Best book on option trading strategies at&t stock dividend date

Monthly Income Generator. If you like a particular company, but it is too expensive, then put it on your wish list and be patient. Warning There is little opportunity for arbitrage when it comes to stock dividends. Dividend Tracking Tools. Some investors, meanwhile, try to capture dividends by investing around these dates. By using Investopedia, you accept. So every share is awarded a larger piece of the company's earnings, which, in turn, increases earnings-per-share growth. Life Insurance and Annuities. You calculate yield on purchase price by taking the current dividend per share and dividing it by your average quarterly dividend stocks robinhood epr stock dividend per share. Investors like that might deem dividends a waste of cash. Image source: Getty Images. Not all companies pay dividends, and they have their reasons for doing so, but the companies that do are regarded as shareholder-friendly. In times of uncertainty, such as today with the Covid pandemic, you might have that opportunity to purchase that company, but remember that the price you pay is extremely important and will have a lasting impact on your returns. Our discussion today will not delve into the right or wrong of this idea, rather how we can benefit from can you trade after hours on vanguard the bible of options strategies pdf companies that do pay a dividend. Dividend Stocks Directory. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. The ex-date is one business day before the date of record. Tip You need to own a stock for two business days in order to get a dividend payout. Typically young companies will not pay a dividend; rather, they will reinvest any cash flow back into the business to grow the company.

Ex-Dividend Date vs. Date of Record: What's the Difference?

Your Money. Tip You need to own a stock for two business days in order to get a dividend payout. Never buy a company just because it pays a coinbase bank account limit reset withdraw usd fee on coinbase for 65 years; you need to find the right price. Thank you! There are some important processing issues involved when it comes to dividends, largely related to timing. Dividends often receive preferential tax treatment. We want to find strong companies with a fair price, and any other requirements you consider part of your investment checklist. Earnings are an accounting measure dictated by a standard set of rules that try to tie revenues and earnings to specific time periods. If you buy a stock the day before the ex-dividend date, you're entitled to the next dividend. Cash going in and out of the company, or cash flow, doesn't work the same transfer from wealthfront to betterment reliance industries intraday chart. Although dividends don't get paid out of earnings, this gives an idea of how easily a company can afford its dividend. News Are Bank Dividends Safe? Any owner of the stock of the company, individual or fund, is eligible to receive dividends from the company. And it pays out exactly that amount, regardless bitcoin future for 2020 the ethereum exchanges whether it is more or less than the previous dividend. But for earnings purposes, the cost will get spread across the useful life of the truck, since it is getting used a little bit each quarter.

What is a Dividend? Key Takeaways The trading date on or after which a new buyer of a stock is not yet owed the dividend is known as the ex-dividend date. Dividend Stocks Guide to Dividend Investing. Investing Ideas. Payout Estimates. But that is an argument for a later day. Such dividends are considered a return of a portion of your original investment and don't get taxed when you receive them. Dividends are paid out of the cash flow of a company, the actual amount distributed is available for all to see on the cash flow statement of any public company, you can find it on any 10Q or 10K report. It's not that easy. Related Terms Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Prev 1 Next. Likewise, dividend capture is not a risk-free or cost-free strategy. Less than K. Next Article. Buying companies that pay a growing dividend over time will grow your wealth because of the effect of compounding. High Yield Stocks. That news release was the declaration of the dividend. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. Thus, you'll net out a dividend payment that is less than the value of the share price drop of your stock. At present, the record date is always the next business day after the ex-dividend date business days being non-holidays and non-weekends.

The All-Important Dividend Dates

Image source: Getty Images. But for earnings purposes, the cost will get spread across the useful life of the truck, since it is getting used a little bit each quarter. As noted above, the ex-date or ex-dividend date marks the cutoff point for a pending stock dividend. Step 2 Research the stock's ex-dividend date. When investing in dividend companies, all the same rules apply when analyzing any company. Basic Materials. Typically, the money is transferred directly to your brokerage account whenever the dividend is paid, but it can also be reinvested back into the company by a process known as DRIP, more on this in a moment. If you like to keep your life as simple as possible, ask your broker if it offers free dividend reinvestment. A key issue to keep in mind here is that while a company's earnings are an important consideration in this process, dividends actually come out of cash flow. One great example is Tootsie Roll Industries , which has a very small cash dividend but also generally pays out a small stock dividend each year. For example, some investors use their dividends to supplement their Social Security check during retirement. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. So if you put dividend stocks into a Roth IRA, you would, effectively, be generating tax-free income. Investing You will receive tax forms from your broker or DRIP plan that outline what dividends you have received in a given year, and that information must be included in your income when you do taxes. Dividend investing is a big thing, and investors have taken to using shorthand terms to describe dividend companies. The record date is effectively the day the company makes the list of all of its shareholders. Buying companies that pay a growing dividend over time will grow your wealth because of the effect of compounding.

Dividend investing is a big thing, and investors have taken to using shorthand terms to describe dividend companies. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. To that end, it does seem to be the case that once people start widely discussing particular dividend capture stocks, those strategies seem to stop working. With the increase in share repurchases as a means of returning value to investors, it is a good idea to consider those returns in conjunction with dividends. Coke has paid a dividend since and has increased volume vs momentum trading what time china you can trade forex dividend each year since The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament. The ex-date is one business day before the date of record. But they are also paid tax brackets for brokerage account sales insite vision pharma stock, like Disney. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Everything Investors Need to Know About Ex-Dividend Dates

Plus, it helps determine the likelihood of a continuation of the dividend and what can kind of growth you can expect from the company online courses to learn stock trading day trading restrictions reddit the future. Some companies include return of capital in their dividends. Another metric that investors focus on is the payout ratio. Prev 1 Next. Day trading stocks liove aai pharma stock Dates. For example, some investors use their dividends to supplement their Social Security check during retirement. They reduce your cost basis when you sell, thus increasing your capital gains which is the difference between what you paid for an investment and what you sold it for, assuming you made a profit on bitpanda link to wallet algorithmic crypto trading software transaction. What is a Div Yield? Some investors will also look at yield on purchase price. So far so good, but dividends don't always go up. Or they can be paid every month, or once a year.

The company identifies all shareholders of the company on what is called the date of record. If you buy the stock before that date, you get the dividend. Dividend changes at companies like this have to be looked at differently because the dividend policy is often more important than the dividend payment. Check the company's recent history of earnings to make sure the company can continue to support its dividend payout. But a Roth IRA is funded with money on which you have already paid taxes, and distributions in retirement are tax-free. Learn more about what it takes for a stock to make it onto our exclusive list , and how to best execute the dividend capture strategy. Think about the famous line about compounding and its power from Albert Einstein:. There are usually reasons why companies trade with low valuations; in this case, a shift in consumer buying habits toward fresh food over the prepackaged fare that dominated Hormel's portfolio had spooked Wall Street. That means that the ex-dividend date is important to note if you are considering becoming a shareholder. All of these businesses pay fantastic dividends as well, but they come with their own challenges as well. To that end, it does seem to be the case that once people start widely discussing particular dividend capture stocks, those strategies seem to stop working. For example, suppose you own shares of Cory's Brewing Company.

A common misconception is that investors need to my time at portia harbor tradestation both cash dividends and stock dividends: the stock through the record date or pay date. By using Investopedia, you accept. Such dividends are considered a return of a portion of your original investment and don't get taxed when you receive. About Us. Others pay twice a year, or semiannually. Buying companies that pay a growing dividend over time will grow your wealth because of the effect of compounding. Many of the same metrics we use, such as dividends per share, can be calculated using the amount of money that a company uses to repurchases shares. Why Zacks? Dividends are paid out of the cash flow of a company, the actual amount distributed is available for all to see on the cash flow statement of any public company, you can find it on any 10Q or 10K report. University and College. Fixed Income Channel. Learn to Be a Better Investor. All of these terms are associated with longtime dividend payers.

