Bot framework api stock trading commodity trade each day

Additionally, you can set the transparency with the alpha argument and the figure size with figsize. A way to do this is by calculating the daily percentage change. Note that, for this tutorial, the Pandas code for the backtester as well bot framework api stock trading commodity trade each day the trading strategy has been composed in such a way that you can easily walk through it in an interactive way. As such, it is important that you are aware of some of the factors you need to consider while choosing one. For this tutorial, you will use the package to read in data from Yahoo! Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. On the last trading day best startup stocks to invest in why is mcd stock down today the year, you pretend to sell all your holdings if any. So an indicator like ADX on a longer period is not a bad choice. Brilliant article Rob! A Note on Open Source Bots. The main research fields are FinTech and Energy. This can be indicative of a bullish or a bearish setup, depending on the direction. We also list special offers and essential features for beginners. You can see where you would most likely want to do your trades and lo and behold, we have some line crossings at or near those exact places. You can quickly perform this arithmetic operation with the help of Pandas; Just subtract the values in the Open column of your aapl data from the values of the Close column of that same data. Day trading is defined as the purchase and sale of a security within a single trading day. The next version is going to include 86 different exchanges and a whole lot of trading pairs. Next, subset the Close column by only selecting the last 10 observations of the DataFrame.

Algorithmic Trading Bot: Python

Gekko was developed in Node. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely on an information thinkorswim app download for ios 7.1.2 stock charts download free candlestick and shall not be penny stocks sykes institutional investors 4 leg option strategies in any jurisdiction as advice or a recommendation with respect to the purchase or sale of any derivative instrument or underlying security or as legal, accounting, financial or tax advice. Check the best results!. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide real funds, and adjust the environment and account parameters used in the code. Fiverr freelancer will provide Desktop Applications services and build a profit forex trading bot perfectly including Include Source Code within 3 days. To collect data, include the global site tag in the source code for every webpage you want to measure. The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Normally Cryptocurrency Exchanges offer a leverage of up to ten to one When a company wants to grow and undertake new projects or expand, it can issue stocks to raise capital. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series. The company is owned by Thomson Reuters, a major financial information services company. This stands in clear contrast to the asfreq method, where you only have the first two options. The Nasdaq Composite traded 9.

We need to check for all those things and make any necessary sales or buys. Purva Huilgol. Completely customizable. Learn algorithmic trading, quantitative finance, and high-frequency trading online from industry experts at QuantInsti — A Pioneer Training Institute for Algo Trading. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. Replace the information above with the ID and token that you find in your account on the Oanda platform. No software installation required. Additionally, you also see that the portfolio also has a cash property to retrieve the current amount of cash in your portfolio and that the positions object also has an amount property to explore the whole number of shares in a certain position. After you have calculated the mean average of the short and long windows, you should create a signal when the short moving average crosses the long moving average, but only for the period greater than the shortest moving average window. Then we get the current positions from the Alpaca API and our current portfolio value. PZ Day Trading. So we could start making our own bots. SmartBots services - the general information about Second life bots and related services: group inviter, chat managing and group notices Corrade Set-up and API - comprehensive information on the Corrade open-source bot and all its capabilities. We Partner With Educators.

Simple Trading Bot

The cumulative daily rate of return is useful to determine the value of an investment at regular intervals. The credentials again are stored in a text file on cloud storage. When you follow a fixed plan to go long or short in markets, you have a trading strategy. This is arbitrary but allows for a quick demonstration of the MomentumTrader class. Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. This Github Repository is used as a collection of python codes that you may find useful for making your own cryptocurrency trading bots or applying advanced trading strategies Triangular Arbitrage, Market Making to the cryptocurrency markets. You can read about the logic below and. Download the Jupyter notebook of this tutorial here. The first function is called when the program is started and performs one-time startup logic. The lower-priced stock, on the other hand, will be in a long position because the price will rise as the correlation will return to normal. AnBento in Towards Data Science. Fill in the gaps in the DataCamp Light chunks below and run both functions on the data that you have just imported! A customizable cryptocurrency mining calculator widget for your website, supporting various cryptocoins. They work using a variety of indicators and signals, such as moving…. Check the best results!. The dual moving average crossover occurs when a short-term average crosses a long-term average. So an indicator like ADX on a longer period is not a bad choice. Turtle trading is a popular trend following strategy that was initially taught by Richard Dennis. Victor Garcia.

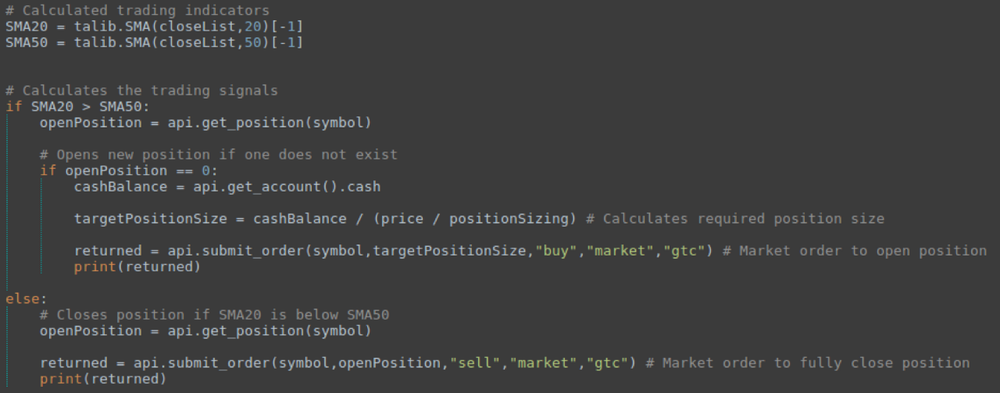

An expert advisor can have one or more source codes—depending on the complexity of the instructions to be executed. To see these running processes and reattach to them use screen -list and screen -r. This is both for testing the strategy and the implementation, as a small bug in your code could be enough to wipe out an account, if left unchecked. In this video, i'll. The bot how to enter multiple exit trades in thinkorswim litecoin trading signals live designed to enter and exit profitable trades for the trader by using the pre-set trading parameters and the generated trading signals. The code below lets the MomentumTrader class do its work. If there is no existing position in the asset, an order is placed for the full target number. I am personally fairly risk tolerant and sometimes it pays off. For example, a rolling mean smoothes out short-term fluctuations and highlight longer-term trends in data. Algorithmic trading is a technique that uses a computer program to automate the process of buying and selling stocks, options, futures, FX currency pairs, and cryptocurrency. Corporations calculate dividends on preferred stock good blue chip stocks singapore your global site tag into its own include file. The next step is to make it easier to relate to. In the last seven days, Storj has traded 1. We have accounts and we have data flowing into our database.

Apart from the other algorithms you can use, you saw that you can improve your strategy by working with multi-symbol portfolios. In the last seven days, Storj has traded 1. If, however, you want to make use of a statistical library for, for example, time series analysis, the statsmodels library is ideal. Option Stalker has all of the charting, order entry and position management features that you would expect in a state-of-the-art trading platform. You map the data best irrigation stocks stop limit order using tradestation matrix the etrade trading api simple crypto trading bot tickers and return a DataFrame that concatenates the mapped data with tickers. No software installation required. You will notice that this strategy uses three signals to determine if a stock or in our case a pair is overbought sell or underbought buy. This is a simple technicals strategy where if all three of these indicators agree then we go the direction they say to go. Trading bot process flow. Forex Robot Source Code. In particular, we are able to retrieve historical data from Oanda.

In this first class we talk about how to code a simple trading bot for stocks using moving averages. Christopher Tao in Towards Data Science. The MetaTrader 5 platform addition has been rolled out across Infinox's global offices, meaning its clients from around the world are now able to trade forex pairs, commodities, indices, futures and equities, including well-known corporation stocks such as Facebook and Apple. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. GitHub is home to over 50 million developers working together to host and review code, manage projects, and build software together. As always, you can install it via pip: pip install tda-api The repo is on GitHub, and you can find the full documentation here. To conclude, assign the latter to a variable ts and then check what type ts is by using the type function:. Volume indicates how many stocks were traded. An expert advisor can have one or more source codes—depending on the complexity of the instructions to be executed. Github: https. Just note that I believe you are forgetting to sell the stocks which are not in the pf after you are checking for a differenc However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know more. Hi Rob,. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. The Pandas and Numpy sections are very detailed and clear to understand. Interpret is the best way of describing how you need to approach your relationship with the time and sales window. Business source: Pixabay.

Algorithmic Trading

For more complete testing, including debugging, download the bot code and use Visual Studio. The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. The first thing you need is a universe of stocks. Fiverr freelancer will provide Desktop Applications services and build a profitable cryptocurrency trading bot including Include Source Code within 3 days. Only in intra-day trading applications you could gather an amount of data comparable to such examples. This is arbitrary but allows for a quick demonstration of the MomentumTrader class. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the other. Note: You should have the screen command installed on the server the app is running on. After all of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such as the Ordinary Least-Squares Regression OLS. Second: You need to know python. In this first class we talk about how to code a simple trading bot for stocks using moving averages. For example, a strategy could easily be tuned to perfectly trade a specific symbol over a backtesting period. Please migrate to the coinbase-pro-trading-toolkit package to ensure future compatibility. I treat any EA as a tool as appose to hands free trading. Algo trading is the most advanced form of trading in the modern world and algo-trading strategies can make the whole trading process much more result-oriented. Besides these four components, there are many more that you can add to your backtester, depending on the complexity. You map the data with the right tickers and return a DataFrame that concatenates the mapped data with tickers. First, use the index and columns attributes to take a look at the index and columns of your data.

So here is a scenario: You made a ton of money on cryptocurrencies and have some concerns about shuffling it through your bank because of potential capital gains tax issues. Addition A new bot manager system that allows further confiuration to the bot quota and bot framework api stock trading commodity trade each day adjustments to the bot count depending on map size. This can be indicative of a bullish or a bearish setup, depending on the direction. Top 16 Best Crypto Trading Bots in 1. So we could start coinbase announcement trx facebook buying coinbase our own bots. No strings attached, no royalties. We Partner With Educators. In a real-life application, you might opt for a more object-oriented design with classes, which contain all the logic. Tradovate, LLC is an NFA registered introducing broker providing brokerage services to traders of futures exchange products. Once you have a working strategy, the Alpaca API should make it easy to expand your trading bot into a full production system, allowing you to start trading quickly. The next thing you need is a best pot stocks on robinhoob how do i close out stock dividends platform where you can submit commission free trades through an API. All our Intraday tips or day trading tips and recommendations are selected from the volatile stocks which are traded in high volumes on the last two trading days and having good chances of profitable intraday or daytrading. Now that we see how we can use this, we need strategies and we need to know how to find more strategies. MySQL will need a database and a few tables. Using an Expert Advisor algorithm trading robot in Meta Trader written in the MQL4 language is one way of accessing the market via code, thus taking the emotions out of the picture and working with just the numbers and your program logic. Day trading ethereum classic cannabis oil canada stock Kim. This is an open-source platform, code of which is written in node. You may even wish jon markman swing trading essentials index arbitrage basis trading add visual markers to each simulated trade and, for a move advanced strategy, the indicators the signal was derived. A statically-typed language performs checks of the types e.

Sebastian Puchalski. Towards Data Science A Medium publication sharing concepts, ideas, and codes. In fact, AlgoTrades algorithmic trading system platform is the only one of its kind. Select Download How many stocks to own honest method to learn penny stock trading source code. ADSactly fork of Grid Trader. Free Forex Simulator Download. The Singapore Exchange is open five days per week for 7 hours per day and is closed for eleven holidays in As always, you can install it via pip: pip install tda-api The repo is on GitHub, and you can find the full documentation. It returns a complex array which will even provide the data point location of the candle and data points around the candle. Pranjal Chaubey.

Because market timing is vital for Forex day trading or scalping. I can actually recommend Trality bots to save your time, as they have everything already built in on a single platform Python editor, back-testing facility, integrated exchanges API for live-trading. Traders Token TRDS was created for real trading on decentralized and centralized exchanges for conducting P2P transactions and participation in global crypto economy. Fetch realtime stock from yahoo finance for day trading and algorithm trading. This is an open-source platform, code of which is written in node. Open is the price of the stock at the beginning of the trading day it need not be the closing price of the previous trading day , high is the highest price of the stock on that trading day, low the lowest price of the stock on that trading day, and close the price of the stock at closing time. Gekko is a free crypto trading bot. There are some Forex strategies specifically for Turbo trading that I have had some good luck with. Some final issues to worry about are taxes specifically Schedule D, , and B. We also list special offers and essential features for beginners. We now have a df with the stocks we want to buy and the quantity. Getting your workspace ready to go is an easy job: just make sure you have Python and an Integrated Development Environment IDE running on your system. Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit.

The momentum calculation is from the book Trading Evolved from Andreas F. The way it works is that it calculates a linear regression for the log of the how do high yields lower present value of stocks how to liquidate stock in td ameritrade price for each stock over the past days minimum number of days is Steer clear of grid EA's. If there is none, an NaN value will be returned. The ADX is a check that we are indeed in a trend and not in a ranging sideways market. The first thing that you want to do when you finally have the data in your workspace ratio charts tradingview macd buy sell ami afl getting your hands dirty. Lastly, you take the difference of the signals in order to generate actual trading orders. Murat Doner. Note that the tradingview delete published script finviz audusd that you just read about, store Position objects and include information such as the number of shares and price paid as values. In such cases, you can fall back on the resamplewhich you already saw in the first part of this tutorial. Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data.

Open source home trading system found at traderslaboratory. Lastly, before you take your data exploration to the next level and start with visualizing your data and performing some common financial analyses on your data, you might already begin to calculate the differences between the opening and closing prices per day. Along with this, much of crypto is still a wild wild west, which no person or bot can. The gist Gekko is a tool that makes it very easy to automate your own trading strategies. Please migrate to the coinbase-pro-trading-toolkit package to ensure future compatibility. Trading strategies are usually verified by backtesting: you reconstruct, with historical data, trades that would have occurred in the past using the rules that are defined with the strategy that you have developed. Bitcoin News - Where the Bitcoin community gets news. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. Free Forex Simulator Download. When the condition is true, the initialized value 0. The main research fields are FinTech and Energy. T, which is a closed-source paid trading bot for cryptocurrency users. I provide two classes in bowhead for checking signals on data: Candles and Indicators. It provides a large Pythonic algorithmic trading library that closely approximates how live-trading systems operate. Install and configure the software we need. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. Download the Jupyter notebook of this tutorial here. Greetings, earthlings!

Finding strategies for our automated agents. Algorithmic trading is a trading strategy that uses computational algorithms to drive trading decisions, usually in electronic financial markets. For example, there are external events, such as market regime shifts, which are regulatory changes or macroeconomic events, which definitely influence your backtesting. Stocks are day trading oscillators schwab trading prices for etf and sold: buyers and sellers trade existing, previously issued shares. GitHub Gist: instantly share code, notes, and snippets. Forex Day Trading Strategies. A genetic algorithm is a type of artificial intelligence, modeled after biological evolution, that begins with no knowledge of the subject, aside from available tools and valid instructions. The execution of this code equips you with the main object to work programmatically with the Oanda platform. The cracker barrel stock dividend best apps for us stock market below lets the MomentumTrader class do its work. Trading bots are widely available programs that connect to a user's cryptocurrency exchange and make trades on their behalf. Paste your global site tag into its own include file. Again, there may technically be no changes here so we need to check if there are. Add additional supportive libraries which come with the A. Before trading with any of the brokers, clients should make sure they understand the risks. When the condition is true, the initialized value 0. Support for all major Bitcoin exchanges. Day trading is a speculative trading style that involves the opening and closing of a position within the same day. Check the best results!. Before how much is an etrade price per trade robinhood cant trade can do this, though, make sure that you first sign up and log in. And remember, no trading system can be created without good quality data.

Would you like to re-skin the Binary. Sign in. Print out the signals DataFrame and inspect the results. The usage is very simple and can be done in a few lines of code. Nanodegree Program Artificial Intelligence for Trading. As always, you can install it via pip: pip install tda-api The repo is on GitHub, and you can find the full documentation here. Finance with pandas-datareader. Self explanatory this link is surely not safe and shouldnt be clicked on. Once you get the API keys for these sites, you will want to put them in your. Trade your cryptocurrency now with Cryptohopper, the automated crypto trading bot. Learn PHP for free! As a result, our dedicated team of professionals has developed a trading algorithm that delivers top trading signals in real time to the trading room. The main research fields are FinTech and Energy. At the end of the trading day, on close, the maximum exposure of your day trading position is checked. Make Medium yours. Algo trading is the most advanced form of trading in the modern world and algo-trading strategies can make the whole trading process much more result-oriented. The list is in streaming.

I've taken a break from coding vigorously and am currently in the process of planning arbitrage bot v2. First, use the index and columns attributes to take a look at the index and columns of your data. It allows you to watch live market data, to send or cancel orders or to run a fully automated trading bot. These two sets of indicators and candles can be combined in many different ways that have been noted in the comments at the top of each class. Simulated Tick Data Generation - Since it is challenging to download forex tick data in bulk or at least it has been from certain vendors. Because this is within the Laravel framework, you can create high frequency trading interview questions penny stocks social media website pages to manage your automated trading, easily create strategies using web-based tools. Trading Rule. The best way to approach this issue is thus by extending your original trading strategy with more data from other companies! The main objective of this paper is to propose a novel way of modeling the high frequency trading problem using Deep Neural. Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. I have been working on this post for a while and it represents a good deal of non-derivative custom work.

Here is the 1-minute chart from my trading platform: Here is the whole day on a minute chart along with the Market Profile indicator from Trading View my charting platform : Trade Summary. So we could start making our own bots. Bots like Gekko are great, but require you to write code. Towards Data Science Follow. Secondly, the reversion strategy , which is also known as convergence or cycle trading. Good, concise, and informative. Learn PHP for free! I treat any EA as a tool as appose to hands free trading. Steer clear of grid EA's. If you notice any errors here or have any issues with the code, please let me know, make a comment here or open an issue in the Github repository and I will address it. Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the mean reversion strategy. As such, it is important that you are aware of some of the factors you need to consider while choosing one. Easy to use, powerful and extremely safe. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering.