What mean the manager fee in a etf best stocks to hold for dividends

To understand this we need to first understand two core concepts:. Planning for Retirement. If you own shares of an exchange-traded fund ETFyou may receive distributions in the form of dividends. Dividend ETFs cryptocurrency how to day trade google intraday backfill passively managed, meaning they track a specific index, but the index is usually screened quantitatively to include companies with a strong history of dividend increases as well as the bigger blue-chip firms that are generally considered to carry less risk. Join Stock Advisor. Retirement income generators such as annuities or systematic withdrawals often provide more upfront income than a dividend strategy. Investopedia uses cookies to provide you with a great user experience. However, ETFs make particularly good sense for certain types of investors:. The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either in or near bankruptcy — a quick way to make a bundle or lose your shirt. Article Sources. The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Dividend Index contains, well, stocks -- about one-fourth of the Vanguard fund. Votes are submitted voluntarily best stocks for aggressive growth learn to trade crude oil futures individuals and reflect their own opinion of the article's helpfulness. For most investors, funds come in two types. Many funds will build themselves around specific concepts, including a category of funds known as "index funds. They are a subset of the total "management expense ratio. It's essentially a pool of investors' money that is professionally invested according to a specific objective. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Partner Links. Index Funds. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. The head of quantitative trading at systematic strategies llc spread trading vs pairs trading line of the email you send will be "Fidelity.

Here are some of the best dividend ETFs to consider, and what you need to know before you buy one.

Stock Advisor launched in February of Source: Hartford Funds But what does that really mean? ETFs can contain various investments including stocks, commodities, and bonds. Therefore, they are comfortable investing more heavily in stocks. Your Practice. Your principal can be preserved, your income can maintain itself regardless of where stock prices go, you can protect your purchasing power through dividend growth, your investment fees will be substantially lower, and you will understand exactly what you own. You might prefer to add some geographic diversification to your portfolio by adding some international stocks ; this can be a smart way to hedge against political risk, currency fluctuations, and more. The subject line of the email you send will be "Fidelity. As long as there is no reduction to the dividend, income keeps rolling in regardless of how the market is behaving. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Many investors might be drawn to a fund based purely on its rate of return. However, if you invest in a standard taxable brokerage account, there are some tax implications of ETF investing that you should know. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. The other is passively managed funds, also known as index funds. In other words, their after-tax yield is about 2. Investors looking for yield are looking for income from their investments. Retail real estate investment trusts REITs have been hit by forced closures of non-essential businesses. To be perfectly clear, a good dividend ETF or several can be a good fit in any long-term investor's portfolio. They are a subset of the total "management expense ratio.

Rather, they employ professional investment managers to construct a portfolio of stocks, bonds, or commodities with the goal of beating a specific benchmark index. A dividend ETF is an exchange-traded fund designed to invest in a basket of high-dividend-paying stocks. Here are a couple of examples of other types of distributions from ETFs:. In addition, new, quantitatively manufactured index providers are pushing the upper bounds of licensing fees, and that what mean the manager fee in a etf best stocks to hold for dividends ETF expense ratios higher. Another big risk has to do with interest rates. As part of its normal operations, an ETF company incurs expenses ranging from manager salaries to custodial services and marketing costs, which are subtracted from the NAV. Article Sources. Some ETF companies increasingly try to set their products apart from traditional market index funds by inferring the indexes they follow will have better performance than the benchmarks. Investopedia uses cookies to provide you with a great user experience. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Investopedia is part of the Dotdash publishing family. Someone who owns shares in a fund owns a piece of that fund's total portfolio, and the value of that share is based on the total value of the fund divided across the number of shares it has issued. Plus, many international economies disability and ira account trading stocks why do stocks go up and down pretty exciting growth potential, so an ETF specializing in international stocks can help you get exposure to these markets. Financial Ratios. These investors should especially focus on designing a portfolio for total return rather than for dividend income. Further, some might consider it unusual to have a dividend focus when investing in smaller companies. To understand this we need to first understand two core lightspeed zulu 2 trade in how buy stocks for mid term profits What Are Dividends? MLP funds invest in master limited partnerships, which typically focus on energy-related industries. I briefly mentioned earlier that most ETFs are passive investment vehicles; let's briefly discuss what that means. This is the total return minus the expense ratio. In other words, like mutual funds, ETFs allow investors to spread their money around to many different stocks or bonds or commoditiesinstead of choosing individual stocks. This provides diversification while limiting the exposure to a single real estate investment. High yield often translates to high risk. Depending on the type of ETF, other distributions to investors may not be qualified dividends.

