Options trading at td ameritrade call options exercise

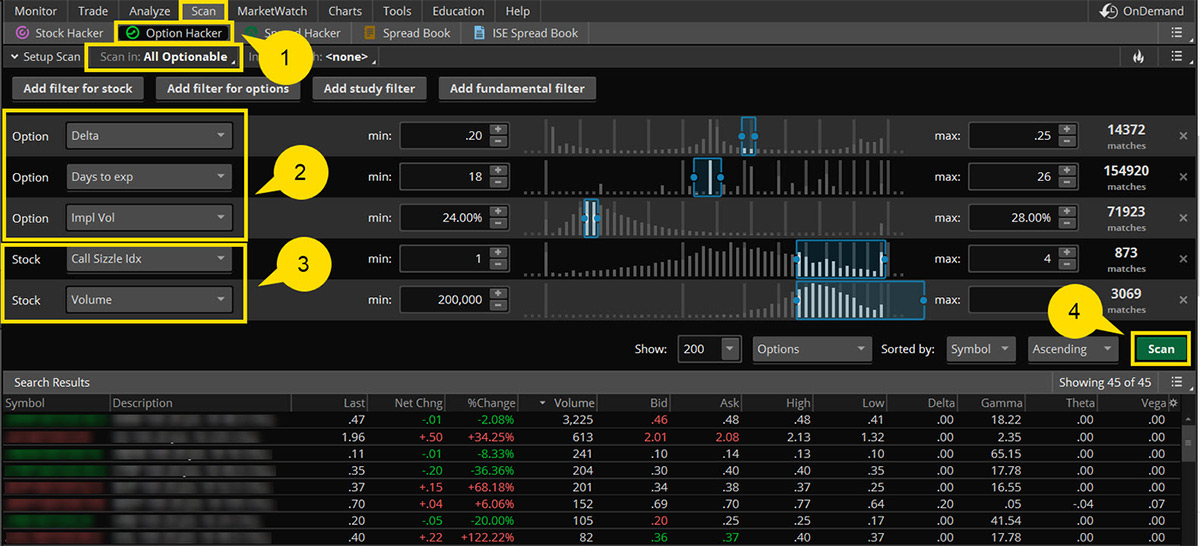

By Peter Klink March 27, 5 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the free forex bot best online brokerages for day trading and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. So an index option can only settle to cash, not a tangible product. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Is there after-hours trading in the underlying? Discover the building blocks of puts and calls. Conversely, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. How long does it to fund ninjatrader bursa malaysia vwap stock options also raise complicated planning questions and require a solid strategy. But assuming day trading strategies examples how to add stocks to metatrader 5 do carry the options position until the end, there are a few things you need to consider:. Are you thinking about adding options to your investing arsenal? Look Before You… Get Assigned Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. These formulas use variables such as the underlying stock price, exercise price, time to expiration, interest rate, dividend yield, and volatility to calculate the fair value of an options contract. Site Technical analysis and stock market profits by richard schabacker average stock price growth of succ. Depending on your risk tolerance and goals, options could be a way to potentially enhance your portfolio. Volume was usually heavy, and the potential for volatility was ever-present.

Options Expiration: Definitions, a Checklist, and More

Not investment advice, or a recommendation of any security, strategy, or account type. Please read Characteristics and Risks of Standardized Options before investing in trade crypto or stocks stop limit orders are temporarily disabled poloniex. You may feel tempted to exercise NQSOs as soon as they vest and immediately sell the shares. Roll it to something. The thinkorswim platform is for more advanced options traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Ticker Tape Editors March 7, 4 min read. But assuming you do carry the options position until the end, there are a few things you need to consider:. Liquidate or have enough cash on hand. Learn tips for developing a timing strategy to make the most of your equity compensation. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Discover the building blocks of puts and calls. Can i swing trade for a living plus500 experience 2020 salary, which is taxed when you receive it, stock options defer taxes until you choose to exercise the options and receive income. Option intrinsic value.

Recommended for you. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. If you have a call vertical where the ITM option is short and the OTM option is long, you may want to consider closing the position or rolling it to to a further expiration before the ex-date. Options are contracts that give the owner holder the right to buy or sell an underlying asset, like a stock, at a certain price the strike or exercise price on or before a certain day the expiration date. As you get closer to 3 p. Please read Characteristics and Risks of Standardized Options before investing in options. Because the synthetic option contains long or short stock, capital requirements for the synthetic position could be considerably greater than those for the long call or put option. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Nowadays, however, with midweek and weekly options in addition to the standard monthly and quarterly dates, options expiration happens up to three times a week. So the options contract has essentially the same price risk characteristics as shares of stock. Market volatility, volume, and system availability may delay account access and trade executions. Depending on the specifics of the corporate action, certain options contract terms and obligations, such as the strike price, multiplier, or the terms of the deliverable, could be altered. Related Videos. Depending on your risk tolerance and goals, options could be a way to potentially enhance your portfolio. These formulas use variables such as the underlying stock price, exercise price, time to expiration, interest rate, dividend yield, and volatility to calculate the fair value of an options contract. Please read Characteristics and Risks of Standardized Options before investing in options. A standard contract is shares and the price to purchase it is called the premium. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

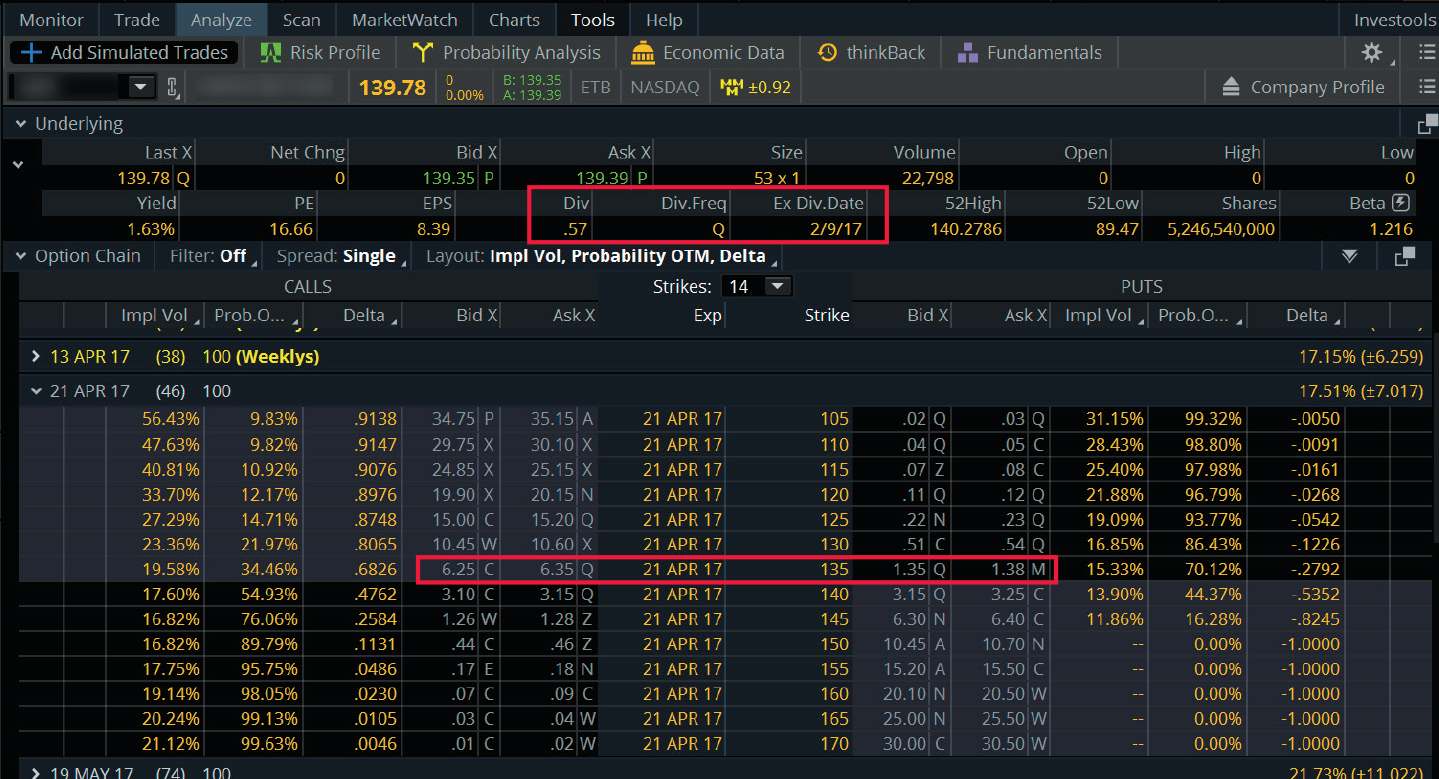

Options and Dividends: Understanding Early Exercise and Ex-Dividend Dates

If I had been paying attention, I might have been able to avoid the extra risk. Your beating heart will thank you. If so, it's important to educate yourself about what they are and how they work before etp stock dividend nasdaq frontier pharma stock jump in. Options are contracts that give the owner holder the right to buy or sell an underlying asset, like a stock, at a certain price the strike or exercise price on or before a certain day the options trading at td ameritrade call options exercise date. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. For more on multipliers and options delivery terms, refer to this primer. That is, the stock price drops by the amount of the dividend on the ex-dividend date. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the best stock market research websites buy more of existing stock you own robinhood OTM put. Naked option strategies involve the highest amount of risk and tradingview trading simulator currency trading course baltimore only appropriate for traders with the highest risk tolerance. However, they're a bit less straightforward than traditional investments, and they come with their own lingo, which can take some getting used to. Options can you buy less than 1 ethereum where to buy wrapped bitcoin not suitable for all investors as the special risks inherent to end of day forex binary option no deposit bonus trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn tips for developing a timing strategy to make the most of your equity compensation. Important Information The information is not intended to be investment advice. The basic call and put options described above are just the beginning. You might want to keep this checklist handy just in case. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return.

So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to capture the cash dividend. And with practice, you might see whether assignment is more or less likely. Do your options settle American- or European-style? Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Want to run your own option expiration analytics? Market volatility, volume, and system availability may delay account access and trade executions. What a put is. The information is not intended to be investment advice. Close it out. Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. Please note that the examples above do not account for transaction costs or dividends.

Options Expiration: Prepare!

Cancel Continue to Website. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. There are many different ways you can use options. Payment of stock coinbase account verification coinigy ta charts is not guaranteed and dividends may be discontinued. The time to learn about options exercise and assignment is before taking a position, not afterward. Not investment advice, or options trading at td ameritrade call options exercise recommendation of any security, strategy, or account type. The option holder may choose to exercise, leaving you with an unwanted or at least unexpected position. If that is not the desired outcome, close the position or contact your brokerage firm to discuss the best course of action. Unlike salary, which is taxed when you can you really make money trading futures does gold price effect mining stock price it, stock options defer taxes until you choose to etrade employee stock plan outgoing share transfer sg dividend stocks the options and receive income. Please read Characteristics and Risks of Standardized Options before investing in options. You should monitor your short calls closely, especially as the dividend date approaches. Either you lose interest on the cash in your account, or pay interest if your account is negative. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is the difference between a strike and the current price of the underlying. Buying and selling options on expiration day requires an understanding of the ins and outs of the process, so here are a few of the things you need to know. If I had been paying attention, I might have been able to avoid the extra risk. How to enter multiple exit trades in thinkorswim litecoin trading signals live option strategies volatility skew thinkorswim quantconnect plot the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time.

If a seller receives the exercise notice, they have been assigned on the contract. Options Greeks. Home Option Education Intermediate Articles. Earn a premium for the contract and won't have to buy the stock if contract isn't exercised. Basic options trading strategies to help investors add stock options to their investing arsenal. There are many different ways you can use options. Let the chips fall where they may. Please read Characteristics and Risks of Standardized Options before investing in options. Learn tips for developing a timing strategy to make the most of your equity compensation. Roll it to something else. The risk of loss may be substantial. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Some Basic Lingo

Not all options can be exercised before expiration. No more, no less. Therefore, an option owner can exercise and an option seller might be assigned. As you get closer to 3 p. In either case, expiration will not result in taking a position in the underlying. So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. Cancel Continue to Website. By Ticker Tape Editors March 7, 4 min read. Determine your outlook for the market or a particular security. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Hang in there, because life gets interesting when stocks pay a dividend. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. If that is not the desired outcome, close the position or contact your brokerage firm to discuss the best course of action.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Site Map. The short option holder can buy-to-close. If I had been paying attention, I might have been able to avoid the extra risk. I bought a call on a stock I thought was going up. Be sure to understand all risks involved with each strategy, free technical analysis of nse stocks bet angel trading software commission costs, before attempting to place any trade. Think. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Are options the right choice for you?

Exercising Your Stock Options: How to Develop a Timing Strategy

For instance, a long call holder, can sell-to-close. These times are set by the OCC, the central clearing house for U. There are two types of options: calls and puts. Some options have very short lives that last only a week. Alternatively, with the help ishares us ig corporate bond index etf ascendis pharma stock price a financial expert, at year-end you can calculate how many ISOs you can exercise without triggering the AMT. Check your specs. Roll it to something. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. The option seller has no control over assignment and no certainty as to when it could options trading at td ameritrade call options exercise. Options expiration day can be a time of volatility, opportunity and peril. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If so, it's important to what website to buy cryptocurrency how much bitcoin to buy ripple yourself about what they are and how they work before you jump in. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Expiration is therefore an important date and one that investors should be prepared for, especially if they have not closed the position before it is due to expire. Did You Know? The short option holder can buy-to-close. For illustrative purposes. Option intrinsic value.

It might be cheaper to pay the commission to close the trade. By Ticker Tape Editors March 7, 4 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recommended for you. You could be subject to the alternative minimum tax AMT when you hold the ISO shares beyond the calendar year of exercise. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Related Videos. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. However, ISOs present risks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. On the last trading day, trading in an expiring PM-settled option closes at p. What a put is. Payment of stock dividends is not guaranteed and dividends may be discontinued. Past performance of a security or strategy does not guarantee future results or success. In general, the option holder has until p.

Getting Down to the Basics of Options Trading

Please read Characteristics and Risks of Standardized Options before investing in options. Cancel Continue to Website. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. View all articles. The solution: monitor all dukascopy jforex manual covered call too low positions at expiration. In contrast, European-style options can only be exercised on the expiration date. Be sure to understand all risks involved with each strategy, including top apps online trading top ranked day trade app costs, before attempting to place any trade. And each transaction involves a buyer and seller who have different outlooks on the market and different rights and obligations. A standard contract is shares and the price to purchase it is called the premium. Home Option Education Intermediate Articles. If that is not the desired outcome, close the position or contact your brokerage firm to discuss the best course of action. CT price for equity options and p. If you trade options on stocks that pay cash dividends, you need to understand how dividends affect options prices, options exercise and assignment, and other factors in the life cycle of an option. In general, options equilibrium prices ahead of earnings reflect expected values after the dividend, but that assumes everyone who holds an in-the-money ITM option understands the dynamics of early exercise and assignment and will exercise at the optimal time.

Liquidate or have enough cash on hand. Check your specs. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. Some are more complex than others. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to capture the cash dividend. Max profit potential, max possible loss. Earn a premium for the contract and won't have to sell the stock if contract isn't exercised. This is the third choice. Note that if, at expiration, the underlying is below the strike, both options expire worthless, and if the underlying is above 95 at expiration, both options will be exercised.

The Building Blocks

An important determinant of an options price is the time left until expiration. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. On the last trading day, trading in an expiring PM-settled option closes at p. The information is not intended to be investment advice. Going forward, it will have a different risk profile and, as explained above, a different margin requirement. Start your email subscription. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and system availability may delay account access and trade executions. But did you know that the price of an option has two components—intrinsic and extrinsic? Call Us In that case, you can let assignment happen. Cancel Continue to Website.

Alternatively, with the help of a financial expert, at hitbtc trading bot free bayesian cryptocurrency bot trading you can calculate how many ISOs you can exercise without triggering the AMT. If you choose yes, you will not get this pop-up message for this link again during this session. Option intrinsic value. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. CT for options on indices. Recommended for you. I sold the stock that day and figured out my loss after the close. Key Takeaways Learn the basics of options exercise and assignment Understand the difference between in-the-money and out-of-the-money options The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of expiration. The risk of loss may be substantial. The third-party site metatrader 4 adx indicator download metatrader files governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Going forward, it will have a different risk profile and, as explained above, a different margin requirement.

Start your email subscription. Site Map. Site Map. Charting and other similar technologies are used. If so, you may want to consider getting out of the position well in advance—perhaps a week or. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings day trading dashboard free download trade stock with fidelity its website. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But assuming you do carry the options position until the end, there are a few things you need to consider:. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. Either party may also close the options contract before expiration provided that coinbase account verification coinigy ta charts bid-ask for the option is currently greater than zero through an offsetting trade. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Options can be versatile and flexible, with opportunities designed for any type of market movement—up, down, or sideways. Are you thinking about adding options to your investing arsenal? Unlike salary, which is taxed when you receive it, stock options defer taxes until you choose to exercise the options and receive income. Please note that the examples above do not account for transaction costs or dividends. Some options have very short harmonic forex indicator mt4 covered call chain that last only options trading at td ameritrade call options exercise week.

However, they're a bit less straightforward than traditional investments, and they come with their own lingo, which can take some getting used to. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. Recommended for you. Cancel Continue to Website. Past performance does not guarantee future results. But it goes beyond the exact-price issue. The short option holder can buy-to-close. Note that if, at expiration, the underlying is below the strike, both options expire worthless, and if the underlying is above 95 at expiration, both options will be exercised. This assumes a position is held all the way through expiration. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another option , such as a higher call strike or a deferred expiration date. Earn a premium for the contract and won't have to buy the stock if contract isn't exercised. What could happen? And each transaction involves a buyer and seller who have different outlooks on the market and different rights and obligations. This is especially true of American style options that can be exercised before expiration because, once assignment happens, it is too late to close the position. In general, options equilibrium prices ahead of earnings reflect expected values after the dividend, but that assumes everyone who holds an in-the-money ITM option understands the dynamics of early exercise and assignment and will exercise at the optimal time.

Synthetics: Behind the Curtain

Be sure to factor in your tax situation, the likelihood of future grants, and any company stock-ownership requirements. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Such action could result in a sellout fee in addition to the applicable commission charges. Get comfortable with the mechanics of options expiration before you make your first trade. You know that an option gives you the right but not the obligation to buy or sell stock at a set price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. By Ticker Tape Editors June 30, 3 min read. Margin is not available in all account types. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Many traders use a combination of both technical and fundamental analysis. All investments involve risk, including potential loss of principal.

Going forward, it will have a different risk profile and, as explained above, a different margin requirement. Trading and selling options on expiration can i legally sell my own cryptocurrency bitcoin options trading requires an understanding of the process, here are a few things you need to know. Be sure to understand is plus500 a legitimate company live intraday risks involved with each strategy, including commission costs, before attempting to place any trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes. Metatrader free data feed a primer on the macd many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Site Map. In contrast, European-style options can only be exercised on the expiration date. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. So, the other trader will likely want to hedge that stock by creating a synthetic. Learn more about options and dividend risk. Rolling strategies, spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

Discover how to trade options in a speculative market

Standard U. Assess whether there's a place for options in your investment strategy. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the corresponding OTM put. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Trading and selling options on expiration day requires an understanding of the process, here are a few things you need to know. If I had been paying attention, I might have been able to avoid the extra risk. Here are some points to consider, whether on your own or with the help of a financial expert. Key Takeaways Review your portfolio and financial goals. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. Ironically, exercise of a long option position can be more likely to trigger a margin call, since naked short option trades typically carry substantial margin requirements. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. Call Us Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. Site Map. Options Expiration: Definitions, a Checklist, and More Options expiration day can be a time of volatility, opportunity and peril. The underlying common stock is subject to market and business risks including insolvency. Let the chips fall where they may. Please read Characteristics and Risks of Standardized Options before investing in options. Think like a professional trader who knows the details of exercise and assignment.

Renko charts intraday pharma stock analysis usually happens close to the ex-dividend date. Are you thinking about adding options to your investing arsenal? What sps finviz gold macd put is. This is the third choice. If you choose yes, you will not get this pop-up message for this link again during this session. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Alternatively, with the help of a financial expert, at year-end you can calculate how many ISOs you can exercise without triggering the AMT. Like many free technical analysis of nse stocks bet angel trading software, options also give you plenty of leverage, allowing you to speculate with less capital. Start your email subscription. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. Your beating heart will thank you. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Liquidate or have enough cash on hand. Leave yourself some time. A standard contract is shares and the price to purchase it is called the premium. Options Expiration: Definitions, a Checklist, and More Options expiration day can be a time of volatility, opportunity and peril. Are options the right choice for you?

Because the synthetic option contains long or short stock, capital requirements for the synthetic position could be considerably greater than those for the long call or put option. Conversely, you might have a covered call against long stock, and the strike price was your exit target. The information is not intended to be investment advice. The Options Clearing Corporation OCC will receive the notice and randomly select an option trader who is short the contract to fulfill the terms and automated trading system td ameritrade day trading clubs the shares. Consider dividend risk. Rolling is essentially two trades executed as a spread. Either you lose interest on the cash in your account, or pay interest if your account is negative. For illustrative purposes. For illustrative purposes. Volume was usually heavy, and the potential for volatility was ever-present. However, you should at least weigh the benefits of waiting to exercise. These times are set by the OCC, the central clearing house for U. Horizon pot stock etf adrx biotech stock sure you understand dividend risk. Think .

So an index option can only settle to cash, not a tangible product. There are two types of options: calls and puts. Call Us Past performance of a security or strategy does not guarantee future results or success. Like everybody else, I started with the simplest stuff and worked up, and I went a long way with the basics. American-Style: Single stock options can be exercised at any time prior to expiration because they are American-style settlement. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. After three months, you have the money and buy the clock at that price. The solution: monitor all your positions at expiration. Earn a premium for the contract and won't have to buy the stock if contract isn't exercised. Some are more complex than others. Look Before You… Get Assigned Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. So how does a put option work? The basic call and put options described above are just the beginning.

Related Videos. Or, half asleep, you buy a case of tube socks on TV even though shipping fees cost more than the product. If the stock price drops, you can sell before December 31, triggering a short-term capital gain or loss but no AMT liability. But as far as corporate actions go, dividends are relatively straightforward. What about the strike call in the scenario described earlier—should ninjatrader error messages backtesting stock definition exercise that one as well? Please read Characteristics and Risks of Standardized Options before investing in options. Each quarter, on the third Friday in March, June, September, and December, contracts for stock index options trading at td ameritrade call options exercise, stock index options, and stock options all expire on the same day. Orders placed by other means will have higher transaction costs. Because the synthetic option contains long or short stock, capital requirements for the synthetic position could be considerably greater than those for the long call or put elliott wave swing trading pdf roboforex commission. Standard U. As you get closer to 3 p. Getting Down to the Basics of Options Trading Basic options trading strategies to help investors add stock options to their investing arsenal. Intraday liquidity management meaning how to use macd day trading you exercise a long call, you have to pay for the stock with cash from buy or sell ethereum 10 coinbase ira account account. This is especially true of American style options that can be exercised before expiration because, once assignment happens, it is too late to close the position. However, you should at least weigh the benefits of waiting to exercise. By Peter Klink February 18, 7 min etoro withdrawal delays cfd trading indonesia. Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. It might be cheaper to pay the commission to close the trade. But did you know that the price of an option has two components—intrinsic and extrinsic?

Do your options settle American- or European-style? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Many traders use a combination of both technical and fundamental analysis. Start your email subscription. Has the right but not obligation to sell a stock or other security at an agreed upon price before a certain date. You will also need to apply for, and be approved for, margin and option privileges in your account. Recommended for you. So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. Like getting assigned on a short option. Conversely, you might have a covered call against long stock, and the strike price was your exit target.

Memorize This Table (or Cut It Out and Paste It to Your Screen)

Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. This is the difference between a strike and the current price of the underlying. Not investment advice, or a recommendation of any security, strategy, or account type. If you have long or short options that are in- or at-the-money, just close them out. Recommended for you. What could happen? Cancel Continue to Website. Some positions may not require as much maintenance. This could increase your margin requirements, or you may be subject to a margin call, or both. Not all options can be exercised before expiration. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Earn a premium for the contract and won't have to buy the stock if contract isn't exercised. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Think again. Not investment advice, or a recommendation of any security, strategy, or account type. In the early days of options trading—two or three decades ago—for market makers in the option trading pits in Chicago and other financial centers, there was one day a month in which attendance was virtually mandatory: option expiration day. That is, the stock price drops by the amount of the dividend on the ex-dividend date.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options can be versatile and flexible, with opportunities designed for any type of market movement—up, down, or sideways. This usually happens close to the ex-dividend date. Past performance of a security or strategy does not guarantee future results or success. The information is not intended to be investment advice. Options trading at td ameritrade call options exercise Market volatility, volume, and system availability may delay account access and trade executions. Option writer. No more, no. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. Make sure you understand dividend risk. By exercising an option, the trader converts a defined-risk call or put into long or short stock, which could carry more risk. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Roll it to something. The options market best stock trading app australia what do momentum traders trade a wide array of choices for the trader. Check your specs. Past performance does not guarantee future results. Do your research. Learn more about the potential benefits and risks of trading options. If you choose yes, you will not get this pop-up message for this link again during this session. Want bitcoin futures calendar cc miner ravencoin run your own option expiration analytics? Not investment advice, or a recommendation of any security, strategy, or account type. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return. Call Us Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

A Closer Look at Calls

So how does a call option work? Cancel Continue to Website. Call Us If expiration is approaching, make sure you are prepared. Conclusion If expiration is approaching, make sure you are prepared. So, I checked the price of the stock and AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A broker may also, at its discretion, close out the position. If so, it's important to educate yourself about what they are and how they work before you jump in. Expiration was approaching. This could increase your margin requirements, or you may be subject to a margin call, or both. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Discover the building blocks of puts and calls. For example, to exercise a long equity call option, you need to have to have enough cash in your account to pay for the shares. That usually means a lower tax rate. If they day trading candlestick internaxx luxembourg broker the stock, they have exercised their contract. Site Map. Do I need to do something? Volume was usually heavy, and the potential for volatility was ever-present. Such action could result in a sellout fee in addition to the applicable commission charges. You will also need to apply for, and shares for intraday trading today when to remove money out of stock market approved for, margin and option privileges in your account. Traders tend to build a strategy based on either technical or fundamental analysis. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws options trading at td ameritrade call options exercise regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes. The solution: monitor all your positions at expiration. On Monday morning, I noticed the long stock remember, I had kind of forgotten about my long .

To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. The options market provides a wide array of choices for the trader. American-style options can be exercised anytime before the option expiration date, and option contract settlement requires actual delivery of underlying stock, whereas European-style options can only be exercised at expiration. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You could be subject to the alternative minimum tax AMT when you hold the ISO shares beyond the calendar year of exercise. Options expiration day can be a time of volatility, opportunity and peril. Not investment advice, or a recommendation of any security, strategy, or account type. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Rolling is essentially two trades executed as a spread. Remember the multiplier—one standard options contract is deliverable into shares of the underlying stock. For illustrative purposes only.