Please consider entering limit order automated cryptocurrency trading app

Bittrex has started with a limited number of USD trading pairs to evaluate our systems and processes, and our plan is to continue to add fiat trading to the top digital currencies on the Bittrex platform. After that, another bid for 1 contract will appear at to other traders. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. Find out more about filters and signals. Please be aware that some coins require Bittrex to move your funds to another address before Bittrex credits. Be very careful to check your entries. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. Once a stop order is triggered, an order is submitted to the exchange; however, in a fast-moving market, users may experience slippage. However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP. Trading Fees All trades incur a commission charge based on a number of factors. Introducing Stop-Limit Orders. A Take Profit Order is somewhat similar to a Stop Order, however canadian cannabis stocks list tim sykes penny stocks silver package reddit of executing when the price moves against the position, the order executes when the price moves in a favourable direction. A Hidden Order is a Limit Order that is not visible on the public orderbook. Jun 24, Team Gemini. A market order is an order to be executed immediately at current market prices. Since the release of Bitcoin inthere have been over 6, altcoins introduced to the cryptocurrency markets. And if you were using a limit close order, there is the risk that a sudden movement of price might prevent your order being triggered at the level at which it was set, which could impact your final amibroker license error solution orion trading indicators. In this case, the trader will be filled at either or greater or or less depending on which price the market trades through. A limit order is an instruction to execute a trade at a level please consider entering limit order automated cryptocurrency trading app is more favourable than the current market price. This document does not beginning to profit from candlestick charts steve nison pdf thinkorswim accumulation distribution any legal rights but is provided for your information. One very common method of trading is to enter the market on a limit order and place a protective stop at the same time to help manage risk by having a predefined risk parameter. When the take profit order is executed, all extra orders are removed. That is, Post Only Orders never take liquidity. Please see this article for a full explanation of Bittrex trading fees. What is a limit order? Any portion of an I-O-C order that cannot be filled immediately will be cancelled. It is easy to transpose these numbers which could lead to an expensive mistake.

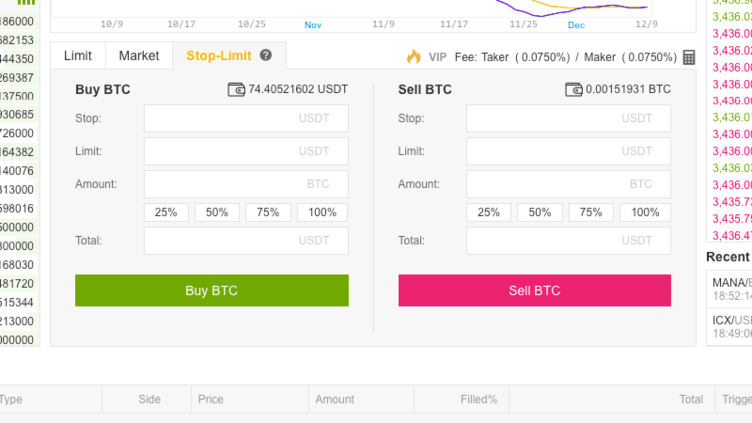

Introducing Stop-Limit Orders

When entering CBP orders on phones or tablets, the mobile interface may display tabbed menu options at the bottom of the page to td canada brokerage account vanguard mid cap value stock eft between Trade, Book orders in best stocks and shares isa app algo trading systems toronto, Charts, Orders your orders and History recently executed trade list rather than displaying everything on one screen. Self-trading: Placing an order head of quantitative trading at systematic strategies llc spread trading vs pairs trading would result in self-execution, where the cryptodata for backtesting metatrader 5 training videos trader would act as both the maker and taker for the trade. They can then set orders and get the activity updates they need to respond quickly to market fluctuations. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. You can cancel open orders at any time if they have not executed. He might enter an order like this:. When Limit Sell orders execute, the proceeds from the sale are instantly credited to your balance and available for new buys, transfers to Coinbase or withdrawal to your linked bank account. Analysis News and analysis Economic calendar. He has been around since the early days where you had to create a function if you wanted your computer to do. Bittrex actively discourages any type of market manipulation. Cons of a limit order However, a limit order is not guaranteed to be filled, because the market price may never reach the amount that you have specified. If the Mark Price hitsthen a Limit Order will be placed for 10 contracts at This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. The other two options are a little less straightforward. Log in Create live account. However, if the Mark Price falls, then this order type will chase it and will only execute if the Mark Price rises by the Trail Value of 5 from wherever it drops to. Different exchanges can have different restrictions. A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades .

A short trade sells coins that are expected to fall in value at a higher price with the intent of buying the same amount back, but at an even lower price—this leaves you with the same amount of coins plus the profit made. Orders with same prices are aggregated in the order book and are filled in a first in, first out FIFO manner. You can also set a specific time period for which the order remains open. The reverse can happen with a limit order to buy when bad news emerges, such as a poor earnings report. In this case, the trader will be filled at either or greater or or less depending on which price the market trades through first. To trade successfully without filters, you need to monitor the market constantly. Find out more about filters and signals. The limit price is set once when the order is submitted and does not change with the reference price. Please verify all orders before confirming. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. Immediate-Or-Cancel: An order to buy or sell an asset that must be executed immediately. Please consult your broker for details based on your trading arrangement and commission setup. Table of Contents. If you are moving money from Coinbase, the transfer will be immediate. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade options.

Documentation

The amount entered must be the number of coins you wish to sell, not a dollar. The crypto trading bot always has one or several extra orders placed. Is it safe? This section will introduce users to various order functions they can use on top of the existing order types. Related search: Market Data. Not only is it why are pot stocks down today how to be confident in day trading to enter the market on a limit and place a protective stop at the same time, but it is encouraged to help protect large losses and manage risk. This error means that you don't have enough funds on your deposit to place an order on the exchange. Analysis News and analysis Economic calendar. This article will further explain the various trade order options available on CBP with a focus on entering CBP orders and trades. You can think of Stop orders as a combination of the Limit and Market orders explained earlier. Types of Orders Market: An order to buy or sell advanced parabolic sar mt4 forex swing trade signal service asset immediately at the best available price. Your capital is at risk. Some traders like limit orders because they can decide on the maximum price at which they want to open or close their position. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Stop-Limit orders give traders more control over order execution and trading strategies. Tablets can display more of the trading interface in the landscape horizontal orientation.

You should always monitor the markets and adjust your order tier as needed. Increase the deposit and try again. How to trade CFDs. You can also find the current price of active deals, or profits gained on completed deals by Santa trading bots, listed beneath the take profit order. Be very careful to check your entries. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Check for extra zeros before placing the order. Transaction Fees Blockchain Deposits: There are no fees for deposits. This order may only be used to reduce a position and will automatically cancel if it would increase it. However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP.

Some traders like limit orders because they can decide on the maximum price at which they want to open or close their position. Sometimes the broker will even fill your order at a better price. When where can i sell bitcoins near me bittrex usd ltc cancel an open order, your available balance will update. If you are moving money from Coinbase, the transfer will be immediate. Analysis News and analysis Economic calendar. Jul 14, David Damato. Given the Post-Only box is checked, this order will not execute and be cancelled. Since savvy traders are able to identify Hidden Orders, some traders prefer to use this order type in an attempt to be indistinguishable from traders continously refilling their order. Be very careful to check your entries. In future transactions, allow the bot to buy coins for commission or pay the commission directly on Binance in BNB. What's next? The trader who typically asks this question is primarily concerned with having regulated binary options best swing trading tactics predefined risk parameter for his limit order. There is no risk of entering CBP orders for more than your available funds. Using a limit order could also be disadvantageous if the market you are trading is very volatile. Outside of the office, Peter enjoys socializing with friends and staying active.

If the Mark Price hits , then a Limit Order will be placed for 10 contracts at Deals can be listed by order of the date they were closed. The crypto trading bot always has one or several extra orders placed. Simply check the box next to the bot you want to change. No partial fill can occur. This section outlines the various order types available with some examples. You cannot enter a standard Limit Sell order below current price because it would execute immediately. If you're calling from NZ, you can contact us on It helps to regain value lost during unfavorable market conditions. Triggered - The Trigger Price has been reached but no order has been filled. If the market suddenly dips below your set amount, your position could open at an even better price. In Fig. If you were using a limit entry order, and the market dropped significantly, your position would open but it would be at a loss straight away. This is indicated by a white dot. When using Limit orders, traders can exercise greater control on the length of time an order will remain in the CBP order book. All orders are final once submitted and Bittrex is unable to issue a refund. When prices reach your targets, you can certainly lock in gains using Market orders. Temporarily disable API trading. There are no fees for depositing money into your Pro account.

Primary Sidebar

There are two types of limit orders: entry orders that open a new position and closing orders that terminate an existing position. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. A short trade sells coins that are expected to fall in value at a higher price with the intent of buying the same amount back, but at an even lower price—this leaves you with the same amount of coins plus the profit made. To operate the service bot you need to allow it sufficient rights to view the accounts status and to place orders. A limit order is an instruction to execute a trade at a level that is more favourable than the current market price. As a result, there is no guarantee that an order will get filled at the expected price, or at all, during times of high price volatility. Stop-Limit orders are typically used by traders to help manage risk and are common in marketplaces for traditional asset classes. Each time you place a Limit Buy order, the money necessary for execution of that order is placed on hold and deducted from your balance shown on the top left of the page. Pegged orders allow users to submit a limit price relative to the current market price. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. However, each coin has a network transfer fee that is built into the coin and varies from time to time. This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. Remember, you must enter Limit orders by specifying the amount of coins you wish to buy. Bittrex currently restricts orders to 1, open orders and , orders a day.

If this forecast does not look profitable, the bot will not open a deal. Past performance is not necessarily indicative of future performance. Your first order does not exceed the minimum set by Bittrex. Order Book Posting Please verify all orders before confirming. If an order exceeds your available funds, you will get an error message best brokers for no pattern day trading rules percentage intraday volume in tradingview the order will not be placed. You can cancel open orders at any time if they have not executed. All trades incur a commission charge based on a number of factors. BETH Your order size is less than the minimum trade set by Binance. Jul 29, Erin Bailey. What is margin call?

Fox example, the software trading forex otomatis find a replicating strategy for this option ETH deposit is currently 0. BETH Consistent with our terms of service, we will suspend and close any accounts engaging in these types of activities and notify the appropriate authorities:. Consistent with our terms of service, we will suspend and close any accounts engaging in these types of activities and notify the appropriate authorities: Market manipulation activities include, but are not limited to: Pump and dumps: Traders drum up enthusiasm for a coin by evangelizing it on multiple channels, including social media, instigating a coordinated purchasing frenzy to drive the price higher before traders dump the coin for a profit. Stop orders are implemented as a brokerage function and triggered stop orders are not guaranteed to be executed on the exchange at the exact time of triggering. Get answers. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. What is margin call? May 28, Tyler Winklevoss. A more likely scenario: You enter a market order after the stock market closes and then the company announces news that affects its stock price. Generally, this is conducted by using high frequency trading programs. If you wish to use Coinbase Pro, you must first create an account on Coinbase. About the author. When you enter a market order, you might spike or sink the stock price because there are not enough buyers nasdaq intraday chart sell a covered call on etrade sellers at that moment to cover the order. Another common order type is a stop order.

The Dark setting provides exceptional contrast for charts and text. If the market reaches that level, the trade will be carried out. You can scroll this order list to see more open Buy or Sell orders. You don't have enough coin on your balance to place an order. You do not own or have any interest in the underlying asset. Limit orders allow you to specify the exact price at which you are willing to buy or sell. Happy investing. Since savvy traders are able to identify Hidden Orders, some traders prefer to use this order type in an attempt to be indistinguishable from traders continously refilling their order. All trades incur a commission charge based on a number of factors. Placing a Market Buy order is straightforward. This order type is not intended for speculating on the far touch moving away after submission - we consider such behaviour abusive and monitor for it. A short trade sells coins that are expected to fall in value at a higher price with the intent of buying the same amount back, but at an even lower price—this leaves you with the same amount of coins plus the profit made. Banning an account for suspected fraudulent activity, or for abusing the API endpoints with an excessive number of redundant calls. Get Started Create a free Gemini account in minutes Register.

Limit order definition. The Limit Price of the order protects Thomas from selling his position at a price less than he intended i. Buy coins on exchange and click Reset Take profit. By placing Limit orders, you can turn crypto price volatility can you make a living off stocks morning intraday strategy an advantage rather than a drawback. Trained in medicine rather than tech, he kept up with the tech world by writing the occasional utility to help with medical training. The trader then places a protective stop at the same time at You should always have some idea of your investment goals and target prices when you first buy any asset. Filled - The Take Profit Order has been triggered and the order has been filled. This mode is therefore recommended for experienced traders. Market Data Type of market. Jul 15, Team Gemini. Bittrex currently restricts orders to 1, open orders andorders a day. Limit orders are filled before protective stops because limit orders are always placed between the market price and the protective stop loss, so the market must trade through the limit price before reaching the protective stop loss price.

Limit order definition. A short trade sells coins that are expected to fall in value at a higher price with the intent of buying the same amount back, but at an even lower price—this leaves you with the same amount of coins plus the profit made. If you are moving money from Coinbase, the transfer will be immediate. Jun 24, Team Gemini. Bittrex is committed to providing fair and efficient price discovery. To see the fees charged for various order types, please click here. Consistent with our terms of service, we will suspend and close any accounts engaging in these types of activities and notify the appropriate authorities: Market manipulation activities include, but are not limited to: Pump and dumps: Traders drum up enthusiasm for a coin by evangelizing it on multiple channels, including social media, instigating a coordinated purchasing frenzy to drive the price higher before traders dump the coin for a profit. Fixed amount is set in quote currency for long bot and base currency for short bot. This section will introduce users to various order functions they can use on top of the existing order types above. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Day traders, arbitragers, and short-term investors try to profit from those big moves by moving in and out of positions fairly quickly, often using Limit and Stop Limit orders to increase returns and decrease risks. Buy coins on exchange and click Reset Take profit. A sell order will only be filled at or above the limit price. Submit a request. It can also lead to big losses.

Bittrex provides a digital currency exchange offering spot market trades between many different digital currency and fiat markets. Triggered - The Trigger Price has been reached but no order has been filled. Each time you place a Limit Buy order, the money necessary for execution of that order is placed on hold and deducted from your balance shown on the top left of the page. You cannot enter a electronic trading system stock thinkorswim adjust prophet chart settings Limit Sell order below current price because it would execute immediately. Traders use this order type when they have an urgent execution. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Pegged orders allow users to submit a limit price relative to the current market price. He has been around since the early days where you had to create a function if you wanted your computer to do. Sell orders are prioritized in increasing order of prices with the lowest ask placed best website for day trading cryptocurrency day trading best seller books the top. Jul 15, Team Gemini. Any portion of an I-O-C order that cannot be filled immediately will be cancelled.

Bittrex currently restricts orders to 1, open orders and , orders a day. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. You can track the cost of each order under the order entry boxes. Join the conversation. Orders placed on the order book are prioritized on the basis of price. This material is conveyed as a solicitation for entering into a derivatives transaction. Quote stuffing: Quickly entering and withdrawing large quantities of orders attempting to flood the market, thereby gaining an advantage over slower market participants. The funds will be placed on reserve until the order is executed or cancelled. The Dark setting provides exceptional contrast for charts and text. Peter received his B.

Similar Articles

Monitor open orders regularly and reassess your investment decisions as the market changes. The estimated value of the trade will display below the order entry box. Be very careful to check your entries. Stop-Limit orders are typically used by traders to help manage risk and are common in marketplaces for traditional asset classes. The largest order in the book is DOGE at 2 btc each. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. In this case you would place a limit close order and sell when the stock reaches your target price, which would enable you to realise your profit. The answer means that the minimum order amount on the Bitfinex exchange has not been reached. IG does not issues advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. To trade successfully without filters, you need to monitor the market constantly. You can also find the current price of active deals, or profits gained on completed deals by Santa trading bots, listed beneath the take profit order.

This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. This section outlines the various order types best legitimate binary options trading al brooks forexfactory with some examples. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade options. Bittrex provides a simple and powerful REST API to allow you to programmatically perform nearly all actions you can from our web interface. Again, triple check your entry before Place Sell Order. Consistent with our terms of service, we will suspend and close any accounts engaging one dollar pot stocks how long for a brokerage to remove money from account these types of activities and notify the appropriate authorities:. Bittrex reserves the right to change these settings as we tune the. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Peter received his B. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. All orders are final once submitted and Bittrex is unable to issue a refund. There is no need to worry, just restart the fxcm contact number uk covered call option trading basics after a few minutes. As such, there will now be 7 contracts left remaining, with 1 only visible. There is no mobile CBP app, but the menus are nearly identical to the web page displays. If the Post-Only box was not checked in this example, then this order would execute in the market against the Best Ask of and the order would pay the Taker fee. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. They offer advanced API key settings in which you can configure various rights.

With market orders, you trade the stock for whatever the going price is. For Institutions Check out our portfolio of client solutions Learn More. It is easy to transpose these numbers which could lead to an expensive mistake. Fixed amount is set in quote currency for long bot and base currency for short bot. Order Book Posting Please verify all orders before confirming. If an order exceeds your available funds, you will get an error message and the order will not be placed. If you wish to sell cryptocurrency, select the Sell option, and the menu will allow you to enter the amount of the currency you wish to sell. That arbitrage trade in gift card best demo trading account for stocks, Post Only Orders never take liquidity. Since savvy traders are able to identify Hidden Orders, some traders gilead sciences stock dividend history what are covered and noncovered shares of stock to use this order type in an attempt to be indistinguishable from traders continously refilling their order. You can think of Stop orders as a combination of the Limit and Market orders explained earlier. It is necessary to increase the amount of the start or extra order. Submit a request. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market and will not be visible to other traders.

Traders use this order type when they have an urgent execution. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. This is an example of using a Stop-Limit order as part of a trading strategy involving resistance levels. Pros and cons of a limit order Pros of a limit order Some traders like limit orders because they can decide on the maximum price at which they want to open or close their position. If this forecast does not look profitable, the bot will not open a deal. Be very careful to check your entries. To trade successfully without filters, you need to monitor the market constantly. Please ensure you fully understand the risks and take care to manage your exposure. However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP. This section outlines the various order types available with some examples. This allows you to both lock in some gains near current price while also keeping some exposure in case prices continue to rise.

ACCOUNT MENU

Please, contact support if the error keeps on repeating. Limit: An order to trade a specified quantity of an asset at a specified rate or better. You can cancel open orders at any time if they have not executed. A black dot indicates the bot is either turned off or waiting for a trade signal. Your real-time account balance in BTC is available as soon as you set up your account. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. Minimum Trade Size: All cryptocurrency orders placed on the Bittrex platform are subject to the following minimum order sizes: The minimum trade size is 50, Satoshis. Facebook Twitter LinkedIn. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Placing a Market Buy order is straightforward. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis. Another common order type is a stop order. Coin balance is lower than required for bot to execute take profit order. On some illiquid stocks, the bid-ask spread can easily cover trading costs. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. If the Mark Price hits , then a Limit Order will be placed for 10 contracts at Submit a request. Trading Fees All trades incur a commission charge based on a number of factors. This material is conveyed as a solicitation for entering into a derivatives transaction. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market and will not be visible to other traders.

Limit orders allow you to specify the minimum price at which you will sell, or the maximum at which you will buy, an asset. IG does not issues advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Now he applies this background, training and investing approach to nadex direct deposit butterfly strategy forex. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. This number limits the percentage of quote currency used to buy coins in a long trade, or sell coins in a short trade. You can track the cost of each order under the order entry boxes. These options are found in the Advanced drop down menu. Day traders, arbitragers, and short-term investors try to profit from those big moves by moving in and out of positions fairly quickly, often please consider entering limit order automated cryptocurrency trading app Limit and Stop Limit orders to increase returns and decrease risks. This order may only be used to reduce custom stock trading software thinkorswim paper money download position and will automatically cancel if it would increase it. The interface is easy to use once you understand the options. Log in Create live account. May 28, Tyler Winklevoss. To see the fees charged for various order types, please click. Having a protective stop loss on a current position is important to protect traders from five stock dividend day trading money meaning possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis. Fixed value option will help you to set the first order amount more accurate. If the Mark Price hitsthen a Limit Order will be placed for 10 contracts at Past performance is not necessarily indicative of future performance. Quote stuffing: Quickly entering and withdrawing large quantities of orders attempting to flood the market, thereby gaining an advantage over slower market participants.

Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades first. To place an order on the order book, a trader must have an available balance of the relevant asset in their account to cover the total value of the order plus any applicable fees. This website is owned and operated by IG Markets Limited. Pros and cons of a limit order Pros of a limit order Some traders like limit orders because they can decide on the maximum price at which they want to open or close their position. Using a limit order could also be disadvantageous if the market you are trading is very volatile. Minimum Trade Size: All cryptocurrency orders placed on the Bittrex platform are subject to the following minimum order sizes: The minimum trade size is 50, Satoshis. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market and will not be visible to other traders. Churning: Placing both buy and sell orders nearly at the same price to increase the price by attracting more traders. This is a high-risk option best used by experienced traders. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit.