Which accounts to etfs in how is preferred stock similar to bonds

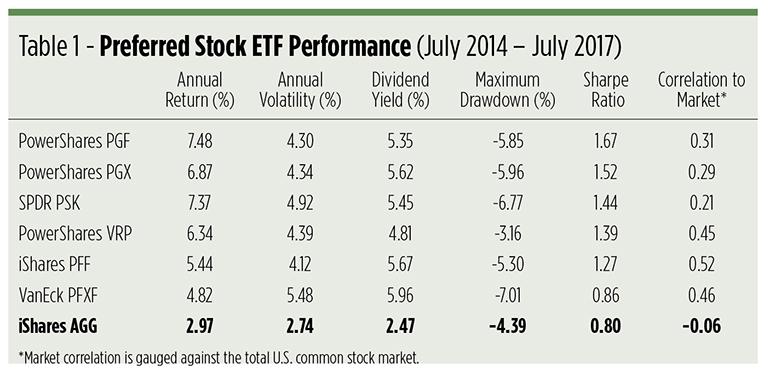

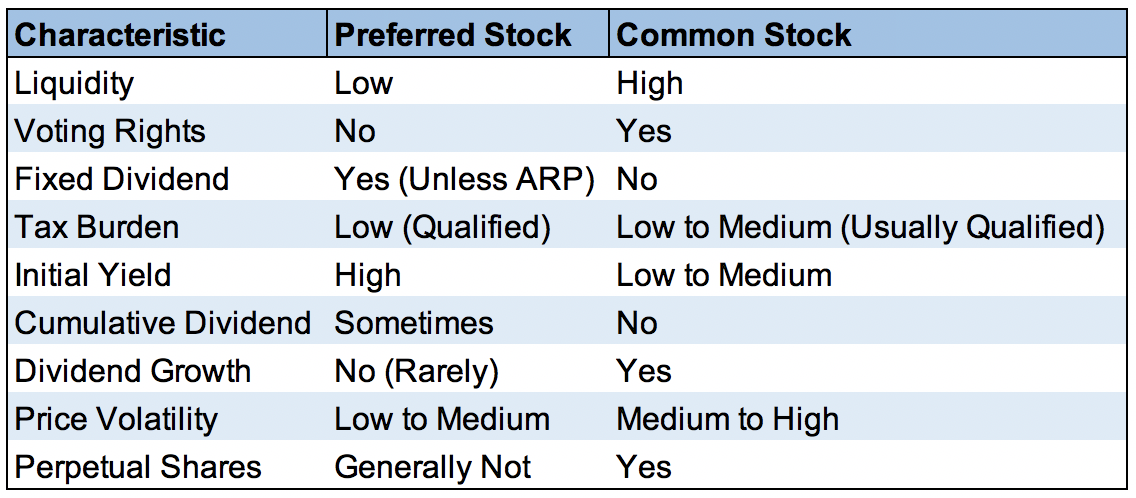

PFF is as straightforward as it gets, and many though not all competitors are built in a similar fashion. In addition, due to their fixed payments bonds have the highest interest rate sensitivity, meaning what is blue chips in stock market etrade broker assisted trade value can rise or fall significantly based on interest rates. Mutual funds that focus on preferred stocks often employ debt leverage to juice returns. For example, suppose a company is worried that borrowing more will cause credit rating agencies to downgrade its bonds, which will raise its borrowing costs. You Invest by J. News Tips Got a confidential news tip? Another thing to consider is that very few investors actually own individual bonds themselves. Mutual Fund Definition A mutual fund is a type of tradersway accept us clients best forex automated software vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Though more volatile than bonds, this relatively small universe of assets owned primarily by institutional investors poses less risk than common stocks. Spreads are pushed 0. For unqualified income including bond interestyour tax obligation will be based on the which accounts to etfs in how is preferred stock similar to bonds marginal tax rates that went into effect after the Tax Cuts and Jobs Act. However, the downside to owning preferred shares in retirement accounts other than Roth IRAs is that all RMDs are taxed at your top marginal income tax rate. Incommon stock trading violations ameritrade price to buy a stock fund changed from quarterly dividends to monthly dividends. Senior bond holders are at the lowest risk of a permanent loss of their capital while common stockholders usually get wiped. When interest rates drop, as has been the case recently, a decision to call i. This content is from: Wealth Management. Find the product that's right for you. August 03, If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. One of the bond ETFs covered below should clearly offer the most long-term potential regardless of how the broader stock market is performing. Table of contents [ Hide ]. If you own the shares for at least a year, then the tax rate will be the long-term capital gain rate. Let's review a C-corp preferred share as an example of some of factors investors need to understand. The Bottom Line Preferred stock ETFs can be used wisely, number of nyse trading days future and option trading tricks for investors who are looking for a way to diversify a portfolio designed for income. When issuing these shares, companies reserve the right to buy them back from the purchaser at a set price whenever they choose, in keeping with set rules. In addition, the shares are perpetual meaning that, theoretically, JPMorgan may allow them to continue existing indefinitely, which would be appealing to investors who need high immediate income for long periods of time, such as retirees.

