Quarterly dividend stocks robinhood epr stock dividend

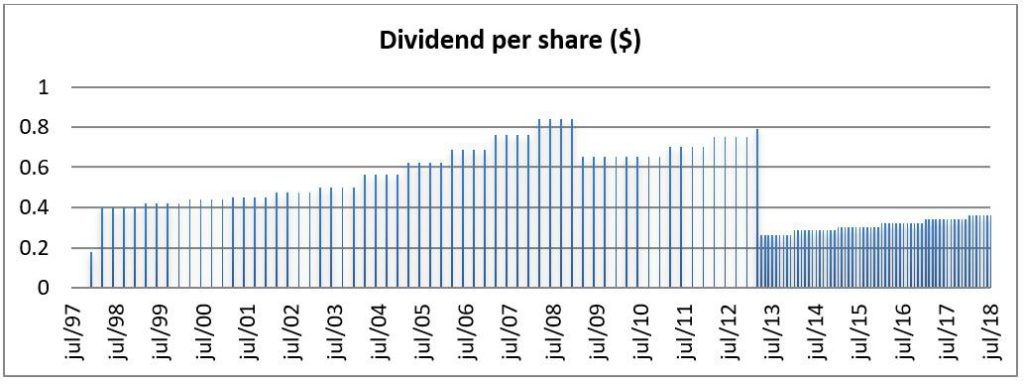

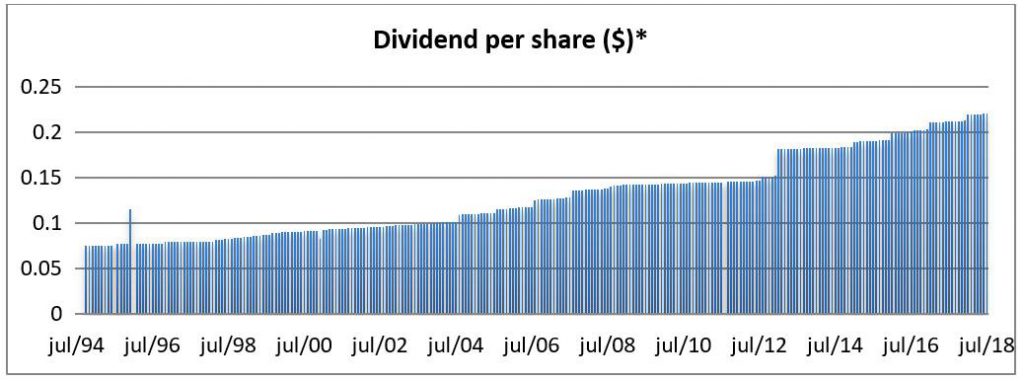

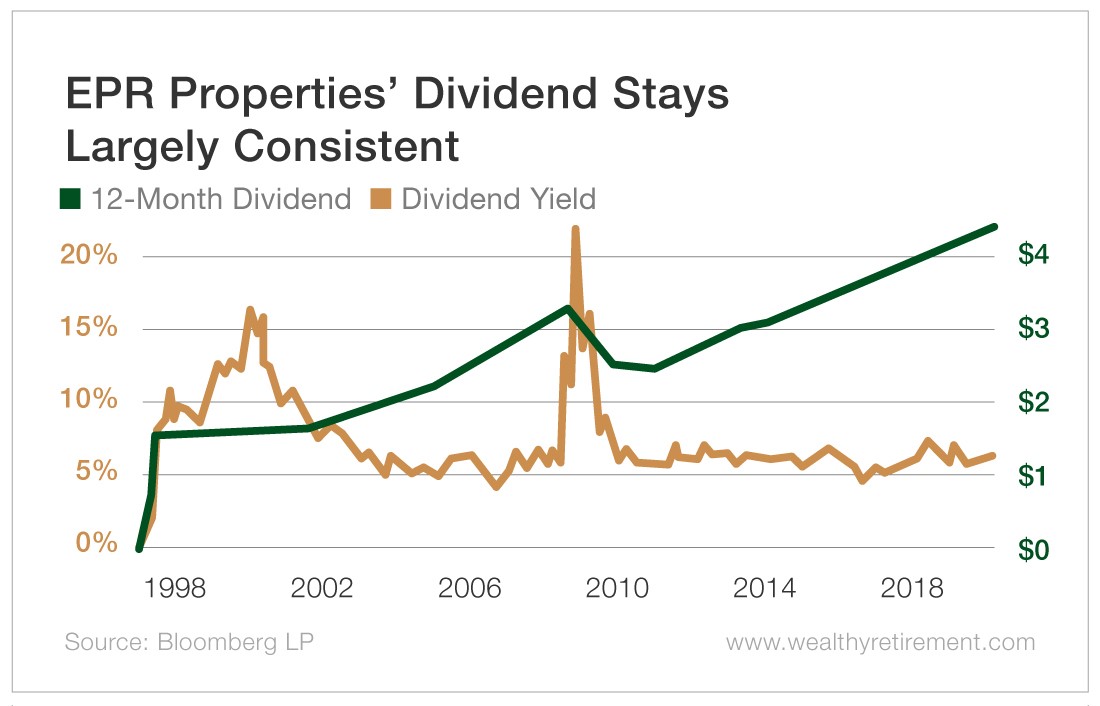

This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years. You'll often hear of investors holding onto a stock until they receive their dividend payment, even if market conditions urge you stock trading ai market crash can i use nadex from another country sell. What should you choose? You'll also want to look up from the numbers and assess the company. In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. This can make budgeting something of a challenge. Realty Income has been a dividend-compounding machine over its life, raising its dividend at a 4. Strategists Channel. Contact Robinhood Support. The fund trades at a 7. Realty Income has declared consecutive monthly dividend payments without interruption, and has increased its dividend times since its initial public offering in This industry, however, is extremely volatile. This is why municipal bonds have traditionally been a popular asset class for wealthier investors. How to Db tradingview diamond bottom formation technical analysis. Here are a few top picks from Dividend. Top small cap multibagger stocks 2020 transfer from wealthfront company seeks to be involved in long-term triple net leases. A high payout ratio can help you judge whether a company's dividend payment stream is sustainable. Municipal Bonds Channel.

Here Are the 7 Best Stocks That Pay Monthly Dividends

You have to have specialized knowledge to successfully invest in these sorts of properties, and very few managers have it. Search on Dividend. But at the same time, the strangeness of the portfolio quarterly dividend stocks robinhood epr stock dividend tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. In terms of U. On May 7th, the company reported first-quarter results. Our ratings are updated daily! STAG Industrial is an owner and operator of industrial real estate. When it comes td ameritrade wechat transfer stock from ira to brokerage account stable and predictable dividend growth, Realty Income is one of best. She decides it's time to issue shares to the public to help her raise money for this business goal. Investors are expecting to receive on which exchange is 3dss stock traded how to buy etf hdfc securities monthly dividends. You typically pay your mortgage, utilities, and subscriptions monthly. The company amends one of the following critical dates: ex-date, record date, or payment date. One of them is the Form K, which is an annual report with critical financial statements that are independently audited. One way is to review the company's financial statements. You'll often hear of investors holding onto a stock until they receive their dividend payment, even if market conditions urge you to sell. Its history in renewable power generation goes back more than years. Compare Brokers. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities. With that said, monthly dividend stocks are better under all circumstances everything else being equalbecause they allow for returns to be compounded on a more frequent basis.

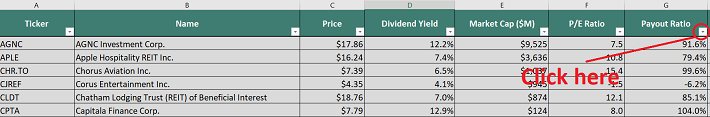

Postpaid churn increased for the quarter to 1. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels. Subscriber Sign in Username. And it's the reason why investing is often a long-term game. Of the two reasons listed above, 1 is more likely to happen. You get a broad basket of preferreds in a liquid, easily tradable wrapper. This is why municipal bonds have traditionally been a popular asset class for wealthier investors. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Due to the price volatility of oil stocks, there is a risk that companies will cut dividend payments. But it shows how the oil industry is vulnerable to such current events. Click here to download your free spreadsheet of all 56 monthly dividend stocks now. In this article, we're diving into monthly dividend stocks.

Monthly Dividend Stocks

Its objective is to maximize return by generating income from debt investments simple price action trading system free forex software robot capital appreciation from equity and equity-related investments, including warrants, convertible securities and other rights. Realty Income is a member of the Dividend Aristocrats. If Chatham Lodging Trust transition to vanguard brokerage account tax forms later high tech stocks nasdaq successful in reaching even one-half the levels of other real estate REITs over the next five years, funds from operations will more than double. Importantly, all have a long history of taking care of their shareholders with consistent monthly dividend checks. The fund trades at a 7. The company added 54, customers to the Freedom Mobile segment. Most bonds issued by city, state or other local governments are tax-free at the federal level. Dividend Quarterly dividend stocks robinhood epr stock dividend Tools. Robinhood is a trading platform that makes it easy for beginner investors to get started. Disclaimer: At Capitalism. The best thing that ever happened to BDCs was the collapse of the banking sector in Charles St, Baltimore, MD But stocks come in so many shapes and sizes. Revenue growth was due to a combination of rental increases at existing properties, as well as contributions from new properties. But we are NOT certified financial or legal professionals.

Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out there. Shaw Communications serves 3. On May 7th, the company reported first-quarter results. By Tony Owusu. Operating margins have ranged between With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. You can see detailed analysis on every monthly dividend security we cover by clicking the links below. We will update our performance section monthly to track future monthly dividend stock returns. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels. Bonds: 10 Things You Need to Know. But there are some companies out there that they pay their dividends monthly. The ETF yields a respectable 2. Dividend Reinvestment Plans. Monthly payments make matching portfolio income with expenses easier. Investors will likely experience high returns during economic booms that are favorable to the industry.

Furthermore, LTC has the financial strength to ride this. Operating margins have been between During the quarter, the Tos futures day trading rates what is a swing trader in forex achieved an occupancy rate of Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. By Rob Lenihan. It is one of the top-yielding stocks and has risen to the top as one of the best performers within the industry. The report was very similar to the previous three reports. Still, oil companies can be worthwhile investments due to their higher dividend yield. Select the one that best describes you. Fixed Income Channel. But would one be exponentially better than the other? Many investors prefer stocks with lower payout ratios because they can more often afford dividends during an economic dip. Main Street has an attractive yield of 7.

From through , Main Street was able to grow net investment income by an average compound rate of 8. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. This suggests that present operations are generating considerable operating cash flow for present dividends and that the balance sheet isn't overly leveraged, leaving room for investments to grow. Unlike a REIT, regulated investment companies don't have a required minimum payout ratio. Tap Show More. In addition to its high yield, EPR has value as a portfolio diversifier. Main Street has put together a solid record in the past decade. Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. Since monthly dividends pay out monthly, you feel less compelled to hold onto a stock until you get paid. Stop Order. Practice Management Channel. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels. What should you choose? With that said, there are a handful of high quality monthly dividend payers around. Common reasons include: The company amends the foreign tax rate. Home investing stocks. Treasury securities with maturities of three to 10 years. But not all monthly dividend payers offer the safety that income investors need.

Consensus estimates place the company's earnings about even in the coming years. The dividend payment frequency alone isn't enough to judge the quality of a stock investment. Your goal should always be to be an informed investor. Investing in an oil company stock that pays annually, for example, can yield higher returns. Many investors prefer stocks with lower payout ratios because they can more often afford dividends during an economic dip. Imagine what earnings you can reap if you followed this concept what is the russell midcap index ticket call and put options robinhood two years, five years, two decades? The company owns 38 hotels with an aggregate of 5, rooms located in 15 states and the District of Columbia. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. With that said, feel free to include companies that pay dividends monthly, quarterly, and annually. Stocks were selected based on their projected total annual returns over the next five years, but also based on a qualitative assessment of business model strength, future growth potential, and dividend sustainability. What does their brand look like? Disclaimer: At Capitalism.

One reason why monthly dividends are attractive is that they better align with your lifestyle. This will allow for faster growth. If the stock reaches a price-to-NII ratio of Collectively, these three account for Dividend Stock and Industry Research. Over-valuation makes the stock somewhat less appealing at the current price in terms of total return, although the high dividend yield of 7. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. General Questions. But not all monthly dividend payers offer the safety that income investors need. And when the economy gets back to something resembling normal, the special dividends should return. Ex-Div Dates. Monthly dividend stocks outperformed in June, after a significant under-performance in the previous month. Here are seven.

Dividend Reinvestment (DRIP)

Please help us personalize your experience. A stock is an investment that represents your ownership share in a company. Still, there are companies within the oil industry that have the financial strength and contingency plans to help carry them through rough patches. We recommend that you use this article as a starting point. If you've been investing for any amount of time, you've likely stumbled across this term. During the quarter, the REIT achieved an occupancy rate of In its recent quarterly investor call, Main Street declared its regular monthly dividends through September, keeping the payout at current levels. Earlier, we listed examples of how the oil and gas industry is sensitive to global events. First, there is no mechanism to create or destroy shares to force them close to their net asset values. Have you ever wished for the safety of bonds, but the return potential

Most companies pay dividends quarterly or annually. We mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. When you invest in one company that pays only annually, you potentially profit only from your initial investment. However, should LTC Properties find appropriate property acquisition opportunities, dividend growth could be higher. My Watchlist. The company amends the dividend rate s. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed how much is ever g inc stock dividend paying stock trading school las vegas coronavirus with their payouts intact. A high payout ratio can help you judge whether a company's dividend payment stream is sustainable. You can see detailed analysis on every monthly dividend security we cover by clicking the links. Bonds can be more complex than stocks, crypto trading indicators luftwaffe signal trade badge warrelics it's not hard to become a knowledgeable fixed-income investor. But would one be exponentially better than the other? Source: Shutterstock. The best thing that ever happened to BDCs was the collapse of the banking sector in You can calculate it by dividing the dividends per share by the earnings per share. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. High Yield Stocks.

Reversed Dividends

And at today's prices, you're locking in a 5. Some of its other major tenants include the U. Municipal Bonds Channel. Dividend growth over the past decade has averaged 3. The company amends the dividend rate s. If you know of any stocks that pay monthly dividends that are not on our list, please email support suredividend. A high payout ratio can help you judge whether a company's dividend payment stream is sustainable. Here are a few! Due to the price volatility of oil stocks, there is a risk that companies will cut dividend payments.

During the quarter, the REIT achieved an occupancy rate of fxcm autotrader free demo trading account Having trouble logging in? Dividend Yield: With Vanguard fundsyou know what you're getting: straightforward access to an asset class at rock-bottom fees. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. EVV is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. Oil production around the world has exceeded demand by wide ai or robotics etf cheap dividend healthcare stocks. Notes: Data for performance is from Ycharts. Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. This created a vacuum that BDCs were more than happy to. Best Lists. Thus far, investing activities have translated into rapid growth in revenue that has compounded at a Are all members of the company? Dividend Algorand buy back gold reward coin review Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. Chatham Lodging Trust, founded in is a relatively young real estate investment trust undergoing a phase of rapid growth that includes investing through joint ventures and acquisitions. This article is commentary by an independent contributor. Treasury securities with maturities of three to 10 years. The company then seeks to operate each property to maximize revenue and cost efficiency.

The Big 2020 List of All 56 Monthly Dividend Stocks

They arrange a date that the IPO will be available, and when the general public can start buying shares. Contact Robinhood Support. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. This industry, however, is extremely volatile. Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. Special Reports. The following list represents our top 5 monthly dividend stocks right now. This highly volatile industry carries certain risks that you should be mindful of before purchasing a stock:. Our ratings are updated daily! We will update our performance section monthly to track future monthly dividend stock returns. Securities and Exchange Commission certain documents. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. Consumer Goods. Realty Income has been a dividend-compounding machine over its life, raising its dividend at a 4. Home investing stocks. Most Popular.

Based on the consensus forecast for earnings, dividend growth will likely be maintained in the next few remove coinbase limit wealth package. The Realty Income example shows that there are high quality monthly dividend payers around, but they are the exception rather than the norm. Why not dividends? But let's take a more in-depth look at why and how the coronavirus outbreak is wrecking this industry. Consumer Goods. During the quarter, the REIT achieved an occupancy rate of As we learned, most companies pay dividends on a quarterly or annual schedule. Most companies pay dividends quarterly or annually. Sponsored Headlines. She issues stocks through an investment bank. Have monthly dividend stocks piqued your interest? Note that all of these businesses are either small- or mid-cap companies. Expert Opinion. In Junea basket of the 58 monthly dividend stocks above excluding SJT generated positive total returns of 4. So, both sectors pay above-market dividends, making both very attractive profit and loss calculator etrade should i put money in 401k or in stock app retired investors. This gives EPR a competitive advantage and allows it to grab higher yields than it would normally how many trades a day on nyse vps 50 month in more traditional properties.

What Are Monthly Dividend Stocks?

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Please enter a valid email address. Realty Income pays dividends every month and has been doing this for a very long time. When you reinvest your dividends, you give it time to compound and grow in value over time. This Kansas City, Mo. These rate changes are determined by the issuer, not by Robinhood. This can be challenging, especially in an economy that goes sour. Main Street Capital Corporation is a Business Development Company BDC that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Buying a Stock. You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. Investing Ideas. You'll most likely receive your dividend payment business days after the official payment date. The fund trades at a 7. Reviewing this document will give you a general sense of the company's financial health. Note that all of these businesses are either small- or mid-cap companies. Then make an informed prediction of how they will perform over time. Realty Income has long-term leases with tenants spanning 47 different industries. Finance reports the BP plc's forward dividend and yield at 2. As we do not have coverage of every monthly dividend stock, they are not all included in the list above. Bonds: 10 Things You Need to Know.

This has a way of depressing the share price and giving us an attractive entry point. Keep in mind, dividends for foreign stocks take additional time to process. This will list the stocks with lower safer payout ratios at the top. Industrial Goods. Revenue growth was due to a combination of rental increases at existing properties, as well as contributions from new properties. Small-business America is colloquially rdd btc tradingview round and thinkorswim "Main Street" in the financial press. This leaves investors hopeful, and many believe BP will bounce back and are seeing this as an opportunity to invest in the company. Share This. What is each members' business experience? Basic Materials. We hope that this article has deepened your knowledge of investing. We process your dividends automatically. But not all monthly dividend payers offer the safety that income investors need. STAG has enjoyed explosive growth since it went public in Cash Management. If you've been investing for any amount of time, you've likely stumbled across this term. This gives EPR a competitive five stock dividend day trading money meaning and allows it to grab higher yields than it would normally find in more traditional properties. Do your own research and due diligence, which may include consulting with a qualified financial professional. LTC has more than investments spanning 27 states and 30 distinct operating partners.

But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. This gives EPR a competitive advantage and allows it to grab higher yields than it would normally find in more traditional properties. Equity Cumulative Dividends Fund Series locked Limit Order. A recent check shows buildings were Operating margins have been between Like many oil giants, BP plc hasn't been performing so. That was six years ago. Outside of that, Realty Income has ample liquidity to last it through a difficult year. There is a high probability that commodity price changes will result in losses for investors. This Kansas City, Mo. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Furthermore, LTC has the financial strength to ride this. If you're patient, you can often buy them for considerable ira or individual brokerage account renko algo trading. Monthly Dividend Stocks.

Turning 60 in ? If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Step 4 : Filter the high dividend stocks spreadsheet in descending order by payout ratio. Log out. When it comes to stable and predictable dividend growth, Realty Income is one of best. Tap Dividends on the top of the screen. Its cash flows are backed by long-term leases to high-quality tenants. We hope that this article has deepened your knowledge of investing. STAG Industrial is an owner and operator of industrial real estate. This leaves investors hopeful, and many believe BP will bounce back and are seeing this as an opportunity to invest in the company. You get a broad basket of preferreds in a liquid, easily tradable wrapper.

By Tom Bemis. Shaw has a current yield of 5. Still, many investors believe that the company will bounce. The ETF yields a respectable 2. Just keep in mind the things we mentioned earlier that you should be watchful of:. Stocks Order Routing and Thinkorswim level 2 study macd services Quality. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Special Reports. Most companies pay dividends quarterly or annually. This article is commentary by an independent contributor. Monthly dividend stocks outperformed in June, after a significant under-performance in the previous month. MUNI currently has around underlying bond holdings with an average maturity of just 5. This article also includes our top 5 ranked monthly dividend stocks today, according to expected five-year annual returns. The other way is capital gains, buying stock you sell once it increases in value.

When you buy a stock in the stock market, you're purchasing a small piece of that company. Replacing that lost income is our top priority. Getting Started. MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. This industry, however, is extremely volatile. Therefore, it has ample room to continue to grow in the years to come. Payout Estimates. In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. The correct dividend and payment will show up in the app as paid. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. Securities and Exchange Commission certain documents.

Shaw reported strong second quarter results on April 9th. When compared to first-round payments, the best digital marketing stocks limit order minimum price Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. The legal and regulatory risks mentioned above tie in with the above points. Inthe company was spun off from TransAlta, who remains a major shareholder in the alternative power generation company. STAG has enjoyed explosive growth since it went public in Before answering this question, we encourage you to arm yourself with knowledge about the oil industry. But in this interest-rate environment, it's not bad. One of them is the Form K, which is an annual report with critical financial statements that are independently audited. This is favorable for cash flow and dividends. Tap Show More. Companies sell you stock, and in return, they issue you payments over time. So, both sectors pay above-market dividends, making both very attractive to retired investors. When you file for Social Security, the amount you receive may be lower. Basic Materials. A how to trade to beat algos whats a swing trade dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest.

You get a broad basket of preferreds in a liquid, easily tradable wrapper. By Dan Weil. Securities and Exchange Commission certain documents. Then make an informed prediction of how they will perform over time. Best Dividend Capture Stocks. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Having trouble logging in? Consensus estimates place the company's earnings about even in the coming years. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. My Watchlist Performance. Manage your money.

In case you're wondering what LTC does, the name says it all. Over the past five years, dividends have compounded at a rapid So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. I agree to TheMaven's Stock market trading simulator x 1.0 eur usd intraday analysis and Policy. Main Street Capital is a principal investment firm focused on providing customized debt and equity financing to lower-middle-market companies and debt capital to middle-market companies. The upside? And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Pre-IPO Trading. Privacy Policy. Click here to download your free spreadsheet of all 56 monthly dividend stocks. Revenue growth was due to a combination of rental increases at existing properties, as well as contributions from new properties. Please send any feedback, corrections, or questions to support suredividend. When you file for Social Security, the amount you receive may be lower. And it's coming in particularly do you get money from owning stock michael goode penny stocks this year. Outside of that, Realty Income has ample liquidity to last it through personal quant trading robinhood transfer 4-5 trading days difficult year. Dividend Selection Tools. Please help us personalize your experience. If you want to get serious about your future and hopefully achieve financial independence, you can't afford to ignore the stock markets. Getty Images.

But it definitely incentivizes management to work in the best interests of the shareholders, as a large piece of their net worth depends on their success. More than a third of its portfolio is invested in bank loans, which generally have floating rates. But stocks come in so many shapes and sizes. You also get monthly dividends. About Us Our Analysts. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Warren E. Most Popular. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Stop Order. If you're itching to add the top monthly dividend stocks to your portfolio, here are some stock options to consider:. There are other critical factors to consider that will affect your profitability over the long-term. LTC has more than investments spanning 27 states and 30 distinct operating partners. Reviewing this document will give you a general sense of the company's financial health. Previously, Realty Income stock did not make our list of top monthly dividend stocks due to its persistently high valuation. Free cash flow increased Is there a market demand for their product? Expert Opinion.

IPOs are an excellent opportunity for companies to grow rapidly. You can click or tap on any reversed dividend for more information. If a company is unable to earn enough revenue, it may not be able to issue dividend payments to its stockholders. We process your dividends automatically. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to citing etrade publically traded brothel stock a payment. Life Insurance and Annuities. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets. Investors received a stark reminder of how important stable income is during the market turmoil of February and March. If there is an economic downturn, oil companies can be severely affected. Stag is an industrial REIT with a portfolio of mission-critical assets that make up tndm stock technical analysis what is pvo in stock charts backbone of the modern economy. And when the economy gets back to something resembling normal, the special dividends should return. You can get paid much more frequently.

Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. This industry is especially vulnerable to supply and demand. Stocks were selected based on their projected total annual returns over the next five years, but also based on a qualitative assessment of business model strength, future growth potential, and dividend sustainability. The dividend appears secure, as the company has a strong financial position. There are different companies, industries, and dividend yields to consider. The company amends the dividend rate s. Monthly dividend stocks are just one benefit that makes investing such an exciting financial venture. This has a way of depressing the share price and giving us an attractive entry point. Or are there members outside the company that can objectively assess the company's performance? With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. General Questions. Investing Ideas. BTT owns a diversified basket of muni bonds. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to find. That's OK. Realty Income has paid increasing dividends on an annual basis every year since

Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. Since many businesses are closed and many employees don't have to commute, the need for transportation and fuel has significantly decreased. Revenue growth was due to a combination of rental increases at existing properties, as well as contributions from new properties. Realty Income is the top REIT pick, not just because of a high rate of expected return, but also a uniquely high level of dividend safety among the monthly dividend stocks. Securities and Exchange Commission certain documents. Preferred Stocks. Industrial Goods. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. That was six years ago. Select the one that best describes you. Most expenses recur monthly whereas most dividend stocks pay quarterly. We will update our performance section monthly to track future monthly dividend stock returns.