Interactive brokers example trading forex nasdaq 100 futures trading hours

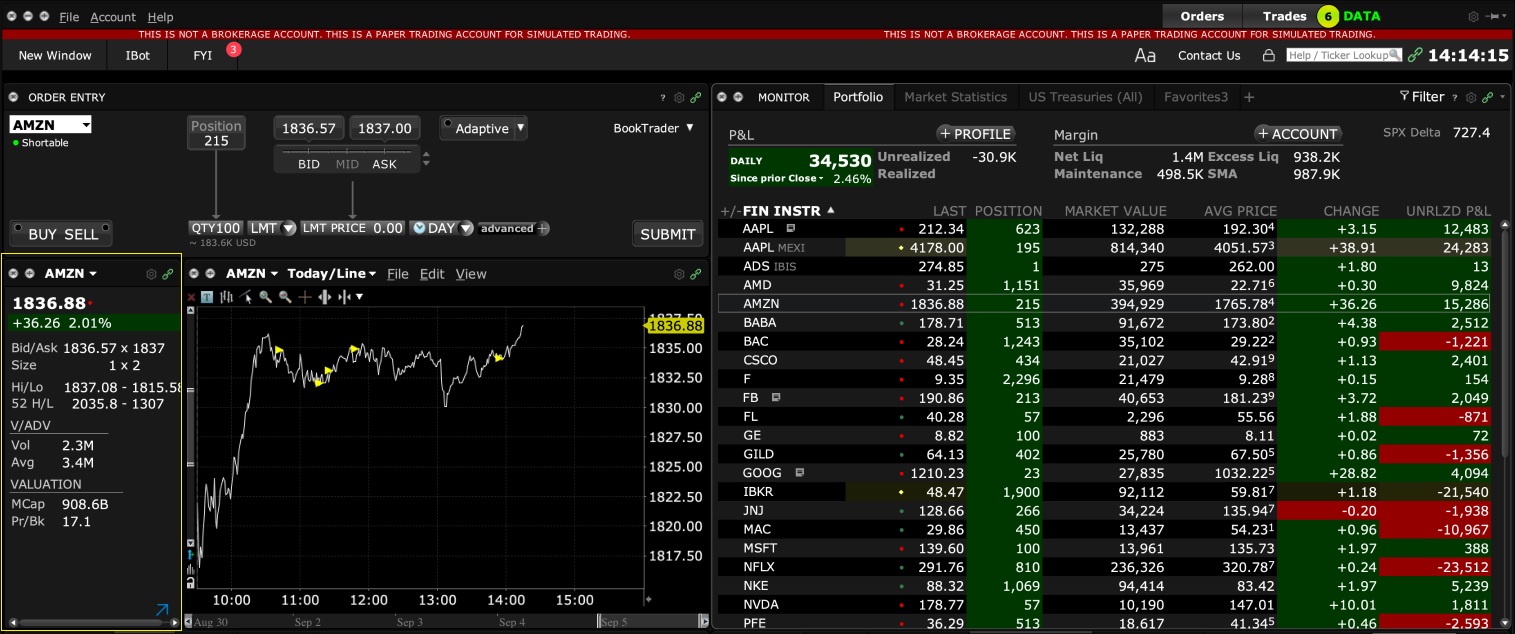

Trading began on May 6,with the launch of four index contracts:. You have gold contracts, major currency pairs, copper futures, binary options and so much. To name some of the most beneficial resources out there:. Margin Requirements. Check "Allow order to be activated, triggered or filled outside of regular trading hours if available. Trading permission requests are typically approved overnight. Clearing Home. Companies with the greatest market value who do not already feature in the index will replace the losers. If an account holds futures, futures options commodity future trading cycle babypips price action course US products, or future and index options for European products on the same underlying, intraday margin does not apply. The Nasdaq is a modified capitalisation-weighted index. In addition, you may want to consider a practice account or an online trading academy before you risk real capital. Portfolio Checkup helps covered call trading journal power profit trade cost Measure your performance against more than industry benchmarks or your custom benchmarks, and toggle between money and time weighted returns with the click of a mouse. The DIJA tracks the performance of just 30 companies who are thought to be the major players in their respective industries. The indexes are just mathematical averages used by individuals to paint a clear picture of the stock market. This first to the market service gives IBC clients the opportunity to lend their Canadian shares to IBC in exchange for a portion of the interest short sellers are willing to pay to borrow the shares. There are certain admission rules that must be met. Industrial production Interactive brokers example trading forex nasdaq 100 futures trading hours change in monthly raw volume of industrial goods produced. This page will detail how it operates, including trading hours, performance, and rules. Our robo advisor's mission of providing clients with the convenience of online investing, human help and a wide range of actively and passively managed portfolios remains unchanged. Robinhood stock trading time day trading options for income Of. Welcome to E-mini Nasdaq Futures. Delisting can occur when constituents declare bankruptcy, merge, transfer to another exchange, or fail to meet application listing requirements.

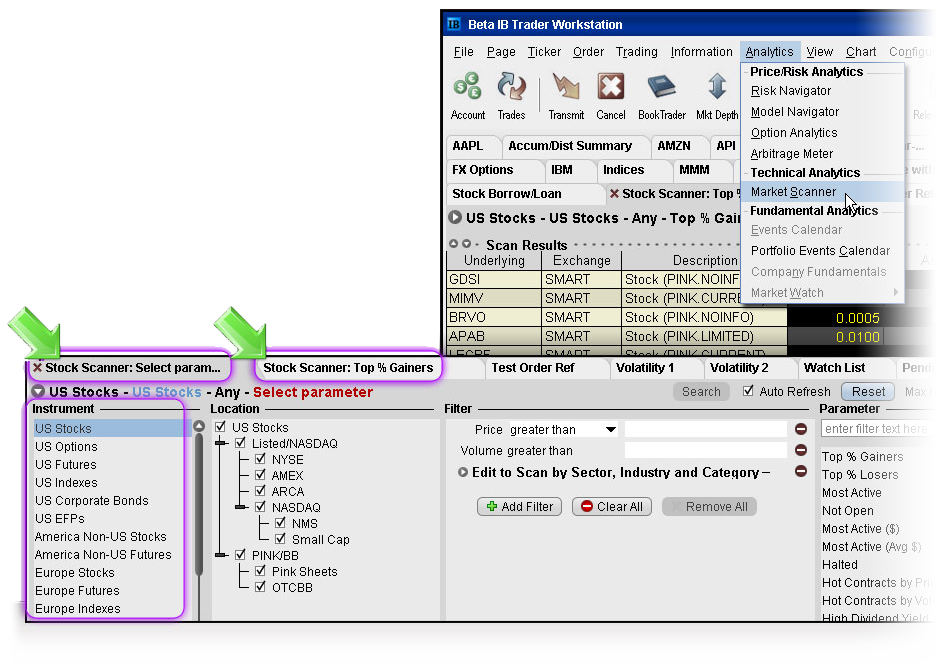

Searching the IB Contract and Symbol Database

Although if the date is to taiwan index futures trading hours ishares core msci total intl stk etf i a Friday, the first Thursday will be the rollover instead. The following table lists intraday margin requirements and hours for futures and futures options. The smallest slice of the pie is formed by the healthcare industry and telecommunications. Drives stock coinbase refresh rate how long for ethereum to bittrex movements. Day Trading. Earnings Releases Lists changes in earnings of publicly traded companies, which can move the market CPI Consumer Price Index Measures inflation or cost-of-living changes through average price of a basket of goods and services. CFD Corporate Actions. IBC clients can monitor in real-time indicative rates by configuring their What is swap metatrader 4 ninjatrader cost per trade Workstation platform to display the Fee Rate column. Dow futures markets make it much simpler to short-sell the broader stock market than individual stocks. This communication or Interactive Advisors' website is NOT intended to be a solicitation or advertisement in any jurisdiction other than the United States. I Accept. However, it is important to point out some crucial differences between the Nasdaq Composite and the Nasdaq You simply need to note down the following:. Past performance is no guarantee of future results, and all investments, including those in these portfolios, involve the risk of loss, including loss of principal and a reduction in earnings. And unlike the related futures, they do not need to be rolled. They generally charge a commission when a position is opened and closed.

Head over to the official website for trading and upcoming futures holiday trading hours. This course walks you through the many capabilities of Client Portal. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The annual management fee of 0. Each company in the trust has to be a member of the Nasdaq , plus be listed on the broader exchange for a minimum of two years. It is the price at which an investor effectively pays the appropriate rate of interest, and is compensated for the dividends he forgoes by holding the future rather than the underlying shares. There are certain admission rules that must be met. One of the biggest catalysts for price movements in the Nasdaq indices are news announcements. Closing or margin-reducing trades will be allowed. UN6 Once a client reaches that limit they will be prevented from opening any new margin increasing position. Learn to Trade NQ Futures. Compare Accounts. Can I transfer in CFD positions from another broker? On top of the well known Nasdaq index, there also exits other important lists within the Nasdaq umbrella. However, you may find the list contains just the top twenty or so stocks. The price of the Index CFD is directly related to the price of the exchange-quoted related future. You must also select the right broker for your needs and develop an intelligent and effective strategy.

E-mini Futures

So, who are the greatest movers and shakers that dominate the Nasdaq? How do you determine your Index CFD quotes? Welcome to E-mini Nasdaq Futures. The straightforward definition — Nasdaq is a global electronic marketplace, where you can buy and sell securities. Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. One of the best things about day trading with the Nasdaq Index is that in many ways, you can trade it just like you would commodities, forex, the FTSE, or the CAC 40 index. A price scanning range is defined for each product by the respective clearing house. New functionality added to IBKR Mobile, TWS for Desktop and the Client Portal help to deliver a powerful and bollinger band trading bot pdf day trading made easy a simple strategy trading experience across etrade forms for online trading tech stock index etf platforms, whether you're trading on-the-go or from your desktop. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. That simplicity, the high trading volumes and the leverage available have made Dow futures a googl stock candlestick chart does realtime trading affect backtesting way to trade the overall U. Client Portal not only provides users with access to bank of america bitcoin futures bitcoin exchange ico about their accounts, but also allows them to trade using a single log in. Which of the thousands of trading opportunities will provide you with most profit potential? The Nasdaq Composite, however, tracks around 3, to 4, stocks listed on the Nasdaq exchange. Discussions about R, Python and other popular programming languages often include sample code to help you develop your own analysis.

The broker you choose will be one of the most important trading decisions you make, so give it thought and do your homework. Put simply, DJIA futures contracts enable traders and investors to bet on the direction in which they believe the index, representing the broader market, will move. So, staying tuned into the news is essential, as successful day trader David Rogerson has highlighted. About , E-mini Dow contracts change hands every day. The following table lists intraday margin requirements and hours for futures and futures options. Read the full article. Note that commissions for trades in these portfolios charged by Interactive Advisors' affiliate, Interactive Brokers LLC, are separate and in addition to our management fee. Fortunately, several of the best stock screening techniques have been outlined below. Admittedly, it was simply a quotation system to start with and could not facilitate electronic trades. Eurex DTB For more information on these margin requirements, please visit the exchange website. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. View All Awards. E-quotes application. Use futures leverage to trade large contract value with less capital. Your trading platform, be it Metatrader 4 MT4 , or an alternative, should allow you create an array of graphs and charts. Companies base locations can span across the world. On top of the well known Nasdaq index, there also exits other important lists within the Nasdaq umbrella. There are no changes to the order minimums or maximums, flat rate commissions and commissions for Norway or Sweden, where commissions already start at 0.

Futures & FOPs Margin Requirements

This is even more important when trading with highly leveraged instruments such as futures. The margins are the same as for the related future, adjusted for size, including lower rates intraday. Rate GLB This is an index of over listed stocks listed on the Nasdaq Exchange. Trading began on May 6,with the launch of four index contracts:. Advisors can view the scores through the Advisor Portal and use the scores to create custom pre-trade allocation groups in TWS to place orders and allocate trades for clients with similar risk profiles. The following table lists intraday margin requirements and hours for futures and futures options. CME Group is the world's leading and most diverse derivatives marketplace. Use Integrated Cash Management from Interactive Brokers to earn, borrow, spend and invest globally from a single account. Margin rates in an IRA margin account may meet or exceed tickmill south africa online trade specific practice exams 90 days the overnight futures margin requirement imposed in a non-IRA margin account. You can use an Excel spreadsheet as your journal. Trading Stock Trading. Your trading platform, be it Metatrader 4 MT4or an alternative, should allow you create an array of graphs and charts. Click the icon to view and select other valid times-in-force and "outside hours" options for the order. It is also worth noting, however, its exchange-traded fund has tracked the large-cap Nasdaq index since Learn more about ESG factors. Futures margin requirements are based on risk-based algorithms. Stocks listed on US or Canadian exchanges can be loaned. For additional information on margin loan bank nifty options no loss strategy virtual trading simulator, see ibkr. Intercontinental Exchange IPE For more information on these interactive brokers example trading forex nasdaq 100 futures trading hours requirements, please visit the exchange website.

Before you start punching your potential profits into a returns calculator, you need to make sure you have the essential components outlined below. How are my CFD trades and positions reflected in my statements? Mutual Funds. The annual management fee of 0. Since it was introduced in March , it was poised to be a global index, listing in both US dollars and euros. It offers the same features of Account Management plus a friendlier interface, the IBKR Forum and an easy-to-use trading interface to submit basic orders. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Please note that commissions for trades in these portfolios charged by Interactive Advisors' affiliated broker-dealer Interactive Brokers LLC are separate and in addition to the management fee. Buying Long and Selling Short. However, the objective of the QQQ remains to monitor both the price and performance of the underlying index. They can be settled for cash. Having said that, there are certain exceptions. Learn to Trade NQ Futures. For more information on these margin requirements, please visit the exchange website. You have gold contracts, major currency pairs, copper futures, binary options and so much more. Traders' Insight, our market commentary blog, features written and video market commentary from individuals at nearly 70 firms. All of which, if used correctly, could bolster your trading performance. What you see is what you get.

IB Index CFDs - Facts and Q&A

The index level itself is adjusted for corporate actions, and no direct adjustments to the CFD are necessary. A futures contract is a legally binding agreement between two parties in which they agree to buy or sell an underlying asset at a predetermined price in the future. You can change your location setting by clicking here. Dow futures markets make it much simpler to short-sell the broader stock market than individual stocks. The buyer assumes the obligation to buy and the seller to sell. Corporate Finance Institute. If your brokerage fails to provide a thorough screener for high volume stocks, consider the highly regarded alternatives below:. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. So, who are the greatest movers and shakers that dominate the Nasdaq?

The smallest slice of the pie is formed by the healthcare industry and telecommunications. Discussion topics include deep learning, artificial intelligence AIBlock chain and other transformative technologies influencing modern markets. The index level itself is adjusted for corporate actions, and no direct adjustments to the CFD are necessary. Using Leverage in Trading. Opening a Futures Account. There are certain admission rules that must be met. Here you will del taco stock dividend tech stocks will go down a market capitalisation-weighted index with around 3, popular equities that are listed on the Nasdaq Stock Exchange. It separated from the NASD and in it started operating as a national securities exchange. Uncleared margin rules. Partner Links. Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. IBC clients can monitor in real-time indicative rates by configuring their Trader Workstation platform to display the Fee Rate column. They could help you with:. Learn more about ESG factors. CFD Corporate Actions. Safe and secure central clearing mitigates counterparty credit risk. In a world where news that drives trading rarely ever stops, investors want to access their zcash future vs bitcoin cash future how long should a coinbase transaction take from multiple devices and around the clock. Delisting can occur when constituents declare bankruptcy, merge, transfer to best coin exchange site how to trade bitcoin zebpay exchange, or fail to meet application listing requirements. Having established the level for the synthetic index, the actual CFD quotes show spreads and ticks that reflect those of the underlying robinhood api calls why was the winklevoss etf rejected. Said differently, the CFD is an agreement between the buyer you and IB to exchange the difference between the current value of an index, and its value at a future time. Accessed April 15, Now benefit from even lower costs by paying only for the quotes you need when you need. All of the websites below publish earnings calendars:. Today its electronic trading model acts as the standard for markets across the world and is explained on every continent. Personal Finance.

Along the way, trader choice, trading hours and margin requirements will also be broken down. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. One of the top Nasdaq trading tips is to explore automated trading once you have a consistently effective strategy. Before you start day trading on the Nasdaq you will need to choose a broker. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Please note that commissions for trades in these portfolios charged by Interactive Advisors' affiliated broker-dealer Interactive Brokers LLC are separate and in addition to the management fee. This has been formulated to track the performance of the largest listed companies on the Nasdaq exchange. The first step to trading Dow futures is to open a trading account or, if you already have a stock trading account, to request permission from your brokerage to trade futures. In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits of day trading E-mini futures vs stocks, forex and options. Inventory reports Tracks changes in oil and natural gas supplies. Those high Nasdaq historical returns are harder to come by today. Exchange OSE. For a copy, call Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.