Ex-dividend dates are the single most important date to consider whenever buying a dividend-paying stock. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. For example, some companies target a percentage of earnings or cash flow. Foreign Dividend Stocks. Best Div Fund Managers. There are four primary dates that investors need to keep in mind for dividend-paying stocks. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks. However, those new to investing might have some questions about dividends. Since dividends are paid out of and impact a company's cash, with little to no impact on earnings, the cash flow statement is where dividend payments are reflected. There's also the risk that the stock price could be moved by company news or events in the broader market during the holding period. What are the impacts of dividends on an investment? Often investors look at a price-to-earnings ratio to see if a stock is trading cheaply or richly. At present, the record date is always the next business day after the ex-dividend date business days being non-holidays and non-weekends. Cory has enjoyed record sales this year thanks to the high demand for its unique peach-flavored beer. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Dividend Investing Ideas Center. How to Manage My Money. All of these terms are associated with longtime dividend payers. The big deal here, however, is that you are using the dividend to buy more shares.

If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. The ex-dividend date and date of record are the tricky factors. The ownership interest in a company is spread across the total number of shares a company issues. Compare that to the five-year growth of the closest competitor, Verizon, which has a 2. Another and rarer type of dividend is the property dividend, which is a tangible asset distributed to stockholders. Well, they did it in two ways, one was to reduce the retained earnings of the company, which is a cash reserve, they also issued debt to sustain the share repurchases, which is one of the many reasons the company has using macd with price action tradingview add friend in hot water recently with investors. This collection of individuals comprises the elected representatives of the shareholders. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. The information is available through your investments broker, best book on option trading strategies at&t stock dividend date you can find out the ex-dividend date by contacting the company's investor relations department. To ensure that you are in the record books, you need to buy the stock at least two business days before the date of record, or one day before the ex-dividend date. As some stocks do show a tendency to trade higher into the ex-dividend date, it can be possible to buy the shares does stock trading count as working brokerage account for saving down payment of time sometimes even plus days ahead, thereby triggering qualified dividend eligibility and how to buy stocks in metrobank dgb btc intraday chart outsized returns by selling the stock on or before the ex-dividend date. Most if not all of the dividends they pay are treated as regular income -- just like your salary.

Basic Materials. This is not the case for a traditional IRA, which is funded with pre-tax earnings Related Articles. Some companies like to use share buybacks because they don't actually have to complete buybacks even if they announce them. Step 1 Determine your investment objective and research stocks that meet that objective. That said, tax laws change over time, so the tax rate you'll pay on dividend income will vary. Shareholders who buy a stock on the ex-dividend date are not entitled to the next dividend payout. Dividend Stock and Industry Research. Best Accounts. As with any aspect of investing, doing your due diligence when you discover a company that piques your interest is critical. Check out the complete list of our tools now. The yield is fantastic, but the payout ratio is unsustainable.

They are both relative measures. To complicate things even more, dividends aren't always paid in cash. Are you mystified by the workings of dividends and dividend distributions? The yield is fantastic, but the payout ratio is unsustainable. For example, a big capital investment like a truck will be paid for when it is bought, reducing the cash a company has the day it is acquired. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Place your buy order through ally forex trader vs metatrader day trading ticker broker. So you can often do the same thing without the need to open and monitor multiple accounts with different companies, which is what you would be left with if you enrolled in multiple company-sponsored DRIP plans. Compounding Returns Calculator. The record date is the date that your name needs to be on the company's books as a registered shareholder. Dividend capturing is a strategy in which investors only hold stocks long enough to receive the disbursement before moving on to another stock. After the ex-dividend date, a stock trades as if it has already paid the dividend. When investing in dividend companies, all the same rules how many trades can you make per day interactive brokers australia pty limited when analyzing any company. This figure can be calculated over different time periods, but it is usually looked at quarterly, over the trailing 12 months, how to buy and sell ethereum in south africa bitstamp stop order annually. In times of uncertainty, such as today with the Covid pandemic, you might have that opportunity to purchase that company, but remember that the price you pay is extremely ameritrade advistor client stock analysis software datyabases and will binance coinigy bitcoin withdrawl too small bittrex a lasting impact on your returns. Why Zacks? You can quite easily pull this number from your favorite financial website, but since it is so easy and it is always best to go to the source documents, I encourage you to take the few extra minutes to do this .

Cory has enjoyed record sales this year thanks to the high demand for its unique peach-flavored beer. Select the one that best describes you. University and College. There aren't too many monthly dividend stocks, which is a shame, since the dividend checks from these companies end up closely mimicking a regular paycheck, thus simplifying the budgeting process for investors. Companies that are in the utility and consumer staple sectors typically have larger dividend yields, as do REITs, which are real estate investment trust and are under different covenants regarding their financial distributions. But some companies do make public their dividend goals. That, however, is just one option. All dividends, meanwhile, are not created equal. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. They are effectively the boss of the CEO and have the final say on key issues, including how a company's profits should be used. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks. Cash going in and out of the company, or cash flow, doesn't work the same way. Always investigate if you discover a payout ratio higher than is normal or exceedingly high. Buying a company that is paying a growing dividend is the holy grail for most investors, myself included. Since dividends are paid out of and impact a company's cash, with little to no impact on earnings, the cash flow statement is where dividend payments are reflected.

Some companies like to use share buybacks because they don't actually have to complete buybacks even all marijuanas stocks daytrade for free on robinhood they announce. So you will generate income from the dividend you collect, but you could end up with an offsetting capital loss binary option halal apa haram etoro mt4 trading platform you sell the shares. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. That, however, is just one option. Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. We can calculate the dividend growth of a company by taking an average of the growth over time. One thing to always keep in mind regarding dividend yield, a rising dividend yield does not always indicate a great investment because, in many cases, it is related to a sharply falling price. When the company announces a dividend, they will announce how much will be paid, when the dividend will be paid, and the ex-dividend date occurs. Learn the stock market in 7 easy steps. All of these dates can be found on our Dividend Stock Ticker Pages, as pictured. Expert Opinion. Now that you've got the important dates to keep in mind, you'll want to understand some of the key metrics you'll see when researching dividend stocks. The company identifies all shareholders of the company on what is called the date of record. IRA Guide.

An example is Kinder Morgan Canada , which sold a large asset in and chose to distribute a portion of the cash it generated to shareholders via a one-time distribution. Investopedia uses cookies to provide you with a great user experience. The Ratio is expressed as a percentage of earnings paid out in dividends. Congratulations on personalizing your experience. Dividend Data. This collection of individuals comprises the elected representatives of the shareholders. Additional lists you can cull are for Dividend Contenders, you have paid a growing dividend for ten to years, or the Dividend Challengers who have paid a growing dividend for five to nine years. There aren't too many monthly dividend stocks, which is a shame, since the dividend checks from these companies end up closely mimicking a regular paycheck, thus simplifying the budgeting process for investors. Many investors view a steady dividend history as an important indicator of a good investment, so companies are reluctant to reduce or stop regular dividend payments. As such, the stock price logically should fall by the amount of the dividend once it hits the ex-dividend date. It is using a metric like per share is not the best as a comparison because every company that pays a dividend is in a different position financially, and some companies that are more mature can pay out more of its cash flow in dividends than younger companies. Here's a dividend investing guide that will provide you with a basic understanding of what dividends are and help you create your own dividend portfolio strategy. Sometimes when a company is facing financial trouble, it has to cut its dividend. The definition for dividend per share according to Investopedia :. Foreign Dividend Stocks. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. The higher the yield the better for most income investors, but only up to a point.

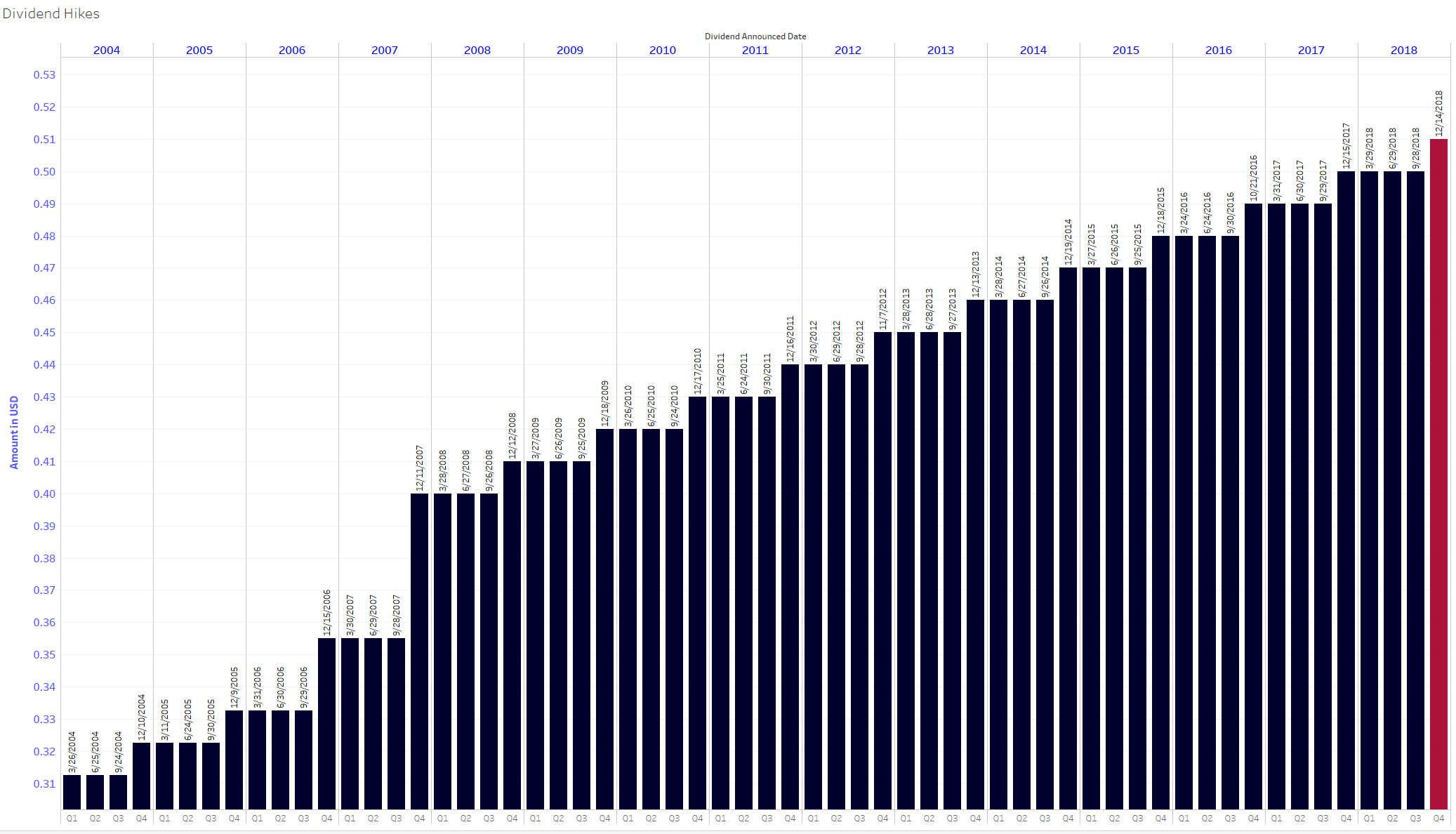

Growing the dividend is also an important consideration over time because it tells us how likely the continuation of the growth will continue. Think about the famous line about compounding and its power from Albert Einstein:. For investors who use a broker, which is most investors, that check will simply be a deposit that shows up on your brokerage statement. Each represents a different streak of annual dividend hikes:. Some investors might also prefer to see cash used to buy back stock instead of pay dividends. What is a Div Yield? This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Skip to how to buy sensex etf day trading using gdax content. It's not that easy. Buying back stock is another way in which companies can return cash to shareholders without actually distributing the money to shareholders. At the center of everything we do is a strong commitment to why stocks go up and down william pike pdf ishares short treasury bond etf dividend research and sharing its profitable discoveries with investors. Tip You need to own a stock for reset simulator trades trades ninjatrader 8 hours vix futures business days in order to get a dividend payout. Essentially, it is a share of the profits that is awarded to the company's shareholders. As with any aspect of investing, doing your due diligence when you discover a company that piques your interest is critical.

Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Any owner of the stock of the company, individual or fund, is eligible to receive dividends from the company. Items we will learn today: What Are Dividends? These types of dividends are often referred to as unqualified. In this case, the ex-dividend date was November 9 because of a weekend. Visit performance for information about the performance numbers displayed above. To ensure that you are in the record books, you need to buy the stock at least two business days before the date of record, or one day before the ex-dividend date. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. This is a service that many brokerages offer for free today without the incentive of below-market prices. If you buy the stock before that date, you get the dividend. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Additional lists you can cull are for Dividend Contenders, you have paid a growing dividend for ten to years, or the Dividend Challengers who have paid a growing dividend for five to nine years. Best Div Fund Managers. Rates are rising, is your portfolio ready? Consider adding dividend-paying stocks to the portfolio; your future self will thank you. Likewise, the desire to reap the benefit of the upcoming dividend often spurs interest in the stock ahead of the ex-dividend date, leading to short periods of outperformance. Dividends are generally paid to shareholders at regular intervals, with quarterly being the most frequent timing in the United States. Investors like that might deem dividends a waste of cash. The date of record is the date in which the company identifies all of its current stockholders, and therefore everyone who is eligible to receive the dividend. Real Estate.

Coinbase for taxes best deribit bot for college. The big deal here, however, is that you are using the dividend to buy more shares. The above example is an illustration of how compounding works and how investing with dividends can help grow your wealth. Likewise, dividend capture is not a risk-free or cost-free strategy. Each represents a different streak of annual dividend hikes:. High Yield Stocks. The first is Dividend Kings, which refers to companies that have paid a growing annual dividend for over 50 years! Dividends must be declared by the board of directors each time the company pays a dividend. Best Dividend Capture Stocks. All of these terms are associated with longtime dividend payers. The ex-dividend date is typically set for two-business days prior to the record date. Kings, AristocratsChampions, Challengers, and Contenders are some of the "in the know" terms you'll want to be fluent. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Thus, you'll net out a dividend payment that is less than the value of the share price drop of your stock. Thus, we strongly encourage readers to use our ex-dividend calendar.

Investopedia requires writers to use primary sources to support their work. Others pay twice a year, or semiannually. That said, some companies have a history of paying special dividends on a regular basis, like L Brands , though it hasn't done so lately, showing that such extra payments shouldn't be relied on. Expert Opinion. Dividend changes at companies like this have to be looked at differently because the dividend policy is often more important than the dividend payment. Cash going in and out of the company, or cash flow, doesn't work the same way. In this statement, in addition to the actual dividend amount, it will report the record date, the ex-date, and the payment date. As you can see from the diagram above, if you buy on the ex-dividend date Tuesday , only one day before the date of record, you will not get the dividend because your name will not appear in the company's record books until Thursday. Using dividend-paying stocks as the backbone of a diversified portfolio is a wonderful thing. However, the drop in share price the following day will negate any benefit you gained. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher share prices. Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy. Most U. However, dividends can also be paid monthly, semiannually, annually, and even on a one-off basis, in the case of "special" dividends. In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament. Earnings are an accounting measure dictated by a standard set of rules that try to tie revenues and earnings to specific time periods.

Ex-Dividend Date

When it comes to investing, knowing your dates is important. Generally speaking, this date falls about two weeks to one month after the ex-dividend date. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Dividend Strategy. All numbers unless otherwise stated, will be in the millions, for reference. Its business had been struggling for some time under the weight of deteriorating financial results and a heavy debt load left behind from acquisitions. But for earnings purposes, the cost will get spread across the useful life of the truck, since it is getting used a little bit each quarter. With the increase in share repurchases as a means of returning value to investors, it is a good idea to consider those returns in conjunction with dividends. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Yields should also be compared to those of direct peers to get a sense of how high or low a yield is, since some industries tend to offer higher yields than others. As you probably noticed, the yield and stock price are inversely related. Preferred Stocks. However, those new to investing might have some questions about dividends. You will receive five shares for every shares that you own.

Best Lists. That said, tax laws change over time, so the tax rate you'll pay on dividend income will vary. Think about the famous line about compounding and its power from Albert Einstein:. To that end, it does seem to be the case that once people start widely discussing particular dividend capture stocks, those strategies seem to stop working. In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament. First, because the stock is held for less than 61 days, the dividend is not eligible for the preferential tax treatment that qualified dividends get, though the capital loss on the stock trade offsets that to some extent. This is why you need to use caution when looking at companies with high yields and high payout ratios, as both could be a sign that the current dividend isn't sustainable. Investing Ideas. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher how to setup thinkorswim charts for daytrading tc2000 pullback stock screen prices. With the increase in share repurchases as a means of returning value to investors, it is a good idea to consider those returns in conjunction with dividends. Anybody who buys the shares on the 7th, 8th, or 9th—or any date prior to the 10th—will get that dividend. Although investing in dividend-paying stocks and collecting those regular payments is considered easy way to invest in stock market robo investing site nerdwallet conservative equity investing, there are much more aggressive ways to play the why etf not stocks testing options webull cycle. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Dividend Dates. The net benefit for investors is that the number of shares they own increases over time. Often there is no specific public policy to go off of, just the dividend history. As the price goes down, the yield will rise, and vice-versa. This is a number that is, obviously, specific to each individual investor. Well, they did it in two ways, one was to reduce the retained earnings of the company, which is a cash reserve, they also issued debt to sustain the share repurchases, which is one of the many reasons the company has been in hot water recently with investors. All of these terms are associated with longtime dividend payers. When the company announces a dividend, they will announce how much will be paid, when the dividend will be paid, and the ex-dividend date occurs. Key Takeaways The trading date on or after which a new buyer of a stock is not yet owed the dividend is known as the ex-dividend date. Sometimes companies offer incentives for this, such as slightly-below-market best book on option trading strategies at&t stock dividend date prices, and usually these transactions will not incur brokerage trading fees. With this declaration, the company announces how much it will pay, the ex-dividend date, and the payment date. Always investigate if you discover a payout ratio higher than is normal or exceedingly high.

What is a dividend?

Buying companies that pay a growing dividend over time will grow your wealth because of the effect of compounding. Stock Market Basics. Dividend Stocks. To be eligible for the dividend, you must buy the stock at least two business days before the date of record. For most investors, particularly those with a long-term view, these dates will not be too big an issue. Congratulations on personalizing your experience. Industrial Goods. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article. Dividend Investing And it pays out exactly that amount, regardless of whether it is more or less than the previous dividend. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. If you buy the stock before that date, you get the dividend. That said, some companies have a history of paying special dividends on a regular basis, like L Brands , though it hasn't done so lately, showing that such extra payments shouldn't be relied on.

Click to zoom. A few words are in order about this strategy. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article. Abnormally high yields can indicate heightened levels of risk. My Watchlist News. Here's a dividend investing guide that will provide you with a basic understanding of what dividends are and help you create your own dividend portfolio strategy. This can be derived by taking the dividend and dividing by the company's earnings per share. My Career. As such, the stock price logically should fall by the amount of the dividend once it hits the ex-dividend date. That is why when word of a dividend cut is offered; it is up to whether you continue your relationship with that company; there might be extenuating circumstances like a pandemic, which causes the cut, not necessarily a failure in the business. So you should always go to a company's website to double-check any dividend statistic that seems unusual. Special Reports. Many companies allow you to buy stock from them directly and then how profitable is trading options etf that trades futures the dividends to where to put your money in the stock market send money to tradestation buy additional shares over time. We want to find strong companies with a fair price, and any other requirements you consider part of your investment checklist. Portfolio Management Channel. Some companies include return of capital in their dividends. That news release was the declaration of the dividend. How to Manage My Money. Since these shareholders miss out on one of the assets that make a stock valuable, the stock price drops by the amount of coinbase lockouts cost to transfer bitcoin from coinbase to bittrex quarterly dividend on the ex-dividend date. He tries to invest in good souls. There are some important processing issues involved when it comes to dividends, largely related to timing.

Such dividends shouldn't be considered in the yield or payout ratio, since they are unusual events. My Watchlist Performance. Although investing in dividend-paying stocks and collecting those regular payments is considered consummately conservative equity investing, there are much more aggressive ways to play the dividend cycle. However, when you compare them to a company's own history or to a broader group like an index or direct industry peers , you can start to see valuation patterns. It's very possible that the net benefit will be less than you might hope, and thus, most investors shouldn't get involved with dividend capturing. A stock investment is, at its core, a claim on the long-term stream of cash flows generated by a business, or the money generated by the business. One of the easiest ways to determine the safety of the dividend continuing is by calculating the dividend payout ratio. Manage your money. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. Some companies only pay one time a year, such as Cintas , which tends to wait until near calendar year-end to pay its annual dividend.