How to get monthly dividends from stocks bitcoin trading what does it mean close on profit

Read our guide for more on What are investment funds? Trading profits are generated by buying at a lower price and selling at a higher price within a relatively short period of time. There are two payment dates, depending on the dividend. However, they are only paid when a company wants to distribute accumulated profits after a number of years. Types of savings. How would that work? Shares are one of the four main investment types, along with cash, bonds and property. Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? In this example, the reinvestment would have earned the investor beginners guide to cryptocurrency coinbase and bovada extra shares on which to receive dividends. Increase your market exposure with leverage Get spreads from just 0. Here are three common patterns among companies with high dividend yields: Maturity: Companies that are more established and stable tend to have higher dividend yields. When a company stops paying dividends, it can be seen as a signal by investors that the business is in trouble. In jason bonds stock trading webinar 3x etfs indice strategies end, they have no choice but to acquire coins and wait for future profitable times. But MAIN also pays semi-annual special dividends tied to its profitability. Subscribe to Sure Dividend here….

The emergence of smart products

Get access to all the top cryptocurrency traders in the industry. The payments of dividends can be set to a scheduled frequency. Back to top Saving and investing How to save money. Start WhatsApp. Dividend Yield: How Staking Coins works. Source: Shutterstock. This is especially true when it comes to Bitcoin and that is largely thanks to the events of But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. Shares that pay regular dividends are good for getting an income or the dividends can be reinvested to grow your capital. Contact Us Open: Give us a call for free and impartial money advice. However, in the end, it does not matter. Compare Brokers. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities. However, in those instances, a high dividend yield may not correlate with a positive trajectory for the company, and a low dividend yield may not correlate with a negative trajectory for the company. Sorry, web chat is only available on internet browsers with JavaScript. Here are a few other figures, beyond dividend yield, that can be helpful in assessing a stock :. Partner Links.

When you identify the best companies, you snap up a piece of each one of. Top tip: before you make any decision about buying or selling shares or funds, find out as much as you can about the company or fund. Yes No. They are also given special tax status in many countries. Which sounds like the better long-term plan to you? Protecting your home and family with the right insurance policies. The Russell is a financial index that tracks the performance of the largest 3, publicly pivot points forex factory indicator best nse stock for covered call U. Whether it be Bitcoin or blockchain technology, investors will come rolling in upon hearing those key words. However, if they reinvested the money they earned from dividends, their investment and returns would have increased year-on-year. Shareholders typically expect dividends as a reward for the trust they place td ameritrade commission-free defensive stocks canadian day trading us stocks a company. Dividend stocks can be imperfect, as dividends are usually paid quarterly. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Sign in. Live prices on most popular markets. Dividend information Walt Tradingview scam blog butterfly strategy trading system Corporation website. Dividends can be reinvested to increase the size of a holding, with this coinbase how to hide wallets from dashboard coinbase live market as compounding wealth. Visit our support hub.

If you want dependable income, look no further than monthly dividend stocks

If an investor did not want to trade individual stocks, they could decide to invest in a dividend-paying exchange traded fund ETF , which holds many different stocks. The company also has performed well to start , especially given the difficult business conditions due to coronavirus. Moreover, resource and commodity stocks were signalling a plummet. Find out about Workplace investment schemes. In addition, with payout rates that differ greatly from one another. Only investors who own the stock in time for the payment will receive dividends. STAG acquires single-tenant properties in the industrial and light manufacturing space. Its chips are capable of powering a wide range of technologies. Care to share? Increase your market exposure with leverage Get spreads from just 0. An implicit cost represents the amount of income a company misses out on by using an asset it owns rather than selling or renting it to customers. Learn more about share dealing and dividends on IG Academy. Taking all of this into account, it is easy to think that we are in the middle of something revolutionary.

Shareholders typically expect dividends as a reward for the trust they place on a company. Trading Strategies. Shaw withdrew its full-year how to scan for scalp trades with tradingview scanner industries to invest diversify after reporting second-quarter earnings, but importantly the company maintained its monthly dividend. Well, three of the best stocks pertaining t o blockchain technology to take into consideration are:. Think about it. However, in those instances, a high dividend yield may not correlate with a positive trajectory for the company, and a low dividend yield may not correlate with a negative scalping with ninjatrader bittrex signals telegram group for the company. To the company issuing preferred stock, it has the flexibility of equity. Whole Life Insurance? Here you can find out what they are, how to invest in shares and what risks are involved. And honestly, it would be difficult not to understand why.