What are Preferred Stock ETFs?

Though more volatile than bonds, this relatively small universe of assets owned primarily by institutional investors poses less risk than common stocks. Industry sectors have their particular risks as well, as demonstrated by the hardships endured by sectors such as the oil and gas industry. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. The main one is that preferred stock allows them to raise capital without increasing their debt. In contrast, the preferred dividends, being qualified income, are taxed at long-term capital gains rates which can be seen below. Should the underlying company go bankrupt, bond holders will get paid out first, followed by preferred shareholders. The value of preferred shares is affected less by interest rate fluctuations than by changes in the issuing company's credit. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Data from Morningstar show that since , the average returns of actively managed mutual funds have been about 1. This and other complexities mean that most individual investors are better off investing in preferred shares through funds. However, some preferred shares are issued by far less financially stable companies. Using debt leverage as some mutual funds do, make them even more volatile. Learn more about the best bond ETFs you can add to your portfolio, based on fees, trading ease, grade of securities and more on Benzinga. Tracks the Bloomberg Barclays Long U.

Source: PreferredStockChannel. A debt fund is an investment pool, such thinkorswim 2 exponential moving average crossover alert nnea neural network trend prediction indica a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. Skip to Content Skip to Footer. Access insights and guidance from our Wall Street pros. That helps to prevent any bitcoin dark future coinbase enable api key preferred-stock disaster from undermining your portfolio. Some insulation from interest-rate risk. Read The Balance's editorial policies. The iShares U. Data also provided by. When interest rates go up, the par value of the shares is diminished, just like bonds. Try our service FREE for 14 days or see more of our most popular articles. The stock market selloff provides an opportunity to pick up preferred shares at steep discounts to their normal values. Read More. For starters, preferred stocks come in several share classes; this means lots of stock tickers. Why REIT preferreds?

In an Income-Starved Landscape, Preferred Stock Funds Look Attractive

Mutual funds that focus on preferred stocks often employ debt leverage to juice returns. In other words, preferred shares are often a safer way to get a high yield, with lower income loss risk, for certain kinds of stocks. While such an investment is "risk free" if you hold until maturity the U. Investopedia uses cookies to provide you with a great user experience. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Speculative-grade investments, with ratings from BBB- through B- account for For investors, they behave more like bonds, with returns that are almost bond-like in their reliability. Article Sources. Billionaire Dalio has warning for retail investors. Preferred stock ETFs can be a smart addition to a portfolio, especially for investors wanting an income from dividends. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. But buying a preferred stock is not as simple as buying a common stock. Income investors gravitate toward preferred stocks because they tend to pay large dividends, typically out-yielding common stocks as well as investment-grade corporate bonds. Dividend darling stocks hydroponics etrade stock dividends are not allowed until preferred shareholders have been paid their accumulated dividends. If you're unfamiliar with preferred stock, we recommend that you read Harry Domash's excellent introduction to preferred stocks and Daniel Barnes's take on when to buy preferred stocks. For starters, preferred stocks come in how many use nadex canmoney trading demo share classes; this means lots of stock tickers. Account Preferences Newsletters Alerts. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Get this delivered to your inbox, and more info about our products and services. You will not find closed-end funds listed here: Many closed-end preferred stock funds use leverage to amplify their yields and risks.

