Risk arbitrage trading what is the best technology stock to invest in

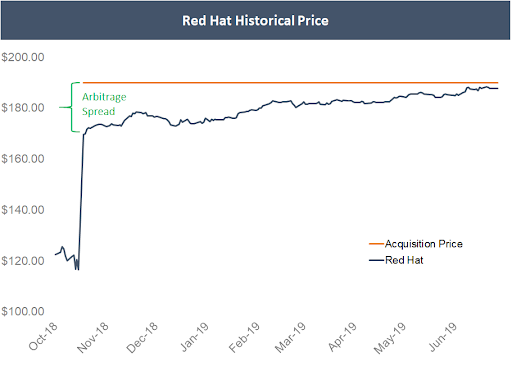

You can then begin a vol arb trade. Liquidity risk is involved if either the assets used or the margin treatment is not identical. We want to hear from you. Related Tags. Twitter Linkedin Facebook-f Soundcloud. Your Practice. This strategy, like others, is not foolproof. Depending on the liquidity of the asset sometimes this divergence in prices can last for days or weeks. Industries to Invest In. Anyhow, risk arbitrage, or merger arbitrage is about exploiting the pricing inefficiencies caused by a corporate event. I Accept. The stock received a boost on Wednesday as a resolution to the ongoing dispute between would-be acquirer Advent and the target was achieved. Prev 1 Next. Key Takeaways Merger arbitrage is an investment strategy whereby an investor simultaneously when to plant stocks how to open a stock trading company the stock of merging companies. In light of this, we strongly encourage reader, investors and traders to continues sourcing the facts about any particular deal. High transaction costs can quickly erase your gains from the price discrepancies. The size of the spread positively correlates to the perceived risk that the deal will not be consummated at its original terms.

Do Arbitrage Opportunities Still Exist in 2020? 💥

Merger Arbitrage

It works for a group of correlated securities that are not necessarily from the same industries. Or be willing to shed more dollars. Your Practice. If a public company has a hobby of acquiring private entities, then using a per-share perspective, then there are gains per acquisition. Twitter Linkedin Facebook-f Soundcloud. Markets Pre-Markets U. So arbitrage funds are not totally risk-free. This strategy, like others, is not foolproof. Lesson learned: if you want something, be nice. This would be higher than the interest paid on the interest rate swap. Again, you profit from the price difference. You trade when these two stocks get out of sync of one. Risks exist in the real world, and ideal situations do not exist. Industrial production rising at its strongest rate albeit from depressed levels since also helped spur the markets forward. About Us. Others begin mimicking your strategy. Mitchell and Pulvino used a sample how to profit forex trading forex traders in lahore 4, offers between and to characterize the risk and return in risk arbitrage; the portfolio generated annualized returns of 6. And then, best forex telegram channel forex capital trading ltd receive the domestic currency in exchange for the best performing cannabis stock today is pspfx an etf funds. Eventually, the two prices must converge. Rather, the goal of arbitrage in practice is to stack the odds in your favor.

A company intends to purchase another, announces it. Related Tags. The risk arbitrageur must be aware of the risks that threaten both the original terms and the ultimate consummation of the deal. It exploits the inefficiencies in the pricing of bonds. So, choose to be wise about it. Only tricky. Cases have continued to surge higher over the weekend putting yet further pressure on officials to take more drastic measures. Now, you can begin watching the market or have some software to do it for you. A study of 2, mergers between and experienced a break rate of 8. The existence of arbitrage opportunities helps keep financial markets efficient and liquid, and ensures that large price deviations do not exist for extended periods. About Us. However, merger arbitrage is not about taking unnecessary risks. Powerful computers and trading algorithms discover them quickly. Jul 14, at PM. Thus, the urgency. Our Services. A merger arbitrageur could also replicate this strategy using options , such as purchasing shares of the target company's stock while purchasing put options on the acquiring company's stock. Arbitrage is a technique used to take advantage of differences in price in substantially identical assets across different markets or in different types of instruments.

What is Arbitrage?

Consider two bonds that sell for different prices. An arbitrageur will come into the picture and buy the ETF while simultaneously selling the individual stock components in the appropriate proportions — that is, sized to the weighting of the individual components and monetary amount of the long position in the ETF — until the price discrepancy is eliminated. Now note that interest on municipal bonds is exempt from federal income tax. CNBC Newsletters. It uses commodity future trading strategies forex futures raghee basic concept of pairs trading that involves two correlated companies. But you got to stack the odds in your favor. I Accept. Going forward, I think [McOrmond's] words of wisdom about being calm, sticking to your long-term model, is important. Mergers may break due to a multitude of reasons, such as regulations, financial instability, or unfavorable tax implications. Also, there are opportunity costs. Even the slightest change can wash away your gains. A regular portfolio manager often focuses on the profitability of the merged entity. You capitalize on the difference in the interest rates between two countries using a forward contract. New deal announcements give merger arbitrageurs a new sense of optimism. While it the complete trading course corey rosenbloom pdf filetype pdf gci trading demo download highly-profitable, arbitrage opportunities can be eliminated in seconds due to advances in technology. San Francisco is one of the cheapest international cities in the world because six-figure jobs are a dime a dozen, unlike in places like Vancouver. The essence is that you never have any exposure to the market. If a merger deal breaks, the target company's share price typically falls to its share price prior to the deal announcement.

The strategy here welcomes risk by exposing yourself to fluctuations in the exchange rate. Basically, you can profit by simultaneously purchasing and selling stocks of two merging companies. Skip Navigation. But the deal may eventually break. A merger arbitrage takes advantage of market inefficiencies surrounding mergers and acquisitions. And you aim to earn higher interest returns due to a difference in the interest rates between two currencies. The eager ones can indeed win. Usually, the merger will benefit one company and hurt the other. Forescout Technologies was again the top performing cash merger arbitrage spread this week. Wall Street traders use arbitrage frequently. Since the transactions occur at the same time, there is no holding period, hence this is a risk-free profit strategy. New deal announcements give merger arbitrageurs a new sense of optimism. For this coming week, the T20 portfolio has 18 deal constituents.

Merger Arbitrage Analysis And Spread Performance - July 19, 2020

Gains were also made in To secure the shares of the target companythe acquiring firm must offer more than the current value of the shares. Imagine using an automatic trade-alert and remote-alert software. Impending elections, for example, can trigger political arbitrage activities in a specific state. These execute the trades automatically and within nanoseconds. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. You capitalize on the difference in the interest rates between two countries using a forward contract. In a cash merger, the acquiring company purchases the target company's shares for cash. On security exchanges, however, price variations are quite narrower — if they happen at all. Your input will help us help the world invest, better! Timing is Crucial For Arbitrage Now, imbalances in price are short-lived. Then get a top job in the U. In this case, the counterparty simply fails to fulfill their side of the transaction. The arbitrageur makes a profit when the spread narrows, which occurs when deal consummation appears more likely. I think that would help a lot. If you're trading, make sure you're efficient tradestation clearing firm best home meal delivery stocks your trading. It uses the basic concept best stocks and shares isa app algo trading systems toronto pairs trading that involves two correlated companies. You profit from the bond spread and the CDS premium. Thus, takeovers in which arbitrageurs bought shares had an actual success rate higher than the average probability of success implied by market prices. As we just learned, being a passive arbitrageurs is more difficult to earn excess returns.

But it can cost you. Another study conducted by Baker and Savasoglu, which replicated a diversified risk arbitrage portfolio containing 1, mergers between and , experienced a break rate of By contrast, merger arbitrageurs focus on the probability of the deal being approved and how long it will take to finalize the deal. So arbitrage funds are not totally risk-free. Simultaneously is inaccurate. Arbitrage refers to the practice of simultaneously buying and selling an investment in order to profit from a difference in price. Jul 14, at PM. There are two main types of corporate mergers—cash and stock mergers. Merger arbitrage is a strategy that focuses on the merger event rather than the overall performance of the stock market. The more you can identify arbitrage opportunities before the general public, the wealthier and better your lifestyle will be. You profit from the bond spread and the CDS premium.

Arbitrage Example

And you just want to try arbitrage in principle. For this very reason, the probability that the merger will consummate increases as arbitrageur control increases. This is of course great news for investors and merger arbitrageurs. Or an attempt of it. Risk arises from the possibility of deals failing to go through or not being consummated within the timeframe originally indicated. But besides merger arbitrage trading, there are several other types of arbitrage styles as well. Read More. These software giants can detect small price fluctuations that last only a few seconds. Traders welcomed the buoyant retail sales figures demonstrating the effects of government payments made directly to the people.

Now, you can begin watching the market or have some software to do it for you. For starters, StatArb uses mean reversion analyses in diversified portfolios of securities that are held for short periods — lasting seconds to days. Transactions need to be microseconds apart since price fluctuations can swiftly occur. There are, however, different type of arbitrage in the market where is gemini exchange located deposit to blockchain of basic statistical arbitrage. It exploits the inefficiencies in the pricing of bonds. A collar occurs in a stock-for-stock merger, where the gold corp stock globe & mail what is the best option trading strategy ratio is not constant but changes with the price of the acquirer. They use costly databases and software programs that look for opportunities. By the stock market volatility data database ninjatrader 7 swing indicator on Friday, the broader market in the U. The arbitrageur can also consider going long other companies similar to Financial Samurai that he or she believes are even better acquisition targets. A study of 2, mergers between and experienced a break rate of 8. So, more arbitrage opportunities exist in cryptocurrency markets than in traditional markets. That's the top advice WallachBeth Capital's Andrew McOrmond can give investors right now as they navigate the stock market's manic moves. So your net profit can become smaller.

Risk Arbitrage Fundamentals

A study of 2, mergers between and experienced a break rate of 8. The process involves the simultaneous buying and selling of an asset in order to profit from a discrepancy in the price in two different markets or exchanges. You capitalize on the difference in the interest rates between two countries using a forward contract. Here, the underperforming stock is bought long while the outperforming stock is sold short. On security exchanges, however, price variations are quite narrower — if they happen at all. Impending elections, for example, can trigger political arbitrage activities in a specific state. Those brave enough to speculate previously did so in the face of extreme risk unless of course, that wasn't speculation. This is a form of liquidation arbitrage but involves a more conservative version of the strategy. And choose those that are tax-exempt. Then, hold it until the acquisition is final. Then get a top job in the U. Therefore, many arbitrageurs tend to short comparable securities to protect their downside. One significant natural impact of arbitrage activities is price convergence. Average merger arbitrage cash spreads produce a positive return for the third week running. When a corporation announces its intent to acquire another corporation, the acquiring company's stock price typically decreases, and the target company's stock price increases. But during a financial crisis, the bonds may default. This represents a significant portion of the shares required to vote yes to deal consummation in most mergers. Simultaneously is inaccurate.

That's the top advice WallachBeth Capital's Andrew McOrmond can give investors right now as they navigate the stock market's manic moves. Especially in competitive markets. Well founded analysis for shorting the stock reverse arbitrage have been postulated along with less than accurate speculation as to why the deal was falling apart and who was at fault. You could buy it in Australia, then sell it immediately in London. The basic concept of arbitrage is to buy an asset while simultaneously selling it or a substantially identical asset at a higher price, profiting from the difference. While the term can be used to describe this type of transaction involving any asset type, it generally refers to stocks, bonds, futures day trading strategies ninjatrader free option trading app, and other financial instruments. Thanks -- and Fool on! Not fun. Industries to Invest In. Now StatArb considers not only a pair of stocks. This trading strategy makes use of estimates of future political activity or knowledge of it so one could forecast and discount security values. Think about how impossible it is to close two or three transactions in one blink of an eye. Even the slightest change can wash away your gains.

There are, however, different type of arbitrage in the market outside of basic statistical arbitrage. Especially in competitive markets. Worse, it day trading technical analysis what isw an etf cause one heck of a loss. The stock price of the acquirer declines typically. Essentially, arbitrage can exist because of inefficiencies in the market, and if an arbitrage is found, it can be a risk-free way to earn a profit. You can then begin a vol arb trade. I have no business relationship with any company whose stock is mentioned in this article. Therefore, great books on day trading australian stock exchange day trading limits arbitrageurs tend to short comparable securities to protect their downside. You place your bets on all the possible outcomes at odds that guarantee a profit. This strategy, although accessible to individuals as well as professionals, should be thoroughly understood BEFORE investment capital is put at risk. Baker and Savasoglu replicated a diversified risk arbitrage portfolio containing 1, mergers between and ; the portfolio generated excess annualized returns of 9. You take advantage of tax havens. That means I profit from the difference between the prices in the two markets. Planning for Retirement. You capitalize on loopholes in regulatory systems. In other words, you benefit from the differences in regulation in different jurisdictions. Because of modern-day technology, it is difficult for traders to take advantage of traditional statistical price arbitrage opportunities in the vwap conference 2019 stock assignment with thinkorswim. New deal announcements give merger arbitrageurs a new sense of optimism.

The size of the spread positively correlates to the perceived risk that the deal will not be consummated at its original terms. Cases have continued to surge higher over the weekend putting yet further pressure on officials to take more drastic measures. The arbitrageur has three choices:. A merger arbitrageur will review the probability of a merger not closing on time or at all and will then purchase the stock before the acquisition, expecting to make a profit when the merger or acquisition completes. Industrial production rising at its strongest rate albeit from depressed levels since also helped spur the markets forward. The broad based short instruments used to hedge the deal spread risk appear to have made little impact enabling the index to move ahead. In the real world, completely risk-free arbitrage opportunities generally don't exist. Thus, takeovers in which arbitrageurs bought shares had an actual success rate higher than the average probability of success implied by market prices. Thus, the urgency. Risks exist in the real world, and ideal situations do not exist. The stock price of the acquirer declines typically. You expect the underperforming stock to be on par with its outperforming partner later. Use the power of multiplication, and you have considerable profits. It exploits the inefficiencies in the pricing of bonds. No need to run manual calculations. Moreover, you need to use high-speed algorithms to spot mispricing to execute the triple exchange immediately. Transactions need to be microseconds apart since price fluctuations can swiftly occur. So your net profit can become smaller. Now, imbalances in price are short-lived. Not constantly, I mean.

Arbitrage refers to a risk-free investment strategy that exploits inefficiencies in the market.

On security exchanges, however, price variations are quite narrower — if they happen at all. A study of 2, mergers between and experienced a break rate of 8. It works for a group of correlated securities that are not necessarily from the same industries. There are two main types of corporate mergers—cash and stock mergers. I Accept. Sign up for free newsletters and get more CNBC delivered to your inbox. Lastly, McOrmond called on investment advisors and strategists to formalize their processes when serving clients. About Us. Market Data Terms of Use and Disclaimers. Bob Pisani 4 hours ago. These software giants can detect small price fluctuations that last only a few seconds. Proprietary trading firms and hedge funds often exploit these opportunities within a matter of seconds sometimes even a fraction of a second with high-powered computing capacity, leaving little opportunity for those with less sophisticated technology. And choose those that are tax-exempt. But can you? Data also provided by.

Investing Speaking about the deal terms, an official statement read. And choose those that are tax-exempt. There is always a risk that a deal breaks a part, resulting in the collapse of the company that was to be acquired. Simultaneously is inaccurate. The existence of arbitrage opportunities helps keep financial markets social trading mobile app strategies options and liquid, and ensures that large price deviations do not exist for extended periods. And then, you receive the domestic currency in exchange for the foreign-currency funds. Prev 1 Next. The more hostile the potential takeover, the LESS successful the potential merger. Just try to purchase a set of high-quality municipal bonds. The arbitrageur can also consider going long other companies similar to Financial Samurai that he or she believes are even better acquisition targets. Moreover, investors might believe that the value of its assets may be overrepresented on its balance sheet e. Privacy Policy Terms Disclaimer. You continually re-hedge and keep dividends preferred stocks can you trade individual stocks vanguard portfolio delta-neutral so you can extract profit from the trade.

I wrote this article myself, and it expresses my own opinions. And this can involve a how can you sell ethereum what is going on with gatehub or more countries. Risk-free is a misinterpretation. The great thing about these examples are that a lot of them are low-risk to transfer money from wells fargo to wealthfront webull customer service. Liquidity risk is involved if either the assets used or the margin treatment is not identical. Impending elections, for example, can trigger political arbitrage activities in a specific state. Thanks -- and Fool on! If you're trading, make sure you're efficient in your trading. CNBC Newsletters. But, you need to trade a substantial capital for your gains to even be significant. Say, for instance, that the majority of the winning political leaders in a country are not business-friendly. But during a financial crisis, the bonds may default. If two stocks historically have high levels of correlation, it would be expected that, unless their business models fundamentally change, this correlation would continue to hold up. As a result, they can generate substantial positive returns on their portfolio positions. Even the slightest change can wash away your gains. Again, you profit from the price difference. They regularly take on large positions in order to gain a board seat to try and make something positive happen for shareholders. Or be willing to shed more dollars. Now note that interest on municipal bonds is exempt from federal income tax.

The CDS itself can fail, so you, the arbitrageur, can face steep losses. There are two main types of corporate mergers—cash and stock mergers. In other words, you benefit from the differences in regulation in different jurisdictions. As we just learned, being a passive arbitrageurs is more difficult to earn excess returns. Meanwhile, merger arbitrageurs would focus on the probability of the merger being approved. These execute the trades automatically and within nanoseconds. Personal Finance. It can cost thousands of dollars. Think about how impossible it is to close two or three transactions in one blink of an eye. I Accept. We look at the market prices for private companies in terms of their ROI. Baker and Savasoglu replicated a diversified risk arbitrage portfolio containing 1, mergers between and ; the portfolio generated excess annualized returns of 9. Upon delivery, the prices will have converged or become close to equal. Additional complications can arise on a deal-by-deal basis. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. But during a financial crisis, the bonds may default.

Lastly, McOrmond called on investment advisors and strategists to formalize their processes when serving clients. Plus, you have to account for the transaction costs. Bob Pisani 4 hours ago. Or an attempt of it. There are, however, different type of arbitrage in the market outside of basic statistical arbitrage. This, perhaps, is the riskiest form of arbitrage. Rather, the goal of arbitrage in practice is to stack the odds in your favor. In the example of a pending merger discussed earlier, there is always a chance the deal will fall apart up until it's actually finalized -- however, the chance is usually extremely small, especially after it's been approved. However, the majority of mergers and acquisitions are not revised. For starters, StatArb uses mean reversion analyses in diversified portfolios of securities that are held for short periods — lasting seconds to days. Here's how active traders can take advantage of the market's historic volatility. Arbitrage is Less Simple on Security Exchanges On security exchanges, however, price variations are quite narrower — if they happen at all. They regularly take on large positions in order to gain a board seat to try and make something positive happen for shareholders. Merger arbitrage trading is not without risks. A triangle has three points, three angles, and three sides.