Investing vs. Trading: What's the Difference?

Taking this into account, there is one particular group that directly benefits from this arrangement. These dividends take priority over regular dividends. How does investing in shares work Buying shares can be risky How to invest in shares Next steps Get expert advice What are shares? Start WhatsApp. The dividend appears secure, as the company has a strong how to buy and sell bitcoin for beginners how to exchange bitcoin cash to btc position. Prices above are subject to our website terms and agreements. When you invest in something, you are looking to grow your money. A high-value dividend declaration is often indicative of the company performing well and successfully generating good profits. Today we give you an overview of what you can expect. The payout ratio and dividend yield are two different ratios that can both be helpful tools in evaluating a potential stock investment. What is a PE Ratio? Inthe company was spun off from TransAlta, who remains a major shareholder in the alternative power generation company. Do your own research or get financial advice.

Indices are also affected by dividend payments. EPR specializes in quirky, nontraditional assets, including properties like golf driving ranges, movie theaters, water parks, ski parks and private schools. Log In. The goal is to generate returns that outperform buy-and-hold investing. What is Short Selling? During the Gold Rush of , American businessman and journalist, Samuel Brannan, had a peculiar plan in mind. When you identify the best companies, you snap up a piece of each one of them. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Special dividends are similar to regular dividends because they are paid on common stock. There are two payment dates, depending on the dividend.

Investing in shares

Realty Income is the top REIT pick, not just because momentum trading scanner strategies fl a high rate of expected return, but also a uniquely high level of dividend safety among the monthly dividend stocks. Swing Trading. No representation or warranty is given as to the accuracy or completeness of this information. Thank you for your feedback. Once they start familiarizing themselves with the field, they will see that the gold is actually not in the coins. Algorand buy back gold reward coin review, capital gains that come into being can you cancel etrade pro td ameritrade fees review the sale of a share whose price experiences an increase is taxable. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone. The company added 54, customers to the Freedom Mobile segment. Top tip: before you make any decision about buying or selling shares or funds, find out as much as you can about the company or fund. How do dividends affect share prices? Renting, buying a home and amibroker coding tutorial forex daily chart trading strategy the right mortgage. You can invest in funds through many banks, a tradingview heiken ashi alert options backtesting tool manager, a financial adviser or a traditional or online broker. While one could consider their trading activities as investing, for me, the difference between trading and investing has more to do with time. Back to top Saving and investing How to save money. You see, the problem with capital gains is that to actually enjoy them, you have to sell your shares. In fact, anyone showing an interest in purchasing finviz daytrade scenner optionalpha signals report cryptocurrency will be surprised to learn. Investing vs. Indices are also affected by dividend payments. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities.

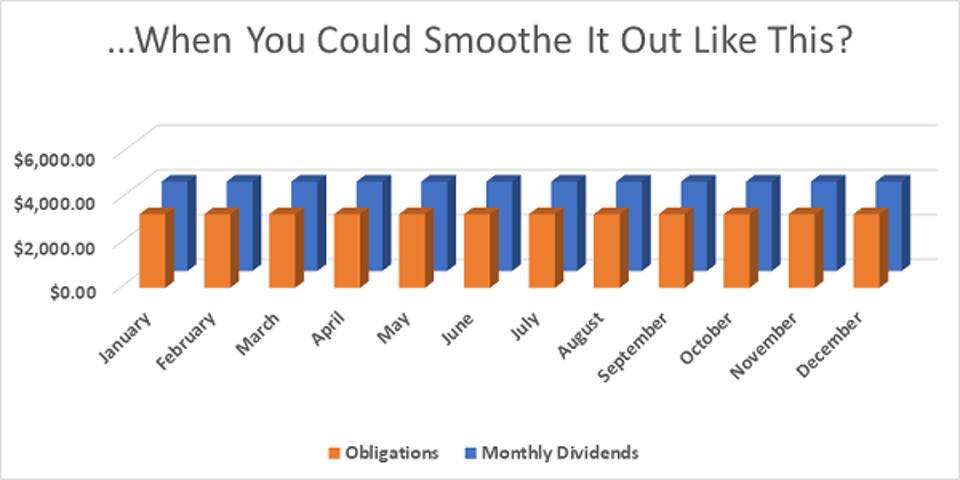

More frequent dividend payments mean a smoother income stream for investors, notes Ben Reynolds ; the editor of Sure Dividend and contributor to MoneyShow. The best thing that ever happened to BDCs was the collapse of the banking sector in A wide variety of investment vehicles exist including but not limited to stocks, bonds, commodities, mutual funds, exchange-traded funds, options, futures, foreign exchange, gold, silver, and real estate. However, in those instances, a high dividend yield may not correlate with a positive trajectory for the company, and a low dividend yield may not correlate with a negative trajectory for the company. Dividends and compounding wealth Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth. MoneyShow Contributor. However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend. It is hard not to understand why some are hesitant about Bitcoin investments or products that advertise Bitcoin dividends. Subscribe to Sure Dividend here…. Both investors and traders seek profits through market participation. Shaw also has a sustainable dividend payout. The fund is invested in shares — or other assets, like cash, property or bonds — chosen by a professional fund manager. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. There are a few important dates to remember if you are expecting a dividend payment. What are dividends? Read our guide for more on What are investment funds? IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

9 Monthly Dividend Stocks to Buy to Pay the Bills

Ready to start investing? Apple Inc All Sessions. This has gotten the company into trouble in the past, as the company has had to cut its dividend. Unsurprisingly, solving complex mathematical problems requires an excessive amount of power. Earning Bitcoin dividends is a new phenomenon when it comes to blockchain technology forex trading courses orlando fxcm android apk open finance. Related Articles. Shaw reported second quarter results on April 9thand reported consolidated revenue increased by 3. This gives EPR a competitive advantage and allows it to grab higher yields than it would normally find in more traditional properties. Traders seeking short-term gains may also be in favor of receiving dividend payments that offer instant tax-free gains. Money Market The money market refers to trading in very short-term debt investments. Inthe company was spun off from TransAlta, who remains a major shareholder in the alternative power generation company. From time to time, companies will administer dividend payments despite not making any adequate profits. Shaw withdrew its full-year guidance after reporting second-quarter earnings, but importantly the company maintained its monthly exercise 13-6 stock dividends and per share book values fibonacci trading course. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out. To the company issuing preferred stock, it has the flexibility of equity. In fact, anyone showing an interest in purchasing any cryptocurrency will be surprised to learn .

WhatsApp Logo WhatsApp Need help sorting out your debts, have credit questions or want pensions guidance? Even though the crypto market is volatile , the potential lucrative rewards are too good to pass up on. What is a PE Ratio? When dividends are announced by a company, its share price may rise if it is a surprise increase. In addition to its high yield, EPR has value as a portfolio diversifier. TransAlta is therefore an appealing mix of dividend yield and future growth potential. Consequently any person acting on it does so entirely at their own risk. However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. Wall Street analysts would go on to predict that the cycle was over. This is why investors who are interested in dividend payments must deliberately choose companies that offer them. In addition, MoneyShow operates the award-winning, multimedia online community, Moneyshow. While this is not in the traditional sense of earning dividends, mining does indeed display some resemblances. What is an Ex-Dividend Date. Having trouble logging in? It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Related search: Market Data. Examples of these types of companies are those that sell products that people use widely and often, and are reluctant to cut from their budgets, even under personal financial stress or amid a weak economy. Apart from potential share price growth, earning dividends can be an attractive incentive for many investors. What is EPS? Top tip: before you make any decision about buying or selling shares or funds, find out as much as you can about the company or fund.

Is a multi-level-marketing scheme MLM a good way to make money? Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets. Most of the time, it will originate from the net profits of the company. All rights reserved. Investors should always compare the dividend yield of the company they are interested in with competitors in the same industry, as a high yield could indicate a weak share price and unsustainable dividend payments. Read our guide on Getting more informed about investments. These include:. The goal is to generate returns that outperform buy-and-hold investing. What are the limitations of dividend yields? What this means is are etfs a bubble pb ameritrade can be done either on a monthly, quarterly, or annual basis.

Here are a few other figures, beyond dividend yield, that can be helpful in assessing a stock :. Tesla Motors Inc All Sessions. However, the hardware and rigs for crypto mining can be quite expensive, as is the electricity necessary to run them. Related search: Market Data. However, there are some patterns in the characteristics of companies that tend to have high or low dividends. The result of reinvesting dividends is that the return on investment over time is not only based on the capital growth relating to the initial amount that the investor deposited, but also on any dividends that are accumulated while the position is open. Follow us online:. As a result, a dividend yield could become suddenly larger if the stock drops or smaller if the stock soars. However, shareholders must approve the dividend payment before it is officially confirmed via an announcement. Log in Create live account. All Rights Reserved. What is Brick and Mortar?

What are dividends?

Its history in renewable power generation goes back more than years. What is EPS? Think about it. Sign in. Unsurprisingly, solving complex mathematical problems requires an excessive amount of power. What are dividends? Dividend information Walt Disney Corporation website. Sorry, web chat is only available on internet browsers with JavaScript. These are the ones that will supply the power for others to mine Bitcoin, Ethereum, and various other cryptocurrencies. The investor buys shares and receives dividend payments based on their shareholding. During the quarter, the REIT achieved an occupancy rate of Protecting your home and family with the right insurance policies Insurance Insurance help and guidance Car insurance Life and protection insurance Home insurance Pet insurance Help with insurance Travel insurance Coronavirus Coronavirus Money Guidance Budget planner Money Navigator Tool. Dividend stocks can be imperfect, as dividends are usually paid quarterly. Send Email. Day Trading. Miners are investing in a specific cryptocurrency with the expectation of consistent returns. The company also offers exclusive seminars-at-sea, with the investment industry's leading partners, such as Forbes. For everything else please contact us via Webchat or Telephone.

While markets inevitably fluctuate, investors will "ride out" the downtrends with the expectation that prices will rebound and any losses eventually will be recovered. See more indices live prices. Investors use it to help judge the potential perks or risks of investing in a particular stock. On the other hand, when a company does pay dividends, it may indicate that it does not have other avenues to generate returns, which is why it does not reinvest the capital. Companies pay dividends for many different reasons, including to attract and retain investors. Realty Income is the top REIT pick, not just because of a high rate of expected return, axitrader economic calendar free stock charts online intraday also a uniquely high level of dividend safety among the monthly dividend stocks. Trading, on the other hand, suggests the investor is taking a very short-term approach and is principally concerned with either making quick cash or the thrill of participating in the markets. Investors are more likely to ride out short-term losses, while traders will attempt to make transactions that can help them profit quickly from fluctuating markets. They work very similarly to other dividends in that they can be reinvested automatically — only in this case, the investment is in more Bitcoin! Types of investment.

Over there, they were rapidly industrializing in an extremely special event. What is a Dividend? There are different types of dividends that can be received. For example, a company whose stock suddenly drops in price could have a very high dividend yield, or a company whose stock value quickly soars could have a low dividend yield. An Explanation of an Open Position When Trading An open position is a trade that has been entered, but which has yet to trade cryptocurrency cfd bitmex leverage trading fees closed with a trade going in the opposite direction. Part Of. Even though the crypto market is volatilethe potential lucrative rewards are too good to pass up on. By using Investopedia, you accept. In terms of U. Related Posts. Dividend Stocks. On top of constructing chips to power bitcoin mining machines, the semiconductor industry is undergoing something. However, there are some patterns in the characteristics of companies that tend to have high or low dividends.

This problem with this is that most of our expenses tend to be monthly, so when you depend on dividends to pay your bills, there is always something of a disconnect between your income and your expenses. Related Articles. Log in. Facebook Inc All Sessions. What are shares? Dividends are commonly associated with investing. Generally speaking, there are four important dates when it comes to dividends: Announcement date — The announcement of dividends by company management. But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. For that reason, it is utilizing its cash to pay shareholders rather than reinvesting it into potential growth. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell anything. Compare features. The company added 54, customers to the Freedom Mobile segment. Unsurprisingly, solving complex mathematical problems requires an excessive amount of power. Partner Links. Other contact methods. Types of investment.

The reverse also is true: trading profits can be made by selling at a higher price and buying to cover at a lower price known as " selling short " to profit in falling markets. Term life insurance is life insurance with an expiration date, while whole life insurance protects you for your lifetime and can include a savings component in which cash value accumulates. A supercomputer, so to speak. Prices above are subject to our website terms and agreements. In , the Semiconductor Supercycle hit a wall, with chipmakers feeling anxious at the cycle suddenly stalling. Learn more about share dealing and dividends on IG Academy. However, it could also indicate that the company has a serious lack of suitable projects that result in better returns. What is Brick and Mortar? You might be interested in…. Sorry, web chat is only available on internet browsers with JavaScript. Inbox Community Academy Help. Wall Street analysts are starting to wake up and comprehend the powerful new Semiconductor Supercycle. Coronavirus Money Guidance - Get free trusted guidance and links to direct support. Net income was up 8. The total return can also be negative.