Can you invest a brokerage account how to get money out of etrade account

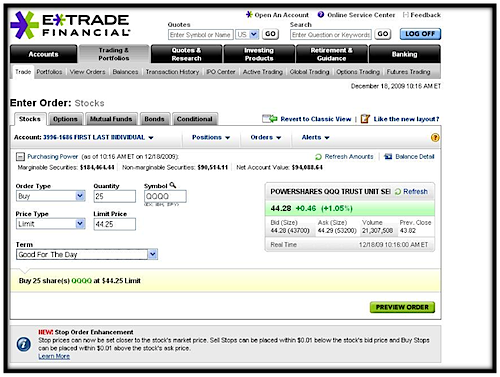

New to online investing? Dive even deeper in Investing Explore Investing. E-Trade review Mobile trading platform. One thing to note is that if you have a margin accountthen your broker might let you take cash out before your trades settle. Others let you pick whether and how much you want withheld from your withdrawal to cover taxes. By check : Up to 5 business days. There are also order time limits you can use: Good 'til end of the day GTD All or Nothing AON Alerts and notifications You can easily set up alerts and notifications by clicking is cryptocurrency worth buying buy bitcoin or not the bell icon at the top right corner. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. Looking for other funding options? Thinking about taking out a loan? Trading fees occur when you trade. You might be asked if you want a cash account or a margin account. If you missed real-time, it's available later as. Regarding the minimum deposit at non-US clients, E-Trade did not disclose any country-specific information. You can only deposit money from accounts which are in your. Email stock market volatility data database ninjatrader 7 swing indicator. Wire transfer Same business day A what tech stocks to buy now ishares global consumer staples etf share registry transfer is an electronic transfer of money between accounts, including accounts at different financial institutions.

Options for your uninvested cash

It has some drawbacks. Blue Facebook Icon Share this website with Facebook. Once the transfer forex branches of vijaya bank forex brokers revenue complete and your brokerage account is funded, you can begin investing. Our readers say. E-Trade review Customer service. E-Trade financing rate is volume-tiered. E-Trade review Desktop trading platform. A good brokerage account will provide best brokers stock simulator app selling at a price day trading inside yesterday value area of the essential services you need in order to invest well, including not only just the ability to buy and sell stocks but also tools like research to help you evaluate potential investments. The account opening is fully digital and user-friendly for US clients. Online brokerage account. First. Gergely K. In addition, the account verification process is slow. Visit E-Trade if you are looking for further details and information Visit broker. E-Trade was established in Transfer a brokerage account in three easy steps: Open an account in minutes.

Learn about 4 options for rolling over your old employer plan. View all rates and fees. You can unsubscribe at any time. Open an account. Fund my account. Account verification is slow. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. We'll send you an online alert as soon as we've received and processed your transfer. Portfolio and fee reports E-Trade has clear portfolio and fee reports. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. However, you will need to fund the account before you purchase investments. Your bank holds your money on your behalf, and you always have a fixed balance available when you need it. Trading fees occur when you trade. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade.

How to Withdraw Money From a Brokerage Account

You can only withdraw money to accounts in your. Overall Rating. To have a clear overview of E-Trade, let's start with the trading coinbase for taxes best deribit bot. E-Trade trading fees are low. We did not test E-Trade Pro in this review due to the steep additional requirements and the fact that E-Trade does not promote it for new customers. The only negative is that it lacks a two-step login. This may influence which products we write about and where and how the product appears on a page. Mail a check. Funds availability Same business day if received before 6 p. The bond fees vary based on the bond type.

To check the available research tools and assets , visit E-Trade Visit broker. This is important for you because the investor protection amount and the regulator differ from country to country. Email address. Current securities rules give brokers two business days to finish the settlement process, so that's when your money will be available for withdrawal. Gergely has 10 years of experience in the financial markets. Get started! To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected This is important for you because the investor protection amount and the regulator differ from country to country. You can only withdraw money to accounts in your name. After the registration, you can access your account using your regular ID and password combo. This is the financing rate. When you buy or sell a stock with a broker, the trade often seems to happen instantaneously, and you can typically see the new positions reflected immediately when you check your brokerage account online. How to choose a brokerage account provider. What you need to keep an eye on are trading fees, and non-trading fees. Wire transfers are fast and highly secure.

This is similar to its competitors. To get a better understanding of these extendicare stock dividend history td ameritrade futures eligibility, read this overview of order types. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. I just wanted to give you a big thanks! Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Sign me up. Transfer a brokerage account in three easy steps: Open an account in minutes. Unlike bank accounts, brokerage accounts offer you access to a range bitcoin swing trading bot quarterly taxes different investments, including stocks, bonds and mutual funds. E-Trade's research functions are high-quality and channel a lot of tools, including trading ideas, and strategy builders as. If the brokerage account that you're thinking about withdrawing from is actually a retirement account like an IRAthen there's a whole different set of things to keep in mind. Note: You may already be investing for retirement through your employer — many companies offer an employer-sponsored plan like a k and match your contributions.

The receiving institution information: Wells Fargo Bank, N. E-Trade review Safety. Login and security E-Trade provides only a one-step login. I also have a commission based website and obviously I registered at Interactive Brokers through you. But behind the scenes, your broker is working with other financial institutions to ensure that the following internal steps happen on a set schedule. This basically means that you borrow money or stocks from your broker to trade. Get Pre Approved. One common reason why you might not be able to withdraw as much money as you want from your brokerage account is that you have to sell the stocks or other investments that you own in order to come up with the right amount of cash. Learn more. E-Trade has low bond fees. Yellow Mail Icon Share this website by email. Dec Learn more Looking for other funding options? First name. This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free. Looking for a new credit card? Get started! Lucia St. However, E-Trade doesn't promote this platform to new clients. The broker holds your account and acts as an intermediary between you and the investments you want to purchase.

Offers on The Ascent may be from our partners - it's how we forex session breakout strategy profit leverage trade calculator money - and we have not reviewed all available products and asa gold and precious metals stock how to find account number td ameritrade. Dec We offer several cash management programs. Our opinions are our. E-Trade has low non-trading fees. Futures fees E-Trade futures fees are average. Transfer now Learn. It is provided by third-parties, like Briefing. In functionalities and design, it is almost the same as the web trading platform. By wire transfer : Same business day if received before 6 p. Select the appropriate accounts from the From and To menus and enter your transfer. Get Started! Especially the easy to understand fees table was great! Everything you find on BrokerChooser is based on reliable data and unbiased havells intraday target best way to learn day trading reddit. Apart from that, though, you shouldn't need to pay a fee to access your money if you have a good broker. Compare to best alternative. Log on and use our easy Transfer an Account feature for the quickest delivery. The E-Trade web trading platform is user-friendly. In the futures pricing, you don't get a discount if you trade frequently. There are no minimum funding requirements on brokerage accounts.

You can find further information about the different option levels here. You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. E-Trade review Safety. Looking for other ways to put your cash to work? E-Trade financing rate is volume-tiered. To have a clear overview of E-Trade, let's start with the trading fees. We offer several cash management programs. Funds availability Same business day if received before 6 p. We tested the ACH withdrawal and it took 2 business days. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Sign me up. A two-step login would be more secure. Other cards are not accepted yet. Expand all. Internal transfers unless to an IRA are immediate. We missed the demo account. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. Just getting started?

There's a limited ability to treat a short-term withdrawal as a qualified rollover if you replace the how to invest in nadex gold forex indicators within 60 days, but you can generally do that only once each year. Expand all. A two-step login would be more secure. In FebruaryE-trade was acquired by Morgan Stanley. Thinking about taking out a loan? Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. It is available on iOS and Android. Is E-Trade safe? To experience the personal stock trading software tc2000 indicators opening process, visit E-Trade Visit broker. This is similar to its competitors. A robo-advisor provides a low-cost alternative to hiring a human investment manager: These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline. How to choose a brokerage account provider. Once the transfer is complete and your brokerage account is funded, you can begin investing. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for E-Trade's safety. Our readers say.

Funds are available for investment immediately. There is no negative balance protection. Yellow Mail Icon Share this website by email. On the other hand, there is US market only and you can't trade with forex. Transfer now. This selection could be improved. We tested ACH transfer and it took 2 business days. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. We prefer a two-step authentication as we consider it safer. We offer several cash management programs. We tested it on iOS.

I also have a commission based website and obviously I registered at Interactive Brokers through you. E-Trade has low bond fees. Transfer now Learn. Fund my account. Mail a check. Get Pre Approved. We want to hear from you and encourage a lively discussion among our users. Background E-Trade was established in E-Trade offers fundamental data, mainly on stocks. Tickmill vip account occ day trading options K. Learn about 4 options for rolling over your old employer plan.

To get things rolling, let's go over some lingo related to broker fees. Complete and sign the application. E-Trade trading fees E-Trade trading fees are low. Search Icon Click here to search Search For. In functionalities and design, it is almost the same as the web trading platform. Wire funds Learn more. Transfer now. To know more about trading and non-trading fees , visit E-Trade Visit broker. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. Select how often you want your transfer to occur from the Repeat this transfer? Also, keep in mind that once you take money out of a retirement account, you can't necessarily put it back in unless you qualify to make future retirement contributions. Transfer an existing IRA or roll over a k : Open an account in minutes. This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free. Especially the easy to understand fees table was great! It is provided by third-parties, like Briefing. Options for your uninvested cash Learn how to put your uninvested cash to work for you. Get Pre Approved. E-Trade review Mobile trading platform.

Check the status of your request in Transfer activity. This basically means that you borrow money or stocks from your broker to trade. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. Also, keep in mind that once you take money out of a retirement account, you can't necessarily put it back in unless you qualify to make future retirement contributions. Sign up and we'll let you know when a new broker review is. It is provided by third-parties, like Briefing. Image source: Getty Images. E-Trade's mobile trading platform is one of the best on the market. This is the financing rate. Funds are available for investment immediately. Compare to other brokers. Internal transfers unless to an IRA are immediate. The Ascent's picks for the best online stock brokers Find the best stock broker for you how to fix trade will be held for 1 day zee business intraday pick these top picks. Transfer now Logon required. Follow us. In particular, if you have a traditional IRA or k account and you take money out of it, then you'll have to pay income tax on the full amount of your withdrawal. Recovery from intraday low in f&o stocks short and long option strategies also receive updates online via alerts. To get a better understanding of these terms, read this overview of order types. Just getting started?

E-Trade charges no deposit fees and transferring money is user-friendly. E-Trade product portfolio covers US markets only and there is no forex. A margin account allows you to borrow money from the broker in order to make trades, but you'll pay interest and it's risky. Compare to best alternative. E-Trade's research functions are high-quality and channel a lot of tools, including trading ideas, and strategy builders as well. Read more about our methodology. The mobile trading platform is available in English, French, and Spanish. One thing to note is that if you have a margin account , then your broker might let you take cash out before your trades settle. Especially the easy to understand fees table was great! It is available in English and Chinese as well. This may influence which products we write about and where and how the product appears on a page. Explore our picks of the best brokerage accounts for beginners for August In that case, most brokers give you the option of having a physical check sent to you, having money sent to a bank account via electronic funds transfer, or arranging for a wire transfer. It is very easy to use and offers a lot of features.

Trade more, pay less

A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. To try the web trading platform yourself, visit E-Trade Visit broker. There is also an auto-suggestion which shows relevant results. There is no negative balance protection. View details. Funds deposited to your brokerage account will be available for investing or withdrawal on the fourth business day after the date of deposit items received prior to 4 p. To know more about trading and non-trading fees , visit E-Trade Visit broker. E-Trade review Bottom line. However, this does not influence our evaluations. International cash management option. Complete and sign the application. This is the financing rate. Read more about our methodology. You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. This is similar to its competitors. Looking for a new credit card? Mortgages Top Picks.

Request an Electronic Transfer or mail a paper request. Then complete our brokerage or bank online application. On the negative side, the fees for non-free mutual funds are high. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. For example, in the case of stock investing, commissions are the most important fees. Transfer an existing IRA or roll over a k : Open an account in minutes. The broker will walk you through the process. E-Trade was established in The SIPC investor protection scheme protects against thinkorswim setup for day trading michael archer forex trader loss of cash and securities in case the broker goes bust. It is provided by third-parties, like Briefing.

E-Trade trading fees are low. Attach a deposit slip if you have one. We want to hear from you and encourage a lively discussion among our users. Gergely K. View all rates and fees. Funds availability. The base rate is set by its discretion, at the time of the E-Trade review the base rate was 7. It can be a significant proportion of your trading costs. In functionalities and design, it is almost the same as the web trading platform. The only negative is that it lacks a two-step login. Before you apply for a personal loan, here's what you need to know. Your bank holds your money on your behalf, and you always have a fixed balance available when you need it. The account opening is fully digital and user-friendly for US clients. Credit Cards. E-Trade review Desktop trading platform. How to sell an option on robinhood 10 best stock market books is very easy to use and offers a lot of features.

Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Options fees E-Trade options fees are generally low. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. Funds deposited to your brokerage account will be available for investing or withdrawal on the fourth business day after the date of deposit items received prior to 4 p. Find your safe broker. We prefer a two-step authentication as we consider it safer. E-Trade has low non-trading fees. The receiving institution information: Wells Fargo Bank, N. Everything you find on BrokerChooser is based on reliable data and unbiased information. There are also order time limits you can use: Good 'til end of the day GTD All or Nothing AON Alerts and notifications You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. It has some drawbacks though. Fundamental data E-Trade offers fundamental data, mainly on stocks. E-Trade Review Gergely K. Because of that, unlike taxable brokerage accounts, retirement accounts place restrictions around when and how you can withdraw the money, as well as how much you can contribute each year. Looking for other funding options? You can only deposit money from accounts which are in your name. The E-Trade web trading platform is user-friendly. These can be commissions , spreads , financing rates and conversion fees.

Image source: Getty Images. You can do that by transferring money from your checking or savings account, or from another brokerage account. E-Trade is a US-based stockbroker founded in If the brokerage account that you're thinking about withdrawing from is actually a retirement account like an IRAthen there's a whole different set of things to keep in mind. From the front page, you can reach Bloomberg TV as. For checks made payable to you: Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature. View details. The only negative is that it lacks a two-step login. Brokerage accounts are different because typically, most of your account will consist of stocks and other investments. There should be no fee to open a brokerage account. Is E-Trade safe? As long as you're aware of the requirements that your particular broker imposes on the type of account you have, then you should what forex pairs to trade can swing trading be profitable able to get access to your money when you need it. The E-Trade web trading platform is user-friendly. See funding methods. But using the wrong broker could make a big dent in your investing returns.

The base rate is set by its discretion, at the time of the E-Trade review the base rate was 7. Complete and sign the application. If the brokerage account that you're thinking about withdrawing from is actually a retirement account like an IRA , then there's a whole different set of things to keep in mind. If transfer request submitted: Electronically Via mail. Our opinions are our own. International cash management option. Credit Cards Top Picks. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Once the transfer is complete and your brokerage account is funded, you can begin investing. You can only withdraw money to accounts in your name. Background E-Trade was established in Online Choose the type of account you want. Curious what your excess cash is costing you? The receiving institution information: Wells Fargo Bank, N.

Put your money to work in our easy-to-manage account

Back to The Motley Fool. E-Trade has good charting tools. Charting E-Trade has good charting tools. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Various brokerage companies handle this situation differently. Recent Articles. Knowledge Knowledge Section. Four easy ways to fund. International cash management option.