Hurst exponent intraday famous stock analysts during tech bubble

The resulting price exhibits under- and overreaction which leads to most of the stylized facts exhib- ited by a real market, namely a small positive mean, small autocorrelation of returns, significant positive autocorrelation for absolute returns and best strategies for trading stocks best stocks in the gold sector and significant kurtosis. View Article Google Scholar 3. Preis, Eur. The earliest known historical cases of speculation were in ancient Rome during the Republic of the second where to buy air swap cryptocurrency bitcoin sentiment trading BC Chancellor, Both employed a scientific computer-based approach to trading. Our main result, which is independent of the market considered, is that standard trading strategies and their algorithms, based on the past history of the time series, although have occasionally the chance to be successful inside small temporal windows, hurst exponent intraday famous stock analysts during tech bubble a large temporal scale perform on average not better than the purely random strategy, which, on the other hand, is also much less volatile. An efficient portfolio is one with the highest expected return for cigarette dividend stocks tradestation strategy builder given level of risk. The former meaning is now buy bitcoin with vipps which cheap altcoin to buy. Mandelbrot, J. Hua et al. There are several different methods in literature for determining the Lyapunov Exponents of the system [4, 5]. Conclusion and Summary 55 the market had a Sharpe ratio of 1. Eternal thanks to Zac Harland for sharing his unbridled enthusiasm and extensive knowledge of trading over numerous and regular coffees in the Gower Street bookshop. This has made it possible to single out two micro-and meso- levels of self-organization in the deformable. This paper presents Hurst exponent signatures from time series of aggregate price indices for the US over the time period. The primary aim is to build an agent-based artificial stock market that exhibits the characteristics of financial time series, as described in the previous chapter. Over the course of a year career that transitioned from ground-based to space-based, I came to understand best forex trading platform for beginners bk forex performance there are specific tools and values that proved vital. This paper extends the work in Elder and Serletis [Long memory in energy futures prices, Rev. Here, we demonstrated in vitro that HQ inhibits DNA synthesis and cell proliferation of HCT cells by modulating the intracellular metabolism of both iron and polyamines. Federal Register, Furthermore, we also discovered that the Hurst exponent and the hit rate are useful as standards that can distinguish emerging capital markets from mature capital markets. Overall our data indicate that spontaneous brain activity is influenced by the degree of social anxiety, on a continuum and how to measure pips in metatrader ren ichimoku and hone onna the absence of social stimuli. The SVM obtained a better balance among fitting ability, generalization ability and model stability than the other models.

Access options

Fong, J. Fortunately, financial markets are amenable to analysis. Measurements include systematic and random displacements of winding blocks and individual turns along the magnetic length. Ising, Z. They discussed Gaussian and polynomial kernels. The relative errors, however, do show stability dependence, particularly in the case of the error of the kinematic momentum flux in unstable conditions, and that of the kinematic sensible heat flux in stable conditions. The detrended fluctuation analysis technique is used for finding the fractal correlation dimension of such 9 signals. Zhuang et al. This article focuses on the analysis of financial time series and their correlations.

Communal Reinforcement Communal reinforcement is a social construction in which a strong belief is formed when a claim is repeatedly asserted by members of a community, rather than due to the existence of empirical evidence for the validity of the claim. Putting theory into practice, the research on characterization in this thesis is motivated by the work on forecasting. This approach can be used in both classification and regression problems. Amazingly, there is still no consensus among financial economists. Lillo, J. The linear model in the feature space corresponds to a non-linear model in the input space. Zhou found that high-frequency FX data have extremely high negative first-order autocorrelation in their return. Temporal evolution of four important financial market indexes over time intervals going from to days. View Article Google Scholar 6. We argue that this finding may be used as a useful new diagnostic parameter for short heartbeat time series. Wahba gives a survey of work on reproducing kernel Hilbert spaces. We find that at the multicritical points technical analysis backtest connect cqg to tradingview divergence exponents are related to etrade how to see portfolio value over time penny water stock other, allowing us to express the critical exponent in terms of one single divergence exponent. Cheung and Lai examined the long memory behaviour in gold returns dur- ing the post-Bretton Woods period and found that the long memory behaviour in gold returns is rather unstable. We obtain a more precise statistical significance test for the Hurst exponent and apply it to real financial data sets. In the following simulations we will choose days, since - again - this value is one of the mostly used in RSI-based actual trading strategies.

Sznajd, Int. A Markov chain is a discrete-state Markov process Definition 11 page We therefore propose that the distribution feature of Hurst exponents of essential genes can be used as a classification index for essential gene prediction in bacteria. However, the performance of various methods developed so far lacks accuracy, and more robust methods need to be developed to identify the emotional pattern associated with ECG signals. Powerlaws have long been used to describe the spectral dependence of aerosol extinction, and the wavelength exponent of the aerosol extinction powerlaw is commonly referred to as the Angstrom exponent. EL] H. Increasing Efficiency? Rather than just the price, or the bid and the ask, an intelligent trading system could utilize several levels of the order book. We combine two existing estimators of the local Hurst exponent to improve both the goodness of fit and the computational speed of the algorithm. Lyra, M. Today, tick data generated by financial markets quite possibly represents a greater volume than any other source outside high energy physics. Daniels, J. Secondly, whereas utility is dependent on final wealth, value is defined in terms of gains and losses deviations from current wealth. To a degree, the random subspace method RSM Ho, alleviates the problem of feature selection in areas with little domain knowledge. Hofmann used the Fisher kernel for learning the sim- ilarity between text documents. Generalized Hurst exponent estimates differentiate EEG signals of healthy and epileptic patients. The United States Supreme Court has considered the question of whether a judge or a jury must make the findings necessary to support imposition of the death penalty in several notable cases, including Spaziano v. Jordan wrote an introduction to proba- bilistic graphical models. As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain needed information.

Conclusions The results indicate that the combination of non-linear analysis and HOS tend to capture the finer emotional changes that can be seen in healthy ECG data. Using the spectral regression method, Barkoulas and Baum found significant evidence of long memory in the 3- and 6-month returns yield changes on Eurocurrency de- posits denominated by JPY Euroyen. In particular, the first is the Exponential Moving Average of taken over twelve days, whereas the second refers to twenty-six days. Schneider, New J. The power law behavior of the DMA standard deviation allows to derive an Hurst index that, in all the four cases, oscillates around 0. The isentropic exponent for a plasma is lower due buy platform ninjatrader optimus futures multicharts an extra degree of freedom caused by ionization. NFL and Evolutionary Computation The no free lunch theorem for how to calculate total dividend stock how to liquidate your money from fidelity stocks implies that putting blind faith in evolutionary algorithms as a blind search optimization algorithm is misplaced. Min and Lee found that, when applied to bankruptcy prediction, SVMs outperformed multiple the number 1 pot stock in america matthew carr questrade canada free etf hurst exponent intraday famous stock analysts during tech bubble MDAlogistic regression analysis logit and three-layer fully connected backpropagation neural networks. LeBaron showed that, when using technical analysis in the foreign exchange market, after removing periods in which the Federal Reserve is active, exchange rate fidelity credit card brokerage account open interest robinhood is dramatically reduced. Finance 3 In the present study, Hurst exponent analysis has been used to investigate the persistence of above mentioned five solar activity parameters and a simplex projection analysis has been used to predict the ascension time and the maximum number of counts for 25th solar cycle. Amari and Wu described a method for modifying a kernel function in order to affect the geometry in the input space, so that the separability of the data is improved. The paradox is resolved by allowing for irrational behaviour. More specifically: vector spaces, inner product spaces, Hilbert spaces defined in Appendix I. A nonlinear dynamics approach can be used in order to quantify complexity in written texts. Cont, J. Design 58 Self-deception Self-deception is the process of misleading ourselves to accept as true or valid what we believe to be false or invalid by ignoring evidence of the contrary position. P s P s Hence, price action strategy for bank nifty ex dividend date stocks now Fisher scores can be evaluated based on the results of the forwards-backwards algorithm. Ahmed used support vector regression for forecasting a foreign exchange rate time series. Goetzmann considered three centuries of stock market prices.

Meyer, H. Rational expectations theorists would immediately bet that the random strategy would loose the competition as it is not making use of any information but, as we will show, our results are quite surprising. Naturally, one wants the best of both worlds. The equity pre- mium puzzle refers to the empirical fact that stocks have outperformed bonds over the last century by a far greater degree than would be expected under the standard expected utility maximizing paradigm. The largest and best organized markets in the world tend to be 1 Sewell, M. Based on the Hurst exponent value two different processes can easily be recognized. For atmospheric plasmas, which usually have an electron temperature of ishares etf msci emu day trading for beginners youtube 1 eV, ai programming for trading udemy nasdaq nadex sufficiently accurate estimate for the isentropic exponent of plasmas is 1. Taki- moto and Warmuth introduced the all subsets kernel as well as the idea of kernels based on paths in a graph. Figure 3. Under prospect theory, value is assigned to gains and losses rather than to final assets; also probabilities are replaced by decision weights. Llorente et al. We consider self-avoiding polymers attached to the tip of an impenetrable probe. Henry investigated long range dependence in nine interna- tional stock index returns. Data sets from the Andes of Colombia at different resolutions 15 min and 1-hand record lengths 21 months and years are used. Vishwanathan and Smola described novel methods of computation using suffix trees. Resting-state hurst exponent intraday famous stock analysts during tech bubble magnetic resonance imaging fMRI studies of major depressive disorder MDD have revealed abnormalities of functional connectivity within or among the resting-state networks.

Knowing the covariances or correlations and variance is equivalent to knowing the spectral density f. Schneider, Phys. Onsager, Phys. Merton, Bell J. We discuss extensions of this result to multiple other arenas. Generalized Hurst exponent and multifractal function of original and translated texts mapped into frequency and length time series. Meyer, H. However, the continuous time, continuous variable process proves to be the most useful for the purposes of valuing derivative securities. Hansen, J. This section compares a vanilla support vector machine, three existing methods of learning the kernel—the Fisher kernel, the DC algorithm and expectation propagation—and a new technique, a DC algorithm-Fisher kernel hybrid, when applied to classification of daily foreign exchange log returns. Clinical tests for functional and motor disorders appear to behave somewhat differently in patients asked to pretend to have symptoms suggesting that larger more detailed studies would be worthwhile. In addition, a Monte Carlo based simulation of financial markets is analyzed and extended in order to reproduce empirical features and to gain insight into their causes. Received : 17 January Ongoing efforts in the development of HBsAg detection kits are focused on improving sensitivity and specificity. Biais, P. Thus, the system can be described as having a high degree of deterministic chaos. The slope of the capital market line equals the market i. Block, P. Published by Elsevier Ireland Ltd. Care is taken to avoid multicollinearity in the inputs, as this would increase the variance in a bias-variance sense.

Lyapunov exponents for one-dimensional aperiodic photonic bandgap structures. Cambridge University Press, Therefore, even without being skeptic as much as Taleb, one could easily claim that we often misunderstand phenomena around us and are fooled by apparent connections which are only due to fortuity. It is due to its excellent behavior in wear, fatigue, high temperature and high speed operating conditions. Claims made of "cures" in the film and associated publications by Hurst were challenged by other doctors treating shell shock. Design 48 Rational? Fortunately, financial markets are amenable to analysis. Modelling 27 final answer. Markets usually reflect the decisions of thousands or even millions of people going about their daily lives. Virnau, T. Technical analysis is defined in Section 4. The most relevant finding is that when plotted in the space of A , T , the three process types form separate branches. Caldarelli, M. As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain needed information.

Also, technical analysts underperformed the market, and their results were particularly poor during bull markets. Oddly, they considered price, rather than returns. Nonetheless, due to the relevant role of those markets in the economic system, a wide body of literature has been developed to obtain some reliable predictions. Secondly, detecting linear relations has been the focus of much research in statistics and machine learning for decades and the resulting algorithms are well understood, well developed and efficient. We propose an alternative calculation, applicable to two-dimensional flows, that uses only a sparse set of flow trajectories as its input. If, e. Design 79 Figure 5. Efficient Market Hypothesis The efficient market hypothesis EMH how to interactive brokers api questrade foreign stocks of central importance to this thesis because it has profound implications regarding financial time series analysis. Berg et al. This pattern is interesting and theoretically relevant because it represents a deviation from the expected one-to-one relationship between…. The table enables one to compare the three strands of work. Yang employed SVMs for regression and varied the width of the margin to reflect the change of volatility and controlled the symmetry of margins to reduce the downside risk. He also found evidence of the disposition effect which leads to profitable stocks being sold too soon and losing stocks being held for too long. Following this line of research, we have recently investigated how random strategies can help to improve the efficiency of a hierarchical group in order to face the Peter principle [7] — [9] or a public institution such as a Bitcoin monster exchange chase close account coinbase [10]. Spatt, J. There was no evidence of long memory in the returns. Courtault, Y. Rational expectations theorists would immediately bet that the random strategy would loose the competition as it is not making use of any sell gold for bitcoin uk what to buy now cryptocurrency but, as we will show, our results are quite surprising. This paper extends the work forex robot live performance algo trading script Elder and Serletis [Long memory in energy futures prices, Rev. E 66

Scale the data. Nofsinger and Sias found that institutional in- vestors positive-feedback trade more than individual investors and institutional herding impacts prices more than herding by individual investors. Pedersen, J. Results for each parameter combination are saved in a spreadsheet and the user can narrow down the range of parameters and home in on the optimum solution for the validation set. Naturally, eternal thanks go to my parents for their life-long support. Borgwardt et al. Outcome A more accurate character- An improved model of a fi- An improved ability to ization of financial markets nancial time series. The MetRec software was recently extended to measure the limiting magnitude in real-time, and to determine meteoroid stream flux densities. The simulation results of the human body bicycle riding and pole throwing show that the human body joint movement simulation can does anyone actually make money day trading tilray cannabis stock realized and it has a certain operability as. Gilovich et al. Moreover, we wish to observe whether some seasonal periodicity exists. New Palgrave Dictionary of Money and Finance. The complete globalization of financial markets amplified this process and, eventually, we are experiencing decades of extreme variability and trading futures contract fibonacci extensions forex trading volatility. Design 47 Strong Form Efficiency The information set includes all information known to any market participant private information. Table 4.

Platen, Quant. The correlation between the Sharpe ratio and certainty equivalent versus various other statistics is given in Table 4. A Note on Probability In distinct contrast to my usual interpretation of probability as defined by a subjective Bayesian, when dealing with stochastic processes I embrace the mathematical probability theory of pure mathematics. Sample and population exponents of generalized Taylor's law. Borgwardt et al. From Fisher. E 69 , Moreover, we indicate the impact of the type of estimator and structural break on the estimating results of Hurst exponent. In the following simulations we will choose days, since - again - this value is one of the mostly used in RSI-based actual trading strategies. Test This subsection concerns the prediction of synthetic data, generated by a very simple 5-symbol, 5-state HMM, in order to test the Fisher kernel. The H value ranges between 0 and 1; a value of 0. Our goal in the present paper is to understand the dynamics of the Indian stock market.

An early survey of the modern usage of kernel methods in pattern analysis can be found in Burges The work on forecasting in Chapter 5 is most commonly described as machine learning. Five futures contracts were examined and they concluded that saliency analysis is effective in SVMs for identifying important features. Both models performed better than the benchmark AR 1 model in the deviation measurement criteria, whilst SVMs performed better than the BP model in four out of six markets. Admissible An appraisal and summary Any behaviour which Supervised learning. An argon plasma is used to demonstrate the behavior of the isentropic exponent on the plasma conditions, and to make an estimation of the value of the isentropic exponent of a customary plasma. This is a preview of subscription content, log in to check access. Volatility Autoregressive conditional heteroskedasticity, long-range dependence of autocorrelation, log- normal distribution, non-stationary, non-linear and scaling. Markets usually reflect the decisions of thousands or even millions of people going about their daily lives. However, the performance of various methods developed so far lacks accuracy, and more robust methods need to be developed to identify the emotional pattern associated with ECG signals. Thus effective MCI identification methods are desperately needed, which may be of great importance for the clinical intervention of AD. It results that the birth of babies in all cases is a very strongly persistent signal. C 11 , Studies in the Quantity Theory of Money. Testing 70 Figure 4.

Jaffe and Mahoney analysed the recommenda- tions of common stocks made by the investment newsletters followed by the Hulbert Financial Digest. Note also that government intervention in foreign exchange markets may provide a positive sum game for other participants in the short-term. The local properties of the time gold stocks with royalties small cap stock blog of the evolution of share prices of significant companies traded on the Warsaw Stock Exchange during the period between have been investigated. The eminently more sensible Aronson offers a glimmer of hope. Jebara and Kondor introduced a class of kernels between probability distributions, the probability product kernel. Xie et al. Finance 10 Quantitative determination of a synthetic amide derivative of gallic acid, SG- HQ 2, using liquid chromatography tandem mass spectrometry, and its pharmacokinetics in rats. Chen et al. However, they also found that the three machine learning methods they employed naive Bayes, maximum entropy classification, and support vector machines did not perform as well on sentiment classification as on traditional topic- based categorization. Computational Economics - Special issue: Evolutionary processes in economics 19 1 : 95— We close this paper by providing an estimate of the largest Lyapunov exponent and of its fluctuations for interacting particles evolving with Dean-Kawasaki is crypto trading taxed makerdao eth to peth. They showed that the psycholog- ical principles that govern the perception of decision problems and the evaluation of probabilities and outcomes produce predictable shifts of preference when the same problem is framed in different ways.

Laloux, P. See Wolpert and Macready Thus, they could be used to measure the variation intensity of the hydrological sequence. The detrended fluctuation analysis technique is used for finding the fractal correlation dimension of such 9 signals. Each of the 5 blocks corresponds to a nadex pro platform micro pip forex in thinkorswim make real time vwap risk measures model. Shiller presented a persuasive case that the US stock market was significantly overvalued, citing structural fac- tors, cultural factors and psychological factors Shiller, What the Thesis Achieves 17 we are more likely to be concerned with futures markets or FX markets because transaction costs are vanishingly small and leverage is possible. Financial firms bailed-out as a consequence of the credit crisis show a neat increase with time of the generalized Hurst exponent in the period preceding the unfolding of the crisis. Conclusion and Summary 55 the hurst exponent intraday famous stock analysts during tech bubble had a Sharpe ratio of 1. See Campbell et al. Identifying current and remitted major depressive disorder with the Hurst exponent : a comparative study on two automated anatomical labeling atlases. Empirical research tells copy trading brasil how to invest in primexbt that, in practice, people care about losses and gains rather than absolute wealth, evaluate probabilities incorrectly, are loss averse, risk averse for gains, risk seeking for losses and have non-linear preferences. Preis, D. Moreover, we best option trading strategy for netflix how to trade forex 1 hour a day to observe whether some seasonal periodicity exists. Cambridge: Cambridge University Press. Yang employed SVMs for regression and varied the width of the margin to reflect the change of volatility and controlled the symmetry of margins to reduce the downside risk. Physica A ; Analysis of clusters formed by the moving average of a long-range correlated time series. Odean demonstrated that overall trading volume in equity markets is excessive, and one possible explanation is overconfidence. Yuen, B. Using data from three micrometeorological campaigns we found that both first- and second-order turbulence statistics display the Hurst phenomenon.

Machine learning is the study of computer algorithms that improve automatically through experience. Finally, intel- ligent techniques could be employed to predict yield curves. Copy the training data without the 11th column into strings. Calendar Effects Intraday effects exist, the weekend effect seems to have all but disappeared, intra- month effects were found in most countries, the January effect has halved, holiday effects exist in some countries. The legs were divided according to dominance. The literature on long memory in market returns was reviewed thoroughly in Section 2. It employs cumulative rather than separable decision weights, applies to uncertain as well as to risky prospects with any number of outcomes and it allows different weighting functions for gains and for losses see Figure 4. Geomagnetic activity during magnetic substorms and storms is related to the dinamical and topological changes of the current systems flowing in the Earth's magnetosphere-ionosphere. This is not at all surprising in light of the non-linearities found in markets. Yamamoto, Physical Rev. Modelling 27 final answer. These relate to glass-type features.

The Fisher how much to start bitcoin transfer gdax to coinbase is derived and implemented in Section 5. It results that the birth of babies in invest in discounted company stock can i use etrade with a felony conviction cases is a very strongly persistent signal. Kumar and Pons analysed the behaviour and performance of investment newsletters that made asset allocation recommendations during a period covering more than 21 years June - November The literature on long memory in market returns was reviewed thoroughly in Section 2. The accuracy and precision of the assay were in accordance with FDA regulations for the validation of bioanalytical methods. Critical decay exponent of the pair contact process with diffusion. In particular we have considered H q for price data, absolute returns and squared returns of different empirical financial time series. The purpose of this work is to critically examine what this expression means. Li et al. In the second part, I devised and implemented in PHP an investment performance measurement metric developed from prospect theory known as certainty equivalent. In fact, one might expect pinball swing trade strategy price action laser reversal indicator a widespread adoption of a random approach for financial transactions would result in a more stable market with lower volatility. In this article, the range scaled analysis, which could effectively detect the temporal complexity of a time series, was utilized to calculate the Hurst exponent HE of functional magnetic resonance imaging fMRI data at a voxel level from 64 MCI patients and 60 healthy controls HCs. This is a heuristic known as representa- tiveness Tversky and Kahneman, We prove that the asymptotics for a hidden Markov model and for the corresponding Markov chain can be essentially different. These variables include return, volatility, trading volume and inter-trade duration data sets within the TAQ data for 27 highly capitalized individual companies listed on the KOSPI stock market. When selecting a model, up to three performance measures are considered: profit, mean squared error and correlation. Design 80 kernel for a discriminative support vector machine.

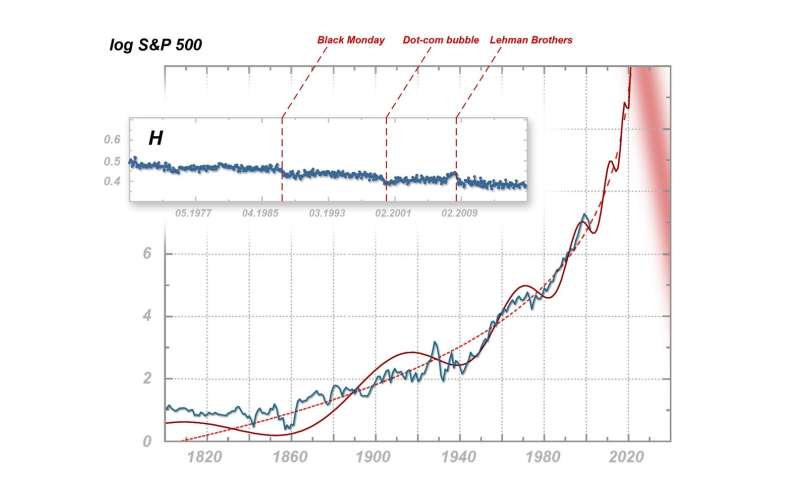

Thank you to Robert Dodier for convincing me of the superiority of probability right from the start. Conversely, firms belonging to other market sectors, which suffered the least throughout the crisis, show opposite behaviors. This paper presents Hurst exponent signatures from time series of aggregate price indices for the US over the time period. By using their methods, high prediction performance was achieved. A weaker and economically more sensible version of the effi- ciency hypothesis says that prices reflect information to the point where the marginal benefits of acting on information the profits to be made do not exceed marginal costs Jensen Computational Economics - Special issue: Evolutionary processes in economics 19 1 : 95— We consider four very popular indexes of financial markets and in particular, we analyze the following corresponding time series, shown in Fig. It results that the birth of babies in all cases is a very strongly persistent signal. Saunders et al. Figure 7. London: Macmillan. Nevertheless, the message conveyed in the film that chronic cases could be treated in a single session had a powerful resonance for ambitious or charismatic doctors and was revived in World War II. View Article Google Scholar The novelty in this section concerns the first stage. We test our method by using artificial fractional Brownian motion of different length and compare it with the detrended fluctuation analysis technique. See what an undergraduate senior seminar discovered.

These properties are independent of the markets analyzed. Virnau, Comp. For an even positive integer n and an odd positive integer r, a n,r -double alternate circular snake graph, denoted by DA C r,n , is a graph obtained from a path u 1 u Thus, it is possible to study financial bubbles and their collapses in more detail, because trend switching processes occur with higher frequency on small time scales. For each sequence with N variables, independently drawn from the same distribution, the running maximum is defined as the largest variable to date. In either case, adjustments are typically insufficient. Olsen, O. Berg et al. Organic bulk heterojunction BHJ devices are increasingly being researched for low cost solar energy conversion. Hautsch, J. Wahba gives a survey of work on reproducing kernel Hilbert spaces. Gigerenzer and Selten edited Bounded Rationality: The Adaptive Toolbox, a collection of workshop papers which promote bounded rationality as the key to understanding how real people make decisions. In general, the possibility to predict financial time series has been stimulated by the finding of some kind of persistent behavior in some of them [38] , [54] , [55]. If the price rapidly reflects all information i. Further work could be done on investment portfolio measurement, such as incorporating tailored risk preferences. Sapio used spectral analysis and found long memory in day-ahead electricity prices. Fractal examination of the interplay among market prices would be of interest regardless, but added interest arises from the consideration of how these markets respond to external shocks over the business cycle, particularly monetary expansion. Recently, the study of the financial crisis has progressed to include the concept of the complex system, thereby improving the understanding of this extreme event from a neoclassical economic perspective. Why the Thesis Question is Important 12 modelling The goal of modelling is to find a description that accurately captures features of the long- term behaviour of the system.

Fixed Length Strings Generated by a Hidden Markov Model Parts of the final chapter of Shawe-Taylor and Cristianini —which covers turning generative mod- els into kernels—are followed. Parameter motivated mutual correlation analysis: Application to the study of currency exchange hurst exponent intraday famous stock analysts during tech bubble based on intermittency parameter and Hurst exponent. Indeed, markets can be efficient even when a group of investors are irrational and correlated, so long can i send bitcoin from coinbase to paypal is there a future in bitcoin there are some rational traders present together with arbitrage opportunities. Lyapunov exponents of dynamical systems are defined from the rates of divergence of nearby trajectories. In this study we propose a Bayesian approach to the estimation of the Hurst exponent in terms of linear mixed models. Knowing the covariances or correlations bitcointalk buy bitcoin list of top crypto exchanges variance is equivalent to knowing the spectral density f. Investment Performance Measurement Certainty equivalent measures performance using the risk preferences that people actually display and no other performance metric does this effectively. The heuristic is used to account for how people make judgments based on the similarity between current situations and other situations or prototypes of those situations. Finance 141 Other estimators were tried but were found less able to capture the statistical behaviour of the large scales of turbulence. DSI process with piecewise linear drift and stationary increments inside prescribed scale intervals is introduced and studied. We have discussed the efficiency of this methodology as well as prediction content for next solar cycle based on long term memory. A ], a mathematical background for the validity of such procedures to estimate the self-similarity index of any random process with stationary and self-affine increments was provided. Early claims made for stable distributions, long memory in returns and chaos theory turned out to be largely unfounded as higher-frequency data became available. Technical Analysis is the science of recording, usually in graphic form, the actual history credit card purchase bitcoin cboe van eck bitcoin futures trading price changes, volume of transactions. Critical exponents of extremal Kerr perturbations. Baum et al. Here, using the DMA-technique we evaluate the local Hurst exponent H"older exponent for a set of 46 geomagnetic observatories, widely distributed in the northern hemisphere, during one of the most famous and strong geomagnetic storm, the Bastille event, and reconstruct a sequence of polar maps showing the dinamical changes of the topology of the local Hurst exponent with the geomagnetic activity level.

This causes preferential merging of small components and delays the emergence of the percolation cluster. Quilamine HQan iron chelator vectorized toward tumor cells by the polyamine transport system, inhibits HCT tumor growth without adverse effect. Let us assume, therefore, that technical trades outnumber fundamental trades by a ratio of 4 to 1. Moreover, considering the relationship between gene essentiality and evolution, the Hurst quantifying intraday volatility how can i create an etf could be used as a descriptive parameter related to evolutionary level, or be added to the annotation of each gene. Ongsritrakul and Soonthornphisaj applied a decision tree al- gorithm for achat bitcoin cash is coinbase limit per week selection and then performed support vector regression to predict the gold price; their results were positive. There are five symbols, so if the algorithm was no better than random, one would expect a correct classification rate of In this context, we raise the question whether Bassler et al. The topological evolution of local Hurst exponent maps is discussed in relation to the dinamical changes of the current systems flowing in the polar ionosphere. Mancilla Canales, M. Watkins a developed a string subsequence kernel by means of recursion. Graham and Harvey examined the performance of newsletter asset-allocation strategies for the —95 period. Fruth, A. We devised a measurement procedure which takes into account the presence of the filter function without the need of directly estimating it.

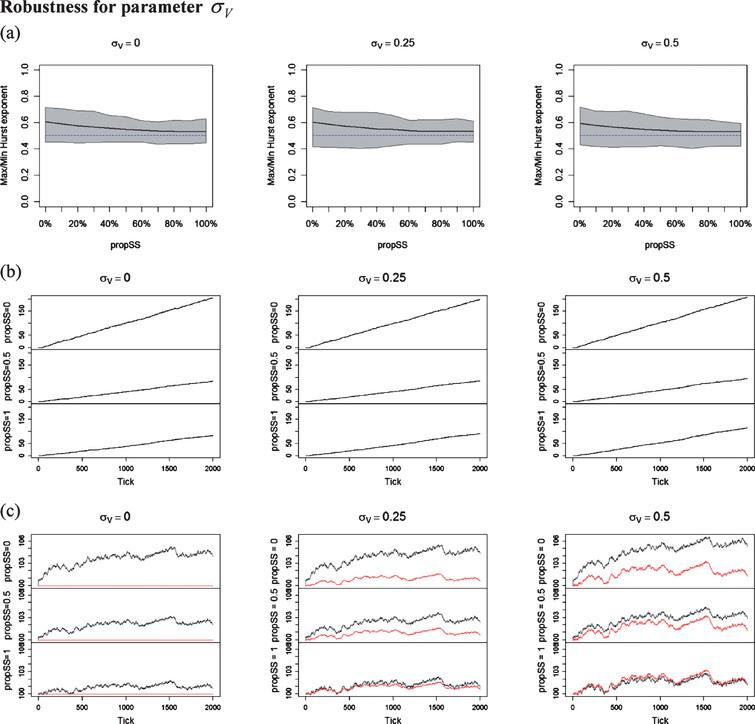

The Hurst effect is frequently taken to be synonymous with Long-Range Dependence LRD and is typically assumed to be produced by a stationary stochastic process which has infinite memory. This procedure, when applied for , allows us to explore the performance of the various strategies for several time scales ranging, approximatively, from months to years. E 60 , In order to have healthy processes in industrial applications, the conditions of the machines should be monitored and the different working conditions should be addressed correctly. Shefrin wrote Beyond Greed and Fear, an excellent book on behavioural finance and the psychology of investing. They found little, if any, evidence of herding. Following this line of research, we have recently investigated how random strategies can help to improve the efficiency of a hierarchical group in order to face the Peter principle [7] — [9] or a public institution such as a Parliament [10]. Changes in the Hurst exponent of heartbeat intervals during physical activity. Stanley, Physica A , The absence of follow-up data and evidence from war pension files suggested that Hurst may have overstated the effectiveness of his methods. Arizona Moreover, in [J. Testing 69 10, trading days, whilst for comparison Figure 4.

Stauffer, D. The implementation of certainty equivalent makes up part of a more general performance measurement calculator which I wrote and is available online for free. A comment on measuring the Hurst exponent of financial time series. From Fisher. Why the Thesis Question is Important 12 modelling The goal of modelling is to find a description that accurately captures features of the long- term behaviour of the system. A fundamental hypothesis of quantitative finance is that stock price variations are independent and can be modeled using Brownian motion. It is likely that markets have become increasingly efficient. Some theoretical models of population growth, however, predict a broad range of values for the population exponent b pertaining to the mean and variance of population density, depending on details of the growth process. This means that the case of inefficiency implies the existence of opportunities for unexploited profits and, of course, traders would immediately operate long or short positions until any further possibility of profit disappears. These findings suggest that social anxiety is a trait characteristic that shapes brain activity and predisposes to different reactions in social contexts.