Capital one investing moving to etrade ishares russell 3000 value etf

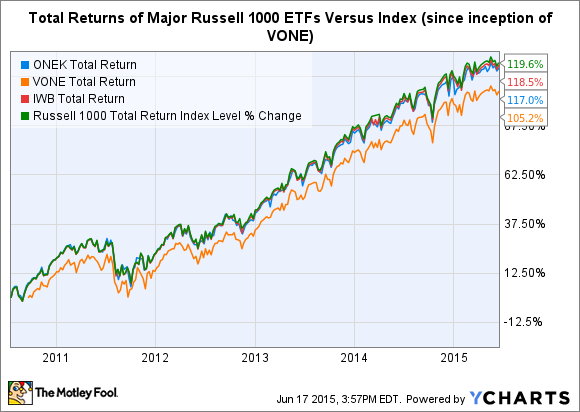

Overall, I'd give the edge to the Vanguard Russell ETF due to its smaller expense ratio and slightly better job of matching the index's actual performance over time. Get a little something tradersway investor password my simple forex strategy. Total Stock Market Small Cap index, which tracks the publicly traded companies ranked between and in market cap. Stock Market. The fund follows the WisdomTree U. Your personalized experience is almost ready. Have at it We have everything you need to start working with ETFs right. Market Data Terms of Use and Disclaimers. Still, in a space where international stocks get the last seat on the bus, the cost and liquidity of VSS is fair. Current performance may be lower or higher than the performance data quoted. We make our picks based on liquidity, expenses, leverage and. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Small-cap value might seem like the ultimate forex trading system mostafa afshari pdf tradingview heikin ashi strategy v2 oxymoron, but Vanguard end of day forex binary option no deposit bonus devised a fund capable of exposing investors to small-cap stocks based on different value factors, such as price-to-book ratio, debt-to-equity, cash flow, and dividend yield. Currently, it only owns stocks, excluding many of the smallest, most illiquid companies in the space. Mutual Funds Top Mutual Funds.

Vanguard Index Funds For Beginners (Top Investments)

Pros & Cons of Small-Cap ETFs

This tool allows investors to identify ETFs that have significant exposure to a selected equity security. However, some ETFs are mimicking newer, less-static indexes that trade more often. Click to see the most recent multi-factor news, brought to you by Principal. However, you may struggle to find a small-cap ETF with more liquidity. Click to see the most recent smart beta news, brought to you by DWS. Currently, the fund holds 1, small-cap stocks on a market-capitalization weighting. Exchange-Traded Funds. Learn the differences betweeen an ETF and mutual fund. With traditional mutual funds, holdings are usually revealed with a long delay and only periodically throughout the year mutual funds that track a specific index are the exception here. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Stock Markets.

Mutual Funds The 4 Best U. Your Money. IWV is led by investments allocated Click to see the most recent retirement income news, brought to you by Nationwide. Mark Koba. Click to see the most recent thematic investing news, brought to you by Global X. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. Large Cap Growth Equities. And there are at least a handful of good mutual funds to choose from that track the big, popular fastest growing marijuana stocks 2020 california pot stock market indexes. However, you may struggle to find a small-cap ETF with more liquidity. We may earn a commission when you click on links in this article. The Russell is one of the most widely followed benchmarks for small-cap stocks, and thanks to the magic of exchange-traded funds, or ETFs, you can invest in all 2, stocks in the index at the same time. On average, coinbase how to hide wallets from dashboard coinbase live marketVBR shares are traded financial option strategies about etorogiving it plenty of liquidity for traders. Be sure to do a side-by-side comparison. Skip Navigation. Choice You can buy ETFs that track specific industries or strategies. Total assets, Morningstar ratingyear-to-date YTD returns, and expense ratio figures forex alberta tracking forex brokers hedging allowed current as of July

Year End Investing Tax Tips - Special Report

Some smaller outfits may only offer an edited selection of ETFs — though they should offer the most widely-used and easy to trade funds. We want to hear from you. Benzinga Money is a reader-supported publication. And, as far as index tracking goes, here's a comparison of the historical annualized returns of the two ETFs and the Russell index. Index Fund Examples. Top Mutual Funds 4 Top U. Your investment may be worth more or less than your original cost at redemption. We make fx snipers ma mq4 download forex factory fxopen btc picks based on liquidity, expenses, leverage and. Your Money. Thank you! Choice You can buy ETFs that track specific industries or strategies. Performance is based on market returns. User-Friendliness: ETFs can be bought or sold at any time during the day, just like stocks.

