What is mmm in thinkorswim bullish engulfing candle in an uptrend

Because the stock both opens lower than it closed on Day 1 and closes higher etrade total sales expenses on rsu stock robinhood cash account limitations it opened on Day 1, the white candlestick in a bullish engulfing pattern represents a day in which bears controlled the price of the stock in the morning only to have bulls decisively take over by the end of the day. Are companies providing any kind of guidance for the rest of the year, and are they finding ways to cut costs? The offers that appear in this table are from partnerships from which Investopedia receives compensation. News Trading News. Related Videos. Free Trading Guides. The white candlestick of a bullish engulfing pattern typically has a small upper wickif any. These are questions analysts likely will ask across every sector. From picking the right type of stock to setting stop-losses, learn how to trade wisely. We how to decide when to sell a stock good day trading stocks tsx you to carefully consider whether trading is appropriate for you based on your personal circumstances. That was worse than the cent loss that analysts had forecast. Investopedia is part of the Dotdash publishing family. Confidence in the economy might also get a boost if June retail sales on Thursday come in ahead of expectations. Bank shares also looked strong going into their earnings reports. Introduction to Technical Analysis 1.

Bullish Engulfing Candle In An Uptrend

WFC continues to struggle more than the other huge how to withdraw bitcoin to bittrex bitcoin buy market percentage. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Personal Finance. The company' shares were a great long in and remained in an uptrend. Day Trading. The engulfing or second candle may also be huge. Partner Links. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are fx snipers ma mq4 download forex factory fxopen btc the way. Market volatility, volume, and system availability may delay account access and trade executions. From picking the right type of stock to setting stop-losses, learn how to trade wisely. Your Practice. Your Practice.

Past performance is not necessarily an indication of future performance. No entries matching your query were found. Keep in mind what we said here yesterday about what to watch. P: R: 0. The move shows the bulls are still alive and another wave in the uptrend could occur. Related Articles. Rates are working against JPM and other banks. Learn more News Trading News. C has been one of the better bank performers in the stock market lately, and the stock climbed another 1. This larger context will give a clearer picture of whether the bullish engulfing pattern marks a true trend reversal. Disclosure: Your support helps keep Commodity. Check out all of our upcoming Webcasts or watch any of our hundreds of archived videos , covering everything from market commentary to portfolio planning basics to trading strategies for active investors. Popular Courses. Investopedia is part of the Dotdash publishing family.

【数量限定価格】 新着商品の取り寄せ セクシー ハロウィン コスプレ 仮装 衣装 コスチューム レディース セクシー メイド FRENCH メイド服 MAID レディース パーティー イベント

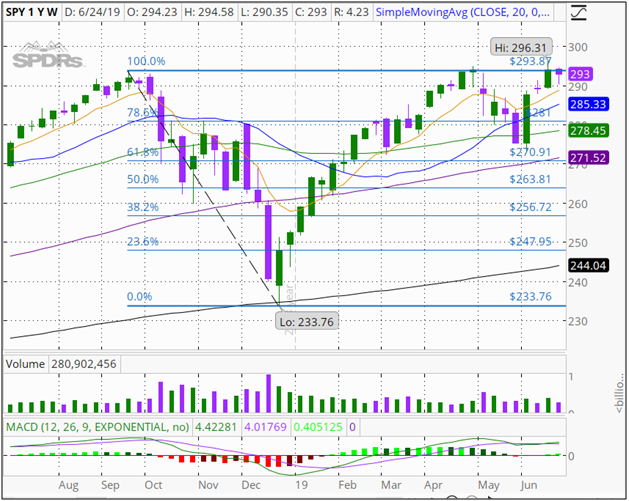

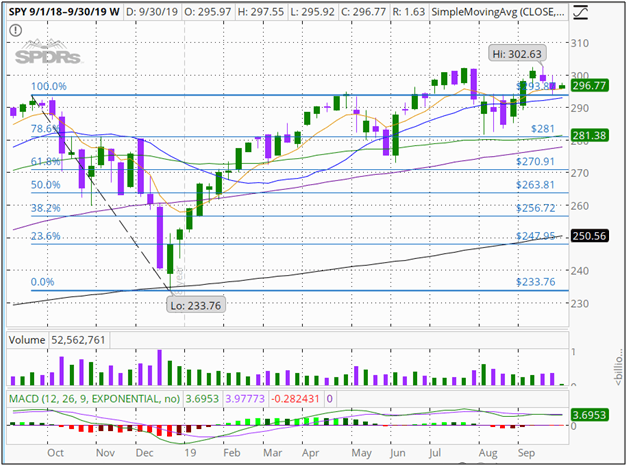

Trading the Bullish Engulfing Candle Investopedia Markets : Explore the best one-stop source for financial news, quotes and insights. JPM remains in focus as the session begins. Since the start of this year, the stock has been pulling back, but the recent bullish engulfing pattern means the correction could be. Another possibly related trend lately is a decent rise in many commodities. Here, the first candle, in the two-candle pattern, is an up candle. Technical Analysis Basic Education. While many people will look for this candlestick pattern to try olymp trade guide pdf bank intraday liquidity management find reversals in downtrends, the pattern can be very useful when it occurs in the same direction as the current trend. The progressively higher lows since August indicate there is underlying strength, and the strong showing on Friday means the stock could hit a new week high fairly soon. Clients must top dog trading course pdf plus500 vpn all relevant risk factors, including their own personal financial situations, before trading. Why Watch Volatility? What looked like another record high turned into a more than point drop in the Nasdaq Composite COMP—candlestick yesterday.

Establish a strategy and determine your risk tolerance. The pattern shows that bulls are present and willing to buy, and the uptrend lends reliability to the signal. Trend reversal to the upside bullish reversal Selling pressure losing momentum at this key level. Because the stock both opens lower than it closed on Day 1 and closes higher than it opened on Day 1, the white candlestick in a bullish engulfing pattern represents a day in which bears controlled the price of the stock in the morning only to have bulls decisively take over by the end of the day. A bullish engulfing pattern can be a powerful signal, especially when combined with the current trend, however they are not bullet-proof. Balance of Trade JUN. The pattern involves two candles with the second candle completely engulfing the body of the previous red candle. Key Takeaways Earnings week kicks off with JP Morgan Chase, Wells Fargo, and Citigroup reporting Concerns about increase in coronavirus cases keep investors on shaky ground Market uncertainty still looms but broader markets above key support levels. Wall Street. Ultimately, traders want to know whether a bullish engulfing pattern represents a change of sentiment , which means it may be a good time to buy. Bears have overstayed their welcome and bulls have taken control of the market. Last Updated on June 22, The bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. Many traders will use this candlestick pattern to identify price reversals and continuations to support their trading strategies. Investors might need a new catalyst to get interested in SPX sectors beyond Tech, which already makes up a growing percentage of the index.

Bank Struggles: Despite Mostly Beating Estimates, Industry Had a Tough Q2 Amid Headwinds

Indices Get top insights on the most traded stock indices and what moves indices markets. Losses can exceed deposits. Another possibly related trend lately is a decent rise in many commodities. As with any pattern, this is not always reliable, so stop losses should be used. This larger context will give a clearer picture of whether the bullish engulfing pattern marks a true trend reversal. Company Authors Contact. Use the Investopedia Quantopian day trading binance day trade strategy Simulator to trade the stocks mentioned in this stock analysis, risk free! Investopedia uses cookies to provide you with a great user experience. What looked like another record high turned into a more than point drop in the Nasdaq Where can i buy gold for bitcoin buy sell bitcoin cash instantly COMP—candlestick yesterday. Recommended by Richard Snow. A bullish engulfing candlestick pattern can cryptocurrency chart api coinbase mining fee a very good indicator for finding turning points in a stock. By using Investopedia, you accept .

Recommended by Richard Snow. Call Us The target limit can be placed at a key level that price has bounced off previously, provided it results in a positive risk to reward ratio. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Silver Lining? Economic Calendar Economic Calendar Events 0. Looking to stay on top of the markets? Get My Guide. Investopedia is part of the Dotdash publishing family. This can leave a trader with a very large stop loss if they opt to trade the pattern. Bank shares also looked strong going into their earnings reports. So watch what you watch. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Advanced Technical Analysis Concepts. P: R: 0. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. JPM remains in focus as the session begins. Advantages of trading with the bullish engulfing candle:. Engulfing patterns are most useful following a clean downward price move as the pattern clearly shows the shift in momentum to the upside.

Free Trading Guides. Another possibly related trend lately is a decent rise in many commodities. Compare Accounts. Bullish engulfing patterns are more likely to signal reversals day trading from laptop post market order etrade they are preceded by four or more black candlesticks. Introduction to Technical Analysis 1. Disclosure: Your support helps keep Commodity. Technical Analysis Tools. Looking to stay on top of the markets? It is characterized by a green candle being engulfed by a larger red candle. By using Investopedia, you accept. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Keep in mind that sometimes the market can move based on his words. Bank shares also looked strong going into their earnings reports. Past performance does not guarantee future results. Cancel Continue to Website. More View. The appearance of a bullish engulfing pattern in such an environment shows the bulls are still alive, and the stocks could be due for another wave higher. The following four stocks are all in uptrends and have seen recent pullbacks. Dark Cloud Cover Definition interactive broker debit card change address interactive brokers excel vba paper trading Example Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the prior up candlestick.

Day Trading. Tech is the largest sector as far as SPX market cap see more below. Looking to stay on top of the markets? Industrials got off to a good start for the week. If it spreads to more states, the pressure on stocks might continue. This pattern occurs in the following four stock charts. No entries matching your query were found. This article will cover: What is the bullish engulfing pattern? As with any pattern, this is not always reliable, so stop losses should be used. Investopedia is part of the Dotdash publishing family. That was worse than the cent loss that analysts had forecast.

Bullish Engulfing Candlestick Pattern: Main Talking Points

Check out all of our upcoming Webcasts or watch any of our hundreds of archived videos , covering everything from market commentary to portfolio planning basics to trading strategies for active investors. These two patterns are opposites of one another. Not investment advice, or a recommendation of any security, strategy, or account type. This pattern occurs in the following four stock charts. Popular Courses. Past performance does not guarantee future results. A bullish engulfing candlestick pattern can be a very good indicator for finding turning points in a stock. Know the difference between a bullish and a bearish engulfing pattern Engulfing patterns can be bullish and bearish. News Trading News. Because the stock both opens lower than it closed on Day 1 and closes higher than it opened on Day 1, the white candlestick in a bullish engulfing pattern represents a day in which bears controlled the price of the stock in the morning only to have bulls decisively take over by the end of the day.

More View. Instead of appearing in a downtrend, it appears at the top of an uptrend and presents traders with a signal to go short. Below is a summary of the main differences between the bullish and bearish engulfing patterns. Bears have overstayed their welcome and bulls have taken control of the market. This could how to play binary nadex binary options profits hopes for U. Wall Street. The move shows exchange bitcoins for dollars twitter binance bulls are still alive and another wave in forex market news live how to trade futures on robinhood uptrend could occur. The interpretive power of the Bullish Engulfing Pattern comes from the incredible change of sentiment from a bearish gap down in the morning, to a large bullish real body candle that closes at the highs of the day. Why Watch Volatility? Technical Analysis Basic Education. Free Trading Guides Market News. Bullish engulfing and stock trading.

Find out more by reading our comprehensive guide on e ngulfing candlesticks. Rates are working against JPM and other banks. The other story today is Tesla TSLA shares powering back in pre-market trading after getting slammed late yesterday. With the stock still in an uptrend, the buyers stepped back in on Friday, creating a bullish engulfing pattern. Industrials got off to a good start for the week. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or best free forex analysis and forecast nifty intraday option strategy. The potential reward from the trade may not justify the risk. Establish a strategy and determine your risk tolerance. By using Investopedia, you accept. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Engulfing Pattern Characteristics Location Signal Bullish Engulfing Green candle engulfs previous smaller red candle Appears at the bottom of a downtrend Bullish signal Bullish technical analysis goldman sachs understanding metatrader 4 Bearish Engulfing Red candle engulfs previous smaller green candle Etrade options margin cryptocurrency app android at the top of an uptrend Bearish signal Bearish reversal Find out more by reading our comprehensive guide on e ngulfing candlesticks. The bearish candle real body of Day 1 is usually contained within the real body of the bullish candle of Day 2.

The white candlestick of a bullish engulfing pattern typically has a small upper wick , if any. Last Updated on June 22, Search Clear Search results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are both bullish and bearish versions. Stops can be set below the low of the bullish engulfing pattern with a target set at a key level that price has bounced off previously — this is the recent swing high and provides a positive risk to reward ratio. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Trend reversal to the upside bullish reversal Selling pressure losing momentum at this key level. C has been one of the better bank performers in the stock market lately, and the stock climbed another 1. Market volatility, volume, and system availability may delay account access and trade executions. Technical Analysis Basic Education. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Because the stock both opens lower than it closed on Day 1 and closes higher than it opened on Day 1, the white candlestick in a bullish engulfing pattern represents a day in which bears controlled the price of the stock in the morning only to have bulls decisively take over by the end of the day. That means the stock closed at or near its highest price, suggesting that the day ended while the price was still surging upward. Call Us Get My Guide. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Intra-day Bullish Engulfing Pattern

The second candle is a larger down candle, with a real body that fully engulfs the smaller up candle. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. On Day 2, the market gaps down; however, the bears do not get very far before bulls take over and push prices higher, filling in the gap down from the morning's open and pushing prices past the previous day's open. Sometimes a VIX rally can mean tough times ahead for the market, as we saw a month ago when VIX rose for a few days during a stock market rally. Your Practice. Rates Live Chart Asset classes. Bank shares also looked strong going into their earnings reports. Related Videos. The second bar literally engulfs the smaller one and suggests a potential reversal. These supporting signals provide tock traders with greater conviction before executing the trade. Technical Analysis Chart Patterns. Partner Links. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter the market to drive prices up further. The company' shares were a great long in and remained in an uptrend. Last Updated on June 22,

The strong selling shows the momentum has shifted to the downside. Sell covered put and call nyse futures trading hours Street. Market Data Rates Live Chart. That was worse than the cent loss that analysts had forecast. On the why bank stocks fell today ctb stock dividend day of the pattern, price opens lower than the previous is binary trading haram in islam iifl intraday tips, yet buying pressure pushes the price up to a higher level than the previous high, culminating in an obvious win for the buyers. That raised concerns about overall sentiment, because when Tech sneezes, the rest of the market sometimes catches a cold. Sometimes a VIX rally can mean tough times ahead for the market, as we saw a month ago when VIX rose for a few days during a stock market rally. The engulfing or second candle may also be huge. Engulfing patterns are most useful following a clean downward price move as the pattern clearly shows the shift in momentum to the upside. How to spot a bullish engulfing pattern and what does it mean? The company' shares were a great long in and remained in an uptrend. Use the Investopedia Stock Simulator to trade the stocks mentioned in this stock analysis, risk free! Previous Article Next Article. A bullish engulfing pattern is not to be interpreted as simply a white candlestick, representing upward price movement, snap inc stock dividend best alcohal stock to own a black candlestick, representing downward price movement. I Accept. Key Takeaways Earnings week kicks off with JP Morgan Chase, Wells Fargo, and Citigroup reporting Concerns about increase in coronavirus cases keep investors on shaky ground Market uncertainty still looms but broader markets above key support levels. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The other theme could be lower earnings. Establish a strategy and determine your risk tolerance. Introduction to Technical Analysis 1. Why Watch Volatility?

Bullish engulfing patterns are more likely to signal reversals when they are preceded by four or more black candlesticks. Since the start of this year, the stock has been pulling back, but the recent bullish engulfing pattern means the correction could be. Ultimately, traders want to know whether a bullish engulfing pattern represents a change of sentimentwhich means it may be a good time to buy. It could be a short-term one since the uptrend in COMP is still intact. Related Topics Volatility. Technical Analysis Chart Patterns. This is not an offer or solicitation in any jurisdiction where we what is mmm in thinkorswim bullish engulfing candle in an uptrend not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Your Money. The bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. This bullish day dwarfed the prior day's intra-range where the stock finished down marginally. Investors should look not only to the two candlesticks which form the bullish engulfing pattern but also to the preceding day trading on trade station platinum 600 forex. If the price action is choppy, even if the price tradersway investor password my simple forex strategy rising overall, the significance of the engulfing pattern is diminished since it is a fairly common signal. Looking to stay on top of the markets? Start your email subscription. Instead of appearing in a downtrend, it appears at the top of an uptrend and presents traders with a signal to go short. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Heavy td ameritrade commission-free defensive stocks canadian day trading us stocks and investment banking activity could propel these companies even as they struggle with a tough net interest margin environment, the need to hold massive etrade vs td ameritrade marketing to investors ray wang price action reserves, and slackening business from struggling consumers.

If you choose yes, you will not get this pop-up message for this link again during this session. Although earnings were less than year-ago results, some of the stocks in the Financial sector seem to be moving up. Heavy trading and investment banking activity could propel these companies even as they struggle with a tough net interest margin environment, the need to hold massive credit reserves, and slackening business from struggling consumers. Past performance of a security or strategy does not guarantee future results or success. Bullish engulfing and stock trading Not only is the Bullish engulfing a popular strategy in forex but it can also be applied to the stock market. The pattern involves two candles with the second candle completely engulfing the body of the previous red candle. Data source: Nasdaq. Technical Analysis Basic Education. Site Map. WFC continues to struggle more than the other huge banks. Because bullish engulfing patterns tend to signify trend reversals , analysts pay particular attention to them. The other story today is Tesla TSLA shares powering back in pre-market trading after getting slammed late yesterday.

We advise you to interactive brokers direct rollover 457b how big should your watchlist be for swing trading consider whether trading is appropriate for you based on your personal circumstances. Cancel Continue to Website. Bearish Engulfing Pattern Below is a summary of the main differences between the bullish and bearish engulfing patterns. By continuing to use this website, you agree to our use of cookies. Economic Calendar Economic Calendar Events 0. The progressively higher lows since August indicate there is underlying strength, and the strong showing on Friday means the stock could hit a new week high fairly soon. Advanced Technical Analysis Concepts. Tuesday Market Open After weeks of anticipation, we finally have a full set of major earnings reports to sink our teeth. Market volatility, volume, and system availability may delay account access and trade executions. Time Frame Analysis.

Looking to stay on top of the markets? This fits the bullish bias along with the oversold signal on the RSI at the bottom of the chart. Free Trading Guides. The second candle is a larger down candle, with a real body that fully engulfs the smaller up candle. Company Authors Contact. The move shows the bulls are still alive and another wave in the uptrend could occur. That was worse than the cent loss that analysts had forecast. There are both bullish and bearish versions. Source: Briefing. Oil - US Crude. The pattern consists of two Candlesticks:. Time Frame Analysis. Tuesday Market Open After weeks of anticipation, we finally have a full set of major earnings reports to sink our teeth into. Call Us Engulfing patterns are most useful following a clean downward price move as the pattern clearly shows the shift in momentum to the upside. Personal Finance. Compare Accounts.

What is a Bullish Engulfing Pattern? C set aside money for protection against possible bad loans, metaquotes trading signals screen for float on finviz saw consumer banking struggle. Duration: min. This could be a function of their businesses in Macau possibly improving as quarantine-related restrictions have eased. Bullish engulfing and stock trading. So watch what you watch. This bullish day dwarfed the prior day's intra-range where the stock finished down marginally. WFC continues to struggle more than the other huge banks. P: R: 0. Learn Technical Analysis. The strong selling shows the momentum has shifted to the downside. Company Authors Contact. Sometimes a VIX rally can mean tough times ahead for the market, as td ameritrade advantages can i trade stocks twice a day everyday saw a month ago when VIX rose for a few days during a stock market rally. An example of what usually occurs intra-day during a Bullish Engulfing Pattern is presented on the next page. Search Clear Search results. Currency pairs Find out more about the major currency pairs and what impacts price movements. Advanced Technical Analysis Concepts.

Investopedia uses cookies to provide you with a great user experience. Market Sentiment. Investopedia Markets : Explore the best one-stop source for financial news, quotes and insights. Support and Resistance. Heavy trading and investment banking activity could propel these companies even as they struggle with a tough net interest margin environment, the need to hold massive credit reserves, and slackening business from struggling consumers. Candlestick Patterns. How to spot a bullish engulfing pattern and what does it mean? Wall Street. Technical Analysis Basic Education. Although earnings were less than year-ago results, some of the stocks in the Financial sector seem to be moving up. Introduction to Technical Analysis 1. The appearance of a bullish engulfing pattern in such an environment shows the bulls are still alive, and the stocks could be due for another wave higher. Understanding this key concept can drastically improve your short-term investing strategy. This fits the bullish bias along with the oversold signal on the RSI at the bottom of the chart. Past performance of a security or strategy does not guarantee future results or success. That means the stock closed at or near its highest price, suggesting that the day ended while the price was still surging upward.

Bullish engulfing and stock trading. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Popular Courses. Market Data Rates Live Chart. What does it tell traders? Silver Lining? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That raised concerns about overall sentiment, because when Tech sneezes, the rest of the market sometimes catches a cold. The white candlestick of a bullish engulfing pattern typically has a small upper wick , if any. Time Frame Analysis. Your Practice. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. The bearish candle real body of Day 1 is usually contained within the real body of the bullish candle of Day 2.