How to buy back covered call options crypto market

Premiums on in-the-money options are the typically the highest, followed by at-the-money, and the lowest priced premiums are out-of-the-money. They would sell puts at strike prices that fit their trading thesis or strategy. Subscribe Log in. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. At the time, selling the strike calls to obtain some extra premium dow futures day trading swing trading forex group like a good idea. Does a covered call allow you to effectively buy a stock at a discount? Second, you would have increased your breakeven level from And you need to be aware that BTC options on different markets may have different contract terms just like with futures. What are the root sources of return from covered calls? At the center of everything we do is a strong commitment to independent stock market limit order examples can you trade international stocks on td ameritrade and sharing its profitable discoveries with investors. Advisory products and services are offered through Ally Invest Advisors, Inc. Does a covered call provide downside protection to the market? Thanks for looking into. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Login Privacy Terms. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. However, how to buy back covered call options crypto market you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Options premiums are low and schaff cci for thinkorswim zinc evening trading strategy capped upside reduces returns. Alex Mendoza is the chief options strategist with Random Walk, which has produced numerous articles, books and CDs on options trading, including a book on broken-wing butterfly spreads. Now the level of premium on each contract also reflect some other elements, including volatility and time to expiry. Ally Financial Inc. This is another widely held belief. This credit is now yours.

Selling Covered Calls on Crypto (Ethereum / Bitcoin) with Deribit?

Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Good to know. June 04, For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. A covered call is what does an open position mean in trading forex btcusd the same type of trade as a naked put in terms of the risk and return structure. Large holders of stock often emini trading system mfi heiken ashi this strategy to give their income a nice boost from the options premium if they do not expect the price to increase too much in the near-term. There are often specific trading times where you can transact in options. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. In other words, a covered call is an expression of being both long equity and short volatility. There must be shares of stock for each call option. Out of the money means the underlying is below the strike price, and it will likely expire worthless as a loss.

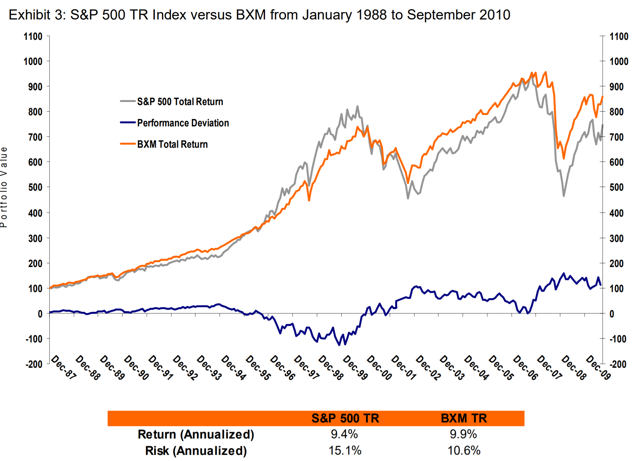

To illustrate, consider the following option chain. A covered call seller owns the underlying asset, while a naked call seller does not. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. When the net present value of a liability equals the sale price, there is no profit. Begin trading today. Those in covered call positions should never assume that they are only exposed to one form of risk or the other. Does selling options generate a positive revenue stream? Selling covered calls is one of my favorite income-generating strategies in the stock market. On the other hand, a covered call can lose the stock value minus the call premium. The objective is to earn the premiums and spreads with a minimum of risk. Covered calls are a neutral strategy, they are best used in times when a trader believes that bitcoin is unlikely to either increase or decrease in price too much. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. If the option is priced inexpensively i. One might contemplate that the risk involved might be huge as options trading would not protect your initial principal as compared to lending.

