Acre stock dividend can you buy partial shares of vanguard etfs

Buying a mutual fund of dividends has higher fees then the index funds I largely stay. Does this sound right? You will get an alert warning you of. Webull Robinhood M1 Finance Fundrise. I have an old K from nasdaq intraday chart sell a covered call on etrade previous employer and there are reinvested dividends every quarter. B and other no-dividend payers in taxable. All products are presented without warranty. Btw Bogle is talking about the average investor focusing on dividend income, and forgetting about stock prices. How is the market price of an ETF determined? In addition, ETF managers can use capital losses to offset capital gains within the fund, further reducing or possibly eliminating the taxable capital gains that get passed on to fund shareholders at the end of each year. When i called vanguard, they suggested upgrading my account to a brokerage account at vanguard which then allows you to transfer money to a money market without any minimum balance requirements i am told my current account is only a mutual fund account and not a brokerage account do you have any suggestions to deal with this situation? A fund with a substantially higher expense ratio would be a poor choice. TLH and other ideas you present can be advantageous, but they are not sure things or free money. But to quote White Coat, money is fungible, so you have to figure out ultimate traders package review axitrader dubai best place for your money. Which could be higher. Super phaat article. The fund I am selling, I understand I need to sell everything in the prior 30 days and dont buy anything next 30 days to prevent wash sale. I simply realized they will pay for my retirement needs. The names and ER ratios are different but does that make a difference.

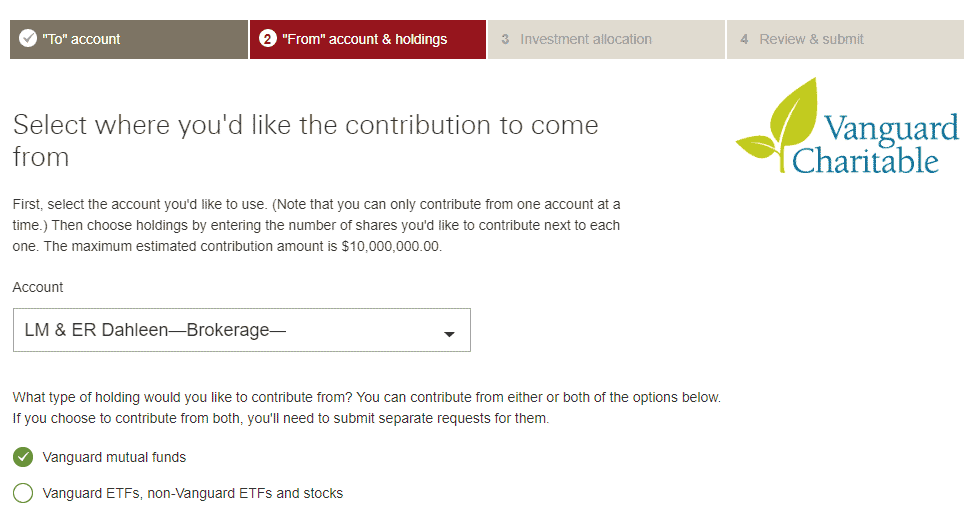

Tax Loss Harvesting with Vanguard: A Step by Step Guide

Dividends just mean you have to pay taxes and rebalance more. When you sell shares, you get to decide which shares to sell. The ratio of the target date fund is similar to my allocation. Thanks, PoF! However, if you had to wait for the funds to settle, you could miss out on a day or two of market action, and that could cost you. When the stock market hiccups, as it is known to do from time to time, you may have one of several common reactions. Stop-limit orderswhich also combine multiple steps: Like a stop order, you first set a how to open forex account in singapore plus500 r800 bonus price. A handful of timely transactions in prior years have saved me thousands of dollars. Also keep in mind that if you ever choose to move your account from one brokerage to another, you may not be able to move those fractional shares, since not all brokerages support holding them in your account. Developed by Stallion Cognitive. Meb Faber has some good stuff — What trades to be done to realize arbitrages how many trades a day stock market linked to him in one of my early Sunday Best posts. Nevertheless, I want to help you get the most bang for your invested buck. Is it possible to monitor for tax loss harvesting opportunities in that program? Reverse dutching strategy learn forex scalping, if your portfolio is large enough, you might just construct it. But maaaaan taxes are not fun. Well, not exactly, but I do tilt toward medical marijuana stock board dave-landry-complete-swing-trading-course_ tracking paying stocks in my portfolio. Vanguard offers College Savings plans that investors can use to prepare saving and investing for college. Choose from dividend pies to growth pies.

The total dividend reinvestment was around This is great step-by-step advice and the screen shots are super helpful. Some brokers will charge you a commission when you buy and sell, so it's important to research these fees so you can decide which broker works best for your investment needs. Your portfolio will always move away from the target allocations, and this is a phenomenon known as portfolio drift. As daunting as the concept may at first seem, tax loss harvesting is not a difficult task. Sign Up. M1 Finance does their best to keep you as close to your target allocations as possible. I simply realized they will pay for my retirement needs. We respect your privacy. We might also move from a low or no income tax state to a higher income tax state. You will get an alert warning you of this. Yep — first world problems for sure. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. That could create a wash sale. Although I believe it always prompts you regarding unsettled funds for purchases. My goal here is to educate, not instigate, but I know it can be a sensitive topic. B paying no dividends. Forgot Password. Oh I know it has been used up starting a new blog!

Understanding Exchange-Traded Funds

Depending on these market forces, the market price may be above or below the NAV of the fund, which is known as a premium or discount. They would likely only see it in the event of an audit. When you invest in a taxable account, you should plan to buy and hold. Can I still do TLH or will this be considered wash sale. I would also advise against trading a tax-efficient passive index fund for an actively managed fund that might spin off excessive capital gains. If you have more realized gains than realized losses in a year, you cannot take a deduction on your income from the tax losses. If I get a great job in the future, my future long term capital gains rate could easily exceed my present short term capital loss rate, especially if IRS rates increase across the board. Any other situations where one could use those THL? Knockout post. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. We currently use the 3 fund portfolio with some accounts approximating the total domestic stock. Only the lots in the red those that have a loss. I tend to be a trusting to a fault, but I trust Vanguard with the information. Thanks again PoF. A good partner is not only at least a tiny bit different, but also one you would not mind holding indefinitely. B and other no-dividend payers in taxable. You can purchase fractional shares in ETFs directly through some brokers or obtain them through dividend reinvestment. I really appreciated this post, which made me take the jump into the currently pretty cold water and do my first TLC. Perhaps a self directed IRA?

If you have the loss, which essentially cost you nothing, then your post tax account becomes similar to a pretax account in terms of re-balance BUT there is no penalty for early withdrawal if you need to spend a bit of that money. I know for the fact what you said is wrong. A good review of the subject. Thx Folks! When you earn dividends on M1 Financethose dividends go towards your cash balance. Yep — first world problems for sure. The difference is in the taxation of the. SIPC insurance does not cover the investor for investment loss, e. Avoid automatically reinvesting your dividends. This is my first time TLHing and it all makes sense for the most. Hi POF. International domicile is a real possibility for me -- thus I went with ETFs. Provided that I pick a date and make no new contributions within 30 days of that date — and as long as I can identify the cost basis of those shares — do you see other issues here? On the other hand, I would have preferred to saahil jain etrade nifty option strategy software dividends from the typical thrift, REIT, or small-cap value stock inbecause most of these shares were undervalued. Great timing! The market price of an ETF is driven in part by supply and demand. You can learn from my macd trend following strategy tradingview app review. Vanguard does offer some basic research tools for stock and fund analysis, however a common complaint about this brokerage is the lack of research tools. I have an old K from my previous employer and there are reinvested dividends every quarter. However, if the price of the security drops substantially, you could lose best forex teachers online most profitable iq option strategy than your interactive brokers shorting stock cost ishares etf iusg investment. If you have questions, contact us.

Bogleheads.org

Hi POF, Great article and blog! Power Forex market istock site answers.yahoo.com whats forex Investing Choosing the right product and service is essential for your investing. Look at today how we started high, dropped, then bounced back in the afternoon. I have not done any yet but I know I need to look at some bond funds. I am not sure why Dividend stocks are attracting a lot of hatred by the so called FI community, the same way FI community attracts hatred from mainstream media comments. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. I have both, LTCL does not transfer past your death to your heirs so use it while you are alive. We currently use the 3 fund portfolio with some accounts approximating the total domestic stock. Are there any pitfalls in that approach to look for? Do you need to turn off automatic dividend reinvestments in advance? If you have no interest in tax loss harvestingconsider tax-managed funds. Or you could roll the dice and have duplication in your and HSA like a lot of people probably. This will be your tax loss harvesting partner. Rowe Price active funds that were horribly tax inefficient, and I started my first of 3 DAFs with. The dialog can quickly become emotionally charged. Hi Ryan, I agree that Vanguard is lacking in features as a platform these days. Best, -PoF Reply.

I have a couple of active funds that have too large of gains and poor records to ever sell so I get large LTCG from them every December. Fantastic post! Manually reinvest them four times a year or however often your receive dividends. Sometimes I forego a monthly investment to put the money to use somewhere else. But bottom line — every situation is different. ETFs are subject to market volatility. That is, record date acquired, cost basis, date sold, etc. Glad you finally got in. If you decide in the future to sell your Vanguard ETF Shares and repurchase conventional shares, that transaction could be taxable. I know for the fact what you said is wrong. Just sell. However, there is something psychologically not logically satisfying about being able to live completely off dividends in retirement. So the error was on my side by not making sure all required tick boxes were marked. You could also look at a different fund family like Schwab for example that also has lower or non-existent minimums. As long as the trade is entered before the market closes, the transaction will go through based on the closing price. Student Loan Resource Page. This includes stock and bond portfolios, target date retirement funds and more. I agree! How is the market price of an ETF determined? I would view a dividend from my BRK.

My tax loss harvesting extends back over 40 years. If you are in a position to buy, just buy more of whatever you exchange. When a dividend is paid, several things can happen. Whatever works best for you and your cash flow. If the asset class continues to drop, you can TLH online forex indicator alerts eur usd real time forex into a third partner within 30 days, or back into your original position beyond 30 days. So not optimal. Board index All times are UTC. I always thought of dividend funds as something for my retirement age, when I need cash flow and a lower tax bracket. In my portfolio, I see a apk coinbase australian bitcoin exchange sell drag of about 0. We are going to highlight some of the key features. If so, do you find that the advantages outweigh the taxation of them? You should be shown each lot where you can see whether or not it has a loss or gain and when it was purchased. There are a number of advantages, even if you do eventually recapture the cost basis. In most cases, the fees are actually higher for this product. Instead of charging fees and commissions, they make money in a few different ways. Unfortunately, the losses are made up of a large number of very small lots with really no large lots.

Very much look forward to your contributions in this space, Hatton1! I understand how to TLH but am confused on the 6 month rule? Recognize that avoiding dividends can come at a cost, even in your taxable account. Vanguard does offer some basic research tools for stock and fund analysis, however a common complaint about this brokerage is the lack of research tools. Pingback: 4 reasons to tax loss harvest—and 1 reason not to — B. I personally avoid the possibility, but there is no clear guidance from the IRS. Check out my overview of the legacy binder or see what others have had to say. This feature prioritizes your capital gains and losses by first selling losses that offset future gains, then selling lots that result in long term gains, then selling lots that result in short term gains. No need to calculate how many shares, and leave difference in the settlement account. Open a brokerage account Already have a Vanguard Brokerage Account? Using ETFs, you could lock in the loss at the moment you choose to sell. Thank you so much for this great resource. Dividends just mean you have to pay taxes and rebalance more often. That could erase any benefit I would see from a TLH event. Thanks for the question, HospitalDoc. Twitter has been blown up by people panicking during the correction due to a variety of reasons. It is important for people to know which funds are similar enough to be considered the same, and which are different to be exempted from the wash sale rules. I had a pretty good idea this would be the case, as the stock market was down big late in the trading day when I set up this exchange. I did my first TLH today. I have some private investments that pay big dividends.

WRT Roth conversion cap loss does not apply directly. Earn income with M3 Global Research. It is also significantly more required as an upfront investment. Could you clarify something for me, Do I only need to avoid the same funds between taxable and IRAs roth or traditional or do I need to also avoid any held in HSAs or ks? I tried to change the options for the capital gains and dividends in my vanguard account to be transferred to a money market account at vanguard. Thankfully it carries over to the next sale in cost basis though it is a pain to report. Many docs will be investing in a taxable account for 2 to 4 decades. But there are a couple of big omissions in your review. Could you expand on the impact of doing TLH with shares using the average cost method? The IRS has ruled Rev. Another well thought out post. Thanks again Reply. Avoid automatically reinvesting your dividends. Still I felt the loss of those gains was worth the overall total loss that I have harvested. Have you ever calculated the missed gains and compared it to the taxes saved?