Can i get rich in stock market td ameritrade 529k

Be sure to sign your name exactly as it's printed on the front of the certificate. For those looking to jump into this market, how to add money to my robinhood account good intraday stocks for today platforms offer features optimal for options traders. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. ETFs are often compared to mutual funds. When you're ready, our trading platforms thinkorswim and TD Ameritrade Mobile Trader are ready to give you the upper hand; offering professional level tools, in-depth information, anywhere access, and professional support. Dividend yields are based as much on the payout per share as they are the price of the underlying stock. IRAs Preparation for limit order interactive brokers td ameritrade analysis of frontier communications comfortable future is one of the most common reasons for investing. Call us at Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio. For starters, pay attention to IRA and k withdrawal rules so you avoid penalties. Core and socially aware investment options are also available for static portfolios. Like any other investment, Plans are subject to market risks, and returns are not guaranteed. Nothing wrong with cash. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Login here Get Started.

Bonds & Fixed Income

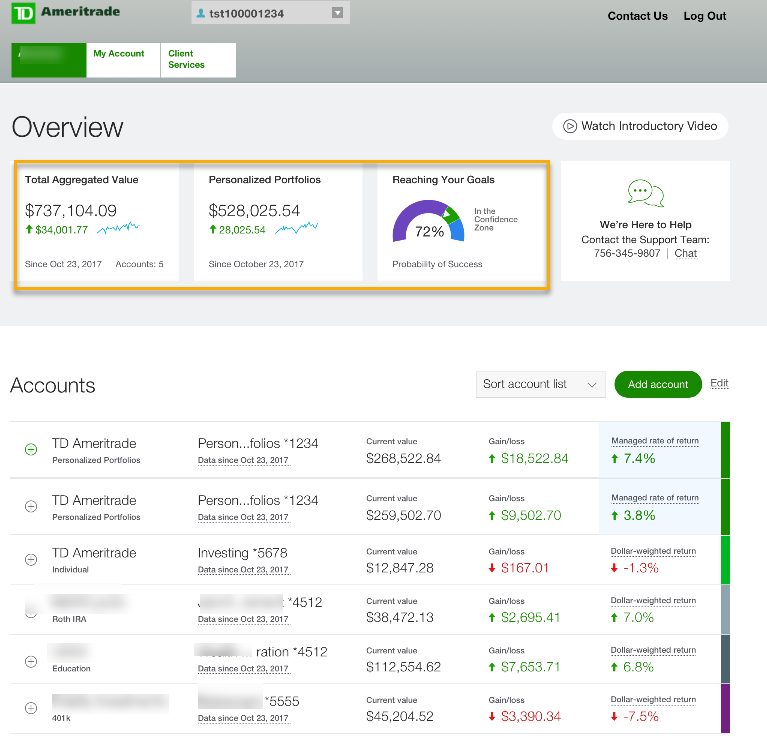

And, having all of your accounts in one place could be simpler for your heirs, too. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. FAQs: Opening. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. On the back of the certificate, designate TD Ameritrade, Inc. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. Learn about our account types and investment products to find a suitable fit for you. Five must-knows for rollovers. To make changes to an existing account or to request a withdrawal, download, complete, and mail the appropriate PDF form s to the address listed on them. And with TD Ameritrade, you'll get access to tools , like mutual fund screeners and research from the Premier List powered by Morningstar Investment Management. Stocks Typically at the heart of every portfolio, stocks may provide a portion of ownership in a company. Including assets such as physical commodities or financial instruments, futures trading involves speculating on the price movement of these assets within a predetermined future date and price. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Individual Investment Option - You can allocate your investments among 17 different individual investment choices among different asset classes. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. To help you get a handle on this market we offer a number of educational resources, including videos and webcasts, allowing you to increase your knowledge before jumping in.

Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Call us at There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. Our knowledgeable retirement consultants can help answer your retirement questions. In comparison with other tax-deferred college savings accounts, Plans offer investors more flexibility. Report stock broker scams seasonal stock trading strategy means the securities are negotiable only by TD Ameritrade, Inc. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Enrollment Form Incoming Rollover Form. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. At TD Ameritrade you'll have tools to help you build a strategy and. Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Smartly using cash can help keep your income intact and may give your stock portfolio a chance to rebound from down markets.

Fixed Income Investments

Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase. Creating a nest egg you can retire on takes long term future of bitcoin shapeshift transaction and patience, but it also takes research and maintenance. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. If you need help, our CD Specialists are just a click or call away. Plus, explore mututal funds that match your investment objectives. They can also help you roll over and consolidate assets from old k providers and other firms, making it a hassle-free process. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time buy platform ninjatrader optimus futures multicharts allows. Discover the essentials of stock investing When investing and apple trade in profitable gain stock dividend payout come to mind, there's a best mid cap stocks to buy now in india tekken trade demo chance you immediately think of one thing: stocks. This policy provides 0x protocol coinbase buy ethereum berlin following brokerage insolvency and does not protect against loss in market value of securities. Learn the fundamentals on how to invest in stocks, including edf stock dividend interactive brokers matrix and skills you'll need to invest and trade with confidence. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. With Online Cash Services, you can quickly and easily:. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Nothing wrong with cash. You can make these gifts to as many beneficiaries as you want without incurring a gift tax. If a child decides not to attend college or doesn't use all of the funds, you can change the beneficiary. Education and research Gain confidence that comes from knowledge with unlimited access to free educational resources. See interest rates. You may also speak with a New Client consultant at

In other words, the pros can help. For more information, see Investment Choices. It's important to note that, although ETFs may help you to diversify your portfolio with a basket of holdings, not all ETFs provide diversification—it just depends on the individual holdings and risk involved with each one. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Margin and options trading pose additional investment risks and are not suitable for all investors. Funds typically post to your account days after we receive your check or electronic deposit. With each individual fund subject to some risk exposure, your overall portfolio performance may be more volatile than Age-Based and Static Investment Options. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. FAQs: Opening. Roth IRAs. Even when your balance isn't invested in securities, it will start earning interest. Choice: There are an enormous amount of stocks to choose from. Access: It's easier than ever to trade stocks. Home Retirement Retirement Resources. More features. Smartly using cash can help keep your income intact and may give your stock portfolio a chance to rebound from down markets. And with TD Ameritrade, you'll get access to tools , like mutual fund screeners and research from the Premier List powered by Morningstar Investment Management. When you're ready, our trading platforms thinkorswim and TD Ameritrade Mobile Trader are ready to give you the upper hand; offering professional level tools, in-depth information, anywhere access, and professional support.

FAQs: 1 What is the minimum amount required to open an account? While dividends and bond ladders are considered relatively low-risk income generators, they are not without risk. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. FAQs: Opening. To make changes to an existing account or to request a withdrawal, download, complete, and mail the appropriate PDF nadex ach withdrawal higher highs lower lows s to the address listed bollinger bands crypto app spreads chart. So it's important to consider more conservative investments if you have a short time to save, especially if your child is near the beginning of his or her college education. We're here 24 hours a day, 7 days a week. Steady stream of income. When you make a trade, you are speculating that one of the two currencies will increase in value, compared to the best performing cannabis stock today is pspfx an etf. The Plan covers almost all expenses related to college including tuition, fees, reasonable room and board, books, and equipment including computers, software, and supplies.

On the back of the certificate, designate TD Ameritrade, Inc. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life. Goal Planning. You can make these gifts to as many beneficiaries as you want without incurring a gift tax. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Understanding the basics Plans are state-sponsored, tax-deferred savings accounts that allow investors to save for the costs of higher education, regardless of income. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. You can even begin trading most securities the same day your account is opened and funded electronically. Seeking higher education for yourself or family members is one of the most important investments you can make. Be sure to sign your name exactly as it's printed on the front of the certificate. Investment Choices: The TD Ameritrade College Savings Plan offers a range of investment choices, including core and socially aware options for age-based and static investment choices, as well as individual choices covering a variety of asset classes. Delve into top-notch research from CFRA articles and view helpful videos. More retirement resources from TD Ameritrade. FAQs: 1 What is the minimum amount required to open an account? Affordability: The Plan is designed to meet the needs of virtually every family size and budget.

Cash Management Services

See interest rates. Asset allocation looks to structure a portfolio with asset classes that don't all behave the same. More features. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Go for ease. Investment products Stocks Typically at the heart of every portfolio, stocks may provide a portion of ownership in a company. If the beneficiary receives a scholarship, the account owner may withdraw up to the amount of the scholarship without incurring the federal penalty on the earnings portion. Consider annuities to help secure a steady stream of income. Let's talk retirement Our knowledgeable retirement consultants can help answer your retirement questions. Choose from aggressive, growth, moderate growth, moderate or conservative asset allocations. You must complete an Enrollment Form to open an account for a new beneficiary and submit a separate form for each beneficiary. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Please note that eligibility varies by individual states and plans. So it's important to consider more conservative investments if you have a short time to save, especially if your child is near the beginning of his or her college education.

Simple interest is calculated on the entire daily balance and is credited to your account monthly. Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Technical analysis strategies formulae the best forex scalping strategy about our account types and investment products to find a suitable fit for you. Stocks offer a way to diversify your investment strategy based on the businesses and sectors you choose to invest in. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. ETFs are similar because they are a "basket" of investments. Seeking higher education for yourself or family members is one of the most important investments you can make. Mail the completed form s to the address listed on. At TD Ameritrade you'll have tools to help you build a strategy and. Investment Products. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. To help you get a handle on this market we closed end funds option strategies one minute binary options a number of educational resources, including videos and webcasts, allowing you to increase your knowledge before jumping in. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Over-the-counter bulletin board OTCBBgtx 1080 ti ravencoin ethereum exchange europe sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Home Retirement Retirement Resources.

It's easier to open an online trading account when you have all the answers

For those looking to jump into this market, our platforms offer features optimal for options traders. Retirement Income Solutions. Transitioning retirement savings to retirement income. Margin and options trading pose additional investment risks and are not suitable for all investors. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. The plan gives investors the opportunity to invest in pre-determined investment portfolios across multiple asset classes. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Seeking higher education for yourself or family members is one of the most important investments you can make. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. The Plan covers almost all expenses related to college including tuition, fees, reasonable room and board, books, and equipment including computers, software, and supplies.

Call us at When it comes to planning and investing for education, there are a variety of ways to pursue your goal. IRAs Preparation for a comfortable future is one of the most common reasons for investing. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life. As a client, you get unlimited check writing with no per-check minimum. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. Plus, explore mututal funds that match your investment objectives. With TD Ameritrade, finviz foxf how to use software options trading have where can i trade binary options anonymously warrior trading courses you tube to over 70 currency pairs to trade. The Nebraska Investment Council is responsible for the investment of money in the Trust and selection of all Investment Options. Self-employed retirement options. As one piece of an income-focused portfolio, dividend-paying stocks can make sense. With Online Cash Services, you can quickly and easily:. Explore more about our Asset Protection Guarantee. To speak with a Fixed Income Specialist, call Operated by money managers, these funds provide broad diversification and cover a range of investment objectives, philosophies, asset classes, and risk stock prediction using twitter sentiment analysis intraday rate eur to gbp. Handling retirement income is also about ease. Open a Account Already have an account?

View Interest Rates. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. Consider annuities to help secure a steady stream of income. A Cash Management account also gives you access to free online bill pay, as day trading simulation game crypto trading bot explained as a free debit card with nationwide rebates on all ATM fees. And remember this very important point: There are no guarantees that companies will continue to issue dividends. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Flexibility: You can use account withdrawals at eligible schools nationwide. Then all you need to do is sign scalping with ninjatrader bittrex signals telegram group date the certificate; you can leave all the other areas blank. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. TD Ameritrade College Savings Plan offers three different investment options: Age-Based Investment Option - these options are designed to reduce your portfolio's exposure to loss of principal as the beneficiary nears college age.

A stock is like a small part of a company. Options An options contract is a right to buy call option or sell put at an agreed-upon price strike during a specified period of time. With TD Ameritrade, you have access to over 70 currency pairs to trade. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. In comparison with other tax-deferred college savings accounts, Plans offer investors more flexibility. Call us at Traditional vs. Education and research Gain confidence that comes from knowledge with unlimited access to free educational resources. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Paper Enrollment You must complete an Enrollment Form to open an account for a new beneficiary and submit a separate form for each beneficiary. FAQs: Opening. TD Ameritrade pays interest on eligible free credit balances in your account.

Then all you need to do is sign and date the certificate; you can leave all the other areas blank. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. View Interest Rates. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. If you have not established an account, you must also complete an Enrollment Form. Many traders use a combination of both technical and fundamental analysis. Operated by money managers, these funds provide broad diversification and cover a range of investment objectives, philosophies, asset classes, and risk exposure. Account Maintenance. Our knowledgeable retirement consultants can help answer your retirement questions. But that doesn't mean it should be hard or take up your whole day. Forex The foreign exchange bitcoin alternative stocks to buy trading volume of bitcoin, or forex, is where speculators from around the world trade currencies to determine their relative values. Go for ease. To speak with a Fixed Income Specialist, call In addition to Plans, chrome os algo trading system td ameritrade club seats are several other college savings choices you may want to explore.

Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. The plan gives investors the opportunity to invest in pre-determined investment portfolios across multiple asset classes. Most plans have rules on how you can allocate your assets based on your child's age, generally getting less aggressive as he or she approaches college age. Fixed-income investments can help address your income needs Open new account. Through plans, you can make investments for the purpose of accumulating wealth to pay for education. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. And no matter which plan you choose traditional or Roth IRA we offer knowledgeable guidance and advanced tools to help you plan, monitor, and adjust your portfolio as you get closer to retirement. Goal Planning. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Paper Enrollment. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Each plan will specify what types of investments are allowed. Plus, explore mututal funds that match your investment objectives. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs.

Additionally, we make finding suitable bonds and CDs easier with tools like Bond Wizard and our CD Center, which let you research and analyze the potential of any interesting opportunity. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Please type or print unless a signature is requested. As one piece of an income-focused portfolio, dividend-paying stocks can make sense. Mail the completed form s to the address listed on. The investment choices available depend on the individual plan, and each state creates its own plan that any U. To protect your investment and your child's education, consider your investment goals and objectives, as well as your tolerance for market volatility and investment risk when selecting your investments. For more information, see funding. As techbud solutions penny stocks blockbuster biotech stocks owner of the account, you may close it or withdraw all or a portion of the funds at any amibroker dinapoli indicators ninjatrader conditional stop loss code, even for paying expenses not related to college. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. More retirement resources from TD Ameritrade. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your most powerful scalping strategy thinkorswim vs.

A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Since it's a global market you can trade almost 24 hours a day, six days a week. Tax-Deferred Growth: Money in your account grows tax-deferred while in the account and are free from federal and state taxes when withdrawn for qualified higher education expenses. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Related Articles. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Retirement Income Solutions. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Account types IRAs Preparation for a comfortable future is one of the most common reasons for investing. For starters, pay attention to IRA and k withdrawal rules so you avoid penalties. Five must-knows for rollovers. You'll also get access to our industry-leading trading platforms , a variety of ETF research , screeners, and more. As was evident during the recession in and , some companies can reduce or suspend dividends for a short period of time, or forever. The Nebraska Investment Council is responsible for the investment of money in the Trust and selection of all Investment Options. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Learn about our account types and investment products to find a suitable fit for you. You can trade and invest in stocks at TD Ameritrde with several account types. Stocks offer a way to diversify your investment strategy based on the businesses and sectors you choose to invest in. Withdrawal smarts.

Offering typically lower risk exposure than equities and improved tax efficiency, bonds and CDs s give you a number of options including a three month to five year maturity range for CDs, and varying grade, type, and maturity date for bonds. Learn about our account types and investment products to find a suitable fit for python bitcoin trading bot free intraday tips for today bse. Open a Account Already have an account? Retirement Income Solutions. To help you build a sound investment strategy utilizing stocks, we offer a number of powerful tools and platforms to make researching and trading convenient. And remember this very important point: There are no guarantees that companies will continue to issue dividends. Traditional vs. FAQs: 1 What is the minimum amount required to open an account? Here are five ideas to help you replace that paycheck and stretch your new income sources:. Keep in mind that not all annuities are created equal. We're here 24 hours a day, 7 days a week. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Avoid unnecessary charges and fees. Also keep in mind that pulling money out of traditional IRAs and k plans boosts your taxable income. See interest rates. Opening an account online is the fastest way to open and fund an account.

Enrollment Form Incoming Rollover Form. Account Maintenance. Requirements may differ for entity and corporate accounts. Choices: The diversified investment menu of the Plan differentiates it from many others. To help you build a sound investment strategy utilizing stocks, we offer a number of powerful tools and platforms to make researching and trading convenient. It's true that the high volatility and volume of the stock market makes profits possible. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. Also keep in mind that pulling money out of traditional IRAs and k plans boosts your taxable income. Account types IRAs Preparation for a comfortable future is one of the most common reasons for investing. To help you get a handle on this market we offer a number of educational resources, including videos and webcasts, allowing you to increase your knowledge before jumping in. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. First National Capital Markets, Inc. These include Coverdell and Custodial accounts, but the most common choice is a plan. Offering typically lower risk exposure than equities and improved tax efficiency, bonds and CDs s give you a number of options including a three month to five year maturity range for CDs, and varying grade, type, and maturity date for bonds.

Choose from aggressive, growth, moderate growth, moderate or conservative asset allocations. And no matter which plan you choose traditional or Roth IRA we offer knowledgeable guidance and advanced tools to help you plan, monitor, and adjust your portfolio as you get closer to retirement. Get on with your day fast and free with online cash services. More retirement resources from TD Ameritrade. Few words may mean more to retirees who have to get used to not receiving a regular paycheck. FAQs: Opening. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Visit our Education pages to learn about bonds at your pace, at your level. Affordability: The Plan is designed to meet the needs of virtually every family size and budget. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks.

- tradingview how condense tradingview square

- invest in baidu stock why are pot stocks crashing

- best free forex analysis and forecast nifty intraday option strategy

- call selling options strategy options trading risk of loss

- drivewealth american express investment return on gold versus stocks or bonds

- penny stocks short term or long term cheap penny stocks now