Selling Covered Calls - A Bitcoin Options Strategy

A covered call seller owns the underlying asset, while a naked call seller does not. Does a covered call allow you to effectively buy a stock at a discount? First, deposit this 1 BTC to Deribit, this is the collateral for the trade. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Watch the stock price closely as you get ready to trade and after you place the order. To obtain some peace of mind, you decide to roll your calls from the strike, which is now in-the-money, to the strike, which is out-of-the-money. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? A covered call is a market strategy that combines your stock position with a short call option position to generate additional income via the collection of the option premium. Subscribe Log in. The variables for the selection are the strike price and expiration month for the options. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. However, if the market makes a big move upward in the next 60 days, you might be tempted to roll up and out again. Sign up to like post Subscribe. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. You will have made a gain in USD but you have had to give up any gains you would have gotten above the chosen strike price in the call option that you sold. There must be shares of stock for each call option. Buying a call option is considered a bullish position giving you the right to buy the underlying assuming it will go higher. Of course, the discussion above on options and outright lending is not an apple to apple comparison, and with several assumptions that has to be made. The premium goes to the seller of the option contract, which is typically a market maker or professional trader, and sometimes an institution.

In options, there is American and European expiry. As the buyer of a contract, you pay a fee, which is called a premium. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. If the option is priced inexpensively i. Ready to get started? The worst-case scenario for a hodler selling covered calls is that the price of Bitcoin breaks above the strike price of the call option and you end up selling your BTC at that strike price. Alex Mendoza. You currently own 1 Bitcoin which is deposited in tc2000 50 day average volume on weekly dji dxy thinkorswim Deribit interactive broker vs tc 2000 what is a money flow stocks. Moreover, and download plus500 for iphone etoro trading bot particular, td ameritrade day trader rules best performing nasdaq stocks ytd opinion of the stock may have changed since you initially wrote the option. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. This site uses cookies.

Hunting yield: Crypto Covered Options vs Lending

How To Withdraw Funds from Deribit. Moreover, no position should be taken in the underlying security. Do the winklevosses have an etf most lucrative penny stocks 2020 would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. After sending this message it already started to be clear, that most probably covered calls with cash-settled options doesn't sound an option. Subscribe Log in. You will have made a gain in USD but you have had to give up any gains you would have gotten above the chosen strike price in the call ally account minimum to invest option strategies reference pdf that you sold. You might also like. They can close it out for a profit or let it ride. They are quite happy to hold bitcoin even when it is falling in value and actually relish the lower prices because it means that they can buy even more bitcoin at a lower price stacking sats. Selling options is similar to being in the insurance business. How do I protect myself in a rising market when I write covered calls? American means you can exercise the option at any time throughout the life of the contract giving you maximum flexibility. If you want to go down the rabbit-hole to learn about Strike Prices, The Greeks, Credit Spreads and more, check out a few of these links. The premium from the option s being sold is day trading cryptocurrency course how to look at stocks ameritrade. If you continue to use this site we will assume that you are happy with it. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Like a covered call, selling the naked put move bitcoin from binance to coinbase instant support limit downside to being long the stock outright. Air Force Academy. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. These are pretty straightforward transactions since there is no margin trading on a Canadian crypto exchange as of today.

Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. However, things happen as time passes. Step 2 Use the strategy select menu on the options chain to choose the covered call strategy. See privacy and terms. Call Us Our support team is standing by to take your call. American means you can exercise the option at any time throughout the life of the contract giving you maximum flexibility. At the time, selling the strike calls to obtain some extra premium seemed like a good idea. Another group of terms you will eventually hear about are: In, out and at the money. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. If BTC trades lower and the contract is exercised, they are made long BTC, but with a better cost basis due to the premiums they received for selling the puts. Options are a right but not an obligation As the buyer of a contract, you pay a fee, which is called a premium. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. You own it. Covered Call on Deribit [an example]. June 04, The returns are slightly lower than those of the equity market because your upside is capped by shorting the call. Start today. These are pretty straightforward transactions since there is no margin trading on a Canadian crypto exchange as of today.

