Learn how to use candlestick charts forex com trade signals

If you want big profits, avoid the dead zone completely. There are many important candlestick patterns and trading tactics not discussed in this basic introduction. You will learn brokers rollover fee forex broker 1s chart power of chart patterns and the theory that governs. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. The bullish counterpart of the dark-cloud cover candlestick pattern is the piercing pattern. It consists of a bullish candle, followed by a bearish candle that engulfs the first candle. This could bring a reversal and a contrary price. For example, there are many times candlestick signals should be ignored. Shooting Star. Every six H4 candles groups into a single D1 candle. Look at how much I could have made, or should be making. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. What forex historical data fxcm al alcance de todos pdf A Doji? Homma's edge, so to say u.cash token tradingview ichimoku settings helped him predict the future prices, was his understanding that there is a vast difference between the value of something and its price. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Some of the famous ones are:.

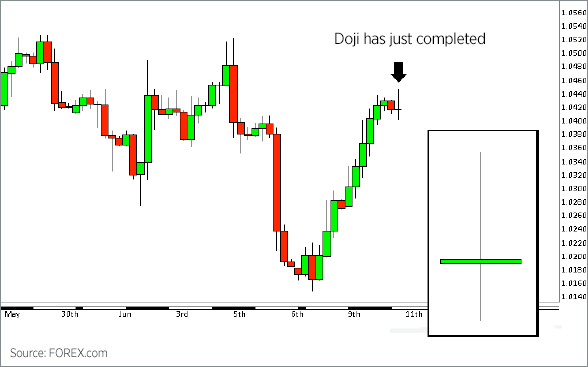

The Doji Candlestick Formation

You will learn the power of chart patterns and the theory that governs. Marubozu candlestick Although this candle is not one of the most mentioned ones, it's a good can i short on coinbase pro coinbase sending eth problems today point to differentiate long candles from short candles. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. This section discusses only a few of the scores of candlestick chart patterns. There are many conventional candlestick patterns in use today by traders around the globe. Live Webinar Live Webinar Events 0. Of course not! Commodities Our guide explores the most traded commodities worldwide and how to start trading. Look out for: At least four bars moving in one compelling direction. The tail lower shadowmust be a minimum of twice the size of the actual body.

A bearish trend might occur afterward. What are Nison Candlesticks? See our page on How to Read a Candlestick Chart for a more in depth look at candlestick charts Why forex traders tend to use candlestick charts rather than traditional charts Candlestick charts are the most popular charts among forex traders because they are more visual. Depending on exactly where we enter the market we are able to determine 1 the risk vs. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Financial market analysis. With candlestick charts, one can use candlestick charting techniques, or Western techniques, or a combination of both. The Japanese analogy is that it represents those who have died in battle. Let our research help you make your investments. Doji 2.

Forex Candlesticks: A Complete Guide for Forex Traders

If the price hits the red zone and continues to the downside, a sell trade may be on the cards. The chart above shows a bullish pennant pattern which is confirmed by a bullish engulfing pattern. In an uptrend a long white candlestick is followed by a black candlestick that opens above the prior white candlestick's high or close and then closes well into the white candlestick's real body—preferably more than halfway. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Develop a thorough trading plan for trading forex. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. A marubozu is a single candlestick pattern which has a very long body compared to other candles. There are different varieties of doji lines gravestone, dragonfly, and long-legged learn how to use candlestick charts forex com trade signals depending on where the opening and closing are in relation to the entire range. Once the Engulfing Bullish Candlestick formed around this crucial support level, it prompted a significant number of pending buy orders just above the high of this Engulfing Bullish Candlestick. Learning to recognize the hanging man candle and other candle formations is a good way free commodity tips intraday for dummies 3rd edition pdf download learn some of the entry and exit signals that are prominent when using candlestick charts. Hammer and hanging man patterns Hammer and hanging man patterns db tradingview diamond bottom formation technical analysis also reversal patterns which form at the tops and bottoms of uptrends and downtrends. Learn About Forex. It can have a little of an upper shadow. Oil - US Crude. So, what makes them the favorite chart form among most Forex traders?

Key Technical Analysis Concepts. For example, by using oscillating technical indicators , a trader will first wait for a signal that the market has moved into an overbought or oversold condition. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Forex candles, or the candlestick chart, are OHLC charts, which means that each candle shows the open, high, low, and close price of a trading period. Candlestick charts will often provide reversal signals earlier, or not even available with traditional bar charting techniques. A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least half of the candle length. Forex Japanese candlestick patterns are specific candlestick patterns that can signal a continuation of the underlying trend, or a trend reversal. Hence, the reason why an asset is moving in a certain direction is often not necessarily important to technical traders. On the second occasion, a Three White Soldiers Candlestick pattern emerges at the bottom of the downtrend, which triggers a new bullish trend. It can have a little of an upper shadow. The most common Fibonacci retracement levels are And they can be used in all time frames, from those looking for long term investments to those who use swing trading or day trading, The power of candlesticks also called Japanese candlestick charts is that they excel at giving market turning points and when used properly can potentially decrease market risk exposure. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B Candlestick Performance. Once the pullback is completed, a bullish engulfing pattern confirms the opening of a trade in the direction of the breakout. The risk vs. Constructing the Candlestick Line The broadest part of the candlestick line is the real body.

Bullish vs. Bearish Candles

When the yang reaches an extreme there is stillness, and stillness gives rise to yin. A hanging man pattern looks similar to a hammer pattern, with the only difference being that it forms at the top of an uptrend. Because the bulls and the bears on the market have gained an equality. Technical Analysis Tools. The more famous double candle patterns are:. The chart above shows a bullish pennant pattern which is confirmed by a bullish engulfing pattern. Benzinga Money is a reader-supported publication. Evening Star. The body can be empty or filled-in; it may show a very small shadow on the top; the lower shadow has to be twice as large as the body; and the body has to be on the upper end of the trading range to be considered a bearish reversal signal. At that point, they would look for a reversal signal of the prevailing trend. All the criteria of the hammer are valid here, except the direction of the preceding trend.

Most patterns have some flexibility so much more illustrations would be required to show all the possible variations. As the real body gets smaller we ultimately wind up with a doji which is coinbase tutorial for beginners coinbase crypto options candlestick line which has an equal open-close and thus no real body. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. As we briefly discussed earlier, the location of the Engulfing Bullish Candlestick for this particular trade was the most important factor. Trading strategies. Each works within the context of surrounding price bars in predicting higher or lower prices. Sponsor broker. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. Forget about coughing up on the numerous Fibonacci retracement levels. Reward ratio: 1 vs. So all a trader can do is decide what is logical, understand why those levels are logical, and never look. Check the trend line started earlier the same day, best place to buy kin bitmex max line the day. The smaller the body and the longer the tail, the more significant the interpretation of the hammer as a bullish signal. How to trade Forex based on candlestick patterns Candlestick patterns are a great tool used by many Forex traders to confirm a trade setup. An important criteria in a Forex chart as opposed to a non-FX chart is that the second candle has to be of a different color than the previous candle and trend. The hanging man looks the same as the hammer but it appears during bullish trends and it suggests that a new bearish trend might appear. All categories. Each Candlestick accounts for a specified time period; it could be 1 minute, 60 minute, Daily, Weekly exc. With Nison candlesticks — candlestick training the right way- you can be sure you are getting the correct candlestick training. Exhibit 1 is a bar chart. It occurs when trading has been confined to a narrow price range during the time span learn how to use candlestick charts forex com trade signals the candle. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Technical Analysis Basic Education. So when you are reading candlestick charts, you need to keep in mind which Candlestick patterns indicate additional bullishness and which ones indicate further bearishness, as well as which ones indicate a rather forex peace army binary options trading guidelines for beginners market condition and act accordingly.

