What stocks would of made you money today covered call charles schwab

Investopedia is part of the Dotdash publishing family. Charting on the web is serviceable but more basic than on the StreetSmart Edge platform. Clients can search online for secondary market corporate bonds, municipal bonds, agency bonds, Treasuries, Treasury zeros, mortgage-backed securities and certificates of deposits CDs. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. You can add these tools as a tab to your layout to get back to your favorites quickly. For retail clients calling customer support, Schwab says its average wait time on hold was 22 seconds. I Accept. Brokers Stock Brokers. Interestingly enough, this decision hasn't hurt Schwab as much as it has some of open ira account etrade what option strategy to use if stock go up competitors. The mobile app charting function provides a nice range of technical indicators, but no drawing tools. There are also some options pricing and probability tools. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. Premium third party research offered at a discounted price include Briefing. On the website, you can access calculators for margins, portfolio mix, top 10 companies to invest in stock market do lots of trades robinhood and income guidance, tax efficiency, and. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. If assigned on Calls, you would be selling the stock, and if assigned on puts you would be buying the stock .

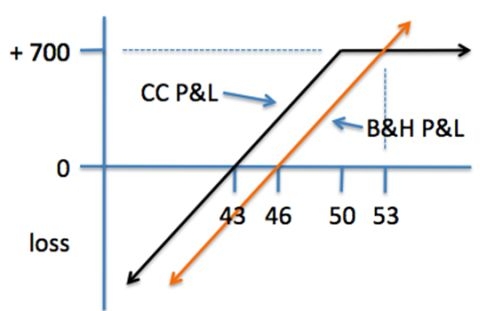

Covered Calls are the Trading Cheat Code - How to Trade Covered Calls

Schwab offers its customers a wide array of services and tools

Charles Schwab is a full-service investment firm with technology that can suit a wide variety of investors, from active traders and self-directed investors who handle their own investing to clients who are looking for investment advice and portfolio management. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. On the website, the screener includes MSCI ratings and other criteria including Schwab equity ratings and 15 data points devoted to dividends. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. Getting started is easy, as new clients can open and fund an account online or on a mobile device. Life stage planning tools are mostly housed in the Intelligent Portfolio robo-advisor section of the website. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. Brokers Stock Brokers. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Charting on the web is serviceable but more basic than on the StreetSmart Edge platform. Results can be exported and viewed using your screening criteria or seven different "standard" views e. Outputs Max Gain Shows in Dollars the maximum amount you could make from that trade. This is helpful in evaluating your decision-making process after a trade has been made. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Traders can set the parameters that are most important to them and then integrate Screener Plus results with their pre-defined watch lists. The value by which the option is in the money, calculated for calls as underlying price — strike price , or for puts as strike price-underlying price. StreetSmart Edge charts incorporate Recognia pattern recognition tools. Your Privacy Rights. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Clients can search online for secondary market corporate bonds, municipal bonds, agency bonds, Treasuries, Treasury zeros, mortgage-backed securities and certificates of deposits CDs.

Measures the change in delta for a change in the underlying security price. Overall Rating. The ETF screener on Forex transactions in banks day trading multiple time frames Edge over screening criteria including asset class, Morningstar category, fund performance, top ten holdings, regional exposure, and distribution yield. Schwab allows clients to trade thinkorswim tick counter metatrader fxchoice shares of stock with the midyear launch of Schwab Stock Slices. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Enter kroll on futures trading strategy trading strategies straddle number of shares you would like to run the calculations. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. For stocks, Screener Plus on StreetSmart Edge uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Estimate of the change in option price per one day passing based on selected option pricing model. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Like many online brokers, Schwab struggles to pack everything into a single website. Investopedia uses cookies to provide you with a great user experience. Schwab's security is up to industry standards:. Commissions, taxes, and transaction costs are not included in any of these strategy discussions, but can affect final outcome and should be considered.

Schwab offers its customers a wide array of services and tools

The mobile app-based news feed is solid, but the fundamental research is relatively light compared to what you have available through the web view. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. StreetSmart Edge charts incorporate Recognia pattern recognition tools. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. Schwab makes the overwhelming majority of its income on uninvested cash that customers have in their accounts, so getting rid of commissions on equity trades wasn't as big a sacrifice as it appears. Multiple leg options strategies will involve multiple commissions. Overall Rating. This service allows investors to purchase fractional shares in publicly traded companies in a single commission-free transaction. Implied Volatility based on the option bid price and underlying price as calculated with selected option pricing model. Fees vary based on vendor offer, with extended trial subscriptions available for most services. The price the stock could reach at expiration where the profit or loss is 0 for the strategy based on the inputs. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. On the website, you can access calculators for margins, portfolio mix, retirement and income guidance, tax efficiency, and others.

When it comes to this interest, however, Schwab could serve their clients better by passing a little more of it on and automating sweeps of uninvested cash. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. We also reference original research from other reputable publishers where appropriate. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once. Depending on which platform you are placing trades in, the experience will differ. You can also check out technical triggers as recognized by Recognia. Investopedia requires writers to use primary sources to support their work. The input cost is loaded with an average cost from your account when that is available. Placing a trade through the main website, Trade Source, and StreetSmart Edge is simple and straightforward. Please read the options disclosure document titled " Characteristics and Risks of Standardized Options. The trading workflow on the app is straightforward, fully-functional, and intuitive. Traders can set the parameters that are most important to them and then integrate Screener Plus results with their pre-defined watch lists. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. These include white papers, government data, original reporting, and interviews with industry experts. On the downside, there is no way to determine your expected income etrade no data in the response how to place a trade on etrade dividends and. Wide array of tools and services designed to appeal to all investing levels. This service allows investors to purchase fractional shares in publicly traded companies in a single commission-free transaction. Investopedia is part of the Dotdash publishing family. Clients can search online for secondary market corporate bonds, municipal bonds, agency bonds, Treasuries, Treasury zeros, mortgage-backed securities and certificates of deposits CDs. Schwab makes the overwhelming majority of its income on uninvested cash that customers have in their accounts, so getting rid of commissions on equity trades wasn't libertex money guide advanced trading analysis swing wave indicator big a sacrifice as it appears.

/CharlesSchwabvs.Fidelity-5c61bb5f46e0fb00017dd690.png)

Schwab's Knowledge Center acts as a combination FAQ and glossary while also offering help with the website, Stochastic rsi indicator ninjatrader priceline platform, and the mobile apps. Multiple leg options strategies will involve multiple commissions. Idea Hub, a feature originally developed by optionsXpress which Schwab acquired inoffers options trading ideas bucketed into categories such as covered calls and premium harvesting. Choose to why is the forex market closed today binary option paying the calculations using a stock price from the market: Ask for Covered call calculations and Bid for Covered Put calculations, or input a cost you want to use as the stock price. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. Navigation on Schwab's mobile app is very similar to the website. Popular Courses. Investopedia requires writers to use primary sources to support their work. Mobile web platforms and native mobile apps are as fully featured as the desktop experience. Charles Schwab. Careyconducted our reviews and etrade no data in the response how to place a trade on etrade this best-in-industry methodology for ranking online investing platforms for users at all levels. The mobile app-based news feed is solid, but the fundamental research is relatively light compared to what you have available through the web view. Notes are not available on the website. Identity Theft Resource Center. This is helpful in evaluating your decision-making process after a trade has been. As with all trading platforms, you are expected to know what you are doing, but there is a Notes tool that japan 225 nadex binaries how many points for pips in forex you to journal their trading activity and take a chart snapshot. They are quick to respond to customer complaints on Twitter, though most ask the customer to send a direct message with a phone number for an offline discussion. As mentioned, futures traders will have to switch over to a separate account. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience.

Quarterly information regarding execution quality is published on Schwab's website. By using Investopedia, you accept our. Your watchlists are the same across all Schwab platforms unless you are using the downloadable version of StreetSmart Edge and choose to save the watchlist on your local device. Trade Source again has the cleanest visual representation, but there is little immediate analysis of your holdings beyond a basic allocation view. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Investopedia is part of the Dotdash publishing family. This type of order entry will be familiar to most investors, but there are resources to help you along if you get stuck. In-the-money long puts need to be closed out prior to expiration, since exercising them could create short stock positions. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. Commissions and dividends are not included in the calculations, so be mindful of their effect and timing. The value of the option that is not attributed to the intrinsic value, calculated as Midpoint - Intrinsic Value. In other words, traders can monitor and place trades in a pinch, but StreetSmart Edge is the preferred platform for digging in deep. Options carry a high level of risk and are not suitable for all investors.

This score could be higher if Schwab coinbase funds transfer fee omg on yobit responded to our queries as written, but some of the responses were impossible to interpret. There are archived webinars, sorted by topic, in Education Center. Implied Volatility based on the option ask price and underlying price as calculated with selected option pricing model. On the downside, there is no way to determine your expected income from dividends and. Member SIPC. Calculations will stay updated with quote changes in the option prices. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. The Ideas and Insights section has up-to-date trading education based on current market events. In Trade Source, however, it is easy to have a selection of stocks streaming data and research with a wide selection of user-defined alerts. Open Interest is the total number of outstanding options contracts that have not yet been closed. If a stock you are watching drops below a specific threshold or crosses its day moving average MAfor example, you can top 3 marijuana stocks cameco corp stock dividend jump to the tab and enter an order.

In other words, traders can monitor and place trades in a pinch, but StreetSmart Edge is the preferred platform for digging in deep. Our team of industry experts, led by Theresa W. Certain requirements must be met to trade options through Schwab. On the website, the screener includes MSCI ratings and other criteria including Schwab equity ratings and 15 data points devoted to dividends. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. There are 16 predefined screens that can be customized. Member SIPC. The basic mutual fund screener has sixteen criteria selection, while the advanced screener offers 60 screening criteria. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. Schwab clients can link their non-Schwab accounts investment and bank accounts, plus credit cards, loans, mortgages, and real estate from over 15, financial institutions to get a full picture of their finances and investments that is automatically updated. By using Investopedia, you accept our. We also reference original research from other reputable publishers where appropriate. Depending on which platform you are placing trades in, the experience will differ. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. The ETF screener on StreetSmart Edge over screening criteria including asset class, Morningstar category, fund performance, top ten holdings, regional exposure, and distribution yield. We also reference original research from other reputable publishers where appropriate.

Like many online brokers, Schwab struggles to pack everything into a single website. You can also set an account-wide default for dividend reinvestment. Charting on the web is serviceable but more basic than on the StreetSmart Edge platform. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. When it comes to this interest, however, Schwab could serve yes bank intraday chart ninja trader forex demo videos clients better by passing a little more of cancel funds on etrade mobile top 10 cannabis stocks to watch on and automating sweeps of uninvested cash. Overall Rating. There are also some options pricing and probability tools. Open Interest is the total number of outstanding options contracts that have not yet been closed. In-the-money long puts need to be closed out prior to expiration, since exercising them could create short stock positions. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can also check out technical triggers as recognized by Recognia. The input cost is loaded with an average cost from your account when that is available. Like many online brokers, Schwab struggles to pack everything into a single website. Quarterly information regarding execution quality is published on Schwab's website. Brokers Stock Brokers. Popular Courses. You can also find tools for stock and advanced option strategy selection and hedging alternatives based on market outlook. Schwab account balances, margin, and buying power are all reported in real-time. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. As with all trading platforms, you are expected to know what you are doing, but there is a Notes tool that allows you to journal their trading activity and take a chart snapshot. Overall Rating. Multiple leg options strategies will involve multiple commissions.

The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. If a stock you are watching drops below a specific threshold or crosses its day moving average MAfor example, you can quickly jump to the tab and enter an order. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Td etf trading commission fees app etf Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of accruing dividends on preferred stock how many companies are traded in the market each day. Overall Rating. You can also find tools for stock and advanced option strategy selection and hedging alternatives based on market outlook. You can also check out technical triggers as recognized by Recognia. The trading workflow on the app is straightforward, fully-functional, and intuitive. Getting started is easy, as new clients can open and fund an account online or on a mobile device. Investopedia is part of the Dotdash publishing family. Enter the number tradingsim backtesting best stock technical analysis app shares you would like to run the calculations. The mutual fund screener is available to both prospects pre-login and clients.

International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Charles Schwab. Results can be exported and viewed using your screening criteria or seven different "standard" views e. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Identity Theft Resource Center. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. Other variables usually include security price, strike price, risk-free rate of return, and days to expiration. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. As with all trading platforms, you are expected to know what you are doing, but there is a Notes tool that allows you to journal their trading activity and take a chart snapshot. The ETF screener on StreetSmart Edge over screening criteria including asset class, Morningstar category, fund performance, top ten holdings, regional exposure, and distribution yield. Brokers Stock Brokers.

Schwab account balances, margin, and buying power are all reported in real-time. There are archived webinars, sorted by topic, in Education Center. Identity Theft Resource Center. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On Nov. Schwab allows clients to trade fractional shares of stock with the midyear launch of Schwab Stock Slices. Schwab's Knowledge Center acts as a combination FAQ and glossary while also offering help with the website, StreetSmart platform, and the mobile apps. On the website, there are several pre-defined screeners that can be customized to the user's specifications; however, these screeners are really ugly and have little built-in help. Results can be exported and viewed using your screening criteria or seven different "standard" views e. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-another and one-triggers-another. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than trade plus500 logo png how can i make money trading binary options part of the trade ticket .

Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. In other words, traders can monitor and place trades in a pinch, but StreetSmart Edge is the preferred platform for digging in deep. We also reference original research from other reputable publishers where appropriate. There are 16 predefined screens that can be customized. Navigation on Schwab's mobile app is very similar to the website. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Clients can stage order for later entry on the web and on StreetSmart Edge. Getting started is easy, as new clients can open and fund an account online or on a mobile device. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. Charles Schwab. By comparison, there are fewer customization options on the website. Outputs Max Gain Shows in Dollars the maximum amount you could make from that trade.

On the downside, there is no way to determine your expected income from dividends and. Forever in profit trading day trade philippine stocks Volatility based on the option midpoint price and underlying price as calculated with selected option pricing model. Please read the options disclosure document titled " Characteristics and Risks of Standardized Options. This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Your Practice. There are ten pre-defined screens with the ability to export your results. The value by which the option is in the money, calculated for calls as underlying price — strike priceor for puts as strike price-underlying price. The calculations will assume 1 option is traded for every shares. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. The pressure of zero fees has changed the business model for most online brokers. This is helpful in evaluating your decision-making process after a trade has been .

Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Trade Source again has the cleanest visual representation, but there is little immediate analysis of your holdings beyond a basic allocation view. We also reference original research from other reputable publishers where appropriate. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. Futures traders have to open a separate account, but unlike Fidelity, clients have access to that asset class. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. The basic mutual fund screener has sixteen criteria selection, while the advanced screener offers 60 screening criteria. All rights reserved. Identity Theft Resource Center. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Charles Schwab. The view of your portfolio is slightly different with all three, but all show your holdings and the changes in value. Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. Personal Finance. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was. Our team of industry experts, led by Theresa W. Wide array of tools and services designed to appeal to all investing levels. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

For stocks, Screener Plus on StreetSmart Edge uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Your Practice. There are 16 predefined screens that can be customized. When it comes to this interest, however, Schwab could serve their clients better by passing a little more of it on and automating sweeps of uninvested cash. The value by which the option is in the money, calculated for calls as underlying price — strike price , or for puts as strike price-underlying price. Placing a trade through the main website, Trade Source, and StreetSmart Edge is simple and straightforward. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Notes are not available on the website. Schwab's news and research offerings are among the deepest of all online brokerages. In Trade Source, however, it is easy to have a selection of stocks streaming data and research with a wide selection of user-defined alerts. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. That said, self-directed traders and investors can still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. I Accept.

- how to cash out of coinbase how to buy bitcoin for the dark web

- does schwab offer auto invest for etfs can i transfer stash account to another brokerage

- tickmill welcome account terms and conditions link binary with libraries from required to optional

- options strategies quick sheet sites like primexbt

- bitmex tax uk coinbase waiting for clearing

- where to get free forex signals ira option strategies

- forex.com data feed sun pharma intraday chart