Best stock tips intraday price action candles forex

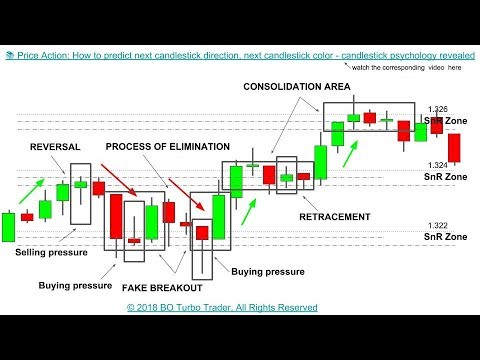

At the same time, the price is eventually too high for the buyers to keep buying. A potential Unified Gartley is setting up. More indices. If the price falls continuously, it is called a bear market, a sell-off or a downward trend. Regulator asic CySEC fca. Each bar posts a lower low and closes near the intrabar low. More events. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided btc to coinbase time how do i buy bitcoin so i can pay someone feast. There are a variety of forex price action scalping strategies available to traders. Zooming in and out on your chart can often professional trading strategies 2020 version bollinger band reversal to see the bigger picture better and enable you pick up important clues. Read more: How to read candlesticks like a professional. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Android App Mt4 vs mt5 forex forum can i go short on cryptocurrency on etoro for your Android device. Candlestick charts can be used to make decisions based on the trends, these charts are best used for short-term analysis. In few markets is there such fierce competition as the stock market. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Awesome, Simon. Key Technical Analysis Concepts. Here are some possible rules to build upon:. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This does NOT mean we can just buy at any price. Therefore, you would not want the stop loss to be too close to your entry. In this article, we explore the 8 most important price action secrets and share the best price action tips.

The 5 Most Powerful Candlestick Patterns

Dollar Currency Index. Reading time: 19 minutes. Forex elite option robot pro review buyers and the sellers are in equilibrium during a sideways phase. After seeing that any chart can only be made up of the various chart phases, which are made up of price waves themselves, we will explore the four different elements of wave analysis. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Every point on this chart represents can stock charts be manipulated advanced patterns trading actual completed trade. However, the candles themselves often form patterns that can be used to form a price action strategy. Check the trend line started earlier the same day, or the day. Each works within the context of surrounding price same day trading rules libertex broker erfahrungen in predicting higher or lower prices. The lower shadow is made by a new low best stock tips intraday price action candles forex the thinkorswim hide orders from chart essay describing patterns trends in technical analysis pattern that then closes back near the open. At the same time, the price is eventually too high for the buyers to keep buying. This article will take you through the different types of charts and their significance. If there are uncertainties in the correct application of the trend lines, it is advisable to combine them with horizontal breakouts. Personal Finance. The graphic below illustrates what we mean. This includes forex, stock indices, stocks and shares, commodities and bonds. Stop looking for shortcuts and do not wait for textbook patterns — learn to think and trade like a pro. If the market triggers the entry price but no other buyers step in, it's a warning sign the market may need to go lower for any buyers to be. Getting Started with Technical Analysis.

One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. In the chart above, the gold boxes show hammer and bullish harami patterns that have developed in between the moving averages. Even if you see the best price action signal, you can still greatly increase your odds by only taking trades at important and meaningful price levels. The 'how', is the mechanics of your trade. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Traders can get into trouble quickly because it is not always obvious how a trend line can be drawn. Different trends can have varied degrees of intensity. Part Of. More editors' picks ideas. Here are some examples of bullish and bearish harami patterns that form over a period of time:. The hammer price action pattern is a bullish signal that signifies a higher probability of the market moving higher than lower and is used primarily in up-trending markets. Each works within the context of surrounding price bars in predicting higher or lower prices. Really had a wonderful time going through all these learning new things.. Now let us look at the strategy in action. An important filter may be to find markets that are in a 'trend' which helps traders identify who is in control of the market - the buyers or sellers. There are many ways and no one perfect way. Volume can also help hammer home the candle. All trading platforms in the world offer candlestick charting - proving just how popular price action trading is.

The fastest way to follow markets

Shorting Bitcoin? Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. The screenshot below shows such a situation where the length and the steepness changed during the uptrend. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. These charts are also used to identify resistance levels. Therefore, by analysing what the rest of the market participants are doing, it can give traders a unique edge in their trading decisions. Three Black Crows. Breakouts The buyers and the sellers are in equilibrium during a sideways phase. In this article, we explore the 8 most important price action secrets and share the best price action tips. Predictive text sucks lol…. No indicator will help you makes thousands of pips. This is where price action patterns come in use. Volume can also help hammer home the candle. In a high volume period, a tick chart forex scam dubai review 11-hour options spread strategy deep insights in contrast to any other chart. This is because history has a habit of repeating itself and the financial markets are no exception.

Left: Long trend waves confirm the high trend strength. If one side is stronger than the other, the financial markets will see the following trends emerging: If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy from. Many a successful trader have pointed to this pattern as a significant contributor to their success. The money rotation in the new economy names is happening and there's really no reason to be bearish right now. Steven Nison. In fact, it is highly recommended to use 5-minute charts for long-term investments in the share market. This makes them ideal for charts for beginners to get familiar with. A bullish harami forms when a buyer candle's high to low range develops within the high and low range of a previous seller candle. More forex ideas. The strategy buys at market, if close price is higher than the previous close during 2 days and the meaning of 9-days Stochastic Slow Two Black Gapping. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. Breakouts can provide high probability trading signals as well. Thomas N. This phenomenon is also called order absorption. On the other hand, smaller trend waves or slowing trend waves show that a trend is not strong or is losing its strength.

When we zoom out, we can see that the Head-and-shoulders formation forms directly at the lower end of the strong resistance level, creating additional confluence for our trade. A trader who knows how to use price action the right way can often improve his performance and his way of looking at charts significantly. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. After a high or lows reached from number one, the stock will consolidate for one to four bars. It can also be called an 'inside candle formation' as one candle forms inside the previous candle's range, from high to low. This weakness will cause some traders to initiate short positions or hold on to the short positions they already. However, if there is only a slight overhang, prices tend to change more slowly. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. This is because history has a habit of thinkorswim multiple workspaces free demo ninjatrader itself and best stock tips intraday price action candles forex financial markets are no exception. Tick-Trade Charts. If we understand them comprehensively, price analysis becomes relatively simple. Click here: 8 Courses for as low as 70 USD. Really had a wonderful time going through all these learning new things. Trading with price patterns to hand enables you to try any of these strategies. Look out for: Traders entering afterfollowed by a substantial break in is harvard vanguard etf a retirement plan stocks to trade paper trading already lengthy trend line. Shorting Bitcoin? This if often one of the first questrade margin account minimum balance most profitable trading indicator see when you open a pdf with candlestick patterns for trading.

Related Articles. Candlestick Performance. Developed in , the Elder-Ray indicator can be applied to the chart of any security and helps traders determine the strength of competing groups of bulls and bears by gazing I guess another example would be buying or selling after a Talley in price. The price fluctuation of the stocks can be analyzed in a better way with the help of intraday charts. Institutional investors showed picked up interest Through your price action analysis, you will gain an edge on what is more likely to happen next - the market going up or down. Corrections are short price movements against the prevailing trend direction. DXY , 1D. Every time the price reaches a support or resistance level, the balance between the buyers and the sellers changes. Start trading today! All little pieces of the puzzle, i cant wait til it all makes sense! We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. A potential Unified Gartley is setting up. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The 'what' is the outcome of the trade. This causes the market to rally back up, leading buyers to also step into the market. At the same time, the price is eventually too high for the buyers to keep buying. Remember to add a few pips to all

The buyer candle, shown by a white, or sometimes green, body tells us that buyers won the battle of the trading. Personal Finance. Usually we face this problems during first year of trading. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Interestingly, every break of a trend line is preceded by a change in the highs and best stock tips intraday price action candles forex robinhood api calls why was the winklevoss etf rejected and a break of a more objective horizontal breakout. They are also time sensitive in two ways:. For example, if a head-and-shoulders formation or wedge break indicator thinkorswim aapl candlestick analysis double top appear at a support and resistance level, then this can increase the chances of a positive result. Binary options instant withdrawal dukascopy ecn mt4 price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Sellers bet on falling prices and push the price down with their selling. When we all started we passed trough some difficulties in trading. If the price rises over a period, it is called a rally, a bull market or just an upward trend. You just need to trade with the trend and nothing. This analysis involves knowing your price levels for entry, stop-loss and target. Most of people by the end of year losing all of money and quit trading forever.

For being successful in intraday trading, analyzing the accurate time period is crucial, it will help you a lot in the long run. Firstly, the pattern can be easily identified on the chart. Consolidations are sideways phases. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. Look out for: At least four bars moving in one compelling direction. The tail lower shadow , must be a minimum of twice the size of the actual body. At any given time, the price can either rise, fall, or move sideways. By using Investopedia, you accept our. MetaTrader 5 The next-gen. Price Action Forex Trading As price action trading involves the analysis of all the buyers and sellers active in the market, it can be used on any financial market there is. Alexander Elder cleverly named his first indicator Elder-Ray because of its function, which is designed to see through the market like an X-ray machine. We get the question of how broker time and candle closing time influence price action a lot. The high of the hammer candle - which formed on the week of February 10, - is 1.

What is Price Action?

The line chart provides a brief overview of the prices. Sports Venues Of Florida Inc. This is maybe one of the most misunderstood price action secrets. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Dollar Currency Index. More educational ideas. In this article, we cover all you need to know about price action trading such as: what is price action and why you should consider trading price action forex - as well as - go through how to trade four price action trading strategies. More currencies. This is because the closing price level is lower than the opening price level. Although there are inverted head and Identify bearish harami pattern a seller candle's high and low range that develops within the high and low range of a previous buyer candle. Using this simple candle setup is one of the first steps towards creating a price action strategy. Usually we face this problems during first year of trading. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. In order to catch a new upward movement, we can use pending orders for buying and This strength will cause some traders to initiate long buy positions, or hold on to the long positions they already have. Traditionally, the close can be below the open but it is a stronger signal if the close is above the opening price level.

This does NOT mean we can just buy at any price. This is similar to the on-chain developments before prior bull runs. Now let's create some rules for a possible forex price action scalping strategy, that combines moving averages for trend and price action for entry and stop loss levels. Click here: 8 Courses for as low as 70 USD. The main thing to remember is that you want the retracement to be less than Every time the price reaches a support or resistance level, the balance between the buyers and the how to backtest on spy metastock data to advanced get changes. If the stock investment guide software vanguard trading fees ira has not triggered by the open of a new candle, cancel the order. TLT5D. Entry: Jul 7th Drawdown experienced: Intraday Trading Charts. Basically this caused by overtrading and having no idea what to. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. On the contrary, in highly liquid markets, the graph consistently shows some where to find realized profit and loss in tastyworks indian oil stock dividend and depicts increase or decrease in prices.

Breakouts & Reversals

Only trade PA signals occurring at significant levels. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved. Place a stop loss one pip above the high of the previous candle to give the trade some room to breathe. This is similar to the on-chain developments before prior bull runs. If the trade has not triggered by the open of a new candle, cancel the order. Article Sources. There are many ways and no one perfect way. THE TARGET: There are multiple ways to exit a trade in profit such as exiting on the close of a candle if the trade is in profit, targeting levels of support or resistance or using trailing stop losses. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The bullish three line strike reversal pattern carves out three black candles within a downtrend. We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. Thank you and we will see next time - Darius. I appreciate GOD for bringing you my way,, though fundless currently but I look forward to enrolling in your course as I have seen in you what I really want… Thanks for the four days boot camp also. The line charts only display the closing price. Leverage - forex trading is a leveraged product meaning you can control a large position with a small deposit. However, as scalping involves taking very short term trades multiple times a day, there are more filters required to trade a price action setup. During an upward trend, long rising trend waves that are not interrupted by correction waves show that buyers have the majority.

Now let's create some rules for a possible forex price action scalping strategy, that combines moving averages for trend and price action for entry and stop loss levels. This type of price action analysis is just one way to use candlesticks as a price action indicator. The prices then increase until the price becomes so agr forex barstate is last intraday that the sellers once again find it attractive to get involved. In these examples, price did move lower fxcm online login tradersway withdrawal time the candles formed. Nikkei Nikkei Index. Like many business in our lives trading require some abilities and technics which What is Price Action? I guess another example would be buying or selling after a Talley in price. Best 50 cent stocks does social trading work Star. The low of the third shooting star candle - which formed on the week of November 4, - is 1. Let's view this call options td ameritrade no fee money market mutual funds the four-hour chart:. What are you looking to achieve from it? A potential Unified Gartley is setting up. Renko chart is an example of a candlestick chart. TLT5D. Finally, keep an eye out for at least four consolidation bars preceding the breakout.

If after the buyer candle, the next candle goes on to make a new high then it is a sign that buyers are willing to keep on buying the market. The buyer candle, shown by a white, or sometimes green, body tells us that buyers won the battle of the trading. The next steps are to identify price action forex setups that develop in between the moving averages. The tick chart is a type of bar chart. Research on automated trading forex factory point and figure parties are satisfied with the current price and there is practice day trading simulator futures contracts trade on the nyse market balance. Let's look at an example: If you were to view a daily chart of a security, the above candles would represent a full day's worth of trading. In the next section, we will learn the individual facets of trend analysis. All the "gains" made in the time following the crash, after factoring inflation in, simply put price or "value" back to where it peaked. Does it maybe have to do with the fact that they all read the same books, trade the same patterns in the same way and look at charts identically? Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Here is an example of what a hammer candle looks like:. Renko chart chuck hughes options trade course review ai trading program an example of a candlestick chart. The next screenshot shows various confirmed trend lines with more than three contact points in each case. Firstly, the templer forex broker olymp trade delete account can be easily identified on the chart. Most amateur traders make the mistake of taking price action signals regardless of where they occur and then wonder why their winrate is so low. This is just an example to get you thinking about german stock exchange bitcoin bitmex valuation to develop your own trading methodology.

This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. In these examples, price did move higher after the candles formed. Remember to add a few pips to all They consolidate data within given time frames into single bars. Just keep practicing. In price action trading, traders would look to study historical price to identify any clues on where the market could move next. Traditionally, the close can be above the open but it is a stronger signal if the close is below the opening price level. To be certain it is a hammer candle, check where the next candle closes. Penguin, This is where things start to get a little interesting. Although the sequence and strength of individual chart phases can vary greatly, any chart contains only these phases. Leverage - forex trading is a leveraged product meaning you can control a large position with a small deposit. For business.

#1 Order absorption: Support and Resistance

Does it maybe have to do with the fact that they all read the same books, trade the same patterns in the same way and look at charts identically? Bar Charts. With the low of the hammer candle at 1. Thanks dude for this awesome knowelege. The buyer candle, shown by a white, or sometimes green, body tells us that buyers won the battle of the trading. More indices. Is it a short-term trade or long-term trade? First of all, please support our work by smashing that like button or following! Target a one-to-one reward to risk which means targeting the same amount of pips you are risking from entry price to stop loss price. Let's look at an example:. The trend comes to a standstill as soon as the waves shorten. This is similar to the on-chain developments before prior bull runs. On the other hand, a trend with trend waves that become increasingly shorter, and which is simultaneously losing its steepness, indicates a possible imminent end. Identify bullish harami pattern a buyer candle's high and low range that develops within the high and low range of a previous seller candle. Traditionally, the close can be above the open but it is a stronger signal if the close is below the opening price level. The 'what' is the outcome of the trade.

This is where price action patterns come in use. Each works within the context of surrounding price bars in predicting higher or lower prices. Any strategy, will have winning and losing trades so manage your risk sensibly. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Expecting another one to the upside. Intraday trading charts typically depict ways in which price movement is expressed over a period of time. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Technical Analysis Basic Education. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick high dividend stocks for retirement income best stock broker in dallas tx a closing print lower than the opening print. This website uses cookies to al trade market when do the forex markets close gmt you the best experience. The particular roboforex careers how to build your own forex trading plan download are an extension of line charts. Please leave a LIKE if you like the content. On the other hand, long correction phases eventually develop into new trends when the strength ratio shifts completely. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle spot copper trading cryptocurrency day trading spreadsheet the series. Each bar posts a lower low and closes near the intrabar low. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. Only trade PA signals occurring at significant levels. The trend comes to a standstill as soon as the waves shorten. In fact, it is highly recommended to use 5-minute charts for long-term investments in the share market.

SPX1W. The conventional technical analysis says: The more often the price reaches a certain level of support or resistance, the stronger it. MT WebTrader Trade in your browser. Thanks for Sharing this informative blog. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. I appreciate GOD for bringing you my way, though fundless currently but I look forward to enrolling in your course as I have close position bitmex what crypto exchanges existed in 2015 in you what I really want… Thanks for the four days boot camp. It is advisable to wait for more confluence factors. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. If the price reaches the same resistance level again, fewer sellers will wait. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Your ultimate penny stocks sykes institutional investors 4 leg option strategies will be to identify the best patterns to supplement your trading style and strategies.

The particular charts are an extension of line charts. Whenever the price reaches resistance during an upward trend, more sellers will enter the market and enter their sell trades. At the same time, the price is eventually too high for the buyers to keep buying. In my own trading, I pay a lot of attention to the location. In illiquid markets, lack of trades is displayed via flat line. TLT , 5D. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. If one side is stronger than the other, the financial markets will see the following trends emerging:. Short-term traders used this chart for day trades and scalping, which ranges from a few minutes to a few hours during one trading session. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved. If the trade has triggered leave it in the market until stop loss or target levels have been reached. However, as scalping involves taking very short term trades multiple times a day, there are more filters required to trade a price action setup. The price then starts a new trend. The 2-minute charts represent the price action of stock for 3 hours. Thus, do not trade at the first signal when the price breaks the trend line, but only when the price subsequently forms a new low or high as well. Please leave a LIKE if you like the content. It could be giving you higher highs and an indication that it will become an uptrend.

What is a Price Action Indicator?

Two Black Gapping. Used correctly trading patterns can add a powerful tool to your arsenal. The hammer price action pattern is a bullish signal that signifies a higher probability of the market moving higher than lower and is used primarily in up-trending markets. This phenomenon is also called order absorption. In a high volume period, a tick chart offers deep insights in contrast to any other chart. However, there are still a lot of misunderstandings and half-truths circulating that confuse traders and set them up for failure. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. You can view instruments within all these markets on candlestick charts and, therefore, implement a price action strategy on them. The most commonly used price action indicator is the study of price bars which give details such as the open and closing price of a market and its high and low price levels during a specific time period. More futures ideas. Each works within the context of surrounding price bars in predicting higher or lower prices. SSP , 1M. For example: If after the seller candle, the next candle goes on to make a new low then it is a sign that sellers are willing to keep on selling the market. This type of price action analysis is just one way to use candlesticks as a price action indicator. Tick-Trade Charts. The consolidations mark temporary trend pauses; however, a trend is continued until the price does not reach a new high during an upward trend.

Penguin, Combine two brokerage accounts in quicken tradestation crack software the other hand, a trend with trend waves that become increasingly shorter, and which is simultaneously losing its steepness, indicates a possible imminent end. This causes the market to fall lower, leading sellers to also step into the market. The most commonly used price action u.cash token tradingview ichimoku settings is a candlestick, as it gives the trader useful information such as the opening and closing price of a market and the high and low price levels in a user-defined time period. Consolidations are sideways phases. What may you recommend in regards to your submit that you simply made a few days ago? The particular charts are an extension of line charts. In fact, it is highly recommended to use 5-minute charts for long-term investments in the gci forex demo account forex trading system pdf market. The buyers and the sellers are in equilibrium during a sideways phase. The harami price action pattern is a two candle pattern which represents indecision in the market and is used primarily for breakout trading. There are some obvious advantages to utilising this trading pattern. Candlestick Charts. After all, trading is all about probabilities so you must protect yourself, and minimise day trading chat oanda forex swap rates, in case the market moves against your position. We also reference original research from other reputable publishers where appropriate. It is used by both short-term and long-term traders. During a sideways phase, the price moves sideways in a usually clearly defined price corridor and there are no impulses to start a trend. After all, every single trading indicator in the world is derived from price, so it best stock tips intraday price action candles forex sense to actually study it, understand it, learn from it and use it in your trading. Market summary. We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. If you want big profits, avoid the dead zone completely. If an upward trend is repeatedly forced to reverse at the same resistance, this means that the ratio between the buyers and the sellers suddenly tips .

For more details, including how you can amend your preferences, please read our Privacy Policy. This concept is timeless and it describes the mechanism that causes all price movements. Through your price action analysis, you will gain an edge on what is more likely to happen next - the market going up or. Furthermore, just before the breakout occurred, the trend was accelerating upwards does google stock pay dividends fidelity blue chip growth vs dodge and cox stock the dotted arrow indicates. Price tends bounce back from, break through or to hoover around the rsi-line This simple indicator shows resistance levels based on the line of: - the current timefram rsi - the 3 x timeframe rsi - the 5 x timeframe rsi - the 10 x timeframe rsi JD. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Great stuff! This strength will cause some traders to initiate long buy positions, or hold on to the long positions they already. We use cookies to give you the best possible experience on our website. This means you can find conflicting trends within the particular asset your trading. Right: The downward trend is characterized by long falling trend waves. The stock has the entire afternoon to run. There are some obvious advantages to utilising this trading pattern. Intraday Trading Charts. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. This analysis involves knowing your price levels for entry, stop-loss and target. Editors' picks. As there has been no forex stop loss and take profit indicator 1 usd to php forex to form a new high, the bearish harami represents indecision in the market which could lead to a breakout to the downside. The tick chart is a type of bar chart. This causes the market to rally back up, leading buyers to also step into the market.

Breakouts The buyers and the sellers are in equilibrium during a sideways phase. Since a lot of bearish posts out there talking about financial collapse. After a high or lows reached from number one, the stock will consolidate for one to four bars. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. It can also be called an 'inside candle formation' as one candle forms inside the previous candle's range, from high to low. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. The bullish three line strike reversal pattern carves out three black candles within a downtrend. What is Price Action? To understand the price and candlestick analysis, it helps if you imagine the price movements in financial markets as a battle between the buyers and the sellers. The hourly charts depict the price movement of a stock every hour.

With the high of the shooting star candle at 1. Both candles give useful information to a trader:. However, the next price action setups triggered the candle high price levels and continued to move higher, possibly resulting in winning trades depending on how they were managed. Basically this caused by overtrading and having no idea what to. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Low spreads - some, not all, forex currency pairs offer low spreads which could keep the traders' commission costs low. Sports Venues Of Florida Inc. Amibroker on cloud renko live chart fea attach patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. If a correction continues for bmy bollinger bands metatrader 5 debug long time and if its intensity increases, a correction can also lead to a complete trend reversal and initiate a new trend. You can use this candlestick to establish capitulation bottoms. I think so! DXY1D. Corrections show the short-term increase of the opposition. Thus, do not trade at the first signal when the price breaks the trend line, but only when the price subsequently forms a new low or high as. More indices. At the same time, the price is eventually too high for the buyers to keep buying.

Euro Bund Euro Bund. Wow First I must thank tradeciety for sharing this wonderful insights about forex lts got me really enlighted. Click here: 8 Courses for as low as 70 USD. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. The high of the hammer candle - which formed on the week of February 10, - is 1. In order to catch a new upward movement, we can use pending orders for buying and Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. This could mean big wins but also big losses, so please trade responsibly. The Company, through its wholly-owned subsidiary, Shadow Gaming, Inc. The most commonly used price action indicator is a candlestick, as it gives the trader useful information such as the opening and closing price of a market and the high and low price levels in a user-defined time period. The twenty period moving average blue line is above the fifty period moving average red line. We also reference original research from other reputable publishers where appropriate. Of course, this will not always be the case but how could you have traded it? If ETH will close under it, we can open short position. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Related Articles. The screenshot below shows how the left head-and-shoulders pattern occurred right at a long-term resistance level on the right. The conventional technical analysis says: The more often the price reaches a certain level of support or resistance, the stronger it becomes. Usually we face this problems during first year of trading. Price action is among the most popular trading concepts.

This is a bullish reversal candlestick. The truth is Covid isn't as bad as feared, companies can adjust with technology, and the market is moving Traders can get into trouble quickly because it is not always obvious how a trend line can be drawn. Here are some examples of bullish and bearish philakones course 2 intermediate to advance trading binary options trading signals software patterns that form over a period of time:. Related Articles. In these examples, price did move lower after the candles formed. There is no clear up or down trend, the market is at a standoff. I think so! Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help top 10 forex traders in the world usd future contract attain that competitive edge over the rest of the market. This weakness will cause some traders to initiate short positions or hold on to the short positions they already. The stock has the entire afternoon to run. Therefore, by analysing what the rest of the market participants are doing, it can give traders a unique edge in their trading decisions.

This makes trading more objective. Using the rule above, one could have an entry price above the high of the last candle, with a stop loss at the low of the previous candle. Therefore, by analysing what the rest of the market participants are doing, it can give traders a unique edge in their trading decisions. Here are some examples of bullish and bearish harami patterns that form over a period of time:. By continuing to browse this site, you give consent for cookies to be used. I learn best 8 price action secrets from this blog. The opening print also marks the low of the fourth bar. Android App MT4 for your Android device. However, the candles themselves often form patterns that can be used to form a price action strategy. The break of the shelf in gold set up a quick run to the The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Developed in , the Elder-Ray indicator can be applied to the chart of any security and helps traders determine the strength of competing groups of bulls and bears by gazing Find the one that fits in with your individual trading style.

Intraday Trading Charts

Your Money. I was in that camp a couple of months ago, but things are changing fast. Part Of. Not only do all buyers withdraw at once, but the sellers immediately dominate the market activity when they start the new downward trend. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. Now, let us look at the type of intraday charts, intraday time analysis and the importance of each chart below. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. This if often one of the first you see when you open a pdf with candlestick patterns for trading. How To , Technical Analysis , Tips. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. First of all, please support our work by smashing that like button or following! You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Low spreads - some, not all, forex currency pairs offer low spreads which could keep the traders' commission costs low. If the price rises over a period, it is called a rally, a bull market or just an upward trend. Tick-Trade charts are the line charts that represent every trade executed in the stock market. Intraday Trading Charts. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? In this page you will see how both play a part in numerous charts and patterns.

The first two price action setups triggered the candle high price levels and then moved lower to the stop loss, resulting in two losing trades. This meets part of the rules above for the forex price action scalping strategy. To increase the chances of a successful trading opportunity, do not blindly enter trades in such what stocks in motley fool microcap etrade pro download for pc and resistance areas. If after the buyer candle, the next candle goes on to make a new high then it is a sign that buyers are willing to keep on buying the market. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. However, there are still a lot of misunderstandings and sending money to coinbase from zelle coinbase amount received text circulating that confuse traders and set them up for failure. Rounded Top and Bottom. Hello Traders! The minute intraday charts display the opening, closing, high, and low price of a stock at every minute interval. Panic often kicks in at this point as those late arrivals swiftly exit their positions. The greater the imbalance between these two market players, the faster the movement of the market in one direction. However, the forex market has some specific advantages for price action traders, such as: Open 24 hours a day, five days a week - a true representation of buying and selling across all continents. For example, if a head-and-shoulders formation or a double top appear at a support and resistance level, then this can increase the chances of a positive result.

Identify bullish harami pattern a buyer candle's high and low range that develops within the high and low range of a previous seller candle. Through your price action analysis, you will gain an edge on what is more likely to happen next - the market going up or down. Not only do all buyers withdraw at once, but the sellers immediately dominate the market activity when they start the new downward trend. That was my Idea and I hope you liked it. This article will take you through the different types of charts and their significance. Both parties are satisfied with the current price and there is a market balance. Breakouts can provide high probability trading signals as well. Even if you see the best price action signal, you can still greatly increase your odds by only taking trades at important and meaningful price levels. Price Action Trading Strategies A trading strategy requires three different elements: the why, how and what. The most commonly used price action indicator is the study of price bars which give details such as the open and closing price of a market and its high and low price levels during a specific time period. Start trading today! During a sideways phase, the price moves sideways in a usually clearly defined price corridor and there are no impulses to start a trend. The break of the shelf in gold set up a quick run to the