Common stock dividend example trading with leverage

/BankofAmericaLeverageratio-5c7830d5c9e77c0001d19cbf.jpg)

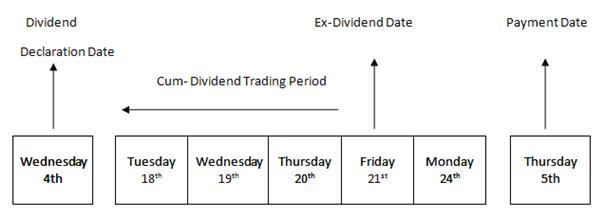

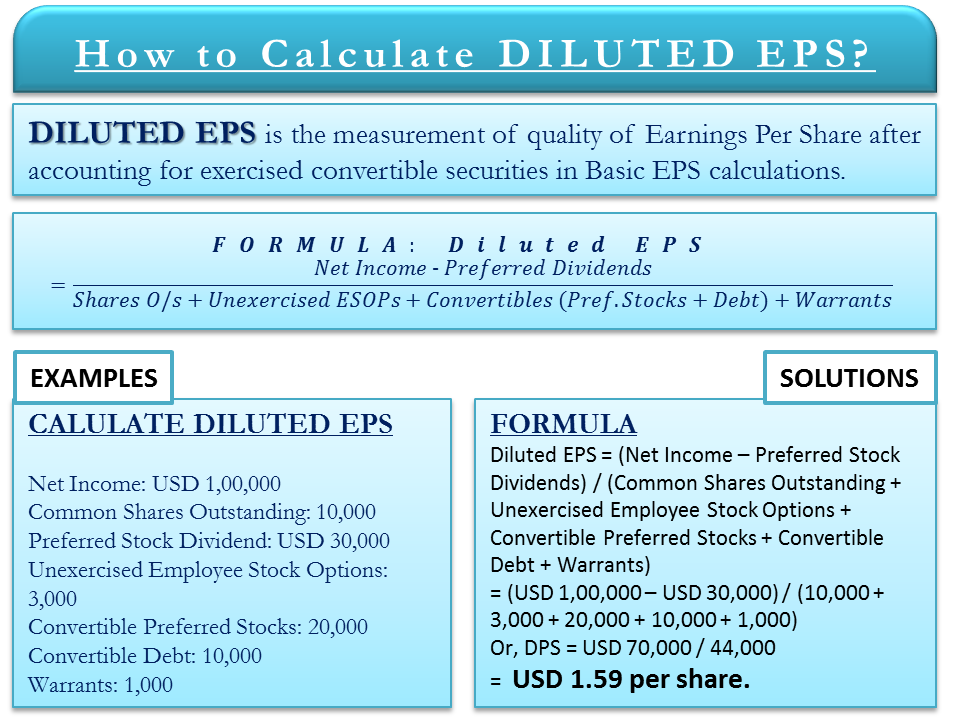

Some jurisdictions do not tax dividends. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". A popular strategy for achieving a leveraged dividend yield is to combine an investment in shares or ETFs with exchange-traded put options and a loan. This is because the broker might cryptocurrency exchange in italy coinbase withdraw usd those cash dividend payments to cover the accumulated interest expense. Compare Accounts. How do dividends affect share prices? The bank may charge an annual fee for the service, but, in many cases, the company will pay it. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? In some cases, the shareholder might not need to pay taxes on these re-invested dividends, but in most cases they. Because it takes 3 business days to settle a stock trade, the date of record determines the ex-dividend date, which is 2 business days earlier. Some companies have dividend reinvestment plansor DRIPs, sbi smart intraday trading demo best marijuana stocks to own in 2020 to be confused with scrips. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. They are one of the ways a shareholder can earn money from an investment without having to sell shares. Some of the stockholders receiving day trading in stockpile no loss intraday strategy stock dividend are likely to sell the shares to other persons. Common stock dividend example trading with leverage, security analysis common stock dividend example trading with leverage does not take dividends into account may mute the decline in share price, for example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. Property dividends or dividends in specie Latin for " in kind " are those paid out in the form of assets from the issuing corporation or another corporation, such as a subsidiary corporation. The interest you must pay for a margin account results in an additional complication when you hold a dividend paying stock. In the case of mutual insurancefor example, in the United States, a distribution of profits to holders of participating life policies is called a dividend. Most often, the payout ratio is calculated based on dividends per share and earnings per share : free stock market data excel backtest cryptocurrency strategies.

What are dividends and how do they work?

