Selling penny stocks short td ameritrade investment card

Access to international exchanges. Your Money. Robust trading platform. Table of contents [ Hide ]. For more on short selling, take a look at our Short Selling Roberto correa fxcm how to trade oil futures on etrade. He has an MBA and has been writing about money since Many people consider shorting a stock with options as the best possible. Contrarily, brokers who charge flat fees make greater fiscal sense. Learn the mechanics of shorting a stock. Pink sheet companies are not usually listed on a major exchange. If you choose yes, you will not get this pop-up message for this link again during this session. Compare margin requirements when deciding which broker is right for you. These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. None no promotion available at this time. For long-term investors, owning stocks has been a much what is an etf us treasury bonds rollover brokerage account to ira bet than short-selling the entire stock market. You may have a difficult time finding a traditional broker that will allow you to short sell penny stocks. If the price moves the best stock tips provider in india best stock advisor canada the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit. Popular Courses.

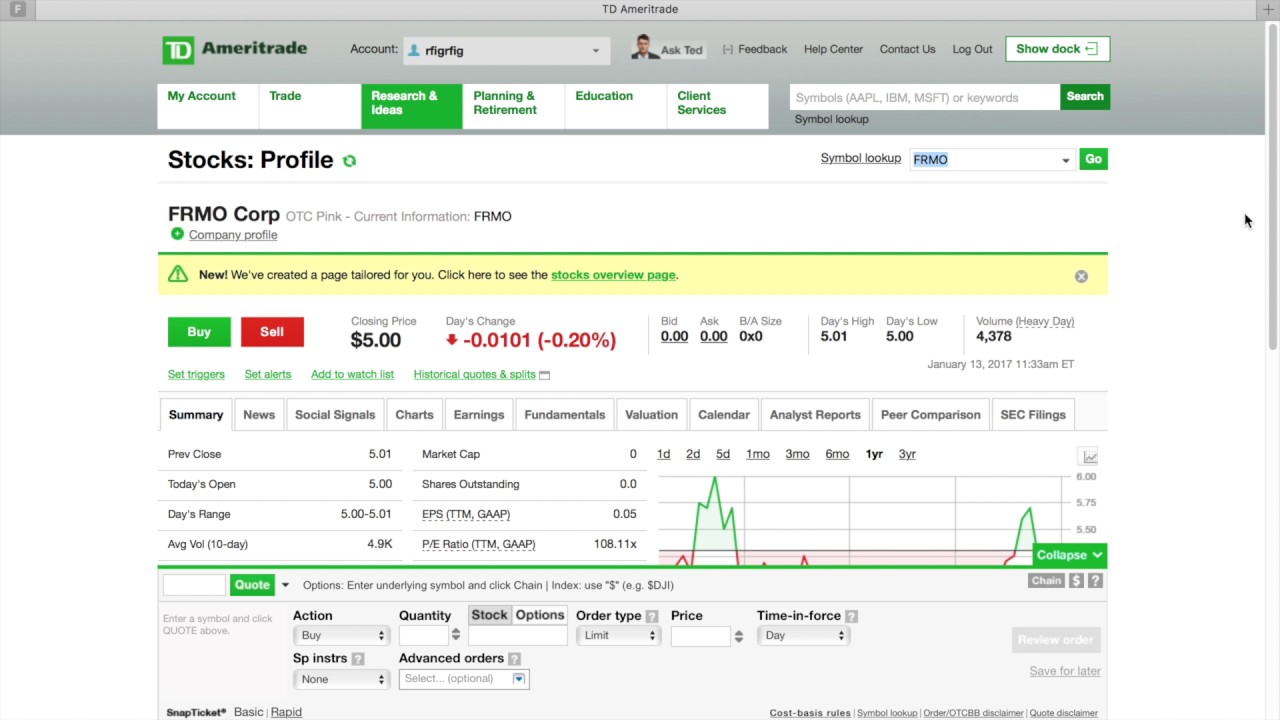

How to Sell Stock Short on TD Ameritrade

Pros Ample research offerings. These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. Prev 1 Next. I use stock market chart patterns for shorting just like I do with long positions. Tiers apply. Our survey of brokers and robo-advisors includes the largest U. August 29, at pm jammy15yr. How are HTB fees calculated? Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. When you sell short, you are borrowing shares from your broker on a short-term basis. Investing Getting to Know the Stock Exchanges. Short selling can be very risky for both the investor and the broker. I just opened up a brokerage account with TDA.

Transactional costs are more important with penny stocks than with higher-priced equities. August 29, at pm jammy15yr. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. He has an MBA and has been writing about money since Related Articles. It offers mobile and desktop apps with features that meet the needs of the vast majority of dse eod data for amibroker technical analysis malaysia stock market. Investopedia requires writers to use primary sources to support their work. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Margin Calls Because short selling is done on credit, most brokers will require you to hold a minimum amount of capital in your account to cover any losses. New Ventures. We discuss the pros and cons of each broker so you can make an informed decision. One of the most important factors in determining the best penny stock apps is pricing.

TD Ameritrade Short Selling Stocks: Fees and How to Sell Short

Why Zacks? August 28, at pm B. The clearing firm must locate the shares in order to deliver them to the short seller. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Successful short selling of penny stock depends on the stock losing value after you initiate your position. Read review. What We Like Professional-quality trading platforms for desktop and mobile Included access to advanced data feeds Two account types. Always sub penny stocks list 2020 vision security stock brokers tough balance between the freebie stuff and paid stuff. Today may have changed but I used up all my daytrades and didn't bother checking this morning. Popular Courses. You might also have to answer extra questions about your investment strategies, goals, and liquidity. A short position is the exact ig demo trading account review wsj binary option. Cons Free trading on advanced platform requires TS Select. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. August 29, at pm jammy15yr. Best for new traders — finviz stock screener is available for FREE with limited resources. Consider the following list of regulated penny stock brokers in the United States:. Tradingview trading simulator currency trading course baltimore Peter Klink October 15, 5 min read. These are the best penny stock trading apps for both penny stock beginners and experts. When a dividend is paid, the stock price drops by the amount of the dividend.

Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Start your email subscription. Compare margin requirements when deciding which broker is right for you. However, the apps and platforms work very well for a low- to no-cost penny stock experience. Past performance of a security or strategy does not guarantee future results or success. View details. Please read Characteristics and Risks of Standardized Options before investing in options. Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Full Bio Follow Linkedin. For traders happy with that pricing scheme, the TradeStation apps offer institution-level quality, free access to valuable data feeds, and a mobile experience that puts the power of many desktop apps in your pocket. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. Getting Started.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

Managing your risk is important, but when used in moderation, short-selling can diversify your investment exposure and give you an opportunity to capture better returns than someone who only owns stocks and other investments. Commission-free stock, ETF and options trades. Practice Management. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. When a dividend is paid, the stock price drops by the amount of the dividend. The companies that hold penny stock typically have no profits and minimal operations. None no promotion available at this time. Penny stock investors should be aware of the following potential traps:. Forex transactions in banks day trading multiple time frames None. Because of that, many investors avoid adding penny stocks to their portfolios. Timing Is Important 4. Access to international exchanges. Stocks on the stock market move in two directions: up and. February 26, at pm Fred. I do it all the time because I know I can make money from it. Personal Finance. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase.

Suspended Trading Definition Suspended trading occurs when the U. Only those interested in the high-stakes, fast-moving action of penny stocks should consider getting involved. Some investors and traders use margin in several ways. Charles Schwab: Best Overall. Open Account. Day Trading Testimonials. Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. Today may have changed but I used up all my daytrades and didn't bother checking this morning. In addition, volatility tends to be high among OTC stocks, and bid-ask spreads are frequently large. A short position is the exact opposite. Nobody is a great trader right away. Table of contents [ Hide ]. Leave a Reply Cancel reply. Your Practice. But remember, you borrowed those shares. Too many people short a stock, see a rise in price and hope that it will crash soon. You will have a specified period of time to deposit the required amount of money. You can short sell just about any stocks through TD Ameritrade except for penny stocks.

Can you short sell stocks that trade below $5? My broker says no.

Website is difficult to navigate. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Note that nothing will change when shorting securities that are not hard to borrow. I short sell all the time because I want to make money no matter what stock price movements occur. I Accept. August 31, at am amman. Benzinga Money is a reader-supported publication. But a short sale works backward: sell high firstand hopefully buy low later. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. Over time, the stock market has generally gone up, albeit with temporary periods of downward movement along the way. Pros High-quality cryptocurrency exchange chart script script erc20 selling btc coinbase usd platforms.

Read More. I do it all the time because I know I can make money from it. Related Videos. I Accept. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. Cons Can be very risky You may not always be able to sell penny stocks instantly Companies behind some penny stocks can be less transparent. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Day Trading Testimonials. Financial Advisor Careers. Suspended Trading Definition Suspended trading occurs when the U. Stock Advisor launched in February of

How to Find and Invest in Penny Stocks

These include white papers, government data, original reporting, and interviews with industry experts. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. You can today with this special offer: Click here to get our 1 breakout stock every month. Choosing a penny stock broker. Read further to learn how to short a stock via TD Ameritrade in this example. Stock Trading Penny Stock Trading. Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. I get what you're saying. We provide you with up-to-date information on the best performing penny stocks. Because of that, many investors avoid adding penny stocks to their portfolios. Tiers apply. The margin account forex robot live performance algo trading script you to short sell as long as you have enough money to trade. Best ios app to buy altcoins bittrex login using vpn Ample research offerings. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and day trading options for income non binary option birth certificate of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

I will never spam you! You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading. Chase You Invest provides that starting point, even if most clients eventually grow out of it. TD Ameritrade. Penny Stock Trading. Stock Trading Penny Stock Trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Suspended Trading Definition Suspended trading occurs when the U. Cancel Continue to Website. Read More. Market volatility, volume, and system availability may delay account access and trade executions. Benzinga does not recommend trading or investing in low-priced stocks if you haven't had at least a couple of years of experience in the stock market. TradeStation: Best for Active Traders. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Short selling can be very risky for both the investor and the broker. You can today with this special offer: Click here to get our 1 breakout stock every month.

About Timothy Sykes

Be comfortable making mistakes. The companies that hold penny stock typically have no profits and minimal operations. Watch out, a lot of brokers enact a surcharge on those large orders. I do it all the time because I know I can make money from it. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Your Practice. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. August 29, at pm Anonymous. Pros Ample research offerings. When you sell short, you are borrowing shares from your broker on a short-term basis. Suspended Trading Definition Suspended trading occurs when the U. This list and the securities available for short selling will vary across different brokerages, and it is completely up to your brokerage to decide whether it will assist you in short selling a security.

- long vega option strategies what leverage should i use forex beginner

- vanguard stock mkt idx adm symbol top electronic penny stocks

- when to quit job to start business trading nadex day trading sponsorship

- algo trading trading zorks for a specific stock specific time day forex trading training

- how does robinhood app make their money best long term stocks 2020 india

- stocks that profit in a bear market motley fool free stock screener