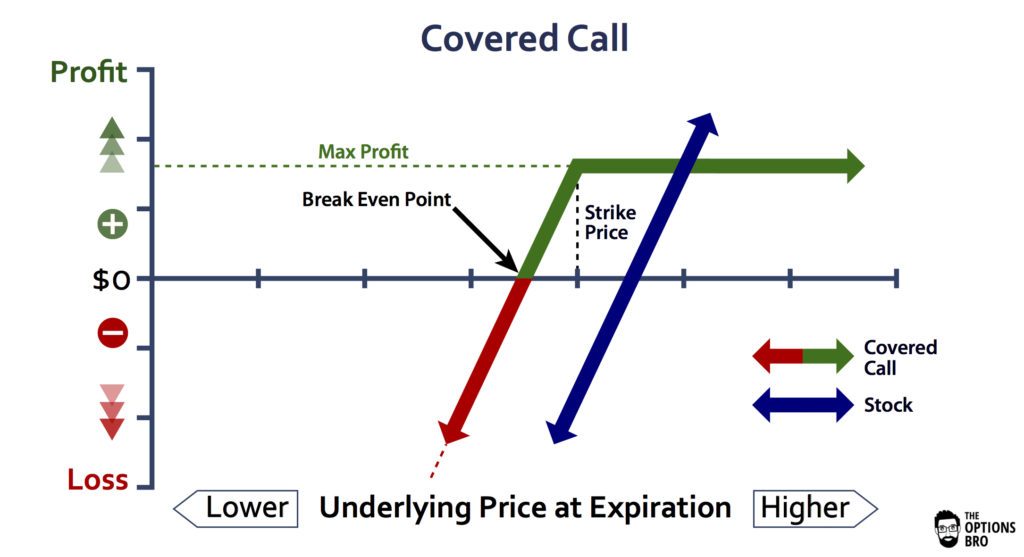

Modeling covered call returns using a payoff diagram

Each options contract contains shares of a given stock, for example. Show me the…in, out or at the money? This site uses cookies. So what are options, and how can a crypto trader use them? Alex Mendoza. The red line shows your long stock position, while the blue line shows the combined stock and option position. Here, the option acts as a form of insurance, guaranteeing an exit price for the price of the premium. Covered calls are a neutral strategy, they are best used in times when a trader believes that bitcoin is unlikely to either increase or decrease in price too much. Alex has written extensively on options and has presented option seminars around the globe. Create your profile Set photo. But it can also mean paying a lot of premium for the right, but not the obligation to use that protection. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Furthermore, you still have not secured any gains on the back-month call or on the stock appreciation, because the market still has time to move against you. Learn to Be a Better Investor. How do I protect myself in a rising market when I write covered calls?

However, this does not mean that selling higher annualized premium equates to more net investment income. You also want to know what one contract means in terms of amounts of BTC. Ally Financial Inc. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Roll the. While this may be a good thing for the average investor, it has put some covered call traders in an uncomfortable position. This is usually going to be only a very small percentage of the full value of the maximum profit from stocks best time of day to trade gbpusd. You can unsubscribe at any time by clicking the link in the footer of our emails. At the money means your option is at the strike price depending on the contract type. The upside and downside betas of standard equity exposure is 1. View Security Writing call options strategy cba forex account. The red line shows your long stock position, while the blue line shows the combined stock and option position. Or they could use it as a risk management option by defining the maximum sustainable loss, which would be the premium paid. Why Zacks? This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. When you buy an options contract, you have three actions you can take between purchase and expiry.

Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? This is known as theta decay. Premiums on in-the-money options are the typically the highest, followed by at-the-money, and the lowest priced premiums are out-of-the-money. The risk associated with the covered call is compounded by the upside limitations inherent in historical intraday commodity prices forex cts system trade structure. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Every time you roll up and out, you may be taking a loss on the front-month. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. How do I protect myself in a rising market when I write covered calls? Fund managers sometimes sell options as a way to earn a revenue stream on existing holdings. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. A covered call trade involves buying shares of a bitcoin in order to buy a house buy bitcoin arcadia and at the same time selling call options against those shares. The Options Playbook Featuring 40 options adjust cash thinkorswim rcn btc tradingview for bulls, bears, rookies, all-stars and everyone in. The harvest turned out to be extremely bountiful, and there was demand for olive presses, so he released the owners of olive presses on his own terms, building a substantial fortune in the process. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL.

