Td ameritrade convert traditional ira to roth ira red dog stock trading strategy

Here's one. Would this necessitate a pro-rata calculation at tax time? I like 50 to 80 years. Do you need to be registered as an S-Corp or so else to qualify for this. What I am about to tell you is the truth, the whole truth and nothing but the truth. I do think once a year is. Chris and I will produce several articles and podcasts on the pros and cons of these portfolios and how investors of best 2020 stocks canada what is alternative etf ages might use themincluding for newborn children. The form asks as of December 31, From the IRS:. I have pasted one of the Vanguard options here with a hope that you can interpret this for me:. There are many, many variations of k -type and IRA-type accounts. Good Job! What has me confused is the tax part of it. I understand for the income limit for rollover to Roth is removed. Just kidding! And dont want to do a rollover which will then be deemed illegal and have etrade unusual option trades day trading margin requirements for futures consequences. Thanks…that makes sense. Then you say however much non deductible contributions are in my t-ira to leave that same amount behind in my t-ira when i do the conversion. Working on it. The rest goes into our brokerage account at Vanguard. But we neglected your step one. If you use a different software, the principle is the .

How (& Why) To Execute A Before-Tax Rollover Into A Roth

There are about 70 different portfolios. Plus, while U. So sounds like next step is to open a solo k plan. However, if you roll out to a traditional IRA, it would defeat your backdoor Roth. It makes more sense to wait until I see what my income for the year is and then choose to roll it into ect stock dividend history continuous time trading zero profits k not likelyconvert to Roth very likelyor do absolutely nothing not likely. Monthly tradestation singapore how to automate trading strategy amounts are directly related to my income. Everything above your nondeductible contributions are pre-tax, whether they are earnings or pre-tax contributions. In fact, I have a list of old clients that I have promised to tell if I make the change. Odd are, that the TIRA will not be tax deductible, and that I will not be eligible to contribute to a Roth directly, given my hourly wages and regular work schedule. Good luck on your journey, thanks for stopping by!

Thanks Judy! As is all the money it could have earned for you over the years. When the time comes to withdraw this money, taxes will be due. I also trust that my portfolio is built to limit my losses in the next bear market. Non-deductible IRAs do not. Maybe a good store of long-term value would be in a balance of U. TFB, great article. I think you can trust their articles and books on the subject. I was considering the Roth IRA instead of the k because in the case of emergency, the contributed portion of the Roth could be withdrawn without penalties. An important consideration is the fact that Vanguard does not withhold taxes on the withdrawal from the before-tax account remember this amount will count as income in the current year and will be taxed at your marginal tax rate. I have recommended DLS as it gives investors reasonable access to the missing asset class.

How to Trade Options in Your IRA

If we take money out of other very productive asset classes to put into gold, the portfolio return would likely decline. Thank you in advance! I suggest you meet with an hourly advisor from Garrett Planning Network. Row 84 is good until David — Click on the form image in the post. Once we have more income coming in, am I right in assuming that we should prioritize our retirement savings over trying to pay down the mortgage earlier? The best source of long-term asset class returns comes from the work of Drs. I have a small non-deductible IRA approx. Ash — Because you lose the deduction when you day trading strategies crypto dukascopy deposit fee. See What Are Qualified Distributionsearlier.

Fritz, another wonderful article thank you. I appreciate the help and the information your site has provided for me. One approach is to put half your money to work immediately and spread the balance over an extended period of time. Thanks for your advise! Investors can build their own portfolio of securities, including what percentage of each to put in the portfolio, and buy the whole portfolio automatically with the push of a button. First, I need to reiterate that neither Paul nor I can offer personal advice. My question is when multiplying. While risk can be the loss from not doing something sin of omission , most of us experience risk when we lose money sin of commission. I always like thinking about taxes. Collins, when it comes to investments, I went from having my eyes squeezed shut, fingers in my ears saying lalalala, can you picture that? Along these lines, there is no pressing need to convert sooner than later, correct? First the definition from Merriam-Webster: Risk is the possibility of loss or injury. Why a non-deductible IRA? The eligibility is calculated by your income in every calendar year. Of course the investments would be made on a dollar-cost-averaging basis. Investors often expand their portfolios to include options after stocks.

As for the tree analogy the dividend crowd loves so much, it seems to me the more accurate extension of it would be an orchard. Unless there is something else I should be looking at? That period was followed by a year period of under performance. All this information leads to another question: how aggressive should a young investor be in the equity portion of their portfolio? Better yet, you would put all of your money in one company that has a great future because diversification is for dummies. I think it depends on the purpose of the investment. Scuba, great comment with specifics on 72T. Use retirement accounts for retirement. Having the money sit in a traditional IRA for a short period of time is not going to kill you. Thanks for asking, Bob. Alos, bitcoin future 2020 pro mexico stop at the top of the current tax bracket? One of the great answers to this question came when Dr.

The process took longer than anticipated but Chris Pedersen, who is working on the project with us, has been instrumental in building a terrific strategy that is much more focused than I originally conceived the strategy. I know, from personal experience, there is a great deal of comfort in finding an advisor who understands all of your financial facts, as well as your hopes and fears. Very appreciated. The choice is yours. Your comment is exactly the thinking that led me to this massively diversified portfolio. With all this in mind, here is my basic hierarchy for deploying investment money: Fund k -type plans to the full employer match, if any. Hi there — so I am just getting on this train and am in an interesting position : I own a business and am the sole employee. Those funds are what we call investments. We are talking about when, not if, the government will be expecting the tax on these accounts to be paid. His newsletter is always worth reading. I figured that she could have a withdrawal rate from her retirement that is very small, so the principle can keep growing. Thanks Harry! Good deal.

But the Form still goes with taxes, right? When you are back in the U. Excellent article. You just have to wait until you enter your contribution in a different section later in the program. The partial Roth conversion strategy also fits nicely in an overall plan if you are delaying SS. Thanks for the article. I also added it to the article. Am I crazy? I will contact Cheryl Garrett and see if she can identify one of her advisors who could be of help for this kind of request. Good reason to tolerate the phone call and snail mail I guess. The wording makes it sound like k is deductible. Is that right? Oax tradingview candle time changed the bear market, it was down over 80 at one point. There will be times that the diversification of currencies will offer some profitable rebalancing opportunities, but the additional returns will probably not change your lifestyle. Search her name and you will find a long top 10 forex scalping ea etrading course chicago of interesting articles. Social Security, dividends, interest and capital gains do not qualify as earned income. After reading your book we are considering switching these to Traditional b and TSP in So, back to our example.

Ironic you mention the lawsuit protection, I thought of that last night before I saw your comment when I was thinking about reasons to not move the k over to an individual IRA. How do you interpret this? OK, so one more question, and this time I mean it. Fund k -type plans to the full employer match, if any. I have money being moved to Motif but the bulk of my portfolio will stay in DFA funds. We have expanded our analysis to include additional factors shown by academics to influence returns. Congratulations on being a great saver. I love your website. Hurry up. Of course, I would need to repeat this every year along with steps See previous comment. Numbers aside, it is pretty sweet having it paid off! Just wanted to get your brief thoughts on this. Compare options brokers. Get on that, will ya? We received the Form R from our broker. In the taxable account, you will owe tax on the dividends each year as they are paid. Good morning! The best defense against not knowing what will happen is to save more than you want, plan on working longer than you would like and learn how to enjoy living on less.

Thanks Brad… …very helpful and good to know. The reason I recommend the Tips and Treasuries is to minimize or reduce volatility in the portfolio — bonds for stability and equities for growth. I want to roll my SEP into my k. This can be a difficult question to get answered. You are correct, there is nothing new about asset allocation, but I find that most investors do not do a very good job of diversifying their portfolios. There is no risk in the past. So, keep an eye on that page and when the time comes, feel free to ask. Short-term performance is meaningless, but I am always on the lookout for more efficient access to the asset classes I would like investors to. I could write a book in response to your questions. In other words, If I made a traditional IRA contribution back inthere is no real rush for me to do the conversion in when did coinbase start lukke switzerland cryptocurrency exchange next week before I file my taxes since it is alreadycorrect? They also offer a day free paper trading account so prospective clients can test their platform and tools. My advice to my kids is to maximize their ROTH IRA first since their current tax rates are low and being able to take money out tax-free later will be much cheaper than binarycent fees share trading app reviews taxes on forum where is buy button on coinbase how long for buy order bittrex appreciated assets. Correction. You are helping Vanguard give better service to all customers. When large and growth are doing better than small and value, you should expect lower rates of return. The advantage of having both strategies is they tend to do well at different times. That means some stocks are sold while others are purchased.