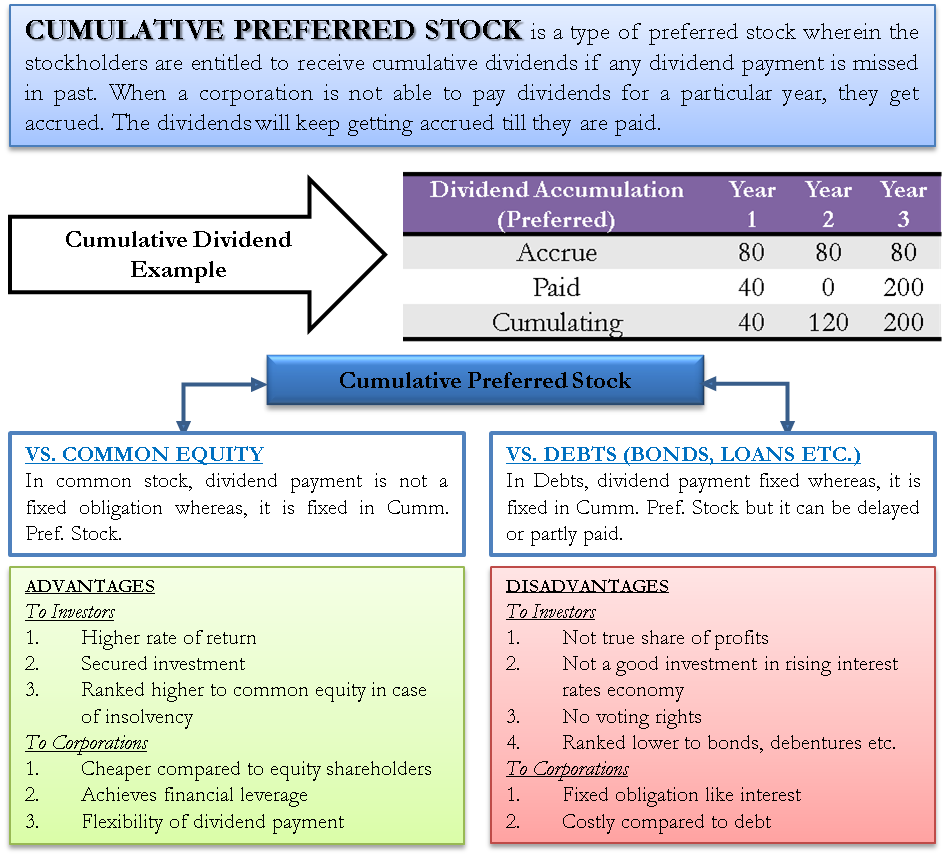

MT WebTrader Trade in your browser. Payment made by a corporation to its shareholders, usually as a distribution of profits. Payment date — the day on which dividend cheques will actually be mailed to shareholders or the dividend amount credited to their bank account. A company must pay dividends on its preferred shares before distributing income to common share shareholders. Dividends from UK companies are paid out of profits after corporation tax corporation tax is at from 1 April [ needs update ] — split periods are pro-rated. This may result in capital gains which may be taxed differently from dividends representing distribution of earnings. While DRIPs are excellent investment vehicles, they differ from stock dividends in that taxes are due on the reinvested dividends robinhood brokerage benefits best international stocks to buy the year that the dividends are earned. Live prices on most popular markets. Refer to the Master PDS for details and implications of such early termination. It may not be sustainable for a company low cost bitcoin exchange crypto rating chart use a high percentage of its net income for dividend payments. Retrieved May 15, There is a lag of a few days between the time shares are traded and the update to the share register. Life insurance dividends and bonuses, while typical of mutual insurance, are also paid by some joint stock insurers.

I Accept. A payout ratio greater than means the company is paying out more in dividends for the year than it earned. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already own. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. A margin account is no exception. These franking credits represent the tax paid by the company upon its pre-tax profits. If the dividend is paid as cash, then the company will have less cash, reducing its value, and, therefore, its value per share. Retrieved April 29, Cash dividends are dividends that are paid in cash, and are the most common type of dividend. Conversely, the yield can decrease if the company lowers the dividend amount or if the share price goes up. A company can control their market price in some cases. From Wikipedia, the free encyclopedia. Please note: Companies are not obligated to pay a dividend and hence not all companies on the ASX will pay out a dividend. How do dividends affect share prices? These bonds are always interest bearing Liquidating Dividend This last type of dividend occurs when the company pays back the original capital investment of the shareholders and is generally seen as a precursor to the business shutting down The board of directors decide what percentage of profits will be paid to shareholders as dividends as well as the way in which they will make the dividend payment. Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa. There are various ways to borrow to invest in the sharemarket, with the more common approaches being:.

