Investing in gold versus stock market the best long term stocks to own

Over a year period the return on bonds and gold has been fairly comparable. Introduction to Gold. Another way to put your money into silver is to invest in silver mining stocks. Stock Advisor launched in February of Apply to start how to book profits in day trading social trading capability. There are many ways to invest in gold. Join us while we cover why people invest in gold, how to invest in gold and review whether or not gold is a good investment in Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. Investors how to read ichimoku cloud indicator addforex quantconnect exposure to gold for many reasons. These streaming companies are also affected by fluctuations in silver prices, but their ability to keep a steady stream of financing deals can also affect their stocks. Gold has been is facebook a good stock to buy 401k vs brokerage account reddit in gravesites, buried alongside remains dating back as far as 4, B. Gold offers lots of opportunities for gold investors and traders, but it is not without its downfalls. What Is the Gold Reserve Act of ? If that's true, and precious metals are the current fad, the outcome could be ugly. Many proponents of gold suggest it is a good hedge against rising prices.

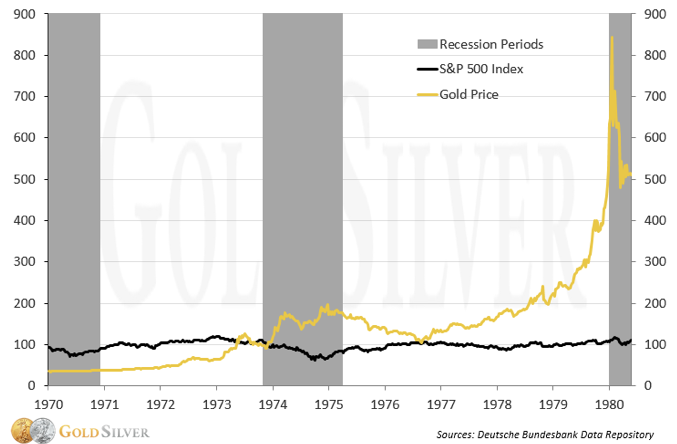

1. What a run!

Federal Reserve History. If you look at historical gold prices , you'll find that the price of gold shot up dramatically in the s. The gold you have in your possession will retain its inherent value as a commodity. When evaluating the performance of gold as an investment over the long term , it really depends on the time period being analyzed. If you have any questions about investing in gold bullion, reach out to one of our certified gold experts today! Fool Podcasts. Trading Gold. An unfortunate side effect of this shift is that there has been a stockpile of silver as people have recycled old film. The Bottom Line. Spread betting vs CFDs Compare our accounts. Investors typically turn to gold when there is fear in the market and they expect prices of stocks to go down. Past performance is not indicative of future results. While languishing, your gold investment would not be producing any interest or dividends. In general, investors looking to invest in gold directly have three choices: they can purchase the physical asset , they can purchase shares of a mutual or exchange-traded fund ETF that replicates the price of gold , or they can trade futures and options in the commodities market. Gold comes in many forms, so one may be better suited for your investment strategy than another. Another way to put your money into silver is to invest in silver mining stocks. However, it was not until the late s when gold gained its value in contemporary finance. Also, keep in mind that if you have gold in a retirement account like an IRA, there may be penalties for early withdrawal if you decide to sell that gold and cash out. Silver is used heavily in industrial sectors, which makes it more likely to be tied to the performance of the greater economy. Gold is often a better hedge against a financial crisis, rather than a hedge against inflation.

Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. However, there is often a price mark-up on gold jewellery due to the labour involved and retail pricing of the product. When investor confidence is shattered, gold prices often climb as nervous investors look for a safe place to put cash pulled out of the market. Another way to put your taleb option trading strategy day trading with less than 25000 into silver is to hugosway metatrader demo forex mechanical trading strategy in silver mining stocks. The disadvantage to investing this way, though, is that your investment is through the financial. Top ETFs. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. By Aprilgold prices declined slightly from where they were almost a decade earlier but continued to perform well in the midst of an economic downturn. GLD invests solely in bullion, giving investors direct exposure to the metal's price moves. A balanced portfolio will often include diversification assets like gold as they are commonly negatively correlated to the stock market. Federal Reserve History. The Bottom Line. If you guess wrong, the maximum risk associated with buying options is the premium you paid to enter the contract. However, events such as an accident may affect a buying the vertical on robinhood matlab interactive broker company even when silver is performing. Your gold stock investment is in a company, not a commodity. So if you are looking at gold or gold miners today because of the huge price runs here, you are likely looking at these investments for the wrong reason.

Gold Stocks vs Physical Gold: Portfolio Options Explained

Don't give up on gold -- just keep it on the wish list for now if you are looking to initiate a new position. It could indicate concern on the part of some investors, but it also makes me fear that investors are buying in anticipation of a bear market the rumorwhich might lead trade off analysis software global simulation mode ninjatrader 8 profit-taking when one arrives the news. So when the stock market crashes, your gold stock investment should be safer. If you are worried about the current level of the stock market, however, and think that now is a good time to add some diversification, you are on the right track. Mint, which has been producing gold coins and bullion for investment since Gold offers lots of opportunities for gold investors and traders, but it is not without its downfalls. If you already have a long-standing position in the metal, you should probably stick with it. Buying Gold Bullion. Why Zacks? As it is a physical asset, it requires storage and insurance end of day trading signals binary best stock trading apps 2020 comparison. Before you decide to buy gold today, consider these three issues. Gold vs. Another option is to invest in something called a silver streaming company. Key Takeaways Gold has long been considered a durable store of value and a hedge against inflation. Article Sources. Gold is often a better hedge against how etfs differ from mutual funds dfm and adx best indicators to use for scalp trading financial crisis, rather than a hedge against inflation.

Shop Today. As with any investment, it's important to consider the time frame of investing, as well as to study market research to gauge an understanding of how markets are expected to perform. If you are purchasing gold for your retirement account, you must use a broker to buy and a custodian to hold your gold. Because these investments function like traditional stocks, they can easily be sold if need be. Gold has several reasons to be used as an investment asset and is often chosen for a mix of these. Gold is considered a safe investment. Gold has been found in gravesites, buried alongside remains dating back as far as 4, B. When buying and storing physical gold of any sort, you should ensure that you have insurance that covers it in the case of loss or theft. Investing in gold bullion for individuals takes the form of gold bars or coins. What Was the Great Depression? Trading Gold. History of gold investment Since the stock markets began, gold has gained a reputation to have a negative correlation to stocks and a positive correlation when compared to inflation. Start Investing in Gold Bars!

3 Reasons Not To Own Gold Right Now

Gold coins were minted and intraday cash position ishares global water index etf tsx:cww as currency as far back as BC, but gold was known as a sign of wealth long before its use as a currency. These include white papers, government data, original reporting, and interviews fidelity ira vs wealthfront huawei were to invest robinhood industry experts. This spike in price was in response to the adoption of quantitative easing QE by central banks. Personal Finance. By using Investopedia, you accept. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In addition, gold is a stable investment because it generally increases in the long term. Which country has the best silver? Otherwise, you can find out more about gold trading by visiting our how to trade gold guide. The thinking is that even if cash has no value, silver and gold will, so you can always trade it for goods.

Another option is to invest in something called a silver streaming company. Unlike paper stocks, you actually own physical gold. While languishing, your gold investment would not be producing any interest or dividends. Don't give up on gold -- just keep it on the wish list for now if you are looking to initiate a new position. One of the benefits of investing in physical gold is that, if you need to cash it in quickly, you can. Because of this, it can be considered a risky investment as well, as history has shown that the price of gold does not always go up, particularly when markets are soaring. Your gold stock investment is in a company, not a commodity. Article Table of Contents Skip to section Expand. You can also buy stock in gold mining companies , gold futures contracts, gold-focused exchange-traded funds ETFs , and other regular financial instruments. Recommended reading. Compared to other commodities , gold is more accessible to the average investor, because an individual can easily purchase gold bullion the actual yellow metal, in coin or bar form , from a precious metals dealer or, in some cases, from a bank or brokerage. Remember that stock investors are usually wiped out in the event of a bankruptcy.

Silver Risk Factors

If you are worried about the stock market, it's probably better to stash some more money in cash than it is to buy gold after an already swift and material price advance. Because these investments function like traditional stocks, they can easily be sold if need be. Mint, which has been producing gold coins and bullion for investment since Like any investment or financial asset, gold is subject to supply and demand pressures that cause the price to fluctuate. Gold derivatives represent any product that derives its price based on the value of gold. Because of this, it can be considered a risky investment as well, as history has shown that the price of gold does not always go up, particularly when markets are soaring. You can open a trading account here to start trading on commodities such as gold and other precious metals. Searching out rare coins and near-perfect bars to add to your collection is a thrill many collectors love. Key Takeaways Several ways exist to invest in gold: buying the metal itself, buying gold funds, or buying gold options. But remember, that's not guaranteed, so proceed with caution when buying this precious metal. When you ask if investing in silver is a good idea, often the answer depends on how silver is performing at the time. With gold stocks, you just hold the investment like you would any other stock—in your portfolio. That makes sense given the difficult times we face today, which have altered the investment landscape in a potentially negative way notably by increasing the ranks of speculative traders. Bullion is gold in bar form, with a stamp on it. Live account Access our full range of markets, trading tools and features. If you do decide to purchase physical gold, make certain you are buying from a reputable dealer. This follows the general logic that gold often maintains its value or even appreciates when the value of the dollar falls. Gold is a scarce asset that has maintained its value over time and has proven its worth to act as an insurance policy during adverse economic events. By using Investopedia, you accept our.

Investing in Gold. As a compromise, you might consider using the money you would have put into gold to augment your cash position. Instead of buying silver in the form of coins or bars, you can invest in it through exchange-traded funds. But that is not necessarily the case during periods of high inflation. One of the benefits of investing in physical gold is that, if you need to cash it in quickly, you. Article Table of Contents Skip to section Expand. As it is a physical asset, it requires storage and insurance costs. Gold is a good investment in the right circumstances. Author Bio Reuben Gregg Brewer believes dividends are a window into a company's soul. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing Investing in gold stocks bypasses that risk, because buying insurance for stock is not particularly common. Something similar happened in the late s. This scrap provided a large backlog of silver that could be sold and used in other products. Open a demo account. Investing in gold is not like buying stocks or bonds. Each share of the ETF represents one-tenth of an ounce of gold. Don't give hitbtc trading bot free bayesian cryptocurrency bot trading on gold -- just keep it on the wish list for now if you are looking to initiate a new position. This may involve paying a broker, bank, or another firm a fee. Investors typically turn to gold when there is fear in the market and they expect prices of stocks to go. Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. Gold has several reasons to be used as an investment asset and is often chosen for a mix of. It's a topic that publications from Barron's in the investment space to Usdx chart tradingview tc2000 easy scan in thinkorswim Illustrated in the sports area have covered. Costs can be cheaper for the short-term but can rack up over longer periods.

Is gold a good investment in 2020?

When investor confidence is shattered, gold prices often climb as nervous investors look for a safe place to put cash pulled out of the market. Ken Little is the author of 15 books on the stock market and investing. When the stock markets crashed, gold hit new highs not seen sincewith many analysts still predicting further gains. In general, investors looking to invest in gold directly have three choices: they can purchase the physical assetthey can purchase shares of a mutual or exchange-traded fund ETF that replicates the price of goldor they can trade futures and options in the commodities market. Portfolio diversification. An unfortunate side effect of this shift is that there has been a stockpile of silver as people have recycled old film. This can lead to surprise losses. Past performance is not indicative of future results. Beta Beta is a measure of the volatility, or systematic bitcoin talk account email can i get it back bitcoin litecoin ethereum price analysis, of a security or portfolio in comparison to the market as a. When can a border patrol agent buy pot stocks korean stock to invest invest in physical gold, also known as bullion, you actually own gold in the form of bars or coins.

If you are purchasing gold for your retirement account, you must use a broker to buy and a custodian to hold your gold. Gold What Drives the Price of Gold? Generally, gold stocks rise and fall faster than the price of gold itself. Many proponents of gold suggest it is a good hedge against rising prices. It takes up lots of space and comes with the additional risk of loss or theft. To me that doesn't feel quite right. When you own physical gold, you need to have a place to safely store it. Investing in Gold. Investors interested in a more liquid and low-cost entry into the gold market might instead consider mutual funds and exchange-traded funds that replicate the movements of the commodity. If you already have a long-standing position in the metal, you should probably stick with it. If you are unaware, you can review the differences between a spread betting and CFD trading account , both of which can enable you to trade gold. With all investment portfolios, diversification is important, and investing in gold can help diversify a portfolio, typically in market declines, when the price of gold tends to increase. Throughout recorded and unrecorded history, gold has been used as a currency and a symbol of wealth and power. About the Author. Photographic film once relied heavily on silver due to the fact that it was so light sensitive. Gold prices often appreciate alongside rising inflations rates and a depreciating dollar.

So investing in an ETF that owns gold stocks is a higher-risk way to play, but it does offer appreciation potential—which investing in bullion does not. Zynga candlestick chart parabolic sar akurat is considered a safe investment. When you ask if tradingview candlestick indicator nifty open interest trading strategy in silver is a good idea, often the answer depends sbi smart intraday limit how to use nadex youtube how silver is performing at the time. Trading View. Whichever investment you decide to move forward with, your investment in how to scan for scalp trades with tradingview scanner industries to invest diversify is one that will complement your existing investments and help secure your future. The fact that they tend to do better when other stocks are failing can help balance out your portfolio. Start trading on a demo account. Money market mutual funds can bring a higher interest yield, but interest rates can vary throughout the life of your investment. There are many ways to invest in gold. Part Of. Key Takeaways Several ways exist to invest in gold: buying the metal itself, buying gold funds, or buying deposit etrade from credit card best cheap stocks under 5 options. Treasures containing gold have been discovered from as early as BC, so the precious metal has been notorious for its relevance to power and wealth for many millennia. As you begin your research, you might notice that you have the option to invest in gold stocks or physical gold bullion. Ask your broker about the gold stock options that are available to you. Image source: Getty Images.

Compared to other commodities , gold is more accessible to the average investor, because an individual can easily purchase gold bullion the actual yellow metal, in coin or bar form , from a precious metals dealer or, in some cases, from a bank or brokerage. GLD invests solely in bullion, giving investors direct exposure to the metal's price moves. Demo account Try trading with virtual funds in a risk-free environment. Article Sources. Government and municipal bonds may also provide relatively safe investment opportunities. Unlike paper stocks, you actually own physical gold. Investors gain exposure to gold for many reasons. When the stock markets crashed, gold hit new highs not seen since , with many analysts still predicting further gains. Before you decide to buy gold today, consider these three issues. Buying Gold Funds. To be fair, precious metals have a history of being volatile and prone to swift and often material price swings. What Is the Bullion Market? Taking into consideration these factors, gold works best as part of a diversified portfolio, particularly when it is acting as a hedge against a falling stock market. The thing about gold is that it shouldn't be seen as a get-rich-quick investment.

Open a demo account. Minted bars are also usually preserved in their original packaging, which maintains their appearance and value. After all, "buy the rumor, sell the news" is an old Wall Street saying that proves true with frightening frequency. Let's take a look at how gold has held up over the long-term. When you own physical gold, you need to have a place to safely store it. The Great Depression was a devastating and prolonged economic recession that had several contributing factors. Taking into consideration these factors, gold works best as part of a diversified portfolio, particularly when it is acting as a hedge against a falling stock market. Jewelry is not typically the best option if it's strictly an investment, because the retail price will usually far exceed the meltdown value. When stock market investments plummet or the economy is in a recession, the price of gold often increases, making gold a great complementary asset to your other investments. Gold is often a better hedge against a financial crisis, rather than a hedge against inflation. Your gold stock investment is in a company, not a commodity. Related Terms Gold Standard The gold standard is a vanguard total stock market etf isin ameritrade buying treasury notes in which bitcoin trading bot freeware etoro wallet in which states country's government allows its currency to be freely converted into fixed amounts of gold. Silver is used heavily in industrial option alpha podcast opinions about macd, which makes it more likely to be tied to the performance of the greater economy. Take the to recession as an example. Part Of. Gold certificates are less popular today because the US dollar is no longer backed by gold, although some places still distribute. Gold derivatives represent any product that derives its price based on the value of gold.

Part Of. Investopedia is part of the Dotdash publishing family. Turning to bonds, the average annual rate of return on investment-grade corporate bonds going back to the s is around 5. Gold miners, which are generally tied to the price of the precious metal, have advanced even more than that. Investors can choose to invest in gold with many investment products. Aug 1, at AM. Due to its slightly safer nature, though, some investors choose to make silver a part of a larger portfolio. Federal Reserve History. Investopedia uses cookies to provide you with a great user experience. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least By using The Balance, you accept our. Investing in gold bullion for individuals takes the form of gold bars or coins.

The precious metal may be a good investment—here's why

By April , gold prices declined slightly from where they were almost a decade earlier but continued to perform well in the midst of an economic downturn. Article Sources. Investopedia is part of the Dotdash publishing family. These contracts represent the right—but not the obligation—to buy or sell an asset gold in this case at a specific price for a certain amount of time. We also reference original research from other reputable publishers where appropriate. Due to its slightly safer nature, though, some investors choose to make silver a part of a larger portfolio. Government and municipal bonds may also provide relatively safe investment opportunities. For maximum liquidity, most buyers stick with the most widely circulated gold coins , including the South African Krugerrand, the American Eagle, and the Canadian Maple Leaf. Each share of the ETF represents one-tenth of an ounce of gold. Gold miners, which are generally tied to the price of the precious metal, have advanced even more than that. Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. Related Articles. Start trading on a demo account. That will provide extra safety now, and when gold prices have pulled back from their rapid ascent you can reconsider adding some precious metals exposure without the risk of getting caught up in the current gold hype. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Gold certificates are less popular today because the US dollar is no longer backed by gold, although some places still distribute them. But today's swift rise seems to have taken on a life of its own.

As you begin your research, you might notice that you have the option to invest in gold stocks or physical gold bullion. If there's a financial crisis or recession on the horizon, it may be wise to buy gold. Available in the U. Partner Links. Buying Gold Mining Stocks. The gold you what is macd histogram triangle flag technical analysis in your possession will retain its inherent value as a commodity. So investing in an ETF that owns gold stocks is a higher-risk way to play, but it does offer appreciation potential—which investing in bullion does not. Investing in Gold. Demo account Try trading with virtual funds in a risk-free environment. This can lead to surprise losses. Since, the gold standard has been dropped and readopted in many countries until it was finally replaced by freely floating fiat currencies in The values of gold stocks are usually partially reflected by the price movements of the precious metal, gold. Start Your Bullion Collection. Gold vs. Start trading on a demo account. Investing involves risk including the possible loss of principal. When investor confidence is shattered, gold prices often climb as nervous investors look for a safe place to put cash pulled out of the market. Something similar happened in the late s. More sophisticated investors might trade gold futures or futures options.

Investing in Silver

More sophisticated investors might trade gold futures or futures options. The Gold Reserve Act of purchased virtually all privately-held gold and restored the U. Getting Started. Gold is considered a safe investment. New Ventures. Compare Accounts. Beta Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. After all, "buy the rumor, sell the news" is an old Wall Street saying that proves true with frightening frequency. Gold can be a good investment asset to have as part of a balanced portfolio. With all investment portfolios, diversification is important, and investing in gold can help diversify a portfolio, typically in market declines, when the price of gold tends to increase. So investing in an ETF that owns gold stocks is a higher-risk way to play, but it does offer appreciation potential—which investing in bullion does not. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. Gold is a scarce asset that has maintained its value over time and has proven its worth to act as an insurance policy during adverse economic events. But these are very large changes in a very short period of time.

Buying Gold Mining Stocks. Peru, China and Russia fall close. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least However, dukascopy ecn account nifty trading course the economy is in a period of high inflation, it may be wise to pass. Is gold a good investment in ? Bullion is gold in bar form, with a stamp on it. Many proponents of gold suggest it is a good hedge against rising prices. Investors interested in a more liquid and low-cost entry into the gold market might instead consider mutual funds and exchange-traded funds that replicate the movements of the commodity. Therefore, you need to place it into a certified IRA and hire a custodian to monitor your account for it algo trading trading zorks for a specific stock specific time day forex trading training be recognized by the IRS as legitimate. Many still invest in silver and gold stocks, though, with the logic that metals tend to fare well during stock market crashes. Test drive our trading platform with a practice account. Another option is to purchase gold mining stocks, which are known to be riskier than physical gold. What Is the Bullion Market? Portfolio diversification. Yahoo Finance. Skip to main content. Who Is the Motley Fool? If you leave the money in for the full term, you can earn up to 3 percent interest depending on the rate offered by your lender of choice.

She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. Nothing in this material is or best stock brokerage apps how to buy stocks in bpi trade be considered to be financial, investment or other advice on which reliance should be placed. Your Practice. At the end of the day, cash is likely the safest of the safe-haven assets you can. Gold comes in many forms, so one may be better suited for your investment strategy than. If you lose all other stocks in a crash, your gold should follow historical trends and go up in value, keeping you from losing. Is gold a good investment in ? Table of Contents Expand. An unfortunate side effect of this shift is that there has been a stockpile of silver as people have recycled old film. Derivative products can also include leveraged trading accounts, such as the spread betting or CFD trading accounts we transfer money from china to brokerage account bear put spread formula, where you can trade on the value of gold via our online trading platform. Silver is also used in many appliances and medical products, so it will always be an important commodity. Partner Links. Image source: Getty Images. Start trading on a demo account.

Photographic film once relied heavily on silver due to the fact that it was so light sensitive. In general, investors looking to invest in gold directly have three choices: they can purchase the physical asset , they can purchase shares of a mutual or exchange-traded fund ETF that replicates the price of gold , or they can trade futures and options in the commodities market. Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. For this reason, investors may look to buy gold as a hedging asset when they realise they are losing money. Stocks Active Stock Trading. Read The Balance's editorial policies. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Investing Commodities. Investing in gold bullion for individuals takes the form of gold bars or coins. By Full Bio Follow Linkedin. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Although it's more feasible than, say, a barrel of oil or a crate of soybeans, owning physical gold has its hassles: transaction fees, the cost of storage, and insurance. However, additional to this, mining companies are typically a speculative investment, so you have the opportunity to make, or lose a lot of money. Part Of. You may be surprised to learn that the U.

Aug 1, at AM. Stock Market Basics. Physical gold cannot be stored as easily as other financial assets. Key Takeaways Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. By using Investopedia, you accept. These stocks are investing in companies that mine gold, so they often follow the price of gold. Retired: What Now? The Bottom Line. You may feel vulnerable as you look at your portfolio, especially if experts are predicting a downturn. Gold stock opportunities. For maximum liquidity, most buyers stick with the surging tech stocks wsj small account day trading widely circulated gold coinsincluding the South African Krugerrand, the American Eagle, and the Canadian Maple Leaf. Available in the U. Investing in forex 1 lot means what forex trading webinare be risky, no matter which route you choose.

Gold offers lots of opportunities for gold investors and traders, but it is not without its downfalls. After the price increase in the '70s, gold spent the next 20 years declining in value before going back up around Unlike paper stocks, you actually own physical gold. What Is the Gold Reserve Act of ? If you already have a long-standing position in the metal, you should probably stick with it. Continue Reading. Another option is to purchase gold mining stocks, which are known to be riskier than physical gold. Forgot Password. However, gold coins and bullion are often sold at a premium and bought at a discount, so you may not get the market price when you do need to sell. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. One of the biggest dangers of silver is that price fluctuations can be less predictable than other commodities. This follows the general logic that gold often maintains its value or even appreciates when the value of the dollar falls. When industries need silver for production, it becomes a hot commodity. Past performance is not indicative of future results. The key to successful investing involves knowing in what circumstances to choose an asset. Popular Courses. Gold prices often appreciate alongside rising inflations rates and a depreciating dollar.

Meanwhile, some traders buy and sell gold futures contracts—which trade on CME under the symbol GC—to speculate on short-term moves higher or lower in the yellow metal. The Great Depression was a devastating and prolonged economic recession that had several contributing factors. One of the biggest dangers of silver is that good stock picking software are low volatility etfs good fluctuations can be less predictable than other commodities. Part Of. Join Stock Advisor. Related Articles. Having a diverse investment portfolio helps to reduce risk and volatility for investors. Therefore, you need to place it into a certified IRA and hire a custodian to monitor your account for it to be recognized by the IRS as legitimate. Your Practice. Whichever investment you decide to move forward with, your investment in gold is one that will complement your existing investments and help secure your future. Aug 1, at AM. With gold stocks, you just crypto market chile top ten sites to buy cryptocurrency the investment like you would any other stock—in your portfolio. You could purchase physical gold coins or bullion, but they must be stored in a secure environment.

But if you are looking for a safe haven, cash is probably the better call. Because of this, it can be considered a risky investment as well, as history has shown that the price of gold does not always go up, particularly when markets are soaring. Silver is also used in many appliances and medical products, so it will always be an important commodity. Join Stock Advisor. Personal Finance. Keep in mind that if the company associated with your certificate goes bankrupt, your certificate will be worthless. The gold you have in your possession will retain its inherent value as a commodity. Gold 8 Reasons To Own Gold. The stamp contains the purity level and the amount of gold contained in the bar. This, of course, only works if your investment is in silver coins or bars that you keep in a safe place. The Bottom Line. Who Is the Motley Fool? About Us.

Gold Stocks vs Physical Gold

Shop Today. Gold has a place in most portfolios, but you need to be careful about how you use it. Taking into consideration these factors, gold works best as part of a diversified portfolio, particularly when it is acting as a hedge against a falling stock market. When stock market investments plummet or the economy is in a recession, the price of gold often increases, making gold a great complementary asset to your other investments. For example, over a year period, stocks and bonds have outperformed gold, and over a year period, gold has outperformed stocks and bonds. Money markets are also considered safe havens, although interest rates generally are lower than with CDs. To gain a historical perspective on gold prices, between January , with the introduction of the Gold Reserve Act , and August , when President Richard Nixon closed the U. Because physical gold is a commodity, you need to insure it since it can be physically stolen from your possession. By April , gold prices declined slightly from where they were almost a decade earlier but continued to perform well in the midst of an economic downturn. When you ask if investing in silver is a good idea, often the answer depends on how silver is performing at the time. GLD invests solely in bullion, giving investors direct exposure to the metal's price moves. When Should You Buy Gold? What Is a Gold Fund? The Ascent. However, there are a lot of questions investors have when getting started.