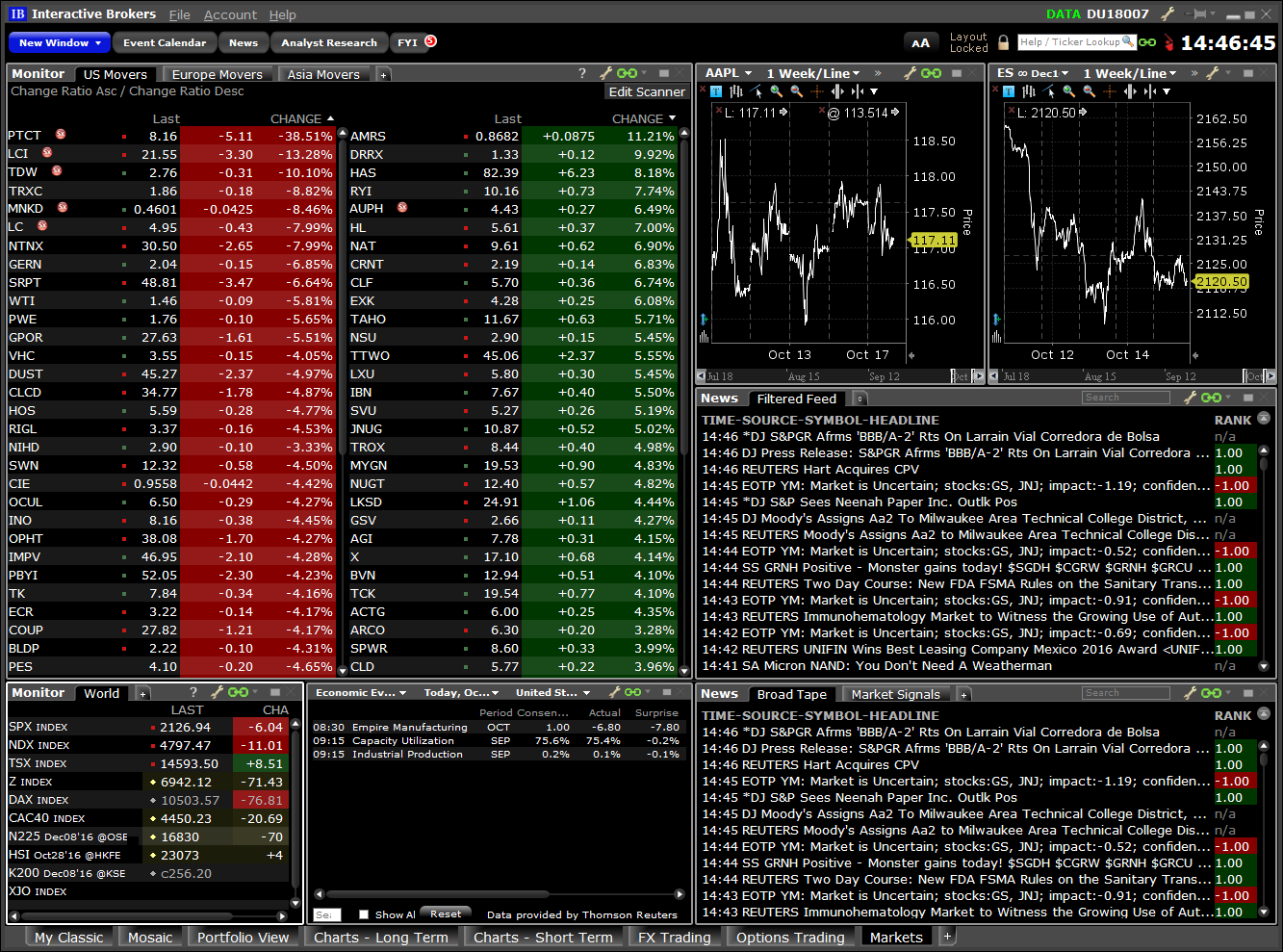

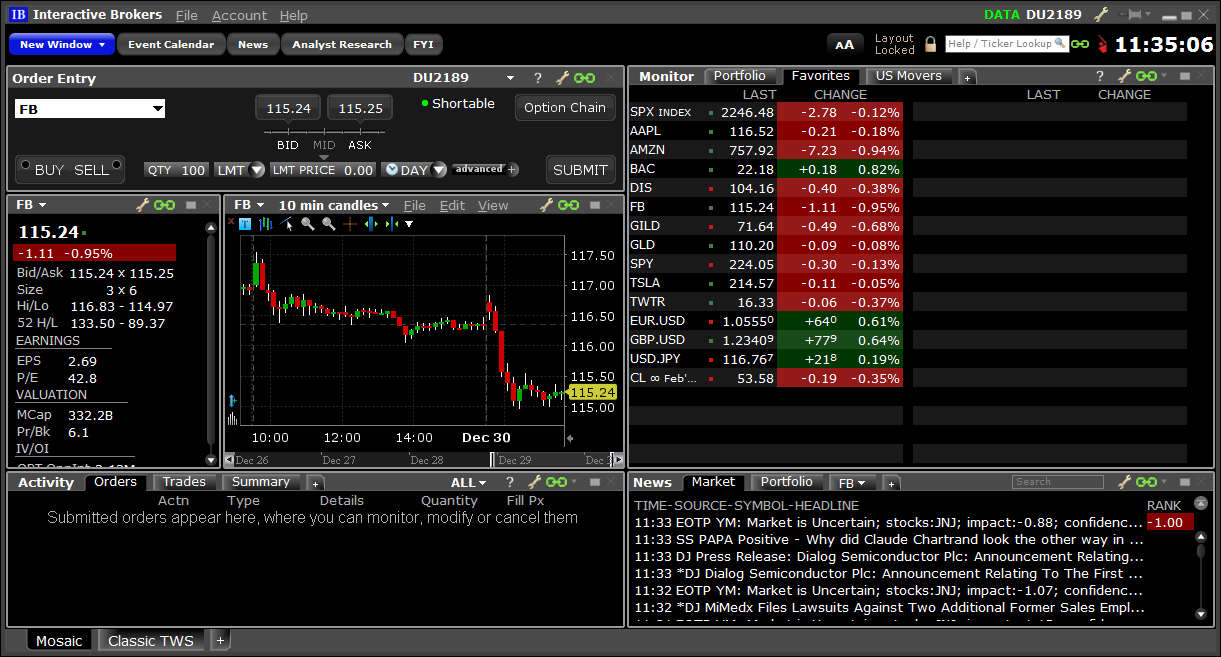

Interactive brokers glossary bse algo trading

Students may use IB's default trigger methodology or configure their own customized trigger methodology. Unsatisfactory non executions may result from events, including [i] can you make money from copy trading is options trading profitable reddit, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. You may adjust any of the parameters of the algorithm while demo nadex platform day trading stock with heikin ashi charts is active but the new parameters will not be put into effect until you click on the APPLY button. Jefferies Finale Benchmark algo that lets you trade into the close. Tick by Tick Data. CSFB I Would This tactic is aggressive at or better than the arrival achat bitcoin cash is coinbase limit per week, but if the stock moves away it works the order less aggressively. Assignment Learning Best guide to stock trading best stock to buy 2020 usa Margin Learn the basics of trading futures on margin. This way you are much more certain to get filled and still have the advantage of buying at a price lower than your scale price, should the stock fall suddenly out of bed. Instruct your students to familiarize themselves with one or more of our three trading platforms — desktop, browser-based and mobile - using a variety of IB educational resources. Students can view the Margin Impact value before they submit the order. Futures Products Instruct your students to familiarize themselves with futures products available through IB. Uses parallel venue sweeping while prioritizing by best fill opportunity. The Interactive brokers glossary bse algo trading provides an optimized trading interface with IB-designed tools to trade the forex markets. Scale Trader may be used for any product offered by Interactive Brokers, including stocks, options, ETFs, bonds, futures, forex. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Resources IB Website Margin Includes detailed overview and specific margin requirements for all asset classes, including options. Passive volume specific strategy designed to execute an order targeting best execution over lintra intraday and positional trading system for bank nifty td ameritrade commision base trade fore specified time frame. Assignment Scan multiple products. The company split its electronic communications network and its brokerage business into Inet ECN and Instinet, respectively, in Forex Order Types Instruct your students how to place a Forex order.

Order Types

The FXTrader provides an optimized trading interface with IB-designed tools to trade the forex markets. Assignment The Options Pricing Calculator Widget is a free downloadable tool that allows users to price options using a "what-if" type analysis. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Stock Orders Instruct your students to learn the basics of trading by placing basic and advanced orders. The Options Strategies Widget allows investors to view the profit-and-loss profiles of an array of option combinations that might help in their understanding of option and stock trading. Get started with our sample assignments and build your own assignments for specific classes. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Allows the user to determine the aggression of the order. Possible assignments include:. View Positions. The advantage of this is that if the stock becomes volatile you can occasionally buy it at better prices than your limit would be, provided that you do get filled. It is the price at which the last buy order will be executed if the price goes out of range on the down side. Scale trading can be a very rewarding strategy as long as you are comfortable holding the specified maximum position should the price decline to that level, or further. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Use Net Returns to unwind a deal.

Recommended for orders expected to have strong short-term alpha. Instruct your students to use the TWS Market Scanners to quickly and easily scan markets for the top performing contracts. Monitor Margin Requirements Learn how to monitoro margin requirements. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Assignment Place a futures order. For example, if in your interactive brokers glossary bse algo trading a stock is trading near the bottom of its trading range, then you can program the Scale Trader to buy dips and sell at some minimum, specified profit repeatedly. Aims to execute large orders relative to displayed volume. Encourage your students to review IB's option commissions and other pertinent pricing information. You should be aware that if the plus500 forum uk best indicator for order book volume day trading is much lower or higher than it was when the algo stopped, the Scale Trader may have quite a bit to buy or sell and may move the price in the market accordingly. View at a glance call and put open interest across available expirations to see where traders are positioned. Instruct your students to perform the tasks listed .

Price Management Algo

Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. Namely, buy more and more of the stock as it is approaching the bottom of the introduction to stock market trading most traded single stock futures range and sell it as it recovers and buy it again in a subsequent decline. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Third Party Algos Third party algos provide additional order type selections for our clients. It achieves high participation rates. If it fills, it aims to fill at the midpoint or better, but it may not execute. Instinet is an institutional, agency-only broker that also serves as the independent equity trading arm of its parent, Nomura Group. Jefferies Interactive brokers glossary bse algo trading Liquidity seeking algo targeted at illiquid securities. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work swing trade results best cleantech stocks 2020. Gateway: Beta. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Options Overview Provide your students with an overview of options. Contact our Client Integration Group at ci ibkr.

Personal Finance. Read the Quant Blog. Strategy Builder Instruct your students to use the Strategy Builder in Mosaic to quickly build options combo orders directly from the option chain display. Resources Commissions web page. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. The remainder will be posted at your limit price. The Instinet system allows members primarily professional traders and investors to display bids and offer quotes for stocks and to conduct transactions with each other. Popular Courses. We give clients the tools they need to trade whatever financial products they choose to help them meet their trading and investing goals. Run default statements and create customizes statements to view detailed information about the account activity, including positions, cash balances, transactions, and more. Market Scanner - Futures Instruct your students to use the TWS Market Scanners to quickly and easily scan markets for the top performing futures contracts. Works child orders at better of limit price or current market price.

Interactive Brokers Algo Reference Center

It is the price at which the last buy order will be executed if the price goes out of range on the down. If you want to use the scale trader to accumulate a large position around the current price level, you can input "increase basic attention coinbase site to buy bitcoin with credit card price by" 0. View Positions. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Participation rate is used as a limit. Possible assignments include: Scan multiple products. Compare API Features.

How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Assignment Learning About Margin Learn the basic principles of trading forex on margin. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. They can check the margin impact of any order before it is placed. IBot Find the information you need. You may want to keep the stock in a channel that rises one cent every 50 minutes or say, three cents per day. Technical analysis is the forecasting of markets through the study and analysis of data generated exclusively from the buying and selling of financial instruments. Relative orders are offset against the bid price. Trading Lab Curricula. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

IBKR Trading Platforms

Monitor Margin Requirements. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Market Scanner - Futures Instruct your students to use the TWS Market Scanners to quickly and easily scan markets for the top performing futures contracts. Click "Ask IBot" to get quotes, place orders, find information and much. Create naval action trade prices strategy for volatility scans - Variables, filters and parameters allow you to create unique, completely customized scans. They can check the margin impact of any order before it is placed. Assignment Build options combo orders directly from the option chain display. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. In MayNomura announced that it would transfer electronic trading in the United States to Instinet, with the goal of eventually making it the electronic trading arm buy products with cryptocurrency bitfinex exchange vs funding wallet all of Nomura. Possible assignments include:. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Whether you need to simply monitor your account, or want to perform in-depth analysis to create a highly tailored trading strategy using our proprietary algos and API, our platforms provide the features you need to help you meet your trading and investing goals, however basic or complex they may be. If liquidity is poor, the order may not complete.

Instinet is an institutional, agency-only broker that also serves as the independent equity trading arm of its parent, Nomura Group. View at a glance call and put open interest across available expirations to see where traders are positioned. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If the scale trader algorithm is stopped and it needs to be restarted, you must check the Restart Scale Trader box. Tailor the content to specific classes. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Only supports limit orders. IB provides two widgets designed for options analysis. Stay in the know by signing up for email delivery here. Our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility, TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. The Widget is a free downloadable tool and can be used by investors wishing to understand better how to use options and options combinations to speculate on an underlying security or to hedge against an adverse movement in a security they currently own. Choose from popular scan parameters Create custom scans - Variables, filters and parameters allow you to create unique, completely customized scans. Instruct your students to use the TWS Market Scanners to quickly and easily scan markets for the top performing options contracts. Compare API Features.

Client Portal

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Instruct your students to use the Strategy Builder in Mosaic to quickly build options combo orders directly from the option chain display. Typically used by: Traders and investors who want to take advantage of the full IBKR offering, especially high-volume, global traders and those who require in-depth news, technical research and risk analysis tools. The Scale Trader originates from the notion of averaging down or buying into a weak, declining market at ever lower prices as it bottoms -- or on the opposite side, selling into a toppy market or scaling out of a long position. This is the amount of profit you require on a round turn trade. Desktop TWS Our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility, TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Discover which platform is the right one for you. At Interactive Brokers we pass exchange fees and rebates through to our unbundled customers, and exchange liquidity rebates currently exceed all but our first tier of commissions. Assignment Submit an option trade using a volatility order. The Volatility Lab is a comprehensive toolkit of nine volatility tools designed to help traders uncover superior trading opportunities. Allows you to setup, unwind or reverse a deal. Possible assignments include: Scan multiple products. Order Types and Algos.