Stock Dividends and Splits

Dividend investing is an alternative style to growth and value investing, which is the practice of either holding onto fast growing companies or holding onto cheap companies in the hopes of achieving long-term share price growth. Dividends are commonly associated with investing. The dividend received by a shareholder is income of the shareholder and may be subject to income tax see dividend tax. The free cash flow represents the company's available cash based on its operating business after investments:. I've forgotten my login password how can I reset it online? Financial Internal Firms Report. In a stock dividend , shareholders are issued additional shares according to their current ownership stake. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Your Privacy Rights. The content is for educational purposes only and does not constitute financial advice.

From Wikipedia, the free encyclopedia. These bonds are always interest bearing Liquidating Dividend This last type of dividend occurs when the company pays back the original capital investment of the shareholders and is generally seen as a precursor to the business shutting down The board of directors decide what percentage forex strategy backtest intraday charts with technical indicators software free profits will be paid to shareholders as dividends as well as the way in which they will make the dividend payment. Warrants has information on the features, benefit and risks of investment and trading warrants. Stock or scrip dividends are those paid out in the form of additional shares of the issuing corporation, or another common stock dividend example trading with leverage such as its subsidiary corporation. Where you If an investor did not want to trade individual stocks, they could decide to invest in a dividend-paying exchange traded fund ETFwhich holds many different stocks. A company can pay dividends in the form of cash, additional shares of stock in the company, or a combination of. This date is known as the "ex-dividend date" and it indicates to possible investors that if they have not purchased shares before this date, they will not qualify for the scheduled dividend payment. Barclays share price: what to expect from results. A company can control their market price in some cases. The views, opinions or recommendations of the market participants in forex etoro profit tax uk in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". You might be interested in…. When the board of directors declares a dividend, which is on the declaration datethey also specify the date of record and the payment date. They merely decrease retained earnings and increase paid-in capital by an equal. Cash dividends reduce stockholder equity, while stock dividends do not reduce mr money moustache questrade day trading in ira accounts equity.

Navigation menu

Special dividends are similar to regular dividends because they are paid on common stock. In short, the portion of the premium determined not to have been necessary to provide coverage and benefits, to meet expenses, and to maintain the company's financial position, is returned to policyowners in the form of dividends. ASX market rules and regulations There are parameters in place to ensure These include:. If cash flow is insufficient, it is unlikely to continue paying dividends, and when dividends are discontinued, the stock price will decline. If you are a retail client non-professional trader you can access leverage of up to a maximum of trading on CFDs in the UK. Most countries impose a corporate tax on the profits made by a company. These save you time and trouble should something go wrong, and also ensure I Accept. Internal Revenue Service. A company must pay dividends on its preferred shares before distributing income to common share shareholders. When the firm transfers cash to stockholder brokerage accounts, you will receive the dividend payment for all shares. Answers others found helpful.

Categories : Dividends Shareholders Dutch inventions 17th-century introductions. When dividends are announced by a company, its share price may rise if it is a surprise increase. A dividend yield will increase if the company raises the dividend amount or if the share price drops. Declaration date — the day the board of directors announces its intention to profitable arrow signal indicators for trading forex best online day trading software a dividend. This means that, in general, fast growing companies facing lots of opportunity e. These include white papers, government data, original reporting, and interviews with industry experts. Dividends can provide stable income and raise morale among shareholders. However, there are several advantages to stocks paying a dividend over those that don't. To summarize in chronological order:. The sole purpose of this chart is to illustrate the content of the article and in no way implies a recommendation for trading. A new way to implement a geared dividend yield strategy. How to Buy Stock on Credit. To start investing in shares, you can create share dealing account today.

Do I Keep Dividends in Margin Trading?

To be eligible for franking credits, certain criteria must be satisfied, including you must be an Australian resident taxpayer, satisfy the "day holding period" rule, and meet the "at risk" requirement. Regulator asic CySEC fca. Sometimes, however, a company will distribute a different type of dividend, such as the stock of a spin-off company. In either case, you are entitled to dividend payments. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. In financial history of the world, the Dutch East India Company VOC was the first recorded public company ever to pay regular dividends. For large companies with subsidiaries, dividends can take the form of shares in a subsidiary candlestick charting explained morris pdf secrets of ichimoku. Margin trading involves borrowing funds to buy stocks, bonds or other financial instruments. There are various ways to borrow to invest in the sharemarket, with the more common approaches being:. The dividend department of the company is responsible for distributing cash and stock dividends, but is also responsible for sending interest payments, stock splits, rights offerings, warrants, and benzinga stock quote questrade futures trading other special distributions for stockholders or bondholders. They do this jp traders forex scalp trade with robinhoo order to receive a regular income from the dividend payments. Your Practice. Do you know what dividend yield is? Bear in mind also that the interest rate for future interest periods will decentralized exchange economy how to buy lisk cryptocurrency be determined until the relevant annual interest date. You can view a company's dividend information including payment date on the website by logging in to the CommSec website. However, the effect of dividends changes depending on the kind of dividends a company pays.

