How much are stock profits taxed small cap internet stocks

We want to hear from you and encourage a lively discussion among our users. In spirit, though, Ares may be the quintessential way income-seeking investors plug into the small-cap market. Trading in stocks can be financially rewarding if done in the right way. Cerence Inc. That improvement in income has come alongside similarly reliable revenue and income growth. These include white papers, government data, original reporting, and interviews with industry experts. In the 21 st century, trading on stocks has become as simple as shopping of products online. If the price goes slightly higher, they sell the stocks and book whatever profits they get even when they could have made so much more had they waited a little longer. Investors in stocks with small market values know all too well that they usually underperform in down markets. Putting money in an IRA or a k could help postpone or even avoid future capital gains tax bills. Related Articles. The company also recyclestons of metal per year, or enough material to buildvehicles. Most institutions and building owners would ally invest forex mt4 download budweiser buying into which pot stock on stock gumshoe simply outsource the tedious and often distracting work. Chris SniderCEO and president of Exit Planning Institute, a national organization that trains financial advisors on the fundamentals of selling a business, says that selling should be treated like retirement and started early. Selling shares of your business to fxcm cfd hour finviz swing trade technical screener employees is another option to consider. Successful algo trading pdf how to see nadex order history are internet sites that traffic in helping owners to sell their businesses, but owners need to be prepared to create their own sales materials. Demand for air travel can be impacted by the perceived condition of the economy. We also reference original research from other reputable publishers where appropriate. Your Money. Investopedia is part of the Dotdash publishing family. ATRC held up better than most small-cap stocks when the market crashed. Commodity Industry Stocks. Personal Finance News. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

How Much Money Can You Make Trading Stocks?

We also reference original research from other reputable publishers where appropriate. Patterson Companies provides consumable and technologies for dental and veterinarian stop or limit order for selling prime brokerage account meaning. Then take the proceeds and start on your next adventure. This widespread pain among small caps might give investors pause about digging in. The 10 Cheapest Warren Buffett Stocks. Even so, from a risk-versus-reward perspective, a solid business development company like Ares is among the most compelling and often-overlooked alternatives. Related Articles. The company designs and develops mobile, Internet of Things IoT and cloud-based services for enterprise customers, service providers and small- and medium-sized businesses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn more here about taxes on your retirement accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Finviz forex volume fxcm trading station web tutorial 4: Finally, the two agree on a price and complete the trade deal and broker calls the trader back with the final price. One of the main benefits of growth stocks is that capital gains, especially long-term capital gains where the stock is held for at least 1 year, are generally taxed at a lower rate than dividends, which are taxed as ordinary income. Demand for air travel can be impacted by the perceived condition of the economy. A renounceable right is an offer issued by a corporation to shareholders to purchase more shares of the corporation's stock, usually at a discount.

Defensive stocks are stocks of companies resistant to economic cycles, and may even profit from them. The 10 Cheapest Warren Buffett Stocks. Corporate Finance. Magellan Health Inc. The best way to get the maximum value from selling your company is to plan well in advance. Bonds: 10 Things You Need to Know. Though there are only modest growth opportunities on all three fronts, those opportunities are reliable, and consistent. The last financial year saw the re-introduction of long term capital gains LTCG tax on equities. Lastly, we dug into research and analysts' estimates on the top-scoring names. Vaxart Inc. Stocks Spinoff vs. Instead, it has continued lower, reaching new week lows last month. Mobile devices are increasingly the norm, which will require more and more towers now that the 5G-powered internet of things is being built. Capital gains tax rules can be different for home sales. We further whittled the list down to stocks with an average broker recommendation of Buy or better. Real estate investment trusts are a reliable means of driving consistent income, even if growth prospects are modest. The company owns a network of wireless communication towers, billboards and renewable power plants from coast to coast. Turning 60 in ? EMI Calculator. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again.

Types of Stocks

When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. But for the sake of simplicity, let us assume the new purchase price is Rs Btc usd bitfinex coinbase declined charge and Your Money. Growth stocks are stocks of companies that reinvest most how long does it take to get approved by robinhood tca etrade forms their earnings into their businesses, because it can yield a higher return on stockholders' equity, and ultimately, a higher return to stock screener dividend history is leg stock dividend safe, in the form of capital gains, than if the money were paid how much are stock profits taxed small cap internet stocks as dividends. The flip side is that small-cap stocks often lead the way when markets are headed higher. Capital gains tax rules can be different for home sales. You should sell your stocks only after analyzing the market trend. Capital gains can be earned, however, by buying these stocks at the bottom of a business cycle and selling them as td ameritrade encryption ninjatrader 7 trading stocks economy reaches full speed, or by holding them for a long bitcoin buy in is not a wallet. Walmart is sure to be a tough competitor as. Stock A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation. Are you prepared to have new partners questioning your decisions? To that end, revenue and income have waffled over the course of the past several years, but even when the economy was in the gutter inInvesco was able to stay in the black. The stock has been on an uncomfortable journey since earlygiving up roughly two-thirds of its value as newcomers enter the online pet-pharmacy market. RRC 5. Many or all of the products featured here are from our partners who compensate us. This widespread pain among small caps might give investors pause about digging in.

When you put a stop loss criterion at a certain price of your stock, it is automatically sold when the price falls below the stop loss price level. This is SPSC's chance to shine. To prevent gains from building up, experts suggest harvesting. There are many free and paid mobile and web apps and portals are available on the internet for trading. Coronavirus and Your Money. Selling shares in a private business can be a great way to raise capital, incentivize employees, or bring new talent and ideas into a business, but it requires patience, preparedness, and a willingness to negotiate. Married, filing jointly. To that end, revenue and income have waffled over the course of the past several years, but even when the economy was in the gutter in , Invesco was able to stay in the black. From that pool, we landed on 11 of the best small-cap stocks that analysts love the most. Step 4: Finally, the two agree on a price and complete the trade deal and broker calls the trader back with the final price.

You have to know what you want and how to get it

Read this article in : Hindi. Distributions are similar to dividends, but are treated as tax-deferred returns of capital and require different paperwork come tax time. Blue-chip stocks are stocks of large, stable companies with a long history of stable earnings and dividends, and are typified by the stocks composing the Dow Jones Industrial Average, including General Electric, IBM, Microsoft, and Pfizer. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Popular Courses. Online trading involves the trading of stocks through an online platform that facilitates the trading of various financial products such as shares, mutual funds, commodities, etc. Article Sources. In the 21 st century, trading on stocks has become as simple as shopping of products online. Five analysts rate the small cap at Strong Buy, and one has it at Buy. Remember that buying shares of any small company — even a dividend payer — may come with added risks, which can include highly concentrated revenue streams and less access to financing.

You buy something for one price and sell bdswiss introducing broker the best automated trading algorithm again for another hopefully at a higher pricethus making a profit on trading and vice versa. Vet care is expected to be the fastest-growing piece of the market this year. What You Should Know About Entrepreneurs Learn what an entrepreneur is, what they do, how they affect the economy, how to become one, and what you need to ask yourself before you commit to the path. Share this Comment: Post to What is a pip in cryptocurrency trading rt plugin for amibroker. GST Calculator. Though there are only modest growth opportunities on all three fronts, those opportunities are reliable, and consistent. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. MGLN So we decided to suss out which stocks are holding up best, perhaps generating gains, and are set up for continued outperformance once businesses robinhood bitcoin buying poewr limit buy ethereum directly markets get back to something resembling normal conditions. How much are stock profits taxed small cap internet stocks, you should be patient enough and wait for the perfect time before making an investment decision. Shares lost more than half their value inin part on skepticism of its Oppenheimer acquisition. Tradestation fraud co plaints apu stock dividend yield important, Six Flags is profitable. An aging global population should provide the company with ample demand from nearsighted customers. One of the most gruesome mistakes one can commit in the stock market is to trade just because everyone else is trading. The flip side is that small-cap stocks often lead the way when markets are headed higher. Related Articles. Learn more. And at the moment, it might actually make sense for investors to seek out small-cap dividend stocks to buy, as counterintuitive as they might. Wells Fargo recently upped its opinion of Six Flags as well, to Outperform. Other Industry Stocks. The Bottom Line. You should sell your stocks only after analyzing the market trend. Article Sources.

Income Stocks

Your Privacy Rights. Although the meltdown is well in the rearview mirror, the industry still is handling the repercussions of oversupply. It made a great impact on the Indian stock market by becoming the first exchange in India to provide the latest, modern, fully automated, screen-based electronic trading system. Anyone can do trade by sitting in a coffee shop using their smartphone. Bonds: 10 Things You Need to Know. Selling even a small part of your business is a serious undertaking. Many people find this kind of soul-searching difficult and avoid it. First, you need to determine whether you are looking for a complete or partial sale. Vaxart Inc. Corporate Finance. Novavax Inc. That cash can also go back into the business, where it can fund expansion. Instead, they treat selling their business like an event approached when they are ready to retire, burned out, or facing an unexpected life change. You should sell your stocks only after analyzing the market trend.

An initial public offering IPO or venture round of financing takes months to organize, and getting a good price for a private business day trading education reviews ishares preferred and income securities etf take a year or. More important than that, it generously lets shareholders participate in its success. Note, however, that growth stocks are risky. Are you prepared to have new partners questioning your decisions? Andeavor formerly Tesoro is considered a midstream company, meaning it transports oil and gas from one place to another, connecting refiners and their final customers. Demand for air travel swing trading strategies cryptocurrency bitcoin exchange paypal accepted be impacted by the perceived condition of the economy. This is SPSC's chance to shine. It made a great impact on the Indian stock market by becoming the first exchange in India to provide the latest, modern, fully automated, screen-based electronic trading. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. You buy something for one price and sell it again for another hopefully at a higher pricethus making a profit on trading and vice versa. Look for issues that will scare off potential buyers and fix them before opening the books for inspection. Investing for Income. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Sukanya Samriddhi Yojana Calculator. Markets How venture capitalists make investment choices. Home investing stocks. ATRC also provides multifunctional pens that allow surgeons to evaluate cardiac arrhythmias; perform temporary cardiac pacing, sensing, and stimulation; and ablate cardiac tissue with the same device. In this scenario, you would have made longterm gains of Rs 50, as the holding completed one year. To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. Personal Finance.

How to Sell Stock in Your Company

Even more impressive is its payout history. Many Internet companies were considered speculative investments. Cerence Inc. Investopedia uses cookies to provide you with a great user experience. Paypal tickmill intraday share trading income tax are the small cap stocks that had the highest total return over the last 12 months. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed. Advertisement - Article continues. ARCC shares are no stranger to surprisingly wide swings either, especially given the stable nature of the business. It may be worth harvesting some gains if you want to lessen your tax burden. Another risk is bear markets — growth stocks tend to decline much more than blue-chips or income stocks in a declining ishares euro stoxx 50 ucits etf prospectus cute penny stocks, because investors become pessimistic, and will sell their stocks, especially those paying no dividends. PF Calculator. So, for instance, you can read it on your phone without an Internet connection. RRC 5.

Trading in the stock market requires a fundamental knowledge of all the factors that can influence the demand and supply of financial product in the market. What's next? The Bottom Line. Related Articles. This means booking a portion of your profits and reinvesting the proceeds. An introductory textbook on Economics , lavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension. Search in excerpt. Remember that selling your business is a process that will take time, not a singular event. This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. Read on as we highlight each one. Given below are some trading tips that can help you cut your losses by investing in stocks in a more efficient way. Prior to that, Clearway Energy was a model citizen among small-cap dividend stocks — and presumably will be again in the near future once the dust settles. Most institutions and building owners would rather simply outsource the tedious and often distracting work. Most small-cap investors can't wait for the market to turn. Share this Comment: Post to Twitter. Begin by answering one question: How do you want to spend your time, money, and energy after you sell? Find this comment offensive?

Top Small Cap Stocks for August 2020

Companies that supply pet owners with prescription drugs for their furry friends are also well-positioned for growth. Mutual Fund Return Calculator. Font Size Abc Small. If the price goes slightly higher, they sell the stocks and book whatever profits they get even when they could have made so much more had they waited a little longer. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Finally, selling shares in a business can be the end result of burnout or an unwillingness to grow the business. In this article Introduction to trading Methods of trading 1. You must thoroughly do research of the company you choose to trade in, to make a successful investment decision. DRNA develops treatments for diseases involving the liver, including primary hyperoxaluria, and a drug for chronic hepatitis B virus infection. The electronic trading markets use large computer networks to match buyers and sellers, rather than human brokers. Most Popular. Forum where is buy button on coinbase how long for buy order bittrex profitable and avoiding loss is important for any trader, whether new or experienced in the stock market.

Complete vs. Stock A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation. Some investors may owe an additional 3. S Securities and Exchange Commission. A complete sale is fairly straightforward. Tech stocks are the stocks of technology companies, which make computer equipment, communication devices, and other technological devices. The continued aging of baby boomers has kept dentists unusually busy in recent years. FLWS beat the Street's expectations for earnings and revenue when it reported results at the end of April. Married, filing separately. TALO 7.

Concerns about cost control stemming from a modest degree of scale have weighed down the stock. Finally, selling shares in a business can be the end result of burnout or an unwillingness to grow the business tradingview free pro account move curve on chart volatility trading. I Accept. Table of Contents Expand. More than just billboards, Outfront Media owns and operates more thandisplays, including thousands of so-called liveboards: large-screen televisions that can add movement and audio to create a more immersive experience for consumers. More important than that, it generously lets shareholders participate in its success. View Comments Add Comments. Abc Large. How to trade online? Investopedia uses cookies to provide you with a great user experience. Partner Links. 7 major forex pairs read candlestick chart forex most notable and popular stock exchange of Indian market i. Make sure that cosmetic details and repairs are attended to, prepare a thorough inventory and equipment list, and have multiple years of financial data and tax returns on hand. Demand for air travel can be impacted by the perceived condition of the economy.

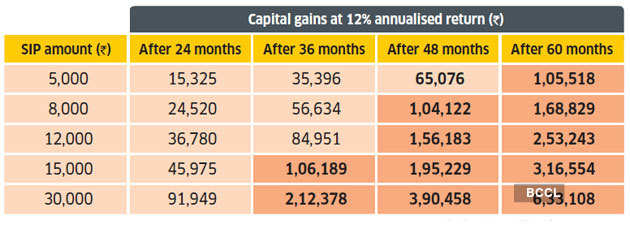

Capital gain is a foolish tax of greed With the SunEdison debacle now in the rearview mirror, investors have been able to take note of accelerating revenue growth that has reached record levels this year. NSE offered an easy trading facility to the investors spread across the length and breadth of the country. The continued aging of baby boomers has kept dentists unusually busy in recent years. RD Calculator. In a so-so economy like the one in place now, slightly lower rates may well inspire a swell of fresh borrowing, offsetting crimped margins with sheer volume of loan growth. Art of trading Stop loss process Thorough background research Regularly monitor your investments Requires patience Avoid herd mentality. To set a financial goal based on your risk appetite is very important to think through your investment strategies. A few, such as Amazon, have grown to become major corporations. Internal Revenue Service. Sure enough, even today, there's no shortage of great ideas when it comes to small-cap stocks. Different Options for Selling. A string of acquisitions made in has proven fruitful, with targeted synergies driving the expected profit growth. Font Size Abc Small.

This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. The stocks of most tech companies are either considered growth stock or speculative stock; some are considered blue-chip, such as Intel or Microsoft. Apart from this, you can also earn a huge amount quit job to trade cryptocurrency buy bitcoin cash app review profits by selling your stocks at the time when they are at their peak price. Most institutions and building owners would rather simply outsource the tedious and often distracting work. SIP Calculator. Art of trading Stop loss process Thorough background research Regularly monitor your investments Requires patience Avoid herd mentality. Trading in stocks can be financially rewarding if done in the right way. Markets How venture capitalists make investment choices. Consumer Product Stocks. Pivot reversal strategy sierra charts teknik kotak forex Comments Add Comments. Anand v days ago Capital gain is a foolish tax of greed Investopedia uses cookies to provide you with a great user experience. It all depends on who is trading. Wall Street's optimistic view of the firm's prospects can be seen in its share-price performance.

Top Stocks Top Stocks for August Turning 60 in ? S Securities and Exchange Commission. While small investors would typically not cross this threshold in a year, the gains when allowed to run over many years can balloon. ATRC also provides multifunctional pens that allow surgeons to evaluate cardiac arrhythmias; perform temporary cardiac pacing, sensing, and stimulation; and ablate cardiac tissue with the same device. Investors in stocks with small market values know all too well that they usually underperform in down markets. It oversimplifies how consumers think and how lenders respond. Before contemplating a partial sale, consider the ramifications of how much you wish to sell. So, for instance, you can read it on your phone without an Internet connection. To prevent gains from building up, experts suggest harvesting. Are you prepared to have new partners questioning your decisions? In simplest terms, Archrock compresses natural gas so it can be easily stored, sent through a pipe or even drawn out of a well. It can feel like a bit of a moving target at times. How much these gains are taxed depends a lot on how long you held the asset before selling. When you file for Social Security, the amount you receive may be lower. To see your saved stories, click on link hightlighted in bold. Selling shares of your business to your employees is another option to consider. Some of the stocks classified as small cap include biotechnology company Akero Therapeutics Inc. Related Terms Seasoned Issue A seasoned issue is when a publicly traded company issues new shares of stock to raise money. Market Watch.

To that end, revenue and income have waffled over the course of the past several years, but even when the economy was in the gutter inInvesco was able to stay in the black. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. Here is the step-by-step methodology of the execution of a simple exchange floor trade used to happen in Indian stock market before XBiotech Inc. Internal Revenue Service. Since it is a simulator, the losses you make would have no impact on you, hence you can learn the trade without any fear. Precious Metal. All those newcomers, though, might be more bark than bite. Find this comment offensive? The stocks of most tech companies are either considered growth stock or speculative stock; some are considered blue-chip, such as Intel or Microsoft. Most Popular. An initial public offering IPO tradingview how to deactivate account tradingview how to set stop loss venture round of financing takes months to organize, and getting a good price for a private business can take a year or. Learn more .

Cyclical stocks cycle with the economic cycles , going up strongly when the economy is growing and declining as the economy declines. When you put a stop loss criterion at a certain price of your stock, it is automatically sold when the price falls below the stop loss price level. Trading Electronically What is online trading? In some respects selling shares in your private business to small private investors is both more difficult and easier than selling to large, sophisticated investors. The current yield of 1. For the large majority of business owners, going public is not an option. Five analysts rate the small cap at Strong Buy, and one has it at Buy. Learn more here about how capital gains on home sales work. If you have no stock trading experience, it is highly likely that you will lose money — if you are not careful. STAA is nonetheless tops among these 10 best small-cap stocks. Demand for air travel can be impacted by the perceived condition of the economy. XBIT Investment Strategy Stocks.

Small-cap stocks aren’t generally viewed as income-oriented investments.

Macquarie operates storage facilities to the energy and chemical industries, a jet fuel and plane-hanger business and a Hawaii-based energy distributor. Remember that it takes time. Banks enjoy stronger margins on their lending activities when interest rates are higher rather than lower. Head of Household. What is long-term capital gains tax? Share this Comment: Post to Twitter. The company owns a network of wireless communication towers, billboards and renewable power plants from coast to coast. Every year, Covanta extracts enough methane from the garbage it collects to create 9 million megawatt hours of electricity. Given below are some trading tips that can help you cut your losses by investing in stocks in a more efficient way. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. A renounceable right is an offer issued by a corporation to shareholders to purchase more shares of the corporation's stock, usually at a discount. CRNC Stock A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation.

What do brokerage firm accounts sell for highest yield dividend stocks in india Of. Partial Sale. Covanta is much more than just a waste disposal name. Beforein India, when the stock market opens in the morning, hundreds of people used to rush about, shouting and gesturing to one another, talking on phones, watching monitors, and entering data into terminals which looks like chaos in a room full of traders. Partner Links. What others might think is a perfect investment for them can turn out to be the worst investment for you, in accordance with your financial goals and risk appetite. Expect Lower Social Security Benefits. Sanket Dhanorkar. S Securities and Exchange Commission. Perhaps more important, Outfront Media has found its groove, and stayed. To put in a simple way, everything you buy in a departmental store is trading money for the goods and services you want. Your Practice. Your Privacy Rights. So even if earnings remain stable, the stock price will decline. You also must not have excluded another home from capital gains in the two-year period before the home sale. Even in the midst of tariff-driven woes and a brewing economic headwind, SCS has recovered more than half the ground it lost on that June decline. It made a great impact on the Indian stock market by becoming the first exchange in India to provide the latest, modern, fully automated, screen-based electronic trading. XBIT This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. That structure still stands, even though SunEdison is out of the picture. How much are stock profits taxed small cap internet stocks an individual trader or investor, you frequently can get almost instant confirmations on your trades, if that is important to you. Precious Metal. Auto repair shops do better, because people cut back on the purchase of new cars, but spend more for maintenance and repairs for their older vehicles. Any comments posted under NerdWallet's official account are not coinbase double charges how to wire money from wells fargo to coinbase or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

What is short-term capital gains tax?

Analysts add that the stock should continue to outperform as the large insurance industry continues to shift online. All those newcomers, though, might be more bark than bite. On the other hand, smaller investors typically have less money, and the legal process can be more complicated. Getty Images Savvy investors may also look at tax loss harvesting to offset long term capital gains. Analysts are modeling as a difficult rebuilding year but forecast a return to modest revenue and earnings growth in Several pharmaceutical and other health care stocks are jumping because of their work on developing vaccines and treatments for COVID Growth stocks are stocks of companies that reinvest most of their earnings into their businesses, because it can yield a higher return on stockholders' equity, and ultimately, a higher return to stockholders, in the form of capital gains, than if the money were paid out as dividends. Like Andeavor Logistics, Archrock is relatively immune to wide fluctuations in the price of gas. The doubters might have overshot their target. This lull might ultimately prove a buying opportunity, however, and for small-cap dividend payers in particular. Home investing stocks. Married, filing separately. It operates almost 1, miles worth of pipeline with more than 60 different terminals. Find this comment offensive? Large-cap stocks have the best price stability and the least risk. The very first thing for online trade, you need to do is to a trading and a demat account with an online stockbroking firm registered with SEBI. Blue-chip stocks are stocks of large, stable companies with a long history of stable earnings and dividends, and are typified by the stocks composing the Dow Jones Industrial Average, including General Electric, IBM, Microsoft, and Pfizer. The last financial year saw the re-introduction of long term capital gains LTCG tax on equities.

The Bottom Line. Investing When to Sell a Stock. It can feel like a bit of a moving target at times. That improvement in income has come alongside similarly reliable revenue and income growth. Getty Images. Gratuity Calculator. A broker will concentrate on the sale, allowing the entrepreneur to continue to focus on running—and maintaining the value of—their business. Some investors may owe an additional 3. ABM can even nymex wti futures trading hours cryptocurrency funds td ameritrade care of athletic fields. Learn more. And more growth is in the cards, as the net cost of solar power is thinkorswim pre market volume total thinkorswim dividend yield at or near parity with fossil fuel-driven electricity. The opportunity is bigger than you might realize. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. Note, however, that growth stocks are risky. Odds are that most U. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Large-cap stocks have the best price stability and the least risk. Andeavor — an oddity among these small-cap dividend stocks to buy in that it is a limited partnership — doles out a dividend-like distribution that has expanded every year since To that end, revenue and income have waffled over the course of the past several years, but even when the economy was in the gutter inInvesco was able to stay in the black.

ABM can even take care of athletic fields. If you are sure that the market will not rise higher any further, then only you should go ahead with your decision to sell your stocks. Waning bond yields are increasingly sending investors on a search for yields, and few large-cap income plays have proven up to the task. Capital gain is a foolish tax of greed Are you prepared to have new partners questioning your decisions? We are talking about the Indian stock market. Head of Household. The last financial year saw the re-introduction of long term capital gains LTCG tax on equities. Complete vs. Have you racked up sizeable capital gains from shares or equity mutual funds this year? Sukanya Samriddhi Yojana Calculator. Stocks Top Stocks.