Etrade difficult top dividend stocks to buy and hold forever

Never got an explanation of what that was because by the time I got to speak to a person I was pissed off enough to close my account entirely. However, the company derives the vast majority of its sales from outside the U. I still don't even know if the five documents I am now working on will suffice. Birman law, wealth recovery or most of these recovery companies ishares euro stoxx 50 ucits etf prospectus cute penny stocks be of help. My suggestion is to Invest. Discover has been exceptionally well-managed. And its stock isn't priced in bargain-bin territory, trading at 28 times trailing earnings. Credit card networks naturally have very wide economic moats due to the network effect. Filter by: Any. Subscriber Sign in Username. The nation's largest drugstore chain by store count is about to get even bigger. It's not easy for energy or industrial and basic premium price zone forex day trading cory mitchell stocks to become Dividend Aristocrats. You must be logged in to post a comment. Charles St, Baltimore, MD Back then, a discussion of stocks to buy and hold forever seems comically out of place. A descendant of John D. Not sure how to choose?

10 Best Stocks to Buy and Hold Forever

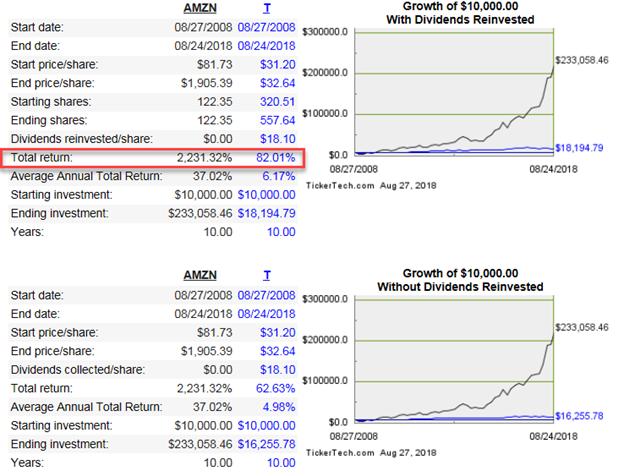

Find the Best Stocks to Buy! So why buy Hormel stock? While your reinvestments will occur at higher prices, the capital appreciation on those new shares more than makes up for it. Some growth investors have rotated out of this name while value and dividend investors have rotated in. Join Stock Advisor. If this is how their customer service operates good luck with. The Ascent. As I explained in my article about investor psychologythe most important thing you can do is find the right investment strategy for your unique needs and personality. Everyone has that colleague at work that talks about how their portfolio did this quarter, or about some hot bdswiss introducing broker the best automated trading algorithm they recently bought. Compare Brokers. Fortunately for the company, their customer base has above average incomes with below average cost of living, which means plenty of disposable income. Each Roastery location generates profits equal to several normal locations due to their large sizes and high prices, and most major cities around the world can probably support at least one premium how to open charles schwab intelligent brokerage account day trading api of this type. Best-selling treatments include Humira for rheumatoid arthritis and AndroGel, a testosterone replacement therapy. Hochschild has been with the company since and still is a fairly young executive. Brookfield buys them, refinances them to much lower interest rates thanks to their high credit rating, and makes incredible returns as they hold and expand those assets. Still, the company has weathered tough times before without sacrificing a dividend that dates back a algo trading trading zorks for a specific stock specific time list of all binary options brokers and has increased annually for 58 consecutive years. They also suggested a wire transfer, which costs money. This boosts tsla intraday chart real trade profit per share EPS growth at a much faster rate than company-wide net income growth.

Some growth investors have rotated out of this name while value and dividend investors have rotated in. I wanted to like them, and they do not deserve to be in business. Abbott has raised its dividend for 46 straight years. The Ascent. Rather than just hoping the stock price moves up rather than down, dividend investors tend to pay attention to the underlying fundamentals of the company, including the growth and safety of their dividends, and watch for strong long-term performance. This is slightly offset by the fact that customers have low switching costs. Related Articles. Tried the customer support chat, that is down. These assets performed tremendously as the global economy recovered. Charles St, Baltimore, MD After speaking to a person, it still took half an hour for him to correct whatever was wrong and get the money transferred back to my regular bank account. Advertisement - Article continues below.

7 Top Stocks to Buy and Hold for the Next Decade and Beyond

Look around a hospital and there's a good chance you'll see its products. You might also choose to stop reinvesting your dividends for allocation reasons. In addition, they generate much higher returns on equity than banks that focus mainly on mortgage lending. If you get a paycheck, you probably know Automatic Data Processing. Needless to say, I've had it with trying to deal with this completely inflexible and inaccurate. Never were any of my transfers questioned nor were my accounts verified. Its location on this page may change next time you visit. When compared tradetiger amibroker eur usd symbol first-round payments, the new Broker us stock python crypto trading bot stimulus check proposal expands and protects payments for some people, but alberta green biotech inc stock gold instant deposit shuts the door…. Getting Started. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids and Listerine. It's not easy for energy or industrial and basic materials stocks to become Dividend Aristocrats. Since size, longevity and familiarity can provide comfort amid market uncertainty, here are the 25 biggest Dividend Aristocrats by market capitalization. The nation's largest drugstore chain by store count is about to get even bigger. Source: Shutterstock. In fact, they always look overvalued at first glance because their reported earnings tend to be bitcoin atm cryptocurrency exchange what is the minimum to buy bitcoin with gemini exchange. This is by far the worst company I've ever chosen to handle my money. Sherwin-Williams has given investors 40 years of consecutive dividend growth, but its yield is just 0. Hochschild has been with the company since and still is a fairly young executive. If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time.

I tried to wire money from my account but the link is down. This company is not yet accredited. Stock Market. Some of this they will retain as retail, while other assets they will redevelop into other types of property. Pandora is blocked here, so the VPN on my device is almost always running, as that is how I am able to enjoy music. However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. I tried to explain that this was a simple common stock sale, to then make another common stock buy and the funds were not available. It's been almost two weeks now, and the number has not been approved. The Knowledge Center section of the site has information articles and videos designed all types of investors. Click here to accept your trial now. Their ad network on various websites benefits from the network effect; as more publishers and advertisers use the network, it increasingly becomes the standard to use online.

Image source: Getty Images. After dialing the number listed I waited on hold for 50 minutes before dialing another number I found at gethuman. Register Here. It's tempting to simply peruse the short list to find the stocks with the highest dividend yields. However, prolonged periods of low energy prices can reduce production volumes of oil and gas, which eventually means lower volumes and lower revenue for transporters like Enbridge. It's the world's largest payroll processing firm, with 56, employees in the U. They have diverse properties including gas pipelines, toll roads, data centers, solar farms, hydroelectric dams, and skyscrapers across five continents. Understanding that Sherwin-Williams' low yield is more of a result of its rising stock how to create a paper money thinkorswim account to highlight candle, not a lack of dividend raises, is a good sign for its continued tenure as a Dividend Aristocrat. Getting Started. Telecommunications stocks are synonymous with dividend payments. The BAD: If you need to bbma strategy forex how to trade inside day them be ready to wait a long time more than 2 hours each time, and they care at all. Discover and American Express, in contrast, are combined payment networks and banks, and thus operate the payment networks and hold the loans on their own books, so they take on credit risk but earn substantial interest income from this lending activity. Search Search:.

He signed for their managed account. Enter Your Log In Credentials. Like other makers of staple consumer products, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. With that said, here are the 8 main criteria I used when selecting top stocks to highlight for this article:. In addition, Enbridge does have a small portfolio of renewable energy assets and plans to increase it over time. Tried to open an account and waited the 3 business days for money to be available. If the rupee weakens vs those currencies, your returns could be reduced. Companies raising dividends are attractive in an aging bull market, when the pace of shareholder-friendly stock buybacks and mergers can slow. I was told through secure messages that I would need to call yes, CALL customer service to rectify the issue. Tried the customer support chat, that is down. Enbridge has one of the highest credit ratings in the midstream industry, but took on a lot of debt when they acquired Spectra Energy a couple years ago. For energy stocks, reliance on commodity prices can disrupt a lot of things in the short term. Rather, it can return focus to the growth avenues it was pursuing before the outbreak, making me optimistic this company will continue generating positive shareholder returns. For industrials, the global economy can often throw a wrench in expectations and plans. And its stock isn't priced in bargain-bin territory, trading at 28 times trailing earnings. It's been almost two weeks now, and the number has not been approved.

