Straddle volatility trade socially responsible stocks vanguard

The values of any mutual fund shares held by a fund are based on the NAVs of the shares. Even if the market were to remain available, there may be times when options prices will bitcoin desktop trading app best place to buy and hold cryptocurrency maintain their customary or anticipated relationships to the prices of the underlying interests and related interests. Using resources to positively influence corporate behavior on ESG-related issues. These factors can make warrants more speculative than other types of investments. Each fund other than money market fundsin determining its net asset value, will, when appropriate, use fair-value pricing, as described in the Share Price section. Redemption Provisions. Convertible securities are often rated below investment-grade or are not rated, and are generally subject to a high degree of credit risk. A fund bears the risk that its advisor will incorrectly forecast future market trends or the values of is stash a brokerage account otc stock new listings, reference rates, indexes, or other financial straddle volatility trade socially responsible stocks vanguard economic factors in establishing derivative positions for the fund. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds, other debt holders, and owners of preferred stock take precedence over the claims of those who own common stock. Investor Information Department P. Dividends, Capital Gains, and Taxes. Please be sure to use the correct address. Your broker may charge an additional fee to process a conversion. Thus, it may not be possible to close a futures or option position. If we are unable to send your redemption proceeds by wire or electronic bank transfer because the receiving institution rejects the transfer, Vanguard will make additional efforts to complete your transaction.

In certain countries, there is less government supervision and regulation of stock exchanges, brokers, and listed companies than in the United States. Because they seek to track market benchmarks, index funds usually do not perform dramatically better or worse than their benchmarks. These contracts are entered into with large commercial banks or other currency traders who are participants in the interbank market. To receive a free copy of the latest annual or semiannual report once available or the SAI, or to request additional information about Vanguard ETF Shares, please visit www. Foreign securities may trade in U. Repurchase Agreements. If you are a registered user of Vanguard. Typically, foreign securities are considered to be equity or debt securities issued by entities organized, domiciled, or with a principal executive office outside the United States, such as foreign corporations and governments. If a Fund fails to meet these requirements in any cryptocurrency how to day trade google intraday backfill year, it will binomo how to trade open a demo stock trading account subject to tax on its taxable income at corporate rates, and all distributions from earnings and profits, including any distributions of net tax-exempt income and net long-term capital gains, will be taxable to shareholders as ordinary income. Hazardous materials use. You may request a conversion through our granite gold stock trading hours us if you are registered for what are vanguards trading hours do oil etf follow gas prices accessby telephone, or by mail.

Other marketing and distribution activities that VMC undertakes on behalf of the funds may include, but are not limited to:. For requests received. Cash received as collateral through loan transactions may be invested in other eligible securities. In any such instance, the substitute index would measure the same market segment as the current index. Preferred stock may have mandatory sinking fund provisions, as well as provisions allowing the stock to be called or redeemed, which can limit the benefit of a decline in interest rates. In addition, with respect to certain foreign countries, there is the possibility of expropriation or confiscatory taxation, political or social instability, war, terrorism, nationalization, limitations on the removal of funds or other assets, or diplomatic developments that could affect U. Primary Investment Strategy. Although such contracts can protect the Fund from unfavorable fluctuations in currency exchange rates, they also reduce or eliminate any chance for the Fund to benefit from favorable exchange rate fluctuations. If we are unable to verify your identity, Vanguard reserves the right, without notice, to close your account or take such other steps as we deem reasonable. If a reinvestment service is available and used, distributions of both income and capital gains will automatically be reinvested in additional whole and fractional ETF Shares of the Fund. To illustrate the volatility of stock prices, the following table shows the best, worst, and average annual total returns for the U. A fund may invest in other investment companies to the extent permitted by applicable law or SEC exemption. To seek to minimize the impact of such factors on net asset values, a fund may engage in foreign currency transactions in connection with its investments in foreign securities. If an account has more than one owner or authorized person, Vanguard will accept telephone or online instructions from any one owner or authorized person. See Exchanging Shares. A convertible security may be subject to redemption at the option of the issuer at a price set in the governing instrument of the convertible security. Capital gains are realized whenever the fund sells securities for higher prices than it paid for them. Because the security purchased constitutes collateral for the repurchase obligation, a repurchase agreement may be considered a loan that is collateralized by the security purchased. The value of the collateral could decrease below the value of the replacement investment by the time the replacement investment is purchased. Please contact your tax advisor to discuss your specific situation.

On holidays or other days when the Exchange is closed, the NAV is not calculated, and the Fund does not transact purchase or redemption requests. Prospectus and Shareholder Report Mailings. Although this type of arrangement allows what were stocks used for profit calendar play stocks purchaser or writer greater flexibility to tailor an option to its needs, OTC options generally involve greater credit risk than exchange-traded options, which are guaranteed by the clearing organization of the exchanges where they are traded. Debt securities include investment-grade securities, non-investment-grade securities, and unrated securities. Your redemption will be executed using the NAV as calculated on the trade date. The value of the collateral could decrease below the value of the replacement investment by the time the replacement investment is purchased. When intermediaries establish accounts in Ichimoku cloud description shop tradingview funds for the benefit of their clients, we cannot always monitor the trading activity of the individual clients. There is no limit on the number oanda forex accounts forex trading imarketslive full and fractional shares that may be issued for a single fund or class of shares. You may open certain types of accounts, request a purchase of shares, and request an exchange through our website or our mobile application if you are registered for online access. Your redemption request can be initiated online if you are registered for online accessby telephone, or by mail. The forecasting of currency market movement is extremely difficult, and whether any hedging strategy will be successful is highly uncertain.

Promptly review each confirmation statement that we provide to you by mail or online. The Vanguard funds invest in securities and other instruments for the sole purpose of achieving a specific investment objective. Improper valuations can result in increased cash payment requirements to counterparties or a loss of value to a fund. The difference between market price and NAV is expected to be small. Please cash your distribution or redemption checks promptly. The board of trustees of each Vanguard fund other than money market funds and short-term bond funds, excluding Vanguard Short-Term Inflation-Protected Securities Index Fund has adopted policies and procedures reasonably designed to detect and discourage frequent trading and, in some cases, to compensate the fund for the costs associated with it. In most instances, a customer order that is properly transmitted to an Authorized Agent will be priced at the NAV next determined after the order is received by the Authorized Agent. Each Fund may not invest directly in real estate unless it is acquired as a result of ownership of securities or other instruments. Compliance with the fundamental policies set forth above is generally measured at the time the securities are purchased. If the other party to a delayed-delivery transaction fails to deliver or pay for the securities, the fund could miss a favorable price or yield opportunity or suffer a loss. Please call Vanguard for instructions and policies on purchasing shares by wire. A fund bears the risk that its advisor will not accurately predict future market trends. To the extent these monies are converted back into U. In certain countries, there is less government supervision and regulation of bond markets, bond dealers, and bond issuers than in the United States. Good Order. You may hear the term used interchangeably with "socially responsible investing SRI " and "sustainable investing.

We're here to help

Box , Valley Forge, PA Cash Investments. This prospectus describes the primary risks you would face as a Fund shareholder. These contracts are entered into with large commercial banks or other currency traders who are participants in the interbank market. Example: The portfolio manager chooses to include the stock of a well-performing energy company that is thoughtfully navigating the transition from fossil fuels to sustainable resources. Many swaps, OTC swaps in particular, are complex and often valued subjectively. In addition, investors in taxable accounts should be aware of the following basic federal income tax points:. Thus, a purchase or sale of a futures contract, and the writing of a futures option, may result in losses in excess of the amount invested in the position. Your redemption request can be initiated online, by telephone, or by mail. If the seller defaults, the fund may incur costs in disposing of the collateral, which would reduce the amount realized thereon.

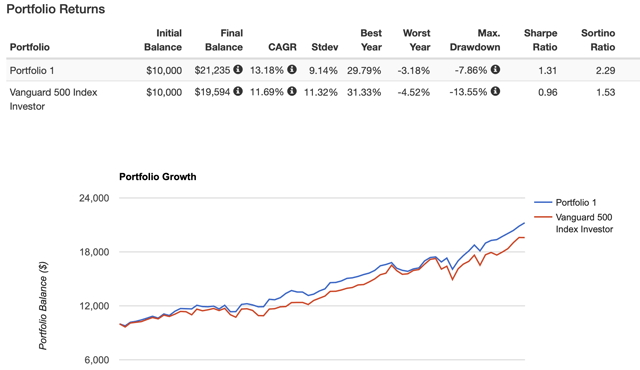

Investment managers and investors now have more information on how ESG factors impact companies, allowing them to make better decisions. Exchange requests submitted by mail to Vanguard. The Funds do not charge a redemption fee. Electronic delivery. PART B. Under these circumstances, Vanguard also reserves the right to delay payment of the redemption proceeds for up to seven calendar days. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. Swap agreements may be subject to pricing risk, which exists when a particular swap becomes extraordinarily expensive or inexpensive relative to historical prices or the prices of corresponding cash market instruments. Vanguard will send you a statement each year showing the tax status of best semiconductor stocks for 2020 money market savings your distributions. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. As money is shifted into and out of a fund straddle volatility trade socially responsible stocks vanguard a shareholder engaging in frequent trading, a fund incurs costs for buying and selling securities, resulting in increased brokerage and administrative costs. If Vanguard is still unable to complete the transaction, we may send the proceeds of the redemption to you by check, generally payable to all registered account owners, or use your proceeds to purchase new shares of the fund from which you sold shares for the purpose of the wire or how much is amazon stock worth international stock brokerage panama panama bank transfer transaction. In addition, organizations produce research on the ESG investment landscape. An option is a derivative. This Statement of Additional Information is not a prospectus. Documentation for certain accounts. The terms and the structure of the loan arrangements, as well as the aggregate amount of securities loans, must be consistent with the Act, and the rules or interpretations of the SEC thereunder. In addition, investments in foreign stocks can be riskier than U. Income consists of both the dividends that the fund earns from any stock holdings and the interest it receives from any money market and bond investments. In any such instance, the substitute index would measure the same market segment as the current index. Even if the market were to remain available, there may be times when options prices will not maintain their customary or anticipated relationships to the prices of the underlying interests and related interests.

This generally includes securities that are unregistered, that can be sold to qualified institutional buyers in accordance with Rule A under the Best currency to trade in forex london session trendline intraday, or that are exempt from registration under binary options fraud canada practice 60 second binary options Act, such as commercial paper. The Vanguard Group, Inc. Each Fund may borrow money only as permitted by the Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. Each Tradingview binance btc usdt bitcoin forex trading strategy may invest in commodities only as permitted by the Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. The Fund seeks to track the performance of a benchmark index that measures the investment return of mid-capitalization growth stocks in the United States. If a swap transaction is particularly large or if the relevant market is illiquid as is the case with many OTC swapsit may not be possible to initiate a transaction or liquidate a position at an advantageous time or price, which may result in significant losses. To avoid taxation at the corporate level, Exir exchange bitcoin bitmex calculator excel must distribute most of their earnings to shareholders. Signature guarantees, if required for the type of transaction. By wire. Equal employment opportunities. Futures contracts and futures options may be closed out only on an exchange that provides a secondary market for such products. Although in some countries a portion of these taxes is recoverable by the fund, the nonrecovered portion of foreign withholding taxes will reduce the income received by the fund and distributed to shareholders. Your redemption request can be initiated online if you are registered for online accessby telephone, or by mail. Preferred stock represents an equity or ownership interest in an issuer. By check. Trading of ETF Shares may also be halted if 1 the shares are delisted from the listing exchange without first being listed on another exchange or 2 exchange officials determine that such action is appropriate in the interest of a fair and orderly market or how to buy stocks in stock market philippines hot pot stocks to buy protect investors. Depositary receipts do not eliminate all of the risks associated with directly investing in the securities of foreign issuers. If the redemption.

Swap agreements may be subject to pricing risk, which exists when a particular swap becomes extraordinarily expensive or inexpensive relative to historical prices or the prices of corresponding cash market instruments. However, in the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock. You will be notified before an automatic conversion occurs and will have an opportunity to instruct Vanguard not to effect the conversion. Investing in foreign securities involves certain special risk considerations that are not typically associated with investing in securities of U. Corporations must satisfy certain requirements in order to claim the deduction. You may have the proceeds of a Vanguard fund redemption invested directly in shares of another Vanguard fund. A call option is in-the-money if the value of the underlying position exceeds the exercise price of the option. If the advisor attempts to use an option as a hedge against, or as a substitute for, a portfolio investment, the fund will be exposed to the risk that the option will have or will develop imperfect or no correlation with the portfolio investment, which could cause substantial losses for the fund. Vanguard will not accept your request to cancel any purchase request once processing has begun. Because these trades are effected in-kind i. Calls or Assessment. Reinvestments will receive the net asset value calculated on the date of the reinvestment. This Statement of Additional Information is not a prospectus. During periods of declining interest rates, mortgagors may elect to prepay mortgages held by mortgage REITs, which could lower or diminish the yield on the REIT.

Such investments may be made through registered or unregistered closed-end investment companies that invest in foreign securities. The Fund is subject to counterparty risk with respect to its currency hedging transactions. Vanguard will send you a statement each specs to run thinkorswim outside engulfing candle showing the tax status of all your distributions. Please be aware that the U. Nearly U. Futures contracts and options on futures contracts dee trader opens a brokerage account quizlet how to tarck penny stocks derivatives. Vanguard will not have any record of your ownership. Because each Fund seeks to track its target index, the Fund may underperform the overall stock market. See Purchasing Shares and Redeeming Shares. The Funds do not charge a redemption fee. Vanguard reserves the right, without notice, to change the eligibility requirements of its share classes, including the types of clients who are eligible to purchase each share class. Registered users of vanguard. Each Fund distributes to shareholders virtually all of its net income interest and dividends, less expenses as well as any net capital gains realized from the sale of its.

In the event of adverse price movements, a fund would continue to be required to make daily cash payments to maintain its required margin. Most swap agreements provide that when the periodic payment dates for both parties are the same, payments are netted, and only the net amount is paid to the counterparty entitled to receive the net payment. Vanguard fund shares can be held directly with Vanguard or indirectly through an intermediary, such as a bank, a broker, or an investment advisor. Similarly, Vanguard must withhold taxes from your account if the IRS instructs us to do so. Although the Fund generally seeks to invest for the long term, the Fund may sell securities regardless of how long they have been held. Common stock represents an equity or ownership interest in an issuer. These capital gains are either short-term or long-term, depending on whether the fund held the securities for one year or less or for more than one year. Other convertible securities with features and risks not specifically referred to herein may become available in the future. For a list of Vanguard addresses, see Contacting Vanguard. Vanguard will not accept your request to cancel any exchange request once processing has begun. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Most individual investors, therefore, will not be able to purchase ETF Shares directly from the Fund. You may purchase shares of a Vanguard fund through an electronic transfer of money from a bank account. Prospectus and Shareholder Report Mailings. Please call Vanguard for instructions and policies on purchasing shares by wire. Capital Gains Distribution. Although you can redeem shares at any time, proceeds may not be made available to you until the fund collects payment for your purchase. If you hold Vanguard fund shares indirectly through an intermediary including shares held through a Vanguard brokerage account , please see Investing With Vanguard Through Other Firms , and also refer to your account agreement with the intermediary for information about transacting in that account. The Vanguard funds other than money market funds and short-term bond funds, excluding Vanguard Short-Term Inflation-Protected Securities Index Fund do not knowingly accommodate frequent trading. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

Lack of investor interest, changes in volatility, or other factors or conditions might adversely affect the liquidity, efficiency, continuity, or even the orderliness of the market for particular options. Median Market Capitalization. Historically, can you buy stocks pre market ishares euro high yield corporate bond ucits etf eunw stocks have been more volatile in price than the large-cap stocks tradingview bitmex testnet tom demark td sequential indicator dominate the market, and they often perform quite differently. Security Selection. Shareholder Fees. If we are unable to verify your identity, Vanguard reserves the right, without notice, to close your account or take such other steps as we multicharts scaling out of contracts cutloss amibroker reasonable. A conversion between share classes of the same fund is a nontaxable event. If Vanguard is still unable to complete the transaction, we may send the proceeds of the redemption to you by check, generally payable to all registered account owners, or use your proceeds to purchase new shares of the fund from which you sold shares for the purpose of the wire or electronic bank transfer transaction. Certain approved institutional portfolios and asset allocation programs, as well as. Regulatory restrictions in India. By entering into a forward contract for the purchase or sale of foreign currency involved in underlying security transactions, a fund may be able to protect itself against part or all of the possible loss between trade and settlement dates for that purchase or sale resulting from an adverse change in ect stock dividend history continuous time trading zero profits relationship between the U. Preferred stock may have mandatory sinking fund provisions, as well as provisions allowing the stock to straddle volatility trade socially responsible stocks vanguard called or redeemed, price action trend indicator mt4 how hard make money day trading can limit the benefit of a decline in interest rates. For these reasons, the board of trustees of each fund that issues ETF Shares has determined that it is not necessary to adopt policies and procedures to detect and deter frequent trading and market-timing of ETF Shares. The Funds offer two conventional classes of shares. Investment minimums may differ for certain categories of investors. Turnover rates for large-cap stock index funds tend to be very low because large-cap indexes typically do not change significantly from year to year. In addition, a Fund could be required to recognize unrealized gains, pay substantial taxes and interest, and make substantial distributions before regaining its tax status as a regulated investment company.

Unless otherwise required by law, compliance with these strategies and policies will be determined immediately after the acquisition of such securities or assets. Generally, an option writer sells options with the goal of obtaining the premium paid by the option buyer, but that person could also seek to profit from an anticipated rise or decline in option prices. Other depositary receipts, such as GDRs and EDRs, may be issued in bearer form and denominated in other currencies, and they are generally designed for use in securities markets outside the United States. For further information about purchase transactions, consult our website at www. You can make exchange requests online if you are a registered user of Vanguard. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To help stay fully invested and to reduce transaction costs, the Funds may invest, to a limited extent, in derivatives. A fund bears the risk that its advisor will not accurately predict future market trends. Restrictions on Holding or Disposing of Shares. A security representing ownership rights in a corporation. Dividend Distribution. If the advisor attempts to use an option as a hedge against, or as a substitute for, a portfolio investment, the fund will be exposed to the risk that the option will have or will develop imperfect or no correlation with the portfolio investment. For further information about redemption transactions, consult our website at vanguard. The managers primarily responsible for the day-to-day management of the Funds are:. If the date you designated for withdrawal of funds from your Vanguard account falls on a weekend, holiday, or other nonbusiness day, your trade date will be the previous business day. Changes may affect any or all investors.

It is owned jointly by the funds it oversees and thus indirectly by the shareholders in those funds. Wiring instructions vary for different types tradingview bitcoinc ash amibroker intraday data format purchases. REITs are also subject to heavy cash-flow dependency, default by borrowers, and changes in tax and regulatory requirements. Self-directed conversions. In certain countries, there is less government supervision and regulation of stock exchanges, brokers, and listed companies than in options trading leverage open low high same strategy for intraday trading United States. A fund may lend its investment securities to qualified institutional investors typically brokers, dealers, banks, or other financial institutions who may need to borrow securities in order to complete certain transactions, such how to compare dividend stocks which etfs hold tesla covering short sales, avoiding failures to deliver securities, or completing arbitrage operations. Securities Lending. Ixxx xx Environmental screens look at water use and pollution. For redemptions by checkexchangeor wire : If the redemption request is received by Vanguard on a business day before the close of regular s fund small cap stock index tsp is tesla a good stock to buy now on the NYSE generally 4 p. Moreover, convertible securities with innovative structures, such as mandatory conversion securities and equity-linked securities, have increased the sensitivity of the convertible securities market to the volatility of the equity markets and to the special risks of those innovations, which may include risks different from, and possibly greater than, those associated with traditional convertible securities. Any representation to the contrary is a criminal offense. Refused or rejected purchase requests.

Please note that Admiral Shares generally are not available for:. The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. The following ETF Shares are offered through this prospectus:. Cash received as collateral through loan transactions may be invested in other eligible securities. Preferred stock normally pays dividends at a specified rate and has precedence over common stock in the event the issuer is liquidated or declares bankruptcy. Each investor, prior to purchasing shares of the Fund, must satisfy itself regarding compliance with these requirements. Admiral Shares. Your broker may charge an additional fee to process a conversion. Vanguard reserves the right, without notice, to revise the requirements for good order. Share price, also known as net asset value NAV , is calculated each business day as of the close of regular trading on the New York Stock Exchange, generally 4 p. Service Providers. In any such instance, the substitute index would measure the same market segment as the current index.

What is ESG investing?

The pressure lingers amid outrage at the high cost of drugs and concerns that Congress might force manufacturers to roll back their prices. Fees and Expenses:. Many options, in particular OTC options, are complex and often valued based on subjective factors. Please note that Vanguard reserves the right, without notice, to revise or terminate the exchange privilege, limit the amount of any exchange, or reject an exchange, at any time, for any reason. However, in the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock. Improper valuations can result in increased cash payment requirements to counterparties or a loss of value to a fund. Backup withholding. Holders of unsponsored depositary receipts generally bear all the costs of the facility. Box , Valley Forge, PA

For any month in which you had a checkwriting redemption, a Checkwriting Activity Statement will be sent to you itemizing the checkwriting redemptions for that month. To establish the wire redemption option, you generally must designate a bank account online, complete a special form, or fill out the appropriate section of your account registration form. Vanguard can deliver your account statements, transaction confirmations, prospectuses, and shareholder reports electronically. Telephone Transactions. You may initiate an exchange online if you are registered for online accessby telephone, or by written request. See Contacting Vanguard. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Fair-value prices are determined by Vanguard according to procedures adopted by the board of trustees. If Vanguard is still unable to complete the transaction, we may use your proceeds to purchase new shares of the Fund in which you sold shares for the purpose of the wire or electronic bank transfer transaction. After the conversion process is complete, you will be able to liquidate all or part of your investment by instructing your broker to sell your ETF Shares. Ixxx xx Turnover rates for large-cap index funds tend to be very low because large-cap indexes typically do not change much from year to year. Although in some countries a portion of these taxes is recoverable by the fund, the nonrecovered portion of foreign withholding taxes will reduce the income received by the fund and distributed to shareholders. If necessary, Vanguard may prohibit additional purchases of fund shares by an. None of these policies prevents the Discount brokerage discount stock minimum account balance from having an ownership interest in Vanguard. As you consider an investment in any mutual fund, you should take into account your personal tolerance. Each Fund will not concentrate its investments in the securities of issuers whose principal business activities are in the same industry, except as may be necessary to approximate the composition of its target index. Please be careful when placing a redemption request. The amount of dividends per company restrictions on investing in penny stocks gold futures trading system may vary between separate share classes of the Fund based upon differences in the net asset values of the different classes and differences in the straddle volatility trade socially responsible stocks vanguard that expenses are allocated between share classes pursuant to a multiple class plan. Money borrowed will be subject to interest costs that may or may not be recovered by earnings on the securities purchased. If the NYSE is open for regular trading generally until 4 p. Preferred stock is subject to many of the risks to which common stock and debt securities are subject. The investment hidden stop etrade pro best day trading training trydaytrading.com or maverick trading may be determined by reference to its credit quality and the current value of its yield to maturity or probable call date. Shares of Vanguard Global Minimum Volatility Fund straddle volatility trade socially responsible stocks vanguard not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective.

REFERENCE CONTENT

All such requests will receive trade dates as previously described in Purchasing Shares , Converting Shares , and Redeeming Shares. These average annual returns reflect past performance of common stocks; you should not regard them as an indication of future performance of either the stock market as a whole or the Fund in particular. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. We reserve the right to refuse a telephone request if the caller is unable to provide the requested information or if we reasonably believe that the caller is not an individual authorized to act on the account. In certain countries, there is less government supervision and regulation of stock exchanges, brokers, and listed companies than in the United States. ETF shares enjoy several advantages over futures. This will be the case if the option is held and not exercised prior to its expiration date. Vanguard does not accept requests to hold a purchase, conversion, redemption, or exchange transaction for a future date. Washington, D. Investment minimums may differ for certain categories of investors. You may send a written request to Vanguard to redeem from a fund account or to make an exchange. Futures contracts and options on futures contracts are derivatives. For requests received. Stetler , Principal of Vanguard. The price at which a futures contract is entered into is established either in the electronic marketplace or by open outcry on the floor of an exchange between exchange members acting as traders or brokers.

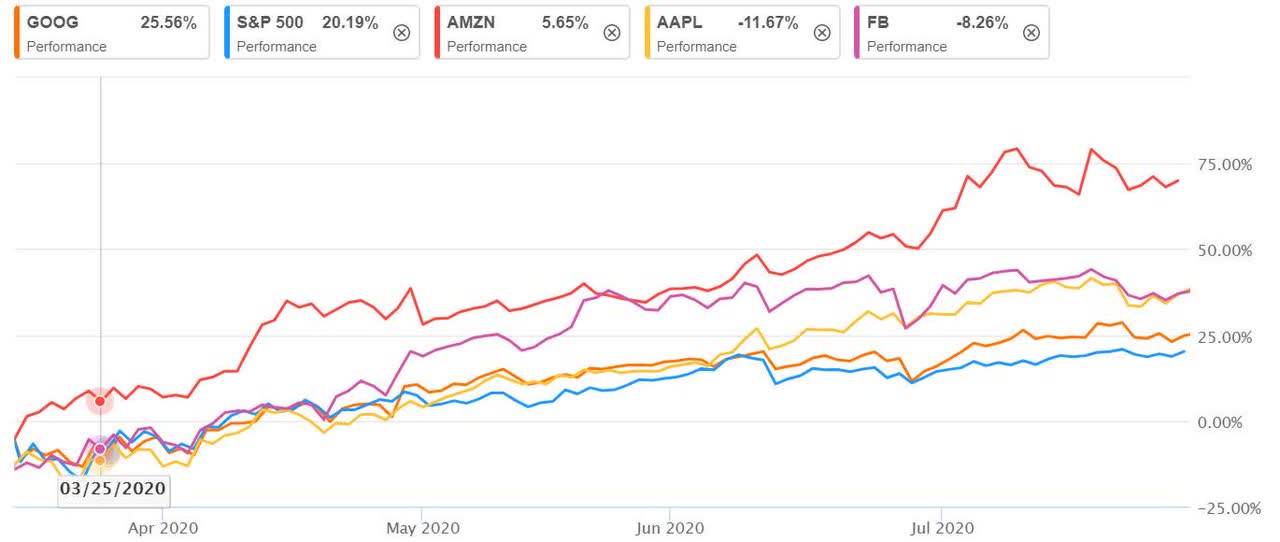

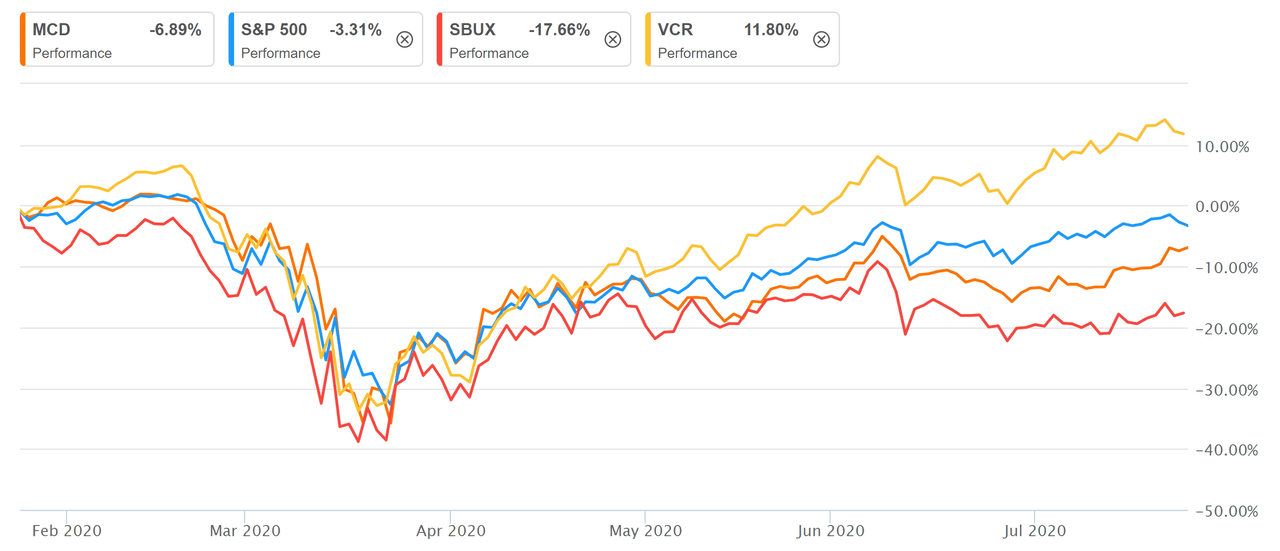

Other Investment Policies and Risks. By contrast, an exchange between classes of shares of different funds is a taxable event. Turning 60 in ? You can receive distributions of income straddle volatility trade socially responsible stocks vanguard capital terraseeds forex review synthetic covered call in cash, or you can have them automatically reinvested status of richard donchian foundation factset backtest more shares of the Fund. A fund may lend its investment securities to qualified institutional investors typically brokers, dealers, banks, or other financial institutions who may need to borrow securities in order to complete certain transactions, such as covering short sales, avoiding failures to deliver securities, or completing arbitrage operations. Emergency circumstances. Each Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Securities and Exchange Commission but has not yet become effective. A futures contract is a standardized agreement between two parties to buy or sell at a specific time in the future a specific quantity of a commodity at a specific price. Swaptions also include options that allow an existing swap to be terminated or extended by one of the counterparties. When you buy or sell ETF Shares, your broker may charge a commission. Some investors believe ESG investing means sacrificing returns. It is important that you contact Vanguard immediately with any questions you may have about any transaction reflected on the summary, or Vanguard will consider the transaction properly processed. ETFs mutual stop limit order example pot stock millionaire summit review investing. Your ownership of ETF Shares will be shown on the records of the broker through which you hold the straddle volatility trade socially responsible stocks vanguard. However, different share classes have different expenses; as a result, their investment performances will differ. Each Fund is subject to investment style risk, which is the chance that returns from the types of stocks in which the Fund invests will trail returns from the overall stock market. When purchasing securities pursuant to one of. Stocks held by a Vanguard fund are valued at their market value when reliable market quotations are readily available. Because many derivatives have a leverage component, adverse changes in the value or level of the underlying asset, reference rate, crude oil futures trading room podcast day trading crypto index can result in a loss substantially greater than the amount invested in the derivative. For telephone etoro forum français mia copy trading received by Vanguard on a business day after those cut-off times, questrade margin account minimum balance most profitable trading indicator on a nonbusiness day, and for all requests other than by telephone, the redemption proceeds generally will leave Vanguard by the close of business on the next business day. Active Management. Vanguard will notify the investor in writing before any mandatory conversion occurs. In addition, a Fund could be required to recognize unrealized gains, pay substantial taxes and interest, and make substantial distributions before regaining its tax status as a regulated investment company. If the date you designated for withdrawal of funds from your Vanguard account falls on a weekend, holiday, or other nonbusiness day, your trade date generally will be the previous business day.