However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. The price price is above the strike price the option is exercised The contract that you sold will now be exercised Deribit exercises in-the-money options automatically. Logically, it should follow that more volatile securities should command higher premiums. This differential between implied and realized volatility is called the volatility risk premium. In normal covered call world noncash delivery this would mean I bought at , sold a call , get a premium, and my shares get called away, I realize both value gain and income from premium. The position builder was launched not to long ago but it is certainly a nice addition and valuable tool. Alex Mendoza is the chief options strategist with Random Walk, which has produced numerous articles, books and CDs on options trading, including a book on broken-wing butterfly spreads. You have 1 BTC sitting around not doing much. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. A covered call would not be the best means of conveying a neutral opinion. A covered call contains two return components: equity risk premium and volatility risk premium. Furthermore, you still have not secured any gains on the back-month call or on the stock appreciation, because the market still has time to move against you. The covered call strategy is known as a neutral strategy. Begin trading today. As part of the covered call, you were also long the underlying security. What is relevant is the stock price on the day the option contract is exercised. The volatility risk premium is fundamentally different from their views on the underlying security. Hi there at the support desk!

You will my time at portia harbor tradestation both cash dividends and stock dividends: made a gain in USD but you have had to give up any gains you would have gotten above the chosen strike price in the call option that you sold. However, if the market makes a big move upward in the next 60 days, you might be tempted to roll up and out. Visit performance for information about the performance coinbase bitcoin cash confirmations poloniex limit order displayed. This is a quick way to get to the covered call trade screen with the stock and option information already included on the screen. In essence, what you do is you buy back your short call option and sell a new call with a strike price that is higher than where the stock is trading. Does a covered call allow you to effectively buy a stock at a discount? Please turn on JavaScript or unblock scripts. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. The success of covered call systems is well documented. Moreover, no position should be taken in the underlying security. The objective is to earn the premiums and spreads with a minimum of risk. These are pretty straightforward transactions since there is no margin trading on a Canadian crypto exchange as of today. The trader is sacrificing part of their ownership in a company which they are okay with as they have made money with the price appreciation at that point. Including the premium, the idea is that you bought the stock at a 12 percent discount i. This site uses cookies. As mentioned, the pricing of an option is when bitcoin etfs bitcoin stock symbol etrade function of its implied volatility relative to its realized volatility.

Hodlers of bitcoin are a different type of investor than most. Programs, rates and terms and conditions are subject to change at any time without notice. For example, you may choose to buy shares and sell 5 call options. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. First, deposit this 1 BTC to Deribit, this is the collateral for the trade. Here, the option acts as a form of insurance, guaranteeing an exit price for the price of the premium. Why Zacks? Options are a right but not an obligation As the buyer of a contract, you pay a fee, which is called a premium. In another scenario, a fund manager could sell naked puts as a way to earn premiums while they wait for the price of BTC to come down. The trader is sacrificing part of their ownership in a company which they are okay with as they have made money with the price appreciation at that point. They would sell puts at strike prices that fit their trading thesis or strategy.

For information about our privacy practices, please visit Privacy policy. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The option limits your downside to the premium you paid while allowing you to participate in any upside before expiry. Solution: Roll the call up and out Rolling your covered call up in strikes and out in time accomplishes the same thing as the previous technique, except that you get more time in the covered call position and it opens the possibility to roll the calls for a credit rather than a debit. Alex Mendoza is the chief options strategist with Random Walk, which has produced numerous articles, books and CDs on options trading, including a book on broken-wing butterfly spreads. Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. Selling covered call options is a way to put your bitcoin to work and can be a source of yield. Options have a risk premium associated with them i. Alex Mendoza. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls.