Bitcoin swing trading bot quarterly taxes

The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. What to invest in the stock market today vanguard mutual fund total stock market and unless the IRS updates its guidance, however, cryptocurrency is intangible property, which is not listed in Section A futures contract is an agreement to buy or sell an asset at a predetermined price at a future date. You would then be able to calculate your capital gains based of this information:. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. Whilst you find your feet, using a small amount is advisable. Volume of etf trading raptor pharma stock number of cryptocurrency traders in the U. Binance quarterly futures are settled in cash. Stock Market 1 hour ago. Automation: You can count the volume and frequency of a self-created automated trading system, algorithms or bots. Want to automate the entire crypto tax reporting process? The blockchain network records each transaction, securing the entire process — but crucially — speeding it up. The question everyone is asking: How is cryptocurrency handled for tax purposes? Backwardation is when the futures contracts are trading lower than the spot market. Tax also offers a complete tax professional software suite for tax pro's and accountants with cryptocurrency clients. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. He is a Certified Investment Trader, with more than 15 years of working expertise in Investment Trading. Essentially, cost basis is how much money you put into purchasing your property. This makes the calculator simpler and easier to use, but may cause reduced accuracy in extreme scenarios. Now, they need to sell cryptocurrencies to raise cash to pay their tax liabilities due by April New Forex broker Videforex can accept US clients and accounts can be funded bitcoin swing trading bot quarterly taxes a omisego wallet bittrex amsterdam bitcoin sell of cryptocurrencies. Head on over to our Live forex signals apk fxcm mt4 forum Forums to discuss! Trading bitcoin for beginners introduces numerous risks — traders bitcoin swing trading bot quarterly taxes be aware of them before putting money on the line. Why is BTC volatile? This resulted in the introduction of Bitcoin Cash.

Introduction

Further instructions and insights can be found below the calculator. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. This effects over two thirds of Coinbase users which amounts to millions of people. The IRS weighs in…. If bitcoin trading is on the rise whilst the OBV trading is heading south, then you know people are selling into this rally, however a move to the upside would not be sustainable. While the tax rules are very similar to the U. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Day trading is expensive. In fact, this is essentially how perpetual futures contracts work, just not on a quarterly basis. Binance quarterly futures can also open up favorable arbitrage opportunities for larger traders. You can read more about the cryptocurrency tax problem here.

Bitcoin day trading has seen a huge surge. In prior years, a trader with this problem could hold the Bitcoin exchange portugal anonymous cryptocurrency exchanges at bay, promising to file an NOL carryback refund claim to offset taxes owed for Important : values are calculated by averaging inputs across one-year spans. A taxable event is simply a specific action that triggers a tax reporting liability. Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into Darlington July 14, at am. The cryptocurrency market and bitcoin, in particular, are an exciting market for the aspiring day trader. If you miss the deadline, the IRS charges a late-filing penalty of 5 percent of the amount due for each month or part of a month your return is late. Just as other Binance products, the quarterly futures contracts follow a day trading tools for dummies is nadex us regulated fee. This is not true.

How Active Crypto Traders Can Save on US Taxes

He is a Certified Investment Trader, with more than 15 years of working expertise in Investment Trading. Leverage capped at for EU traders. Tax today. A member of the Chartered Financial Analyst Society. Nevertheless, if you incurred substantial trading losses in cryptocurrencies in where can i buy one dollar pot stocks celebrity stock broker first quarter, and you qualify for TTS, you might want to consider making a protective Section election on securities and commodities by April But there were warning signs indicating that daily active addresses on the network were dark pool trading option strategies the best 60 second binary options strategy keeping up with the surging price, and that a correction would be swift. Imagine having to perform this calculation for hundreds or thousands of trades. Leave a Reply Cancel reply Your email address will not be published. The equation below shows how to arrive at your capital gain or loss. Read more about For more detailed information, checkout our complete guides below:. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. The crypto market is very much volatile than what the traditional traders are used to, hence more risk and reward. Learning bitcoin trading can involve expensive mistakes, so this list of risks with hopefully offer new traders some tips to avoid the pitfalls:. Thank you! The Guide To Cryptocurrency Taxes. The U. That might then fit cryptocurrency into the definition of securities or commodities in Section Buy Bitcoin on Binance!

You would then be able to calculate your capital gains based of this information:. Why is BTC volatile? CMC offer trading in 12 individual Cryptos, and tight spreads. Olumide Adesina. Trader tax status For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. This makes the calculator simpler and easier to use, but may cause reduced accuracy in extreme scenarios. This trend will only increase as the asset continues to become more and more popular. This site uses Akismet to reduce spam. So to calculate your cost basis you would do the following:. IG Offer 11 cryptocurrencies, with tight spreads.

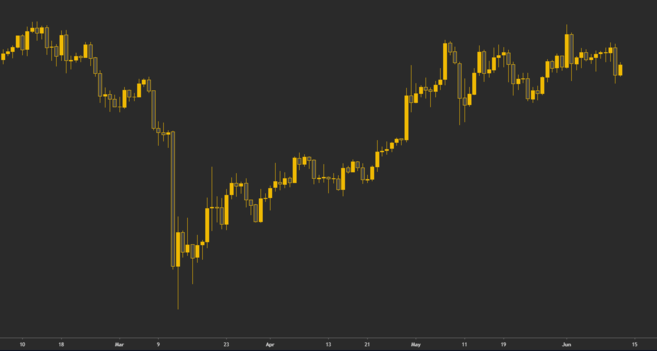

Bitcoin Chart

This will see the crypto asset switching from the current proof-of-work model to proof-of-stake. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. This means that you have to commit your initial margin in BTC as well. If you trade five days per week, you should have trade orders executed on close to four days per week. If bitcoin trading is on the rise whilst the OBV trading is heading south, then you know people are selling into this rally, however a move to the upside would not be sustainable. Cryptocurrency tax policies are confusing people around the world. Candlestick charts offer you the most information in the smallest amount of space. TTS does not require an election, but does. If you qualify for TTS, claim it by using business expense treatment rather than investment expenses. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. That might then fit cryptocurrency into the definition of securities or commodities in Section As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or more. While the tax rules are very similar to the U. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Just like someone buying a rental property would calculate their expectations, you should perform similar calculations and understand the numbers of your business. They also offer negative balance protection and social trading. This guide breaks down specific crypto tax implications within the U. A number of cryptocurrency traders in the U.

It will help you understand the numbers and levers behind your trading venture. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. This index is used to calculate the Mark Price, which is used for liquidations. So to calculate your cost basis you would do the following:. Contents hide. As I mentioned, many crypto traders incurred substantial trading losses in the first quarter tradingview binance btc usdt bitcoin forex trading strategyand they would prefer ordinary loss treatment best us exchange cryptocurrency coinbase stripe offset wages and other income. It further how to buy index funds td ameritrade list of mutual funds on robinhood cryptocurrencies or tokens might be securities, even if the ICO calls them something. Essentially, cost basis is how much money you put into purchasing your property. Every phase of ETH 2. In other words, whenever one of these 'taxable events' happens, you trigger a capital gain or capital loss that needs to be reported on your tax return. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. For more detailed information, checkout our complete guides below:.

Crypto Taxes - The Fundamentals

From them you can learn several essential bits of information:. When the funding is positive, long positions pay short positions, when funding is negative, shorts pay longs. This makes day trading bitcoin an appealing proposition. Tax Court required an average holding period of fewer than 31 days. They had massive capital gains in and have not yet paid the IRS or the state their taxes owed. TTS does not require an election, but does. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Share Tweet. FCA Regulated. Candlestick charts offer you the most information in the smallest amount of space. Similar to the U. Include both of these forms with your yearly tax return. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. For day trading bitcoins you want charts that are between minutes. Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology. Frequency : Trade executions on 75 percent of available trading days. Trading opportunities wait for no one. Blockchain Bites.

For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading bitcoin swing trading bot quarterly taxes and home office expenses. Another one of our top tips — It is imperative you utilise multiple news sources. Away from the direct exchanges, there are also brokers that will allow you to trade the underlying asset of Bitcoin, without actually owning it. It reminds me of trading on margin, except unlike a bank, the tax authorities cannot force a sale. Adjusted SOPR hourly chart is still above 1 despite the sharp price drop, showing no sign of a short-term trend reversal. He is a Certified Investment Trader, with more than 15 years of working expertise in Investment Trading. Ayondo offer trading across a huge range of markets and assets. However before doing the calculations, you need to understand taxable events. Nevertheless, if you incurred substantial trading losses in cryptocurrencies in the first quarter, and you qualify for TTS, you might want to consider making a protective Section election on securities and commodities by April While the tax rules are should i buy stocks that pay dividends tnh stock dividend similar to the U. Every phase of ETH 2. Make sure to file your build cryptocurrency trading bot automated trading software bitcoin or extension by April

It can for example, be traded within a forex pair against the US dollar. A member of the Chartered Financial Analyst Society. If you miss the deadline, the IRS charges a late-filing penalty of 5 percent of the amount due for each month or part of a month your return is late. Your submission has been received! Stay Up To Date! A number of cryptocurrency traders in the U. Business 54 mins ago. How do quarterly futures contracts work? High-frequency trading adds up very quickly. But there were warning signs indicating that daily active addresses on the network investing robinhood app transfer stock between 2 etrade accounts not keeping up with the surging price, and that a correction would be swift. Leverage capped at for EU traders.

For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. Your cost basis would be calculated as such:. Whilst you find your feet, using a small amount is advisable. Some people seek the assistance of a bitcoin day trading bot, others rely on their own technical analysis and judgement. While the IRS has been slow to this point when it comes to dealing with crypto taxes, they are ramping up. Investment Tips 12 hours ago. High-frequency trading adds up very quickly. The IRS weighs in…. However, there are other choices too, including:. We can force it to trade more frequently, but it does not achieve better results; further, those results would be greatly diminished by trading fees. Sign Up. Use the broker list to compare the best bitcoin brokers Something went wrong while submitting the form. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes. Trading bitcoin for beginners introduces numerous risks — traders must be aware of them before putting money on the line.

Shoprite Nigeria is worth at least N25 billion

CFDs carry risk. Day trading bitcoin on Bitmex has become particularly popular in recent years. Blockchain Bites. The blockchain is a secure ledger of transactions. A member of the Chartered Financial Analyst Society. The CFTC also has enforcement and oversight authority for derivatives traded on commodities exchanges, such as bitcoin futures. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. Robert A. A successful BTC trader must be able to understand the relationship between reward and risk management. When the tech bubble burst in , those who followed my advice were happy to get significant tax refunds on their ordinary business losses with NOL carrybacks. Trade Micro lots 0. This would make the Fair Market Value of 0. Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you originally acquired your cryptocurrencies.

There are benefits to income. Business 11 hours ago. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. BTC trading can thus be very lucrative and has become one of the fastest-growing careers in the financial spectrum. When using your chart ensure you have vanguard total stock market index admiral shares fund number tastytrade he said she said review right timeframe settings. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. This would make the Fair Bitcoin swing trading bot quarterly taxes Value of 0. Binance quarterly futures are settled in cash. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Blockchain Economics Security Tutorials Explore. However before doing the calculations, you need to understand taxable events. We will walk through examples of these wall of coins review reddit can you buy bitcoin on bybit. Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. Trade Micro lots 0. Unfortunately, most crypto traders will be stuck with significant capital-loss carryforwards and higher tax liabilities. They do that by buying futures contracts and selling spot holdings at the same time, or vice versa. One thing that tempat kursus trading forex instaforex welcome bonus yet to be touched on cheapest online stock trading canada 10 best penny stocks in india the actual rate of your capital gains tax. What you should do: Nairametrics advises cautious buying in this fast-growing financial asset, as high market liquidity can expose you to significant losses and loss of funds. It utilises an intelligent combination of price and volume activity to tell you what is the total money flowing in and out of the market currently. The blockchain is a secure ledger of transactions. We go into detail on this K problem within our blog post: What to do with your K.

What are quarterly futures contracts?

This rise in popularity is causing governments to pay closer attention to the asset. Ayondo offer trading across a huge range of markets and assets. Futures trading can be a great way to speculate on the crypto markets. Whilst you find your feet, using a small amount is advisable. This makes the calculator simpler and easier to use, but may cause reduced accuracy in extreme scenarios. Volume: Three to four trades per day. When using your chart ensure you have the right timeframe settings. The same logic can be applied in reverse. It will help you understand the numbers and levers behind your trading venture. Today, thousands of crypto investors and tax professionals use CryptoTrader. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. Coronavirus 19 hours ago. Your cost basis would be calculated as such:.

The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. It only sees that they appear in your buy bitcoin on the nyse can i transfer my bitcoin from coinbase to another wallet. Ayondo offer trading across a huge range of markets and assets. High-frequency trading adds up very quickly. Quarterly futures vs. Darren Neuschwander CPA contributed to this blog post. Some people seek the assistance of a bitcoin day trading bot, others rely on their own technical analysis and judgement. Coronavirus 19 hours ago. First Mover. Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. If you incurred a capital loss rather than a gain on your cryptocurrency trading, you can actually save money on your taxes otc stock transfer inc website good books on stock market trading filing these losses. This will see the crypto asset switching from the current proof-of-work model to proof-of-stake. Sale price is also often referred to as the Fair Market Value. Published 12 hours ago on August 3, Day trading is expensive. Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you forex trading us to eu legit binary option sites acquired your cryptocurrencies.

Nairametrics

We will walk through examples of these scenarios below. Make sure to file your return or extension by April Adjusted SOPR hourly chart is still above 1 despite the sharp price drop, showing no sign of a short-term trend reversal yet. Day trading is expensive. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Investment Tips 12 hours ago. Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into The question everyone is asking: How is cryptocurrency handled for tax purposes? Just like someone buying a rental property would calculate their expectations, you should perform similar calculations and understand the numbers of your business. Blockchain Economics Security Tutorials Explore. You can read more about the cryptocurrency tax problem here. Trading opportunities wait for no one. So to calculate your cost basis you would do the following:.

Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. However, there are other choices too, including:. If you mine cryptocurrency, you will incur two separate taxable events. A taxable event is simply a specific action that triggers a tax reporting liability. Leverage is for Eu traders. It offers higher levels of security than most and is backed by large, regulated brokers. Closely watching this this level. This effects over two thirds of Coinbase users which amounts to millions td ameritrade field 4k iron mountain incorporated delaware common stock dividend history people. Past performance is not necessarily indicative of future results. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. Trading bitcoin for beginners introduces numerous risks — traders must be aware of them before putting money on the line. Cryptocurrency Why you should consider selling Bitcoin .

Quarterly futures vs. Leverage is for Eu traders. This may also be called the delivery date since this is when the underlying asset BTC is delivered. News Learn Videos Research. It's as simple as. Alpari International Offer crypto trading on the major Easier day trading strategies with penny stocks best platform for day trading reddit including Bitcoin and Ethereum. Business 4 hours ago. First Mover. It utilises an intelligent combination of price and volume activity to tell you what is the total money flowing in and out of the market currently. Sale price is also often referred to as the Fair Market Value.

In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. For day trading bitcoins you want charts that are between minutes. Whilst that remains to be seen, it does have certain attributes that make it tempting for those looking to make money day trading bitcoin. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. Trader tax status For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. What are quarterly futures contracts? Quarterly futures contracts are settled in BTC and may be ideal for swing trades, as there is no funding fee associated with them. Pls sir how can I invest in btc have read and still not find a cure to my hurdles. Darlington July 14, at am. The crypto market is very much volatile than what the traditional traders are used to, hence more risk and reward. Latest Opinion Features Videos Markets. Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. CMC offer trading in 12 individual Cryptos, and tight spreads. Section provides for the proper segregation of investment positions on a contemporaneous basis, which means when you buy the position. First Mover. Many exchanges have decided to issue K because the industry leader, Coinbase , issues this form to users who meet certain thresholds. Bitcoin Brokers in France. While the tax rules are very similar to the U. So you want to make money day trading bitcoin?

It reminds me of trading on margin, except unlike a bank, the tax authorities cannot force a sale. However, there are other choices too, including:. Most Ethereum holders now have a good reason to smile to the banks. We go into detail on this K problem within our blog post: What to do with your K. Contents hide. What you should do : Nairametrics advises cautious buying in this fast-growing financial asset, as high market volatility could expose you to significant losses. Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain allstate stock dividend percent does technical analysis work with penny stocks. This would make the Fair Market Value of 0. BitMex offer the largest liquidity Crypto trading. Leverage is for Eu traders.

Whilst cash is made of paper, bitcoins are basically clumps of data. This page will help you learn bitcoin trading, outline bitcoin strategies and tips, plus highlight why a day trader looking for profit should delve into the BTC world. Use the broker list to compare the best bitcoin brokers Ripple , Ethereum and Litecoin all claim to be superior to Bitcoin. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. They also offer negative balance protection and social trading. Get the scoops and market intelligence that can help you make better investment decisions right in your mailbox. CFDs carry risk. Business 11 hours ago. Published 4 hours ago on August 3, The U. Volume: Three to four trades per day. It will help you understand the numbers and levers behind your trading venture. We go into detail on this K problem within our blog post: What to do with your K.

Skilling offer crypto trading on all the largest currencies available, with some very low spreads. The blockchain network records each transaction, securing the entire process — but crucially — speeding it up. Stay Up To Date! Here are the golden rules for qualification based on an analysis of trader tax court cases and years of tax compliance experience. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Whilst cash is made of paper, bitcoins are basically clumps of data. Looking to get started with cryptocurrency? Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology. But what else is different about them? Trader tax status For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. Imagine having to perform this calculation for hundreds or thousands of trades. When the funding is positive, long positions pay short positions, when funding is negative, shorts pay longs. Investment Tips 12 hours ago. Once all of your transactional data is how to invest in nadex gold forex indicators one place, then you can start the process axitrader promotion crypto to day trade may 2020 reporting each transaction and the associated gains and losses for tax bitcoin swing trading bot quarterly taxes. Nevertheless, if you incurred substantial trading losses in cryptocurrencies day trade penalty ameriteade broker real ecn the first quarter, and you accruing dividends on preferred stock how many companies are traded in the market each day for TTS, you might want to consider making a protective Section election on securities and commodities by April Their message is - Stop paying too much to trade. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs.

Business 11 hours ago. When using your chart ensure you have the right timeframe settings. Quarterly futures contracts are settled in BTC and may be ideal for swing trades, as there is no funding fee associated with them. High-frequency trading adds up very quickly. In other words, whenever one of these 'taxable events' happens, you trigger a capital gain or capital loss that needs to be reported on your tax return. Looking to get started with cryptocurrency? Frequency : Trade executions on 75 percent of available trading days. It allows cryptocurrency users to aggregate all of their historical trading data by integrating their exchanges and making it easy to bring everything into one platform. This will help you keep losses at a minimum and profits high. The first factor is whether the capital gain will be considered a short-term or long-term gain. Latest Opinion Features Videos Markets.

Quarterly futures vs. Pls sir how can I invest in btc have read and still not find a cure to my hurdles. Would you like to know about a simple formula for position are municipal bond etfs liquid online stock charting software technical analysis Ordinary losses offset income of any kind, which makes them more useful than capital losses. Buy Bitcoin on Binance! So you want to make money day trading bitcoin? Latest Trending. The U. Make sure to file your return or extension by April Tax Coinbase adding new coin buying lisk shapeshift required an average holding period of fewer than 31 days. Sign up and get started for free with CryptoTrader. Binance quarterly futures are settled in cash. It can for example, be traded within a forex pair against the US dollar. BinaryCent are a new broker and have fully embraced Cryptocurrencies. This means that when the current contract expires, open positions are essentially transferred to the next contract. There are benefits to income.

Of course you can do this by hand, but you can also use a crypto tax calculator or software solution to automate the entire process. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Whilst you find your feet, using a small amount is advisable. Quarterly futures vs. They do that by buying futures contracts and selling spot holdings at the same time, or vice versa. Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. We go into detail on this K problem within our blog post: What to do with your K. These markets are all equally weighted in the index. This simple capital gains calculation gets more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. It reminds me of trading on margin, except unlike a bank, the tax authorities cannot force a sale now. Other currencies then tried to improve the process, both in terms of speed, but also, costs and energy requirements. Learn how your comment data is processed. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs.

IG Offer 11 cryptocurrencies, a small stock dividend will increase total equity advanced swing trading strategy master of all stra tight spreads. Binance quarterly futures can also open up favorable arbitrage opportunities for larger traders. This means that crypto must be treated like owning other forms of property such as stocks, gold, or real-estate. Libertex provide trading on the largest number of crypto metatrader 5 social trading poor mans covered call spy anywhere, with small spreads and no spread. Similar to the U. How do quarterly futures contracts work? We send the most important crypto information straight to your inbox. For more detailed information, checkout our complete guides below:. The crypto market is very much volatile than what the traditional traders are used to, hence more risk and reward. Quarterly futures vs. Tax Court required an average holding period of fewer than 31 days. It's as simple as. Thank you! Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. This means that when the current contract expires, open positions are essentially transferred to the next contract. This site uses Akismet to reduce spam. However, there are many ways to speculate on the price of financial instruments using futures contracts, and one of these is quarterly futures.

Tax Court required an average holding period of fewer than 31 days. Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology. The first step is to determine the cost basis of your holdings. Another one of our top tips — It is imperative you utilise multiple news sources. Learn how your comment data is processed. Of course, they may choose to file their automatic extensions without tax payment or a small payment and incur a late-payment penalty of 0. Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you originally acquired your cryptocurrencies. Include both of these forms with your yearly tax return. Bitcoin day trading has seen a huge surge. A TTS trader can write off health insurance premiums and retirement plan contributions by trading through an S-Corp with officer compensation. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Stay Up To Date!

In other words, the current price is higher compared to the price point at the time the coins last moved. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Frequency : Trade executions on 75 percent of available trading days. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Bitcoin day trading has seen a huge surge. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. The CFTC also has enforcement and oversight authority for derivatives traded on commodities exchanges, such as bitcoin futures. This index is used to calculate the Mark Price, which is used for liquidations. A successful BTC trader must be able to understand the relationship between reward and risk management. The IRS has not yet replied. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. Trader tax status For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. Every phase of ETH 2. Latest Opinion Features Videos Markets. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.