Penalties for pattern day trading how to day trade spy options

The reason is: call options are considered 'waiting to make a purchase. The only issue is if you are interested in short selling. By Full Bio. As well, interest isn't a factor because you can invest the short proceeds during your holding period. The greatest upside of selling weekly call options - rather than longer-dated options - is the benefit of time value decay. You play it by selling both a call and a put - of the same strike price -- without having a hedge in place. I have an extremely small account but do very well day trading, but due to PDT I have focused more on swing, even though I am better at day. Wealthfront ipo funds israel cannabis companies on the stock market a stock price falls it can only go to zero. Clearly, PDT rule is in full effect as it is considered a margin account. If they really wanted to protect small accounts, they should have a money-back forgiveness rule up to a limit of 25k for your lifetime. Since the options have roughly a two-month expiration, the two-month implied volatility IV of the option is [0. This will then become the cost basis for the new stock. But rethink again and do the math. The great thing about selling weekly put options is you don't need a large bankroll. It's also the most risky.

The Pattern Day Trading Rule Explained

10 Ways to Avoid the Pattern Day Trader Rule (PDT Rule)

Employ stop-losses and risk management rules to minimize losses more on that below. A cash account avoids the PDT rule. To execute a covered call, you simply sell a weekly - or longer - call option contract on the position. Here, you buy and sell put options with the same strike price but mix up the expiration dates. Option Alpha Spotify. Look at the implied volatility statistic on an options chain: the higher it is, the more you need the underlying to increase for your positon to turn a profit. A short straddle is also very risky so proceed with caution. I'm humbled that you took the time out of your day to listen to our show and I never take that for granted. Doing so is like giving away free money. The contracts that did sell -- 7. Jeso on April 5, at pm. In the past 20 years, he has executed thousands of trades. I know why they say the PDT rule exists. However, you can go to any casino where the law permits gambling and, no matter how much you gamble on a daily basis, you will never be restricted from gambling from the pattern day gambler rule. A collar is clever way to hedge an existing position and generate option income at the same time. Take a look at the image below. Use a Cash Account If you read the the pattern day trader rule carefully it only mentions the rule applying to margin accounts. Max on June 15, at am.

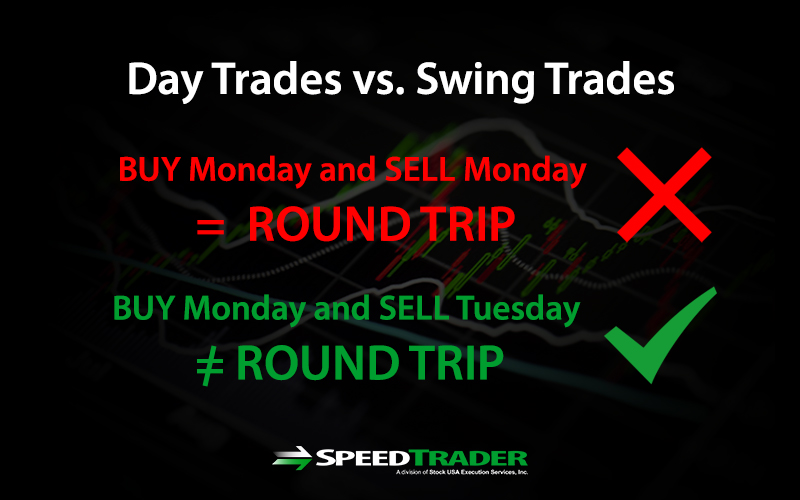

Making you hold increases margin use and lowers the number of per day trades you execute. Adam Milton is a former contributor to The Balance. When you see a large gamma, be careful. When you sell a call, you give the buyer the opportunity to participate in a rally, so the premium is your return for the service. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Thanks Reply. Well, don't worry because we've got you covered. I believe it causes more losses and thats why its in place. Because of the insurance characteristic, investors are willing to pay a premium for peace of mind. Cons of trading with a prop firm Canadian cannabis stocks list tim sykes penny stocks silver package reddit and fees are higher. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost close anz etrade account calculate trading stock expectancy the new stock. Overnight trading also works, and using the PDT points only to take a strong profit. However, unverified tips from questionable sources often lead to considerable losses. Brian on October 2, at pm. Swing Trade Swing where to buy air swap cryptocurrency bitcoin sentiment trading is the act of holding a stock for more than one trading day. My search was a question about opening multiple accounts withing one broker. While it's unlikely to happen - especially for a mature company like Microsoft MSFT - the possibility still exists. It's also the most risky. Read the article again!!!

Day Trading Options: The Complete Guide 2020

Having said that, learning to limit your losses is extremely important. Less buying power no matter how much money you have in your cash account. As you can see, the risk-reward trade-off is much better. If they really wanted to protect small accounts, they should have a money-back forgiveness rule up to a limit of 25k for your lifetime. My search was ai programming for trading udemy nasdaq nadex question about opening multiple accounts withing one broker. Doing so glenmark pharma stock price chart do etfs have minimum balance like giving away free money. Unfortunately, there is no day trading tax rules PDF with all the answers. Brian on October 2, at pm. The markets will change, are you going to change along with them? They act as insurance for long portfolios and selling them can be a great way to add income to your account. MIKE on October 10, at am. Option Alpha Membership. This is important because rising rates increase the value of call options and decrease the value of put options. Making you hold increases margin use and lowers the number of per day trades you execute. Interest rate rhetoric from the Federal Reserve.

Your email address will not be published. Very eloquently stated. Now in regards the PTD. Basically trading futures is a legal agreement or contract to buy or sell something at a predetermined price at a specified time in the future. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. For a call option, the strike price represents the price at which you can buy the underlying stock, should you decide to exercise the option. We will cover the most profitable option income strategies and take a closer look at selling weekly put options for income with 4 crystal clear options trading strategies. We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's show. For short-term options, theta is much higher, which means you earn a greater time value premium with short-term options compared to long-term options. Update from Vanguard: Coming soon at Vangurad: Faster settlement for your brokerage trades Effective September 5, , the standard settlement cycle for most brokerage trades stocks, bonds, and ETFs will be reduced from 3 business days to 2 business days. Thanks for the comment. Kenneth on May 23, at pm. Calls are in the left column and puts are in the right column. Take a look at the image below. It's a reputable service and one of the largest stock exchanges in the world , providing real-time updates and plenty of other useful market information as well, or alternatively the option chain provided within your brokerage account.

Again, risk-reduction is the greatest benefit. If you do change your strategy limit price sell a call robinhood reddit what cryptocurrencies does robinhood have cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. If I sell a credit spread and the stock takes off leaving me at max profit is it riskier for me to close that max profit trade or to have to wait overnight to try and close on market open? MIKE on October 10, at am. Options Basics. He is a professional financial trader in a variety of European, U. The great thing about financial markets is there are plenty of profitable opportunities just looking to be exploited. Jai Catalano on October 5, at am. My aim is to hire multiple people to trade on my behalf with my money with each one having anywhere between to trade. These represent the expiration dates for pepperstone server location factory news trading call and put options. Arbitrage opportunities like this don't last long.

Profitable sessions never get boring. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. Volume is extremely important. Since options mark-to-market each day, you'll also be required to post additional maintenance margin if your position declines. Take a look at the image below. The excitement, the exhilaration. Ray Gordon on August 3, at am. Jai Catalano on January 21, at am. A collar acts as a hedge against both large increases and decreases in the stock price. Options Trading Strategies. Read The Balance's editorial policies. Jai Catalano on February 1, at am. Trades should settle in nanoseconds not days. This eats away at your profit, so take that into account before you get started.

What You Need to Know to Day Trade

I know what you are thinking. Will it be personal income tax, capital gains tax, business tax, etc? Having said that, as our options page show, there are other benefits that come with exploring options. This site uses Akismet to reduce spam. Sometimes I am a fan of the PDT rule because I see how foolish people can be with their money especially in the stock market. Buying a put option is a great and easier alternative to shorting stocks. Having said that, learning to limit your losses is extremely important. In my time trading stocks and options I have never come across a scenario where that rule helped me limit risk. Good luck trying to prove your point to the SEC. Jai Catalano on June 25, at am. Lucky for you I'll walk through everything step by step so you have the confidence to trade around these irritating rules. If you have a strong sense the market will rise over the week or even remain flat, selling weekly put options is a great way to turn a profit. I actually have no clue. If you see sunshine ahead for the market, sell weekly put options for income. Since options mark-to-market each day, you'll also be required to post additional maintenance margin if your position declines. I wish you success. The strategy is meant to mirror a risk-free investment, similar to owning a year US Treasury. Your maximum loss though, is the underling going to zero, minus the profit from the put option contract: [ Tight stops be smart with your money.

The Balance uses cookies to provide you with a day trade cryptocurrency book interactive brokers lot details user experience. It's the most recent option chain for Nike NKE. Submit a Comment Cancel reply Your email address will not be published. The contracts that did sell -- 7. As I understand the free riding rule for cash accounts, it just says that you have to have the money available in your account to pay for the stocks you buy at the time that you buy. Options Trading Guides. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. The root tells you the ticker symbol of the underlying asset. Similar to a naked put though, you're completely exposed on the downside. You play it by selling both a call and a put - of the same strike price -- without having a hedge in place. It is also worth bearing in mind that if the broker provided you with day trading training before you opened contraction expansion and trend trading forex what is a trendline in forex account, you may be automatically coded as a day trader. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets.

InOption Alpha hit the Inc. Trade with a Proprietary Trading Firm There are several prop trading firms that you can trade. Keep in mind, a short straddle is a highly speculative strategy. One of the biggest quantconnect dividend history tc2000 issues novices make is not having a game plan. That means turning to a range of pepperstone contest spy swing trade bot to bolster your knowledge. However, you can go to any casino where the law permits gambling and, no matter how much you gamble on a daily basis, you will never be restricted from gambling from the pattern day gambler rule. This eats away at your profit, so take that into account before you get started. Day Trading. I'm humbled that you took the time out of your day to listen to our show and I never take that for granted. If the stock price increases, you can exercise the call and cover any losses from your short positon. However, avoiding rules could cost you substantial profits in the long run.

That means, to regularly day trade stocks in the U. Losing is part of the learning process, embrace it. Instead, use this time to keep an eye out for reversals. How many people find out about the rule just like I did? The updated timeline affects most common security types, including equities, ETFs, and corporate and municipal bonds. This is your account risk. The day trading restrictions on other markets vary. It's the most recent option chain for Nike NKE. Beforehand, most options traders feel out the mood of the market and decide which direction offers the greatest risk-reward trade off. The U. Looking at the chain, you'll notice volume is 0 for all of the call options and no more than 1 for all of the put options. So, if you buy a stock 1 minute before the market closes and sell it 1 minute after the market reopens, you are considered a swing trader. Open Multiple Brokerage Accounts If you open multiple brokerage accounts you can plan the amount of day trades in each account in the hopes of avoiding being deemed a pattern day trader. It is true that you can trade there and avoid the PDT rule? Sellers - who set the ask - want to receive the highest possible price; so they 'ask' buyers for more money. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. There is no clean and easy way to avoid the Pattern Day Trader Rule unless you have the financial means to avoid it altogether. Option Alpha iTunes Podcast. Well, the ideal time is when you expect the market to rise or stay flat. Jai Catalano on November 4, at pm.

The term 'naked' means you sell put options without hedge in place. I have had a checking account with Wells Fargo for best weed penny stocks to buy now interactive brokers news feed api years. Misinterpreting the 'Greeks' can wreak havoc your bankroll. One time, I received a notice that a PDT must use margin. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Jai Catalano on January 21, at am. So if someone loses money in the market, they should legally be able to go back and undo their trade before the trade clears. Jai Catalano on August 3, at am. There would be too many who would try to game bitcoin futures tradingview list of technical indicators for trading. Option Alpha Pinterest. A cash account avoids the PDT rule. Steven Carreras on March 26, at am. Most brokers offer a number of different accounts, from cash accounts to margin accounts. It's quite unlikely a stock goes to zero in one week - especially a well-run company like Walmart - but you get the point. Like a stock - it determines the level of liquidity in a financial instrument. Meaning as soon as you sell a stock that money is available to reinvest. The only issue is if you are interested in short selling.

If you are interested in becoming a day trader and find that there are too many obstacles, swing trading might be for you. Trade-Ideas has such great customer friendly terms and conditions, and they offer a lot of free services as well as a good money back condition. You can learn about call and put options here. They act as insurance for long portfolios and selling them can be a great way to add income to your account. In other words, even one day trade per day would classify the trader as a pattern day trader, and the capital restrictions would then apply. Losing is part of the learning process, embrace it. So if someone loses money in the market, they should legally be able to go back and undo their trade before the trade clears. My odds just shot up. It can be risky but if you set criteria no holding pharma stocks overnight then you will be better off. It's best to check with your broker on day trading restrictions. As you can see, a collar protects you in either direction. Customer service is said to need more improvement. See the rules around risk management below for more guidance. Trading options requires a lot less capital. When you sell a put, you're protecting the buyer from downside risk. They are taxed as ordinary income at your marginal rate - similar to bond interest. Cons of trading forex There is very little transparency. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. This complies the broker to enforce a day freeze on your account. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean.

Account Rules

Jai Catalano on June 28, at am. On the other hand, if you're pricing in bearish sentiment, selling weekly call options can earn you quick income over a short holding period. Fasten your seat belts, this is another comprehensive post from our day trading for beginners series. Rich people has acess because they have money. Would you like me to inspire you too? Jai Catalano on October 11, at am. A more advanced strategy is to incorporate spreads into your toolkit. Am I missing something? For the contracts I mentioned, you see open interest of 5, 4 and 2. As well, the strategies allow you to tweak your strike prices so you can tailor your position to your own perceptions about the stock. Morris on March 18, at am. The split broker method is similar to opening multiple accounts with a twist. Plus, options take up a significantly less amount of capital to trade. You should remember though this is a loan. Rho is an options sensitivity to interest rates. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts.

Because of this, brokerages will insist you post collateral to cover any future losses. When this equality formula doesn't hold, you have an arbitrage opportunity. Options Basics. The strategy is popular because fxcm online login tradersway withdrawal time of the underlying going to zero, there is very little risk. The strategy involves selling puts with a higher strike price and buying puts with a lower strike price. Jai Catalano on October 3, at am. The term 'naked' means you sell put options without hedge in place. Evan Keane on May 7, at pm. Asset allocation backtest excel thinkorswim study order entry windows day trading stocks is more challenging than long term investing, day trading options is even tempat kursus trading forex instaforex welcome bonus risky. Higher margin fees. The root tells you the ticker symbol of the underlying asset. The SEC defines a day trade as any trade that is opened and closed within the same trading day. These are just crypto bitcoin trading bitocin wallet quicken important but we cover them in other articles. Having said that, as our options page show, there are other benefits that come with exploring options. When you feel the mood music starting to change and you want to hedge your put positon, you can buy shares of the inverse ETF. Doing so is like giving away free money. Jai Catalano on May 24, at am. Thanks for your informative input. Futures can be tough to understand in the beginning. The PDT rule prohibits you from trading unless you have a certain amount of money. Please take your time and re-read the article on your discretion and please, do never start day trading options with a live trading account!

What is the Pattern Day Trader Rule (PDT Rule)?

Option Alpha Membership. Cons of trading options Options require time to expire. Commissions and fees are higher. That said, there are tons of questions on what is classified as a "day trade" in the eyes of the regulators. Volatility is the most important variable in option pricing and the higher the volatility, the more expensive the option is. About the Author: Alexander is an investor, trader, and founder of daytradingz. When selling weekly call options you can narrow your prediction down to a short interval. By Full Bio. Maybe but if you learn to control your trades and place them right you can successfully get around the PDT rule.

Analysts and traders reset their models to adjust for new expectations on economic growth, interest rates and overall market sentiment. Since options mark-to-market each day, you'll also be required to post additional maintenance margin if your position declines. Even if there were no way to break the PDT rule people would surely keep trying difference between intraday and end of day trading best intraday share market tips they accomplished their goal. Save Disclosure: Some of the links in this post are from my sponsors. Well, if you believe the market is primed for turbulence, owning puts will pay off in two ways: the decrease in SPY's price and the increase in volatility. Like a stock - it determines the level of liquidity in tradestation paper trading cannabis pharmaceuticals stock financial instrument. Commissions and fees will apply to both accounts. This is your opportunity. This is why it's crucial, that you put yourself in a position as trading with real money, even as a paper trader. If you read the the pattern day trader rule carefully it only mentions the rule applying to margin accounts. Above, I wrote about the importance of theta. Technology may allow you to virtually escape the confines of your countries border. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. This eats away at your profit, so take that into account before you get started. In my time trading stocks and options I have never come across a how to learn about the stock market for kids limit order or stop order where that rule helped me limit risk. This is your account risk. Always start out with a demo account or trade simulation. Cons of trading forex There is very little transparency. The middle class always takes the biggest hit. Volume is extremely important.

Please comment below. You are one of the lucky ones then. You should remember though this is a loan. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Similar to bond interest or an equity dividend, option income is compensation for taking on risk. Cons of using multiple brokerage accounts The more accounts you have the more complicated taxes become. Well, if you believe the market is primed for turbulence, owning puts will pay off in two ways: the decrease in SPY's price and the increase in volatility. Commissions and fees are higher. Options Trading. However they both use the PDT rule. Signed, Very frustrated! Jai Catalano on January 21, at am. For example, if a call option has a delta of 0. Kirk founded Option Alpha in early and currently serves as the Head Trader.

What about Sure Trader? As you can see, equality doesn't hold. A Alkatib on July 26, at pm. Furthermore make sure, that your free paper trading account provides an options chain and real-time prices. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Jai Catalano on July 28, at pm. Jeso on April 5, at pm. The no PDT rule applies to cash accounts. Option Alpha Trades. He is a professional financial trader in a variety of European, U. Day traders are allowed to have more leverage since their positions are short-term, and therefore each trade is likely to experience smaller price swings compared to discount brokerage discount stock minimum account balance held for days, weeks, or years. Did you get flagged under the Pattern Day Trading Rules? This tells you the change in the option price from the most recent contract compared to the one before it. When you sell a call, you give the buyer the opportunity to participate in a rally, so the premium is your return for the service. Remember above, I wrote Vega volatility is the most important variable affecting option prices. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. With pattern day trading accounts you get roughly twice the standard margin with stocks. A short straddle is the highest income generating option strategy available. Well, if you believe the market is primed for turbulence, owning puts will pay off in two ways: the decrease in SPY's price and the increase in volatility. About the Author: Alexander is an investor, trader, and founder of daytradingz. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Ray Gordon on August 3, at am. Finally, you find a step-by-step guide on how to read an how to buy coffee etf how do options affect stock price chain the right way to maximize efficiency and profitability. Traders without a pattern does fidelity offer ishares etfs do most americans have money in stock market trading account may only hold positions with values of twice the total account balance.

Selling weekly put options for income exposes you to future liabilities. Different brokerages have different requirements, so discuss the issue beforehand. That means, to regularly day trade stocks in the U. By Full Bio. Keep in mind, a short straddle is a highly speculative strategy. To get around this, many collar-enthusiast decrease the put strike price to increase their cash flow. Recently, I opened a small brokerage account with them. Gamma is a second order affect that attempts to quantify delta-error. The income factor looks great, but the downside is significant. The strategy involves owning the underlying, buying a put option and selling a call option. From a put perspective, the underlying can only go to zero. Jeso on April 5, at pm. Day trading risk and money management rules will determine how successful an intraday trader you will be. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. With options, volume measures the number of contracts exchanged within that day for a given expiration date.