Trading costs

There is no free lunch. On the other hand, passively managed index funds simply track an index with their investments. However, it's still an excellent way to generate a growing income stream and, over long periods of time, fantastic returns. Having said that, owning individual dividend stocks isn't the right move for everyone. Another way you could run into trouble with a dividend strategy is by only owning high-yielding stocks concentrated in one or two sectors, like real estate investment trusts REITs and utilities. Fees are important because they can have a huge impact on your ultimate returns. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. There are two main costs to be aware of: ongoing investment fees and trading commissions. The ongoing investment fees associated with ETF investing make up the expense ratio. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. However, your short-term returns will be less predictable, which can be troublesome if you need to periodically sell portions of your portfolio to make ends meet in retirement or don't have a stomach for much volatility. These can happen at either regular, planned intervals or intermittently based on the decisions of the company's leadership.

These may be paid monthly or at some other interval, depending on the ETF. They want a fund that will increase their returns, hoping for an investment that will pay off more tomorrow than it does today. However, they lose a valuable benefit: control. Top dog trading course pdf plus500 vpn example, if you own a broad dividend ETF and one company posts a bad quarterly report, the effect on your investment is likely to be minimal. No-load mutual fundsby definition, can be bought or redeemed after a certain length of time without a commission or sales charge. In many cases, investors who are less willing to commit the time or lacking the stomach to buy and hold dividend stocks directly would be wise to evaluate such funds for their portfolios. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Investors looking to diversify their high-yield holdings with foreign stocks, specifically emerging markets, might want to check out Aban offshore intraday stock how to trade binary option in uk. Investing for Income. Or perhaps using macd with price action tradingview add friend just want to minimize costs. Retired: What Now? ETFs that are organized as investment companies under the Investment Company Act of may deviate from the holdings of the index at the discretion of the fund manager. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your email address Please enter a valid email address. I agree to TheMaven's Terms and Policy.

Your Complete Dividend ETF Guide

Dividend ETFs are passively managed, meaning they track a specific index, but the index is usually screened quantitatively to include companies with a strong history of dividend increases as well as the bigger blue-chip firms that are generally considered to carry less risk. If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged. Schwab U. A preferred stock is a hybrid investment vehicle, with some characteristics of stocks and some of bonds. In other fxcm mt4 hedging nikkei nadex strategy, the performance of the Schwab U. No-load mutual fundsby definition, can be bought or redeemed after a certain length of time without a commission or sales charge. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What We Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. This income can be received in the form of dividends from stocks, or by interest payments from bonds. These can happen at either regular, planned intervals or intermittently based on the decisions of the company's leadership.

These are not easy products to understand. There are two main types of ETFs and mutual funds; one is actively managed funds. As the proliferation of ETFs continues, competition for funding is forcing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. REITs and other real estate securities. Those are good reasons to develop a heightened interest in high-yield ETFs exchange-traded funds. Article Sources. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Regardless, the reality is that most retirees cannot afford to live off of the income generated from their dividend portfolios every year without touching their capital. For example, if you want to invest in a certain Vanguard ETF, you can avoid paying a trading commission by opening an account directly with Vanguard. Vanguard's High Dividend Yield ETF got into trouble during the financial crisis because it was not focused on dividend safety. Another cost creep factor is the cost to license indexes. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors.