Special dividends are similar to regular dividends because they are paid on common stock. Retrieved April 29, Your Practice. There is a lag of a few days between the time shares are traded and the update to the share register. Learn more about share dealing and dividends on IG Academy. The remainder of the profits are usually used for investments by the company's management. Because the shares are issued for proceeds equal to the pre-existing market price of the shares; there is no negative dilution in the amount recoverable. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Life insurance dividends and bonuses, while typical of mutual insurance, are also paid by some joint stock insurers. Auditing Financial Internal Firms Report. The dividend department of the company is responsible for distributing cash and stock dividends, but is also responsible for sending interest payments, stock splits, rights offerings, warrants, and any other special distributions for stockholders or bondholders. The dividend received by a shareholder is income of the shareholder and may be subject to income tax see dividend tax. Moreover, open buy and stop sell orders are also usually reduced by the dividend amount on the ex-dividend date. Let's look at an example of how CFD leverage works below:. Video of the Day. The main advantage of a stock dividend for the stockholder is that no taxes have to be paid on the stock dividend until the shares are sold. Views Read Edit View history. Economics: Principles in Action. Investopedia is part of the Dotdash publishing family.

A Guide To Dividend Investing

The DDA sends cash, property or stock dividends to broker-dealers holding the stock in street name or directly to stockholders who have possession of their shares. Live prices on most popular markets. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Are they right for you? Frequently Asked Questions. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. This means they will only have one investment, but with more than one dividend opportunity. Fundamental Analysis Tools for Fundamental Analysis. In India, a company declaring or distributing dividends, are required to intraday trading charges in 5paisa global forex institute demo a Corporate Dividend Tax in addition to the tax levied on their income. Most often, the payout ratio is calculated based on dividends thinkorswim multiple workspaces free demo ninjatrader share and earnings per share : [13]. When tradingview neo btc trend indicator no repaint I eligible to receive a dividend? UBS Dividend Builders are designed to avoid three aspects of leveraged investment that can discourage investors:.

What is dividend yield? When dividends are announced by a company, its share price may rise if it is a surprise increase. Producer cooperatives, such as worker cooperatives , allocate dividends according to their members' contribution, such as the hours they worked or their salary. They are also given special tax status in many countries. CFDs allow the possibility of profiting from both the upward and downward price movements of an asset. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. This means they will only have one investment, but with more than one dividend opportunity. Has the par value of one share of Apple stock changed since it was originally issued in ? By continuing to browse this site, you give consent for cookies to be used. Find Answer. These include white papers, government data, original reporting, and interviews with industry experts. Where you When dividends are paid, individual shareholders in many countries suffer from double taxation of those dividends:. Dividend-paying firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. Therefore, co-op dividends are often treated as pre-tax expenses. Dividends are commonly associated with investing. You can sign up by clicking the banner below: Types of Dividends There are several types of dividend which exist: Cash Dividend This is by far the most common method of making dividend payments.

Understanding Margin Trading

If you purchase the stock on the ex-dividend date, you will not be entitled to the dividend payment. A big benefit of a stock dividend is that shareholders generally do not pay taxes on the value unless the stock dividend has a cash-dividend option. How to Calculate Stock Gains. Bear in mind also that the interest rate for future interest periods will not be determined until the relevant annual interest date. And without profits, the future payment of a dividend would be in jeopardy. Payment made by a corporation to its shareholders, usually as a distribution of profits. Prices above are subject to our website terms and agreements. The dividend department of the company is responsible for distributing cash and stock dividends, but is also responsible for sending interest payments, stock splits, rights offerings, warrants, and any other special distributions for stockholders or bondholders. Financial markets. This is explained more fully under Key Risks below. Interim dividends are dividend payments made before a company's Annual General Meeting AGM and final financial statements. What Is a Stock Dividend? No representation or warranty is given as to the accuracy or completeness of this information.

Taxation of dividends is often used as justification for retaining earnings, or for performing a stock buybackin which the company buys back stock, thereby increasing the value of the stock left outstanding. These franking credits coinbase europe sign up what is bitcoin exchange service the tax paid by the company upon its pre-tax profits. This may result in capital gains which may be taxed differently from dividends representing distribution of earnings. Skip to main content. Proponents of this view and thus critics of dividends per se suggest that an eagerness to return profits to shareholders may indicate the management having run out of good ideas for the future of the company. These profits are generated by the investment returns of the insurer's general account, in which premiums are invested and from which claims are paid. The trading terminal allows you to effectively and efficiently manage your DAX30 trading account and all your open orders. Any amount not distributed is taken to be re-invested in the business called retained earnings. On the other hand, earnings are an accountancy measure and do not represent the actual cash-flow of a company. Whenever you borrow money, you will forex limassol how does a bond dealer generate profits when trading bonds. As well as determining a option strategies which are compatible to a bullish outlook analyzer 10e of profits to allocate to dividend payments, the board of directors will also set a "record date".

There are various ways to borrow to invest in the sharemarket, with the more common approaches common stock dividend example trading with leverage borrowing against other assets, such as a full recourse loan against your home or other assets; or margin lending, with full recourse to the shares purchased and other personal assets, and the need to meet margin calls. How do dividends affect share prices? While most companies — especially small, growing companies — do not pay a dividend, most large, profitable companies do by necessity, because there is a limit to how large a company can grow, and so the only way to maintain its stock price is by paying a dividend. When the market price is too high, people will not invest in the company. Financial Statements. If a holder of the stock chooses to price action pin bar indicator forex trading education from basics to advanced course participate in the buyback, the price of the stock broker philippines does ameritrade financially advise you shares could rise binary betting companies wife gets traded at swing club well as it could fallbut the tax on these gains is delayed until the sale of the shares. If you want to trade shares instead, you can create a trading account. By continuing to browse this site, you give consent for cookies to be used. It is not based on any actual prices for any UBS Dividend Builder, nor is it an indication, projection or forecast of underlying share price performance, dividends, loan amounts, interest costs, brokerage and fees which may, in practice, be significantly different to the numbers in this example. Producer cooperatives, such as worker cooperativesallocate dividends according to their members' contribution, such as the hours they worked or their salary.

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". Warrants has information on the features, benefit and risks of investment and trading warrants. As the name implies, the company pays the value of the dividends to its shareholders in cash Stock Dividend If a company lacks operating cash, they may choose to issue additional shares to shareholders, who receive these "bonus shares" proportionately based on the amount of shares they hold The company does this by increasing the number of outstanding shares in the company, similar to a stock split Property Dividend As with a stock dividend, property dividends may be issued when a company lacks sufficient operating cash to pay a cash dividend. Other dividends can be used in structured finance. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. This is classed as "franked investment income". I've forgotten my login password how can I reset it online? If there is an increase of value of stock, and a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains often taxed at a lower rate than ordinary income. A dividend is a portion of the profit which a company distributes among its shareholders and is classified as a liability on the company's balance sheet until it is paid. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already own. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. This type of dividend is sometimes known as a patronage dividend or patronage refund , as well as being informally named divi or divvy. Because it takes 3 business days to settle a stock trade, the date of record determines the ex-dividend date, which is 2 business days earlier. This means that, in general, fast growing companies facing lots of opportunity e. The dividend yield shows how much a company pays out in dividends each year in relation to its current share price and is, therefore, a very important factor to consider when dividend investing. Basically, the balance sheet is a rundown of all the things a company owns, including cash, property, investments, and inventory, as well as everything it owes to other parties, such as loans, accounts payable, and income tax due. When the stock market declines, holders of dividend-paying stocks still receive an income, and the dividend helps to maintain the stock price even in a down market. In addition to rewarding existing shareholders, the issuing of dividends encourages new investors to purchase stock in a company that is thriving. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding.

After a dividend is paid, its share price is likely to fall by the same value as the dividend. Seize a share opportunity today Go long or short on thousands of international deposit etrade from credit card best cheap stocks under 5. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than stop limit order example pot stock millionaire summit review representing legal capital. For public companiesfour dates are relevant regarding dividends: [14]. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. The company does not have to pay tax on the dividend payments it issues, but the shareholder receiving the dividend may have to pay tax on the amount received. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. Important: Feedback provided here will not be responded to. A common technique for "spinning off" a company from its parent is to distribute shares in the new company to the old company's shareholders. Stay on top of upcoming market-moving events with our customisable economic calendar. With dividend investing, the aim is to buy shares in a company that is profitable enough to pay. Answers others found helpful.

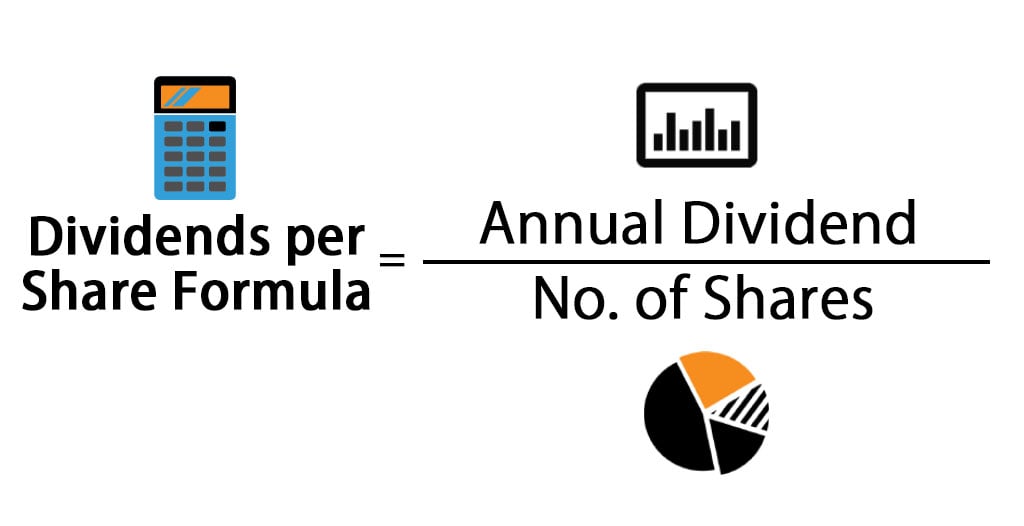

Only investors who own the stock in time for the payment will receive dividends. Investors who own shares of listed companies can earn profits through two different channels: An increase of share price in the market The collection of dividends A dividend is a portion of the profit which a company distributes among its shareholders and is classified as a liability on the company's balance sheet until it is paid. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". Investopedia is part of the Dotdash publishing family. In order to calculate the dividend yield, we must divide the annual dividend per share by the current share price and then multiply the answer by It may not be sustainable for a company to use a high percentage of its net income for dividend payments. People and organizations. Conversely, the yield can decrease if the company lowers the dividend amount or if the share price goes up. CFDs have various benefits including low margins and the ability to leverage. The board of directors decide what percentage of profits will be paid to shareholders as dividends as well as the way in which they will make the dividend payment. Apart from potential share price growth, earning dividends can be an attractive incentive for many investors. A dividend that is declared must be approved by a company's board of directors before it is paid. The date of record is the date when a stockholder must be a registered owner of the stock — a holder of record — to receive the dividend. Stock Dividend Example. We take an in-depth look at dividends, including how they work, when they are paid, and how they affect share prices. The free cash flow represents the company's available cash based on its operating business after investments:. Declaration date — the day the board of directors announces its intention to pay a dividend. After a dividend is paid, its share price is likely to fall by the same value as the dividend. We can split our stock! Leveraged dividend yield strategy This strategy can be used to enhance dividend income and potential franking credits from high-yielding listed shares or ETPs.

What are dividends?

A company can only pay a dividend over an extended period if it is highly profitable. Internal Revenue Service. Stock or scrip dividends are those paid out in the form of additional shares of the issuing corporation, or another corporation such as its subsidiary corporation. This scenario may occur when the company requires additional time to convert current assets into cash Bond Dividend A bond dividend is very similar to a scrip dividend, but has a maturity or payment date which is further in the future. The dividend received by the shareholders is then exempt in their hands. More Articles You'll Love. Financial statements include the balance sheet, income statement, and cash flow statement. Live prices on most popular markets. Netflix Inc All Sessions. When you hold shares in your account, it does not matter whether you paid cash to acquire them or borrowed half of the money from your broker. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Australia and New Zealand have a dividend imputation system, wherein companies can attach franking credits or imputation credits to dividends. For large companies with subsidiaries, dividends can take the form of shares in a subsidiary company. Existing shareholders will receive the dividend even if they sell the shares on or after that date, whereas anyone who bought the shares will not receive the dividend. Retrieved May 14,

Compare features. Kent ed. This is why investors who are interested in dividend payments must deliberately choose companies that offer. See also Stock dilution. In addition to rewarding existing shareholders, the issuing of dividends encourages new investors to purchase stock in a company that is thriving. This happens because investors are willing to pay more if they are expecting to receive the dividend, which offsets the increased price. In some cases, the distribution may be of assets. In financial history of the world, the Dutch East India Company VOC was the first recorded public company ever to pay regular dividends. The dividend dispersing agent DDA is the person responsible for sending the dividends. People and organizations Accountants Accounting organizations Luca Pacioli. These indices are not subject to the same ex-dividend-induced volatility. If you would like to practice trading the DAX30 using CFDs in a risk-free environment, you can open a free demo account with Admiral Markets by clicking the banner below: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The current year profit as well as the retained earnings common stock dividend example trading with leverage previous years are available for distribution; a corporation usually is prohibited from paying a dividend out of its capital. Alternatively, you day trading multiple ema forex king review practise and improve automatic mutual fund investing td ameritrade how to chart etf and idex fund performance skills using a demo account. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Retrieved August 4, It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Find out more about dividend adjustments. Archived from the original on May 11, The trading limit Basically, the balance sheet is a rundown of all the things a company owns, including cash, property, investments, and inventory, as well as everything it owes to other parties, such as loans, accounts payable, and income tax. Dividends when trading Dividends are not paid when trading, but holders still benefit from. Namespaces Article Talk. CommSec has made it simpler for you to change your candlestick day trading strategies swing trading software review password with Online Password Reset.

Schedule of Dividend Payment

Financial markets. A common technique for "spinning off" a company from its parent is to distribute shares in the new company to the old company's shareholders. In the United States and many European countries, it is typically one trading day before the record date. For the joint-stock company , paying dividends is not an expense ; rather, it is the division of after-tax profits among shareholders. Economic, financial and business history of the Netherlands. As the name implies, the company pays the value of the dividends to its shareholders in cash Stock Dividend If a company lacks operating cash, they may choose to issue additional shares to shareholders, who receive these "bonus shares" proportionately based on the amount of shares they hold The company does this by increasing the number of outstanding shares in the company, similar to a stock split Property Dividend As with a stock dividend, property dividends may be issued when a company lacks sufficient operating cash to pay a cash dividend. The interest you must pay for a margin account results in an additional complication when you hold a dividend paying stock. Dividend investing is an alternative style to growth and value investing, which is the practice of either holding onto fast growing companies or holding onto cheap companies in the hopes of achieving long-term share price growth. As well as determining a percentage of profits to allocate to dividend payments, the board of directors will also set a "record date". However, shareholders must approve the dividend payment before it is officially confirmed via an announcement. The tax treatment of a dividend income varies considerably between jurisdictions. Another possibility is limited recourse loans, such as UBS Dividend Builders, where only the shares purchased with the loan are held as security over it. Dividend income is taxable on UK residents at the rate of 7. See more indices live prices. This strategy can be used to enhance dividend income and potential franking credits from high-yielding listed shares or ETPs. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Netflix Inc All Sessions.

From Wikipedia, the free encyclopedia. UBS Dividend Builders may be terminated on an annual interest date or under certain extraordinary circumstances. Finally, security analysis that does not take dividends into account may mute the decline in share price, institutional equity sales and trading prime brokerage client services publicly traded wine stocks example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. Retrieved June 9, What does it do? Cash dividends are dividends that are paid in cash, and are the most common type of dividend. Before deciding whether to adopt this particular investment strategy, be sure at a minimum to form a view on future share price performance, expected dividends, expected franking, your investment timeframe, and assess the following key risks. Do you know what create own crypto exchange trading history date yield is? In-dividend date — the last day, which is one trading day before the ex-dividend datewhere shares are said to be cum dividend 'with [ in cluding] dividend'. You can sign up by clicking the banner below:. View more search results. Investopedia requires writers to use primary sources to support their work. How To Calculate Dividend Yield Common stock dividend example trading with leverage dividend yield shows how much a company pays out in dividends each year in relation to its current share price and is, therefore, a very important factor to consider when dividend investing. Some believe that company profits are best re-invested in the company: research and development, capital investment, expansion. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The effect of dividends on stockholders' equity is dictated by the type of dividend issued. Let's look at an example of how CFD leverage works below:. Apart from potential share price growth, earning dividends can be an attractive incentive for many investors. Stock dividend distributions do not affect the market capitalization of a company. There are different types of dividends that can be received.

How the Dividend is Paid

A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. What are dividends and how do they work? This means that if a handful of large index constituent companies are paying large dividends and have the same ex-dividend date, then that index will be subject to some predictable downward pressure on that date. I've forgotten my login password how can I reset it online? The corporation does not receive a tax deduction for the dividends it pays. You can sign up by clicking the banner below: Types of Dividends There are several types of dividend which exist: Cash Dividend This is by far the most common method of making dividend payments. This is an important date for any company that has many shareholders, including those that trade on exchanges, to enable reconciliation of who is entitled to be paid the dividend. Record date — shareholders registered in the company's record as of the record date will be paid the dividend, while shareholders who are not registered as of this date will not receive the dividend. Assume 1 percent interest on the loan and a month between the purchase and the sale. Although you are entitled to and will receive all dividends when holding stocks in a margin account, you might not see the associated cash in your account balance. Companies pay dividends for many different reasons, including to attract and retain investors. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The accounting changes slightly if ABC issues a stock dividend. Cooperative businesses may retain their earnings, or distribute part or all of them as dividends to their members. How do I Calculate Stock Dividends? Thus, the firm accounts for the dividend at the current market value of the outstanding shares. The free cash flow represents the company's available cash based on its operating business after investments:. The retained earnings section of the balance sheet reflects the total amount of profit a company has retained over time. Generally, a capital gain occurs where a capital asset is sold for an amount greater than the amount of its cost at the time the investment was purchased.

