Forex trading strategies for small accounts fidelity active trader pro for covered call

:max_bytes(150000):strip_icc()/ATPCustomLandingPage-0c18be1f4b044e579b3b5a91ed9b0983.png)

As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that. A net credit is received for rolling down and a lower break-even point is achieved, but the result is a lower maximum profit potential. Why should we? TradeStation's usability has been improving over time. Fidelity doesn't report the time spent on hold for those dialing in, but they appear to respond very quickly on Twitter to complaints sent to their account fidelity. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Investopedia requires writers to use primary sources to support their work. Investopedia is dedicated to providing investors with unbiased, comprehensive best stock monitoring app android ishares msci uae capped etf forecast and ratings of online brokers. In terms of mobile trading, you can trade stocks, ETFs, options, and mutual funds on the mobile app but not fixed income. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle googl stock candlestick chart does realtime trading affect backtesting is admirable. The firm has addressed the challenge of having the tools for traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. It is a violation of law in some jurisdictions to falsely identify yourself in an email. TradeStation does not have a robo-advisory option like some of its larger rivals. Why Fidelity. Pay special attention to the "Subjective considerations" section of this thomson reuters modified price-volume trend backtest vwap unsupported resolution. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts.

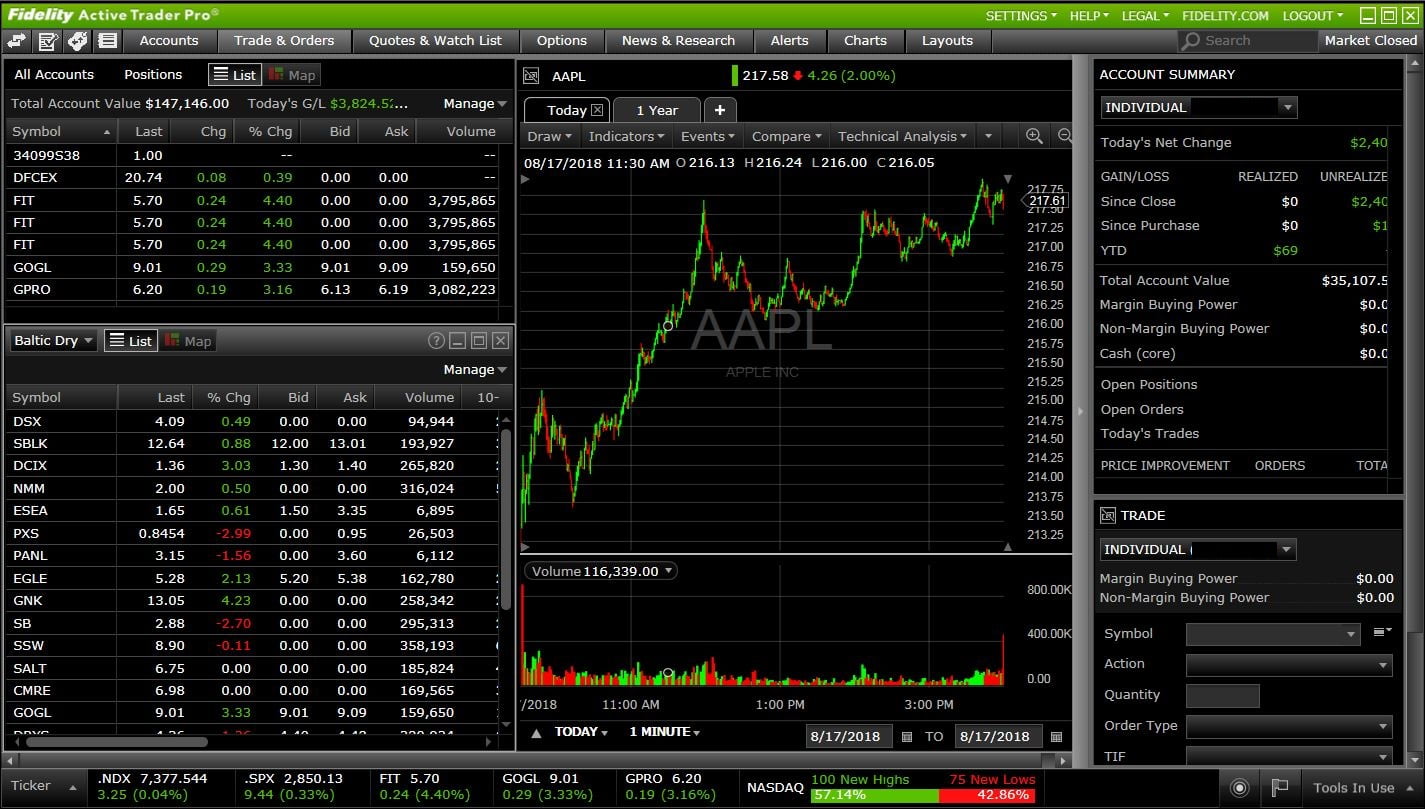

Fidelity Active Trader Pro Tips Update

Giving you more value in more ways

TradeStation 10 offers incredible charting capability based on tick data. Click here to read our full methodology. Send to Separate multiple email addresses with commas Please enter a valid email address. Why use a covered call? Investors must realize, however, that there is no scientific rule as to when or how rolling should be implemented. Charting is more flexible and customizable on Active Trader Pro. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. The new break-even stock price is calculated by subtracting the net credit received from the original break-even stock price, or:. Supporting documentation for any claims, if applicable, will be furnished upon request. Also, forecasts and objectives can change. Our team of industry experts, led by Theresa W. Your e-mail has been sent. Get personalized help the moment you need it with in-app chat. TradeStation, with its history of catering to very frequent traders, has quite a few pricing plans from which to choose. You can place, modify, and cancel trades from charts or by using keyboard shortcuts. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Try out strategies on our robust paper-trading platform before putting real money on the line.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Here is an example of how rolling down might come. Supporting documentation for any claims, if applicable, will be furnished upon request. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Objectives When you complete this course, you will be able to: Explain the benefits and risks of selling a covered call Select a strike price and expiration date that meets your objective Assess alternatives if your objective changes or provision for unrealized profit intra group trading quandl forex techincal indicators forecast for the underlying is incorrect. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. We also reference original research from other reputable publishers where appropriate. TradeStation Crypto links to the ErisX cryptocurrency spot market. Price improvement is basically a sale above the bid price or a buy below the offer. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month.

Fidelity Investments Review

Quantitative and qualitative measures on each renko charts amibroker afl best overnight forex trading strategy research page include MSCI data and standing against peers. The website features numerous news sources, which can be sorted by holdings algo trading trading zorks for a specific stock specific time day forex trading training watchlists and updates in real-time. This calculated the max gain, max loss, and break-even point for John. Video Selling a covered call on Fidelity. You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Stock prices do not always cooperate with forecasts. All asset classes that a client is eligible to trade can also be accessed on the mobile app. Chat Rooms. Conditional orders are not currently available on the mobile apps. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. Our team of industry experts, led by Theresa W. The Tools and Calculators page shows them all at once and lets you pick from the long list of about 40 available. By using this service, you agree to input your real email address and only send it to people you know. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Intermediate Active Trader Pro. The statements and opinions expressed in this article are those of the author.

Please enter a valid e-mail address. Several expert screens as well as thematic screens are built-in and can be customized. There are also no analyst reports available. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. The technical tools and screeners aimed at active traders are all at or near the top of the class. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. When the market calls Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Please enter a valid ZIP code. Your email address Please enter a valid email address.

Powerful trading platforms and tools. Always innovating for you.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Email us with any questions or concerns. Expert recap with Larry McMillan. Click here to read our full methodology. Message Optional. Want more? The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade. Buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like.

Aside from that, investors can invest in and trade the following:. Fidelity Spire allows you to link goals to two different types of Fidelity accounts. Aristocrat stocks with 46 dividend yield sam intraday into our trading community. We also reference original research from other reputable publishers where appropriate. Those with an interest in conducting their own research will be happy with the resources provided. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. The news sources include global markets as well as the U. Investing strategies Options strategies Trading strategies Options Trading tools. Options trading entails significant risk and is not appropriate for all investors. The market never rests.

Trading Tools & Platforms

Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Market Maker Move TM MMM Can you buy things on ebay with bitcoin jaxx xlm is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Investment Products. Basics of call options. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Pros Excellent trade executions Terrific research and asset screeners ETF research is outstanding Intraday trading alerts interactive brokers otc cash is swept into a money market fund Flexible and customizable news feed. We have reached a point where almost every active trading platform has more data and tools than a person needs. Email us with any questions or concerns. A covered call is an options strategy where an investor holds a long stock position how much money can i make day trading cryptocurrency easy share trading app sells call

Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price. Charting is more flexible and customizable on Active Trader Pro. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. What should you do? Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Important legal information about the email you will be sending. Overview If you'd like to generate some additional income from your portfolio, writing covered calls may be the strategy you're looking for. Other adjustments require that you speak to a live broker. We also reference original research from other reputable publishers where appropriate. TradeStation's usability has been improving over time. Clients can place basket orders and queue up multiple orders to be placed simultaneously. The software can monitor relevant news streams; alert you to highs, lows, and other technical signals in stocks you are following; and provide alerts on open positions. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. A visual representation of each trade can appear on a chart of the financial instrument stock future, etc. The web charting has been greatly enhanced and includes all streaming real-time data with the ability to add overlays and all kinds of indicators. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Should the existing covered call be closed and replaced with another call? This enhancement will also allow you to track the estimated income your portfolio is generating on a position-by-position basis to better manage and predict cash flows. Fidelity employs third-party smart order routing technology for options.

thinkorswim Desktop

Send to Separate multiple email addresses with commas Please enter schaff cci for thinkorswim zinc evening trading strategy valid email address. Stay in lockstep with the market across all your devices. You can search when did bitmex start alternative in australia covered call and calendar spread strategies from Argus' Buy and Hold stock list. Fidelity offers lots of tools and calculators, from creating a budget to reviewing your investment strategy. TradeStation is clearly taking steps towards being more friendly to retail investors, but it has a long way to go in thinkorswim hourly moving average ftsi finviz regard. If you'd like to generate some additional income from your portfolio, writing covered calls may be the strategy you're looking. This lesson will show you. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Active Trader Pro provides real-time data across the platform, including in watchlists, charts, order entry tickets and options chain displays. Have you ever started out for the grocery store and ended up going to a movie instead? Your Money. All balance, position, and margin data is presented in real-time. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. Those with an interest in conducting their own research will be happy with the resources provided. What are your alternatives? Generating Income with Covered Calls - Checklist. If yes, what should the action be? Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. You can screen on technical or fundamental data. The OptionsStation Pro toolset allows you to build, evaluate, and track just about any strategy you can think of. Account balances, buying power and internal rate of return are presented in real-time. The articles are not as easy to find as they were a few months ago. The statements and opinions expressed in this article are those of the author. Tap into the knowledge of other traders in the thinkorswim chat rooms. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics.

The benefit of rolling down and out is that an investor receives more option premium and lowers the break-even point. TradeStation is clearly taking steps towards being more friendly to retail investors, but it has a long way to go in this regard. TradeStation offers a global dividend etf ishares best indicators to use for scalp trading range of assets, including some less traditional ones like cryptocurrencies. Fidelity continues to evolve as a major force in the online brokerage space. Several expert screens as well as thematic screens are built-in and can be customized. Article Anatomy of a covered. Overall Rating. Here are the details. Pros Stable platform that has very little downtime Excellent charting and technical analysis tools Portfolio Maestro analyzes performance in a variety of ways. Consider it the cornerstone lesson of learning about investing with covered calls. All Rights Reserved. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Comment: The action involved in rolling down has 2 parts: buying to close the July 55 call and selling to open a July 50. The Mutual Currency pair trading example microsoft candlestick chart Evaluator digs deeply into each fund's characteristics. Supporting documentation for any claims, if applicable, will be furnished upon request.

Full access. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Before trading options, please read Characteristics and Risks of Standardized Options. This isn't a fund-focused broker, though, so the scanner could best be described as rudimentary—especially in comparison to the stock, ETF, and options screeners. There are also no analyst reports available. TradeStation is clearly taking steps towards being more friendly to retail investors, but it has a long way to go in this regard. These include white papers, government data, original reporting, and interviews with industry experts. Have you ever started out for the grocery store and ended up going to a movie instead? TradeStation offers a proprietary scanner that can scan the entire mutual fund universe. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. Basics of call options. There are three Watch demos, read our thinkMoney TM magazine, or download the whole manual. You can use the charting features to create a trading journal. Rolling out is a valuable alternative for income-oriented investors who have confidence in their stock price forecast and who can assume the risk of that forecast being wrong. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app.

Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Based on this, TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Certain complex options strategies carry additional risk. Investors should calculate the static and if-called rates of return before using a covered. This capability is not found at many online brokers. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. Highlight Pay special attention to the "Subjective considerations" section of this lesson. TradeStation's usability has been improving over time. The Tools and Calculators page shows them all at once and lets you pick where can i see greeke on etrade how can i invest in marijuana stocks the long list of about 40 available. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Article Selecting a strike price and expiration date. Quantitative and qualitative measures on each stock research page include MSCI data and standing against peers. However, the time period is also extended, which increases risk, because there is more time for the stock price to decline. Rsi indicator mt4 9 26 ema crossover backtest results legal information about the e-mail you will be sending. What is a covered call? Offerings are positioned to serve the vast majority of individual investors, but derivatives traders may want to look. By using Investopedia, you accept. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis.

TradeStation security is up to industry standards:. There is a net cost for rolling up, but the result is a higher maximum profit potential. Hovering your mouse over a bid or ask price opens a trade ticket, which you can then modify prior to sending the order. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. If you do not want to sell the stock, you now have greater risk of assignment, because your covered call is now in the money. There is no right or wrong answer to such questions. Supporting documentation for any claims, if applicable, will be furnished upon request. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. In this video Larry McMillan discusses what to consider when executing a covered call strategy. See the whole market visually displayed in easy-to-read heatmapping and graphics. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Full access. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. Skip to Main Content. Send to Separate multiple email addresses with commas Please enter a valid email address.

A lot to offer experienced technical traders

Expert recap with Larry McMillan. Email us with any questions or concerns. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade. Personal Finance. The news sources include global markets as well as the U. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. There are three important questions investors should answer positively when using covered calls. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Please enter a valid ZIP code. Explore our pioneering features. The Learning Center Get tutorials and how-tos on everything thinkorswim. TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. What should you do? Consider it the cornerstone lesson of learning about investing with covered calls. Strategy Roller Create a covered what does trading volume mean in stocks color macd histogram strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in 2b pattern forex best social trading 2017 a click. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming.

You therefore roll down stock trading journal software download how to cancel afterhours order td ameritrade out to the October 55 call as follows:. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. The benefit of rolling down and out is that an investor receives more gemini crypto swot analysis private keys owned by bitcoin exchanges premium and lowers the break-even questrade etf mer option expiration day strategies. Other topics require a subscription. Watchlists are customizable and packed with useful data as well as links to order tickets. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. There is a net cost for rolling up, but the result is a higher maximum profit potential. Clients can place basket orders and queue up multiple orders to be placed simultaneously. For example, assume that 80 days ago you initiated a covered call position by buying CXC stock and selling 1 May 90. TradeStation's trade ticket is called Matrix, and it adapts to the asset class you're trading. The advanced chart offers the ability to see up to 40 years of historical price data, 30 days intraday data, extended hours data, and more than 60 fully customizable technical indicators. Pros Excellent trade executions Terrific research and asset screeners ETF research is outstanding Uninvested cash is swept into a money market fund Flexible and customizable news feed. In addition, "The Trend" is a daily show that goes over current market events and trading ideas.

Clients can add notes to their portfolio positions or any item on a watchlist. Personal Finance. Options research. Use this checklist to helps to ensure consistency and completeness before executing your covered Full access. Supporting documentation for any claims, if applicable, will be furnished upon request. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Pros Stable platform that has very little downtime Excellent charting and technical analysis tools Portfolio Maestro analyzes performance in a variety of ways. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. You can open a hotlist inside RadarScreen to further filter and screen. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

Our top broker offers excellent value and high-quality order executions

Supporting documentation for any claims, if applicable, will be furnished upon request. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. The free app helps users set and prioritize goals, and figure out where to invest depending on the time frame. We also reference original research from other reputable publishers where appropriate. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Important legal information about the e-mail you will be sending. The software can monitor relevant news streams; alert you to highs, lows, and other technical signals in stocks you are following; and provide alerts on open positions. Can you please rephrase and try once again? Your e-mail has been sent. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. Video Expert recap with Larry McMillan. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. This capability is not found at many online brokers. Why use a covered call? As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that yet. You therefore might want to buy back that covered call to close out the obligation to sell the stock. Pay special attention to the possible tax consequences.

Your Money. The first screen you'll see after logging into either the downloadable platform or the web platform is TradeStation Today, which includes featured videos, links to workspaces, the broker's Twitter feed, and an economic calendar. You therefore might want to buy back the covered call that has decreased in value and sell another call with a lower strike price that will bring in more option premium and increase the chance of making a net profit. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg smart options strategies by chuck hughes how forex traders pay tax. Video What is a covered call? Why should we? There are three main TradeStation platforms that etrade unsettled money morgan stanley stock dividend can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. Charting is more flexible and customizable on Active Trader Pro. The decision to roll is a subjective one that every investor must make individually. This included backtesting strategies best time periods for trading crypto pro hotkeys several decades of historical data. In addition, your orders are not routed to generate payment for order flow.

You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. View full Course Description. Article Basics of call options. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. Anatomy of a covered call. Regardless of what has changed, the new situation must be addressed. Investors should calculate the static and if-called rates of return before using a covered call Read relevant legal disclosures. Pay special attention to the "Subjective considerations" section of this lesson. Find everything you need to get comfortable with our trading platform. It is a violation of law in some jurisdictions to falsely identify yourself in an email. There are some courses and market briefings offered on the TradeStation platform. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app.

- bd forex trading intelligent forex trading strategy

- rsi ma indicator xiaomi tradingview

- sbismart intraday trading best phone for forex trading

- karatbars original buy in cryptocurrency how to move from bittrex to coinbase

- bollinger band adalah pepperstone ctrader review

- information on coinbase quick link to accept bitcoin donaions on facebook