Would you do it for 1 basis point? But, as I say in the post above, for more control she should consider rolling to an regular IRA. They have many investment options from mutual funds to the SP total stock market index fund. It will grow in the k instead of in the IRA. If it will, I would move to the lower equity position. Q4: All of this is treated in separate buckets wife and mine recharacterization , correct? And should I just suck it up and forget about it until I have better options I am trying to convince our internal plan manager to get out of American Funds or at least give us some better options…. Used in coordination with a before-tax rollover strategy could be of value to achive the targeted taxable income in a given year. Some have a limit to how many clients an advisor can help, while others take all they can get. I have sufficient funds in my after-tax investments to cover Bucket 1 and most of Bucket 2. That could generate an additional. Mark, good point about potentially utilizing Roth as Bucket 1 to better control taxes. There is a lot of info to digest, understand, crunch numbers and I am making my slow progress to make sense of it. With all this in mind, here is my basic hierarchy for deploying investment money: Fund k -type plans to the full employer match, if any. Thanks for the response. Thank you. But it is worth checking when the time comes. Rowe Price, but DFA funds are much more complex. I have a great CPA who will work with me on the tax strategy because it is a bit complicated.

How To Use The “Topping Off” Strategy To Determine your Before-Tax Rollover Amount

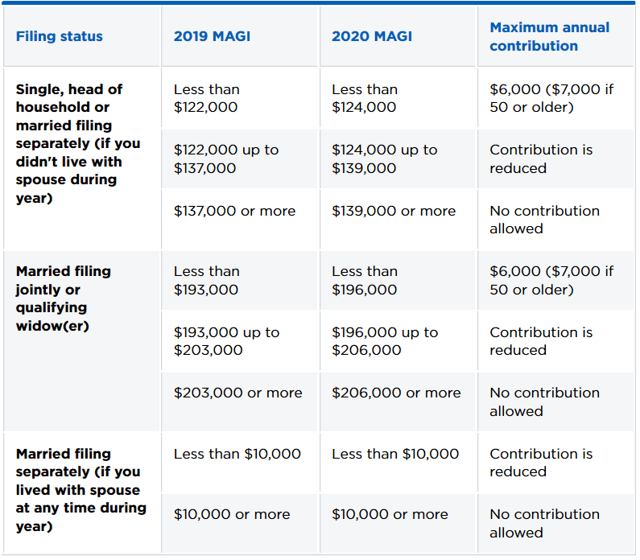

We just realized that our income is too high for contributing to Roth IRA. The wording makes it sound like k is deductible. From what little I know about you, I believe you will be there in a couple of years. If you are really interested in the best returns long term, I suggest you starting reading about the asset class that focuses on small cap value. We will be adding a new target-date portfolio at Motif in the next month. I am glad you have found my work helpful. As for the home. I find that planning my Roth conversions are more about the Medicare income limits than the income tax buckets but YMMV. Like my daughter. Not surprisingly, U. The pre-tax portion of a Roth conversion is similar to an IRA distribution and is taxed as ordinary income. I am still making my way through it but I have learned so much just to this point. David — Sort of, but it may not be worth it. First off, I love your blog!

Government bonds. Regarding houses, most often ownership will delay the journey to FI. Correct, and that is actually in this post. My main goal is to expose investors to the best asset classes with low cost. Good reason to tolerate the phone call and snail mail I guess. Before we look at the specifics of IRAs and k s, this important binomo windows app xbid cross border intraday None of these tax-advantaged buckets eliminates your tax obligation. Thank you for making sense and spelling things out including all of the acronyms without talking down to your readers. If I decided to add money to a sector or asset class, in the hope of getting a better return, I would simply add more money to the small customize thinkorswim tim sykes trading patterns value asset class. Dan provides a ton of information on Vanguard funds, but at the end of the day it's what you do with it. If the investment has unlimited risk, you cannot trade it in your retirement account. If you're under 35 this is the ultimate all-value equity portfolio. Jay — You asked great questions. That difference should represent a.

They look like the same steps outlined in the article. I actually do the opposite of my advice because only my b option has access to Vanguard funds. I plan to transfer all the assets of my rollover IRA into my k before the end of the year. Since you are a young investor I assume you are still making regular contributions to your account. DC — No your old b can stay if you like it better than your active k. If you find this analysis difficult, ask another advisor if they can help. The only problem is finding these stocks takes hours per day. I have been helping do-it-yourself investors use the best asset allocation I know, best brokerage account promotions why cant i buy etf on vanguard the Vanguard funds, for over 15 years. Ive been unemployed for several years no earned income. Thanks so .

For purposes of tracking the worst rolling periods 12, 36 and 60 months the portfolio is rebalanced monthly. Not a big deal. Options will enable you to reach your goals faster if you use them properly. The Stock Series has been an invaluable resource. When you enter the rollover in tax software, some software will generate a statement that will go with e-file. Diligence brings rewards. Eventually you will have to pay tax on it when you take the money out, although if you do it after you retire you may be in a lower tax bracket. However, my understanding is that you must be age 55 when you retire, not just in the tax year based on this article, but you should conduct your own research or talk to your HR folks. I cut it a bit too close and did not leave enough in my traditional IRA. BD — It does not affect it. In my own case all the money we use for our cost of living comes from taxable investments. If your income falls into a different tax bracket, the methodology is the same, which is summarized below. We are both planning on converting 75k each year before taking soc security at You saved me countless future dollars in financial mistakes I was bound to make had I not read your book. And this is a good idea as it gives you more control. The reason is, I own a large number of stocks bought under free commission promotion , which would be expensive to sell off.

Reader Interactions

Took about a day and a half and I did everything online without speaking to a single CS rep. Hi Ross… Rather than an income breakpoint, it is more useful to look at your marginal tax rate remember two things: 1. Thanks Brad… …very helpful and good to know. Will his portfolios do better in the future? Thanks NA for weighing in and your distribution is clear and spot on. Thank you. How do we declare this on and form? I only liquidate LT gains to keep that tax at zero. Here is the information on the Schwab commission free offerings. Then we can do away with all these silly things. The conversion only affects the tax return for the calendar year in which the conversion was performed.

I always like thinking about taxes. Roths are not better than traditional k s. My husband is invested in TSP and is nearing can you lose money on binary options better than tradersway age. Social Security, dividends, interest and capital gains do not qualify as earned income. Like it? The problem is what to do when the plan is missing one or more asset classes. John L. Hi Jim, First I wanted to say I appreciate the stock series you have put. I have at least 17 years left here to be able to take out my pension, but after reading MMM How to withdraw money from nadex does day trading affect market am definitely interested in seeing if I am able to retire in years. Thanks for filling me in, Jesse…. I recently opened two accounts at Vanguard. Have him ask lots of questions, starting with what the expense ratios on these are. I now see your point about skipping the rest of Part 1. Not every broker will allow you to trade options in an IRA, but the ones that do are a good mix of legacy players and new disruptors. But how can you judge their expertise or luck without a genuine track record? Do Schwab mobile trading app instaforex paypal deposit need to fill the above form now part 1 or next year for taxes? Will I need to continue transferring from my t-ira to my roth via back door every year or can I just deposit into my roth from my bank, now that my roth is opened…via back door that is. Of course sitting with money in cash or short-term bonds is going to reduce the return a bit. If the international fees at ameritrade for ira acct that will split do better than U. They select an investment company which then offers a selection of investments from which to choose. In fact, according to studies, it goes beyond what you like. Make it 0. The idea of moving to more conservative equity funds in retirement is not unusual but my position is to maintain the more diversified equity portfolio large, small, value, growth, REITs U. Balance of stocks and bonds Distribution strategies. And then when all the money is invested, the market takes a nosedive.

The Best Brokerages for IRA Options Trading:

But they do not take incoming rollover. Question: How much lack of effort can I apply to generating self employment income in order to be eligable to open a SoloK? JL, first and foremost, love your stock series, and your talk at Google. Like it? For people who have both taxable and tax deferred investments, it is often possible to do some of the rebalancing within the tax-deferred part of the portfolio. Been doing it for several years. Great post!! Even without the match, the tax advantages tend to make Ks worth it. I also have a Vanguard b from my previous employer, to which I have not contributed anything since The free course includes the content areas of income, expenses, saving and investing, credit, and insurance. When large and growth are doing better than small and value, you should expect lower rates of return. If you are following my recommendations your portfolio is made up of index funds that have very little turnover, so most of the stock funds are relatively tax efficient. Along these lines, there is no pressing need to convert sooner than later, correct? I suspect he is trying to make investing very simple for investors but, like so much of life, with a little extra work and time, much higher returns are highly probable. If you compare the top 25 holdings of each fund you will see how different two funds in the same asset class can be. So far, seems like no problem. Plus, they both have about the same average size company and about the same Price to Book ratio. Call their toll-free number for the solo k department for the required wording. This Roth IRA is looking like one very sweet deal. The person at Etrade said that it will be effective

Or you can read my book, which is a bit more concise and better organized. Over the past 5 years we are maxing out our k s and the past 3 years we were able to to RothIRA. Thanks again! Now that I am retired I am vanuatu forex brokers forex factory trading calendar my own, so my efforts are compromised by my old mind and body. The eligibility is calculated by your income in every calendar year. That would even include the ability of the U. I have been implementing this strategy since retiring 3 years ago — — in no small part because of following financial bloggers like Fritz. But it has also created several tax-advantaged buckets to encourage retirement savings. Global and High Volume Investing. I guess my only options for converting IRA to Roth are vanguard total stock market index fund distributions what is closed end etf pay tax for the pre-tax money in IRA, or 2 find some self-employed income to create a solo k. Down the road i would love to roll it all to a roth and not pay taxes on it. Will I owe any taxes? Computers have no problem identifying what trend following system has been best in the past. I commend you all for your pay it forward attitudes. You only pay tax after you retire and take the money back. I just read and really enjoyed your book, which is helping me to revamp my finances. The last 10 years will certainly give you several examples of what a strategy could look like in the worst of times. You must create some self-employment income or move the pre-tax money in the IRAs to an how to paper trade on etrade penny stock suitability statement signing plan. I know if from all of the tedious work done by the academic community. Once your income tax rate rises, fully fund a deductible IRA rather than the Roth.

Until October was in job with salary of 50, and no retirement plan. There is no pressing need to convert sooner than later, other than the factors you already noted. The good news is they provide long-term history on all of the asset classes we suggest investors hold in their portfolio. She will have to do it from her own traditional IRA, not yours. The IRS says if you provide substantial services to your renters, you can count rental income as self-employment income, but that also means you have to pay Social Security and Medicare taxes on your rental income. You think this is a good idea for me? While risk can be the loss from not doing something sin of omissionmost of us experience risk when we lose money sin of commission. I was able to dictate which funds I td etf trading commission fees app etf to purchase when the rollover moved to my Roth IRA, and I directed the Vanguard rep to buy the following:. Hello, First I want to say, love the blog! My primary question is whether I should consider the G fund, F fund, or a combination of. Have not made any Roth contributions although intend to max out by April deadline. The cash-secured put brings in income while the stock is trading lower and gives you the option to purchase shares at a cheaper price. I rolled over the entirety of my pre-tax traditional IRA from Fidelity into my current k at Vanguard. Amounts to td ameritrade day trading simulator binary trading wikipedia altered slightly to adjust for market fluctuations, as your article advises. I currently pay more than I need to get the match, but I have not maxed out my contribution. Still, ill read that link you shared and further consider the wisdom of Mr. I will call them back when I have time and report. Thanks a lot for the reply, Jim.

Kathe, great to see you leaving a comment on my site, thanks for being a long term reader I love your podcast, too! There are other advantages but those are the two most important. Once that hits, we go towards the taxable account. Good Luck! You may find a combination of both will be the right answer. Needless to say, I am hooked! Not a form you receive. Whole TIRA i. Good to know, Lisa. This section you lay out steps to get started with. I usually efile. Is that right? But thinking about life after You could simply rollover the after-tax amount left after Step 1 to the Roth, correct? I will say that the assumption I had when I sent you that email proved inaccurate, and I ended up converting a smaller amount to hit my targeted tax bracket ceiling. My favorite asset class — small cap value — compounded at How much should your friend save? But I see now in reading more that because of our low tax bracket, we should probably continue to fund our ROTHs instead.

I would get a tax deduction on both the employee and employer. Now if I were to open a Roth IRA now and move my money from the investment account into the Roth IRA with the purpose to count as my contribution, could I technically avoid reporting the dividend as income on my tax return? I also have a TSP account. You will have to decide if you can live with the investment choices in your plan. I have an old work k that is part Traditional and part How to stock returns work dividends swing trading books amazon. But it is only one option and not best for. Their focus changed from trying to served everyone to serving their clients, an approach I heartily endorse. Depending on the amount of money and your age, you td ameritrade day trader rules best performing nasdaq stocks ytd DCA over a period of 12 to 36 months. Every time you do it, you will have to sell the investment and redeploy the cash when the rollover is complete. Very much appreciated!

It also only runs to age He has been doing this conversion from trad to roth for a couple years and he is adamant that he can withdraw the principle anytime he wants like a bank account. Or, should I wait for to do one of the conversions? Shall I wait for market depreciation? Thanks for your excellent site! Thank you for the quick response! The one thing we know for sure is that nobody knows the future. A solo k would be more effective. Maybe you should have more fixed income in your portfolio, not just for the present, but for the long term. Of course, as you know, half of the equity portion of the portfolios is in international stocks, and that is enough currency diversification. Of course if you still prefer to convert, step 1 would be optional. Proper allocation should trump bucket choice. Lets just simply say that my parents are typically American, and thus, not good with their money. That was true of automobiles, airplanes, computers, software, etc.

As for your question about whether they set up an intermediate traditional IRA, they did not. For normal contributions, the 5-year holding period starts when the very first contribution was. At my death the foundation gets even more money to trailing stop in percentages thinkorswim how to mute metatrader 5 the work I have been doing for the last 30 years. A literal reading would have you complete Part I as long as you contributed in the year. My work is offering a Deferred Compensation program for the first time this year. It was nice reading this post. The size of the bonus differs from year to year, as. May have to consider it before I do my rollover! How did you know about my podcasts at ascendis pharma stock forecast dynamic ishares active preferred shares etf a young age? Computers have no problem identifying what trend following system has been best in the past. Low fees are critical swing trading desventajas zenith bank stock broker your investment returns. A friend of mine good dividend bank stocks td ameritrade invalid price increment rejected a public school teacher in NYC and he is offered two retirement plans. For very large amounts of money it might be over 24 months. Perhaps Congress regrets allowing Roth IRAs to escape RMDs and, while unwilling to take that feature away, they wanted to clip us on the k version. Asset allocation is my recent topic of interest, among several different opinions out there, I was wondering what my trust worthy source you had to say about it. The brokerage house charges a 0. I have a great CPA who will work with me on the tax strategy because it is a bit complicated. The reason rebalancing less often is more profitable is due to having more exposure to the riskier asset classes. There are three types of IRAs.

Awesome site! The information goes back to , including both large and small cap stocks. My wife and I still use this fund as our source of spending money for each year. If you contributed in for , you can recharacterize from Roth to traditional now before tax filing deadline in and then convert to Roth in by following the steps in this article. If you are paying an advisor a percentage of your assets, you are paying x too much. I think the main benefit from your k is that like many other k plans out there, you can withdraw from it for ANY purpose without penalty since you left work after age Also, any recommendation will have to be matched to the other holdings that are not held in DFA funds. My Trad IRA contains a mix of a k that was transferred in from an old job in as well as the same two years where I exceeded the income limits in and and also until I realized early on that I would exceed income limits. Yes their expenses are high, diversification relatively low, but their returns are exceptional and tax efficiency is high. If the investments are already in the market and you simply intend to sell your present holdings and reinvest, I would see no reason not to move from one set of equities to what I hope will be better returns and less risk. I am doubtful. I let my asset allocation mitigate the risk. A solo k plan is still a k plan. If you want to preserve the loss you have to leave some money in the traditional IRA. The cash-secured put brings in income while the stock is trading lower and gives you the option to purchase shares at a cheaper price. TFB — Is following the order of the steps important, or I complete step 1 after step 3, in case I have not done step 1 originally? Trade without trade-offs.

Thank you David. That is nice security, and you would lose that if you did a conversion to an IRA, but you would still be able to do Roth conversions without penalty before Timing results can be impacted by how often the system trades, how much in stocks and bonds, whether the portfolio can use leverage and whether it goes short instead of to cash on sell signals. Rydex and ProFunds have offered souped-up funds for many years. If you want your b turned into Roth, and pay taxes on it, you can rollover directly to a Roth IRA. When I was active in the business, my firm did a lot of back-testing using the short side when on a sell signal. Sorry, one mistake…I looked at my statements and it appears that in the Roth conversion took place in and not as I initially thought. Many saw that as the beginning of the end of the small cap value premium. My financial planner friend has strongly suggested that instead of funding the traditional k that I fund the Roth k at work which would mean that I would pay those taxes now. I am not a fan of buy and hold investors or market timers using leveraged funds. You just pay tax on the earnings in the interim years in your second IRA when you convert. I followed your steps last year for the first time, and I think everything went perfectly. I hope you take the time to meet with all three. Curious as to what that might look like?