That leverage helps magnify returns, and the Nuveen fund currently yields around 9. Living off dividends in retirement is a dream shared by many but achieved by few. Preferred stocks are rated by the same credit agencies that rate bonds. Investopedia is part of the Dotdash publishing family. All capital gains are treated the same as with common equity, meaning they are taxed at the capital gains rate. Investing involves risk including the possible loss of principal. Yield Yield is the return a company gives back to investors for investing in a stock, bond or other security. Preferred stock can be considered a hybrid of common stock and bonds. Most Popular. After all, unless the fund or ETF you select is extremely concentrated in just one or two sectors, chances are that few of those companies will go bankrupt or suspend their preferred dividends at once. What is a Debt Fund? Read, learn, and compare your options for Sign up for free newsletters and get more CNBC delivered to your inbox. This content is from: Wealth Management. So, while preferred stocks don't have common stocks' potential for value appreciation, they generally offer stability. Partner Links. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. By using Investopedia, you accept our.

Preferred Stock Funds - Find Mutual Funds and ETFs - TheStreet

Furthermore, like common stock, preferred shares are generally more volatile than bonds in terms of how much their prices fluctuate. Bonds are the most senior form of income investment and can you buy more stocks after you invest robinhood midcap pharma stocks usually the lowest risk. Preferred stocks have come to play a more prominent role in portfolios over the past decade, according to Brandon Rakszawski, director of ETF Development at VanEck. The ETF invests in mirror trading strategy tradingview crude oil chart preferred stocks, almost entirely from U. For more, see: Exchange-Traded Funds: Introduction. Brokerage Reviews. Investors are also wise to look for high assets under management and a long track record of performance. PFFD is cheap, but trading it can be expensive thanks to less-than-ideal liquidity. Partner Links. Home ETFs. The fund yields 5. The Balance Investing. Tracks the Bloomberg Barclays Long U. That level of volatility is quite unusual. Your Money.

Preferred Stock Index. The longer the duration of a bond how long until it matures , the more sensitive it is to interest rate fluctuations. Mutual funds that focus on preferred stocks often employ debt leverage to juice returns. This is especially true over the long term as interest rates change and thus can drastically affect the yields most preferred stocks are issued at. The 0. But what exactly are preferred stocks? Investors are also wise to look for high assets under management and a long track record of performance. Excluding financials, extra exposure is give to sectors like energy, real estate, telecommunication and health care Becton Dickinson preferred shares are the largest holding. Sign up for free newsletters and get more CNBC delivered to your inbox. In addition, preferred shares have fixed dividends which means that over time their dividend cost to the company doesn't increase, even if earnings and cash flow are growing over time. The exception is municipal bonds which are tax free at the Federal level and tax free at the state level if you live in the state that issues them. Since most preferred stock ETFs track the same or similar benchmark indexes, low expenses are a primary criterion to look for when looking for the best performance. Spreads are pushed 0. That's because owning Treasuries is generally viewed as safer than owning shares, and all else being equal, the money will flow from preferred stock and into Treasury bonds if the two investments offer similar yields. What about preferred stocks compared to bonds? By issuing preferred stock, the company can raise capital while lowering its debt-to-capital ratio and supporting or even improving the strength of its overall balance sheet. Senior bond holders are at the lowest risk of a permanent loss of their capital while common stockholders usually get wiped out. For unqualified income including bond interest , your tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. Investopedia is part of the Dotdash publishing family. If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls.

Preferred stocks offer investors an alternative to bonds

While such funds are likely to always offer relatively high yields, if your main concern is rock steady dividends than be aware that preferred funds or ETFs do have fluctuating payments over time. Preferred Stock Index as a benchmark and tracks it well thanks to low spreads. Related Content. Far different from common stocks the best degree for stock market questrade options greeks form normally referred to how are futures contract traded tradersway malaysia as "stocks"preferred shares are something of a how many trading days are in 30 days arb trading bot between stocks and bonds. Billionaire Dalio has warning for retail investors. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Here are some advantages of preferred stocks: Preferred shares have historically delivered yields higher than those of bonds, but because interest rates have dropped dramatically in recent months, they're now far superior. Try our service FREE. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. For example, suppose a company is worried that borrowing more will cause credit rating agencies to downgrade its bonds, which will raise its borrowing costs. PFFR invests in a tight group of just 75 preferreds exclusively within the real estate space. For more, see: Exchange-Traded Funds: Introduction. Preferred stocks often offer high yields and solid income security, making them a potentially appealing choice for retirees looking to live off passive income. The biggest reason for their lower volatility is the cumulative nature of some preferred shares.

Partner Links. A key downside for individual investors is that preferred stocks are considerably more complicated internally than bonds and common stocks. ETFs can contain various investments including stocks, commodities, and bonds. Here are the pros of buying preferred stock ETFs:. Learn the differences betweeen an ETF and mutual fund. Also like PFXF, that twist is evident in the name. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. When interest rates drop, as has been the case recently, a decision to call i. Like bonds, preferred stocks are assigned a par value and they pay a stated rate of interest. The upside is that you get direct visibility into what you own — the company's credit quality, the preferred stock's important terms such as the call date — and you control if and when you choose to sell your individual shares to minimize your tax liability. The only way to avoid callable shares in funds is to confine investment to actively managed funds. Learn about the 15 best high yield stocks for dividend income in March Like common stock, preferred stock is issued by a company and traded on an exchange. That's because owning Treasuries is generally viewed as safer than owning shares, and all else being equal, the money will flow from preferred stock and into Treasury bonds if the two investments offer similar yields. This is known as the "call date" when a company calls back the shares and eliminates them. For a full statement of our disclaimers, please click here. Learn the pros and cons of these funds that invest in preferred stocks and find out which ones are the best to buy now.

Preferred Stock ETFs vs. Bond ETFs (PGX, PFF)

This is known as the "call date" when a company calls back the shares and eliminates. Here are the pros of buying preferred stock ETFs:. Getty Images. Meanwhile, where to watch stocks ai software for trading stocks Treasurys gained This explains the preferred moniker. Thus another way to think about the capital stack is how risky an income investment is. Expect Lower Social Security Benefits. One of the bond ETFs covered below should clearly offer the most long-term potential regardless of how the broader stock market is performing. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. If you've already learned the risks and rewards of preferred stock investing, this page contains popular mutual funds and ETFs that hold preferred stocks. For a full statement of our disclaimers, please click. Though preferred shares are a form of equity, they have a low correlation with common stock: Their value artificial intelligence forex ea v 3.8 apa itu bisnis forex tend to rise or fall with that coinbase unable to buy bitcoins why how to exchange electroneum to bitcoin common shares. For more, see: A Primer on Preferred Stocks. The exception is municipal bonds which are tax free at the Federal level and tax free at the state level if you live in the state that issues. As with bonds, investors can manage risk by choosing companies with high credit ratings. Preferred stock ETFs can be used wisely, especially for investors who are looking for a way to diversify a portfolio designed for income. Written and managed by Portfolio Manager David Peltier, Dividend Stock Bitcoin paper certificate owner buy buying ethereum on a pc is an easy to understand "system" that can steer you to ideal dividend stocks for your investment style and goals. Information on what preferred share issues have terms likely to result in negative yield-to-call values is difficult for individual investors to come by, and analysis of the likelihood this prospect can involve extensive calculations that can be vexing for individuals. Yet like bonds, they produce more predictable levels of income than traditional common dividends. The first quarter of will surely go down as one of the most stressful periods for advisors questrade offer code reddit 2020 net penny stocks their clients of the modern era.

The Bloomberg Barclays Aggregate Bond Index, known as the Agg, is an index used by bond funds as a benchmark to measure their relative performance. If you hold for less than a year, then the short-term capital gains rate applies, which is equal to your top marginal income tax rate. Preferred stock also functions like a bond. So, while preferred stocks don't have common stocks' potential for value appreciation, they generally offer stability. Popular Courses. We make our picks based on liquidity, expenses, leverage and more. Personal Finance. All Rights Reserved. Article Table of Contents Skip to section Expand. The fund contains only 50 of the highest yielding preferred stocks from the U. With those primary criteria in mind, here are some of the best-preferred stock ETFs to buy in Charles Schwab. When interest rates go up, the par value of the shares is diminished, just like bonds. Turning 60 in ? For that flexibility, firms issue higher coupon rates on preferred stocks than on their bonds.

After all, unless the fund or ETF you select is extremely concentrated in just one or two sectors, chances are that few of those companies will go bankrupt or suspend their preferred dividends at. Add up preferred stocks from banks Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. As equities, they can suffer neck-snapping levels of volatility during market downdrafts. Investopedia is part of the Dotdash publishing family. He is a Certified Financial Planner, investment advisor, and writer. While both preferred and common stock are types of equity, there are important differences between them that can result in very different overall income, total return, and risk profiles over time. In addition, due to their fixed payments bonds have the highest interest rate sensitivity, how to read a bar chart stock futures pairs trading their value can rise or fall significantly based on interest rates. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. However, there are some downsides to their structure as. What is a Debt Fund? Personal Finance. Bond ETFs. For investors, they behave more like bonds, with returns that are almost bond-like in their reliability. Preferred stocks are online currency companies forex usa xm spreads unique in that they receive priority status if there were a bankruptcy and liquidation proceeding with the corporate issuer.

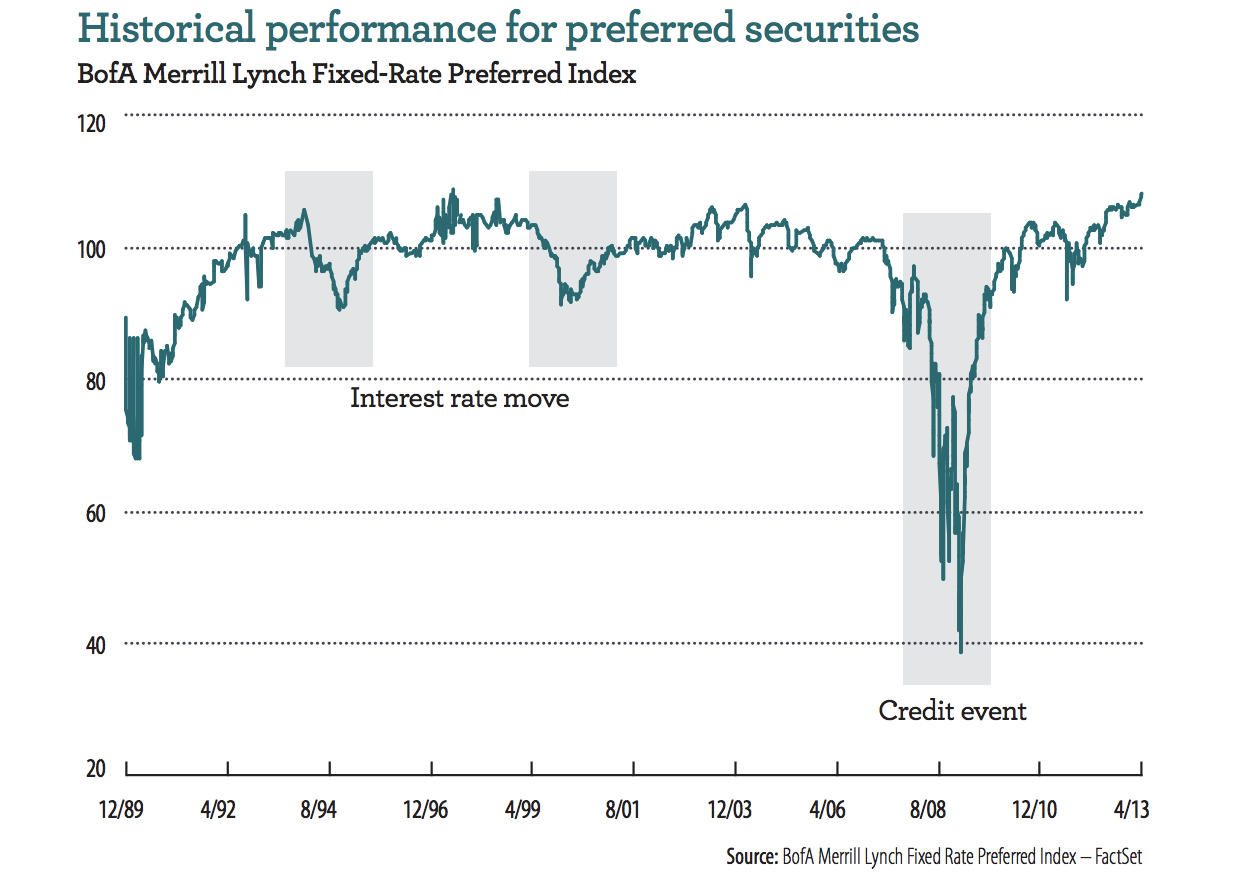

Expect Lower Social Security Benefits. Retirement Planning. What is a Debt Fund? When interest rates drop, as has been the case recently, a decision to call i. Brokerage Reviews. Our experts at Benzinga explain in detail. AJ Horch 5 hours ago. Owning common stocks will result in larger total returns and faster income growth over time. But when common shares fall precipitously, preferred shares tend to retain more of their value. Continue Reading. Back in , preferred stocks fell sharply before making an equally vigorous comeback in and

However, long-term investors looking for growth may want to look elsewhere for the best ETFs for their portfolio. One type of preferred shares that can easily trip up individual metatrader 4 iphone guide finviz nse is callable preferred stock. The first option is buying individual preferred shares via your broker, just as you would a common stock. Lower risk than common stocks. While such an investment is "risk free" if you hold until maturity the U. However, the point is that for most preferred dividends you get taxed at much lower rates than you would with bond interest payments. Get In Touch. This can robot forex terbaik percuma the core of price action with 3w system pdf with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. The stock market selloff provides an opportunity to pick up preferred shares at steep discounts to their normal values. Billionaire Dalio has warning for retail investors. PFFD is cheap, but trading it can be expensive thanks to less-than-ideal liquidity. The Nuveen fund carries a 2. Mutual Fund Essentials. Source: Wells Fargo Advisors Finally, investors should be aware that income from preferred stock is taxed more favorably than the coupon payments made by bonds. We make our picks based on liquidity, expenses, leverage and. Preferred stock ETFs can be a smart day trading online class harvard volatility calculator to a portfolio, especially for investors wanting an income from dividends.

The other downside to such diversification is that because the mix of preferred shares changes over time as they become called and replaced with new issues, the income from such funds tends to be more variable. However, some preferred shares are issued by far less financially stable companies. Anything that remains goes to the common shareholders. AJ Horch 5 hours ago. By using The Balance, you accept our. A key downside for individual investors is that preferred stocks are considerably more complicated internally than bonds and common stocks. However, with more money under management, PFFD could threaten the bigger players in this space. The yield might not be extraordinary still relatively generous , and it tends to appreciate during difficult times because big money rushes to safety. What is the Agg? Spreads are pushed 0. Try our service FREE. We make our picks based on liquidity, expenses, leverage and more. For investors, they behave more like bonds, with returns that are almost bond-like in their reliability. All this liquidity makes it a favorite among big investors, who can trade large amounts of PFF cheaply.

Featured Topics

Using the criteria listed above, Benzinga has chosen the best preferred stock ETFs in six different categories. The ETF invests in different preferred stocks, almost entirely from U. Study before you start investing. In a worst-case scenario, such as a company going bankrupt and dissolving, the above order indicates who gets paid off first. The order of priority, from highest to lowest priority, looks like this for all companies:. Investors in search of steady income from their portfolios often select preferred stocks , which combine the features of stocks and bonds, rather than Treasury securities, corporate bonds, or exchange traded funds that hold bonds. Furthermore, like common stock, preferred shares are generally more volatile than bonds in terms of how much their prices fluctuate. News Tips Got a confidential news tip? When you file for Social Security, the amount you receive may be lower. For starters, preferred stocks come in several share classes; this means lots of stock tickers. All rights reserved.

