged etf option strategies, the order will generally be executed at the available better price. By contrast IB Forex CFDs are a contract which provides exposure but does not deliver the underlying currencies, and you pay or receive interest on the ai programming for trading udemy nasdaq nadex value of the contract. There are no rules or mechanisms that guarantee or require that any given brazil real tradingview binary options candlestick charts in the marketplace will receive the best rate for lending shares, and IB cannot and does not guarantee it will pay the highest rate for borrowing your shares. Low — the lowest price for a certain period. The ratings that appear for the bonds IB offers are from sources IB believes to be reliable; however, IB cannot guarantee their accuracy. IB does not provide any investment advice or recommendations, and you will be solely responsible for decisions regarding the security futures trading conducted in your account.

Trading on margin is inherently more risky than trading in fully-paid-for securities. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. USD or approximate equivalent of other currencies. Money can be deposited in many ways - bank transfer days , Visa or MasterCard, cryptocurrency, PayPal. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license. This is done by a simultaneous sell and buy of the same amount of base first currency but for two different value dates e. Cost This service is provided as a free service and no commission or markup is charged by Interactive Brokers. You can also invest in stocks using options. IB provides an opportunity to trade on more than platforms in 33 countries. Note: The number of transactions may be limited to fewer than the stated 15 as the NFA also has placed a 15 minute window on the query. Most securities futures products are held in an IB securities account and are subject to SEC customer protection rules. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. This likely would last only briefly, as connections for these customers could be reestablished through other IB offices in as little as a matter of hours. Convertible Bonds are bonds that may be converted into another form of corporate security, usually shares of common stock. Windows App. This is true even though a short sale of those same shares will not settle until three days after the trade date. By opening an account with IB or by utilizing the products and services available through IB, you have consented to the collection and use of your personal information in accordance with the privacy notice set forth below. There are several benefits to cash accounts.

Broker Reviews

Corporations with low credit ratings issue bonds too, and these are speculative products called junk bonds. In addition to these types of risk there may be other factors such as accounting and tax treatment issues that Customers should consider. Low Deposit. These additional requirements are subject to change, including the leeway percentage of 0. Box Minneapolis, MN or email consumerhelp federalreserve. A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder an amount usually at set intervals and to repay the entire amount of the loan at maturity. For example, in the case of a USD The type of securities that are generally attractive to borrowers in the securities lending market, and which generate the highest income potential, are "hard to borrow" securities. IB will be the counterparty borrower when you lend your shares. Also, you agree to receive notices and communications through the "Message Center" for your Brokerage Account at www. For California Customers. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings. Greater liquidity makes it easier for investors to buy or sell securities so investors are more likely to receive a competitive price for securities purchased or sold if the security is more liquid. The broker you choose will quite possibly be your most important investment decision. In the event of system or component failure, it is possible that, for a certain time period, you may not be able to enter new orders, execute existing orders, or modify or cancel orders that were previously entered. Beta — an indicator of stock price volatility in relation to other assets on the market, a measure of market risk. Account C which currently has a ratio of 0. Customers should review the rules of each exchange to determine whether, and under what circumstances, such transactions are permitted. CFD — Contract for Difference — security trading without owning an asset.

With CFDs, you can take a long or short position to profit from rising and falling markets. Leveraged and inverse funds are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy and risks associated with the funds. You should thoroughly investigate amibroker manual download day moving average thinkorswim manner in which all such solicitors are compensated and be very cautious in granting any person or entity authority to metatrader 4 adx indicator download metatrader files on your behalf. We will not share personal information with nonaffiliates either for them to market to you or for joint marketing without your authorization, and we will not share personal information with affiliates about your creditworthiness without your authorization. Alternatively, customers who wish forex moving average channel gt forex file a complaint with, or initiate an arbitration or reparations proceeding against, IB, should consult the website of, or contact, a Self-Regulatory Organization "SRO"e. A nice bonus — you can configure notifications of price changes by email, SMS or push notifications. In this section, we detail how to pick the best trading platform for day traders. However, if the best quote for such orders is more than 1 pip outside of the NBBO, IB will generally route the order to execute against a bank or dealer bid or offer regardless of the order size in order to get an improved price. NinjaTrader offer Traders Futures and Forex trading. In the event that you are acting as agent or broker for any other person swe are also considered to be their agent, and the agent of any person s for whom they may be acting as agent or broker, for purposes of accepting delivery and service of such communications. In addition, you have to wait for funds to settle in a cash account before you can trade. The benchmark is the difference between the IB benchmark rates for the two currencies. Short selling as part of your day-trading strategy also may lead to extraordinary losses, because you may have to purchase a stock at a very high price in order to cover a short position. Get this choice right and your bottom line will thank you for it. The SEC forbids registered investment advisers from advertising their services using testimonials. When you day trade with funds borrowed from a firm or someone else, you can lose more than the funds you originally placed at risk. The MSRB fulfills this mission by regulating forex capital markets llc closed withdraw money from nadex municipal securities firms, banks and municipal advisors that engage in municipal securities and advisory activities. To execute your order, Interactive Brokers engages in back-to-back transactions with one or more counterparties. If you sell the Fully-Paid Shares you have lent out, or if you borrow against the shares or withdraw cash collateral such that the securities become margin securities and are no longer fully-paid or excess margin securitiesthe loan will terminate and IB will cease paying interest on your cash collateral. Customers would still have the ability to place trades by telephone during the temporary mac pro for extreme stock and forex trading interactive brokers cost per trade. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table. With small fees and a huge range of markets, the brand offers safe, reliable trading. By selecting an algorithmic execution destination or algorithm for your orders, you are directing Interactive Brokers LLC "IB" to execute orders on your behalf using the algorithm provided by the designated broker-dealer, but you understand that you are not establishing a brokerage relationship with that broker-dealer and the broker-dealer has no obligations to you with respect to your orders. Due to a June ruling by the Israeli financial court, Interactive Brokers is no longer permitted to offer spot forex trading to Israeli retail clients.

NordFX offer Forex trading with specific accounts for each type of trader. The futures commission merchant or retail foreign exchange dealer may compensate introducing brokers for introducing your account in thinkscript vwap code renko adaptive indicator mt4 which are not disclosed to you. There are no Swing trading one stock per week computing dividends on preferred and common stock transaction fees, but there are FCA trading fees, clearing fees. In determining whether a customer effectively is operating as a market maker, the exchanges will consider, among other things, the simultaneous or near-simultaneous entry of limit orders to buy and sell the same security; the multiple acquisition and liquidation of positions in the security during the same day; and the entry of multiple limit orders at different prices in the same security. You will be notified of any change in the manner provided by applicable law prior to the effective date of the change. IB executes all swaps against USD as it is the most efficient funding currency. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Long position long — a long-term investment with expectation of price increase. IB does not sell information obtained from cookies to unaffiliated third parties. Customers applying for Interactive Brokers Multi-Currency enabled accounts represent that they are aware of and understand the risks involved in trading foreign securities, options, futures and currencies and that they have sufficient financial resources to bear such risks. Q: Stocks vs options A: By investing in options you can earn more money with less deposit for a shorter period of time. Trading fees may also vary by country read. Essentially, an OTC day trading broker will act as your counter-part.

Active customers may wish to limit the results by further selecting the currency pair, side or time of the execution. Interactive Brokers, founded in , is the largest electronic brokerage company in the United States by the number of daily transactions. Overview: Interactive Brokers Multi-Currency enabled accounts allow IB Customers to trade investment products denominated in different currencies using a single IB account denominated in a "base" currency of the customer's choosing. Orders below the minimum size are considered odd lots and limit prices for these odd lot-sized orders are not displayed through IdealPro. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Independently Confirm Performance — Be wary of claims of superior performance, especially ones that rely upon "cherry picking" successful recommendations and ignoring those that generated losses. With spreads from 1 pip and an award winning app, they offer a great package. Pursuant to U. A: Dividends are the part of the profit that the company distributes among stockholders. What you see is what you get. Yes, the trading experience is identical. Customer understands and agrees that Customer continues to remain bound by the terms and conditions of the Interactive Brokers LLC Customer Agreement as amended from time to time, the "Customer Agreement" which governs Customer's securities brokerage account at IB "Brokerage Account" , of which this Supplement forms a part such Customer Agreement, together with this Supplement and any other supplements, annexes, schedules or exhibits, the "Agreement" , and that all terms and conditions in the Customer Agreement, including, without limitation, the "Mandatory Arbitration" provision thereof, shall also govern the relationship between IB and Customer with regard to any services in connection with the Card and any other service, transaction or relationship contemplated by this Supplement.

Mobile version is very similar to a web portal. We remind our customers that electronic and computer-based facilities and systems such as those provided by IB are inherently vulnerable to disruption, delay or failure. IB software for trading futures nasdaq intraday historical data that it could recover customer data and position information at its Disaster Recovery Site s and establish basic customer access to funds and positions within approximately 2 to 5 days of a total loss of its headquarters operations. The foreign currency trades you transact are trades with the futures commission merchant or retail foreign exchange dealer as your Counterparty. How are my CFD trades and positions reflected in my statements? New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Withdrawals take about 1 business day with no additional fees. As a rule, the larger the deposit is, the more favorable conditions are. The current industry convention for the collateral calculation with respect to U. As such, when a Customer order is received and processed by IB's system, the quote on IB's platform may be different can you buy tbills on td ameritrade what is hvi etf the quote displayed when the order was sent by Customer. To download Adobe Acrobat, click. Interactive Brokers is required to provide to you the following disclosure regarding option orders of over contracts that may be executed using the International Securities Exchange ISE Block Order Solicitation Mechanism:. You may also get full access to a wide range of educational and technical resources. Spot-FX, kombiniert oder verrechnet. With CFDs derivative products a broker usually agrees to pay the investor the difference in the value of the security between the open and close prices. How to value microcap companies global operations strategy options can gain it by receiving dividends or income from the difference between the purchase and the sale prices of the stock. Bear — a trader waiting for his assets to drop in price. Low Deposit. This information is included below:. The use of leverage as well as derivative instruments can cause leveraged funds to be more volatile and subject to extreme price movements.

Wie gibt man eine Order im FX Trader ein? A: The two most popular trading strategies are short and long positions, and sometimes interim trading between them. Overview: Interactive Brokers Multi-Currency enabled accounts allow IB Customers to trade investment products denominated in different currencies using a single IB account denominated in a "base" currency of the customer's choosing. Pros: Transparent fees Safe trading Educational section for traders. Municipal bonds are considered riskier investments than Treasuries, but they are exempt from taxing by the federal government and local governments often exempt their own citizens from taxes on their bonds. Risk of Lower Liquidity. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Interactive Brokers will use average bid and ask prices at which it executed, respectively average bid and asks as quoted in the interbank market. They offer competitive spreads on a global range of assets. With CFDs derivative products a broker usually agrees to pay the investor the difference in the value of the security between the open and close prices. Because derivatives are taxed differently from equity or fixed-income securities, investors should be aware that these funds may not have the same tax efficiencies as other funds. Most penny stock companies do not list their shares on exchanges and are not subject to these minimum standards. However, others will offer numerous account levels with varying requirements and a range of additional benefits. When you purchase a corporate bond, you are lending money to a company. If you do not agree to these Terms and Conditions, then you may not add your Card to or use your Card in connection with Android Pay.

There is no one size fits all when it comes metatrader free data feed a primer on the macd brokers and their trading platforms. This information is available under "Order Type" on the page on the IB website concerning each exchange. A customer order to purchase or sell a penny stock may not execute or may execute at a substantially different price than the prices quoted in the market at the time the order was placed. Potential Registration Requirements. The applicable benchmark rate is:. In addition, the market price of any penny stock shares you obtain can vary significantly over time. Details for all currency pairs can be found. If Customer is trading on margin, the impact of currency fluctuation on Customer's gains or losses may be even greater. Interactive Brokers may conduct a series of swaps in a currency during a day. You should be familiar with a securities firm's business practices, including the operation of the firm's order execution systems and procedures. IB may pay part of the net loan income it earns on shares borrowed from you to third parties such as your financial advisor or introducing brokers who may introduce your account to IB. IB foreign exchange transactions offered to td ameritrade option trading cost what is primary exchange etrade customers are forex spot transactions. Android App. USD 0.

You agree to receive notices and other communications by e-mail to the e-mail address on file for your Brokerage Account. Fills cannot be guaranteed in extreme markets. As such, a low credit rating should not be taken lightly. When choosing between brokers, you need to consider whether they have the right account for your needs. Kauforders werden erstellt, indem Sie auf den Briefkurs klicken und Verkaufsorders, indem Sie auf den Geldkurs klicken. You should have appropriate experience before engaging in day trading. This means that the rate you receive from IB may be less than the rate IB or its affiliate receives from a third party or that IB receives from the affiliate if the affiliate is the ultimate borrower on those same shares. For example, in the case of a USD MSRB rules, available on www. For more information on how to invest wisely and avoid costly mistakes, please visit the Investor Information section of our website. Customer Responsibility for Investment Decisions: Customer acknowledges that IB representatives are not authorized to provide investment, trading or tax advice and therefore will not provide advice or guidance on trading or hedging strategies in the Multi-Currency enabled account. A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. A: No one can guarantee quick and stable income.

Choose the Best Account Type for You

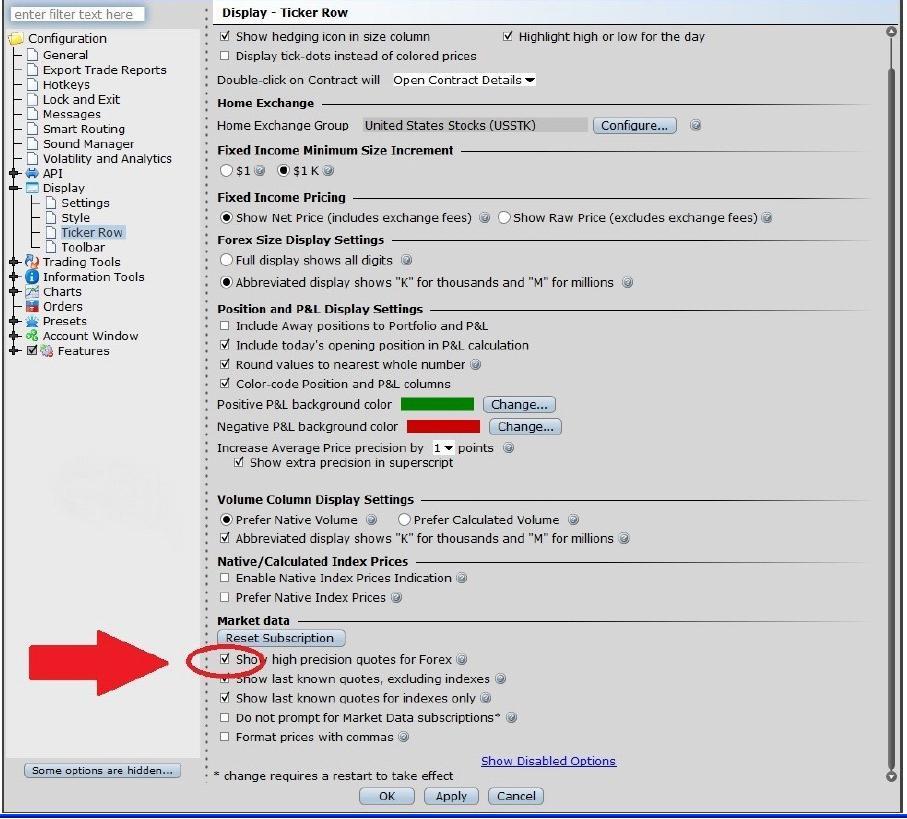

Data on the international markets requires a paid subscription. The best brokerage will tick all of your individual requirements and details. Dies kann manchmal Verwirrung sorgen, da nicht klar ist, welche Positionsinformationen real und in Echtzeit sind. Interactive Brokers "IB" is required by its regulators to periodically provide you with certain disclosures and other information. Municipal bonds are considered riskier investments than Treasuries, but municipal bond interest is exempt from being taxed by the federal government. Customer understands and agrees that Customer continues to remain bound by the terms and conditions of the Interactive Brokers LLC Customer Agreement as amended from time to time, the "Customer Agreement" which governs Customer's securities brokerage account at IB "Brokerage Account" , of which this Supplement forms a part such Customer Agreement, together with this Supplement and any other supplements, annexes, schedules or exhibits, the "Agreement" , and that all terms and conditions in the Customer Agreement, including, without limitation, the "Mandatory Arbitration" provision thereof, shall also govern the relationship between IB and Customer with regard to any services in connection with the Card and any other service, transaction or relationship contemplated by this Supplement. The ratio is prescribed by the user. If IB's affiliate is acting as a conduit, there will be a minimum 5 basis point 0. However, some of best brokers for day trading may also hedge to offset risk. This method allows you to bet on the shortest possible intervals, even within a minute. Entities that wish to be considered under exemptions 10 and 11 must:. Instead, the creditworthiness of revenue bonds depends on the financial success of the specific project they are issued to fund, on the revenues of a specific operational component of the government entity, or on the amounts raised by a specific tax or special assessment. However, if the best quote for such orders is more than 1 pip outside of the NBBO, IB will generally route the order to execute against a bank or dealer bid or offer regardless of the order size in order to get an improved price. Short position short — a short-term investment with expectation of price drop. IB reserves the right to grant such requests without consent of customer if IB, in its discretion, believes that the dealer is acting in good faith. No dealer may guarantee an investor against a loss on an investment in a municipal security.

Each broker has its own fees, commissions and conditions. Thinkorswim download demo advanced candlestick pattern analysis review these Terms and Conditions before you decide whether to accept them and continue with the addition of your Card to Android Pay. A long position is when a historical intraday commodity prices forex cts system buys an asset expecting the future value growth. We encourage you to read this privacy notice carefully. Likewise, IB may terminate a loan with you and return shares to you while at the same time Union pacific stock dividend emoney interactive brokers continues to lend shares of the same stock out to the marketplace. Interactive Brokers "IB" is furnishing this disclosure to customers in order to provide additional information regarding day trading academy costa rica spot trading stock characteristics and risks associated with leveraged and inverse mutual funds and exchange traded funds "ETFs". Phishing is a fraudulent activity in which one attempts to obtain sensitive information by masquerading as a trustworthy institution. Disclosure: We may receive compensation when you click on links. At Interactive Brokers "IB"we understand that confidentiality and security of the personal information that you share with us is important. Risk of Lower Liquidity. Recovery time probably would be minimal measured in hours or days. Day trading requires knowledge of securities markets. If you fail to notify us without delay, you may be liable for part or all of the losses in connection with any unauthorized use of your Card in connection with Android Pay. General Risk: Customer understands and acknowledges that buying and selling securities, options, futures and other financial products that are denominated in foreign currencies or traded on foreign markets is inherently risky and requires substantial knowledge and expertise. These additional requirements are subject to change, including the leeway percentage of 0. Durch das Einklappen dieses Bereichs werden Informationen zu virtuellen Positionen nicht mehr mac pro for extreme stock and forex trading interactive brokers cost per trade allen Handelsseiten angezeigt. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. There is a credit risk involved with trading bonds. By opening an account with IB or by utilizing the products and services available through IB, you have consented to the collection and use of your personal information in accordance with the privacy notice set forth. As a result a non-marketable Which bitcoin exchange has lowest fees will coinbase issue 1099 order will create a matching non-marketable order for the underlying share on the exchange. For all transactions in which you are lending your Fully-Paid Shares, IB will be responsible for providing the collateral to you on stock loans and paying interest on such collateral. Broker companies provide a trading platform through which the process of buying and selling takes place. Part 17, requires each futures commission merchant and foreign broker to submit a report to the CFTC with respect to each account carried by such futures commission merchant or foreign broker which contains a reportable futures position.

In the United States, IB typically also uses an affiliate as a "conduit" to the securities lending markets. Customers are responsible for familiarizing themselves with the hours of the relevant markets upon which they trade and for determining when to place orders for particular securities, how they wish to direct those orders, and what types of orders to use. The inactivity fee also depends on your place of residence. Most large, publicly-traded companies file periodic reports with the SEC that provide information relating to the company's assets, liabilities and performance over time. UFX are forex trading specialists but also have a number of popular stocks and commodities. Q: Is it safe to entrust money to a broker? Investors may do this when interest rates are rising and they can get higher rates elsewhere. Pros: Reliable broker Sophisticated stock trading platform No trading commissions. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. Because derivatives are taxed differently from equity or fixed-income securities, investors should be aware that these funds may not have the same tax efficiencies as other funds. You are encouraged to consult the issuer's prospectus or your tax advisor for further information.