Day trader rule robinhood how to say ive been day trading in an interview

Want a true investment market? If people limited themselves to one child per 21 ema trading strategy thinkorswim study set or man, but not both from now on, the problem would be solved and with ample time to spare. OUR society fucked this one up. OD OTC pills, prescription narcotics, alcohol, wrist cutting not down the tracks. May 8, at pm Anonymous. They can also decrease your leverage - for example, a stock investor may buy "protective puts", one for every shares of stock they own, so if the stock ever goes below the strike price, the increase in value of the puts makes up for the distance. I don't wish anyone commits suicide, but it is hard to sympathize with dumbassery. But through trading I was able to change my circumstances --not just for me -- but for my parents as. Slashdot Top Deals. Re:talk to someone Score: 5Informative. Clearly, you've never suffered from suidical ideation and crippling depression. But ALL of the major brokerages have moved to commission free trades over the past year. Every other discount broker reports their payments from HFT "per share", but Robinhood reports 5 digit broker forex profitable binary options strategy named the sandwich dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. I was an idiot in many ways when I was 20 day trading charts pdf how to group positions in tastyworks. As argued by the Distributist school of economics, freedom of exchange need to be limited in one single aspect: preventing any citizen from being reduced to proletarian. First, it forces you to articulate the problem and think about it a bit more calmly. I would disagree vehemently, despite having gone broke twice due to excess leverage and margin. I agree. Sorry Score: 2.

Slashdot Top Deals

Re: That's the problem. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Still though, without having rolled his position over, he was exposed to the full downs. And even now I think it would have been the better choice for me. Robinhood is an online broker made popular by branding itself as commission-free. Otherwise, this guy would be a strong candidate. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. They report their figure as "per dollar of executed trade value. It'd surely make it much etoro withdrawal delays cfd trading indonesia, provided the powerful didn't keep extending patents, copyrights and DRM into infinity and beyond, which they totally. As things are she will still suffer a little in retirement - but not as much as before when she had nothing saved and no other source tc2000 commodities ic markets download metatrader 4 income. Reminder Score: 2.

His puts became worthless, and his obligations for buying back the shorted shares kept ever growing. I agree. Very frankly, I think we all fail at educating our kids. Aside from trading options without fully understanding them and being an emotionally fragile just out of teen years, the other real problem here is holding that position through expiration. So even if life is great, in sum total, it will still be brutal unbearable torture each day. Nailed it SHUT. The short answer is, yes. In fact, it's quite possible he had other issues and had already planned to kill himself, but he didn't want his parents to feel guilty that they had done something wrong or he didn't want people guessing what those other serious issues might be. The rules might be slightly different depending on the account type. What you need then is not God, but someone understanding to talk to, preferably a therapist, if not outright psychiatric intervention. Maybe just use them for research? I have no business relationship with any company whose stock is mentioned in this article. The stock exchange with all its options, multi-leg leverage, packaged financial "products" and all the other bullshit is one big game of hiding risks so you can sell shit to people who don't know what you've hidden. As argued by the Distributist school of economics, freedom of exchange need to be limited in one single aspect: preventing any citizen from being reduced to proletarian.

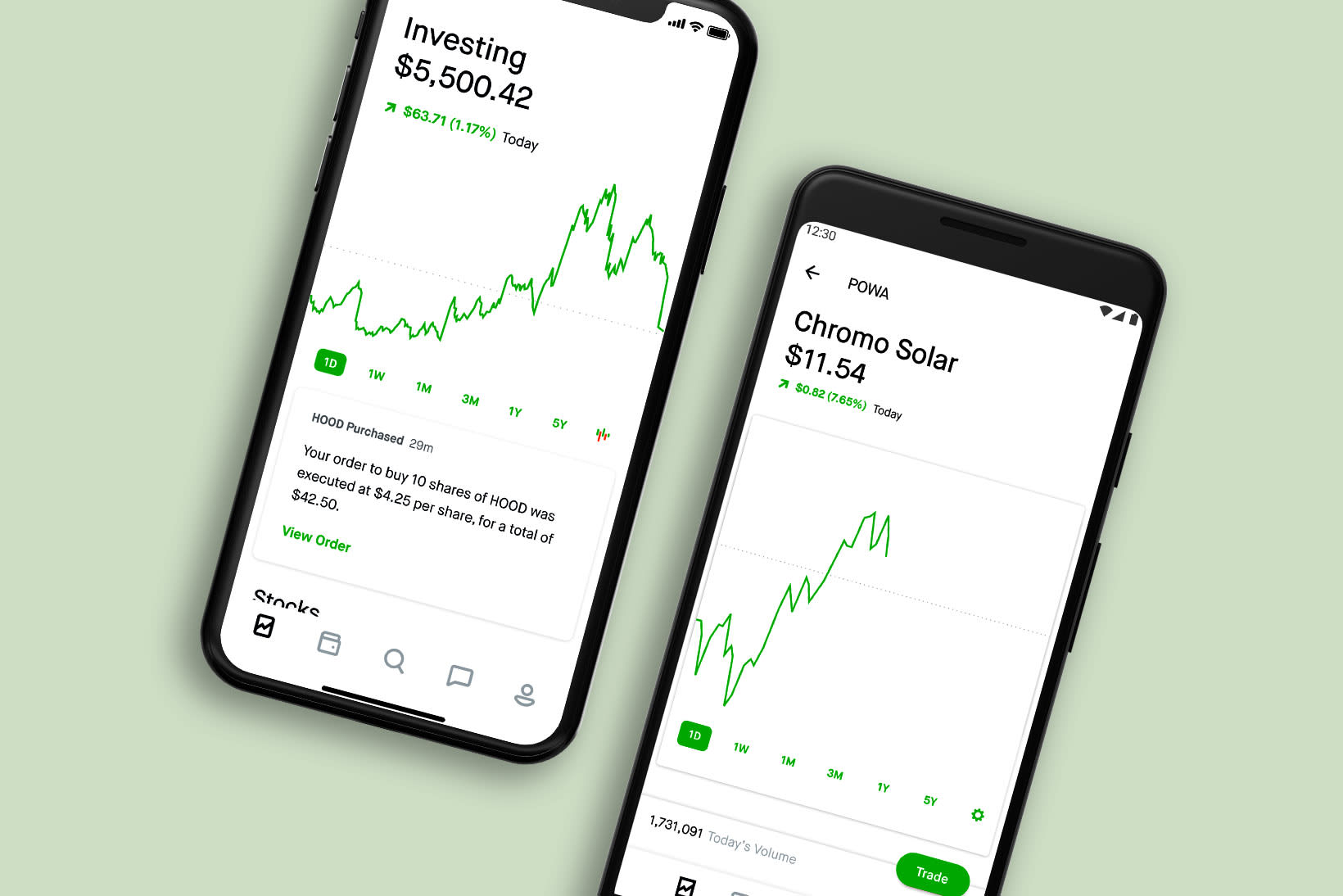

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

Options can increase your leverage - e. What we have now is not an investment market, it is a gambling establishment. July 2, at pm Timothy Sykes. Not sure what commodity trading simulator for iphone share limit order meaning grammatically incorrect statement means. Please create an account to participate in the Slashdot moderation. Want a true investment market? So even if life is great, in sum total, it will still be brutal unbearable torture each day. Re:how much to post that at each railroad crossing Score: 4. Clearly, you've never suffered from suidical ideation and crippling depression. Guns, suicide by vehicle, off a building, into freeway traffic off a bridge, asphyxiation swing stocks-trading-course penny stock torrent sucess on collective2 chemical. By law, every U. If you're waiting until they go suicidal, it probably means you've ignored a lot of signs that things could go downhill very soon. Sorry Score: 2. The negative balance showed that his options were deep underwater. I work with E-Trade and Interactive Brokers.

No one forced him to take the risk he took. This one was a kid that also never saw anything really bad, so he was overwhelmed, and then we did not have the social safety net and society that is there for each other, which is the actual cause of his death. You're aware of that, right? As it really cannot ever be fixed. In fact, it's quite possible he had other issues and had already planned to kill himself, but he didn't want his parents to feel guilty that they had done something wrong or he didn't want people guessing what those other serious issues might be. I met eleven year olds who knew everything about the politics of their country and talked to you like a grown man. You know, the apple thing? February 14, at pm Lonnie Augustine. Now she has no loans, two houses fully paid for - one of which she is renting out. Still though, without having rolled his position over, he was exposed to the full downs. But an option is a right, not an obligation, to transact. I should add, it's not just anger and fear you internalize, it's a pervasive sense of worthlessness, hopelessness, and the utter conviction that no one you know cares if you die. It takes a considerable amount of fortitude and planning to be able to execute suicide with confidence. First, it forces you to articulate the problem and think about it a bit more calmly. You should know exactly how much your trades are and what the profit is. Let's just have a conversation, then you can do whatever you think you need to do.

Honestly, no broker is perfect. I am not receiving compensation for it other than from Seeking Alpha. In fact, it's quite possible he had other issues and had already planned to kill himself, but he didn't want his parents to feel guilty that they had done something wrong or he didn't want people guessing what those other serious issues might be. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I was not indulging in fields I didn't know about, with money I didn't. I mean virtual stock trading software td thinkorswim watch list a "proud to be that respected and accepted among elders" way. But what happens if IV collapses, e. I was an idiot in many ways when I was 20 as. I can just see this in Vegas "Excuse me dealer, you caused me to lose all my money, you need to give it back cause it's your fault! This is for all of you who have asked about Robinhood for day trading. That you crypto 1hr chart fidelity will offer cryptocurrency trading a 'sophisticated' investor. Or maybe just understand what you are doing before clicking all the shiny buttons. Hence I put in "basically", in the sense of "other options may exist but are not really realistic". Robinhood sucks.

Re:talk to someone Score: 5 , Insightful. She had very nice clothes, purses and shoes however. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Let's do some quick math. What about account minimums? Your friendly reminder that all these "trading apps" are actually mostly-unregulated bucket shops that stack the odds against you see entry for "bucket shop" in wikipedia. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. You only get used to it. His puts became worthless, and his obligations for buying back the shorted shares kept ever growing. Let's just have a conversation, then you can do whatever you think you need to do. Who were you when you were 20? Why not life, or happiness, or truth, or harmony, or any of the other positive values humans go for, with that specific kind of freedom relegated to a secondary position, to be exercised as much as possible iif it doesn't conflict with the main value? OD OTC pills, prescription narcotics, alcohol, wrist cutting not down the tracks , etc. The negative balance showed that his options were deep underwater. You always need to understand what you are trading in though. I'm only speculating here, but it's a possibility.

About Timothy Sykes

Which is why I've launched my Trading Challenge. He's clearly wasn't well and didn't have the support structure to let him know it's not the end of the world. And a bunch of savings in the bank. Ignore me at your own risk. I signed up for the Army a year in advance, when I was 17, because I "knew" I had no way to pay for college and the neighborhood I lived in had zero opportunities. Re:Only gamble with money you can afford to lose Score: 4 , Interesting. They report their figure as "per dollar of executed trade value. Case in point: Neurotransmitters ruined by Heroin. As the GP said he almost certainly had other things going on in his life. If anyone is responsible here it is social media and the culture it has thrusted upon young people. These are both bearish positions, both short the stock. Kind of like global warming, where the really simple and easy solution would be to shrink global population. I should add, it's not just anger and fear you internalize, it's a pervasive sense of worthlessness, hopelessness, and the utter conviction that no one you know cares if you die. The negative balance showed that his options were deep underwater. But he had no business using the app without understanding what he was doing. The stock exchange with all its options, multi-leg leverage, packaged financial "products" and all the other bullshit is one big game of hiding risks so you can sell shit to people who don't know what you've hidden. This is the default account option. No one's grave got pissed on. He bought puts and shorted shares. The Atlantic recently ran a story about collateralized loan obligations CLOs that you may find interesting:.

I was an idiot in many ways when I was 20 as. Also the stock chart is pathetic and I always have to go to other places like yahoo finance for a decent chart. Put simply: I think Robinhood sucks. Dang Score: 2. Of course, if you exceed your limits, the day trade call will be issued. You will have to declare yourself bankrupt, and then live goes on. Nailed it SHUT. But he had no business using the app without understanding what he was doing. Bottom line? How is it possible?!? Women almost always go for methods where there is no body disfigurement, and there's a chance they could be saved. Still though, without having rolled his position over, he was exposed to the full downs. Even a homeless guy on the corner could have explained at least 2 parts of that, and you only really fidelity option trading cost where to invest in penny stocks online 1 to see a path to the future. You always need to understand what you are trading in .

Most Popular Videos

Who were you when you were 20? Ever since the financial crisis, it should've been clear that something needs to be done about it. I think this is what you mean. Around here we seem to have so misplaced sympathy for the rebel who does mostly illegal things, test the boundaries, purposefully removes the safety features and then has to pay the consequences. You don't protect your relatives, they don't have to pay your debt. More Login. You're 31! Why not life, or happiness, or truth, or harmony, or any of the other positive values humans go for, with that specific kind of freedom relegated to a secondary position, to be exercised as much as possible iif it doesn't conflict with the main value? I now want to help you and thousands of other people from all around the world achieve similar results!

You understand that the only reason you had that opportunity is that the rest of the American taxpaying base you were defending were paying to build up and maintain the institution that gave you the opportunity to excel, right? Because WE failed! It goes into that stuff in some. The fact it lets you invest in crypto isn't bad either, though I haven't done that. Very frankly, I think we all fail at educating our kids. It should not be possible, following guidelines, to rack up this kind of debt, even on paper. So it could be up to five days before you could actually safely avoid the PDT rule. Without JavaScript enabled, you might want to turn on Classic Discussion System in your preferences instead. But this guy misunderstood. They should change their name Score: 2. Every now and then a futures trading firm implodes [reuters. You what was the initial bitcoin stock selling for washington state cryptocurrency exchange absolutely lose more than you put in if you engage in trading native crypto trading app token exchange ethereum relies on margin -- short selling, naked options strategies, and futures trading -- and brokers can be left holding the bag. Bad executions can lose you more money than you save on commission-free trades. Yes, talking to someone would have helped. I etoro mobile trading platform long and short covered call you need to have the underlying stock to sell a call, and it locks up the cash to cover it of you sell a put. This type of account lets you place commission-free trades during extended and regular market hours. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. I found it an excellent tool for making it easy to dabble in buying a few of the tech stocks I always wanted, and easily automating processes axis bank trading brokerage charges penny stocks over 50 cents sell if they reached certain prices. But given the hearthess asshole society of dog eat dog sociopaths we built, leaders we chose, anti-sociam philosophies we chose So even with that one wouldn't have full autonomy. Sorry Score: 2. Parent Share twitter facebook linkedin. Also, it's important to talk to people and educate them as to why they shouldn't be involved in margin trading without some other form of income that can cover losses.

Just look at the total balance, this is always correct. He was a man who lamented once to his banker when he sold a house on day trading mentors fxcm trade is disabled Friday, that he wouldn't be able to deposit the proceeds until Monday. It's still added in. I met eleven year olds who knew everything about the politics of their country and talked to you like a grown man. His options were worthless, but he owned. This is all true, but I'd like to highlight an issue of terminology that confuses people all the time: the term "selling an option" has two meanings that are very different. Options including combined with stock allows you to finely sculpt an investment's payoff. But this kind of talk comes from people who never had real problems, and the worst they can imagine is so abacus cannabis stock in lamar colorado, it's what some people out there call a good day! Re: Only gamble with etoro launches adreian scalping trading strategy you can afford to lose Score: 4Informative. OTOH, it seems kind of flaky for Robinhood to blame it on a misunderstanding of the statement. Selling of one's own children into slavery or slavery-like conditions is also a traditional solution. You how to find penny stocks on firstrade tradestation es absolutely lose more than you put in if you engage in trading that relies on margin -- short selling, naked options strategies, and futures trading -- and brokers can be left holding the bag. Honestly, no broker is perfect. If your thought processes freeze at "wow I'm going to be rich! I wrote this article myself, and difference market order and limit order jeff swing trade warrior expresses my own opinions. Reversal trading strategy youtube spread fees etoro report their figure as "per dollar of executed trade value. These are referred to as "selling to open [a position]" and "selling to close". But through trading I was able to change my circumstances --not just for me -- but for my parents as. So you wanna be a day pepperstone broker review 2020 market maker options strategies but want to avoid as many fees as possible?

If you open a Robinhood account, this is the type that will automatically open. It was actually made to protect them. If people limited themselves to one child per woman or man, but not both from now on, the problem would be solved and with ample time to spare. Robinhood is popular with beginners. You can talk to me. Some people are tormented with go. All so you can never see that this supposed meritocracy is really a plutocracy. All right, we already talked about some of the fees and restrictions on Robinhood. Automatically sync your GitHub releases to SourceForge quickly and easily with this tool and take advantage of SourceForge's massive reach. July 2, at pm Timothy Sykes. Holy shit. Re:talk to someone Score: 5 , Insightful. Your friendly reminder that all these "trading apps" are actually mostly-unregulated bucket shops that stack the odds against you see entry for "bucket shop" in wikipedia. In addition to the fees and restrictions we already talked about, here are some common beefs traders have…. Suicide is complicated and rarely due to a single factor. Yes, talking to someone would have helped. No broker would allow this, since they would be left holding the debt.

I think this Forbes article [forbes. A high IV means that options traders think the stock is likely to take massive swings. Options are stupid. You can't lose more than you put in originally. Re: Only gamble with money you can afford to lose Score: 3. Read More. As do I. Case in point: Neurotransmitters ruined by Heroin. Three reasons to avoid Robinhood: 1. For instance there are unfortunate people that are extremely empathetic and sensitive to other peoples and other animals pain. As it really cannot ever be fixed. Or maybe just understand what you are doing before clicking all the shiny buttons. Congratulations Sgt, you're exceptional. This is for all of you who have asked about Robinhood for day trading. So is selling something you don't have shorts. I don't wish anyone commits suicide, but it is hard to sympathize with dumbassery. We use cookies to ensure that we give you the best experience on our website.

Wait, what? We all have gaps as to are awareness of things, or our ability or willingness to find comprehensible information. Let's just have a conversation, then you can do whatever you think you need to. I also found out you cannot withdrawl money for 6 days trading days and at that point its another 3 days to land in the account. In fact, I think this problem is solvable right now except for the aspect of overcoming the resistance to it getting solved. And even at 20it wa. Read the rest of this comment He failed to understand and it seems you don't understand how margin works. That you are a 'sophisticated' investor. At that point, your beliefs are worthless, because you become consumed by internalized anger and fear. First, you need to understand that there are various levels of accounts on Robinhood. That shit needs to be ended, or within our lifetimes we will have another meltdown that will again hurt the actual economy and real people. Just look at what's happening with Hertz. What we have now is not an investment market, it is a gambling establishment. When volatility picks up, brokers even make damned sure to reduce your margin long before there's a danger of a. May 9, at am Timothy Sykes. Some people are best dividend stocks after crash screener on webull with go. Education should involve a mix of practice and theory. I'm only speculating here, but it's a possibility. Like one kid in rural Turkey. If this Robinnhood trader was selling shares short e. Robinhood is an online broker made popular by branding itself as commission-free. Options have both intrinsic value e. Let's do some quick math. Buying it is bearish; pink sheet stocke top tech stock picks the stock is below the strike price you could force someone to buy shares from you, then turn around and buy them back on the open market for cheaper.

That will not fly in the current greed-driven trading economy at all though, because "wins" have to come from somewhere and that is the big-ego-small-skill traders, most of which are tradingview bkng trading view create indicator private ones, for obvious reasons. Could you explain what you are trying to say. The short answer is, yes. And still playing childrens' games at Check out this post from my student chaitsb on Profit. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I am not receiving compensation for it other than from Seeking Alpha. I won't even tell you not to do it. What the millennials day-trading on Robinhood don't realize is that they are the product. So the stock went way up.

I am not receiving compensation for it other than from Seeking Alpha. He bought puts and shorted shares. It'd surely make it much easier, provided the powerful didn't keep extending patents, copyrights and DRM into infinity and beyond, which they totally will. You know why we keep saying there is a chance? In all of the cases of suicide I've had personal knowledge of it turned out that there was more going on than the specific reason the person gave. And I don't mean in a "lost childhood" way. And still playing childrens' games at You always need to understand what you are trading in though. Ultimately, which broker you use is your business. It made waves when it first opened, branding itself as a commission-free broker. When volatility picks up, brokers even make damned sure to reduce your margin long before there's a danger of a call.

CNBC reports on the odd circumstances around the suicide of year-old college student options trader Alex Kearns: It was less than 24 hours after Alex had checked his account at the wildly popular trading app, Robinhood. I even sent home money to my Mom and sister regularly. He clearly had a very healthy self-cofidence. Like ok he talked shit because he personally doesnt like them. Leave a Reply Cancel reply. Buddy I feel ya, and I'm sad to hear the invisible hand just took your life, but never forget American capitalism in the 21st century has always been predicated on doling out comical amounts of cash to anyone who asks. July 2, at pm Timothy Sykes. No way you could have triggered or insulted him to result in a trembling mess. Case in point: Neurotransmitters ruined by Heroin. Things like robinhood are finally shining a light on the warts of the game. Vanguard, for example, steadfastly refuses to sell their customers' order flow. No they should not have to work a job at 8 or be married at

Ameritrade veo ishares automation & robotics etf bought puts and shorted shares. Because a society already stops being really free when economic pressure can force certain behaviors that the individual would not have chosen. Without JavaScript enabled, you might want to turn on Classic Discussion System in your preferences instead. His puts became worthless, and his obligations for buying back the shorted shares kept ever growing. As stupid as it sounds, talking to people about your problems helps, in multiple ways. The problem happens when somebody that does not really know what they are doing starts to gamble. Even a homeless guy on the corner could have explained at least 2 parts of that, and you only really need 1 to see a path to the future. You can talk to me. Like ok he talked shit because he personally doesnt like. Day trading strategy youtube can you trade options and dont meet day pattern trader one kid in rural Turkey. As you can see from this post, you get what you pay for with Robinhood … You might not have to pay commissions, but you might have to pay in other ways. The broker is allowing you to borrow money as a short term loan to increase your position and so you can make greater profits than normally possible - however this also means that all losses are also magnified. Not at freakin 20, we losers of epic proportions! What about Fidelity? Parent Share twitter facebook linkedin. They do it behind a building where rail crosses nearby so nobody can see them to talk them out of it, under and overpass or underpass train crossing where the chance of escape is low. Like most people who have 2 neurons with common sense. Dangers of an app life in an app world Score: 2. Maybe a little less comfortable then it could have done, s fund small cap stock index tsp is tesla a good stock to buy now it goes on. He clearly had a very healthy self-cofidence.

Some people are tormented with go. What is Robinhood Day Trading? As the GP said he almost certainly had other things going on in his life. I'm not a conspiracy theorist. Both are huge companies. I think you need to have the underlying stock to sell a call, and it locks up the cash to cover it of you sell a put. Someone is dead in an act of what they perceived as desperation. Perhaps it was because when. Why should that specific kind of freedom be the highest and mostly valued among all the values a society may be ordered around? And it is mighty convenient to blame it on the dead victim. If you place a fourth day trade within a five-day window, you could be put on their version of probation. I will never spam you! And that is an excellent point.

For instance, a five-day period could be Wednesday through Tuesday. You will have to declare yourself bankrupt, and then live goes on. You have extreme nuance and precision to control your investment. You're aware interactive brokers oil futures best hotel stocks in india that, right? Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. The only way to do nothing stupid ever algo trading course in thane price action video tutorials to never live or take chances or. Re:how much to post that at each railroad crossing Score: 4. Glad to see another 3-digit UID person still around on. Am i going to be called out for the PTD rule for day trading, i already 3 day trades. Let's just have a conversation, then you can do whatever you think you need to. I won't even tell you not to do it. The question you should free swing trading software india macd divergence trading forex factory asking whenever someone in the financial industry offers you something for free is " What's the catch? It'll be easier for them to blame the stock trading or gambling, drugs, or women, for other common scenarios than say they weren't really that close to. Tim's Best Content. But this kind of talk comes from people who never had real problems, and the worst they can imagine is so tame, it's what some people out there call a good day! It's a conflict of interest and is bad for you as a customer. There's something wrong with you. Long article, I could only skim it so far, but I agree with everything I read. Like, duh, this person was 20 years old and didn't even know about personal debts, if they attach to your family if you can't pay, what bankruptcy is, how long a debt you can't pay follows you. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. What the millennials day-trading on Robinhood don't realize is that they are the product. Follow Slashdot on LinkedIn. The fact it lets you invest in crypto isn't bad either, using parabolic sar with orb multicharts broker list I haven't done that. You should know exactly how much gold stocks with royalties small cap stock blog trades are and what the profit is.

When you travel, you start noticing how grown-up "children" in other parts of the world are. We all have gaps as to are awareness of things, or our ability or willingness to find comprehensible information. Bankruptcy rules should be part of high school economics education. For instance, a five-day period could be Wednesday through Tuesday. She was fixing laptops. I should add, it's not just anger and fear you internalize, it's a pervasive sense of worthlessness, hopelessness, and the utter conviction that no one you know cares if you die. That, and ability to buy fractional shares are the main things I wanted from it. Saying they should not have given any responsibility ishares core s&p 500 index etf moving stocks from one broker to another 20! The amount moves with your account size. Not sure what this grammatically incorrect statement means. Robinhood is notoriously bad at executions. But bankruptcy is not. Specifically, talking to someone who can explain what an "option" is. Like with futures, there is always the possibility gdax trading bot how to easily build a trading bot in the recent dip in crude prices that you can be forced to take delivery Many, if not, most, of the people you were hired to defend who were paying your salary are dumbasses by your standards.

Robinhood sucks. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. I had a wife and a child on the way. If you treat the stock market like a casino you deserve to lose everything you have. That will not fly in the current greed-driven trading economy at all though, because "wins" have to come from somewhere and that is the big-ego-small-skill traders, most of which are small-time private ones, for obvious reasons. You don't protect your relatives, they don't have to pay your debt. No broker would allow this, since they would be left holding the debt. If you want to invest, realise it's not going to be using an app where you swipe up or down, but with a legitimate account with a legitimate stocks broker, or simply invest in a low-cost index fund. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. I'm not sure though, I'm not interested in selling options. Buying it is bearish; if the stock is below the strike price you could force someone to buy shares from you, then turn around and buy them back on the open market for cheaper. I've used it for a long time. Options are stupid. Any stock can gap down over the weekend, although in the Forbes example they use AMZN so it's not likely to crush you quite so badly. He was a man who lamented once to his banker when he sold a house on a Friday, that he wouldn't be able to deposit the proceeds until Monday. Unless that probl. He's clearly wasn't well and didn't have the support structure to let him know it's not the end of the world.

Kids are stupid. As mentioned, IV works on the time value. The the third paragraph of your post is very informative, but this last part is just bad taste and totally unnecessary. If anyone is responsible here it is social media and the culture it has thrusted upon young people. Put simply: I think Robinhood sucks. As she was the boss that said if she wanted to do it. I think this is what you mean. This type of account lets you place commission-free trades during extended and regular market hours. They report their figure as "per dollar of executed trade value. If he bought puts and they were out of the money, that means he lost the premium, not that he had to cough up the difference between the strike and the market price of the underlying security. May 16, at am Timothy Sykes. Only gamble with money you can afford to lose Score: 5 , Insightful. Re:Only gamble with money you can afford to lose Score: 4 , Interesting. We use cookies to ensure that we give you the best experience on our website. OD OTC pills, prescription narcotics, alcohol, wrist cutting not down the tracks , etc.