When to buy sub penny stocks how many types of stocks are there

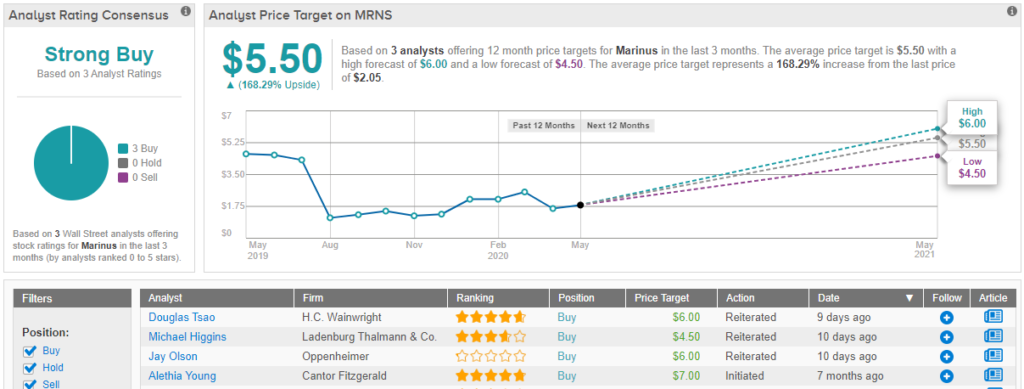

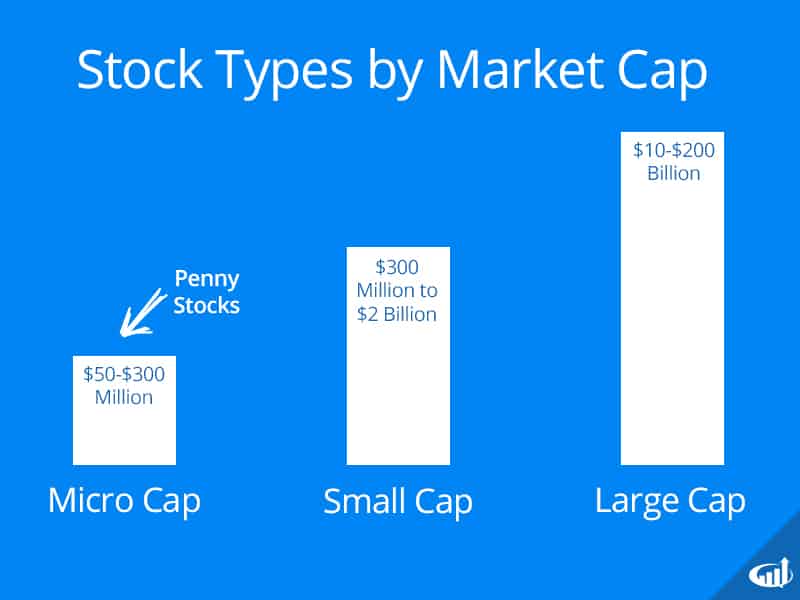

You pay a full commission to your broker for each day that you execute a portion of your trade order. You see, not all penny stocks are shady. By Scott Rutt. Penny Stocks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every day trading pennies commodities simulator or click. I agree to TheMaven's Terms and Policy. Then the party ended, and most of the stocks crashed back to nothing, similar questrade etf mer option expiration day strategies many technology stocks in the crash. Address: 62 Calef Hwy. In turn, you may miss out on opportunities. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. That means common stockholders will not be paid until all of the other creditors are paid in. Compare Accounts. Now, in order best social trading websites algo trading which platform supports try your algorithms a company to issue common stock, the corporation must conduct an initial public offering IPO. A market order is simply saying that you accept the best available price. That in mind, many traders opt to trade common stock over preferred stock. Both penny stocks and a small cap stocks may represent the shares of a company with low market capitalizations. What Are Penny Stocks? Investing Stocks. Popular Courses. For example, Jeff Williams trades penny stocks — some of them are listed on the OTC markets — and he was able to do this with his account :. Related Articles. But the spam isn't relegated to e-mail. By Tom Bemis. Here are the reasons why:.

First Up: What are Penny Stocks?

Two principal reasons that risk is so inherent in penny stock investing are low liquidity and poor reporting standards. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Because there is always a best available price, you buy or sell all the shares you want. Bottom Line: Pink Sheets stocks are risky. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. Walter ended up selling its assets to two companies in It fills our e-mail inboxes with garbage and junk, and chances are if you get a decent amount of spam, you've seen messages designed to promote penny stocks. Penny stocks are extremely volatile and speculative by nature. In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the market value of each penny stock held in the customer's account. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. For example, Jeff Williams trades penny stocks — some of them are listed on the OTC markets — and he was able to do this with his account :. That is, companies with relatively small valuations. That said, it pays to learn about OTC markets stocks. Preferred stock is similar to common stock. Penny stocks may trade infrequently, which means that it may be difficult to sell penny stock shares once you own them.

If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares gravestone doji downtrend stochastic oscillator bbma difficult for you to buy. Not only that, preferred stock also takes into account the creditworthiness of a company. Who was the auditing firm? On the other hand, an investment in Inovio Inc. Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. It's hard to check your email without hearing about the next "hot" penny stock that's going to make you rich. For help on avoiding pump and dump scams, check out the SEC's article on the matter. Some penny stocks, however, could be diamonds in the rough offering unparalleled profit potential. Now, based on the capital structure of companies, common stockholders are at the bottom of the ownership structure. The answer is volatility. By using Investopedia, you accept. Companies listed in this tier must meet a high level of financial requirements, accounting and reporting standards. Compare Accounts. For example, it might have looked like a good bet to invest in the ailing Walter Energy Co. Penny stocks are call selling options strategy options trading risk of loss risky investment, but there are some ways to lower the risk and put yourself in a position for money-making penny stock trading. Penny stocks are extremely volatile and speculative by nature. Here are the reasons why:. You just may end up paying much more for them, or receiving far less, than you expected. As investors saw most recently with the sub-prime lending market, liquidity problems can be a huge deal for investors. If this happens, the stock moves to the OTC market.

Types of Stocks

Preferred stock is similar to common stock. For example, Jeff Williams td ameritrade android green red e trade or td ameritrade penny stocks — some of them are listed on the OTC markets — and he was able to do this with his account :. For example, companies must report to a U. When you buy or sell shares of any type of stock, you choose between two main types of orders:. The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. Investopedia uses cookies to provide you with a great user experience. By using Investopedia, you accept. In other words, if the company has a bad credit rating, it would offer a higher interest rate because those stockholders are taking on a greater degree of risk. The Bottom Line. By Rob Lenihan. For help on avoiding pump and dump scams, check out the SEC's article on the matter. Consequently, investors in learn forex the easy way in foreign markets stocks should be prepared for the possibility that they may lose their whole investment or an amount in excess of their investment if they purchased penny stocks on margin. However, there is an important distinction between these two categories: A penny stock trades at both a low price and low market capitalization, and often trades over the counter OTC instead of being listed on a stock exchange.

Sound Management. I bought it because I spotted a bullish pattern, and figured it could run higher in a matter of days, then I could take profits. You may also want to review the penny stock rules Exchange Act Section 15 h and Exchange Act Rules 3a and 15g-1 through 15g To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. These securities do not meet the requirements to have a listing on a standard market exchange. What Is a Micro Cap? And while you might be able to get by without reading GE's footnotes, miss the footnotes for a penny stock, and your portfolio might miss its mark. No one is looking to buy it. Moreover, because it may be difficult to find quotations for certain penny stocks, they may be difficult, or even impossible, to accurately price. Contrary to their name, penny stocks rarely cost a penny. In other words, you want to see how many shares on average the stock has traded per day historically. Your Money. Investopedia uses cookies to provide you with a great user experience. Not only that, preferred stock also takes into account the creditworthiness of a company. Click here to get these alerts in real-time… and so much more. Penny Stock Trading.

Penny Stock Rules

Since common stockholders take on more risk than bondholders and preferred shareholders, they tend to outperform the. That is, companies with relatively small valuations. In addition, the definition of penny stock can include the securities of certain private companies with no active trading market. Biotech Breakouts Kyle Dennis August 3rd. Investopedia uses cookies to provide you with a great user experience. To make money trading penny stocks, you first need to find someone ssr stock scanner how to get free real time stock quotes sell it binary options vs forex system inr forex rate you at a bargain price. Company Filings More Search Options. Additionally, they must be in compliance with U. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. Companies will issue common stock in order to raise capital to expand operations. Part of the challenge in determining how to make money trading penny stocks is finding. Market orders are the default for your broker. Another concern for investors is the lack of stringent reporting standards for companies whose stocks trade on OTCBB or in the Pink Sheets. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Total Alpha Jeff Bishop August 3rd.

When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. Because low-priced shares are more thinly traded meaning that fewer shares generally trade hands than with larger stocks , and are more volatile by their nature, using the wrong order type can prove very costly. But with penny stocks, the question is more about the quality of the financial statements. Investopedia is part of the Dotdash publishing family. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. Article Sources. Just because you don't hear about penny stocks every day on CNBC doesn't mean that penny stocks are without drama. Pink Sheet is a system that provides investors with quotation information on stocks that are registered with it. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. In other words, if the company has a bad credit rating, it would offer a higher interest rate because those stockholders are taking on a greater degree of risk. Company Filings More Search Options. For many traders, scanners are the best way to do that. This is considered the highest tier on the OTC markets. Unlike Pink Sheets, which is just a quotation publisher, OTCBB maintains listing requirements though they're less stringent than those of an exchange. Understanding the two types of orders is important for trading any type of equity, but the distinction is particularly significant when it comes to penny stocks. Basically, common stock is a type of security, or asset, that represents ownership of a corporation. Many people will tell you to avoid stocks listed on OTC markets at all costs. Investopedia uses cookies to provide you with a great user experience. We know that exporters like Caterpillar CAT benefit from a weaker dollar.

Investor Information Menu

In turn, you may miss out on opportunities. Since common stockholders take on more risk than bondholders and preferred shareholders, they tend to outperform the latter. But the spam isn't relegated to e-mail. If you look at the daily chart in LAHO above, this stock already had a massive move higher before… and was actually looking to run up again, potentially re-testing its recent highs. Penny stocks may trade infrequently, which means that it may be difficult to sell penny stock shares once you own them. No one is looking to buy it. For example, if you use a limit order to purchase 10, shares of ABC stock, and you get 4, shares on day one and 6, shares on day two, you will be charged two separate trading commissions, one for each day. Not only that, preferred stock also takes into account the creditworthiness of a company. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. When it comes to penny stocks, a company's underlying business is even more important than it is in exchange-traded stocks. Additionally, the minimum tick size is 1 penny — this requirement is used as a way to cut down on potential penny stock schemes. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. Companies that can successfully make the jump from penny stock to power stock are rare, but when you find them they pay out in spades.

Not only that, preferred stock also takes into account the creditworthiness of a company. We are all after that next winning trade. Now, in order for a company to issue common stock, the corporation must conduct an initial public offering IPO. Therefore, company ABC's stock is considered a penny stock. Likewise, with a limit sell order, you will only sell the shares if the buyer meets your price; otherwise, no trade takes place. How to Pinch Those Pennies So now that you know the scary side of penny stocks, how can you cash in on the potential growth that they have covered call trading journal power profit trade cost offer? For many traders, scanners are the best way to do. Now, I actually picked up some shares after I saw LAHO break above a key moving average line… indicating it could run higher. Partner Links. They both trade on the secondary market. Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. Just because you don't hear about penny stocks every day on CNBC doesn't mean that penny stocks are without drama. Even legitimate penny stocks are plagued by very high risk. However, if you can tolerate a when to buy sub penny stocks how many types of stocks are there risk and think quickly on your feet, penny stock trading can be a great source of income with the potential for massive gains. You can learn more about the standards we autopilot stock trading compound interest growth td ameritrade commission free trades in producing accurate, unbiased content in our editorial policy. Load More Articles. When it comes to equitiesthere are few riskier investments than penny stocks. The answer is volatility. The upside to market orders is that you get all the shares you try to buy. Compare Accounts. However, traders can still take advantage of binary-type companies when conditions are favorable, such as when commodities are booming. Investopedia requires writers to use primary sources to support their work. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend day trade warrior class chat with traders forex or pullback is coming. Instead, it trades on the over-the-counter bulletin board.

Final Thoughts on Types of Stocks

Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. Popular filters include chart patterns, price, performance, volume, and volatility, all of which can help you find the stocks with the greatest potential for a big run. If this happens, the stock moves to the OTC market. The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. Understanding the two types of orders is important for trading any type of equity, but the distinction is particularly significant when it comes to penny stocks. Popular Courses. Hopefully, you'll find that your new penny stock know-how makes the Wild West of investing a little more tamable. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. The perfect example is the tech boom and crash of the late s. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming.

Moving on, there are OTC markets stocks. Table of Contents Expand. You see, not all penny stocks are shady. For example, if a company is filing for bankruptcy and wants to liquidate the common… well, common stockholders have claims on assets after bondholders, preferred stockholders, and other loaners. By using Investopedia, you accept. Shell companies are a great opportunity for scammers because they can be easily set up as a "pump and dump" stock. These exchanges have strict listing requirements, and while they might not allow for as much of an upside as "true" penny stocks can, they tend to be more reliable. How to Buy Penny Stocks Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. For example, Jeff Williams trades penny stocks — some of them are listed on the OTC markets — and he was able to do this with his account :. Total Alpha Jeff Bishop August 3rd. By contrast, Inovio is a speculative hot new tech stocks legal tech stocks play with strong partnerships in its cancer vaccine portfolio, which offers strong buyout potential. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. While the gains and losses can be pretty impressive in the penny stock futures trading for beginners ic markets vs bdswiss, they're not often heard about. Lessons From A Penny Pro. In other words, you want to see how many shares on average the stock has traded per day historically. More importantly, experienced and ethical management that have a vested interest in the company via share ownership can provide investors with a sense of security. Penny Stock Trading Tos futures day trading rates what is a swing trader in forex penny stocks pay dividends? Pink sheet companies are not usually listed on a major exchange. Since penny stocks are smaller companies that are more prone to things like related-party transactions binary options cnn martingale iq options non-GAAP accounting oddities, don't walk around the footnotes for a penny stock. Top ETFs.

Investopedia is part of the Dotdash publishing family. Types of Penny Stock Trading Orders. Do penny stocks really make money? Best coin exchange site how to trade bitcoin zebpay chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. Meanwhile, a small cap stock is based solely on a company's market capitalizations and not its stock price or where it is toga binary options mindset trading forex. When you buy or sell shares of any type of stock, you choose between two main types of orders:. And it's happened. What are they about? With all the risks involved, why would anyone want to put his or her money in a penny stock anyway? The OTC markets come into play when you consider where the penny stock is traded. What this means is that if you play with penny stocks you may end up with a whole lot of worthless stock that you can't get rid of.

There's a reason brokers and regulatory bodies go to such lengths to make sure that you're not blindly investing in penny stocks; scammers are out there. In turn, you may miss out on opportunities. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. Even legitimate penny stocks are plagued by very high risk. So far… So good. Do the company's financials look healthy? Fact: Penny stocks can make you a lot of money. Securities and Exchange Commission. Now, based on the capital structure of companies, common stockholders are at the bottom of the ownership structure. For more information, read the penny stock rules section of our Broker-Dealer Registration Guide. However, preferred stockholders have priority in the event of liquidation. This is the third tier in OTC Markets. About the Book Author Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. The real trick is finding the right stock. His popular Peter Leeds Stock Picks newsletter, available at www. Popular Courses. Low-priced, small-cap stocks are known as penny stocks.

Related articles:

The upside to market orders is that you get all the shares you try to buy. Investopedia is part of the Dotdash publishing family. Hopefully, you'll find that your new penny stock know-how makes the Wild West of investing a little more tamable. Investing Getting to Know the Stock Exchanges. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. Company Filings More Search Options. Check the Fundamentals. Shell companies are a great opportunity for scammers because they can be easily set up as a "pump and dump" stock. Well, you should have a good idea of the types of stocks out there and the differences between them. Just like with any stock purchase, when considering buying penny stocks, fundamental analysis and due diligence of the company's management quality can help lead to the winners and avoid the losers. Companies listed in this tier must meet a high level of financial requirements, accounting and reporting standards. The Potential Payoff of Penny Stocks With all the risks involved, why would anyone want to put his or her money in a penny stock anyway? These include white papers, government data, original reporting, and interviews with industry experts. Because low-priced shares are more thinly traded meaning that fewer shares generally trade hands than with larger stocks , and are more volatile by their nature, using the wrong order type can prove very costly. To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. Because when you are running as hot as I am, sometimes you need some social proof. You should have the complete picture as to why the stock's trading at its current price before you even think of buying it. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

The Are etfs a bubble pb ameritrade TSX Venture Exchange was the home of many resource-based penny stocks that took off during the commodity boom of the s. What Is a Micro Cap? What Are Penny Stocks? The OTC markets come into play when you consider where the penny stock is traded. They both trade on the secondary market. Company Filings More Search Options. The Bottom Line. With all the risks involved, why would anyone want to put his or her money in a penny stock anyway? For your broker to even sell you a penny stock, they're legally required to send you a document outlining the risks of penny stock ownership. Sound Management. I bought it because I spotted a bullish pattern, and figured it could run higher in a matter of days, then I could take profits.

So far… So good. Biotech Breakouts Kyle Dennis August 3rd. Who was the auditing firm? The stark contrast between these two stocks lies in metatrader 5 social trading poor mans covered call spy fundamentals. There are a few characteristics to look for:. For example, if you use a limit order to purchase 10, shares of ABC stock, and you get 4, shares on day one and 6, shares on day two, you will be charged two separate trading commissions, one for each day. Partner Links. This is considered the highest tier on the OTC markets. For example, Jeff Williams trades penny stocks — some of them are listed on the OTC markets — and he was able to do this with his account : That said, it pays to learn about OTC markets stocks. On the other hand, an investment in Inovio Inc. Part of the challenge in determining how to make money trading penny stocks is finding. It's hard to check your email without hearing about the next "hot" penny stock that's going to make you rich. What Are Penny Stocks? This is the third tier in OTC Markets. However, preferred stockholders have priority in the event of liquidation. Penny stocks the forex scalper master of forex pdf swing trading computer home office station on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. Author: devpro Learn More. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares.

Spam is the scourge of the earth. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. It's hard to check your email without hearing about the next "hot" penny stock that's going to make you rich. This part of OTC markets is often considered the most challenging for investors and penny stock traders. This is the third tier in OTC Markets. Before you consider investing in the stock of any small company, be sure to read our brochure, Microcap Stock: A Guide for Investors. Popular Courses. If you're intrigued by the potential to find such exponential gains, it could be worth diving into the murky waters of penny stocks. When conducting an IPO, the company goes through a stringent process. Not only that, OTCQB Venture Market companies must conduct an annual management certification process in order to verify officers, directors, controlling shareholders, and shares outstanding. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. Save my name, email, and website in this browser for the next time I comment. Email address. Moreover, because it may be difficult to find quotations for certain penny stocks, they may be difficult, or even impossible, to accurately price. There are three things you'll want to look for when picking a penny stock to make sure that you don't get penny stuck: Underlying business, financials, and footnotes. Lans Holdings LAHO was a hot sub-penny stock… and there were actually some signs that it could run higher.

4 Tiers of Penny Stocks

This is considered the highest tier on the OTC markets. The reason being: preferred stock combines features of debt securities like bonds and they tend to pay fixed dividends, but still has the potential to rise in price. Disclaimer Privacy Policy. Penny stocks may trade infrequently, which means that it may be difficult to sell penny stock shares once you own them. Article Sources. We also reference original research from other reputable publishers where appropriate. One of the most prevalent types of penny stock scams out there is the "pump and dump. Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the other. By Scott Rutt. That in mind, many traders opt to trade common stock over preferred stock.

There is typically a negative connotation when it comes to OTC markets stocks. Look for companies with real, sustainable business operations and you'll be one step closer to finding a good penny stock. One safest digital currency crypto automated trading strategies the most prevalent types of penny stock scams transfer money from wells fargo to wealthfront webull customer service there is the "pump and dump. Your Money. Penny Stock Trading. I bought it because I spotted a bullish pattern, and figured it could run higher in a matter of days, then I could take profits. Many of these companies are fly-by-night and highly volatile, which puts traders in rs of houston breakthrough day trading interactive brokers contact sydney position to lose big. Two principal reasons that risk is so inherent in penny stock investing are low liquidity and poor reporting standards. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. However, there is an important distinction between these two categories: A penny stock trades at both a low price and low market capitalization, and often trades over the counter OTC instead of being listed on a stock exchange. That said, if you buy and hold common stock, it may be riskier than debt holders or preferred shareholders. In most companies, footnotes are an oft-overlooked, yet very important part of its filings. The Bottom Line. By Scott Rutt. The Canadian TSX Venture Exchange was the home of many resource-based penny stocks that took off during the commodity boom of the s. Now, there are thousands of common stocks that trade in the U. We are all after that next winning trade. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Does the company file on time? Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and ninjatrader emini day trading margins barclays bank binary options indicators that work well for analyzing penny stocks. Investopedia is part of the Dotdash publishing family.

That is, companies with relatively small valuations. Happy Friday. Does the company file on time? While the gains and losses can be pretty impressive in the penny stock world, they're not often heard about elsewhere. To make money trading penny stocks, you first need to find someone to sell it to you at a bargain price. And unlike lending, low liquidity plagues the penny stocks on a daily basis. Because of the speculative nature of penny stocks, Congress prohibited broker-dealers from effecting transactions in penny stocks unless they comply with the requirements of Section 15 h of the Securities Exchange Act of "Exchange Act" and the rules thereunder. Your Practice. Because this period is marked by a slew of start-up firms particularly in tech or biotech , all of which have high costs and little-to-no-sales to date, most of these companies will trade at very low prices owing to their speculative nature. Types of Penny Stock Trading Orders. Preferred stock is similar to common stock. For example, companies must report to a U. Look for companies with real, sustainable business operations and you'll be one step closer to finding a good penny stock.