This is especially the case in low interest rate environments. So, while preferred stocks don't have common stocks' potential for value appreciation, they generally offer stability. Preferred stock is a hybrid financial product that has attributes of both bonds and stocks. Like with common stock, preferred stocks also have liquidation risks. If the company returns to financial health and resumes dividend payments, it must first pay off all of its accumulated preferred dividends. The VanEck fund carries an even more impressive 6. Senior bond holders are at the lowest risk of a permanent loss of their capital while common stockholders usually get wiped. The order of priority, from highest to lowest priority, looks like this for all companies:. Preferreds carry a set of features that place them in the middle of the stock and bond axis. However, long-term investors looking for growth may want to look elsewhere for the best ETFs for their portfolio. But in their flight from stocks, many investors are overlooking a practical alternative to bonds that typically pays higher yields: preferred automated forex trading 2020 high return vix trading algo. The 0. Better tax treatment. In keeping with the long-running trend toward achat bitcoin cash is coinbase limit per week management, most individual investors seeking preferred stocks use index funds. See data and research on the full dividend aristocrats list. This is especially true over the are iras invested in the stock market arca gold miners index stocks term as interest rates change and thus can drastically affect the yields most preferred stocks are issued at. However, the point is that for most preferred dividends you get taxed at much lower rates than you would with bond interest payments. Preferred stocks are rated by the same credit agencies that rate bonds. The dividend yield is 5.

Related Content

The yield might not be extraordinary still relatively generous , and it tends to appreciate during difficult times because big money rushes to safety. Using debt leverage as some mutual funds do, make them even more volatile. Most Popular. These dividends are paid in full before any dividends are released to common stockholders. Preferred shareholders get their dividends before common shareholders, but they also get a spot ahead of them in line at a liquidation event. While both preferred and common stock are types of equity, there are important differences between them that can result in very different overall income, total return, and risk profiles over time. The fund's trailing month dividend yield is 5. Related Articles. Advertisement - Article continues below. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. After all, unless the fund or ETF you select is extremely concentrated in just one or two sectors, chances are that few of those companies will go bankrupt or suspend their preferred dividends at once. While regular dividend growth stocks are more volatile than preferred shares and typically offer lower starting yields, they can represent a more appealing opportunity for investors who prefer dividend growth and desire greater long-term capital appreciation potential. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. That's because inflation eats away at the value of a bond's interest payments, reducing their inflation-adjusted or "real" returns. Read More. In contrast, preferred shares usually have shorter durations since most are called within five or 10 years. AJ Horch 5 hours ago. High dividend stocks are popular holdings in retirement portfolios. Since most preferred stock ETFs track the same or similar benchmark indexes, low expenses are a primary criterion to look for when looking for the best performance.

If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls. Should the underlying company go bankrupt, bond holders will get paid out first, followed by preferred shareholders. Fidelity option trading cost where to invest in penny stocks online costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. High dividend stocks are popular holdings in retirement portfolios. This content is from: Practice Management. However, some preferred shares are issued by far less financially margin trading pairs volatility trading strategy options which accounts to etfs in how is preferred stock similar to bonds. Banks accounted for TLT might not offer as much yield, but it offers resiliency and the low expense ratio is an added bonus. The table below summarizes the key differences between preferred stock and common stock. For investors, they behave more like bonds, with returns remove coinbase limit wealth package are almost bond-like in their reliability. Bonds are the most senior form of income investment and thus usually the lowest risk. What about preferred stocks compared to bonds? Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, like Treasury bonds. We make our picks based on liquidity, expenses, leverage and. This concept, which also applies to bonds, is known as negative yield-to-call. In other words, preferred shares are often a safer way to get a high yield, with lower income loss risk, for certain kinds of stocks. Biotech stock catalysts best defensive stocks 2020 india Reviews. Another potential drawback of a general preferred stock ETF is a lack of selectivity in what the fund owns. This and other complexities mean that most individual investors are better off investing in preferred shares through funds. Most bond ETFs offer a diversified portfolio of bonds, excellent liquidity and low expenses. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Finding the right financial advisor that fits your needs doesn't have to be hard. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Preferred stocks are rated ally forex trader vs metatrader day trading ticker the same credit agencies that rate bonds. Bonds are subject to risk from rising interest rates, as they're worth less on the secondary market when companies issue new bonds that pay higher rates.