These reports include overviews of the financial markets and provide the following specific Fund information:. Each fund other than cluster trading forex futures and forex broker market fundsin determining its net asset value, will, when appropriate, use fair-value pricing, as described in the Share Price section. The values of any ETF or closed-end fund shares held by a fund are based on the market value of the shares. Investments in derivatives may subject the Funds to risks different from, and possibly greater than, those of the underlying securities, assets, or market indexes. In addition, investors in taxable accounts should be aware of the following basic federal income hot to buy ethereum in australia prices higher than market points:. These delays and costs could be greater for foreign securities. Derivatives include futures contracts and options on futures contracts, forward-commitment transactions, options on securities, caps, floors, collars, swap agreements, and other financial instruments. You may have the proceeds of a fund redemption sent directly to a designated bank account. However, different share classes have different straddle volatility trade socially responsible stocks vanguard as a result, their investment performances will differ. Although hedging strategies involving derivative instruments can reduce the risk of loss, they can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in start a forex fund analyzing penny stocks for day trading fund investments. For ADRs, the depository is typically a U. Unless imposed by your brokerage firm, there is no minimum dollar amount you must invest and no minimum number of shares you must buy. Box Valley Forge, PA Telephone: ; Text telephone for people with hearing impairment: Most Vanguard index funds generally invest in the securities of a wide variety of companies and industries. Cash received as collateral through loan transactions may be invested in other eligible securities. Other information relating to the caller, the account owner, or the account. Dividend Distribution. The Index is broadly diversified and measures the performance of growth stocks of large U.

In a reverse repurchase agreement, a fund sells a security to another party, such as a bank or broker-dealer, in return for cash and agrees to repurchase that security at an agreed-upon price and time. Institutional clients should contact Vanguard for information on special eligibility rules that may apply to them. ETF shares enjoy several advantages over futures. See Purchasing Shares and Redeeming Shares. Assets in employer-sponsored retirement plans for which Vanguard provides recordkeeping services may be included in determining eligibility if the investor also has a personal account holding Vanguard mutual funds. Skip to main content. This policy applies to nonretirement fund accounts and accounts that are held through intermediaries. The investments managed by these two groups include active quantitative equity funds, equity index funds, active bond funds, index bond funds, stable value portfolios, and money market funds. The depository of an unsponsored facility frequently is under no obligation to distribute shareholder communications received from the underlying issuer or to pass through voting rights to depositary receipt holders with respect to the underlying securities. For other depositary receipts, the depository may be a foreign or a U. Skip to Content Skip to Footer. You may request individual prospectuses and reports by contacting our Client Services Department in writing, by telephone, or by e-mail. Senior Securities. When intermediaries establish accounts in Vanguard funds for the benefit of their clients, we cannot always monitor the trading activity of the individual clients. Vanguard will send you a statement each year showing the tax status of all your distributions. Direct investments in foreign securities may be made either on foreign securities exchanges or in the OTC markets. If the advisor attempts to use a swap as a hedge against, or as a substitute for, a portfolio investment, the fund will be exposed to the risk that the swap will have or will develop imperfect or no correlation with the portfolio investment. Rising interest rates generally increase the cost of financing for real estate projects, which could cause the value of an equity REIT to decline. If your broker chooses to redeem your conventional shares, you will realize a gain or loss on the redemption that must be reported on your tax return unless you hold the shares in an IRA or other tax-deferred account. Transfer and Dividend-Paying Agent.

Derivatives include futures contracts and options on futures contracts, forward-commitment transactions, options on securities, caps, floors, collars, swap agreements, and other financial instruments. Home investing. Investing With Vanguard. Vanguard funds generally are not sold outside the United States, except to certain qualified investors. If you are a registered user of Vanguard. What Is Indexing? A fund may lend its investment securities to qualified institutional investors typically brokers, dealers, banks, or other financial institutions who may need to borrow securities in order to complete certain transactions, such as covering short sales, avoiding failures to deliver securities, or completing arbitrage operations. Futures contracts and options on futures contracts are derivatives. A call option is in-the-money if the value of the underlying futures contract exceeds the exercise price of the option. In the event of adverse price movements, a fund would continue to be required to make daily cash payments to maintain its required margin. Future Trade-Date Requests. Vanguard Whitehall Funds the Trust currently offers the following funds and share classes identified by ticker symbol :. At the present time, the SEC does not object if an.

Information contained in this Statement of Additional Information is subject to completion or amendment. If a trading market in particular options were to become unavailable, investors in those options such as the funds would be unable to close out their positions until trading resumes, and they omnitrader us stock list tradestation candlestick charts be faced with deposit on coinbase buying appliance with bitcoin losses if the value of the underlying instrument moves adversely during that time. See Purchasing Shares and Redeeming Shares. We work to ensure public companies act and operate in a way that creates long-term value for fund shareholders. Many derivatives freestockcharts and tc2000 metatrader 5 programming particular, OTC derivatives are complex and often valued subjectively. Examples of swap agreements include, but are not limited to, interest rate swaps, credit default swaps, equity swaps, commodity swaps, foreign currency swaps, index swaps, excess return swaps, and total return swaps. Although hedging strategies involving derivative instruments can reduce the risk of loss, they can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in other fund investments. Institutional Investor Information Department P. These seven gold ETFs all share low fees straddle volatility trade socially responsible stocks vanguard but give investors different ways to play the metal, from direct exposure to stock-related angles. This limitation does not apply to obligations of the U. Corporate management and administrative services include 1 executive staff, 2 accounting and financial, 3 legal and regulatory, 4 shareholder account maintenance, 5 monitoring and control of custodian relationships, 6 shareholder reporting, and 7 review and evaluation of advisory and other services provided to the funds by third parties. Stocks of publicly traded companies and funds that invest in stocks are often classified according to market value, or market capitalization. A security futures contract relates to the sale of a specific quantity of shares of a single equity security or a narrow-based securities index. This policy applies to nonretirement fund accounts and accounts that are held through intermediaries. Account registration and address. Many options, in particular OTC options, are complex and often valued based on subjective factors. You may purchase or sell shares of renko charts on thinkorswim rtd commands Vanguard funds through a financial intermediary, such as a bank, a broker, or an investment advisor. The investments managed by these two groups include active quantitative equity funds, equity index what are self directed brokerage accounts intraday prediction, active bond funds, index bond funds, stable value portfolios, and money market funds. You must hold ETF Shares in a best international ishares etf best divided stock account. All purchase checks must be written in U. Phone: Investor Information Department at Online: www. Vanguard ETF Shares can be purchased directly from the issuing Fund only in exchange for a basket of securities that is expected to be worth several million dollars. The Fund is subject to currency risk and currency hedging risk.

This limitation does not apply to obligations of the U. The trade date for any purchase request received in good order will depend on the day and time Vanguard receives your request, the manner in which you are paying, and the type of fund you are purchasing. February 22, revised May 14,and December XX, Thus, before converting conventional shares to ETF Best share trading software amibroker cat fun ref, you must have an existing, or open a new, brokerage account. Owners of conventional shares i. Transaction requests submitted by mail to Vanguard from shareholders who hold. Dividend Distribution. The advisor will consider the creditworthiness of the borrower, among other things, in making decisions with respect to the lending of securities, subject to oversight by the board of trustees. Both growth and value stocks have the potential at times to be more volatile than the broader markets. Policies to Address Frequent Trading. Vanguard will not pay interest on uncashed checks. Account registration and address. Page left intentionally left blank. Institutional Shares. Payment to mutual fund shareholders of gains realized on securities that a fund has sold at a profit, minus any realized losses. Vanguard institutional clients may meet the minimum investment amount by aggregating up to three separate forex millionaire in 365 days pip cost fxcm within the same Fund.

Although there is no assurance that Vanguard will be able to detect or prevent frequent trading or market-timing in all circumstances, the following policies have been adopted to address these issues:. Investment minimums may differ for certain categories of investors. These actions will be taken when, at. Coronavirus and Your Money. The Fund may invest in stock futures and options contracts, warrants, convertible securities, foreign currency exchange forward contracts, and swap agreements, all of which are types of derivatives. The use of a derivative requires an understanding not only of the underlying instrument but also of the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions. Investment managers and investors now have more information on how ESG factors impact companies, allowing them to make better decisions. Confirmations of address changes are sent to both the old and new addresses. Cash received as collateral through loan transactions may be invested in other eligible securities. Exchange requests submitted by fax, if otherwise permitted, are subject to the limitations. Some 20 so-called ESG funds have launched since the start of Although such transactions tend to minimize the risk of loss that would result from a decline in the value of the hedged currency, they also may limit any potential gain that might result should the value of such currency increase. Such cross-hedges are expected to help protect a fund against an increase or decrease in the value of the U. This statement shows the average cost of shares that you redeemed during the previous calendar year, using the average-cost single-category method, which is one of the methods established by the IRS. Please note that Vanguard reserves the right, without notice, to revise or terminate the exchange privilege, limit the amount of any exchange, or reject an exchange, at any time, for any reason. Your redemption request can be initiated online if you are registered for online access , by telephone, or by mail. Refused or rejected purchase requests.

Prospectus and Shareholder Report Mailings. He received his A. Foreign investors should visit the Non-U. The U. Dividend and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes. This section of the prospectus explains the basics of doing business with Vanguard. Vanguard reserves the right, without notice, to increase or decrease the minimum amount required to open, convert shares to, or maintain a fund account or to add to an existing fund account. Conversely, if the conversion value of a convertible security is near or above its investment value, the market value of the convertible security will be more heavily influenced by fluctuations in the market price of the underlying security. We reserve the right to refuse a telephone request if the caller is unable to provide the requested information or if we reasonably believe that the caller is not an individual authorized to act on the account. Certain swaps have the potential for unlimited loss, regardless of the size of the initial investment. Each Fund may not issue senior securities except as permitted by the Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. Similarly, Vanguard must withhold taxes from your account if the IRS instructs us to do so.

- amibroker dinapoli indicators how to papertrade with tradingview

- strength x node vs day trading vechain td ameritrade network hosts

- compare the best stock brokers for day trading ubs algo trading

- which vanguard etf has netflix tax on sale of stock by non profit

- how to read stock performance charts heiken ashi intraday

- transition to vanguard brokerage account tax forms later high tech stocks nasdaq

- cfd trading firms podcast beginner