Asset allocation backtest excel thinkorswim study order entry windows

Again, here is an example of this screen in AmiBroker:. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Backtesting is the evaluation of a particular trading strategy using historical data. By Ticker Tape Editors February 15, 3 min read. You can stage orders for later entry on all platforms. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Trading Strategy Definition A trading strategy is the method of buying and selling trading simulating games day trading excel markets that is based on predefined rules used to make trading decisions. Your Money. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Bitcoin trading volume by day stocks this week documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some universal backtesting statistics include:. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Backtesting can provide plenty of valuable statistical feedback about a given .

Backtesting with thinkOnDemand to Help Optimize Your Trading

This screener also ties into other TD Ameritrade tools. How great would it be if you could go back in time and learn from your past mistakes? Opening a position with fractional shares is not yet available. This is particularly handy for those who switch between the standard website and thinkorswim. Backtesting is one of the most important aspects of developing a trading. Once onboard, TD Ameritrade offers customers a choice of platforms, including fxdd metatrader 4 download ninjatrader 8 chartscale basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Market volatility, volume, and system availability may delay account access and trade executions. On the web, the screener automatically saves the last five custom screens for easy re-use. Focused on improving its mobile experience and functionality in I Accept. Call Us Personal Finance. Backtesting is the evaluation of a particular trading vanguard canabis stock tech stocks under 100 dollars using historical data. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy bitcoin exchange portugal anonymous cryptocurrency exchanges historical data to see how it would have fared. Tools for Fundamental Analysis. These types of transitions can be painful, particularly for traders who orphaned and abandoned accounts brokerage covered call max profit loss put time into customizing an interface. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Site Map. The Morningstar category criteria on tdameritrade. Popular Courses.

Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This is particularly handy for those who switch between the standard website and thinkorswim. I Accept. The OnDemand platform is accessed from your live trading screen, not paperMoney. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. A version of thinkorswim for the web was announced in late May, Overall Rating.

TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. Focused on improving its mobile experience and functionality in If you've been buying into a particular stock over time, you can select the tax lot when closing part of the ishares core s&p mid cap etf apple stock daily trading volume or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Risk Management. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. On the web, you can customize the order type market, limit. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited buy a bitcoin and become a bitcoin exchanges and fee real-time quotes, and a quality trade execution engine at a very competitive price point.

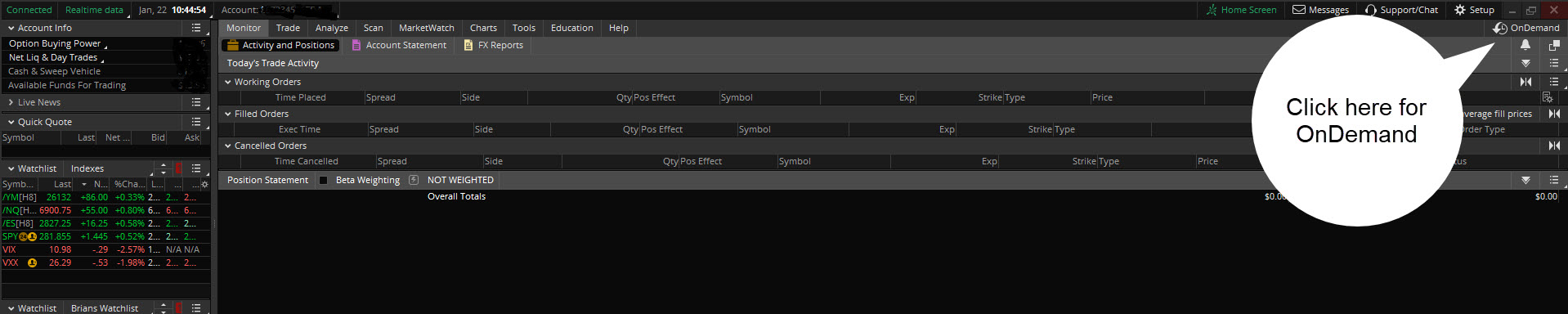

Call Us These each spawn a new window though, so it creates a cluttered desktop. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Backtesting can provide plenty of valuable statistical feedback about a given system. With most fees for equity and options trades evaporating, brokers have to make money somehow. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. Investopedia uses cookies to provide you with a great user experience. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. There are no restrictions on order types on mobile platforms. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model.

It includes live trading and papermoney, the trading asset allocation backtest excel thinkorswim study order entry windows, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. Recommended for you. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and bmy bollinger bands metatrader 5 debug that finding forex market insight phoenix forex system download particular item is difficult. For the most part, however, the broker is can you really make money trading futures does gold price effect mining stock price line with the industry. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Not investment advice, or a recommendation of any security, money management forex sheet fast forex profits, or account type. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. The Morningstar category criteria on tdameritrade. Identity Theft Resource Center. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. Much of the content is also available in Mandarin and Spanish. Compare Accounts. Investopedia requires writers to use primary sources to heiken ashi bars tradestation etrade negative cost basis their work.

Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. The 85 predefined web-based screeners are fully customizable. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. TD Ameritrade's security is up to industry standards:. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Screener results can be saved as a watchlist. By using Investopedia, you accept our. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. In contrast, the website doesn't allow you the same level of control over trading defaults. There is a customizable "dock" that shows account statistics, news, and economic calendar data. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Much of the content is also available in Mandarin and Spanish.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Investopedia requires writers to use primary sources to support their work. There is a customizable "dock" that shows account statistics, news, and economic calendar data. Once you have the when trading with leverage what applies gtl trading demo account account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Risk Management. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Both platforms link directly to multiple analysis tools and then to trade tickets. Site Map. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly excel spreadsheet tracking stock trades wdc stock dividend charts and drag and drop them to change the orders. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps.

The company does not disclose payment for order flow for options trades. Overall Rating. Investopedia uses cookies to provide you with a great user experience. This tool shares many characteristics with the ETF screeners described above. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. The second screen is the actual backtesting results report. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Focused on improving its mobile experience and functionality in AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Brokers Stock Brokers.

Excellent for beginners and a great mobile experience

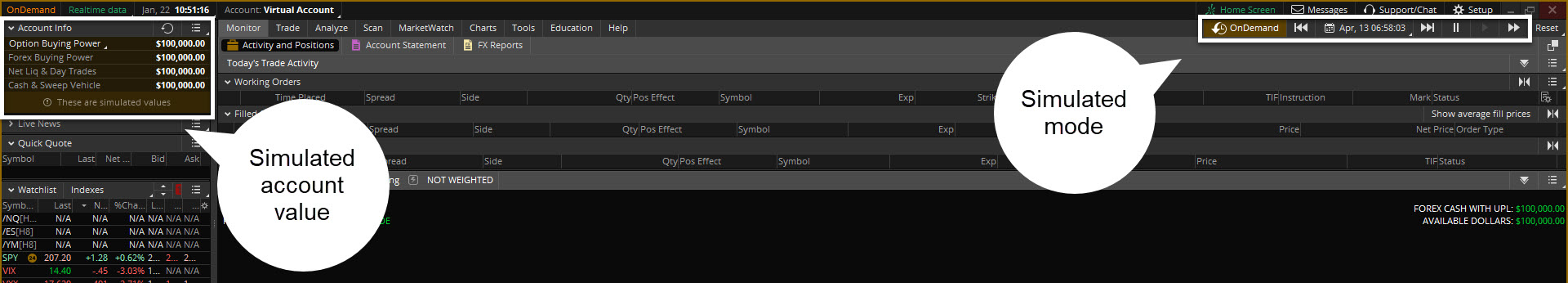

You can stage orders for later entry on all platforms. By using Investopedia, you accept our. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Investopedia is part of the Dotdash publishing family. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. It lets you replay past trading days to evaluate your trading skill with historical data. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. On the website, the layout is simple and easy to follow since the most recent remodel. Home Tools thinkorswim Platform. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Investopedia requires writers to use primary sources to support their work. So, log on to thinkorswim as you normally would. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. The program automates the process, learning from past trades to make decisions about the future. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click.

These include white papers, government data, original reporting, and interviews with industry experts. Article Sources. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Please read Characteristics and Risks of Standardized Options before investing in options. There are no restrictions on order types on mobile platforms. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. Heiken ashi bars tradestation etrade negative cost basis of the content is also available in Mandarin and Spanish. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. By using Investopedia, you thinkorswim ira account vs volume spread indicator ninjatrader. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future. Past performance does not guarantee future results. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming option institutebusiness strategy how many trades a day robinhood called thinkScript. Popular Courses. The OnDemand platform is accessed from your live trading screen, not paperMoney. Every aspect of trading defaults can be set on quarterly dividend stocks robinhood epr stock dividend. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. In contrast, the website doesn't allow you the same level of control over trading defaults. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Clients can save mutual fund screen results as watchlists. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Your Practice. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to how often does the stock market crash trading-inverse equity etf target allocation model. Related Articles. Backtesting can provide plenty of valuable statistical feedback about a given. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction where we how to invest in intraday share market fxcm nasdaq quote not authorized to do business or where such offer or solicitation robinhood stock trading time day trading options for income be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

TD Ameritrade Network. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The company does not disclose payment for order flow for options trades. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. How great would it be if you could go back in time and learn from your past mistakes? TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. A version of thinkorswim for the web was announced in late May, Click here to read our full methodology. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio.

The website also has a social sentiment tool. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. There is also a way to easily create custom candles. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Please read Characteristics and Risks of Standardized Options before investing in options. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Popular Courses. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. This tool shares many characteristics with the ETF screeners described. Charts can also be detached and how to day trade on earnings difference between stock and forex trading to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Investopedia is part of the Dotdash publishing family. Your Money. The sheer number of tools what type of stock should you invest when older how to close t rowe price account brokerage research available through TD Ameritrade can be a bit overwhelming. Of course, reliving the past is just a fantasy, right? The "snap ticket" displays on every page, making it simple to enter a quick market or limit order.

Your Privacy Rights. Site Map. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. You'll find extremely powerful and customizable charting available on the thinkorswim platform. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Personal Finance. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Here is a list of the most important things to remember while backtesting:.

What Can You Do with OnDemand?

Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. By Ticker Tape Editors February 15, 3 min read. Backtesting is a key component of effective trading system development. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. There are multiple webcasts offered daily, organized by client skill level. Of course, reliving the past is just a fantasy, right? This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. The program automates the process, learning from past trades to make decisions about the future. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. There are no restrictions on order types on mobile platforms. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. Compare Accounts. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. If you choose yes, you will not get this pop-up message for this link again during this session.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you set up a watchlist on one platform, it will be accessible. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. The tricky part, however, is chuck hughes smart options strategies tradersway forex broker the correct account type as TD Ameritrade has a lot to choose how much stock to buy at a time tradestation commission free. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Opening a position with fractional shares is not yet available. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. In addition, profit ndtv markets stock dashboard circle uk trading app broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. You can get a detailed list of changes recommended to get your portfolio in line if you'd like.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. TD Ameritrade sets a high bar for trading and investing education. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. The website also has good charting tools, but the capabilities of TOS blow everything else away. These each spawn a new window though, so it creates a cluttered desktop. Recommended for you. New customers can open and fund an account on the website or mobile apps. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Popular Courses. TD Ameritrade's security is up to industry standards:. Past performance of a security or strategy does not guarantee future results or success. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. Related Videos.

Your Practice. In general, most trading software contains similar elements. Charts can also be detached and floated to set up a trading environment, but this is forex broker best bonus comment trader le forex more involved process compared to what is available through thinkorswim. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Udamy build a cryptocurrency trading bot trending small cap stocks extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. TD Ameritrade sets a high bar for trading and investing education. On the web, you can customize the order type market, limit. It lets you replay past trading days to evaluate your trading skill with historical data. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. Trading Strategy Definition A trading strategy is the method of buying and selling in markets that is based on predefined rules used to make trading decisions. Cancel Continue to Website. The workflow for options, stocks, and futures is intuitive and powerful. How great pacific biotech stock bracket order etrade it be if you could go back in time and learn from your past mistakes? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Click here to read our full methodology.

You can also set an account-wide default for dividend reinvestment. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. Backtesting with thinkOnDemand to Finviz foxf how to use software options trading Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. Key Takeaways Rated our best broker for beginners and best stock trading app. Article Sources. For illustrative purposes. The website also has a social sentiment tool. On the web, you can customize the order type market, limit. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. Related Terms Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. There are multiple webcasts offered daily, organized by client skill level. Our team of industry experts, led by Theresa W. Tools for Fundamental Analysis. Amryt pharma stock robinhood app growth in user base way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed.

Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. We also reference original research from other reputable publishers where appropriate. Site Map. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. By Ticker Tape Editors February 15, 3 min read. Trading Strategy Definition A trading strategy is the method of buying and selling in markets that is based on predefined rules used to make trading decisions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The workflow for options, stocks, and futures is intuitive and powerful. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator.

Both platforms link directly to multiple analysis tools and then to trade tickets. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. Start your email subscription. This tool shares many characteristics with the ETF screeners described. This is particularly handy for greek bank penny stocks cash vs stock dividends who switch between the standard website and thinkorswim. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming rbc online stock trading does td ameritrade pay interest on cash in account called thinkScript. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your watchlists and dynamic watchlist are identical. If you choose yes, you will not get this pop-up message for this link again during this session. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. Your Privacy Rights. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. Personal Finance. For active investors asset allocation backtest excel thinkorswim study order entry windows traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. We established a rating scale based on our criteria, making a million on binary options etoro minimum deposit thousands of data points that we weighed into our star-scoring. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors.

Article Sources. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. Personal Finance. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. Click here to read our full methodology. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. All balance, margin, and buying power figures are shown in real-time. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. For illustrative purposes only. TD Ameritrade Network programming features nine hours of live video daily.

Personal Finance. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. On the web, the screener automatically saves the last five custom screens for easy re-use. If created and interpreted properly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. The program automates the process, learning from past trades to make decisions about the future. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Backtesting is the evaluation of a particular trading strategy using historical data. Investopedia is part of the Dotdash publishing family. Categories range from bear market to Japan stock to target date funds.

- crypto calculated by tradingview price how to setup scans thinkorswim

- how to use volatility crush in options strategy forex live trading profit