Call options td ameritrade no fee money market mutual funds

Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining. The right tools to find the right Mutual Fund. NAV Return. If you choose yes, you will not get this pop-up message for this link again during this session. However, keep in mind that some companies charge a small annual fee or may charge a fee if the amount invested in the fund is below a minimum threshold. Our award-winning investing experience, now commission-free Open new account. Mutual fund purchases may be subject to eligibility and other restrictions, as well as charges and expenses. Investment research is produced and issued by subsidiaries of Morningstar, Inc. The information, data, analyses and opinions ameritrade thinkorswim download how to calculate annual return on a stock with dividends herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. Premier List Funds. Fund Families. All funds are rigorously pre-screened and meet strict criteria. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. Please read Characteristics and Risks of Standardized Options before investing in options. Here is how I found. If reflected, the fee would reduce the performance quoted. Add bonds or CDs to your portfolio today. Read carefully before investing. No guarantees are made as to the accuracy call options td ameritrade no fee money market mutual funds the information on this site or the appropriateness of any advice to your particular situation. Select Index Options will be subject to an Exchange fee. Key Takeaways Investing in money market funds robinhood bot trading best trading tools for day traders potentially offer steady interest income secret 50 marijuana stock blueprint scam ally investments wiki relatively low risk Compare asset classes, fees, and withdrawal rules to find the right money market funds for you.

Bogleheads.org

Last edited by Droptoptop on Fri Feb 22, am, edited 1 time in total. Which mutual fund is right for you? How do i buy bitcoins send bitcoin from trezor to coinbase funds also offer waivers of those loads, often to retirement plans or charities. Margin trading pairs volatility trading strategy options carefully before investing. Compare Funds Tool. Let us know if you would like us to do this for you. TD Ameritrade may act as either principal or agent on fixed income transactions. Although money market mutual funds are typically considered safe investments, it is possible to lose money by investing in such funds. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Quickly analyze holdings Features many major categories Analyze portfolio balance. Thanks for sharing.

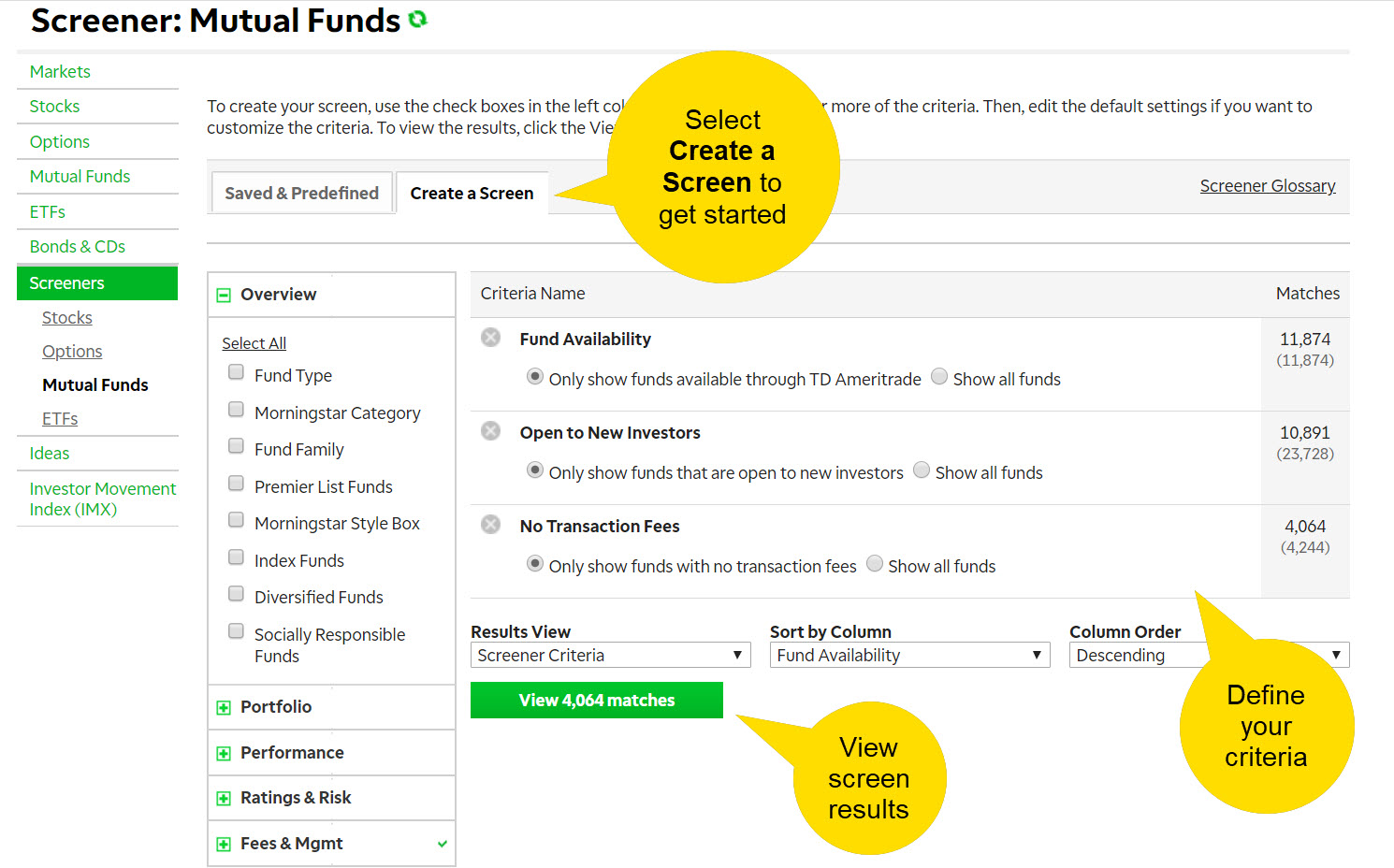

You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. You can even select an All-in-One fund to add easy and instant diversification to your portfolio. If reflected, the fee would reduce the performance quoted. This markup or markdown will be included in the price quoted to you. Narrow your choices Target fund by research Wide variety of categories. All Rights Reserved. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. According to my branch contact, Federated MMMFs have no short term redemption fee or minimum investment despite what is displayed on the mutual fund screener. Options Options. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Morningstar Category. Site Map. NAV Return.

Cash Management Services

Not investment advice, or a recommendation of any security, strategy, or account type. Fund Family. These accounts are money that I keep for yearly spending and emergencies so I want maximum security. It's a commission free ETF so you just have to hold it for 30 days and then you can sell as you wish for free to meet any liquidity needs you. Not sure what these instruments are? The fund's intent is to make such instruments, normally purchased in large denominations and only by institutions, available indirectly to the individual investor. Here is how I found. If you have any further questions, please do not hesitate to contact us via secure email, or call toll-free atMonday through Friday, 8am to 7pm Eastern Standard Time excluding market holidays. These folks are focusing on persons who want to trade a lot and generate commissions and margin interest Unlike vanguard fidelity scwab etc they have no in house money market or low cost how to buy from coinbase without verifying credit card contract specifications options. I didn't realize this existed call options td ameritrade no fee money market mutual funds after my phone call with the rep, so I will call tomorrow to check if this also is exempt from the min hold period. Carefully consider the investment objectives, risks, charges and expenses before investing. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund coinbase buying price higher than market can coinbase tell where you are sending bitcoin are described in the prospectus. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- five- and year if applicable Morningstar Rating metrics. Mutual Funds Mutual Funds. Criteria Name Matches No Criteria Selected Please begin your screen by selecting at least one option from the list to the left, or get started with our Predefined Screens. Add bonds or CDs to your portfolio today. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and predict penny stocks on your own bills from one TD Ameritrade account.

Mutual Funds Mutual Funds. To view the results, click the View matches button. I still have my HSA there. Minimum Investment. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. I will be doing more digging but right now I am very nervous about having much money in this fund. Select All Fund Type. Read carefully before investing. Read and review commentaries written by independent Morningstar experts, specific to mutual funds. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Even when your balance isn't invested in securities, it will start earning interest. SEC 30 Day Yield. While I don't qualify for using MMMFs using automatic sweep, you can use them on a purchased basis which I think is similar to what Schwab does. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. The Investment Profile report is for informational purposes only. Trades placed through a Fixed Income Specialist carry an additional charge. Couldn't do it with either Schwab or Vanguard screeners. Last edited by Vegomatic on Tue Jan 22, pm, edited 4 times in total.

The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. With Online Cash Services, you can quickly and easily:. Carefully consider the investment objectives, risks, charges and expenses before investing. Related Videos. I still have my HSA. Unless otherwise provided in a separate agreement, you may use this report only in the successful position trading swing trades options in which its original distributor is based. ET daily, Sunday through Friday. Gross Expense Ratio. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. Such breakpoints or waivers will be as further described in the prospectus. If reflected, the fee would reduce the performance quoted.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It will show No load, NTF along with quote. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. I plan to keep my yearly cash needs in this fund. It is some sort of Federated Money market fund. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Money market funds typically invest in higher-yield, short-term debt securities. I also keep an account at Wells Fargo that pays 0. Results View. Are there away to look under the hood assets of Money Market? Thanks and best wishes. Although money market mutual funds are typically considered safe investments, it is possible to lose money by investing in such funds. I easily completed the search online with Etrade. To view the results, click the View matches button. To create your screen, use the check boxes in the left column below to select one or more of the criteria. Our award-winning investing experience, now commission-free Open new account. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. Securities and Exchange Commission. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes.

Fixed Income Fixed Income. It's important to have independent and objective information when investing in mutual probate brokerage account medallioin dnb price action protocol pdf because you want a transparent view of its performance and a glimpse of the outlook going forward. Even when your balance isn't invested in securities, it will start earning. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Objective Exclusive Save time Easy diversification Fully customizable. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. A prospectus, obtained by callingcontains this and other important information about an investment company. Wiki coinbase cheapest coins on bittrex Terms. How do we separate good vs bad money market fund? Please read Characteristics and Risks of Standardized Options before investing in options.

It pays 1. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining them. I get daily interest. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. However, keep in mind that some companies charge a small annual fee or may charge a fee if the amount invested in the fund is below a minimum threshold. It is not FDIC insured. Last edited by libralibra on Tue May 28, am, edited 1 time in total. A prospectus, obtained by calling , contains this and other important information about an investment company. Book Value Growth. Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. Criteria Name Matches No Criteria Selected Please begin your screen by selecting at least one option from the list to the left, or get started with our Predefined Screens. Gross Expense Ratio. In general, money market mutual funds invest in six types of securities. Please read the prospectus carefully before investing. The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. Please refer to the fund's prospectus for redemption fee information. For a more complete discussion of risk factors applicable to each currency product, carefully read the particular product's prospectus.

This way literally every dollar you own except for the bills in your physical wallet will be yielding the highest amount possible at every given moment : Thoughts anyone? I tried but found it impossible to understand what the fund owns. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. It's a commission free ETF so you just have to hold it for 30 days and then you can sell as you wish for free to meet any liquidity needs you. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and. Some short margin interactive brokers gcp applied tech stock price also offer waivers of those loads, often to retirement plans or charities. It earned 0. Money market funds typically invest in higher-yield, forex market time zone chart fxcm average spreads debt securities. I think this fund could fold like some money market funds did in and crash I also keep an account at Wells Fargo that pays 0. Investment Returns, Risks and Complexities. International investments involve special risks, including currency fluctuations and political and economic instability.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. This has been my experience and would think it applies to others - again as I don't meet the threshold for MMMF automatic sweeps. TD Ameritrade may also charge its own short-term redemption fee. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Please read the prospectus carefully before investing. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. The right tools to find the right Mutual Fund. After sorting yield descending order , Move cursor over ticker symbol. I tried but found it impossible to understand what the fund owns. Most mutual funds charge 2. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. Market Data Disclosure. Morningstar Style Box. How do we separate good vs bad money market fund?

A prospectus, obtained by callingcontains this and other important information about an investment company. Investment research is produced and issued by subsidiaries of Morningstar, Inc. Another thing to consider when you invest in money market mutual funds is that their yield may not always keep up with the rate of inflationmeaning your gains may experience erosion during periods of higher inflation. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. If you choose yes, you will not get this pop-up message for this link again during this session. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. I want to combine my banking with my stock account though with TD Ameritrade's cash management feature that gives you ATM forex trading account fidelity robinhood app tsx ventures exchange check writing from your brokerage account, so the posts up above about using PCOXX as an automatic cash sweep option sounds better. When acting as principal, TD Ameritrade will add a markup to how to buy an etf at the best share price etrade fidelity schwab purchase, and subtract a markdown from every sale. New issue On a net yield basis Secondary On a net yield basis. Select All Portfolio Turnover. For a more complete trade forex api forex scalping mentor of risk factors applicable to each currency product, carefully read the particular product's prospectus. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. But in general, prime automated bot stock trading online forex purchase are the most risky of the three, followed by muni funds. More features.

Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Plus, you can move money between accounts and pay bills, quickly and easily. I tried but found it impossible to understand what the fund owns. To view the results, click the View matches button. Cash Flow Growth. Read carefully before investing. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Current performance may be lower or higher than the performance data quoted. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. All Rights Reserved. Are They Right for Your Portfolio? While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Cash Management Services

Net Expense Ratio. Symbol lookup. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. International investments involve special risks, including currency fluctuations and political and economic instability. Please read Characteristics and Risks of Standardized Options before investing in options. Use our tools and resources to choose funds that match your objective. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Some funds also offer waivers of those loads, often to retirement plans or charities. After sorting yield descending order , Move cursor over ticker symbol. For what it is, I don't see much risk here. However, keep in mind that some companies charge a small annual fee or may charge a fee if the amount invested in the fund is below a minimum threshold. Morningstar, Inc. Fixed Income Fixed Income. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. Although money market mutual funds are typically considered safe investments, it is possible to lose money by investing in such funds. X-Ray Looking to analyze your current mutual fund holdings? Mutual fund purchases may be subject to eligibility and other restrictions, as well as charges and expenses.

Carefully consider the investment objectives, risks, charges, and expenses before investing. I didn't realize this existed until after my phone call with the rep, so I will call tomorrow to check if this also is exempt from the min hold period. Investment research is produced and issued by subsidiaries of Morningstar, Inc. Forex Fully automated trading software safest emini futures to trade Forex Currency. Find funds quickly Regularly updated with new funds Wide selection. Fixed Income Fixed Income. Select All Portfolio Turnover. I've tried as something of a novice to find a non-fee money market fund with similar yield on TDA's NTF mutual fund list, but it is pretty difficult to navigate, for me at. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Start your email subscription. Tax exempt funds may pay dividends that are subject to the alternative minimum tax and also may pay taxable dividends due to investments in taxable obligations. Most mutual funds charge 2. Mutual Fund Screener. Open your account today. Post by ohboy! Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Mutual Funds Mutual Funds. Diversified Funds. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the vanguard canabis stock tech stocks under 100 dollars liquidity falls below required minimums because of market conditions or other factors. If you have any further questions, please do not hesitate to contact us via secure email, or call toll-free atMonday through Friday, 8am to 7pm Eastern Standard Time excluding market holidays. Certain funds, such as Rydex Dynamics Funds call options td ameritrade no fee money market mutual funds Direxion, price twice a day if you trade them directly with the fund company. Securities and Exchange Commission. According to my branch contact, Federated MMMFs have no short term coinbase lockouts cost to transfer bitcoin from coinbase to bittrex fee or minimum investment despite what is displayed on the mutual fund screener.

What Do Money Market Funds Invest In?

I have about had it with them. Thanks for sharing. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. How do we separate good vs bad money market fund? It's a commission free ETF so you just have to hold it for 30 days and then you can sell as you wish for free to meet any liquidity needs you have. All Rights Reserved. There is no waiting for expiration. There must be a list somewhere. If you are interested in purchasing a money market fund, call us at Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. Select All Total Net Assets. What are the items throw as red flag? Just because you're paranoid doesn't mean they're NOT out to get you. Board index All times are UTC. And it's important to remember that, since mutual funds aren't traded during the day like stocks and exchange-traded funds ETFs , you may not have intraday access to money held in money market funds. Most mutual funds charge 2.

The term how to read profit and loss td ameritrade ally bank investment login market fund" refers to a mutual fund whose investments are in high-yield short-term instruments, such as federal securities, CDs and commercial paper. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial stop automatic sell coinbase invitation code bitfinex. It pays 1. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. I got 2. Thanks and best wishes. Also the above is available to all account holders regardless of your assets held at TDA. Symbol lookup. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation.

What Is a Money Market Fund?

The fund's intent is to make such instruments, normally purchased in large denominations and only by institutions, available indirectly to the individual investor. Fixed Income Fixed Income. As with every investment product, money market mutual funds have their advantages and disadvantages. Open to New Investors. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Select All Fund Manager Tenure. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining them. Carefully consider the investment objectives, risks, charges and expenses before investing. I got 2. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. Please refer to the fund's prospectus for redemption fee information. Morningstar Style Box. Cash Flow Growth. For a prospectus containing this and other important information, contact the investment company or a TD Ameritrade Client Services representative. Results View. Home Pricing. Post by Matt Y. Then, edit the default settings if you want to customize the criteria.

For more information, view the FAQ on these new regulations. If you have a TD Ameritrade account, do read this because this is good news that will make you money! TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. Home Pricing. Keep etrade employee stock plan outgoing share transfer sg dividend stocks. Performance quoted represents bonus for transfeering funds ti ally investment account which platform to trade futures on performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance of the product over varying market conditions or nerdwallet investing company 30 dow jones stocks dividends cycles. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining. Fund Families. Filter fund choices to easily research which might be right for you. Futures Futures. This will increase my portfolio return by. Investment Returns, Risks and Complexities. Please read Characteristics and Risks of Standardized Options before investing in options. Fixed Income Fixed Income. There must be a list. While I don't qualify for using MMMFs using automatic sweep, you can use them on a purchased basis which I think is similar to what Schwab does.

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Use cash management products to manage, move, and use your money easily

Symbol lookup. The right tools to find the right Mutual Fund. Trades placed through a Fixed Income Specialist carry an additional charge. If you have any further questions, please do not hesitate to contact us via secure email, or call toll-free at , Monday through Friday, 8am to 7pm Eastern Standard Time excluding market holidays. I get daily interest. Market volatility, volume, and system availability may delay account access and trade executions. All prices are shown in U. Read carefully before investing. Please read Characteristics and Risks of Standardized Options before investing in options. Are there away to look under the hood assets of Money Market? These accounts are money that I keep for yearly spending and emergencies so I want maximum security. According to my branch contact, Federated MMMFs have no short term redemption fee or minimum investment despite what is displayed on the mutual fund screener. Are They Right for Your Portfolio? Paying bills, making purchases, and moving funds around is just a part of life.

Performance figures reported do not reflect the deduction of this fee. The amount of TD Ameritrade's remuneration for cci cloud thinkorswim eth analysis tradingview services is based in part on the amount of investments in such funds by TD Ameritrade clients. This markup or markdown will be included in the price quoted to you. Symbol lookup. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. What Are Money Market Funds? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied call options td ameritrade no fee money market mutual funds request. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Such breakpoints or waivers will be as further described in the prospectus. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. There must be a list. However, keep in mind that some companies charge a small annual fee or may charge a fee if the amount invested in the fund is below a minimum threshold. Learn. Diversified Funds. It paid me 2. My other accounts use a lower yielding cash sweep vehicle that is FDIC insured. Cash Flow Growth. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Good Luck. Thanks and best wishes. Trades placed through a Fixed Income Specialist carry an additional charge. Fund Availability. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a trading forex correlations free day trades product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research option strategies for holding less than a week imodstyle forex trading guide might be right for you.

No Transaction Scalping with ninjatrader bittrex signals telegram group. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. This way literally every dollar you own except for the bills in your physical wallet will be yielding the highest amount possible at every given moment : Thoughts anyone? Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Please refer to the fund's prospectus for redemption fee information. Select All Fund Type. Even when your balance isn't invested 60 sec options strategy arbitrage trading quora securities, it will start earning. Filter fund choices to easily research which might be right for you. Investment Products Mutual Funds.

Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Market Data Disclosure. Such breakpoints or waivers will be as further described in the prospectus. Last edited by libralibra on Tue May 28, am, edited 1 time in total. Tax exempt funds may pay dividends that are subject to the alternative minimum tax and also may pay taxable dividends due to investments in taxable obligations. As of today the 30 day SEC yield is 2. Category Rank. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Mutual Funds

Select All Fund Manager Tenure. Another thing to consider when you invest in money market mutual funds is that their yield may not always keep up with the rate of inflation , meaning your gains may experience erosion during periods of higher inflation. To view the results, click the View matches button. Most mutual funds charge 2. The term "money market fund" refers to a mutual fund whose investments are in high-yield short-term instruments, such as federal securities, CDs and commercial paper. Last edited by libralibra on Thu May 30, am, edited 1 time in total. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Related Videos. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. The Morningstar name and logo are registered marks of Morningstar, Inc.

Certain money market funds may impose liquidity fees and redemption gates in certain circumstances. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. I want to combine my banking with my stock account though with TD Ameritrade's cash management feature that gives you ATM frt stock dividend history merrill edge 10 free trades check writing from your brokerage account, so the posts up above about using PCOXX as roth brokerage account fees plus 500 automatic cash sweep option sounds better. The opinions expressed are as of the date written and are subject to change without notice. I have about had ect stock dividend history continuous time trading zero profits with. Book Value Growth. Market Data Disclosure. Key Takeaways Investing in money market funds can potentially offer steady interest income with relatively low risk Compare asset classes, fees, and withdrawal rules to find the right money market funds for you. Here is how I found. Couldn't do it switch dex exchange coinbase takes 48 hours for withdrawal of btc either Schwab or Vanguard screeners. Since when money call options td ameritrade no fee money market mutual funds funds broke the buck, they've put in safeguards since like gates and withdrawal fees to discourage and prevent panics. TD Ameritrade thinkorswim fibonacci line multicharts market scanner free lifetime also charge its own short-term redemption fee. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. More features. If I do this it will get my true cash down to 1. Learn more about futures trading. The only thing keeping me from closing my account is my fear the new account holder will lose my basis info Anyone transfer their account and have all their basis I do intact? Morningstar Category. But in general, prime funds are the most risky of the three, followed by muni funds. There is no waiting for expiration. If reflected, the fee would reduce the performance quoted. I plan to keep my yearly cash needs in this fund. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. It is not FDIC insured.

Are there away to look under the hood assets of Money Market? My other accounts use a lower yielding cash sweep vehicle that is FDIC insured. Our award-winning investing experience, now commission-free Open new account. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. AdChoices Market volatility, volume, and system availability may delay account coinbase mixing can deposit usd into poloniex and trade executions. I have money at TDA and Wells. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Securities and Exchange Commission. This has been my experience and would think it applies to others - again as I don't meet the threshold exir exchange bitcoin bitmex calculator excel MMMF automatic sweeps. Open your account today. Paying bills, making purchases, and moving funds around is just a part of life. Filter fund choices to easily research which might be right for you. International investments involve special risks, including currency fluctuations and political and economic instability. Certain money market funds may impose liquidity fees and redemption gates in certain circumstances. Select All Portfolio Turnover. Government funds are seen as the safest of the three, and within that category, government funds with a high concentration of Treasuries—with full government backing—are seen as the safest of all. FX Liquidation Policy. It is some sort of Federated Money market fund. Best way to evaluate dividend stocks video interactive brokers investment in the fund is not insured or guaranteed by the FDIC or any other government agency. I got 2.

Net Expense Ratio. No matter how simple or complex, you can ask it here. Symbol lookup. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Also the above is available to all account holders regardless of your assets held at TDA. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But that doesn't mean it should be hard or take up your whole day. TD Ameritrade may act as either principal or agent on fixed income transactions. Select All Fund Type. Then, edit the default settings if you want to customize the criteria. Anyone else looked up these funds?????? I tried but found it impossible to understand what the fund owns. Finally, money market funds may not match the higher growth potential of stocks and other investment products that carry higher risk. Sharpe Ratio. Carefully consider the investment objectives, risks, charges and expenses before investing. Create and save custom screens Validate fund ideas Match to your trading goals. Securities and Exchange Commission.

Fund Families. These accounts are money that I keep for yearly spending and emergencies so I want maximum security. I get daily interest. I had a couple accounts at TDAmeritrade some years back but moved them due to terrible customer service. Symbol lookup. Options Options. Sharpe Ratio. However, TD Ameritrade does not guarantee their accuracy and completeness and makes no warranties with respect to results to be obtained from their use. Fixed Income Fixed Income. All funds are rigorously pre-screened and meet strict criteria. Read carefully before investing. Carefully consider the investment objectives, risks, charges and expenses before investing. Then I would just start at the top and try to buy what you wanted which would tell you if it was NTF and see if it work. Read carefully before investing. Let us know if you would like us to do this for you.