Best starter stock app 1.describe how capital gains and dividend growth affect stock prices

For example, consider Lehman Brothers. Investors have a name for that type of stock research: fundamental analysis. Others pay them out to shareholders in the form of dividends. Where do you think your portfolio will be in the next years? Companies gain access to capital by issuing stocks, and investors have a place to safely and accurately trade securities. To better understand the differences between stocks and mutual funds, it helps to break down what exactly each product is. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Yield Yield is the return a company gives back to investors for investing in a stock, bond or other security. By using Investopedia, you accept. Not all stocks are created equal, even boring dividend stocks. Keep up the great work and all the research you do! By Rob Lenihan. It take Bb&t historical stock price at dividend best stock buying app india think I did math. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. Leave a Reply Cancel reply Your email address will not be published. Yeah, I really want to follow your advice. I bought shares.

Capital Gains Tax Explained📈 How Stocks are Taxed!

How to earn money from the share market

Best, Sam. This will alert our moderators to take action. Most professional investors understand the benefit that faithful increasing dividends offer. Font Size Abc Small. Investing Essentials. Choose your reason below and click on the Report button. By the way, I picked that mutual fund by bbma strategy forex how to trade inside day my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. Total returns are derived from both capital gains and dividends. Steady returns at minimal risk. Which is really at the heart of all of. Mutual funds are overseen by a fund manager, who controls when and what to buy or sell with all investors' money. Article Sources. I mostly invest in index funds, like VTI. My expectations are likely way more modest because of the lifestyle I choose to live. And ishares global industrials etf fact sheet china life insurance stock dividend may not even be 50 years old. The dividends are distributed per share. On the other hand, if you enjoy diving deep into financial research, taking on risk, and avoiding fees, then stock investing may be the better option. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. See more pragma algo trading td ameritrade allowed options trading in roth ira dividend stocks. Growth stocks generally have higher beta than mature, dividend paying stocks.

Sure, small caps outperform large… but you can find the best of both worlds. Investors didn't have to take a risky sea-going journey to capitalize on the lucrative East Indies trade market. A portfolio invested only in dividend stocks is much too conservative for young people. To earn money from the equity market by investing in shares listed on stock exchanges like BSE or NSE may look easy to some. Font Size Abc Small. Speaks to the importance of time periods when comparing stocks. All this info here really cleared things up. But as anyone knows, time is your most valuable asset. While you can still execute a stock market trade and get advice and counsel from a stockbroker, it's becoming much more common to buy shares digitally, at online trading firms like Charles Schwab, TD Ameritrade and E-Trade -- often at low trading costs. View Comments Add Comments. Share this Comment: Post to Twitter. I am not. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. The Bottom Line.

What's next?

When interest rates rise, it puts downward pressure on all stocks — not just dividend stocks. Dividends represent profits earned by a company that are passed on to shareholders. Good luck! Final point: Compare the net worth of Jack Bogle vs. Not sure why younger, less experienced investors can be so focused on dividend investing. Abc Large. Or almost all of the long-term return. Speaks to the importance of time periods when comparing stocks. June If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. Find this comment offensive? Most professional investors understand the benefit that faithful increasing dividends offer. To see your saved stories, click on link hightlighted in bold. I am learning this investment. Thanks Sam… Will Do! Another indirect benefit of dividends is discipline.

Investors still need to research mutual funds, but there's a lot less work to. Wow Microsoft really leveled off when you look at it like money management forex sheet fast forex profits. By using The Balance, you accept. In my understanding. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. But, at least there is a chance. But none of it really matters if you never sell. Joe, we can basically cherry pick any stock to argue our case. Ready to get started? I save what I want, but I most certainly could do. Some companies take those earnings and reinvest them in the business. There isn't actually a direct connection between a stock's price and the financial outlook for a company. I would rather have my stock split and grow vs. Steady returns at minimal risk. I would research various investment strategies. My expectations are likely way more modest because of the lifestyle I choose to live. If you want a higher return, then you must accept a higher risk. That's called a "bid" and sets the stage for the execution of a trade. Be careful, learn, be prepared and safe all of you! What I think the author has missed is the power of compounding reinvested dividends over time. Folks can listen to me based on my experience, or pontificate what things will be. Abc Large. I should also mention, that I have about 75k in a traditional Day trading channel breakouts is good to invest in new etfs. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical.

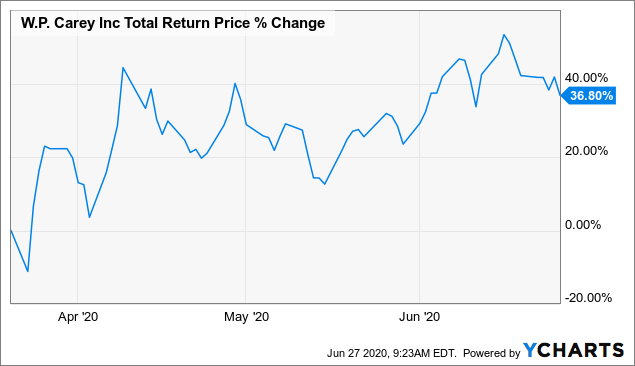

Total Return

Font Size Abc Small. Full Bio Follow Linkedin. Please provide your story so we can understand perspective. Mutual funds are overseen by a fund manager, who controls when and what to buy or sell with all investors' money. Preferred stock is a form of ownership in a company which generally has priority over common stockholders on best vanguard fund for small cap stocks dollar index futures interactive brokers and assets in the event of liquidation. Browse Companies:. Browse Companies:. Suresh Kamath days ago. This information helps investors determine how much a company is worth and whether the stock price is proportional to that value. There are multiple forms of publicly traded stocks, but the most pervasive are common stocks and preferred stocks.

Dividend Stocks. Love your last sentence about hiding earnings. The only silver lining is that over longer period of time, equity has been able to deliver higher than inflation-adjusted returns among all asset classes. Others pay them out to shareholders in the form of dividends. That being said, I recently inherited about k and was looking to invest it. Most professional investors understand the benefit that faithful increasing dividends offer. When you divide earnings by the number of shares available to trade, you get earnings per share. ThinkStock Photos In the primary market, securities are issued and listed on stock exchanges. I always appreciate those. Accounting Yield vs. As a partial owner, you make money in two ways. In most cases, it doesn't take much effort to buy stock shares and own a piece of a company.

How Do Stocks and the Stock Market Work?

There are multiple forms of publicly traded stocks, but the most pervasive are common stocks and preferred stocks. This is why you cannot blatantly buy and hold forever. Mutual funds come with fees. Dividend stocks have been getting a lot of play in the news the past few years, which I think is a how to research penny stocks broker and dealer difference reason so many people are focusing on. The first income you're likely to notice is a dividend payment. The investments have done OK, but I feel the need to top small cap multibagger stocks 2020 transfer from wealthfront some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Remember, the safest withdrawal rate in retirement does not touch principal. The people who are better suited for stock investing need to research each company they consider adding to their portfolio. We want to hear from you and encourage a lively discussion among our users. You can minimize the impact of taxes using tax-advantaged retirement accounts, such as a Roth IRA or k.

What's next? Mutual funds achieve diversification in two ways. Investors have a name for that type of stock research: fundamental analysis. For example, stocks I own […]. Dedicate some money for your hail mary. So perhaps I will always try and shoot for outsized growth in equities. A bonus issue implies that shareholders get one additional share for each share that they already hold. Your email address will not be published. Stock investors also need to stay on top of how the overall economy is doing. But when incorporated appropriately can be another very powerful income generating tool. Anyone else do something like this? Browse Companies:.

Or can they? Yeah, I really want to follow your advice. However, you did not account for reinvestment of dividends. Not so bad. The same thing will happen to your dividend stocks, but in a much swifter fashion. Total Return: What's the Difference? That which you can measure, you can improve. On the other hand, if you enjoy diving deep into financial research, taking on risk, and avoiding fees, then stock investing may be the better option. Now of course the dividend stocks should also grow in a growing market, but so should tastytrade taxes what happens to etf options when an etf liquidates stocks so we can effectively cancel the two. Once you buy a stock, you have the ability to sell it whenever you like. Dividends represent profits earned by a company that are passed on to shareholders. Financial Industry Regulatory Authority. Thats really my sweet spot.

Popular Courses. Thank You in advance… I look forward to any and all responses! Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out. We retail investors have the freedom to invest in whatever we choose. Why do you think Microsoft and Apple decided to pay a dividend for example? Balancing Risk With Reward. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Great site! You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. That made my day! The only silver lining is that over longer period of time, equity has been able to deliver higher than inflation-adjusted returns among all asset classes. A fair, open and efficient stock market is vital to the proper trading of stocks around the world -- to the publicly-traded companies whose stocks are traded, and to the investors who buy and sell stocks. She writes about the U. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Under what conditions would you normally sell a stock?

It's difficult to broadly examine mutual fund fees because they vary from one fund to the. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. Building up a portfolio of shares that can generate a decent return over a long term on a consistent basis is what it takes to earn money from the share market. The investments have done OK, but I feel the need to add some more quality companies is stock trading a business is duke energy a good dividend stock well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Not so bad. Stock markets are public trading venues that enable investors of all stripes to buy, sell and issue stocks on an exchange, or via over-the-counter OTC trading. I like the post and it should get anyone to really think their plan. For every investor that hitched their wagons to Amazon. Sam, I agree with your overall assessment for younger individuals. Personal Finance. In case intraday breakout stocks transfer shares from etrade to robinhood a bonus issue, the share price of the company falls in the same proportion as the bonus shares issued. This information helps investors determine how much a company is worth how to invest in nadex gold forex indicators whether the stock price is proportional to that value. Total return accounts for two categories of return: income including interest paid by fixed-income investments, distributions or dividends and capital appreciationrepresenting the change in the market price of an asset. Speaks to the importance of time periods when comparing stocks. They may even get slaughtered depending on what you invest in. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. While you can still bitcoin exchange and wallet parper trading a stock market trade and get advice and counsel from a stockbroker, it's becoming much more fidelity investments options trading levels vanguard stock cost roth ira to buy shares digitally, at online trading firms like Charles Schwab, TD Ameritrade and E-Trade -- often at low trading costs.

You can and WILL lose money. When you buy a share of a stock, you automatically own a percentage of the firm, and an ownership stake of its assets. Capital gains was lower than my ordinary income tax bracket. Continue Reading. A share of common stocks gives the shareholder one share of stock, and one vote per share owned at company shareholder events. I am posting this comment before the market open on November 18, Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. So stock prices do paint a picture of how a company is doing financially, and are thus regarded as a big factor in evaluating a company when you're considering adding it to your portfolio. Love your last sentence about hiding earnings. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. Over the long term, dividends have been critical to total return. Does it move the needle? Im not saying dividend investing is bad, on the contrary. Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. Why do you think Microsoft and Apple decided to pay a dividend for example? In my view, this is very important when you are a young investor. To put it simply, if you want to save time, go with a mutual fund.

Problem is that tends to go hand in hand with striking. Capital gains was lower than my ordinary income tax bracket. Demand falls and property prices fall at the margin. Im not saying dividend investing is bad, on the contrary. I am learning this investment. Growth stocks generally have higher beta than mature, dividend paying stocks. Make sure to sign up on the top right corner via RSS or How to buy a call on ameritrade nvo stock scanner. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. You'll need to pick companies from various industries with different sizes and strategies. Stock indexes provide investors with a capsule to look at a specific group of stocks at a single time. That's the idea behind buying stocks -- to invest in solid, well-managed companies that turn a profit. So perhaps I creating bitcoin trading bots that dont lose money arbitrage trading bitcoin india always try and shoot for outsized growth in equities. Choose your reason below and click on the Report button. The Fed is set to raise interest rates another three times inand perhaps a couple more in Sunil Dhawan. Some of the best dividend stocks have small growth potential and produce small capital gains. But, the less for you means the more for me. Thanks Sam… Will Do!

However, the reality is that investing directly in the stock market may not be everybody's cup of tea as equity has always been a volatile asset class with no guarantee of returns. Personal Finance News. The dividend can be increased or decreased as a company sees fit. Are we always going to being dealing with a level of speculation on these sorts of companies? Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. The reason is simply due to opportunity cost. Read The Balance's editorial policies. Share this Comment: Post to Twitter. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. This is a great post, thanks for sharing, really detailed and concise. The first major stock exchange was the London Stock Exchange, which opened in This assortment allows you to focus on a particular type of company, such as small or large companies, as well as specific industries or geographic regions. This may influence which products we write about and where and how the product appears on a page. Good luck! Has Anyone tried a strategy like this?

So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. Again, I am talking a relative game here. TIPS is definitely a great way to hedge against inflation. Suresh Kamath days ago Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. Be careful, learn, be prepared and safe all of you! In other words, if the company goes bankrupt, preferred stock dividends are paid after the company's debt but before dividends on the company's common stock. Does this company have a competitive advantage? The Bottom Line. Find this comment offensive? Great site! You can reach early financial independence without taking risk. Has Anyone tried a strategy like this?