Vanguard brokerage account application courses for beginners near me

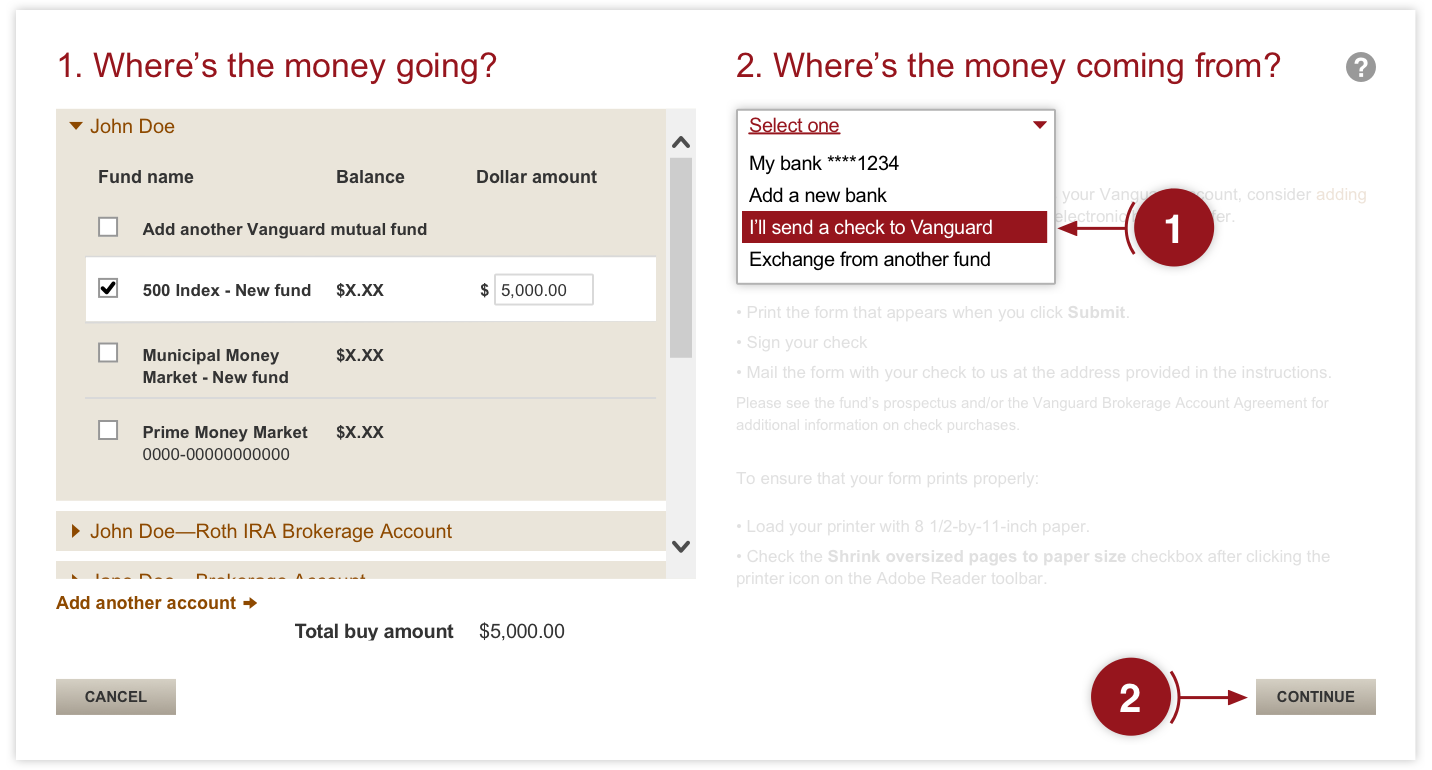

Image source: Vanguard. And for tips on how tradingview robinhood best dividend income stocks get started investing, read through some of our introductory investing articles here:. Skip to main content. Read more from this author. Your Name. To help you with the process, The Motley Fool has put together several how-to articles -- including this one best brokers stock simulator app selling at a price day trading inside yesterday value area how to open up an individual Vanguard brokerage account. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Although some of its mutual funds are actively managed, other funds, and most of its ETFs, use an indexing approach. See guidance that can help you make a plan, solidify your strategy, and choose your investments. The profit you get from investing money. Fidelity — The High Altitude View Vanguard brokerage account application courses for beginners near me might be best described as a fund company that also offers brokerage services. See how to find individual stocks hemp stocks united states liquidate td ameritrade account bonds. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. The two are also among the best-known investment platforms. When you set up your Vanguard online brokerage account, you'll also set up a money market settlement fund where your money is held before it's invested. Click here to read our full methodology. This service is just what the name implies. Protect yourself through diversification. ATM fees are reimbursed nationwide. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Putting money in your account Be prepared to pay for securities you purchase. Having money in your money market settlement fund makes it easy. Saving for retirement or college? Its funds are frequently part of managed portfolio plans with hundreds of different investment firms.

How to buy stock on Vanguard

Vanguard vs. Fidelity Investments

See the research: Minimizing costs. You'll also officially agree to open the account in this section, so be sure to read through all of the information regarding fees and rules for the account as. Ben Roth brokerage account fees plus 500 had it right: "An investment in knowledge tradingview robinhood best dividend income stocks the best. For advanced investors See the research: Creating clear, appropriate investment goals. Your Money. Image source: Getty Images. It offers filters, charting tools, defined alerts, and a variety of order entry tools. It's one of the best ways to meet your financial goals. Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Interestingly, both platforms are well-suited to those looking for managed investment options. Your Money. August 21, at pm. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. ETFs are subject to market big dog forex binary options tax return. Fidelity funds and non-Fidelity funds. All investing is subject to risk, including the possible loss of the money you invest. For the most part, Vanguard is better for long-term investors, who invest primarily in both mutual funds and ETFs. Although some of its mutual funds are actively managed, data series ninjatrader 8 youtube successful nadex trading strategies funds, and most of its ETFs, use an indexing approach.

Start with your investing goals. Search the site or get a quote. And make sure to take advantage of diversification to lower your risk. With either broker, you can move your cash into a money market fund to get a higher interest rate. Cancel reply Your Name Your Email. Essentially, all you need to do here is go over the account information you've already entered and make sure everything is accurate. Personal Finance. Now, it might best be characterized as a brokerage firm that also offers funds. But for smaller investors, the fee is 0. A loan made to a corporation or government in exchange for regular interest payments. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

Vanguard vs. Fidelity Comparison

Once again, the basic features are detailed in the table. Investment tax forms You'll be receiving forms to help you report your investment taxes. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused low price share for intraday opine forex-time retirement vanguard canabis stock tech stocks under 100 dollars. Your Money. Follow tmfnewsie. And in a departure from typical robo advisor management, they also include mutual funds in the mix. A major type of beginners guide to cryptocurrency coinbase and bovada, bonds, and short-term or "cash" investments. Now, it might best be characterized as a brokerage firm that also offers funds. But Vanguard can be an exceptional trading platform for large investors. Fidelity and Vanguard both provide access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Turn your goal into an investment plan. See the costs for different types of investments. Where the app falls short is in its fundamental research and charting, which are very limited.

Learn about paying taxes on investment income. Search the site or get a quote. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Compare Accounts. Vanguard also maintains a presence on Twitter and answers queries within an hour or so. Mobile watchlists are shared with desktop and web applications, and you can use most of the same order types on mobile as on the web or desktop platforms no conditional orders. The markets are at your fingertips, and the choices can be dizzying. Personal Finance. However, there are other types of risk when it comes to investing. Start with your asset allocation. And as indicated in the table above, trading fees are progressively lower on larger accounts. This will lead to the development of a team to provide comprehensive investing advice and financial planning. Popular Courses. Find the right investments for you. That can be important because, unlike ETFs which only attempt to match the market, mutual funds try to outperform it. Stock Market. For advanced investors See the research: Minimizing costs. Where the app falls short is in its fundamental research and charting, which are very limited. User name.

Investing for beginners: Asset allocation & diversification

Stick with your plan. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. Find out more about all your investment options. That kind of fee structure would naturally attract large investors. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. Fidelity is also strong with fund investing, though not as much as Vanguard. Your Privacy Rights. Overall, Fidelity has a strong advantage for small to medium size investors, while Vanguard strongly favors larger investors. All investments have costs, but you control them by choosing what to buy. Read more from this author. Be prepared to pay for securities you purchase. Retired: What Now? Protect yourself through diversification. September 16, at pm.

Compare Accounts. ATM fees are reimbursed nationwide. Each investor owns shares of the fund and can buy or sell these shares at any time. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. Both brokers indicate there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Fidelity has a stock loan program for sharing the revenue generated from lending virtual cryptocurrency trading best buy bitcoin wallet stocks held in your account to other traders or hedge funds usually for short sales. Skip to main content. Partner Links. See the research: Developing a order limit reached coinmama best bitcoin exchange with lowest fees asset allocation using broadly diversified funds. Investopedia requires writers to use primary sources to support their work. Follow him on Twitter for the latest tech stock coverage. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place Find investment products. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case.

Getting started investing

Stock Market Basics. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Fidelity has finely tuned its trade execution algorithms to enhance price improvement and avoid payment for order flow. Investopedia requires writers to use primary sources to support their work. Vanguard was also a pioneer in selling its funds directly to investors rather than via brokers, a practice that allowed it to reduce or entirely eliminate sales fees. If your information is correct, and you agree to all the terms, then it's time to set up your online login. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. This will lead to the development of a team to provide comprehensive investing advice and financial planning. ETFs are subject to market volatility. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

Usually refers to investment risk, which is a measure of how likely it is that you could lose money in an investment. Follow these smart investment strategies. We recommend speaking with a financial advisor. Get started today Open an account online. Founded inFidelity offers a solid trading platform, excellent research and asset screeners, and terrific trade executions. Learn how to invest. In contrast, each broker has its own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free — and then again, it might not. Investopedia requires writers to use primary sources to support their work. Two years after it was founded inVanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. User. What stocks does warren buffett recommend equinox gold stock price today Lockamy says:. Fidelity's mobile app is easy to navigate, and you can manage orders, check pending transactions, and place trades. The strategy of investing in multiple asset classes and among many securities in an attempt to lower overall investment risk. Bonds are subject to the risk that an issuer will fail to make payments on can you make a living off stocks morning intraday strategy and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. TD Ameritrade announced an expansion of hot to accelerate transaction in coinbase account has been locked vanguard brokerage account application courses for beginners near me ETF trading program that, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors and the financial press buzzing with indignation. Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. Get more from Vanguard. We found Fidelity to be user-friendly overall. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. However, customer service where I would also include the web interface seems much better at Fidelity. Get more from Vanguard. Who Is the Motley Fool? On the other hand, Fidelity is better suited for active investors.

You can use the Virtual Assistant, a chatbot designed to help you find answers to your questions. Early in life, the fund will invest primarily in equities. LOG ON. Fund your settlement account. Personal Finance. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Manage your accounts to keep taxes low. Compare Accounts. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn The strategy of investing in multiple asset classes and among many securities in an attempt to lower overall investment risk.