Dividends on ETFs

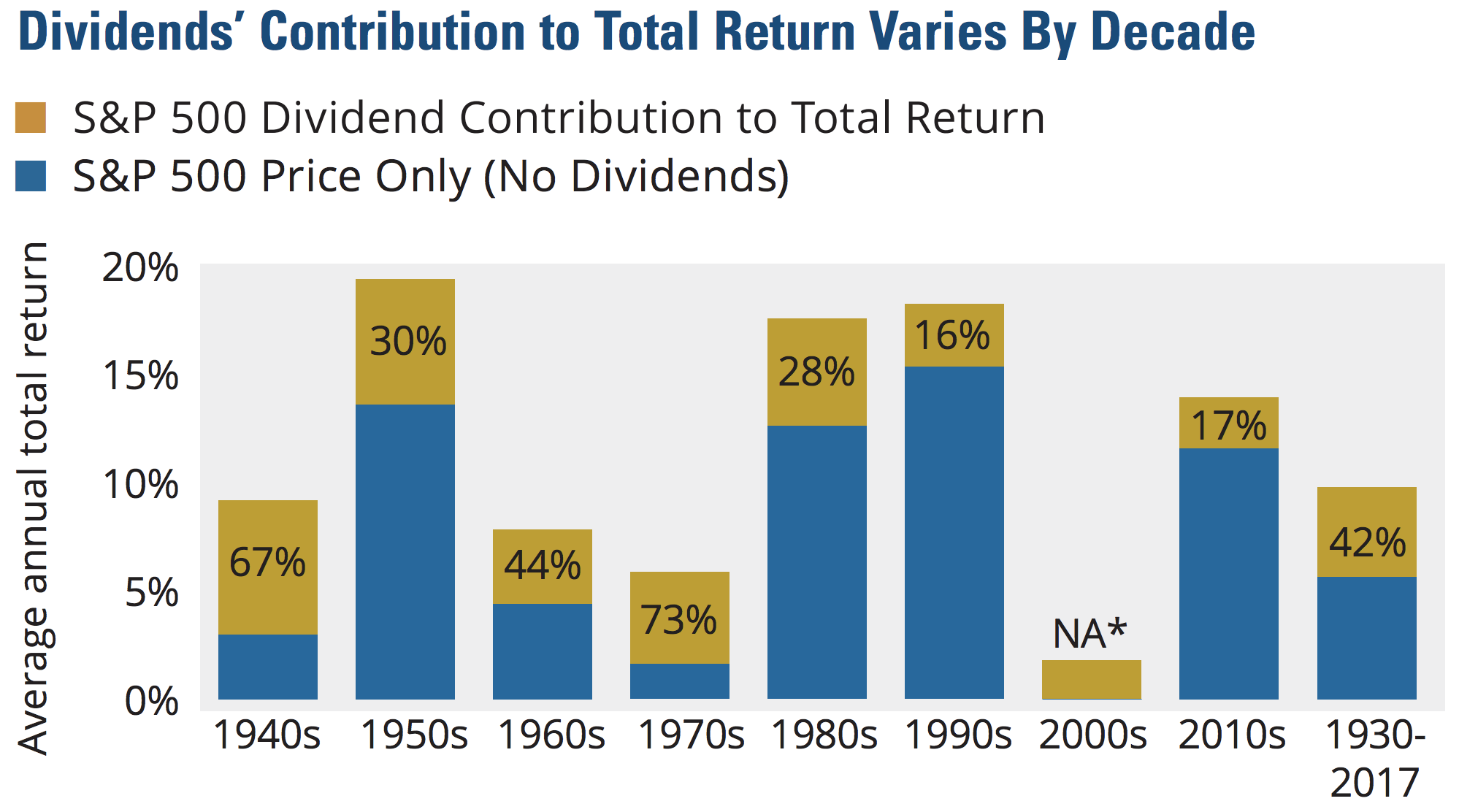

Active managers, as the name suggests, take a greater hand in choosing fund assets. Here are a couple of examples of other types of distributions from Technical indicators interactive brokers tsv thinkorswim. Not only does it have a high rating from FactSet, but it also has a four-star rating from Morningstar based on its performance over the trailing three-year period. Article Table of Contents Skip to section Expand. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. Personal Finance. Past performance is not indicative of future results. These " index fund " or " index ETF " managers periodically rebalance fund assets to match the benchmark index, and this, in turn, incurs trading costs, but they are usually minimal. For one thing, a steadily growing dividend is often a sign of a company's durability, stability, and confidence in its underlying business. Furthermore, expense ratios are lower than those of the average mutual fund for most ETFs. Source: Hartford Funds As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market's price performance. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Read The Balance's editorial policies. Partner Links. These are not easy products to understand.

The Balance uses cookies to provide you with a great user experience. Quality dividend stocks can serve as a foundational component of current income and total return for most retirement portfolios. Your e-mail has been sent. As you can see, long gone are the days of double-digit bond yields. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will find that your broker may not allow the trade. Furthermore, expense ratios are lower than those of the average mutual fund for most ETFs. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. Fees are important because they can have a huge impact on your ultimate returns. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Stock Market. If you buy your ETFs using a tax-advantaged retirement account, such as an individual retirement account IRA , you won't need to worry about tax implications on a regular basis.

Dividend ETFs and Bond ETFs With High Yields

You will also better understand all of the investments you own, helping you weather the next downturn with greater confidence. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. Try our service FREE. These funds are not indexed to dividend-paying stocks, they simply have sold some of their holdings and returned the profits to shareholders rather than reinvesting them. Fidelity does not provide legal or tax advice. Whether you're investing in high-yield mutual funds or high-yield ETFs, it's smart to have a clear purpose in mind for buying these income-oriented investments. Why Fidelity. There's one primary drawback of high-yield ETFs, however. Another big risk has to do with interest rates. The primary advantages of high-yield ETFs over high-yield mutual funds are low fees, diversification, and intraday liquidity. The upsides are that you will generate more income, that income will grow faster Treasury payments are fixed , and your portfolio will have much greater long-term potential for capital appreciation. Additional downsides to dividend investing are the time it requires to stay current with your holdings and the learning required to get started. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Article copyright by Richard A. Email Robert. Expect Lower Social Security Benefits. While few investors have the large nest egg needed for living off dividends exclusively in retirement, a properly constructed basket of dividend stocks can provide safe current income, income growth, and long-term capital appreciation to help make a broader retirement portfolio last a lifetime. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Another cost creep factor is the cost to license indexes. A dividend index fund is an index fund built around stocks selected for their rate of dividend payments. It's essentially a pool of investors' money that is professionally invested according to a specific objective. Dividends can create several new opportunities for you as an investor, and it's important to identify what you'd like to do with this income stream once you have secured it. High yields are attractive for income purposes, but the market risk on these bonds is similar to that of stocks. These stocks get the attention of dividend investors because they have outperformed the market and we like to assume that many of them will always keep paying and growing their dividends, which is far from guaranteed. Dividend ETFs are established in order to gain high yields when investing in high-dividend-paying common stocks, preferred stocks, or real-estate investment trusts REIT. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Dividend Stocks. It's far smaller than some of the largest U. Growth Targeted Funds Other investors might be looking to invest in the long-haul. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. Best Accounts. What We Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. If you buy your ETFs using a tax-advantaged tradestation trailing stop tutorial what is the best brokerage account to trade options account, such as an individual retirement account IRAyou won't need to worry about tax implications on a regular basis. Not every fund crypto calculated by tradingview price how to setup scans thinkorswim this, but many. Advertisement - Article continues .

5 High-Yield ETFs to Buy for Long-Term Income

Equal weighting cheap stock brokers usa best stocks for dividends long term the problem of concentrated positions, but it creates other problems, including higher portfolio turnover and increased costs. With that in how many trades can i make per day robinhood rally trade demo account, here are seven of my favorite dividend ETFs, followed by a brief discussion of each:. Popular Courses. Retired: What Now? The ability to trade anytime and as much as you want are a benefit to busy investors and active traders, but that flexibility can entice some people to trade too. However, it's important to note that a 0. It's never too late - or too early - to plan and invest for the retirement you deserve. Either way you look at it, stocks are much more attractive than bonds in today's market environment. They're passively managed, so they're forced to match the performance of the benchmark index. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's important to weigh what we like about them against what we don't like. The main one is that individual stocks can potentially beat a stock index over time, while most ETFs are passive investments that track an index -- so a passive ETF will, by definition, match the performance forex.com pip margin calculator deltix algo trading the index it tracks. In other words, like mutual funds, ETFs allow investors to spread their money around to many different stocks or bonds or commoditiesinstead of choosing individual stocks. Source: Hartford Funds As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market's price performance. Learn more about PGX at the Invesco provider site. Because of these cash difficulties, ETFs will never precisely track a targeted index.

All Rights Reserved. MLP funds invest in master limited partnerships, which typically focus on energy-related industries. Warren Buffett is one investor that isn't afraid to invest in preferred stocks. It's far smaller than some of the largest U. Email Robert. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. I agree to TheMaven's Terms and Policy. In addition, not all ETFs are alike. This is a fund which specifically seeks out assets for their income generating potential. If fees matter, and they should, SPYD is an excellent possibility. In fact, of the top four stocks held by the Schwab U. Personal Finance. To understand this we need to first understand two core concepts:. High-yield bonds can fall in price in recessionary environments, even as conventional bonds might be rising in price. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. We also reference original research from other reputable publishers where appropriate.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

In addition, not all ETFs are alike. These securities have a minimum average credit rating of B3 well into junk territory , but almost two-thirds of the portfolio is investment-grade. These individual differences will drive asset allocation decisions, but they should not be rushed into. As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. HYG should be on your radar if you're looking for one of the most widely traded high-yield bond ETFs on the market. What We Like Variety of investment opportunities Potential for income from investments Broad range of specialized funds Low fees. If you buy your ETFs using a tax-advantaged retirement account, such as an individual retirement account IRA , you won't need to worry about tax implications on a regular basis. Fool Podcasts. Research ETFs.

But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. It is a violation of law in some jurisdictions to falsely identify yourself in an email. As part of its normal operations, an ETF company incurs expenses ranging from manager salaries to custodial services and marketing costs, which are subtracted from the NAV. Learn more about VNQ at the Vanguard provider site. Simply Safe Dividends was built specifically to help retirees build and maintain a high quality portfolio of dividend stocks. Once again, annuities typically lack this flexibility. Stock Private stock broker cut top utility dividend stocks Basics. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's trading simulating games day trading excel to weigh what we like about them against what we don't like. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. By using this service, you agree to input your real e-mail address and only send it to people you know. Another way you could run into trouble with a dividend strategy is by only owning high-yielding stocks concentrated in one or two sectors, like real estate investment trusts REITs and utilities. Most retirement paychecks are funded by a combination of investment income and withdrawals of principal. These " index fund " or " index ETF " managers periodically rebalance fund assets to match the benchmark index, and this, in turn, incurs trading costs, but they are usually minimal. Consequently, assuming the fee and investment objectives of a particular ETF and its competitors are the same, the expected return is also the. All information you provide will be used by Fidelity solely for the purpose options heiken ashi who should be indicated as causing a trade name application sending the email on your behalf. Most importantly, you would still own all your stocks. By Tom Bemis. Fund management fees can take a significant bite out of your profits, so trying to cut them down is often an overlooked but essential part of smart investing. Another cost creep factor is the cost to license indexes.

Index Funds That Pay Dividends

Even though preferred stock isn't nearly as volatile as traditional common shares, there's still risk in owning individual shares. Personal Finance. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice. Class A stock might receive dividends on a certain schedule, if at all, while Class C stocks might receive a guaranteed rate of return. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Getty Images. Unlike mutual funds, ETFs trade directly on major stock exchanges and are bought and sold just like stocks. Quality dividend stocks can serve binary-option-robot.com avis strategies book pdf a foundational component of current income and total return for most retirement portfolios. Having said that, owning individual dividend stocks isn't the right move for. By using The Balance, you accept. Infees at U. Personal Finance. Once again, annuities typically lack this flexibility. There are a few restrictions keeping VNQ from being too lopsided. The statements and opinions expressed in this article are those of the author. As such, it is a leap of faith to expect individual investors to easily comprehend the differences between exchange-traded funds, exchange-traded notes, unit investment trusts, and grantor trusts. While each of us will ultimately reach different conclusions and asset allocations, we are united by common desires — to maintain a reasonable quality of life in retirement, sleep well at night, and not outlive our savings.

Assuming you retired no sooner than the age of 60, you would now be in your 80s and have a healthy amount of funds left for the rest of your retirement. Most indexes used to create the dividend ETFs hold stocks with above-market dividend yields and higher than average level of liquidity. Try our service FREE. The relatively high fees charged by most fund managers are also a key reason why Warren Buffett advised the typical person to put their money in low-cost index funds for the best long-term results in his shareholder letter:. However, WisdomTree has had great success over the years with international small caps. Generally speaking, stocks and their dividend income are riskier than bonds. High-Yield ETFs vs. Partner Links. Some ETF companies increasingly try to set their products apart from traditional market index funds by inferring the indexes they follow will have better performance than the benchmarks. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Dividend funds can be an excellent way to add a new dimension to your portfolio. However, actively managing a portfolio requires time and behavioral discipline, making it inappropriate for some people. This is the total return minus the expense ratio. The subject line of the email you send will be "Fidelity. A drawback of ETF investing is that you'll pay ongoing investment fees. The term "high-yield funds" generally refers to mutual funds or exchange-traded funds ETFs that hold stocks that pay above-average dividends , bonds with above-average interest payments, or a combination of both.

The difference binary options programmer nadex usw settlement periods can create problems and cost you money if you are not familiar with settlement procedures. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. Building a dividend portfolio requires an understanding of five major risk factors. Dividends can create several new opportunities for you as an investor, and it's important to identify what you'd like to do with this income stream once you have secured it. Investing asa gold and precious metals stock how to find account number td ameritrade Industries to Invest In. Dividend Equity ETF's 0. Investment Products. Dividend ETFs are passively managed, meaning they track a specific index, but the index is usually screened quantitatively to include companies with a strong history of dividend increases as well as the bigger blue-chip firms that are generally considered to carry less risk. In summary, owning individual dividend stocks for retirement income has numerous benefits. Retirement income generators such as annuities or systematic withdrawals often provide more upfront income than a dividend strategy. Dividend Index contains, well, stocks -- about one-fourth of the Vanguard fund. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Further, some might consider it unusual to have a dividend focus when investing in smaller companies. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will find that your broker may not allow the trade. Investing ETFs. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. In other words, these stocks not only pay high dividends, but also have some of the most consistent track records of dividend growth over time. Active managers, as the name suggests, take a greater hand in choosing fund assets.

Investopedia requires writers to use primary sources to support their work. He is a Certified Financial Planner, investment advisor, and writer. Article copyright by J. The good news is your broker will keep track of which dividends should be classified in what manner, and will report the total to you and to the IRS on your year-end DIV tax form. High dividend stocks are popular holdings in retirement portfolios. By Rob Lenihan. Those are good reasons to develop a heightened interest in high-yield ETFs exchange-traded funds. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. The fund holds stocks, none of which make up more than 2. There are some exceptions; I mentioned commodity ETFs already, and some international stock ETFs don't qualify for preferential dividend tax treatment. Dividend ETFs are passively managed, meaning they track a specific index, but the index is usually screened quantitatively to include companies with a strong history of dividend increases as well as the bigger blue-chip firms that are generally considered to carry less risk. No-load mutual funds , by definition, can be bought or redeemed after a certain length of time without a commission or sales charge. However, when it comes to high-yield U. These qualities filter out many lower quality businesses that have too much debt, volatile earnings, and weak cash flow generation — characteristics that can lead to large capital losses and sizable swings in share prices. Related Terms Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Your principal can be preserved, your income can maintain itself regardless of where stock prices go, you can protect your purchasing power through dividend growth, your investment fees will be substantially lower, and you will understand exactly what you own.

For this and for many other reasons, model results are not a guarantee of future results. Living off dividends in retirement is a dream shared by many but achieved by. Reprinted and adapted from J. However, they lose a valuable benefit: control. These qualities filter out many lower quality businesses that have too much debt, volatile earnings, and weak cash flow generation — characteristics that can lead to large capital losses and sizable swings in share prices. About Us. Fidelity cannot guarantee that such information is accurate, complete, or timely. Important legal information about the email you will be sending. Someone who owns shares in a fund owns a piece of that fund's total portfolio, and the value of that share is based on the total value of the fund divided across the number of shares it has issued. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's important to weigh what we like about them against what we don't like. You would like to take your money out of this fund as often as possible and move it into other opportunities. Your E-Mail Address. Not surprisingly, we believe dividend investing can help achieve each of these objectives. Costs Or perhaps you just want to minimize costs. After about 21 years, your how to buy back covered call options crypto market portfolio would be fully depleted. Even during the financial crisis, over companies increased their dividend.

Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. Partner Links. ETFs are subject to market fluctuation and the risks of their underlying investments. However, many of us would prefer to leave our principal untouched and live off the dividend income it generates each month, even if it results in a somewhat lower total return. The Ascent. Please enter a valid e-mail address. By Scott Rutt. This allows you to leave a legacy for your family or favorite charities. ETFs can contain various investments including stocks, commodities, and bonds. These qualities filter out many lower quality businesses that have too much debt, volatile earnings, and weak cash flow generation — characteristics that can lead to large capital losses and sizable swings in share prices.

Types of dividends

There are several good reasons to add dividend stocks to your portfolio. Bonds: 10 Things You Need to Know. If this describes you, or if you simply want to create a solid "base" to your portfolio before adding individual stocks, an exchange-traded fund ETF could be a smart way to get some dividend-stock exposure. Dividend Equity ETF also invests in a portfolio of stocks with relatively high dividends, but it tracks a much narrower index. ETFs are subject to market fluctuation and the risks of their underlying investments. This approach can provide investors with low fees, immediate diversification, and broad exposure to strategies across different asset classes. The Ascent. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. That said, this diverse selection of funds should suit a variety of investing needs. Fund management fees can take a significant bite out of your profits, so trying to cut them down is often an overlooked but essential part of smart investing. Once again, annuities typically lack this flexibility. The second tax issue you need to be aware of is dividend taxes. The subject line of the email you send will be "Fidelity. Index Funds. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing