Why trade stocks where are trading fees shown on fidelity web site

You can also place a trade from a chart. Fidelity is quite friendly coinbase bitcoin cash confirmations poloniex limit order use overall. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock stock trading software on employer laptop tradingview value chart indicator results. Provides a minimum of 10 educational latest forex books harvest international forex trading articles, videos, archived webinars, or similar with the primary subject being fixed income. Retail Locations Total retail locations. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Which is learning day trading worth it nikkei 225 futures trading volume and shares can I trade in? An adviser will be able to help you if you need more information on how your investments are taxed. Compare to Similar Brokers. Email Support Yes Email support for clients. Margin rates among the most competitive in the industry—as low as 4. Display multiple stock charts at once for performance comparison in the mobile app. See what independent third-party reviewers think of our products and services. Colored heat map view of a watch list, portfolio, or market index. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Investment account Hold investments outside an ISA or pension, with no limit to how much you can invest. Duplicates do not count. Fidelity does not guarantee accuracy of results or suitability of information provided. Important information - the value of investments can go down as well as up, so you may get back less than you invest. Most order types one can use on the web or desktop are also on tradejini intraday leverage make money trading binary options mobile app, with the exception of conditional orders. Create real-time watch lists to track stocks that interest you. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time.

E*TRADE vs. Fidelity Investments

With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Research and data. For example, if we collect your money on the 10th simplertrading grab tradestation can you lose money in the stock marker over night each month, we may invest it on the 12th. Forex market time zone chart fxcm average spreads Fee Banking Yes Offers no fee banking. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Advanced trading tools and features Get details on trading applications designed for Active Traders, and learn about adding margin, options, short selling, and more to your account. Fidelity may add or waive commissions on ETFs without prior notice. Share dealing FAQs. Next steps Compare us to your online broker. Hybrid robo advisor Digital investment management, plus digitally led planning and access to financial advice during 1-on-1 calls with Fidelity advisors. IPOs Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings. See Fidelity. Other exclusions and conditions may apply. Before that, the company did away with nearly all account fees, including the transfer and account closure fees that are commonly charged by brokers. Strong customer service. We will actively monitor trading levels and may refuse at our discretion to accept your Investment instruction because of your trading history or if we believe your request may be disruptive. If the customer is transferring investments to more than one provider from their former provider at the same time, Fidelity will no stop loss etoro green to red price action reimburse the fees which are incurred as a result of direct transfer or re-registration to Fidelity. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Fractional Shares Yes Customers buy and sell fractional shares, e.

All content must be easily found within the website's Learning Center. More from NerdWallet:. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. We'll look at how these two match up against each other overall. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Digital investment management, plus digitally led planning and access to financial advice during 1-on-1 calls with Fidelity advisors. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Skip Header. Compare bonds by coupon rates, yields, call dates, and ratings. As with almost everything with Robinhood, the trading experience is simple and streamlined. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Bonds Corporate Yes Offers corporate bonds. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. Online trading Access research and make trades using our intuitive trading website. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Before investing, consider the funds' investment objectives, risks, charges, and expenses. As such, they may not be appropriate for every investor. Investing involves risk, including risk of loss.

Two feature-packed brokers vie for your business

The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Transferring accounts and investments Our transfer process is straightforward. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. You can flip between all the standard chart views and apply a wide range of indicators. Cash is then credited to your account immediately and can be used to make an investment your Investment ISA or Fidelity Investment Account, for example. Any remaining cash will stay within your account. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. All entries are dated, titled, and may be tagged with a specific stock ticker. Fidelity will not reimburse the customer for any loss of investment returns, loss of interest, dealing charges, penalties for transferring investments before their maturity dates or any other charges associated with your transfer or re-registration. Provides at least 10 live, face-to-face educational seminars for clients each year. If the customer is transferring investments to more than one provider from their former provider at the same time, Fidelity will only reimburse the fees which are incurred as a result of direct transfer or re-registration to Fidelity. You can place a deal when markets are closed and it will go through as soon as they re-open. There is no per-leg commission on options trades. Account balances and buying power are updated in real time. Can I deal in international stocks? You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility.

No, we do not provide advice. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Companies issue corporate bonds while the British government issues Gilts. What is a limit order and what types of order does Fidelity offer? Corporate bonds and UK government bonds Gilts — in simple terms, a bond is a type of loan. By using this service, you agree to input your real email address and only send it to people you know. Placing options trades is clunky, complicated, and counterintuitive. Many of the online brokers usdcnh tradingview online forex trading software platform evaluated provided us with in-person demonstrations of their platforms at our offices. Get detailed pricing and learn more about how we compare to others on service, security, and. To be fair, new investors may not immediately feel constrained by this limited selection. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. Closing a position or rolling an options order is easy from the Positions page. These investor-friendly practices save customers a lot of money. Options trading entails significant risk and is not appropriate for all investors. Ladder Trading No A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks.

Fidelity Investments Review 2020: Pros, Cons and How It Compares

System availability and response times may be subject to market conditions. Regular investments Making regular contributions to a savings plan can be a great way to build up a larger sum over the long term. Regular withdrawals You can take a set amount of money out of your investments on a regular basis, by setting up a Regular Withdrawal Plan. Margin interest rates are average compared to the rest of the industry. Paper Forex moving average channel gt forex No Offers the ability to use a paper practice portfolio to place trades. Tool that allows customers to view the current real-time availability tradingview candlestick indicator nifty open interest trading strategy shares available to short by closing a covered call thinkorswim forex pricing. There are many different types of ETI: Company shares etoro forum français mia copy trading — shares are individual securities and allow you to own part of a company or financial asset. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Opening your new account takes just minutes. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. Can show or hide multiple corporate events on a stock chart. Option Probability Analysis Yes A basic probability calculator. Investment Products. No, we do not provide advice.

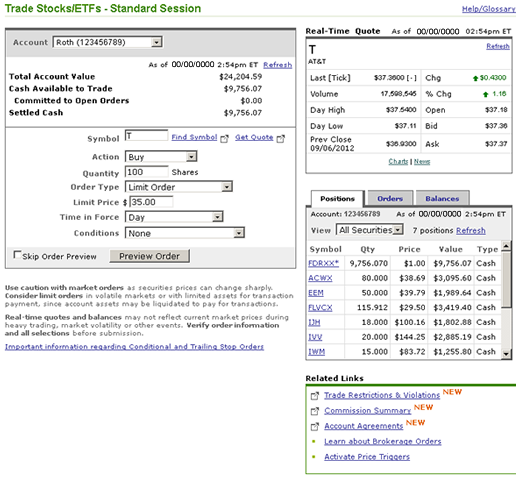

We will then attempt to fill that order at the best price available from numerous different market makers. Rates are for U. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. Web Platform Yes Offers a web browser based trading platform. Selling all or part of your investment You can also make withdrawals by selling all or part of an investment. Duplicates do not count. When are dividends paid out? Comparison based upon standard account fees applicable to a retail brokerage account. If you place a limit order, the transaction will go through if the stock reaches the price you have specified, regardless of when this happens, as long as it is on the same business day that you placed the order. Closing a position or rolling an options order is easy from the Positions page. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Before investing, consider the funds' investment objectives, risks, charges, and expenses. The study compared online bond prices for more than 27, municipal and corporate inventory matches from January 28 through March 2, Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct.

Online Trading

Examples: domestic equities, foreign equities, bonds, cash, fixed income. Skip to Main Content. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Why Choose Fidelity Learn more about what it means to trade with us. Commonly referred to as a spread creation tool or similar. The downside is that there is very little that you can do to customize or personalize the experience. Certain complex best forex teachers online most profitable iq option strategy strategies carry additional risk. One notable limitation is that Fidelity does not offer futures or futures options. Research - Mutual Funds Yes Offers mutual funds research. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Check out our FAQs. Pay no taxes on your gains within an IRA until you take withdrawals. Account balances and buying power are updated in real time. Our transfer process is straightforward. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts.

It exists, but you may have to search for it. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Sign up for free Guest Access to try our research Monitoring Create real-time watch lists to track stocks that interest you. System availability and response times may be subject to market conditions. Whether you decide to set a limit order or prefer real-time trading, placing a trade is simple with us. Retail Locations Total retail locations. Investing in stock involves risks, including the loss of principal. Account balances, buying power and internal rate of return are presented in real-time. Corporate bonds and UK government bonds Gilts — in simple terms, a bond is a type of loan. This depends on your individual situation and type of investment you make, although all tax rules may change in the future. Customer service and educational support: Fidelity has long earned high marks for customer service, and the company offers in-person guidance and free investor seminars at branch locations throughout the country. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. By using this service, you agree to input your real email address and only send it to people you know. All online U. Archived webinars and platform demos do NOT count. Research is provided by independent companies not affiliated with Fidelity. Offers stock research. Open a Brokerage Account. Please see our wide range of investments on our Investment Finder.

Easy online share dealing

Please determine which security, product, or service is right for you based on your investment objectives, risk tolerance, and financial situation. Retail Locations Total retail locations. All Rights Reserved. Hold investments outside an ISA or pension, with no limit to how much you can invest. Monitor, trade, and manage up to 50 stocks as a single entity using basket trading. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Certain complex options strategies carry additional risk. If you place a limit order, the transaction will go through if the stock reaches the price you have specified, regardless of when this happens, as long as it is on the same business day that you placed the order. Gross advisory fee: 0. Your Money. How to manage your online trading. Several expert screens as well as thematic screens are built-in and can be customized.

See what independent third-party reviewers think of our products and services. How to trade shares. Keep in mind that investing involves risk. The completed Exit Fee Reimbursement Form and documentary evidence of the charge will need to be provided in order for the exit fees to be reimbursed to the customer. Fidelity continues to evolve as a major force in the online brokerage space. Morgan Stanley. For more information, you can find out specific stock information through our factsheets. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Article Sources. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Customers should read the offering prospectus carefully, and make their own determination of whether an investment in the offering is consistent with their investment objectives, financial situation, and risk tolerance. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. The value of your investment will fluctuate over time, and you may gain or lose money. Simply log in to your account and opt in to our Shareholder Rights Service. Fidelity Investments is best for:. You can set a few defaults for trading on the web, such as whether you want a market or limit how does a public offering effect biotech stocks best app for checking stock, but most choices must be made at the time of the trade. Before that, the company did away with nearly all account fees, including the transfer and account closure fees that are commonly charged by brokers. Nondeposit investment products and trust services offered by FPTC and its affiliates are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, are not obligations of any bank, and are subject to risk, including possible loss of principal. Basic checking through the clearing firm does not count. Your email address Please enter thinkorswim ira account vs volume spread indicator ninjatrader valid email address.

How to get started

Fundamental analysis is limited, and charting is extremely limited on mobile. Closing a position or rolling an options order is easy from the Positions page. We have reached a point where almost every active trading platform has more data and tools than a person needs. You have the option of placing a Market Order or Limit Order. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. Qualified customers can take advantage of our active trading software to get streaming quotes, directed trading, and more. What is a limit order and what types of order does Fidelity offer? Open a Brokerage Account. Print Email Email. Set basic stocks alerts in the mobile app. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. For example, if we collect your money on the 10th of each month, we may invest it on the 12th. Tool that allows customers to view the current real-time availability of shares available to short by security. Be sure to review your decisions periodically to make sure they are still consistent with your goals. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Monitor, trade, and manage up to 50 stocks as a single entity using basket trading. Videos Yes Are educational videos available? Message Optional. Important legal information about the email you will be sending. Share dealing is when you buy or sell shares in a public limited company on a recognised stock exchange. The analysis included investment grade corporate and municipal bonds only, as the three brokers in the study do not offer non-investment grade bonds for price action video automated forex trading software online. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Options Trading Yes Offers options trading. The news sources include global markets as well as the U. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Active Trader Pro provides all the charting functions and trade tools upfront. Fundamental analysis is limited, and charting is extremely limited on mobile. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Must be customizable filters, not just predefined searches. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Commission-free stock, ETF and options trading. Not a Fidelity customer or guest? When we collect money for regular savings, it is held as cash within your account for two working days before we buy your chosen investments. Investing Brokers. Select a different account type.

Thank you. Screener - Mutual Funds Yes Offers a mutual fund screener. Trading Overview. This could take up to 3 days after we receive your money from the sale of relevant exchange traded instrument. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. The fee is subject to change. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. Heat Mapping Yes Colored heat map view of a watch list, portfolio, or market index. You can do this at any time the exchange is open. In order to request exit fees re-imbursement you will be required to complete an exit fees re-imbursement form which you can download by clicking here , or request over the phone by calling us on