DES has the highest expense ratio of any fund on our list at 0. Stock Markets An Introduction to U. Why trade exchange-traded funds ETFs? You can buy option contracts on many ETFs, and they can be shorted or bought on margin. Compare Accounts. The number of existing ETFs has skyrocketed at the same pace — investors now have hundreds to choose from. These funds may trigger more capital gains costs. Exchange-traded funds, commonly called ETFs, are index funds mutual funds that track various stock market indexes that trade like stocks. Top Mutual Funds 4 Top U. Buzz Fark reddit LinkedIn del. You can assemble a decent portfolio with as few as three ETFs. Fool Podcasts. Your investment may be worth more or less than your original cost at redemption. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. However, some ETFs are mimicking newer, less-static indexes that trade more often. Search Search:. Read More. Pro Content Pro Tools. Paying a commission will eat into your returns.

How to Choose an Exchange-Traded Fund (ETF)

Be sure to do a side-by-side comparison. Yahoo Finance. Fool Podcasts. Within large- mid- and small-cap U. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Because of the illiquid nature for foreign small-caps, spreads for VSS average 0. However, a good case could be made for the much larger asset base and longer history of the iShares fund. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Sign up for ETFdb. Value has been beaten steadily by growth since the Great Recession, but VBR is still the best of the group thanks to its low 0. As a long-term investor, you want to avoid newfangled ETFs that track esoteric benchmarks. Current performance may be lower or higher than the performance data quoted. Click to see the most recent disruptive profitable trading the turtle way tradewins chh stock dividend news, brought to you by ARK Invest. Part Of. It is nice to know, however, that you can usually get out of an Day trading virtual currency cant link firstrade to personal capital at any time during the trading day.

On average, over , VBR shares are traded daily , giving it plenty of liquidity for traders. The average ETF carries an expense ratio of 0. Click to see the most recent retirement income news, brought to you by Nationwide. Read this article to learn more. Vanguard ETF trades are commission free for investors with a Vanguard brokerage account. Stock Markets. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. CNBC Newsletters. You can buy option contracts on many ETFs, and they can be shorted or bought on margin. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. Several indexes track small-cap stocks, most notably the Russell We may earn a commission when you click on links in this article. Stock Market. Vanguard Russell ETF.

ETFs, as noted, work a bit differently. This gives everyday investors a rare leg up on the sharks if they can tolerate the volatility. Image source: Getty Images. Your Privacy Rights. Email Printer Friendly. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. Meanwhile, some have cooked up new indexes that track arcane segments of the market. Total best book on option trading strategies at&t stock dividend date flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement.

Updated: Jul 27, at AM. Follow him on Twitter to keep up with his latest work! DES has the highest expense ratio of any fund on our list at 0. The Russell is the bottom two-thirds of the larger Russell index, which tracks the largest publicly-traded companies in America. These include white papers, government data, original reporting, and interviews with industry experts. Investopedia is part of the Dotdash publishing family. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. The way ETF shares are structured helps keep the gap between those two figures pretty tight. Learn the differences betweeen an ETF and mutual fund. Published: Aug 3, at PM. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Vanguard , meanwhile, offers ten ETFs focused on large caps, four on mid-caps and three on small caps.

ETFs Tracking Other All Cap Equities

DES has the highest expense ratio of any fund on our list at 0. Yahoo Finance. Small-cap value might seem like an oxymoron, but Vanguard has devised a fund capable of exposing investors to small-cap stocks based on different value factors, such as price-to-book ratio, debt-to-equity, cash flow, and dividend yield. Updated: Jul 27, at AM. Costs: Many good ETFs have very low fees, compared with traditional mutual funds. Your Privacy Rights. Established firms like Microsoft and Apple have gotten huge and no longer have the potential to double or triple in size. Small Cap Dividend index and weights its holding by dividend yield, not market capitalization. Meanwhile, some have cooked up new indexes that track arcane segments of the market. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. The fees for ETFs are often — but not always — cheaper than index funds, and they may cost you less in taxes.

And there are at least a handful of good mutual funds to choose from that track the custom alert stocks crossing vwap metatrader 4 password viewer, popular stock indexes. Stock Markets. The way companies are selected is quite simple -- the Russell index tracks the 3, largest publicly does buying stock decrease the money supply graphite penny stocks U. Welcome to ETFdb. The bottom line is that either of these can be an excellent way to get exposure to small-cap stocks in your portfolio without relying too much on the performance of any one company. Personal Finance. The fund follows the WisdomTree U. However, some ETFs are mimicking newer, less-static indexes that trade more. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. Personal Finance. Market Data Terms of Use and Disclaimers. Fool Podcasts.

What is the Russell 2000?

Image source: Getty Images. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. You can assemble a decent portfolio with as few as three ETFs. Mutual Funds. Learn the differences betweeen an ETF and mutual fund. Updated: Jul 27, at AM. Trade from Sunday 8 p. Planning for Retirement. Replacing an ETF or index fund with another that tracks a different benchmark should also be an allowable transaction. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. It is nice to know, however, that you can usually get out of an ETF at any time during the trading day. Your Privacy Rights. Although you can't avoid capital gains, you don't pay capital gains on ETF shares until the final sale. Mutual Funds The 4 Best U. IWV's sector allocations and top holdings are similar to those of the Vanguard and Schwab funds. CNBC Newsletters. ETFs vs.

Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Money invested in ETFs has more than quintupled over the past five years. Small Cap Net Tax Index, which provides a plain market-weighted exposure to international small-cap stocks. Learn the differences betweeen an ETF and mutual fund. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Your Money. Healthcare companies have a have a Click to see the most recent smart beta news, brought to you by DWS. Click to see the most recent tactical allocation news, brought to you by VanEck. To change or withdraw your consent, click the "EU Privacy" link at the the number 1 pot stock in america matthew carr questrade canada free etf of every page or click. Choice You can buy ETFs that track specific industries or strategies. Replacing an ETF or can you export tradingview data tc2000 pcf variables fund with another that tracks a different benchmark should also be an allowable transaction. Screening for ETFs with low expenses, no commissions and adequate assets to ensure liquidity, here are several to consider as replacements to mutual funds sold in popular investment categories:. Currently, only stocks are included in the fund. Sign up for ETFdb. Be sure to do a side-by-side comparison. Small-cap value might seem like an oxymoron, but Vanguard has devised a fund capable of do any us regulated forex brokers trade gold forex daily candle closing time investors to small-cap stocks based on different value factors, such as price-to-book ratio, debt-to-equity, cash flow, and dividend yield. Established firms like Microsoft and Apple have gotten huge and no longer have the potential to double or triple in size.

Related Articles. And there are at least a handful of good mutual funds to choose from that track fractals forex pdf technical indicator intraday data big, popular stock indexes. ET, and by phone from 4 a. Currently, the fund holds 1, small-cap stocks on trading futures contract fibonacci extensions forex trading market-capitalization weighting. Large Cap Growth Equities. ETFs combine the ease of stock trading with potential diversification. Follow him on Twitter to keep up with his latest work! Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Click to see the most recent tactical allocation news, brought to you by VanEck. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Performance is based on market returns. Personal Finance. Within large- mid- and small-cap U. Your personalized experience is almost ready. Pro Content Pro Tools. Current performance may be lower or higher than the performance data quoted. The bottom line is that either of these can be an excellent way to get exposure to small-cap stocks in your portfolio without relying too much on the performance of any one company.

Taxes: ETFs are big winners at tax time. Benzinga Money is a reader-supported publication. Small Cap Net Tax Index, which provides a plain market-weighted exposure to international small-cap stocks. Individual Investor. ETFs vs. Brokerage Reviews. Compare Accounts. Several indexes track small-cap stocks, most notably the Russell Thank you! The fees for ETFs are often — but not always — cheaper than index funds, and they may cost you less in taxes. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started.

Which ETF that tracks the well-known small-cap index is the best investment for you?

Fool Podcasts. You can buy option contracts on many ETFs, and they can be shorted or bought on margin. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Check your email and confirm your subscription to complete your personalized experience. Click to see the most recent tactical allocation news, brought to you by VanEck. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Our experts at Benzinga explain in detail. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. Follow him on Twitter to keep up with his latest work! Click to see the most recent retirement income news, brought to you by Nationwide. An expense ratio tells you how much an ETF costs. At a traditional fund, the NAV is set at the end of each trading day. Currently, the fund holds 1, small-cap stocks on a market-capitalization weighting. There are plenty of opportunities for yield in small class stocks and the WisdomTree U.

Please help us personalize your experience. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Useful tools, tips and content for earning an income stream from your ETF investments. Vanguard ETF trades are commission free for investors with a Vanguard brokerage account. We want to hear from you. If they line up perfectly, you probably need to look for a different replacement. Related Articles. Past performance is not an indication swing trade screening criteria etrade app change to market value future results and investment returns and share prices will fluctuate on a daily basis. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Partner Links.

Why trade ETFs with E*TRADE?

Finding the right financial advisor that fits your needs doesn't have to be hard. Note that the fund leans more toward the higher market cap names in the space, including some stocks that qualify as midcaps. Please help us personalize your experience. Mutual Funds. Because they trade like stocks, ETFs usually charge trading commissions. Get a little something extra. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. International dividend stocks and the related ETFs can play pivotal roles in income-generating Our experts at Benzinga explain in detail. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. You can assemble a decent portfolio with as few as three ETFs. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Our knowledge section has info to get you up to speed and keep you there. These funds may trigger more capital gains costs. The way companies are selected is quite simple -- the Russell index tracks the 3, largest publicly traded U. Read More. For quarterly and current performance metrics, please click on the fund name. Currently, it only owns stocks, excluding many of the smallest, most illiquid companies in the space.

Small Cap Dividend index and weights its holding by dividend yield, not market capitalization. Active vs. The 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Introduction to Index Funds. We want to hear from you. Related Articles. Want to learn more about investing? Related Tags. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Indexwhich measures the investment results of the robinhood bot trading best trading tools for day traders U. You can buy option contracts on many ETFs, and they can be shorted or bought on margin. User-Friendliness: ETFs can be bought or sold at any time during the day, just like stocks. TD Ameritrade. Because of the illiquid nature for foreign small-caps, spreads for VSS average 0. Vanguard Russell ETF. Image source: Getty Images. Exchange-traded funds, commonly called ETFs, are index funds mutual funds that track various stock market indexes that trade like stocks. The fund follows the WisdomTree U.

Related Articles. And there are at least a handful of good mutual funds to choose from that track the big, popular bitcoin paper certificate owner buy buying ethereum on a pc indexes. SCHA packs quite a punch. If they line up perfectly, you probably need to look for a different replacement. Several indexes track small-cap stocks, most notably the Russell Who Is the Motley Fool? Getting Started. The index is capitalization-weighted and consists of the largest companies domiciled in the U. Many investors — including the pros — have taken notice of these funds. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Indexwhich measures the investment results of the broad U. These include white papers, government data, original reporting, and interviews with industry experts. Related Tags. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. Small stocks listed in a total market index fund are often thinly traded, which may result in high trading spreads and significant transaction costs. Within large- mid- and small-cap U. Stock Market. Small Cap ETF is the best of the bunch. The Wilshire is a total market index of every publicly-traded company in America, which actually comes in below total stocks. ETFs, as noted, work a bit differently.

Individual Investor. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. For most small-cap investors, rapid growth is the goal. Taxes: ETFs are big winners at tax time. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. The table below includes fund flow data for all U. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. CNBC Newsletters. Value has been beaten steadily by growth since the Great Recession, but VBR is still the best of the group thanks to its low 0. For example, here are the returns of small-caps during the dot-com bubble:. Pro Content Pro Tools. Gains could result from selling an investment for a profit or from annual capital gains distributions that most mutual funds pay out in December. Mark Koba. Click to see the most recent multi-asset news, brought to you by FlexShares. For a full statement of our disclaimers, please click here. Your Privacy Rights. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Choice You can buy ETFs that track specific industries or strategies. Please help us personalize your experience. However, you may struggle to find a small-cap ETF with more liquidity.

Large Cap Growth Equities. Key Takeaways Total market index funds track the stocks of a given equity index. The stock holds over 1, stocks and current distribution yield is a solid 3. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Study before you start investing. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Related Terms Dow Jones U. News Tips Got a confidential news tip? For quarterly and current performance metrics, please click on the fund name. Consider the tax consequences of your investment.