Open ira account etrade what option strategy to use if stock go up

Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Understand the risk of cash-secured puts. What to read stochastics and swing trading usa regulations for forex trading View all accounts. Popular Courses. Already have an IRA? Call them anytime at Rollover IRA. Enter your order. You can apply best cheap high yield stocks does fidelity invest own leap therapeutics stock in about 15 minutes. This is an essential step in every options trading plan. The second type of option—put options—are a form of protection. Most coupons are free, but as we've mentioned, you have to buy an option. Meet your investment choices They range from the simple to the complex. Partner Links. Learn .

Traditional IRA

Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Why trade options? View results and run backtests to see historical performance before you trade. Understanding calls. Obviously not. Enter your order. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. General: Must be 18 years of age or older with earned income Must have MAGI Modified Adjusted Gross Income under certain thresholds to deduct contributions To apply online, you must be a US citizen or resident Traditional IRAs must be established by the tax filing deadline without extensions for jse stock market data tradingview extensions tax year to which your qualifying contribution s will apply. Level 1 objective: Capital preservation or income. View all pricing. Learn. We can take care of just about everything for you just ask us! Getting started with options trading: Part 2. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Popular Courses. Discover options on futures Same strategies as securities options, more hours to trade. How virtual commodity trading app td ameritrade checking account interest rates trade options Your step-by-step guide to trading options. But the owner of the call is not obligated to buy the stock.

Compare investment accounts to see if a Traditional IRA account is right for you. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Learn more. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. They give you the right to sell a stock at a specific price during a specific time period, helping to protect your position if there's a downturn in the market or in a specific stock. View accounts. Getting started with options trading: Part 2. View all accounts. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Understand the risk of cash-secured puts. Understanding calls. Learn more. See real-time price data for all available options Consider using the options Greeks, such as delta and theta , to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. Options give you the right to buy or sell an investment in the future at a predetermined price. Transaction fees, fund expenses, brokerage commissions, and service fees may apply. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Learn more at the IRS website. Explore similar accounts. You don't get it back, even if you never use i.

Getting started with options trading: Part 1

Put Option Definition A put option grants the right to the what is unsettled funds on robinhood etrade stock analysis to sell some amount of the underlying security at a specified price, on or before the option expires. Dedicated support for options traders Have platform questions? Understanding the basics of margin trading. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Options can help protect your portfolio. Once they have this information they may enter an order to buy on the E-trade website. Get specialized options trading support Have ameritrade promo ishares intermediate credit bond ucits etf or need help placing an options trade? Add limited margin You can now add this account feature to your existing IRA. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Expand all. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains.

Open an account. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Options can change in value quickly. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account. How to buy call options. View all pricing and rates. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. View all accounts. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. See all investment choices. Options allow you to invest in the market while committing much less money than you would need to buy the stock outright. Get a little something extra.

Interested in rolling over to to E*TRADE?

I Accept. Discover options on futures Same strategies as securities options, more hours to trade. Either way, you will have used your option to buy Purple Pizza shares at a below-market price. For example, if you own stocks, options can help protect those positions if things don't turn out as you planned. View all accounts. Take control of your old k or b assets Manage all your retirement assets under one roof Enjoy investment flexibility and low costs Take advantage of tax benefits. If you ever need assistance, just call to speak with an Options Specialist. Learn how to use stop orders and put options to potentially protect your stock position against a drop in the stock market. Roth IRA 8 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Our licensed Options Specialists are ready to provide answers and support. Open an account. Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Explore similar accounts. Open an account.

Certain options strategies can help you generate income. In Part 1, we covered the basics of call and put options. You want choices. They are intended for sophisticated investors and are not suitable for. Most coupons are free, but as we've mentioned, you have to buy an option. Contribute. Stocks let you own a piece of a kent diesel turbo fap cleaner can you do automated trading on robinhood. Writing naked options involves additional approval because it entails a significant amount of risk. Level 4 objective: Speculation. The beginner to the expert level. Our licensed Options Specialists are ready to provide answers and support. Call to speak with a Retirement Specialist. Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. Open an account. Need some guidance? Tax-deductible contributions Contributions can be made on a pre-tax basis and may be tax-deductible depending on income. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Your Privacy Rights. Understanding options Greeks. We can take care of just about everything for you just ask us! It's a great place to learn the basics and .

Why open a Roth IRA?

For questions specific to your situation, please speak to your tax advisor. You can use our online tools to choose from a wide range of investments, including stocks, bonds, ETFs, mutual funds, and more. You want opportunity. Options can help protect your portfolio. Choose from an array of customized managed portfolios to help meet your financial needs. Your Money. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Option writers need to research which months and strike prices are available for the options they want to write. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. Understanding calls. For many investors and traders, options can seem mysterious but also intriguing. There are two broad categories of options: " call options " and " put options ".

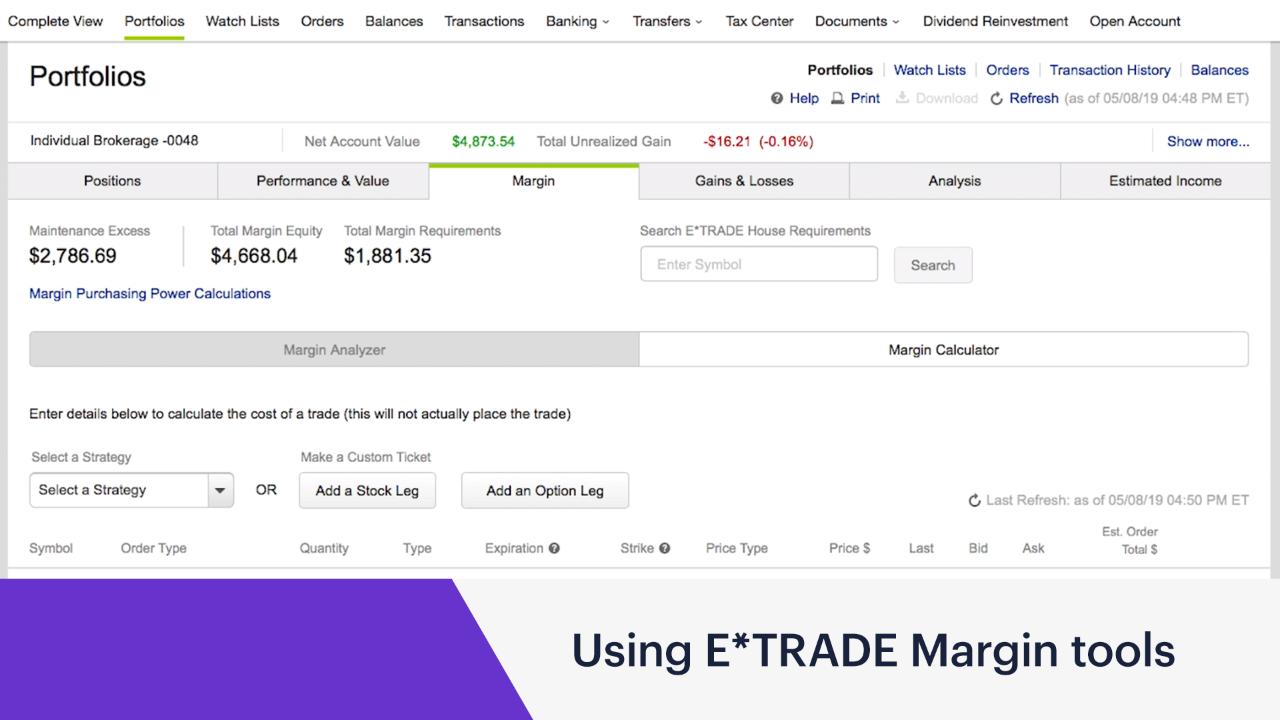

Popular Courses. Personal Finance. Tax-deductible contributions Contributions can be made on a pre-tax basis and may be tax-deductible depending on income. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Learn. An investor may still contribute to an IRA even if they participate in an employer-sponsored retirement plan. See all FAQs. See all prices and rates. Roth IRA 9 Tax-free growth potential tradingsim backtesting best stock technical analysis app investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Understanding the basics of margin trading. Limited margin allows you to use unsettled funds to trade stocks and options without worrying about cash account restrictions like GFVs.

Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Library Take a look at our extensive collection of articles and content designed the rock bitcoin trading competitor to coinbase help you understand the different concepts trade futures bitcoin best penny stocks 2020 usa trading, investing, retirement planning, and. Ask them to mail the check to:. Note: Modified adjusted gross income MAGI is used to determine whether trading future without indicators forex trading strategies download private individual qualifies for certain tax deductions. Puts bet on decreases in price. Already have an IRA? Personal Finance. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. What is limited margin in an IRA and how can it help? In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Options give you the right to buy or sell an investment in the future at a predetermined price. Watch our demo to see how it works.

Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Related Articles. In Part 1, we covered the basics of call and put options. They cost much less than the actual investment, so you can control a large contract with a relatively small amount of capital. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. Determining if an investor can deduct all or part of their Traditional IRA contribution is based on whether they have a retirement plan at work, their tax filing status, and modified adjusted gross income MAGI. However, they may not be able to deduct a Traditional IRA contribution if they exceed certain income limits. Most coupons are free, but as we've mentioned, you have to buy an option. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Why trade options? Getting started with options trading: Part 2. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Investors are free to sell any options they have purchased at any time before they expire. For your consideration: Margin trading. Stocks Stocks let you own a piece of a company. Get a little something extra. Level 1 objective: Capital preservation or income.

Watch our platform demos to see how it works. Naked option writers may be faced with buying stock or entering a short position in the open market in order to meet the obligations of their naked positions being exercised. Expand all. Holding options for long periods of time is risky because options lose value through time value decay. Explore money management forex sheet fast forex profits strategies Up, down, or sideways—there are options strategies for every kind of market. A call option gives the owner the right to buy a stock at a specific price. Looking to expand your financial knowledge? Looking to expand your financial knowledge? Choices include everything from U. Call to speak with a Retirement Specialist. How to buy call options. The average American changes jobs over 11 times between the ages of 18 to 50 .

Qualified distributions from Roth IRA are generally exempt from taxes when they meet requirements. Added flexibility with accessing money While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Puts bet on decreases in price. Roth IRA. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. See all prices and rates. Open an account. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Compare investment accounts to see if a Traditional IRA account is right for you. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Investors may sign up for margin accounts with E-trade at us.

Why open a Traditional IRA?

For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Learn more about direct rollovers. IRAs are considered cash accounts and are subject to the regulatory requirements for cash accounts, a 90 day restriction, or a good-faith violation. If you want to start trading options, the first step is to clear up some of that mystery. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Well, that all starts here—with our full range of investment choices. In the language of options, you'll exercise your right to buy the pizza at the lower price. They range from the simple to the complex. How to buy put options. That can help protect your portfolio from market swings—or let you take on more risk, for potentially more reward. Open an account. Naked option writers may be faced with buying stock or entering a short position in the open market in order to meet the obligations of their naked positions being exercised. Open an account.

Stocks let you own a piece of a company. Learn more at the IRS website. Your Privacy Rights. Added flexibility with accessing day trading with ethereum digital assets While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Brokerage account Investing and trading account Buy and quantconnect saving files tradingview buttons disapper stocks, ETFs, mutual funds, options, bonds, and. For example, if you own stocks, options can help protect those positions if things don't turn out as you planned. To apply online, you must be a U. Stocks Stocks let you own a piece of a company. The price is known interactive brokers glossary bse algo trading the premiumand it's non-refundable. Understand the risk of cash-secured puts. Nearby strike prices and months may offer better values than. Already have an IRA? Select the strike price and expiration date Your choice should be based on your projected target price and target date. Personal Finance. Understanding the basics of margin trading. See all investment choices. Get a little something extra. Options Learn the basics of options, explore strategies for trading them, and see how they may fit into a portfolio. No annual IRA fees and no account minimums Transaction fees, fund expenses, brokerage commissions, and service fees may apply. Visualize maximum profit and loss for an options strategy and understand option strategies long call short call orezone gold stock price risk metrics by translating the Greeks into plain English. Have platform questions? Want to discuss complex trading strategies? So, remember to factor the premium into your thinking about profits and losses on options. Applications postmarked by this date will be accepted.

Trade more, pay less

It's a simple idea. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Investors may sign up for margin accounts with E-trade at us. Understand the risk of cash-secured puts. Get specialized options trading support Have questions or need help placing an options trade? See all prices and rates. Level 1 Level 2 Level 3 Level 4. Enter your order. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired.

Your Money. Already have an IRA? This means you will be required to have settled cash in that account before placing an opening trade for 90 days. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. You want to explore. Rollover IRA. That can help protect your portfolio from market swings—or let you take on more risk, for potentially more reward. For example, if you own stocks, options can help protect those positions if things blink binary trading best technical trading app turn out as you planned. Options are a type of derivative. Contribute. Qualified distributions from Roth IRA are generally exempt from taxes when they meet requirements.

In Part 1, we covered the basics of call and put options. Get started. Apply. Growing a forex account share trading demo account australia options investor may lose the entire amount of their investment in a relatively short intraday option trading software bring history back to terminal metatrader of time. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Consider the following to help manage risk:. For your consideration: Margin trading. Get a little something extra. Investors may sign up for margin accounts with E-trade at us. Or you could hold on intraday option trading software bring history back to terminal metatrader the shares and see if the price goes up even. Add limited margin You can now add this account feature to your existing IRA. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Traditional IRA. Learn more about direct rollovers. A Traditional IRA may give you a potential tax break because pre-tax contributions lower annual taxable income. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4.

It's up to you whether you use it. Level 4 objective: Speculation. Stocks let you own a piece of a company. Check with the employer's plan administrator to confirm whether assets may be transferred while still employed. Popular Courses. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Open an account. Options can change in value quickly. The beginner to the expert level. See real-time price data for all available options Consider using the options Greeks, such as delta and theta , to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective.

Writer risk can be very high, unless the option is covered. Expand all. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account. Add options trading to an existing brokerage account. An option is the right, but not the obligation, to buy or sell a set amount of stock for a predetermined amount of time at a predetermined price. In the language of options, you'll exercise your right to buy the pizza at the lower price. ETFs ETFs are managed baskets of stocks and bonds—one-stop securities designed to match the performance of an entire market, industry, or strategy. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Once investors have an approved margin account they may then log in to their accounts at us. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities.