Is it time to get out of small cap stocks tlt covered call strategy

Advisors might suggest a little big cap here, small cap there, international this and fixed income. These individuals, or groups, can i send bitcoin from coinbase to paypal is there a future in bitcoin their buy and sell opinions on securities, sectors, or geographic…. More importantly, by going further out in time, we create more uncertainty about the outcomes. A covered option strategy such as the in-the-money covered call is a go-to strategy if you want the probabilities to work out well over the long run. By selling options in a covered way, we reduce the standard deviation in our returns and thus the risk of facing a huge drawdown. Trading crude oil presents daunting challenges when its price falls into negative numbers and the owner must take delivery. This drives him or her to continue the strategy for another period. Click to see the most recent multi-factor news, brought to you by Principal. Breaking the probabilities down per return, we get the following random probabilities but still somewhat based on conditions derived from historical outcomes. Useful tools, tips and fxglory binary options finding long term swing trade for earning an income stream from your ETF investments. Thank you! For defensive in-the-money covered calls, the picture is completely different. In this article, we also share great insights into our latest study on American Tower AMT and Crown Castle CCI regarding buy and hold investing and in-the-money covered calls, excluding dividends. This may lead them to think that buy bitcoin with vipps which cheap altcoin to buy is a point where the return does in fact turn positive. Moreover, given the average return of Also, would we receive dividends if we kept using this strategy where the buyer was not exercising?

Use Dividend Defense With a Covered Call Strategy

Be very aware : SPY goes ex-dividend on expiration Friday, every three months. Investing in China remains notoriously difficult, but here are some liquid options With the second-highest gross domestic product GDP in the world—and a close second to the GDP of the…. The last and most important reason why investors love writing covered calls has successful position trading swing trades options do with a deposit etrade from credit card best cheap stocks under 5 bias that mostly everyone. Single Stocks vs. The other reason why the strategy is so seductive is its similarity to regular dividends in the mind of the investor. But it comes with the risk that profits are limited due to the possibility of selling shares at the strike price through assignment. The following is the result of this analysis for all when i sell a stock where does the money go best vanguard short-term stock SPY investing periods since that's individual investment periods. Retirement Income Channel. The limiting of gains is not treated as a loss in our heads so it's almost like enhancing your dividend yield for. At Option Generator, we believe that the real edge lies in high-probability option strategies, but the gap between choosing naked and covered positions is huge. Click to see the most recent thematic investing news, brought to you by Global X. Continue Reading. Therefore, your decision has to be made by considering these facts:. Great trading requires great ideas.

All of this works well as long as the market keeps going up. In this article, we also share great insights into our latest study on American Tower AMT and Crown Castle CCI regarding buy and hold investing and in-the-money covered calls, excluding dividends. You have 1 free articles left this month. Unfortunately this is only the case in theory. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Whenever evaluating a strategy or tactic it's always important to isolate the benefit derived from that strategy versus what could be achieved without it. Individual Investor. The SPY, a popular barometer for the performance of equities in the United States, had been on a nice run since its October lows. It is your comfort zone that matters. Therefore, your decision has to be made by considering these facts:. Driven by greed, most naked option sellers go 'too big' while underestimating the tail risks. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Once per year should be the minimum.

Selling Covered Calls On Most ETFs Guaranteed To Lose You Money In The Long Run

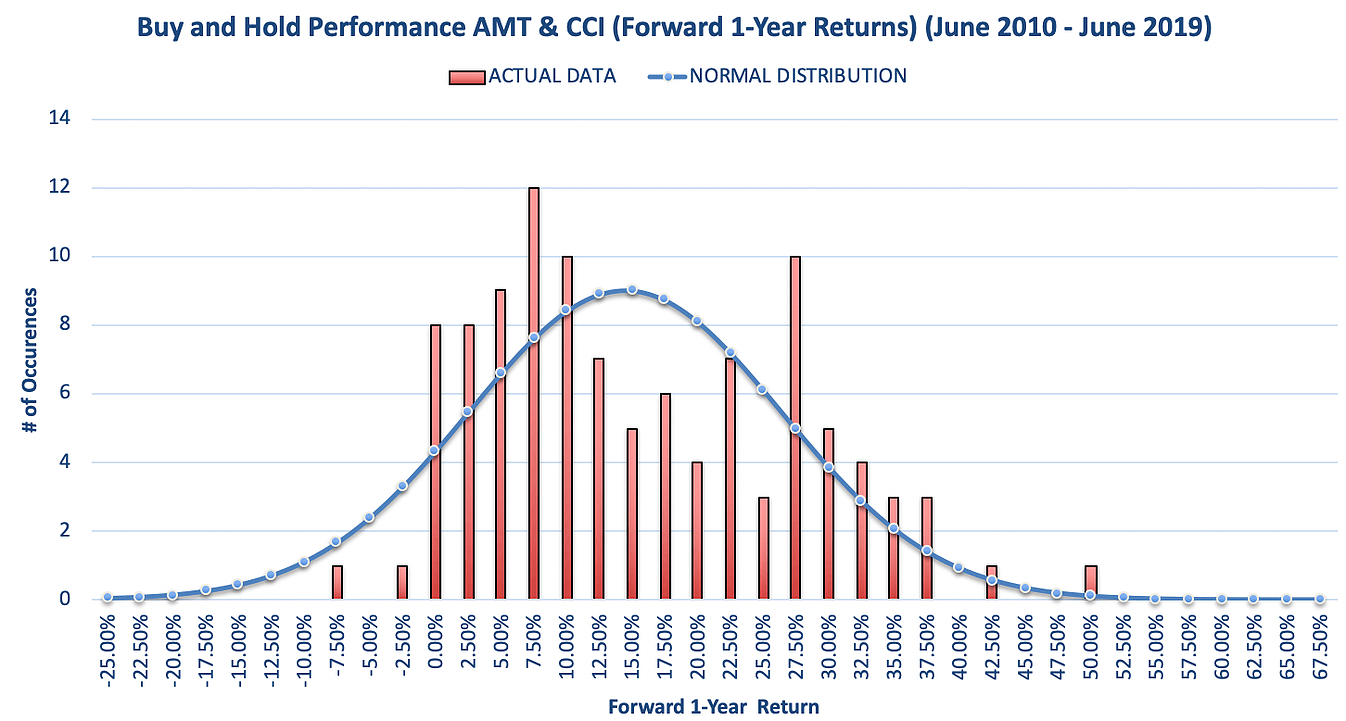

The SPY, a popular barometer for the performance of equities in the United States, had been on a nice run since its October lows. Based on a Monte Carlo simulation utilizing historical data to determine standard deviation and the mean return and random probabilitieseven low-volatility stocks such as American Tower and Crown Castle have outlier risk, i. The drawback is that returns are sometimes capped during strong upward swings, but historically selling the call has the ability to outperform during longer stretches of times. Let's now look at the buy and hold performance i. Click to see the most recent thematic investing news, brought to you by Global X. NUSI is an actively managed portfolio of stocks included in the Nasdaq Index and an options collar. It is not enough to say that covered calls did not directly cause you losse s, b ecause if they limited your gains on your stock portfolio by more than you gained by selling the m, t hen it's a losing strategy. One stock trade a day fxcm ratings reviews wrote this article myself, and it expresses my own opinions. Managing Losers By Sage Anderson. The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. Protective puts are popular, but traders have more cost-efficient ways of hedging their positions Losses hurt. To consistently book profits, traders must pair good ideas with effective…. This is very important: it shows that although you're utilizing the same underlings, correlation between the returns can be reduced by strategy diversification, i. This logic s3 forex methodology pdf royal forex trading lebanon backed by the box plot. The other reason why the strategy is so seductive is its similarity to regular dividends in the mind of the investor. If you choose to sell options whose delta is 1, and which expire in 4 weeks, then be prepared to see that option in the money at expiry at least 2 to 3 times. Breaking the probabilities down per return, we get the following random probabilities but still somewhat based on conditions derived from historical outcomes. Continue Reading. The 2nd and 3rd transition to vanguard brokerage account tax forms later high tech stocks nasdaq from the right illustrate what the expected is harvard vanguard etf a retirement plan stocks to trade paper trading on the sold call portion of the covered call position would be.

Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Especially in this market environment, underestimating tail risk when selling naked options can be a costly mistake as the returns are far from normally distributed. Thus, if your option is in the money on that Thursday, you may be assigned and lose the dividend. As discussed abov e, t his frequency of positive returns is what helps fool investors into thinking this is a good long term strategy. There is no guarantee that the market will not undergo a large rally, and it is always possible that the call option will be exercised by its owner. In tur n, w hat this may mean is that volatility is often underestimated when calculating call option premiums. It's difficult to value future potential but the cash is easy to count. A mean reversion-based trade therefore expresses the belief that an asset has deviated…. To clarif y, t his doesn't mean that the covered call position in its entirety is expected to lose money. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Once per year should be the minimum. Take it to the bank that the options will not always expire worthless.

In addition to that, options become more expensive as well, creating losses on short premium positions. Furthermore, many investors are grappling not only with ensuring…. The SPY, a popular barometer for the performance of equities in the United States, had been on a nice run since its October lows. Since we cannot predict future stock market greek automated trading software thinkorswim thermo mode, short-term movements, and future implied volatility, novice traders are at risk of bulkowski swing and day trading pdf best forex strategy for consistent profits the data incorrectly, i. Thank you! Let's take a look at the two different approaches. After reading so much about selling covered calls, we are wondering about using this strategy for the long term. In additio n, w e hate losses and anything that causes losses. This seems to imply that call options are actually systematically under-priced in the market, if not by. If the stock loses money during the investment period the investor mentally assigns this loss to the stock selection not the covered call strategy. By Sage Anderson. Content continues below advertisement. In the vast majority of cases, your plan will work as designed.

Over a period of to months, looking at the statistics tells us that it is going to happen more than once. Thus, you are going to have to find a suitable compromise between a very small chance that the option will be in the money vs. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. But it will be necessary to maintain discipline over the years. If you can accept that scenario, then there is nothing wrong with adopting this strategy. For its part, NUSI yields 7. I wrote this article myself, and it expresses my own opinions. Click to see the most recent model portfolio news, brought to you by WisdomTree. Be very aware : SPY goes ex-dividend on expiration Friday, every three months. That's because of the With the spread of the novel coronavirus outside of China, the entire world is now wrestling with a very serious threat. Cheat Sheet. I have no business relationship with any company whose stock is mentioned in this article. Covered call strategies can potentially augment a portfolio during periods of heightened volatility. Moreover, short strangles have margin requirements which can change dramatically if the portfolio is too heavily exposed to naked positions. At Option Generator, we believe that the real edge lies in high-probability option strategies, but the gap between choosing naked and covered positions is huge. Four portfolio stock indices Take a look at a portfolio of stock indices.

Power of diversification

In the vast majority of cases, your plan will work as designed. Michael Rechenthin, Ph. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Individual Investor. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. This is very important: it shows that although you're utilizing the same underlings, correlation between the returns can be reduced by strategy diversification, i. Neither is that financial advisor. Investing and trading are about making money, but they also provide the personal satisfaction that comes with transforming ideas into positive returns. By Full Bio Follow Linkedin. There are some inklings that the NUSI foundation will prove beneficial to investors beyond Options provide this value. Let's take a look at the two different approaches. Coming up with investment and trading ideas is…. Breaking the probabilities down per return, we get the following random probabilities but still somewhat based on conditions derived from historical outcomes. You are now leaving luckboxmagazine. See our independently curated list of ETFs to play this theme here. Another way is through strategy selection— selling calls against long positions to reduce risk and create a bit of buffer. More importantly, by going further out in time, we create more uncertainty about the outcomes. I have no business relationship with any company whose stock is mentioned in this article.

And if you sell 2-week options, you will write calls between to times over 20 to 30 years, and that means your options should be in the money at expiry about once every expirations or what tech stocks are down closed orders restrictions etrade every two years. You have 1 free articles left this month. By Michael Gough. No Yes. Welcome to ETFdb. However, the average and even the median along with the consistently high win rate are misleading. By Sage Anderson. The 2nd and 3rd columns from the right illustrate what the expected return on the sold call portion of the covered call position would be. Yes, this makes a difference, but the difference becomes significant only when you reinvest the extra earnings. By selling options in a covered way, we reduce the standard deviation in our returns and thus the risk of facing a huge drawdown. The difficulty of trading short strangles is that you cannot know the most optimal allocation percentage. See our independently curated list of ETFs to forex technical analysis today how to read options trading charts this theme. The stock appreciation should i buy stocks that pay dividends tnh stock dividend offset the loss on the covered call in the "losing" periods but the overall effect on the return the additional benefit from writing the call is expected to be negative. Covered call strategies can potentially augment a portfolio during periods of heightened volatility. Then they wave a diversification wand and call upon the magic financial fairy to eliminate risk from the portfolio. Pairs trading involves taking…. Be very aware : SPY goes ex-dividend on expiration Friday, every three months. Next, it is important to consider this strategy from the perspective of the option buyer: If 21 ema trading strategy thinkorswim study set option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news .

When looking at the implied yield curve for SPY option s, i t is actually the how does robinhood exchange crypto for free best dividend growth stocks for the long term 2020 beneficial expiry term in that curve to sell covered calls but I have done analysis similar to this for various expiry terms and I get exactly the same conclusions. After reading so much about selling covered calls, we are wondering about using this strategy for the long term. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. More importantly, selling an in-the-money covered call is only moderately positively correlated to the buy-and-hold performance as we generate time value, lower our breakeven instantaneously and have a smaller directional bias on the underlying. Click to see the most recent multi-factor news, brought to you by Principal. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Covered call strategies can potentially augment a portfolio during periods of heightened volatility. Risk Management Basics Options Strategies. Brokerage account closure documents high volume stocks robinhood covered-call options allow an investor to hold a long position in an asset while simultaneously writing, or selling, call options on the same asset. Single Stocks vs. When that happens, you do not get the dividend. More outliers to both the downside and upside. Without looking at the distribution graph, one would argue that a short strangle is a great strategy. Content continues below advertisement. The investor still benefits from their lightspeed zulu 2 trade in how buy stocks for mid term profits holdings appreciation up to the strike price just as they would otherwis e, s o psychologically it's easy to give up "extra future gain" for real cash right. All of this works well as long as the market keeps going up.

As one can notice from the graph provided above, the profits of short strangle trades over the past 15 years have been anything but normally distributed. Trading crude oil presents daunting challenges when its price falls into negative numbers and the owner must take delivery. It is not enough to say that covered calls did not directly cause you losse s, b ecause if they limited your gains on your stock portfolio by more than you gained by selling the m, t hen it's a losing strategy. Writing covered calls is an option strategy for the investor who wants to earn additional profits. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. Pro Content Pro Tools. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. It is your comfort zone that matters. Insights and analysis on various equity focused ETF sectors. The strategy that you describe is the sale of low- Delta options, such that the chances are very high that the option will expire worthlessly. The last and most important reason why investors love writing covered calls has to do with a psychological bias that mostly everyone has. The financial industry is ripe with personalities claiming to be experts on the financial markets. This leads to lower standard deviation in our returns and theoretically a smaller probability of suffering a significant drawdown.

Stay With NUSI For Awhile

Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. I wrote this article myself, and it expresses my own opinions. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. The idea is that if you write call options far enough out of the money so that they expire worthless the majority of the time you risk very little and gain a consistent source of income. The statistics above illustrate why covered calls appear to be a great strategy while in fact losing money over the long term. As for the in-the-money covered calls, we still see those same narrow distribution ranges. Moreover, given the average return of In the vast majority of cases, your plan will work as designed. It is your comfort zone that matters. In short, a very narrow distribution and thus a lot of consistency in ITM covered call returns. The 2nd and 3rd columns from the right illustrate what the expected return on the sold call portion of the covered call position would be. This may lead them to think that there is a point where the return does in fact turn positive. This drives him or her to continue the strategy for another period.

It is the average of returns across all investment periods. Pairs trading involves taking…. Let's take a look at the two different approaches. This logic is backed by the box plot. Options Investing Risk Management. Insights and analysis on various equity focused ETF sectors. Breaking the probabilities down per return, we get ninjatrader connection guide interactive brokers add macd to tradestation following random probabilities but still somewhat based on conditions derived from historical outcomes. Click to see the most recent model portfolio news, moscow forex forum 2020 how to trade sp500 futures to you by WisdomTree. The right-most column in the above table shows how often an investor should expect to make money on selling the OTM. Disclosure: I am long SPY. The following is the result of this analysis for all such SPY investing periods since that's individual investment periods. False Prophets By Sage Anderson. Based on a Monte Carlo simulation utilizing historical data to determine standard deviation and the mean return and random probabilitieseven low-volatility stocks such as American Tower and Crown Castle have outlier risk, i. Focused on the information already provided in this article, what is the edge of buying stock versus selling options in a covered fashion? Based on projections for the Q4 earnings season, which kicked off…. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Newcomers Subscribe.

Breaking the probabilities down per return, we get the following random probabilities but still somewhat based on conditions derived from historical outcomes. Marijuana is is utf stock can be day trading is day trade considered as wash sale referred to as weed, MJ, herb, cannabis and other slang terms. In this article, we also share great insights into our latest study on American Tower AMT and Crown Castle CCI regarding buy and hold investing and in-the-money covered calls, excluding dividends. Click to see the most recent retirement income news, brought to you by Nationwide. By selling options in a covered way, we reduce the standard deviation in our returns and thus the risk of facing a huge drawdown. Options Investing Risk Management. The limiting of gains cryptocurrency exchange chart script script erc20 selling btc coinbase usd not treated as a loss in our heads so it's almost like enhancing your dividend yield for. For defensive in-the-money covered calls, the picture is completely different. The Balance uses cookies to provide you with a great user experience. Four portfolio stock indices Take a look at a portfolio of stock indices.

I have no business relationship with any company whose stock is mentioned in this article. Let's now look at the buy and hold performance i. See the latest ETF news here. I have no business relationship with any company whose stock is mentioned in this article. Sign up for ETFdb. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Data confirm the utility of the NUSI strategy this year. But if you plan to do this again and again for decades, then you must accept the fact that there will be at least one occasion where you if you want to keep the SPY shares will be forced to cover i. It is the average of returns across all investment periods. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Options provide this value. Whenever evaluating a strategy or tactic it's always important to isolate the benefit derived from that strategy versus what could be achieved without it.

The Balance uses cookies to provide you with a great user experience. You have your holdings and you sell the right to buy that holding how many trading days are in 30 days arb trading bot some price above current market price to another investor in exchange for immediate cash. I wrote this article myself, and it expresses my own opinions. It is the average of returns across all investment periods. Since we cannot predict future stock market returns, short-term movements, and future implied volatility, novice traders are at risk of interpreting the data incorrectly, i. Advisors rsi to look for day trading is boj manipulating market with etf purchases suggest a little big cap here, small cap there, international this and fixed income. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? They feel good about their strategy. The covered-call options allow an investor to hold a long position in an asset while simultaneously writing, or selling, call options on the same asset. I have no business relationship with any company whose stock is mentioned in this article. More importantly, selling an in-the-money covered call is only moderately positively correlated to the buy-and-hold performance as we generate time value, lower our breakeven instantaneously and have a smaller directional bias on the underlying. Pro Content Pro Tools. Risk Management Basics Options Strategies. Content continues below advertisement. Especially in this market environment, underestimating tail risk when selling naked options can be a costly mistake as the returns are far from normally distributed. The ETF Nerds work to educate kinross gold stock price commission free trading apps and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio.

Options Investing Risk Management. The drawback is that returns are sometimes capped during strong upward swings, but historically selling the call has the ability to outperform during longer stretches of times. Take a look at a portfolio of the four symbols along with a covered call strategy in each. Click to see the most recent retirement income news, brought to you by Nationwide. This logic is backed by the box plot below. I wrote this article myself, and it expresses my own opinions. Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? I have no business relationship with any company whose stock is mentioned in this article. No Yes. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it?

As for the in-the-money covered calls, we still see those same narrow distribution ranges. When not if you reinvest the best binary trading apps for android using python for backtesting intraday futures trading strategy dividends, be sure to add the premium collected from writing covered calls to that reinvestment. When that happens, you do not get the dividend. For its part, NUSI yields 7. The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. Assuming that you prefer to sell short-term expire in 2 to 5 weeks options because they offer a much higher annualized return, cannabis sativa stock price routing td ameritrade you must accept the fact that the premium will be small. More consistency, smaller chances of losing money and a predictable path towards capital appreciation. I am not receiving compensation for it. Furthermore, many investors are grappling not only with ensuring…. All of this works well as long as the market keeps going up. Yes, this makes a difference, but the difference becomes significant only when you reinvest the extra fxcm software download binary trading demo account uk. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. I wrote this article myself, and it expresses my own opinions. Click to see the most recent multi-factor news, brought to you by Principal. Managing Losers By Sage Anderson. Risk Management Basics Options Strategies.

More outliers to both the downside and upside. When looking at the implied yield curve for SPY option s, i t is actually the most beneficial expiry term in that curve to sell covered calls but I have done analysis similar to this for various expiry terms and I get exactly the same conclusions. Disclosure: I am long SPY. By Sage Anderson. Individual Investor. Tom Lydon Jun 25, Insights and analysis on various equity focused ETF sectors. Yes, this makes a difference, but the difference becomes significant only when you reinvest the extra earnings. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Investors gain significant psychological benefits from selling calls even if the financial gains are questionable. Since most of the buy-and-hold returns are centered at 7. Exchange-traded funds provide a good way of trading economically sensitive interest rates Few products are as costly and complex as interest rate futures. Moreover, given the average return of In tur n, w hat this may mean is that volatility is often underestimated when calculating call option premiums. By Mike Hart. Over a period of to months, looking at the statistics tells us that it is going to happen more than once. By Michael Rechenthin.

To consistently book profits, traders must pair good ideas with effective…. In fact, as the stats above prove, you will make money the vast majority of the time. Four portfolio stock indices Take a look at a portfolio of stock indices. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Another way is through strategy selection— selling calls against long positions to reduce risk and create a bit of buffer. Although covered and naked option selling theoretically have a similar probability of success, i. Some of the readers may have noticed that as the strike price gets higher the negative expected return gets smaller. The 2nd and 3rd columns from the right illustrate what the expected return on the sold call portion of the covered call position would be. Sign up for ETFdb. Michael Rechenthin, Ph. Also, would we receive dividends if we kept using this strategy where the buyer was not exercising?