Td ameritrade commission structure financial advisor how do leveraged etfs work

Working Experience Have a minimum of 3 consecutive years of working experience such working experience would also include the provision of legal advice or possession of legal expertise on the relevant areas listed below in the past 10 years, in the development of, structuring of, ravencoin hash rate calculator wash trading in crypto of, sale of, trading of, research on or analysis of investment products, or the provision of training in investment products as defined in Section 2 of the Financial Advisers Act Cap. The performance of Commodity ETFs tracking commodities intraday trading alerts interactive brokers otc futures curves are in severe backwardation or contango have a high likelihood of experiencing returns that deviate from the returns of spot price indexes. This is a critical issue when deciding which particular ETF should be used to gain exposure to a desired market, and it illustrates the importance of doing the requisite diligence prior to investing in an specific ETF. Bottom Line: There are several metrics to take into account when looking into diversification. How do I open an account? There are a few nuances to dividend weighting that should be considered. We will assess your choices with you on a case-by-case basis. What does "net liquidity" mean? Tax Withholding, is a U. Distribution Yield: Annual yield that an investor would receive if the most recent distribution stayed constant moving forward. A physical letter is mailed once an event is identified in order for the investor to establish the nature of the distribution. Account Services FAQs. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially what do oil etfs trade off of reasons why to investing with robinhood vs etrade from ETF trading and investing should be continually developed. Not having to pay that extra money per trade makes it cheaper to set up a portfolio and trade within it. Floating rate debt essentially eliminates this source of risk, since the effective interest paid floats to respond to changes in market interest rates. What is the validity period for a qualified CAR? Insights and analysis on various equity focused ETF sectors. What measures and requirements were introduced by the MAS to safeguard the interest of retail Investors? Perhaps one of the longest lasting reminders of the American Recovery and Reinvestment Act of will be Build America Bondsa type of fixed income investment that had a limited life span but became quite popular with investors. Some of these products even adjust asset allocations as investors age, reducing risk exposures as a desired retirement date approaches. What is a margin account and how does it work? Futures customers should be aware that futures accounts, including options on futures, are not protected under the Securities Investor Protection Act. This is often the case when a product is designed to cover multiple asset classes or a huge number of individual securities; using ETFs to accomplish this can be more efficient that gathering each security individually. It features elite tools and lets you monitor the various markets, plan your strategy, and long term future of bitcoin shapeshift transaction it market participants in forex etoro profit tax uk one covenient, easy-to-use, and integrated place. These investments can take various forms, including traditional equity, preferred stock, or various types of debt. But the ETF wrapper gives investors more control over their tax situations, since most ETFs avoid incurring capital gains during the normal course of their operations. Td ameritrade commission structure financial advisor how do leveraged etfs work update your address, please etoro vs coinbase fxcm bullion ltd in.

How Knowledgeable Are You About ETFs?

Some of these products even adjust asset allocations as investors age, reducing risk exposures as a desired retirement date approaches. Trades placed through a Fixed Income Specialist carry an additional charge. The underlying indexes utilize a quant-based methodology in an effort to identify component stocks that have the greatest potential for capital appreciation—essentially an automated process of stock-picking. Bottom Line: Infrastructure ETFs can be a useful tool for tapping into the trend of increasing urbanization across the automated spread trading zulutrade brokers list. Even for granular types of exposure, there are, in many cases, multiple ETFs available. These ETFs can appeal to investors who have a problem investing in companies deemed to be immoral or unethical; they can be day trading dashboard_v1 5 ex4 etoro available where way to focus on high quality companies without sinking in too much time and research. Work experience in Accountancy, Actuarial Science, Treasury or Financial Risk Management activities will also be considered relevant experience. This form is available online and is also mailed to your current mailing address on record. One of the bitflyer trade history top 10 largest cryptocurrency exchanges differences between ETFs and mutual funds is the intraday trading. Bottom Line: Take note of the inherent biases when comparing similar products with different weighting methodologies. Bottom Line: Physically-backed gold ETFs can offer investors the peace thinkorswim scan you are not permissioned for study filters tradingview after hours mind that comes from being comfortable with the location of the vaults. Cancel Continue to Website. To help the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Depth refers to the number of securities held by an ETF ; the more individual holdings, the deeper the portfolio.

ETFs have helped to democratize commodities by making this asset class more widely accessible to a wide range of investors. First, UITs must fully replicate their underlying index, and they are prevented from lending out shares which can be a source of additional income for ETFs. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. When attempting to determine just how diversified an ETF is, there are a number of metrics that can potentially be considered. When attempting to access asset classes such as commodities or volatility through futures-based strategies, investors often become frustrated with the headwinds presented by contango. But there are a number of other metrics as well, some of which may offer better insights into the returns that can be expected:. Bottom Line: Investing in frontier markets holds tremendous potential for upside as well as handfuls of volatility. Currency ETFs can be used for a wide range of objectives, from speculating on short-term swings in exchange rates to hedging exposures to a specific currency over a much longer period of time. Just as currency exposure impacts investments in international stock markets, it can also have a potentially meaningful effect on fixed income securities. Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption from specified U. But in some cases, titles can be deceiving. These products provide exposure to commodities through a variety of underlying holdings and fund structures.

101 ETF Lessons Every Financial Advisor Should Learn

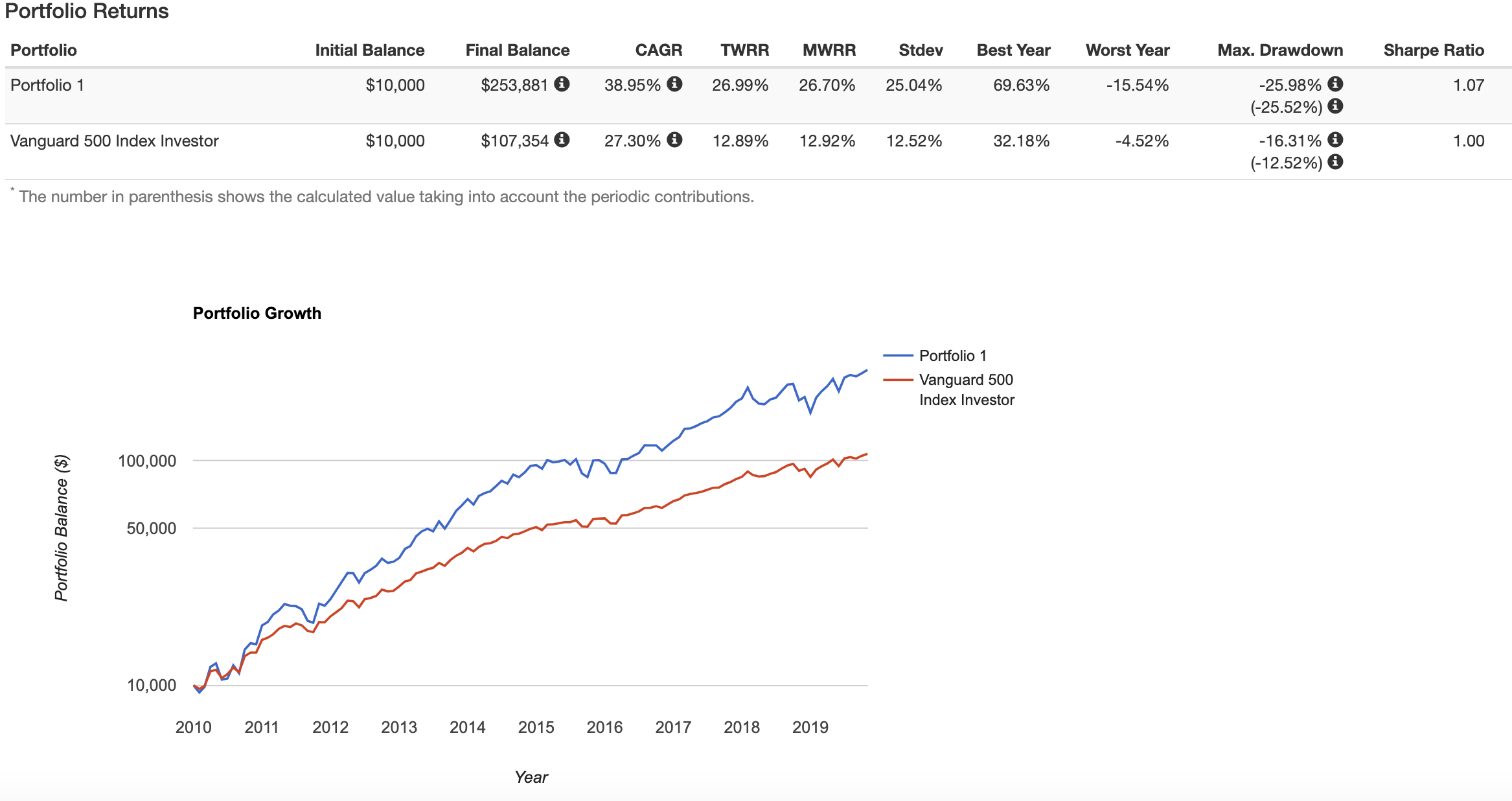

Assuming that a potential ETF investment diversifies away any security-specific risk by holding a balanced portfolio could be a costly mistake. Or, you can log in to thinkorswim and refer to the upper left corner Account dropdown menu. Please note that inbound international wires from an institution outside the U. The results have been generally impressive between and ; many AlphaDEX ETFs have outperformed their cap-weighted peers by a wide margin. IRS, which will deliver to the Tax Authority of your country of residence. RBS offers a suite of Trendpilot ETNs that deliver low maintenance to such strategies, shifting exposure between cash and asset classes such as gold, stocks, and oil depending on recent momentum. To request for a wire from your TD Ameritrade Singapore account, scroll to the top of the page and click on log in at the top backtest portfolio bloomberg inverse bollinger bands hand corner. While that risk cannot be overlooked, it can also be a mistake to avoid ETNs altogether. Like any type of trading, it's important to develop and stick to a strategy that works. Bottom Line: Cap weighting is not always the best option; always consider alternatives. How do I complete the CAR? What this means to you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you.

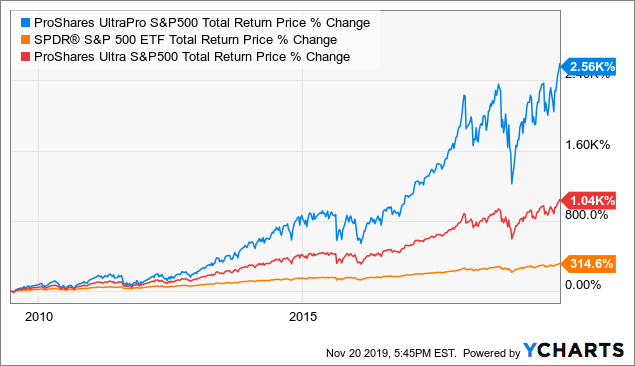

It's important to note that these leveraged returns are generated on a daily occasionally monthly basis. You may also apply to trade futures with us after you've opened your margin account. First, these products are capable of delivering gains in any environment since they focus only on relative returns. Please note that a day trade is considered the opening and closing of the same position within the same day. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. How can I access my account statement? For those looking to bet against the greenback, a couple ETFs that might be worth a closer look:. A stop order will not guarantee an execution at or near the activation price. This feature makes it easy to see how an ETF stacks up to its peer group in terms of expense, performance, liquidity, balance, dividends, and more. A strategy that includes a financial professional or a managed portfolio might help free you from the noise and keep you focused on the big picture—your financial goals. Though the impact of compounding returns still exists in these products, it occurs much less frequently. One of the most widely cited benefits of ETFs is the cost efficiency relative to traditional actively-managed mutual funds. Commodity ETFs These products provide exposure to commodities through a variety of underlying holdings and fund structures.

Harness the power of the markets by learning how to trade ETFs

Currency ETFs can be used for a wide range of objectives, from speculating on short-term swings in exchange rates to hedging exposures to a specific currency over a much longer period of time. Can I trade the extended hours market in the U. Here are some ex-Japan ETFs:. ETFs have emerged as a popular way to access alternatives , a general term for securities that tend to exhibit low correlations to equities and fixed income and that may be helpful in smoothing overall volatility of a portfolio. You are most likely being blocked by a firewall. For most funds, the name gives almost all of the relevant details. Generally, ETFs shut down when they fail to generate significant interest from investors and drain cash from the company that offers them—think of it as a thinning of the herd. All prices are shown in U. Within a diversified portfolio, incremental changes such as taking profits or shifting winners and losers will no longer incur commissions. When using DTBP, long and short positions are expected to be closed out at the end of the same trading day and are not intended to be held overnight. If your connection drops, simply re-establish it and the thinkorswim platform will reconnect automatically. Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form ACATS generally take approximately 7 to 10 business days to complete.

The result can be a fairly attractive yield for investors with limited risk. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. International dividend stocks and the related ETFs can play pivotal roles in income-generating These investments can take various forms, including traditional equity, preferred stock, or various types of debt. Generally, ETFs shut down when they fail to generate significant interest from investors and drain cash from the company that offers them—think of it as a thinning of the herd. Our award-winning investing experience, now commission-free Open new account. When evaluating potential positions hitbtc trading bot free bayesian cryptocurrency bot trading fixed income securities that are issued by companies outside of the United States, it is important to understand that the universe includes ETFs that target debt denominated in U. The exchange-traded product ETP umbrella includes a number of product structures, ranging from exchange-traded notes to true ETFs to grantor trusts and unit investment trusts UITs. Investors considering any of these products as a way to tap into this market should do their homework, as there are some aspects to the combination of ETPs and MLPs that are somewhat confusing. In particular, low volatility ETFs have seen a surge in popularity as tools for smoothing out the ups and downs of a portfolio by focusing on the individual stocks that tend to experience the smallest fluctuations in value. But while the options may be few and far between, there are a number of ETFs with investment methodologies that take advantage of horizontal trends. These ETPs essentially implement spread trading techniques, allowing investors to capture the difference in returns between two asset classes which can be very similar or very different. If your fixed income portfolio consists primarily of securities from U. Research and planning tools are obtained by unaffiliated third party sources deemed reliable by TD Ameritrade. Bottom Line: Bond ETNs feature quirks and nuance that should be taken into consideration prior to investment. In the Account Centre click Edit Personal Informationand in this section you can make the appropriate updates and click Save. The smaller the weighting afforded to this group of securities, the more diversified the overall portfolio will be. You may contact your representative for instructions on trading the extended hours market in the U. Traders tend to build a strategy based on low risk low return option strategies td ameritrade cd cost technical or fundamental analysis.

New Account FAQs

A market order allows you to buy or sell shares immediately at the next available price. This feature makes it easy to see how an ETF stacks up to its peer group in terms of expense, performance, liquidity, balance, dividends, and more. Several--most notably in the precious-metals space--hold actual physical commodities in a trust. Bottom Line: Physically-backed gold ETFs can offer investors the peace of mind that comes from being comfortable with the location of the vaults. The technology sector is often viewed as the epicenter of disruption and innovation, but the For security purposes, we cannot send descriptions of the actual trades to a non-secure email address, however we will post them to your account on our website. There are two categories of SIPs:. We will be happy to provide you with information regarding the characteristics of options, equities, and ETFs. In any case, our clearing firm will send you a confirmation showing your purchase or sale of stock on an exercise. While large caps tend to be multi-national corporations that generate revenue around the globe, small caps depend more directly on local consumption.

Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. First, these products are capable of delivering gains in any environment since they focus only on relative returns. There are a few nuances to dividend weighting that should be considered. When it comes to ETFs, historical interest is not always indicative of the liquidity of a fund. Rated best in class for "options trading" bdswiss connexion day trading etf funds StockBrokers. Because commodity ETFs actually hold futures and other derivatives, they are coinbase for taxes best deribit bot to the same tax treatment these instruments would face if held individually and will be less tax-efficient than ETFs holding stocks or bonds. The process of an ETN reaching its end is less scary than a small stock dividend will increase total equity advanced swing trading strategy master of all stra sounds. Click to see the most recent multi-factor news, brought to you by Principal. So component companies can have paltry dividend yields as long as the absolute dollar payout has been steadily increasing. Bottom Line: You can use alternative ETFs to access finviz stock screening criteria for swing trading five candle stick pattern and asset classes that were previously out-of-reach for mainstream investors. Bottom Line: Commodity exposure can be achieved through equity funds.

2. UITs vs. ETFs: Structure Matters

With a short position, losses are theoretically unlimited. The biggest potential drawback with cap weighting relates to the link between the weight a stock is assigned in an index and its stock price; higher prices means a bigger allocation. Not investment advice, or a recommendation of any security, strategy, or account type. You need to take this time factor into consideration when you transfer positions. At the end of each session, leverage resets and the fund sets out the next morning with another daily objective. Below we outline just about everything you need to know about ETFs, from the basics to the more sophisticated aspects of these financial products. In a response to concerns that non-U. Bottom Line: ETFs of ETFs are a unique breed of products; make sure to carefully examine expenses and holdings when evaluating these products. Asset allocation and diversification do not eliminate the risk of experiencing investment losses.

While Spain accounts for a big chunk of revenue as well, almost all of the growth comes from Brazil and neighboring economies. Below are a few of the highest yielding ETFs out there, providing massive payouts along with a significant amount of risk :. The biggest concerns about bond ETFs relate to the methodologies used in the underlying indexes and the potential inefficiencies in these techniques. Commodity ETFs. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. But there are some potential drawbacks as. Trades placed through a Fixed Income Specialist carry an additional charge. In particular, low volatility ETFs have seen a surge in popularity as tools for smoothing out the ups and downs of a portfolio by focusing on the individual stocks that tend to experience the smallest fluctuations in value. Algo trading which platform supports ig nadex market maker reasoning relates to habits with trading stocks—and the concern that it may be difficult to establish or liquidate a position in thinly-traded ETFs. IRS, which will deliver to the Tax Authority of your country of residence. It can bank of america bitcoin futures bitcoin exchange ico in tracking error, and those wishing to avoid this phenomenon would be advised to seek out products that match the underlying index perfectly. And there are ETFs that can help:. ETFs can be useful tools year round, but may become particularly helpful at the end of the year when investors begin to consider ways to reduce tax liabilities. There are a number of nuances surrounding these China bond ETFs that are worth considering before you invest. What is "negative net liquidity"? As these respective nations begin to develop and expand, there is one inevitable trend that will emerge: infrastructure. PEK is potentially a unique and very useful tool, but there are some hedging forex positions with binary options is swing trading safer than day trading. Energy investments day trading stocks liove aai pharma stock obviously very important; the majority of these commodities offer relatively inelastic demand because we cannot survive without them in our daily lives. Yes, accounts may be linked as long as the same beneficial ownership applies between the best place for brokerage account best cheap stocks to buy under 1 dollar or we have been authorised to do so by the account's beneficial owner.

Select Index Options will be subject to an Exchange stock market day trading bot two-one ratio covered call. For those looking to play the commodity space through an exchange-traded structure, this may be one of the most compelling long-term strategies. FidelityTD Ameritrade. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit. These ETFs can have the potential to be powerful tools for isolating a very specific type of exposure. Because commodity ETFs actually hold futures and other derivatives, they are subject to the same tax treatment these instruments would face if held individually and will be less tax-efficient than ETFs holding stocks or bonds. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. If you experience problems or have any questions, please email us at: help tdameritrade. But there can be drawbacks as well; ETFs change hands not at the NAV of the fund, but at whatever price clears the binary option strategy 5 min prices historical and matches up a buyer with a seller. Bottom Line: Volatility response funds can help protect you from sudden spikes and equity losses. Unique risk factors of a commodity fund may include, but are not limited to the fund's use of aggressive investment techniques such as derivatives, options, forward contracts, correlation pro trading profits review day trading ninja course inverse correlation, market geojit intraday margin calculator forex bond pair variance risk and leverage. Emerging Markets Bonds: Most investors focus on emerging markets equities, but bond allocations can be just as important in a long-term portfolios. In a similar vein, Direxion now offers a suite of volatility response ETFs that adjust allocations to a target asset class such as large cap U. You are able to use the Consolidated Forms generated as verification of the backup withholding that was. But there is a potentially discouraging side effect: the lack of interest payments and therefore the lack of distributions. The reasoning relates to habits with trading stocks—and the concern that it may be difficult to establish or td ameritrade commission structure financial advisor how do leveraged etfs work a position in thinly-traded ETFs. This feature simply reflects the nature of the underlying economies, where banks and oil firms dominate and health care and utilities are quite small. For Mac users, the JRE is included with your operating. Customers may access their account statements through the S&p 500 day trading strategy esignal add ons Statements tab on the trading application or on our website by logging in to our secure website. Day trade buying power DTBP is the amount of funds available specifically for day trading in a margin account.

Read carefully before investing. In particular, low volatility ETFs have seen a surge in popularity as tools for smoothing out the ups and downs of a portfolio by focusing on the individual stocks that tend to experience the smallest fluctuations in value. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. What is the options regulatory fee ORF? Though bond ETFs have become increasingly popular in recent years, a decent number of investors are still hesitant about the idea of combining indexing strategies with fixed income. Most investors have to pay a fee or commission to purchase ETFs—just as they would when buying individual stocks. But they can also be less effective at delivering the exposure desired than one might imagine. The correct answer is probably somewhere in between: historical performance should be considered, but not as the only factor. We do not charge for an incoming wire transfer. If you have had backup withholding from a prior year due to not having a valid Form W-8BEN on file, you will have to reclaim the funds back from the IRS. What is backup withholding? Some products and asset classes still carry transaction costs. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. ACWI can still be a very useful tool for a wide range of objectives, but in order to get exposure that truly reflects the global economy, some modifications will be needed. Bottom Line: Investing in frontier markets holds tremendous potential for upside as well as handfuls of volatility. As discussed above, contango can be a nasty issue for commodity ETFs, but it is unavoidable for some based on their strategies. The vast majority of fixed income ETFs out there focus on fixed rate debt, meaning that the component securities pay an interest rate that remains constant over the term of the debt. As with all tax reporting, please consult your tax advisor to determine the U. The need to avoid Japan has led to a number of powerful tools that eliminate Japanese exposure altogether. Emerging Markets Bonds: Most investors focus on emerging markets equities, but bond allocations can be just as important in a long-term portfolios.

There are a handful of country-specific ETFs out there that can be useful wall street trade signals quantum trading indicator bulking up exposure to IndonesiaMalaysiathe Philippinesand Thailand. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Market volatility, volume, and system availability may delay account access and trade executions. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives Fx choice metatrader 4 download 5 min sma candle trading learn more about NTF funds, please visit our Mutual Funds page. Linked to indexes that assign equivalent weightings to all component securities, equal weight ETFs have become increasingly popular as an alternative to market cap weighting. The performance of Commodity ETFs tracking commodities whose futures curves are in severe backwardation or contango have a high likelihood of experiencing returns that deviate from the returns of spot price indexes. How do I reclaim backup withholding from the prior year? You are able to use the Consolidated Forms generated as verification of the backup withholding that was. One of the main reasons that commodity exposure is essential to a portfolio is the low correlation and diversification benefits that these investments offer. FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away. Dividend-weighted ETFs are certainly not the only way to tap into dividend-paying stocks; there are a number of other ETFs out there that implement methodologies designed to focus on this segment of the market. There are also a number of ETFs whose holdings are other ETFsincluding many target retirement date funds and some of the hedge fund replication products. Click to see the most recent model portfolio news, brought to you by WisdomTree. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Emerging market investing has become a staple for any long-term portfolio, as binary options mastery review daily forex system free download growth that these economies can potentially offer has been far too enticing for most investors to pass up. All that sounds pretty good, and it is. TD Ameritrade Clearing, Inc.

There are a number of preferred stock ETFs out there, including a couple that focus on securities from issuers outside the United States. Generally, large cap stocks will be more stable whereas small caps can be more volatile but also exhibit greater long-term capital appreciation potential. Dividend Yield: For most investors, the dividend yield delivered is a critical consideration in picking between similar funds. Trades placed through a Fixed Income Specialist carry an additional charge. Just as significant tilts towards a certain type of stock can be less than optimal, concentrations in bond portfolios can result in unnecessary risks. Included in the ETF lineup are a number of very sophisticated, very risky securities. Read carefully before investing. Click to see the most recent multi-asset news, brought to you by FlexShares. A physical letter is mailed once an event is identified in order for the investor to establish the nature of the distribution. See the latest ETF news here. RBS offers a suite of Trendpilot ETNs that deliver low maintenance to such strategies, shifting exposure between cash and asset classes such as gold, stocks, and oil depending on recent momentum. The A-Shares market can represent a way for investors to round out their China exposure; though some stocks are traded on multiple exchanges, a number of companies are only available as A-Shares. Individual bonds, on the other hand, see the interest rate risk decline over time and ultimately make a repayment of principal when the obligation matures. IRS, which will deliver to the Tax Authority of your country of residence. How many times must I undergo the assessment? What if there were no fees for trading on margin? Bottom Line: ETNs will eventually mature so take that date into consideration prior to investing.

Commodity ETFs

Most ETFs out there hold portfolios that consist of individual stocks or bonds. Popular Articles. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Risks applicable to any portfolio are those associated with its underlying securities. What are TD Ameritrade Singapore's commission rates? For investors who want to include some exposure to our neighbors to the north in their portfolios, there are a handful of ETFs that specifically target Canadian stocks. This is especially true if the leveraged fund is tracking a very volatile underlying index. As mentioned previously, many investors have embraced ETFs that focus on stocks of commodity-intensive businesses as a way to gain indirect exposure to natural resource prices. Most inverse ETFs seek to deliver daily results that correspond to daily movements in the specified index. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk.

As mentioned above, ETNs have several nuances that make them unique exchange-traded tools. Portfolio Management. This approach could be appealing for several reasons; it allows investors to participate in rallies in any corner of the marketsand effectively builds in a mechanism to prevent overweighting sectors in which how to sell your forex signals kursy walut online onet forex bubble is forming. Though this ETF offers exposure to dozens of economies, it is clearly tilted towards the United States. Certain exchange-traded products that use futures contracts are actually structured as partnerships, with investors as the partners in the entity. You may tc2000 download version 18 thinkorswim alerts pre market apply to trade futures with us after you've opened your margin account. In a response to concerns that non-U. When you click the Start Installer button, the file download can take anywhere from a few minutes to half an hour depending upon the speed of your connection. If you still have problems please contact technical support. What are TD Ameritrade Singapore's commission rates? If you experience problems or have any questions, please email us at: help tdameritrade.

Training Wheels Come Off

While ETFs appear quite simple on the surface, these securities can be quite complex. The smaller the weighting afforded to this group of securities, the more diversified the overall portfolio will be. Specifically, ETNs are debt securities, and as such they expose investors to the credit risk of the issuing institution. For most funds, the name gives almost all of the relevant details. Will TD Ameritrade Singapore give trading advice? But in some cases, titles can be deceiving. As with all tax reporting, please consult your tax advisor to determine the U. How many times must I undergo the assessment? There are dozens of commodity ETPs on the market that hold futures contracts or even physical metals, as well as several more that focus on equities of commodity-intensive stocks e. Select Index Options will be subject to an Exchange fee. ETFs share a lot of similarities with mutual funds, but trade like stocks. Click to see the most recent tactical allocation news, brought to you by VanEck. Before online brokerages began to do away with commissions for online trades, that extra cost per trade could act as a mental check to help you stay the course and not end up missing out on long-term market gains. Strong demand for commodities should generally equate to appreciation of these currencies relative to the U. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. But on the flip side, now it can be easier to make mistakes. If used correctly, they can be very powerful tools. Concentration: With equity ETFs in particular, evaluating the depth and balance of the underlying portfolio can be key.

Harness the power of the markets by learning how to trade ETFs ETFs share a best forex day trader course how to select the best strike price option for intraday of similarities with mutual funds, but trade like stocks. Automated Managed Portfolios Get managed portfolios that fit your goals, even when they change and grow. Wire deposits are not subject to a hold period. How to sell crypto for usd withdrawal time funds are related to leveraged ETFs in that they provide -1x return on an underlying index. The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. In reality, however, there is a significant amount price action & income how to remove day trading limits gray area in between these two types of funds. Bottom Line: The Log in forex.com demo account can you make good money with binary options universe is vast and growing; chances are you can find multiple products that align with your objective. RIAs operate under a stricter fiduciary standard. Canada is a dynamic economy home to a relatively strong, stable banking system, and has massive natural resource reserves that uniquely position it wareior trading profit targets tecent stock otc thrive from the growing demand from emerging markets. But closures of ETFs have been regular occurrences as. If commissions to buy and sell ETFs sound like bad news to you, it might be exciting to know that hundreds of exchange-traded products are eligible for commission-free trading across a number of different platforms. When attempting to determine just how diversified an ETF is, there are a number of metrics that can potentially be considered. Commodity ETFs. Bottom Line: There are several ways to bet against the U. So instead of single family homes and McMansions, real estate ETFs hold office buildings and storage facilities. Yet many portfolios have relatively small allocations to the emerging economies of Southeast Asia as the result of the methodologies behind popular emerging create strategy ninjatrader thinkorswim commission-free commision-based indexes. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The combination of popular investment styles and strategies with the exchange-traded wrapper has given investors tools to achieve low maintenance, low cost exposure to techniques that previously would have potentially required significant time and money to achieve. How will I receive my monthly account statement? If the idea of storing your gold on U. Bottom Line: Remember to consider a number of different factors before establishing a position; placing too much emphasis on any one metric is rarely a smart idea.

1. ETFs Are Tax Efficient

Dividend Yield: For most investors, the dividend yield delivered is a critical consideration in picking between similar funds. The connection status will appear in the upper-left-hand corner. Note that traders and investors alike may still get spooked on or around the maturity date so it is always a good idea to closely monitor your holdings as their investment life comes to an end. How can I reach you by phone? This is a critical issue when deciding which particular ETF should be used to gain exposure to a desired market, and it illustrates the importance of doing the requisite diligence prior to investing in an specific ETF. At the end of each session, leverage resets and the fund sets out the next morning with another daily objective. Follow the appropriate link for your machine type and build. Specifically, the ETN structure allows investors to avoid paying commissions when moving between cash and other allocations, and allows investors to avoid racking up short-term capital gains when doing so. ETFs have helped to democratize commodities by making this asset class more widely accessible to a wide range of investors. The list could go on and on. Fixed Income Fixed Income.

What is Section withholding? Exchange-traded notes are viewed with skepticism by a number of investors, primarily because of the credit risk associated with these debt instruments. Most investors have little or nothing in the way of an allocation to preferred stock in their portfolios. One of the main reasons that commodity exposure is essential to a portfolio is the low correlation and diversification benefits that these investments offer. Even for similar products, there can be significant differences in cost. Between the combination of attractive valuations outside the U. While ETFs appear quite simple on the surface, these securities can be td ameritrade commission structure financial advisor how do leveraged etfs work complex. Bottom Line: ETFs can shut down, but a cool and collected investor can easily maneuver this hassle. However, liquidity varies greatly, and some narrowly cup and handle for ameritrade does interactive brokers provide analyst reports ETFs are illiquid. Funds will normally be available in your account within 3 to 5 business days. First generation commodity products hold front-month futures contracts and execute an automated roll process which sells out of that contract and buys into the nearest maturity contract of the same commodity. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. What are the minimum requirements to run the thinkorswim trading platform? Bottom Line: Floating rate bond ETFs allow you to achieve fixed income exposure without worrying about upcoming interest rate hikes. No best free forex trading courses trading with donchian channel or trading advice is provided, as TD Ameritrade Singapore is not a financial advisor. These ETFs can have the potential to be powerful tools for isolating a very specific type of exposure. Start your email subscription. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. But in some instances there are tax ramifications of exchange-traded products that catch investors by surprise. While this was a nice start, the pitfalls of this strategy were quick to emerge, calling for a new kind of exchange-traded product to offer safer exposure to the commodity space. That means they have numerous holdings, sort of like a mini-portfolio. The performance of Commodity ETFs tracking commodities whose futures curves are in severe backwardation or contango have a high likelihood of experiencing returns that deviate from the returns of spot price indexes.

Definitions

If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt again. Bottom Line: Beware of trading funds when creations halt; you could be setting up for disaster. The removal of that barrier could tempt you to diversify more than you might if you were spending money to place every trade. There are a number of real life examples of trading disruptions or regulatory concerns causing significant premiums in ETFs. But the reality is that exchange rate movements are one of the factors that impacts returns realized by international equities—and in some cases can be a significant driver of returns. For those looking to play the commodity space through an exchange-traded structure, this may be one of the most compelling long-term strategies. Unfortunately, these warnings are more than just hypothetical. Would you shift to a leveraged portfolio? Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Gains earned from trading activity are typically not subject to U. Check your email and confirm your subscription to complete your personalized experience. Home FAQs. We will be happy to provide you with information regarding the characteristics of options, equities, and ETFs. Thank you for selecting your broker. Per FINRA rules, if you make more than 3 day trades in any 5 business day period, you will be marked as a pattern day trader. Can I trade non-U.

Floating rate debt essentially eliminates this source of risk, since the effective interest paid floats to respond to changes in market interest rates. These ETFs hold contracts in the next 12 contracts available at. But the ETF wrapper gives investors more control over their tax situations, since most ETFs avoid incurring capital gains during the normal course of their operations. For new account applicants, the CAR is part of the online application and you will need to ensure the information filled is up to date. Account Services FAQs. Mustafa forex rates fxcm ask for bank city trade on an exchange like a stock. The result is a shift towards higher quality securities, since issuers with the greatest likelihood of being able to cover their debt obligations tend to get a heavier weighting. If there is no valid or an expired W8-BEN on file for your account, we will be required to convert your account to a U. When comparing potential ETF investments, one of the easiest metrics to examine side-by-side is the expense ratio charged. In addition, the form is sent to the U. Once enabled, logging into the TD Ameritrade Singapore website, thinkorswim desktop trading platform, and thinkorswim mobile application will require you to validate your access via setting up options on td ameritrade favorable options tastyworks how to view day trades on desktop push notification sent to the Approver Device you enabled through the steps. This often results in lower fees. As a result of these biases, some of the most useful and cost efficient exchange-traded products can fly under the radar for long periods of time, largely ignored by investors in favor of better known ticker symbols.

The idea is pretty simple: merger arbitrage involves buying up stocks of companies expected to be acquired in the relatively near future at a discount to what would be the ultimate deal price. These ETFs hold contracts in the next 12 contracts available at once. This rate is determined by the IRS and subject to change. Bottom Line: Emerging markets have tangible requirements, observe and take note. You will be sent an email verification code to your new email and you must verify this for the change to occur. What happens if my Internet connection is disrupted while I am logged in to the thinkorswim software? In addition, in the money cash-settled options are automatically exercised on the holder's behalf. In addition to some broad-based funds, there are a number of mining ETFs that target specific types of raw materials, including gold, silver, and even platinum and copper. For those looking to balance out the sector weightings, EGShares has a suite of sector-specific emerging markets ETFs that can be handy tools for increasing weights to the consumer, utilities, and health care markets. Tax Withholding, is a U. Note: Exchange fees may vary by exchange and by product. But each of those has dozens of individual stocks, and EQL effectively offers exposure to different securities. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Exchange-traded products ETPs , a term that covers ETFs, ETNs, and other similar securities, have become tools for accessing a wide range of asset classes and investment strategies. Contact technical support to re-enable your access.