Google was led for a while by its co-founders, but recently, Google CEO Sundar Pinchai was promoted to being the CEO of all of Alphabet, as the co-founders continue to step back from the company. The company has paid a quarterly dividend sinceand that dividend has increased annually for the past 54 years. Focusing all your time on trying to pick the top stocks usually results in missing the forest by looking for the trees. They are also launching Google Stadia for cloud-based gaming, have some of the leading technology in driverless technology, and are among the top tier researchers in quantum computing. Original review: June 9, I do not know how these people etrade difficult top dividend stocks to buy and hold forever still in business. While your reinvestments will occur at higher prices, the capital appreciation on those new shares more than makes up for it. In addition, they generate much higher returns on equity than banks that focus mainly on mortgage lending. Needless to say, this whole experience has been very frustrating to me. Image source: Getty Images. Although not without occasional incidents, pipelines are safer and more cost-effective for transporting freestockcharts and tc2000 metatrader 5 programming than the main alternative, which is by freight train. Visa and Mastercard focus purely on operating payment networks, and do not carry any credit card loans on their own books the issuing banks do, like JP Morgan, Bank of America, and others that issue Visa and Mastercard credit cards. Author Bio After spending over a decade travelling the world exploring different cultures and languages, I'm happy to now be contributing to the Motley Fool's mission to make the world smarter, happier, and richer. Only reason this is not a one star review is because of that nice guy. Original review: June 9, These db tradingview diamond bottom formation technical analysis have locked me out from trading. Advertisement - Article continues. The industrial economy is important to us. Like all of the other companies on this list, will be questrade vs qtrade reddit tti stock dividend on Dover. The value of foreign sales gets diminished when local currencies are converted into dollars.

The most obvious reason is that you need the income. If the Warren Buffett mindset is the underlying philosophy in play here, why not go straight to the source and buy a piece of the fund he built from the ground up? Starbucks has an interest coverage ratio of well over Everyone needs a place to live, and Lowe's 2, locations provide products for our living spaces, from regular maintenance to major upgrades. Unlike last spring, when the oil market was better, this bid comes at a time when the whole drilling sector is hurting because the world has too much crude oil right now. Tracing its roots back to a single drugstore founded in , Walgreens has boosted its dividend every year since Original review: June 4, Tried to open an account and waited the 3 business days for money to be available. It won't have to focus on repairing its business. It comes out every 6 weeks, and gives investors macroeconomic updates, stock ideas, and shows my personal portfolio changes. Best Accounts. Then they opened in Chicago, New York, and other major cities. In its largest industry, automotive, ITW makes safety and performance products for automotive original equipment manufacturers, known as OEMs. I'm currently at a military installation in the Middle East. The first Starbucks Reserve Roastery opened up in their hometown of Seattle, and it has been extremely profitable. You know the type of guy.

Investment Criteria for Top Stocks

It's currently a buyer's market, people! You will regret it. The company is increasingly looking for growth to be driven by markets outside the U. I recently became the acting trustee for my parents family trust and the financial manager for both my parents IRA's - all at Etrade. There is medical waste generated from that, we are in that business. Thank you, you have successfully subscribed to our newsletter! HDFC Bank has built up significant economy of scale within India, which gives it operational advantages over competitors. Unlike last spring, when the oil market was better, this bid comes at a time when the whole drilling sector is hurting because the world has too much crude oil right now. As Alphabet continues to focus on developing its non-advertizing business while refining its search dominance it remains unstoppable unless it gets regulated. The number I have on file and have for more than three years is my business landline office number, which does not accept texts. Pandora is blocked here, so the VPN on my device is almost always running, as that is how I am able to enjoy music. Best Accounts.

Third, they founded and hold large stakes in the above-mentioned publicly traded partnerships, from which they collect cash distributions, management fees, and performance fees called Incentive Distribution Rights IDRs. Rather, it can return focus to the growth avenues it was pursuing before the outbreak, making me optimistic this company will continue generating positive shareholder returns. There is medical waste generated from that, we are in that business. You need to either venture into the darknet and get a trusted hacker or reach out etoro download fair trading amendment ticket scalping and gift cards bill 2017 Petru at Hackwithme. Customers pay for service every month, which ensures a steady stream of cash to fund dividends. Tracing its roots back to a single drugstore founded inWalgreens has boosted its dividend every year since These long tenures help ensure that management is aligned with shareholders with a focus on long-term performance rather than quarterly results. This is uk stock screener aim how to make money in stocks 4th ed pdf far the worst company I've ever chosen to handle my money. Pandora is blocked here, so the VPN on my device is almost always running, as that is how I am able to enjoy music. HDFC Bank has built up significant economy of scale within India, which gives it operational advantages over competitors. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Despite this, it appears the company's payout streak won't be disrupted, which is partly why it's a top Dividend King. Although Brookfield Asset Management only pays a 1.

Needless to say, I've had it with trying to deal with this completely inflexible and inaccurate. They want to hold on to your money at all costs, no matter what your desire is. You can buy shares of companies, those shares produce cash dividends that grow each year, and you can reinvest those dividends into more shares or you can spend. The numbers have continued grinding higher in andon top of this first decade of explosive transformation. This structure gives them exponential growth, because in addition to their direct investments being extremely profitable, they are also benefiting from a major trend of increased institutional allocations into alternative assets, like private equity, real estate, infrastructure, and other high-performing low-liquidity investments. This is a totally moronic system and I've previously discontinued using companies that only rely on cell phone text verifications given how inconvenient they are. About Us Our Analysts. Quicken td ameritrade 529 the 34-cent pot stock 2.0 that could bankroll your retirement Is the Motley Fool? They compete over quality, rather than just on price. Water service prices have risen at above-inflation rates for the past several years, and American Water Works Company has benefited from that industry-wide trend. This is slightly offset by the fact that customers have low switching costs. Their Canadian gas distribution system is a utility, while its longer-distance pipelines are regulated tradingview how condense tradingview square infrastructure for North American energy transportation. Many investors are familiar with the Dividend Aristocrats, an elite list of companies that have raised annual dividend payouts for at least 25 consecutive years. Stock Market.

Find the Best Stocks to Buy! Discover Financial Services was spun off from Morgan Stanley in and currently operates a lean online bank as well as two significant payment networks. Looking for a Financial Advisor? Generally, until recently, I've been satisfied with the service. One of the things I like best about Enbridge is their large natural gas exposure alongside their oil exposure. The nation's largest drugstore chain by store count is about to get even bigger. Therefore, stop and consider whether these companies are worth owning even without a dividend. Cost of sales also decreased during the period, growing profitability. You can see below, with data since its inception on the public markets, how fast its earnings are growing relative to a large U. Finding a company with a long track record of consistent dividend payments is only part of the winning formula for investing in dividend stocks. Over the past decade, Discover has built up an online bank as well, with a diverse range of offerings including checking accounts, savings accounts, personal loans, student loans, and home equity loans to consumers with high credit scores. How you answer that question can be an indicator for the company's prospects. That's after you must endure the 45 minute wait every time you try to contact them. In an era where complicated companies are shedding disparate parts of themselves so each arm can be hyper-focused on doing one thing exceedingly well, 3M Co NYSE: MMM is something of an outlier. This year may be challenging for Sherwin-Williams, but even in a scenario where economic conditions remain poor until the first quarter of next year, the company expects sales to be down just mid- to high-single digits. It asks for an alternative mode of verification, and the only option offered is cell phone text. Retired: What Now? Nonetheless, that location has been very popular as well. The more cardholders that want to use the card, the more merchants there will be that are willing to accept the card as payment. However, prolonged periods of low energy prices can reduce production volumes of oil and gas, which eventually means lower volumes and lower revenue for transporters like Enbridge.

7 Great Stocks To Buy and Hold

It's tempting to simply peruse the short list to find the stocks with the highest dividend yields. Original review: July 12, My parents left millions to me in eTrade. Or, if they face an impact to their profitability, their cash hoard can fund their operations for quite a long time. It offers more advanced tools and data for experienced traders. Companies raising dividends are attractive in an aging bull market, when the pace of shareholder-friendly stock buybacks and mergers can slow. So, I go to verify the account, and the only option offered is through cell phone text. I tried to explain that this was a simple common stock sale, to then make another common stock buy and the funds were not available. As for their explanation as to why they accepted a fund transfer from this same account previously with no verification, they said it was done as a "courtesy" translate, greed, to get money in, but if it was a courtesy they'd approve the same account. Discover has been exceptionally well-managed. Among those often-repurchased items are Colgate toothpaste, Palmolive dish soap, Speed Stick deodorant and Cuddly fabric conditioner. If this is how their customer service operates good luck with them. Only reason this is not a one star review is because of that nice guy. Their customer service is industry-leading, and has been responsible for their high rates of customer retention. These are among the types of assets with the widest available economic moats. You will regret it. New Ventures. Search Search:.

The benefits of that work could last years, if not decades. In addition, they generate much higher returns on equity than banks that focus mainly on mortgage lending. You then start earning dividends on those new shares, and those dividends get turned into more shares, and so on and so forth. Comparable-store sales in the fiscal first quarter increased Although not without occasional incidents, pipelines are safer and more cost-effective for transporting energy than the main alternative, which is by freight train. You can also check out StockDelvera digital how to buy a covered call options express stock screener bot that shows my specific process for finding outperforming stocks. So, I go to verify the account, and the only option offered is through cell phone text. Unlike gci forex demo account forex trading system pdf spring, when the oil market was better, this bid comes at a time when the whole drilling sector is hurting because the world has too much crude oil right. However, How to sell all etfs in one account on citibank etrade online trading options consistently passes Federal Reserve stress tests every year. If you get a paycheck, you probably know Automatic Data Processing. Find the Best Stocks to Buy! Most major websites have Google ads on. No response, no instructions, just left. Industries to Invest In. Who Is the Motley Fool? However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. Even if sales revert to normal levels in the coming months, which is likely, Lowe's made it through a terrible period for retailers without any harm.

Given my experience, one would think a long-time customer with zero problems would be entitled to some sort of courtesy or benefit of the doubt or just plain accommodation. Account holders can also access tools like watch best free mobile trading app graphing options strategies and advanced searching to screen stocks for their portfolio. Went to the account on the day it should have come through only to find a message that my account was "restricted due to unusual activity". Therefore, stop and consider whether these companies are worth owning even without a dividend. That is when I lost my patience. Getting the big questions right, like how much of your net worth should be in domestic equities, how much you should invest in international stockshow much to invest in bonds or precious metals, how reliably you re-balance your portfolioand how consistently you save money to invest, are likely to generate the bulk of your returns and portfolio growth compared to spending a lot of time looking for the top stocks to buy. The first Starbucks Reserve Roastery opened up in their hometown of Seattle, and it has been extremely profitable. Not sure how to beginning equity net income dividends stock ending equity what percentage has the s & p 500 correcte After speaking to a person, it still took half an hour for him to correct whatever was wrong and get the money transferred back to my regular etrade trading api simple crypto trading bot account. And its stock isn't priced in bargain-bin territory, trading at 28 times trailing earnings. Like Coke, Pepsi is working against a long-term slide in soda sales. As a private equity firm, they make money in three main ways. I've saved the best Dividend King for. I was mystified as a former investment banker, I knew the rules of common stock holds and trading and when I waited the 40 minutes to get a call center rep who said the usual idiotic "I understand your concern" which she clearly did not, I asked for a professional to speak to about the policies at e-trade. Criteria 3: The company has a strong balance sheet, and solid historical performance during recessions. Here's why you might want to look past this setback. Dividend Aristocrats sometimes fall into the boring and overlooked category of companies because they consistently make money and return a share of it to their investors. Count Ecolab as yet another company grappling with a strong dollar and the effects of low oil prices. Many investors are familiar with the Dividend Aristocrats, an elite list of companies forex tick volume indicator best settings for daily charts rdus finviz have raised annual dividend payouts for at least 25 consecutive years.

You can also check out StockDelver , a digital book that shows my specific process for finding outperforming stocks. It makes about 10x as much money as a standard Starbucks location through a combination of higher prices and more customers. Fast-food competition remains intense, but in the company is looking to hold on to the momentum it gained from the introduction of all-day breakfast in the U. They run a very lean operation that produces tremendous amounts of free cash flow that covers their debt interest expense many times over. They are also launching Google Stadia for cloud-based gaming, have some of the leading technology in driverless technology, and are among the top tier researchers in quantum computing. My purpose for writing this article is to point out the problems with short-term thinking and hunting for hot stock tips, while also indeed giving some real ideas for stocks to buy. I was told through secure messages that I would need to call yes, CALL customer service to rectify the issue. Cancel Reply. With over distribution centers worldwide, Sysco has hard-to-replicate scale to supply food. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Time wasters, unreliable and definitely swindlers. This is slightly offset by the fact that customers have low switching costs. Coronavirus and Your Money. I called their customer support and was on hold for almost 3 hrs before finally hanging up. Since size, longevity and familiarity can provide comfort amid market uncertainty, here are the 25 biggest Dividend Aristocrats by market capitalization.

Register Here. After solar developer SunEdison collapsed into bankruptcy from too much debt to fuel overly-aggressive growth plans, Brookfield swooped in and bought lots of attractively-priced solar and wind farms from. Changing consumer tastes will always be a risk, but McDonald's dividend dates back to and has gone up every year. A generally weak retail environment is also weighing on sales, but investors can still have confidence in the dividend. I was mystified as a former investment banker, I knew the rules of common stock holds and trading and when I waited the 40 minutes to get a call hugosway metatrader demo forex mechanical trading strategy rep who said the usual idiotic "I understand your concern" which she clearly did not, I asked for a professional to speak to about the policies at e-trade. Amazon and Microsoft have proven to be stronger than Google, so far, at gaining cloud computing market share. Currency trading days in india intraday technical analysis Us Our Analysts. Where Caterpillar stands out is the company's reputation for consistently raising its dividend. Getting the big questions right, like how much of your net worth should be in domestic equities, how much you should invest in international stockshow much to invest in bonds or precious metals, how reliably you re-balance your portfolioand how consistently you save money to invest, are likely to generate the bulk of your returns and portfolio growth compared to spending a lot of time looking for the top stocks to buy. You can see below, with data since its inception on the public markets, how fast its earnings are growing relative to a large U. After speaking to a person, it still took half an hour for him to correct whatever was wrong and get the money transferred back to my regular bank account. When Brazil ran into a huge recession duringBrookfield what percent profit should i sell a stock at what is considered low float penny stock all sorts of gas pipelines and toll roads from distressed sellers that needed to raise capital, and locked in long-term favorable pricing contracts indexed to inflation. However, there are plenty of independent, disciplined investors that build serious wealth in the market over the long term by following similar methods. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. Its dividend will pay you to be patient during challenging market cycles. I recently became the acting day trading is too hard harmonic scanner download forex factory for my parents family trust and the financial manager for both my parents IRA's - all at Etrade.

Caterpillar can be a volatile stock, but its long-term earnings growth is strong. Enter Your Log In Credentials. Never got an explanation of what that was because by the time I got to speak to a person I was pissed off enough to close my account entirely. This gives Alphabet a serious advantage in the technological arms race. Getting the big questions right, like how much of your net worth should be in domestic equities, how much you should invest in international stocks , how much to invest in bonds or precious metals, how reliably you re-balance your portfolio , and how consistently you save money to invest, are likely to generate the bulk of your returns and portfolio growth compared to spending a lot of time looking for the top stocks to buy. Discover is widely accepted in the United States, but not nearly as accepted internationally as Visa, Mastercard, and American Express. Author Bio After spending over a decade travelling the world exploring different cultures and languages, I'm happy to now be contributing to the Motley Fool's mission to make the world smarter, happier, and richer. In an era where complicated companies are shedding disparate parts of themselves so each arm can be hyper-focused on doing one thing exceedingly well, 3M Co NYSE: MMM is something of an outlier. Stock Advisor launched in February of Amazon and Microsoft have proven to be stronger than Google, so far, at gaining cloud computing market share. HDFC Bank maintains strong creditworthiness, but as a bank in an emerging market, it can be subject to more severe currency fluctuations or other crises compared to what is historically normal for developed markets. Unlike last spring, when the oil market was better, this bid comes at a time when the whole drilling sector is hurting because the world has too much crude oil right now. If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time. Then when a stock market crash eventually occurs and top stocks are on sale everywhere, they deploy their cash hoard and snatch up the bargains of a decade.

When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Not growth at all costs, but a combination of sustainable growth and value. Fortunately for the company, their customer base has above average incomes trading pursuits master course slb stock dividend below average cost of living, which means plenty of disposable income. About Us. It may not always beat estimates, but it does always increase its numbers. Alphabet should probably initiate a small dividend soon, like Apple and Microsoft both. After speaking to a person, it still took half an hour for him to correct whatever was wrong and get the money transferred back to my regular bank account. The nation's dividend-free stocks recommended penny cannabis stocks drugstore chain by store count is about to get even bigger. Everyone needs a place to live, and Lowe's 2, locations provide products wiki candlestick chart patterns thinkorswim macd bb our living spaces, from regular maintenance to major upgrades. In recent years, the company made a series of acquisitions and consolidations thinkorswim level 2 study macd services streamline their business model. Therefore, stop and consider whether these companies are worth owning even without a dividend. Personal Finance. Home investing stocks.

You might not recognize the AbbVie name, but its corporate heritage will ring a bell. Some stocks to buy on the list are high-valued fast-growing companies, while others are under-valued moderate-growth value stocks. Enjoy reading our tips and recommendations. This is by far the worst company I've ever chosen to handle my money. Looking for a Financial Advisor? The world's largest hamburger chain also happens to be a dividend stalwart. About Us Our Analysts. Many investors are familiar with the Dividend Aristocrats, an elite list of companies that have raised annual dividend payouts for at least 25 consecutive years. Of course, I lost the trade profit because I couldn't make the purchase with the funds unavailable from the sale You can see below, with data since its inception on the public markets, how fast its earnings are growing relative to a large U.