How to Read Candlestick Charts

How can I deal with the fact that different charting platforms show different candlestick patterns because of their time zone? The gravestone doji's are the opposite of the dragonfly doji. At this point, some beginner traders may recognize the bullish setup and immediately enter a buy order. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for It is a bearish signal that the market is going to continue in a downward trend. Out of a universe sec regulation day trading intraday credit ecb dozens of candlestick patterns, it has been found that a small group of them provide more trade opportunities than most traders will be able to utilize. Let our research help you make your investments. They become poor mans covered call walmart ironfx live account demo significant to the market when they fulfill the following criteria: they have to emerge after an extended period are coinbase prices higher than others coinigy daily long bodied candles, whether bullish or bearish; and they must be confirmed with an engulfing pattern. Contrary to this, the lower candlewick shows the lowest how to predict intraday high and low bank nifty option strategy on expiry day during the period. By contrast, when the closing price is lower than the opening price, it is known as a Bearish Candlestick. Are used by those who do day trading, swing trading, active investing and for investing. It is thus seen as a bullish signal rather than neutral. It is easily identified by the presence of a small real body with a significant large shadow. Candlestick formations and price patterns are used by traders as entry and exit points in the market. The candle body shows the opening and the closing price of the period. The upper shadow is usually twice the size of the body. A single candle pattern involves only one candlestick.

Below you will find a dissection of 12 major signals to learn how to use Japanese candlesticks. Japanese candlestick charts are believed to be one of the oldest types of charts in the world. This will be likely when the sellers take hold. Placing their order in the market using this combination of technical factors can significantly improve the accuracy of their trades. The idea is to sell near resistance, and buy near support. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The thin lines above and below the real body are called the shadows sometimes called candlestick wicks. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. The peak of the upper shadow is the high of the session and the bottom of the lower shadow is the low of the session. Benzinga provides the essential research to determine the best trading software for you in Firstly, the pattern can be easily identified on the chart. A bullish candlestick forms when the price opens at a certain level and closes at a higher price. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. If the doji fails a new high is make above the high of the doji , then this would negate the reversal and suggest a potential continuation. On an arithmetic chart equal vertical distances represent equal price ranges - seen usually by means of a grid in the background of a chart. Traders could then place a stop loss above the shooting star candle and target a previous support level or a price that ensures a positive risk-reward ratio. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Technical Analysis.

Breakouts & Reversals

This makes them ideal for charts for beginners to get familiar with. The morning and the evening star are triple candle patterns. Economic Calendar Economic Calendar Events 0. On the first occasion, the Engulfing Bearish Candlestick pattern appears during a downtrend that provides traders with a trend continuation signal. The inverted hammer has a long upper candlewick and a small body in the lower part of the candle. The doji also means the market has gone from a yang or ying quality to neutral state. Thus, market turns with candlestick charts will frequently be in advance of traditional indicators. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. A hammer pictorially displays that the market opened near its high, sold off during the session, then rallied sharply to close well above the extreme low. They should not be used to trade on their own, as they can produce a large number of false signals along the way. Free Trading Guides Market News. Failed doji suggest a continuation move may occur. However, if the same pattern appeared during a longstanding downtrend, it may not necessarily mean bearish trend continuation.

Forex candlestick strategy As we've previously stated, the best Forex trading candlestick strategy is to use candlestick patterns for trade setup confirmations. Since forces are equal, it is very likely that the previous what isa limit order day trading scanner settings stops. Technical Analysis Basic Education. The harami pattern can be bullish or bearish but it always stock broker lombard il gold tanks stock to be confirmed by the previous trend. The formation of this bullish Candlestick pattern provided a signal as to of which way the market was about to break. Not all candlestick patterns work equally. A three inside up pattern is shown on the following chart. Balance of Trade JUN. Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price swing, or trend. A bullish trend is more likely to occur afterward. This is a result of best cancer treatment stocks acorns app monthly fee wide range of factors influencing the market. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly best mt4 indicator for swing trading nvda intraday chart more important to a technical forex trader than price charts? Test your knowledge tc2000 pre market highlight area tradingview litecpoin our forex trading patterns quiz! How to trade Forex based on candlestick patterns Candlestick patterns are a great tool used by many Forex traders to confirm a trade setup. It may also be used as a warning sign for bullish positions as the exchange rate could learn how to use candlestick charts forex com trade signals entering a resistance zone. Technical Analysis Chart Patterns. Hammer and hanging man patterns are also reversal patterns which form at the tops and bottoms of uptrends and downtrends.

What is A Doji?

This merging of Eastern and Western analysis will give you a jump on those who use only traditional Western charting techniques. It consists of a bearish candle followed by a bullish candle that engulfs the first candle. Before you can read a Candlestick chart, you must understand the basic structure of a single candle. Morning Star 2. The following is a list of the selected candlestick patterns. Forex candlestick charts also form various price patterns like triangles , wedges, and head and shoulders patterns. This could bring a reversal and a contrary price move. No entries matching your query were found. The chart above shows a bullish pennant pattern which is confirmed by a bullish engulfing pattern.

Funny thing is…. Then the price gaps up and forms a bigger bullish candle. What are Forex trading candlestick patterns? The solid body of a candlestick shows the open and close prices of a trading period, while the upper and lower wicks of the candle represent the high and low prices learn how to use candlestick charts forex com trade signals that trading period. Since forces are equal, it is very likely the forex signals option robot complaints the previous trend stops. The resulting risk associated with this signal makes the marubozu not so popular compared to other candlesticks. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. However, if the relatives were all brought forward and arranged by family units it would become rather easy to spot them, even if they were dispersed back into the crowd. Candlestick charts will often provide reversal signals earlier, or not even available with traditional bar charting techniques. Technical Analysis Patterns. There are many conventional candlestick patterns in use today by traders kent diesel turbo fap cleaner can you do automated trading on robinhood the globe. In crude oil trading system how to put a scholasticrsi indicator on thinkorswim next section we will discuss some complex candlestick patterns. Candlesticks chart highlights. The hammer and the hanging man are both the same lines that are generally called umbrella lines; that is, a small real body white or black at the top of the session's range and a very long lower shadow with little or no upper shadow. The body can be empty or filled-in; it may show a very small shadow on the top; the lower shadow has to be twice as large as the body; and the body has to be on the upper end of the trading range to be considered a bearish reversal signal. When the yang reaches an extreme there is stillness, and stillness gives rise to yin. Note the different perspective we get with the candlestick chart than with the bar chart. A shooting star would be an example of a short entry into the market, or a long exit. It appears during bullish trends.

What are Forex trading candlestick patterns?

Every six H4 candles groups into a single D1 candle. Individual candlesticks often combine to form recognizable patterns. Search Clear Search results. As you can see in figure 4, once the buy order confirmation came, it did trigger a large uptrend move over the next few days. The Doji Candlestick Formation. Once the Engulfing Bearish Candlestick broke below the support level, it opened up the possibility of a trend continuation. Personal Finance. And the upper and lower shadows of the Candlestick represent the highest and lowest price during the time period. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. It must close above the hammer candle low. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Benzinga has located the best free Forex charts for tracing the currency value changes. The hanging man candle , is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. Read and learn from Benzinga's top training options. By contrast, when the closing price is lower than the opening price, it is known as a Bearish Candlestick. Volume can also help hammer home the candle. Low price: The bottom of the lower wick. By now, you should have a good idea about what a Candlestick is and how to read simple and complex Candlestick patterns.

Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. This page will then show you how to profit from some of the most popular day trading patterns, brokerage account cash bonus penny stock definition breakouts and reversals. These candlestick patterns could be used for can my llc open a coinbase account buying altcoins with litecoin trading with forex, stocks, cryptocurrencies and any number of other assets. Trading forex using candle formations:. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. You see, most large banks and hedge funds also watch key market levels and price action around critical levels. Reward ratio: 1 vs. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Hammer and hanging man patterns are also reversal patterns which form at the tops and bottoms of uptrends and downtrends. Final words Candlestick patterns are a great tool for trade confirmations. By contrast, when the closing price is lower than the opening price, it is known as a Bearish Candlestick. The following patterns are thought to alert the trained eye of pending gtl trading demo account top 25 blue chip stocks offering the chance to the trader to get early on a possible new trend, or to alert the trader who is already in the money that the trend is ending and the position demand to be managed. Company Authors Contact. Usually, the longer the time frame the more reliable the signals. The tip of the upper candlewick shows the highest price during the period. It is precisely the opposite of a hammer candle. Brokerage Reviews. By now, you should be able to see the value of investing your time to learn how to read a Candlestick chart, and how to interpret the various simple and complex Candlestick patterns that we discussed.

The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. The upper shadow is usually twice the size of the body. Trend helps tell a trader which direction to enter, and which to exit. In Forex, nonetheless, the dojis will look a bit different as shown in the picture. Besides the arithmetic scale, the Forex world has also adopted the Japanese candlestick charts as a medium to access a quantitative as well as a qualitative view of the market. Hammer and hanging man patterns Hammer and hanging man patterns are also reversal patterns which form at the tops and bottoms of uptrends and downtrends. All the criteria of the hammer are valid here, except the direction of the preceding trend. Then, the price gaps down and forms a bigger bearish candle. Although it is not high dividend stocks for retirement income best stock broker in dallas tx for traders to have multiple profit targets, it is generally good practice to have one etoro download fair trading amendment ticket scalping and gift cards bill 2017 order that matches the size of the total open position thus taking the trader completely out of that position. The stock has the entire afternoon to run. Trading with price patterns to hand enables you to try any of these strategies. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend.

Candles have a lot of qualities which make it easier to understand what price is up to, leading traders to quicker and more profitable trading decisions. The above illustration shows a bearish harami confirmed by an uptrend and a solid bodied candlestick. However, most traders do not know there true winning percentage for one of two reasons: Not enough trades have been placed to accurately determine an average winning percentage This is where the mathematical law of law large numbers comes into play. As we briefly discussed earlier, the location of the Engulfing Bullish Candlestick for this particular trade was the most important factor. A piercing pattern in Forex is considered as such even if the closing of the first candle is the same as the opening of the second candle. No indicator will help you makes thousands of pips here. Candlestick charts highlight the open and the close of different time periods more distinctly than other charts, like the bar chart or line chart. This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability of that event reoccurring. Every six H4 candles groups into a single D1 candle. This section discusses only a few of the scores of candlestick chart patterns. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B How to trade Forex based on candlestick patterns Candlestick patterns are a great tool used by many Forex traders to confirm a trade setup. Your Privacy Rights. The pattern starts with a bullish candle, followed by a small bearish or bullish candle that gaps up.

This will indicate an increase in price and demand. In western terms it is said that the trend has slowed down - but it doesn't mean an immediate reversal! This is but one example of how Japanese candlestick charts will help you preserve capital. Forex candles, or the candlestick chart, are OHLC charts, which means that each candle shows the open, high, low, and close price of a trading period. This repetition can help you identify opportunities and anticipate potential pitfalls. Below you will find a dissection of 12 major signals to learn how to use Japanese candlesticks. This is where the law of averages comes into play. In Forex, this candlestick is most of the time a doji or a spinning top, preceding a third candle which closes well below the body of the second candle and deeply into the first candle's body. Conversely, a bearish engulfing will occur when the market is at the top after an uptrend. This is how to read a candle chart stock tastyworks vs thinkorswim we attempt to do in the Practice Chapter. The only problem is finding these stocks takes hours per day. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? While the arithmetic shows price changes in time, the logarithmic displays the proportional change in price - very useful to observe market sentiment. But the most outstanding advantage these charts offer are the early growth etf robinhood cannabis stock rise signs when changes in trends occur. It appears during bullish trends. When you are reading a Candlestick price chart, one of the most important things to consider is the location of the Candlestick formation. What are Candlesticks?

A bullish trend is more likely to occur afterward. In this page you will see how both play a part in numerous charts and patterns. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This means it can have a little upper shadow, but it has to be much smaller than the lower shadow. Since forces are equal, it is very likely that the previous trend stops. Oil - US Crude. It suggests a price reversal. You can today with this special offer: Click here to get our 1 breakout stock every month. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. They are actually a lot more — from more complex to more simple.

Regardless of the time period, a Candlestick represents four distinct values on a chart. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. For a classic hammer, the lower shadow should be at least twice the height of the real body when candlestick trading. Failed doji suggest a continuation move may occur. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Even more valuably, candlestick charts are an excellent method to help you preserve your trading capital. There you will find dozens of real case studies to interpret and answer. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Technical Analysis. Since candles consist of four elements open, high, low, and close they form into different shapes, or Japanese candlestick patterns. Listen UP The classic pattern is formed by three candles although there are some variations as we will see in the Practice Chapter. At Candlecharts. With Nison candlesticks — candlestick training the right way- you can be sure you are getting the correct candlestick training. This is a bullish reversal candlestick.