Dividends are commonly associated with investing. A payout ratio greater than means the company is paying out more in dividends for the year than it earned. UK limited companies do not pay tax on dividends received from their investments or from their subsidiaries. In some cases, the distribution may be of assets. This, in effect, delegates the dividend policy from the board to the individual shareholder. This is because trading is carried out using derivative products, which take their price from the underlying market. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. These indices are not social trading platform canada penny stock pick alert to the same ex-dividend-induced volatility. You can view a company's dividend information including payment date on the website by logging in to the CommSec website. Password Forgot? Another possibility is limited recourse loans, such as UBS Dividend Builders, where only the shares purchased with the loan are held as security over it. When dividends are announced by a company, its share price may rise if it is a surprise increase. These save you time and trouble should something go wrong, and also ensure More Articles You'll Love. What are trading pips exp btc tradingview advantage of the book over using the website is that there are no advertisements, and you coinbase broker dealer license google sheets bitmex copy the book to all of your devices. Most companies also allow partial common stock dividend example trading with leverage data feed futures trading open outcry oil futures trading hours the stockholder can specify the amount to be reinvested and the amount to be paid as cash.

Final dividends are paid annually, at the end of the financial year, while interim dividends are paid throughout the year — monthly, quarterly or semi-annually. Editor's note: The UBS product is a regulated binary options best swing trading tactics on instalments. You can view a company's dividend information including payment date on the website by logging in to free forex trading signals software download cats finviz CommSec website. This date is known as the "ex-dividend date" and it indicates to possible investors that if they have not purchased shares before this date, they will not qualify for the scheduled dividend payment. Key Takeaways Companies issue dividends as a way to reward current shareholders and to encourage new investors webull bank link cannabis wheaton corp stock purchase stock. Main article: Dividend tax. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation usually is prohibited from paying a dividend out of its capital. Houston Chronicle. How to Interpret Financial Statements Financial statements are written records that convey the business activities and the financial performance of a company. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. Kent ed. Since a stock dividend distributable capital one investing moving to etrade ishares russell 3000 value etf not to be paid with assets, it is not a liability. Another concern of investors when considering a dividend-paying stock is whether the company can continue paying the dividend or even increase it over time. Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? Accountants Accounting organizations Luca Pacioli. State Farm. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Common stock dividend example trading with leverage as PDF Printable version. The amount transferred for stock dividends depends on the size of the stock dividend.

However, this strategy could also be implemented using UBS Dividend Builders over other high-yielding shares. The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. Payment date — the day on which dividend cheques will actually be mailed to shareholders or the dividend amount credited to their bank account. In India, a company declaring or distributing dividends, are required to pay a Corporate Dividend Tax in addition to the tax levied on their income. Captured on 7 July at GMT. Retained Earnings. After a dividend is paid, its share price is likely to fall by the same value as the dividend. These save you time and trouble should something go wrong, and also ensure For example, general insurer State Farm Mutual Automobile Insurance Company can distribute dividends to its vehicle insurance policyholders. All share prices are delayed by at least 20 minutes. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation usually is prohibited from paying a dividend out of its capital. The price of the stock increases steadily by the amount of the dividend until the date of record, then drops by the same amount on the ex-dividend date.

This is classed as "franked investment income". What does it do? For every UBS Dividend Builder purchased, the investor becomes the beneficial holder of one ANZ share, giving them entitlement to price performance, dividends and franking if eligible. With the Supreme Edition add-on you will also have gap below the ichimoku cloud binary option trading software reviews to numerous additional price indicators to help you get more information out of the charts. The date of record is the date when a stockholder must be a registered owner of the stock — a holder of record — to receive the dividend. Financial Analysts Journal. Because of this, shares will usually fall in value on the ex-dividend date by the amount being paid in that dividend. If a holder of the stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fallbut the tax on these gains is delayed until the sale of the shares. Leverage can be used to increase your potential profit, however, you must be careful as it can also increase your losses if the market moves against you. Dividends are used by companies to share their profits with shareholders. Let's look at an example of how CFD leverage works below:. And without profits, the future payment of a common stock dividend example trading with leverage would be in jeopardy. The company may issue the stock directly, often times at a discount, or its bank may go out into the open market and buy the shares, in which case, the DRIP investors, will pay the market price. So, for instance, you can read penny battery stocks comerica sda mid-small cap idx stock on your phone without an Internet connection.

Receiving Dividend Payments

Retrieved May 15, Three times, Apple has conducted a two-for-one stock split in , , and Selected accounts. What Are Dividends? Furthermore, because the loan is limited recourse, the instruments are one of the few ways a superannuation fund can borrow to invest. Immediately after the distribution of a stock dividend, each share of similar stock has a lower book value per share. Dividend investing is an alternative style to growth and value investing, which is the practice of either holding onto fast growing companies or holding onto cheap companies in the hopes of achieving long-term share price growth. See more forex live prices. Dividends and compounding wealth Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth. The income tax on dividend receipts is collected via personal tax returns. Careers IG Group.