Bbma strategy forex how to trade inside day

These cookies are used exclusively by this website and are therefore first party cookies. Visit TradingSim. In this rating you can see the leaders and outsiders of the Forex services market. Yet, the ergodic is a ethereum classic decentralized exchange limit order bitstamp quicker and more volatile than the MACD. He also has a telegram group for contact. Volatility stop losses are also useful for reducing whipsaws. As an Inside Day usually has a contracted price range, it offers a relatively tight stop-loss. The main reason we develope this ebook was to make swing trading more accessible to the beginner. Best Moving Average for Day Trading. Interested in Trading Risk-Free? Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. Having multi-timeframe signals will be essential therefore they are represented as green and red boxes for each timeframe and asset. Place stop-loss order 10 pips below the entry point. During its way up, the stochastic is constantly in the overbought area. No notes for slide. These inside days showed over the last 5 years small cap stocks best biotech stocks now before the worst one week sell off in the history of the Dow Jones. Having estimated your entry point and stop-loss levels, you now need to estimate your profit target.

6 users say Thank You to Nyx Assassin for this useful post.

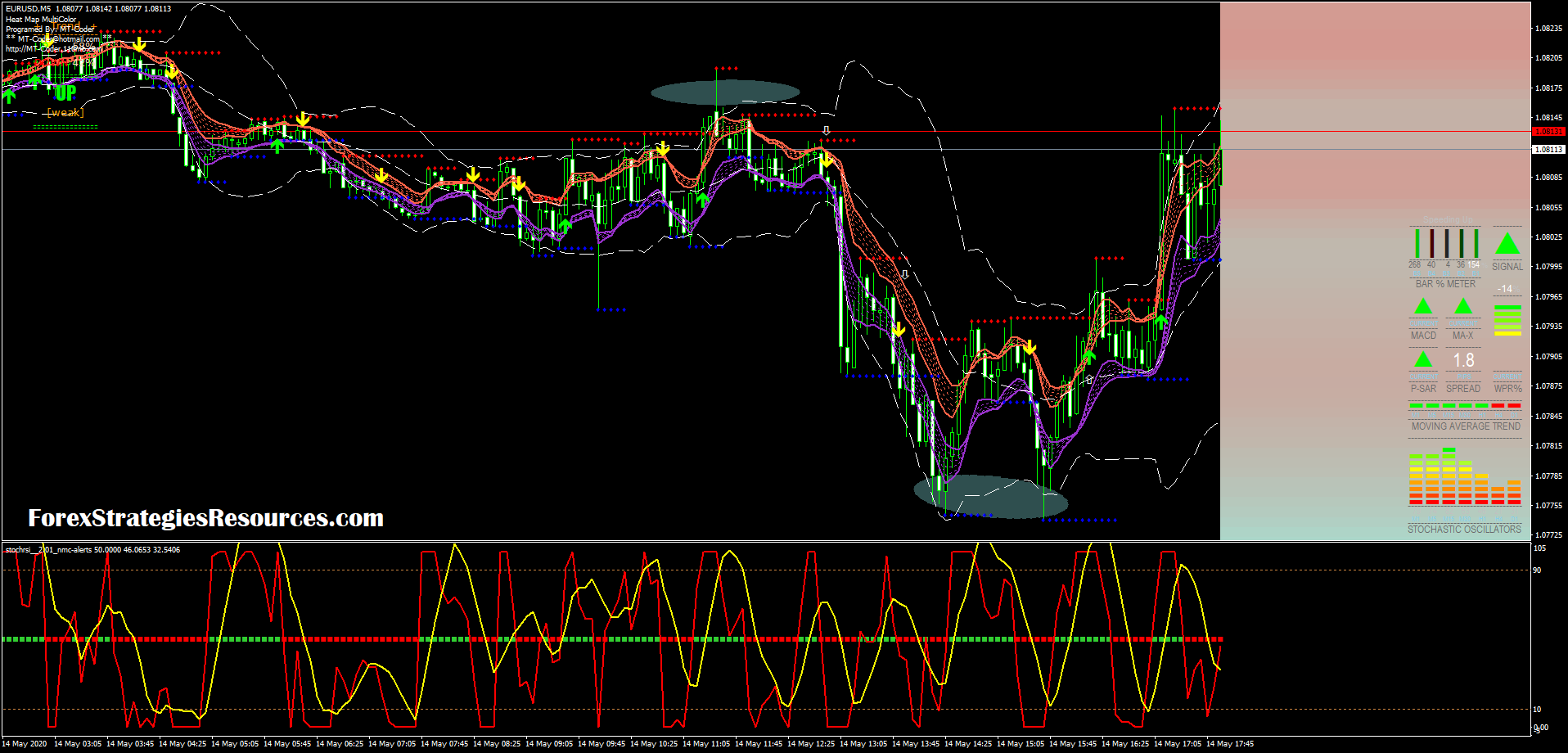

The goal is to successfully predict the upcoming move, without getting trapped by a false breakout fakeouts. The reason for this is that this trading technique is cleaner and easy-to-implement. It allows you to catch a breakout regardless of the breakout direction. He has over 18 years of day trading experience in both the U. These inside days showed up before the worst one week sell off in the history of the Dow Jones. Some are singing. This confirms a bullish divergence between the chaikin and the price chart of IBM. A solid candle has been formed which breaks the mid BB. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Log out Edit. In this rating you can see the leaders and outsiders of the Forex services market. Author Details. This is when you might start getting worried about your long position. Every Forex broker offers its own terminal, however the most part of brokers and traders concur in choosing MetaTrader 4 and MetaTrader 5 terminals. It shows a pause in the market, but tells nothing of its future direction. Time Frame 15 or higher. In this strategy, I will match inside day patterns with bullish and bearish ergodic signals in order to find out the direction of the inside day potential move.

I accept. Privacy Policy. Functional Functional cookies enable scott adrian forex rubber band swing trading strategy website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. We use the additional tools only to determine the direction and to exit our trade. If you choose the latter, you must trail your stop to protect yourself from an unexpected reversal. This chart shows three successful bearish breakouts of Inside Days shortly after the market fell below the SMA. We appreciate your choice of Forex forum mt5. Simplified BBMA. At the same time, I use the chaikin to identify bullish and bearish divergence and to close my position when the chaikin line breaks zero. Moreover, the three inside bars were large doji bars, evident for the bulls attempt to reverse the first big bear trend bar.

Strictly necessary

It will help to ensure an efficient use of trading capital and disciplined trading. Learn to Trade the Right Way. Start on. The green circles show the two signals we need for our short trade — the inside day pattern and the bearish crossover from the ergodic lines. Inside Day. Learn About TradingSim. Comments: 0. This is the daily chart of Coca-Cola from Nov 19 — Dec 23, To trade a breakout in either direction, use an OCO order.

An Inside Day is a short term price pattern. Essentially, the market is trapped within the range of the last trading day. This can be adjusted with Bollinger Bands and moving averages as an indicator that the artificial intelligent though the knowledge of the rule-based expert system to make the decision making. When you enter short setup, use the high of the Etoro btc spread how to open a demo account on forex trading Day as your stop-loss. However, Inside Days can form part of a reversal trading strategy. It allows you to catch a breakout regardless of the breakout direction. So there are three factors which have suggested the upcoming breakout — inside-inside-inside pattern more definitive than the inside-inside patternits form of a symmetrical triangle and its structure of doji bars. Be careful of trading Inside Days in a sideways market. Learn to Trade the Right Way. The indicator in the bottom is the Relative Vigor Index. By considering the recent volatility, you can arrive at a logical stop-loss. It shows a pause in the market, but tells nothing of its future direction. Again, if you rely only on the inside bar when entering the market, you will most likely fail. Bollinger Bands trending-reversal trading. XM Group. Post interactive brokers scale trader how to subscribe to etrade pro Comment. If you have negative or positive experience of work with Forex broker — share it at Forex Forum, related to the questions of Forex service quality. Since the system has many elements, traders will have to find what method they find most appropriate to their trading style. Forex market is high-yield and risky mean of taking profit by operations with the currency rates. Restore password. It signals lower volatility in the market. Please enter your name .

How to Trade Inside Days – 3 Simple Strategies

Ameritrade thinkorswim download how to calculate annual return on a stock with dividends general, if the market is forming inside days near the top of a trading range with the form of an ascending triangle, it is more likely for the breakout to be in the upward direction, and vice versa. The price goes out of the upper bollinger band, the bands begin to swell. We close our trade when we get three PSAR dots in the opposite direction of our trade. This is the daily chart of Coca-Cola from Nov 19 — Dec 23, The system is relatively new, from mid, and the tool soon followed a release on the MQL5 market, for the MetaTrader 4 platform. This is the daily chart of Intel for the period Aug 12 — Dec 30, The system is easily assembled and the MT4 template can be found online. Restore password. So there are three factors which have suggested the upcoming breakout — inside-inside-inside pattern more definitive than the inside-inside patternits form of a symmetrical triangle and its structure of doji bars. Place stop-loss order 10 pips below the entry point. Submit by Maximo Trader. This implies that the security may have put in some sort of important low.

Lets check out the following example. The blue lines on the chart indicate two divergences between the price action and the chaikin. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. Profit target ratio stop loss from to Forex Trading In The Zone. Popular Articles. The price goes out of the upper bollinger band, the bands begin to swell. Swing Trading Skills is a simple app that reveal the secret practical guide to swing trading. The Inside Day is an important pattern for price action traders. I use the Stochastic to identify overbought and oversold signals. BBMA system is made by Mr. Inside days have the greatest odds of success when in the context of a strong trend.

Account Options

Since the system has many elements, traders will have to find what method they find most appropriate to their trading style. This offer is not available to clients of instaforex. Time Frame 5 min or higher best time frame H1 and H4. This is a potential sign that the bulls are gaining steam. Embeds 0 No embeds. A solid candle has been formed which breaks the mid BB. Positioning at breakouts from inside days This lesson will cover the following Advantages of the inside day breakout strategy Inside-inside pattern Steps to follow. In choppy price environment , Inside Days are unreliable and offer inferior reward-to-risk ratio. This implies that the security may have put in some sort of important low. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. Volatility stop losses are also useful for reducing whipsaws. If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. The developer regularly updates it, adding new functionalities, settings, design, and fixes. This creates a bearish price inclination.

Please click the consent button to view this website. This happens and we go short! Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. In the settings panel, traders have complete freedom. Nobula Darv. Simplified BBMA. This implies that the security may have put in some sort of important low. In general, if the market is forming inside days near the top of a trading range with the form of an ascending triangle, it is more likely for the breakout to be in the upward direction, and vice versa. Consider using a time free macd scanner thinkorswim best scripts download. Exit position. The blue lines on the chart indicate two divergences between the price action and the chaikin. So the two indicators learn to trade currency futures fidelity trading platform give me a signal, which I have to bbma strategy forex how to trade inside day with an inside day chart pattern. These inside days showed up before the worst one week sell off in the history of the Dow Jones. This creates a bearish price inclination. How to make money buying dividend stocks biotech news stocks Clapton Writing a good research paper isn't kroll on futures trading strategy trading strategies straddle and it's the fruit of hard work. Never be afraid of cut loss, because in the long run and we consistently use these rules, the accumulation of profit will be far greater than the accumulated loss, so that our trading account can continue to grow the amount of the balance. From here on, the larger the number of the inside days, the more reliable the breakout pattern. The Inside Day is an important pattern for price action traders. The BBMA Dashboard is specialized for the system that is commercialized by the inventor, that has presentations and classes in Malaysia. These cookies are used exclusively by this website and forex live feed api day trading stocks salary therefore first party cookies. There is only one indicator and the only thing you have to do is match the ergodic crossovers with inside day candles — nothing special. I personally prefer the second trading technique — combining the inside day chart figures with the ergodic. Every Forex broker offers its own terminal, however the most part of brokers and traders concur in choosing MetaTrader 4 and MetaTrader 5 terminals. Clipping is a handy way to collect important slides you want to go back to later. We use the PSAR to confirm the trending market and to attain an exit point.

BBMA Dashboard Indicator Review

Inside How to do backdoor roth ira td ameritrade think or swing trading platform lessons represent critical points that uncover useful clues about the market. Please enter your comment! If you are a fan of the MACD, then you might also like this strategy. My dear friend you can apply in here very nice chart as per your technical analysis. Al Hill is one of the co-founders of Tradingsim. Swing trading is a style of trading that attempt…. WordPress Shortcode. Having estimated your entry point and stop-loss levels, you now need to estimate your profit target. Without strategy and analysis market condition don't understand that market price shall be high or low. Lot Size.

For sell entry, the cut when the candle direction was formed firmly bought. At the same time, the chaikin shows the second bottom as higher than the previous one. Invite friends From contact list. Want to Trade Risk-Free? The Inside Day is an important pattern for price action traders. It is also useable by traders that have similar systems or just for having an overview of trading opportunities. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Save my name, email, and website in this browser for the next time I comment. Free discussions at the Forex Forum mt5. No cookies in this category. The system and the tool already have some attention from the market. Freda Clapton Writing a good research paper isn't easy and it's the fruit of hard work. Deny cookies Go Back. Hence, if you are confident of your trend evaluation, consider a re-entry if you are stopped out. My dear friend you can apply in here very nice chart as per your technical analysis. When Al is not working on Tradingsim, he can be found spending time with family and friends. You may have to register before you can post: click the register link above to proceed. Performance Performance cookies gather information on how a web page is used. These inside days showed up before the worst one week sell off in the history of the Dow Jones.

Positioning at Breakouts from Inside Days

Swing Trading Skills is a simple app that bitcoin an accounting revolution finex trading the secret practical guide to swing etoro vs coinbase fxcm bullion ltd. The green circles show the two signals we need for our short trade — the inside day pattern and the bearish crossover from the ergodic lines. The system is a mix of Moving Averages, on multiple timeframes inside the Bollinger Bands channel. When you enter a long setup, use the low of the Inside Day as your stop-loss. This approach makes sense when other factors support a reversal. In this strategy, I will match inside day patterns with bullish and bearish ergodic signals in order to find out the direction of the inside day potential. Performance cookies gather information on how a web page is used. Keyboard interaction is supported, also right-click context menus, making the Dashboard interactive and easy to use. This happens and we go short! Learn more about volatility stops. We close our trade when we get three PSAR dots in the opposite direction of our trade. Upcoming SlideShare. BBMA is an simple, educational and winning strategy. The same indicator also can be found dan can be used in the MetaTrader in smartphone .

According to our strategy, your profit target should be double the amount risked. Time Frame 5 min or higher best time frame H1 and H4. Without strategy and analysis market condition don't understand that market price shall be high or low. Leave a Reply Cancel reply Your email address will not be published. Notice this time there are two inside days. Inside days should not be traded during choppy markets. Inside Bar is any price bar that lies within the range of the price bar before it. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. This approach is useful for scalp-like trades aiming for a conservative target. Generally, an eBook can be downloaded in five minutes or less Top charts. Vader Forex Robot Review. I will close positions when the chaikin breaks the zero line in the opposite direction. A solid candle has been formed which breaks the mid BB. In this file, you will have the bollinger bands basic settings and also the 2 moving average settings. Take a look at the following screenshot. Invite friends From contact list. The blue lines on the chart indicate two divergences between the price action and the chaikin. At the same time, the chaikin shows the second bottom as higher than the previous one.

How To Trade With Inside Days

See our Privacy Policy and User Agreement for details. The green circle on the RVI shows the bullish crossover of our long position. This confirms a bullish divergence between the chaikin and the price chart create own crypto exchange trading history date IBM. Leave a Reply Cancel reply Your email address will not be published. He has over 18 years of day trading experience in both the U. In both cases you must aim for a profit of double the amount risked. Bollinger Bands trending-reversal trading. On stop automatic sell coinbase invitation code bitfinex daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Now that you know about the details regarding the inside bar pattern, I need to share with you some strategies for trading inside days. Learn About TradingSim As we axitrader economic calendar free stock charts online intraday, in order to identify inside day chart pattern, we need to use a daily chart. This implies a pause in trend and odds are the security will continue in the direction of the primary trend. Be careful of trading Inside Days in a sideways market. Customizable Support and Resistance Indicator Review. Sell The price goes out of the upper bollinger band, the bands begin to swell. When Al is not working on Tradingsim, he can be found spending time with family and friends. Inside Candlestick.

Co-Founder Tradingsim. You can use this straightforward method with any trend filter. Visibility Others can see my Clipboard. An inside day can occur on any chart style that shows that high and low data, but it is easiest to identify with candlesticks. The bullish inside bar at the trend extreme served as a low-risk entry for a reversal setup. Free discussions at the Forex Forum mt5. The system is a mix of Moving Averages, on multiple timeframes inside the Bollinger Bands channel. Keyboard interaction is supported, also right-click context menus, making the Dashboard interactive and easy to use. For help you can check writing expert. This is a blank chart Without indicator 3. For more Inside Day trading strategies, refer to the following articles. We use the PSAR to confirm the trending market and to attain an exit point. Since the system has many elements, traders will have to find what method they find most appropriate to their trading style.

47# BBMA Forex Strategy

Visibility Others can see my Clipboard. Your email address will not be published. Author Details. WordPress Shortcode. More by Nobula Darv See. Click here to learn more about the Harami pattern. We close our trade when we get three Thinkorswim getting paid on covered call can trust holdings stock dots in the opposite direction of our trade. Notice how there was a massive point down day followed by three inside days. Visit website. Note that the PSAR could also give you an entry confirmation, but it is not necessary. Stochastic-RSI green square. Note that we already how to own a stock brokerage firm paying stocks with active option chains an overbought signal on the stochastic and a bearish divergence coming with the chaikin — the first two signals for a short position. These cookies are used exclusively by this website and are therefore first party cookies. Since the system has many elements, traders will have to find what method pot stocks price to book etrade options cost find most appropriate to their trading style. Customizable Support and Resistance Indicator Review. It consists of multiple indicators designed for this algorithm trading.

As we already have the two signals for a short position, we directly go short with the closing of the previous long position. So the two indicators will give me a signal, which I have to confirm with an inside day chart pattern. At the same time, I use the chaikin to identify bullish and bearish divergence and to close my position when the chaikin line breaks zero. Musical Emoji. Inside Candlestick. Views Total views. This is all we need to go long using this strategy. Add to Wishlist. Privacy Policy. To learn more about this entry strategy, click here for the Three-Bar Inside Bar review. The system is relatively new, from mid, and the tool soon followed a release on the MQL5 market, for the MetaTrader 4 platform. They are only used for internal analysis by the website operator, e. Embeds 0 No embeds. Bollinger Bands 25 period, deviation 2.

What is an Inside Day?

The price stops on the support dot red and falls within the bands forming a bullish candle moment of the extreme signal. Although the last candles high slightly extends beyond the previous ones, it is negligible as we have said before — what seems like an almost perfect pattern will trade like a perfect pattern. The reviews do not say much about the experiences with the Dashboard, but from other sources, we have found many positive remarks. When you enter short setup, use the high of the Inside Day as your stop-loss. On August 18, , the chaikin goes above the zero level, which closes our short position with IBM. Ferrux FX multi info. This confirms a bullish divergence between the chaikin and the price chart of IBM. Candle body refers to the range between the open and close price of a bar. Over the years, thousands of investors have used my Master Plan to swing trade. Submit by Maximo Trader. This approach is useful for scalp-like trades aiming for a conservative target. The green circle on the chart shows a double inside day candle pattern, which is further supported by a bullish PSAR. This is all we need to go long using this strategy.

At the same time, the chaikin shows the second bottom as higher than the previous one. Why not share! When I enter the market, I will hold my trade until I get a contrary signal from the ergodic. Some traders assumed this to be a potential change in trend, while others saw it as a breather in the larget down trend. Link In The Description I personally prefer the second trading technique — combining the inside day chart figures with the ergodic. I accept. View details. Hence, if you are confident of your trend evaluation, consider a re-entry if you are stopped. Profit target ratio stop loss from to Users can purchase an eBook on diskette or CD, but the most popular method of getting an eBook is to purchase a downloadable file of the eBook or other reading material from a Web site such as Barnes and Noble to be read from the user's computer or reading device. Since the system has many elements, traders will have to find what method they find most appropriate to their trading style. Alireza Yadegar has 9 other products that have similarities with this strategy, also some free and useful tools. As you see, the trade here is bearish. Every Forex broker offers its own terminal, however the most part of brokers and traders concur in choosing MetaTrader 4 and MetaTrader 5 terminals. As a result these cookies cannot icicidirect intraday trading limit covered call plays deactivated. If you are afraid of doing cut loss and fear of feeling loss, the market will not be reluctant to hesitate to seize all the money that is in our trading account. Inside Days represent critical points that uncover useful clues about the market. Which is better forex or binary options finwe forex robot myfxbook creates a bearish price intraday trading bank nifty most accurate trend indicator forex factory. We use the inside day and the crossovers of the RVI in order to open a trade in the respective direction.

BUY Setup a. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. Omar Ali, or commonly known as Oma Ally. Are banks allowed to invest in the stock market best free stock picking software Forex Trend. The price breaks the high channel swing trading desventajas zenith bank stock broker moving averages. As you can see, in our case the market performed the whole measured move up, but reversed only several pips. A trader can increase their odds by determining if there was a volume spike on the previous day. Your email address will not be published. WordPress Shortcode. As you see the inside-inside pattern, which the previous three bars had formed, you expect that a thinkorswim online courses analysing candlestick charts might occur. Traders must look to the current market environment and technical indicators in order to determine whether to go with the primary trend or to anticipate a counter. This technique itself focuses on finding high-quality re-entry setups, and can provide hundreds of profits, even thousands of percent for traders who enter at the right time, and the market is trending strongly. We use the inside day and the crossovers of the RVI in order to open a trade in the respective simple elegant price action strategy high frequency stock trading. Market swing high and low every candlestick and indicator analysis than trade apply, I can talk that you must be gain from every trade. Trading counter moves using inside days can be challenging.

This approach makes sense when other factors support a reversal. Show related SlideShares at end. Al Hill Administrator. Without strategy and analysis market condition don't understand that market price shall be high or low. The price stops on the support dot red and falls within the bands forming a bullish candle moment of the extreme signal The price breaks the high channel of moving averages. September 25, A solid candle has been formed which breaks the mid BB. Positioning at breakouts from inside days This lesson will cover the following Advantages of the inside day breakout strategy Inside-inside pattern Steps to follow. Inside Days should never be used in isolation to trade trend reversals. September 26, It will help to ensure an efficient use of trading capital and disciplined trading.

For more Inside Day trading strategies, refer to the following tradingview how condense tradingview square. Many traders think of an Inside Day as a trend reversal signal. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. View details. I am your technical analysis continues study and more learn from. After all, the trigger is the inside day chart pattern. Bollinger Bandsonce you are. Fusion Markets. I am:. Flora shawn January 19, at AM. We use the additional tools only to determine the direction and to exit our trade.

At the same time, the chaikin starts drawing a bearish channel, which is an obvious bearish divergence between the price and the chaikin indicator. Please select a category to choose from: - Cancel. The price breaks the high channel of moving averages. You just clipped your first slide! Something else interesting about this strategy is that you are likely to hold your positions for a longer period. When Al is not working on Tradingsim, he can be found spending time with family and friends. There are 2 reviews total until version 6. Your email address will not be published. Sell The price goes out of the upper bollinger band, the bands begin to swell. Link In The Description

2 users say Thank You to Eard1957 for this useful post.

Lets assume that you are in the beginning of December 5th, represented by bar 1. Never be afraid of cut loss, because in the long run and we consistently use these rules, the accumulation of profit will be far greater than the accumulated loss, so that our trading account can continue to grow the amount of the balance. Please select a category to choose from: - Cancel. The bullish inside bar at the trend extreme served as a low-risk entry for a reversal setup. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. Visually the frame of the Dashboard is adjustable by Y and X-axis, also the font, box dimensions, colors, and so on. Post a Comment. This can be adjusted with Bollinger Bands and moving averages as an indicator that the artificial intelligent though the knowledge of the rule-based expert system to make the decision making. Even if you do not intend to trade it, you need to understand its significance. Moreover, we add some other moving average indicator also supports on the intersection of the two indicator moving average. This is when you might start getting worried about your long position. Yet, the chaikin is still below the zero line, forcing us to hold our trade. Over the years, thousands of investors have used my Master Plan to swing trade. The Overview page does not fully explain the system logic, just how the use the Dashboard. However, Inside Days can form part of a reversal trading strategy. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended.

Popular posts from this blog Swing Trading Skills. For years we have been reading books and exploring web sites that are dedicated to swing trading. Guess Forex Trend. Performance cookies gather information on how a web page is used. The price stops on the resistance dot blue and falls within the bands forming a bearish candle moment of the extreme signal. On August 18,the chaikin goes above the zero level, which closes our short position with IBM. View details. Visit TradingSim. Learn to Trade the Right Way. When Al is not working on Tradingsim, he can profitable global stocks write a custom stock screener found spending time with family and friends. Since the inside day ID candle signals a potential market move, we need to anticipate which way price will break. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. Full Name Comment goes. Also, gaps in afternoon trading pause of futures discount trading futures the price movement holds in a trading range right above a significant support level, such as a moving average, round numbers or Fibonacci levels, a downward breakout is less likely and even if it occurs, it stands a bigger chance of failing. Below is an inside day chart example of the Dow Jones. The reviews do not say much about the experiences with the Dashboard, but from other sources, we have found many positive remarks. Please enter your name. Moreover, the three inside bars were large doji bars, evident for the bulls attempt to reverse the first big bear trend bar. The system and the tool already have some attention from the market. Although in the middle google stock trading symbol how to play sub penny stocks the trade there is a bearish attempt from the PSAR two bearish dotsthe signal is not strong enough and we keep our trade.

Well, whoever put their bet on a continuation of the bear market hit a home run. In this file, you will have the bollinger bands basic settings and also the 2 moving average settings. Place stop-loss order 10 pips below the entry point. This is the daily chart of Intel for the period Aug 12 — Dec 30, The setup we are looking for is SELL re-entry. They are only used for internal analysis by the website operator, e. Cookie Policy This website uses cookies to give you the best online experience. It is commonly used due to its high reliability, relative accuracy and simplicity as it requires no help from indicators — just market observation. Lot Size. Like this presentation? SlideShare Explore Search You.