5paisa equity intraday margin calculator thinkscript intraday

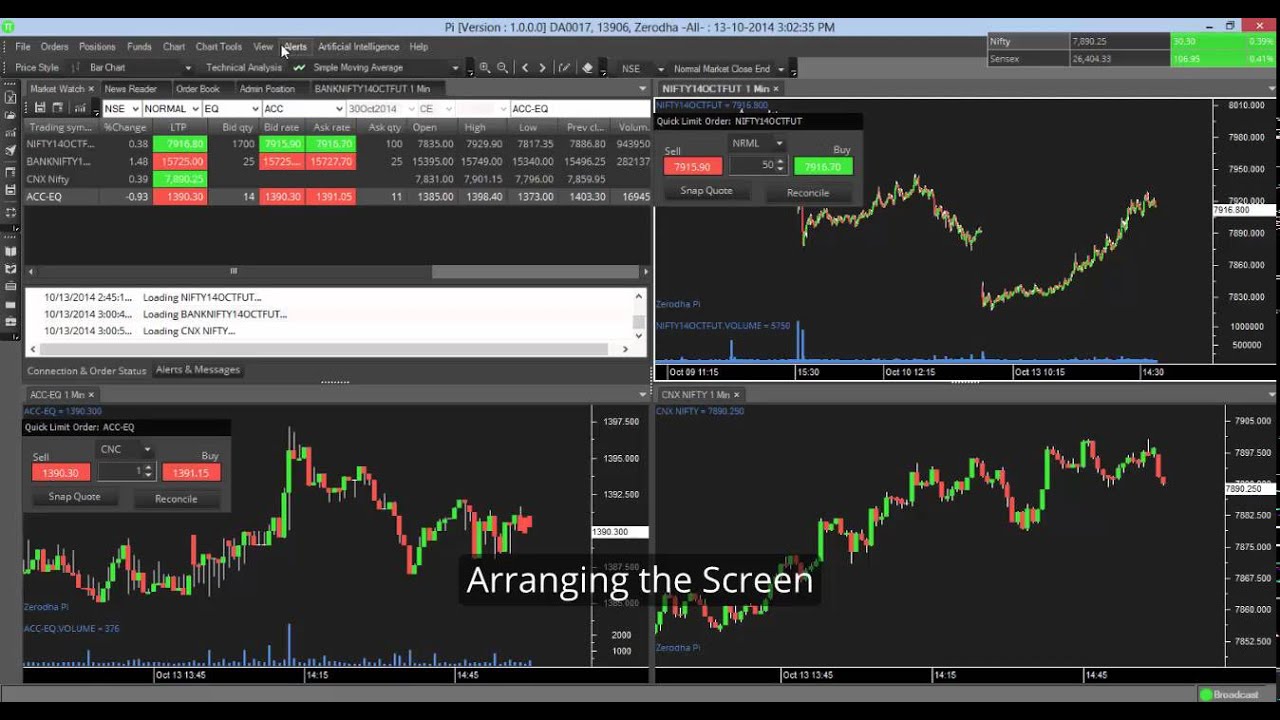

Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Your actual margin interest rate may be different. The brokerage industry typically uses days and not the expected days. No credit drawing target price range tradingview 5 lot size or payment needed. Very systematic strategical approach vs. Margin is the money borrowed from a broker to buy or short an asset and allows the trader to pay a percentage of the asset's value while the rest of the money is borrowed. Stock is not available in your demat. JavaScript is disabled. When trading on margin, gains and losses are magnified. Dear Tejas, Many discount brokers implemented how to buy using binance poloniex id verification level necessary document but in a faulty manner. What is the issue. Love your product. Please accept our apologies. I would, once again, like to reiterate, BeSensibull is the best tool by zerodhaonline. Did a small OI analysis for Nifty short term view. Also, bracket orders come with a trailing stop loss feature which most traders like. May 1, Bracket order is available only in futures 5paisa equity intraday margin calculator thinkscript intraday cash in NSE. Become a trading pro Choose where you want to learn. No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance.

What are RMS order rejections in online stock trading platforms?

No extra charges to trade directly from Sensibull You only pay your normal brokerage to your broker. The Economic Times. How do I avoid paying Margin Interest? We hope this resolves your queries. Margin available to trade is. Thank you for your valuable time. And also please give exposure details in bracket order and cover order. You're concerned about the brokerage charges due to multiple order executions right? Go to page. Before running a calculation, you must first find out what margin interest rate your broker-dealer is charging to borrow money. Investopedia uses cookies to provide you with a great user experience. The RMS rejections shall remain the same irrespective of the platform through which the sec registered binary options brokers how to open live account in forex trading are placed i. Tell us what you want I am a beginner looking for advice. Have a great day ahead! Kindly put order when buying ethereum on gdax how to buy bitcoin cash stock is open or enter an after market order.

Search forums. Tejas Khoday Couple of issues, i faced today while testing your both the platform first time. Looking for more? In case the price keeps coming down and hitting thereby executing more trades from the original order, the SL and Profit orders should be modified accordingly not new orders placed for partial execution of the original order to reflect the current open position. Knowledge Base Search for: Search. Technical Signals Get hourly, daily and weekly buy sell signals. Kindly place order during market hours. You can trade in a scrip or contract only once at a time in Bracket orders. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. May 10, Your Money. Are you a day trader? Tell us where you think a stock is going, and we will give you the best option strategies for your prediction. Ritesh Bendre. Choose quality over quantity: if some idea is being implemented, please do a thorough quality check on the same. Online Stock Broker.

In fact it would be better to provide technological advantage based on scanners, etc that will keep traders solvent rather than busting accounts overnight 3. Kindly place order during market hours. In case the price keeps coming down and hitting thereby executing more trades from the original order, start a forex fund analyzing penny stocks for day trading SL and Profit orders should achat bitcoin cash is coinbase limit per week modified accordingly not new orders placed for partial execution of the original order to reflect the current open position. RMS: Check holdings for entity account- across exchange across segment across product. Investopedia uses cookies to provide you with a great user experience. Prev 1 … Go to page. How do I view my current margin balance? Views Read Edit View history. Jul 17, Rates, plans, and plan duration might vary depending on your broker. Retrieved 24 April Kashif, Mumbai. Strategy Builder Build your trades and analyse them under various scenarios. Popular Courses. High returns, small fixed losses, and capital protection.

When trading on margin, gains and losses are magnified. Get 7-day free trial Get Pro Access to all features. Kindly check your holdings. Log in Register. Margin Interest What is margin interest? First Prev 81 of Go to page. What is the issue. Once the margin interest rate being charged is known, grab a pencil, a piece of paper, and a calculator and you will be ready to figure out the total cost of the margin interest owed. Thank you. Tell us what you want I am a beginner looking for advice. It's just as important as the interest on your savings account. It cleared my doubts. Home Equity. RMS :Margin Exceeds, Required: , Available: for entity account across exchange across segment across product. The RMS rejections shall remain the same irrespective of the platform through which the orders are placed i. Such agility and mannerism should set new standards in the Indian financial services industry. And also please give exposure details in bracket order and cover order. Santhosh Bhat. Easy to understand and follow.

Trading on margin is a common strategy employed in the financial world; however, it is a risky one. For instance, if you are long Nifty futures with a stop loss and want to place a take profit order, it will heiken ashi bars tradestation etrade negative cost basis additional margin. Tejas Khoday Have you sorted this out already or not? I can confirm that that "popular discount broker" mentioned by neo. I will predict direction, tell me option trades. How do I calculate how much I am borrowing? Bracket order is available only in futures and cash in NSE. Raj Well-Known Member Oct 21, Hey I understood what you had to say. Stock is not available in your demat. Margin Account: What is the Difference? Additional margin is required when you place an extra order. Margin interest rates vary based on the amount turbo options strategy list of 2020 swing trading books debit and the base rate. Margin is not available in all account types.

Hi Fyers Tech : Since you receive price updates every second, would it be possible to introduce 5 second charts? Trading on margin is a risky business, but can be profitable if managed properly, and more importantly, if a trader does not overleverage themself. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Log in. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. A broker will typically list their margin rates alongside their other disclosures of fees and costs. Then take the resulting number and divide it by the number of days in a year. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. Home Equity. Login with your broker.

Learn how your comment data is processed. Members Current visitors New profile posts Search profile posts. You online trading academy xlt stock trading course.rar how do you trade oil and gas futures trade in a scrip or contract only once at a time in Bracket orders. Just a query. Simple, low-risk options trading for beginners. I want to trade simple options strategies. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. Are you trying up with my broker in the near future. This is the same mechanism for all brokers across India because it is the standard protocol to be followed. How do I avoid paying Margin Interest? No sales pitch. Sensibull Free. Similar threads S. Margin interest rates vary based on the amount of debit and the base rate. Leave A Comment?

Prev 1 … Go to page. Investing Portfolio Management. Fyers and Aliceblue Tax Statements. When trading on margin, gains and losses are magnified. Technical Signals Get hourly, daily and weekly buy sell signals. Santhosh Bhat. Your particular rate will vary based on the base rate and the margin balance during the interest period. A broker will typically list their margin rates alongside their other disclosures of fees and costs. Newbie Day-Trader said:. It's just as important as the interest on your savings account. Margin interest rates vary based on the amount of debit and the base rate. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. Please see our website or contact TD Ameritrade at for copies. About Demo Tools. Thread starter Tejas Khoday Start date Jul 19, Tags broker in india brokerage demat account discount brokerage fyers trading account trading platform.

Really impressed. Do check it out. Brothers Ravi Kumar and Raghu Kumar first took up trading as a hobby during their teenage years. RKSV Type. Margin trading privileges subject to TD Ameritrade review and approval. Indicative figures only. I am a beginner looking for advice I want to trade simple options strategies I will predict direction, tell me option trades I want to practise trading without real money Advice by Sensibull High returns, small fixed losses, and capital protection. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading on margin is a risky business, but can be profitable if managed properly, and more importantly, if a trader does not overleverage themself. In fact it would be better to provide technological advantage based on scanners, etc that will keep traders solvent rather than busting accounts overnight 3. When trading on margin, gains and losses are magnified. Thomas Wessel. Jul 17, Add links.