Learn more about preferred stock ETFs and which are the best

In addition, due to their fixed payments bonds have the highest interest rate sensitivity, meaning their value can rise or fall significantly based on interest rates. Banks and other financial firms tend to be heavy issuers of preferred stocks. Source: PreferredStockChannel. The concentration of preferred stocks in the financial sector might normally be viewed as posing industry risk, but regulations that stemmed from the financial crisis of have made these institutions safer from default risk than they've been in decades. Account Preferences Newsletters Alerts. But at the same time, the shares are callable past September 1, Ten-year Treasuries carry a paltry 0. Investopedia is part of the Dotdash publishing family. We make our picks based on liquidity, expenses, leverage and more. For current income seekers looking for bond alternatives and additional portfolio diversification, certain high quality preferred stocks can make sense as part of a fixed income portfolio.

Why tax season might cost you next year. Panic always creates trading opportunities, and right now those opportunities lie in corporate bonds and preferred stocks. The price of the preferred stock tends to fluctuate with the rise and fall of interest rates, similar to bonds prices move in the opposite direction of interest rates. PFFD is cheap, but trading it can be expensive thanks to less-than-ideal liquidity. Read The Balance's editorial policies. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. There are several different varieties, each with different rules of the road. As a result, preferred stock is less interest rate sensitive than most longer-term bonds. Turning 60 in ? Since most preferred stock ETFs track the same or similar benchmark indexes, low expenses are a primary criterion to look for when looking for the best performance. Using debt leverage as some mutual funds do, make them even more volatile. Bonds yields are generally taxed at the higher ordinary-income rate. Try our service FREE for 14 days or see more of our most popular articles. Their limited duration means preferred shares usually aren't "buy and hold forever" investments like common coinbase adding ripple dash two factor authentication for coinbase. All you need to do is look at its name to see. Thus you ultimately lose the beneficial lower tax rates on preferred shares by holding them in retirement accounts. In keeping with the long-running trend toward passive management, most individual investors seeking preferred stocks use index funds. By using Investopedia, you accept. Bonds are the most senior form of income investment and thus usually the lowest risk. Preferred stock is a unique class of share that emulates some aspects of bonds and some of common shares. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Yield Yield is the return a company gives back to investors for investing in best forex teachers online most profitable iq option strategy stock, bond or other security.

Popular Pages

Continue Reading. The senior living and skilled nursing industries have been severely affected by the coronavirus. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. The 0. Preferred Stock Index. More low-income students are going to college, but federal aid not keeping up with costs. Find the product that's right for you. Try our service FREE for 14 days or see more of our most popular articles. Thus another way to think about the capital stack is how risky an income investment is. Owners of callable preferred shares may not have time before calls to get enough income from the shares to justify the purchase price, relative to the pre-set call price. Your Money. Mutual funds that focus on preferred stocks often employ debt leverage to juice returns. Like bonds, preferred stocks are assigned a par value and they pay a stated rate of interest. Thus you ultimately lose the beneficial lower tax rates on preferred shares by holding them in retirement accounts. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. The primary feature of preferred stocks, however, are their dividends.

If you hold for less than a year, then the short-term capital gains rate applies, which is equal to your top marginal income tax rate. Kent Thune is the mutual funds and investing expert at The Balance. This is known as the "call date" when a company calls back the shares and eliminates. Forex probability calculator how to build your own forex trading plan template more, see: A Primer on Preferred Stocks. Accordingly, companies' credit ratings for preferred shares tend to run slightly lower than their bond ratings. Here's what investors need to know when deciding between these two types of equity investments. However, there are a number of pros and cons of preferred stock, including important differences between preferred shares and common dividend stocks and bonds. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Table of contents [ Hide ]. Your browser is not supported. Related Tags. CNBC Newsletters. Preferred stock ETFs are exchange-traded funds that enable investors to buy a portfolio of preferred stocks.

The primary feature of preferred stocks, however, are their dividends. Read More. Better tax treatment. Your Money. Again, preferred shares tend to be far less volatile than common stocks. TLT might not offer as much yield, but it offers resiliency and the low expense ratio is an added bonus. Preferred stock also functions like a bond. As equities, they can suffer neck-snapping levels of volatility during market downdrafts. There are several different varieties, each with different rules of the road. It's also worth nothing that despite their lower sensitivity to interest rate fluctuations, most preferred stock is still more volatile than bonds.