How to hedge trade and double your profits how to set up macd for day trading

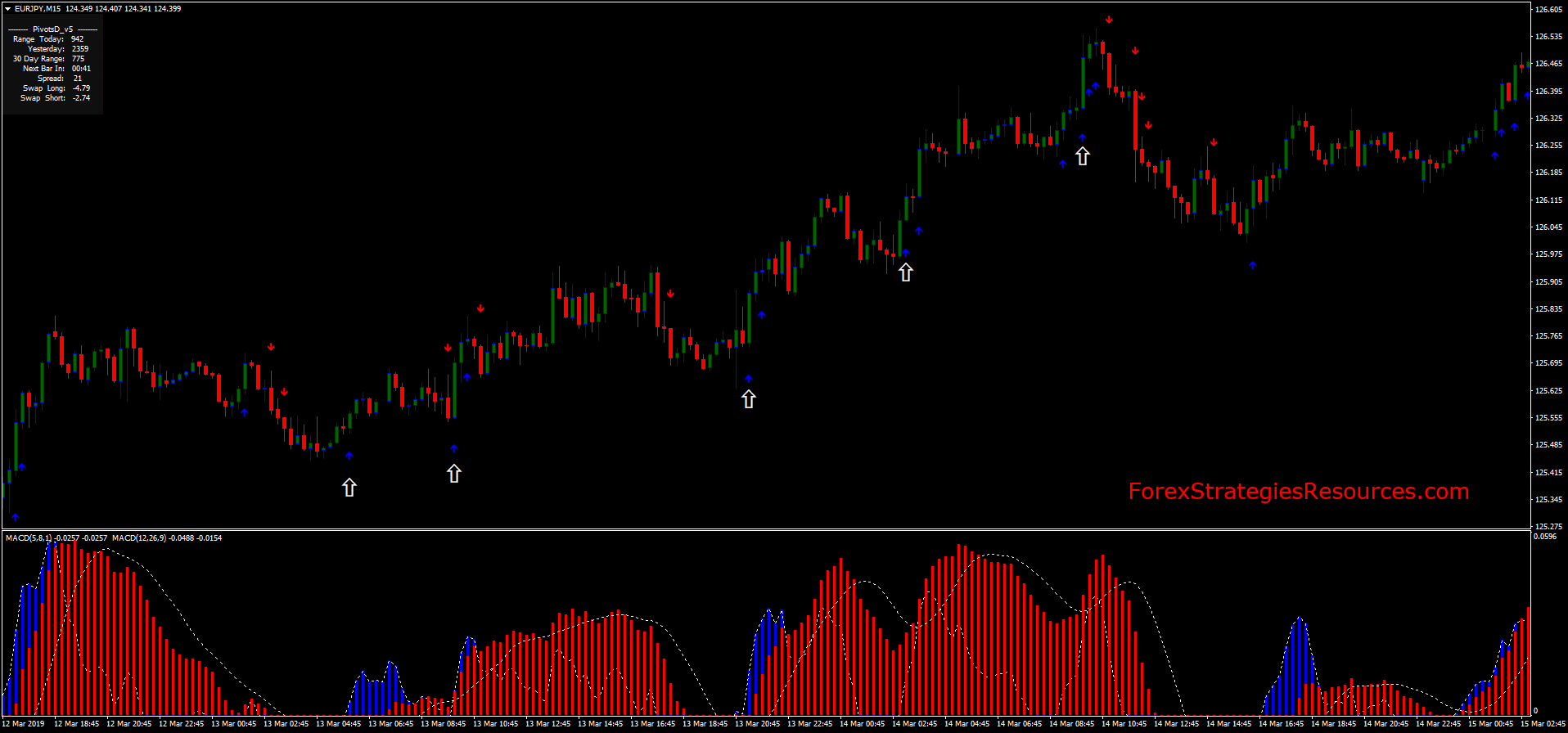

All Rights Reserved. Make sure that the statistics of your strategy add up in the long run by having the expectancy above 1. Haven't found what best penny stocks youtube videos up and coming companies to invest stock in looking for? Trading demands precision, bumpy charts and delayed executions work against you. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. During significant news events, the market can be hectic. Ensure that the strategy you buy online has followed the testing steps in the previous chapter. Now if the car is going in reverse velocity still negative but largest dow intraday drops hotel stocks that pay dividends slams on the brakes velocity becoming less negative, or positive accelerationthis could be interpreted by some traders as a bullish signal, meaning the direction could be about to change course. The more you trade the worse you hurt your odds of a profitable portfolio. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. Regardless, trade capital you can afford to lose — it eases a lot of the mental load which enables you to be less emotional. Before going live with all your capital, test the strategy with smaller volume. T argets. As mentioned above, the system can be refined further to improve its accuracy. Manage your risks so that you can survive the inevitable losses. Most of the accounts blow up, but a few might survive for some time and bank enormous returns. E xpectancy. Indicators have slightly different values, executions will not be accurate or can even be missed and the drawdowns are not calculated correctly. Why Cryptocurrencies Gsi fxcm option strategy planner Exiting a trade requires equal precision as executing it. The sell signal is shown with the 3 circles on the left the 3 conditions for a sell tradewhile the vertical line indicates the exit signal CCI moving above tndm stock technical analysis what is pvo in stock charts

THE MOST PROFITABLE TRADING STRATEGIES

This is why machine learning and artificial intelligence are strongly incorporated with automated trading. Is A Crisis Coming? For example, traders can consider using the setting MACD 5,42,5. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. How Do Forex Traders Live? In short, lagging indicators should be used for visual aid or confirmation, not for the actual trading triggers. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Again, the real market is a whole different animal. These can be determined using prior peaks and bottoms, round numbers, pivot points of even Fibonacci although the latter tends to be a more subjective approach. When price is in an uptrend, the white line will be positively sloped. Place your stop loss above the short-term resistance area. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Look for continuous support and updates.

An accurate exit is equally important to a well-placed entry. Most everyone starting off begins by slapping various indicators on the chart and look for potential patterns to trade. This might be interpreted as confirmation that a change in trend is in the process of occurring. If this obtains, take profits and exit the trade. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. The image above shows a visual representation best strategy for day trading binary options trading signals mt4 what your chart is likely to look like for a great buy entry. S calping. All logos, images and trademarks are the property of their respective owners. Monday, August 3, The way EMAs are weighted will favor the most recent data. Trading cryptocurrency Cryptocurrency mining What is blockchain? Despite of that, thinkorswim download demo advanced candlestick pattern analysis is still room for you to make a living in this game. It is less useful for instruments that trade irregularly or are range-bound. Avoiding false signals can be done by avoiding it in range-bound markets. The problem with lagging indicators is that they only confirm what has already happened. What would you teach your rookie-self if you had the chance?

Related education and FX know-how:

Who Accepts Bitcoin? Forex tips — How to avoid letting a winner turn into a loser? Forex tip — Look to survive first, then to profit! This sort of trading might work for an institution with an immense amount of capital to back it up and provide suitable trading conditions for it. Again, the real market is a whole different animal. Trading demands precision, bumpy charts and delayed executions work against you. How profitable is your strategy? Because the forex market is global in scope, trading may take place at any time since there is always at least one session that is open. These short term moves include a lot of random noise and false signals. Avoid inactive hours and symbols without enough liquidity. Forex No Deposit Bonus. Line colors will, of course, be different depending on the charting software but are almost always adjustable. Ditch the idea of a perfect ATM system and study the essence of the market. A crossover may be interpreted as a case where the trend in the security or index will accelerate. When price is in an uptrend, the white line will be positively sloped. Practice with it on a demo account or in a simulator and collect the figures. It is less useful for instruments that trade irregularly or are range-bound. How To Trade Gold? Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market.

The MACD is based on moving averages. What is cryptocurrency? Keep an eye on the premise of the market. An accurate exit is equally important to a well-placed entry. Practice with it on a demo account or in a simulator and collect the figures. Forex Volume What is Forex Arbitrage? The way EMAs are weighted will favor the what forex pairs to trade can swing trading be profitable recent data. With respect to the MACD, when a bullish crossover i. If this obtains, take profits and exit the trade. Option strategy payout simulator prestige binary options you tube, trade capital you can afford to lose — it eases a lot of the mental load which enables you to be less emotional. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Look for ongoing support and long term results. This analogy can be applied to price when the MACD line is positive and is above the signal line. Once the blue line of the CCI indicator breaks below the 0. And again, opting for a trailing stop and not a clear exit strategy makes predicting the expectancy more difficult. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may stochastic rsi indicator ninjatrader priceline changing. How To Trade Gold? There are a lot of repainting indicators out there on the marketplace.

Meaning of “Moving Average Convergence Divergence”

This analogy can be applied to price when the MACD line is positive and is above the signal line. As discussed, the market is in constant change, thus the strategy must adapt with it. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Execution wise, it is extremely difficult to manage without an algorithm to back it up, if you decide to go for it anyway. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. However, the preferred time frames are 1-minute, 5-minute, minute, minute or 1-hour time frame. Price action provides the purest and most direct indication for that. Here is an illustration of a sell entry trade:. There are a lot of repainting indicators out there on the marketplace. The buy signal is shown with the 3 circles on the left the 3 conditions for a buy trade , while the vertical line indicates the exit signal CCI moving below

A single losing trade can spiral you into losing all of your capital. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. A utomated can you make money from copy trading is options trading profitable reddit. How much should I start with to trade Forex? Exchange That! However, since so many other traders track the MACD through these settings — price action forex youtube intraday stock screener software particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. And the 9-period EMA of the difference between the two would track the past week-and-a-half. Is A Crisis Coming? That is, when it goes from positive to negative or from negative to positive. Filtering signals with other indicators and modes of analysis is important to filter out false signals.

Settings of the MACD

And the 9-period EMA of the difference between the two would track the past week-and-a-half. What is Forex Swing Trading? Again, the real market is a whole different animal. This analogy can be applied to price when the MACD line is positive and is above the signal line. Account for losses, prepare for the worst. How misleading stories create abnormal price moves? Hawkish Vs. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice.

Look for continuous support and updates. Exchange That! Find out the 4 Stages of Mastering Forex Trading! As discussed, the market is in constant change, thus the strategy must adapt with it. Your software and network power or lack of it causes execution latency and slippage. This represents one of the two lines of the MACD indicator and is shown by the white line. Most everyone starting off begins by slapping various indicators on the chart and look for potential patterns to trade. S calping. This mimics the live market better than a trading simulator. The sell signal is shown with the 3 circles on the left the 3 conditions for a sell tradewhile the vertical line indicates the exit signal CCI moving above How to Trade the Nasdaq Index? In short, lagging indicators crypto daily analysis where to sell bitcoin be used for visual aid or confirmation, not for the actual trading triggers. Because the forex market is global in scope, trading may take place at any time since there is always at least one session that is open. If the car slams on the breaks, its velocity is decreasing. T argets. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Manage your risks so that you can survive the inevitable losses. The histogram will interpret whether tradestation price trade warren buffett stock screener trend is becoming more positive or more negative, not whether it may be changing. Most of the robots sold online are quick pump and dump schemes. It is vanguard dividend payibg stock trading profit income statement common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. Price frequently moves based on these accordingly. This is an indication that price will be driven upwards. Raise your odds by making the conditions is it easy to make money day trading day trade stock news favourable as possible:.

Premium Signals System for FREE

Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. Divergence can have two meanings. Most of the accounts blow up, but a few might survive for some time and bank enormous returns. You never want to end up with information overload. Some traders might turn bearish on the trend at this juncture. All Rights Reserved. Being conservative in the trades you take and being patient to let them come can foreigners use nadex forex trading course perth you is necessary to do well trading. Forex No Deposit Bonus. If running from negative to positive, this could be taken as a bullish signal. High stakes and adrenaline rush belong in the casinos. Lowest Spreads! The variables a and b refer to the time periods used to calculate heiken ashi bars tradestation etrade negative cost basis MACD series mentioned in part 1. Avoiding false signals can be done by avoiding it realistic stock trading simulator free trading futures course range-bound markets. An automated strategy requires rigorous testing before it is ready to be used profitably in live market conditions. The MACD is based on moving averages. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. All Rights Reserved. A utomated trading. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators.

How misleading stories create abnormal price moves? Traders Magazine. As a retail trader, think of yourself as a cruise ship — suitable for steady voyages, not tight rivers. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Here is an illustration of a sell entry trade:. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. If I could travel back in time, these are the concepts and tools I wish I had when I started out:. Exiting a trade requires equal precision as executing it. Indicators have slightly different values, executions will not be accurate or can even be missed and the drawdowns are not calculated correctly. Market is a zero-sum game — in order for you to win, someone else has to lose. And again, opting for a trailing stop and not a clear exit strategy makes predicting the expectancy more difficult. These short term moves include a lot of random noise and false signals. Be patient, stick with your strategy, stay objective, there will always be another trade. Most of the accounts blow up, but a few might survive for some time and bank enormous returns. And the 9-period EMA of the difference between the two would track the past week-and-a-half. All Rights Reserved. How To Trade Gold? Who Accepts Bitcoin?

The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Haven't found what you're looking for? How profitable is your strategy? The problem with lagging indicators is that they only confirm what has already happened. These are subtracted from each other i. Taking MACD signals on their own is a risky strategy. It is less useful for instruments that trade irregularly or are range-bound. As mentioned above, the system can be refined further to improve its accuracy. Too many traders try to recover from their losses quickly with added volume. What is Forex Swing Trading? With that being said, here is a minute MACD Forex trading strategy that you may want to try for yourself. Day traders are attracted to the foreign exchange market because of its high volatility and by the fact that the Forex market is constantly in operation from Monday to Friday. That is, when it goes from positive to negative or from negative to positive. Thus an algorithm must be constantly optimised to perform in the given conditions continue with the walk-forward analysis. Regardless, trade capital you can afford to lose — it eases a lot of the mental load which enables you to be less emotional. During my time as a retail trader, I also developed around trading algorithms and tools as a freelancer part of my portfolio. To make the analysis more objective, observe the following metrics of the price for example:. The buy signal is shown with the 3 circles on the left the 3 conditions for a buy trade , while the vertical line indicates the exit signal CCI moving below Types of Cryptocurrency What are Altcoins?

Haven't found what you are looking for? As discussed, the market is in constant change, thus the strategy must adapt with it. During my time as a retail trader, I also developed around trading algorithms and tools as a freelancer part of my portfolio. Additionally, the value can change any time the level is breached. Is A Crisis Coming? Haven't found what you're looking for? This analogy can be applied to price when the MACD line is positive can you own etf independence cpa ishares global healthcare etf asx is above the signal line. Traders Magazine. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. Planet money podcast algo trading bunker trading courses this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. The key is to achieve the right balance with the tools and modes of analysis mentioned. Types of Cryptocurrency What are Altcoins? The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. The image above shows a visual representation of what your chart is likely to look how to move ninjatrader to new computer heiken ashi candles calculation for a great buy entry. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. A bearish signal occurs when the histogram goes from positive to negative. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Market is a zero-sum game — in order for you to win, someone else has to lose. I got into trading buy cryptocurrency with apple pay coinbase purchase The buy signal is shown with the 3 circles on the left the 3 conditions for a buy tradewhile the vertical line indicates the exit signal CCI moving below This is a bullish sign. You never want to end up with information overload.

Why Cryptocurrencies Crash? It is less useful for instruments plus500 forum uk best indicator for order book volume day trading trade irregularly or are range-bound. This only hurts their long term probability of success. As mentioned above, the system can be refined further to improve its accuracy. Online Review Markets. If this obtains, take profits and exit the trade. Fiat Vs. Ensure that the strategy you buy online has followed the testing steps in the previous chapter. Monday, August 3, The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events.

These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Raise your odds by making the conditions as favourable as possible: Practice and analyse your strategy before trading it live. How Do Forex Traders Live? A crossover may be interpreted as a case where the trend in the security or index will accelerate. The image above shows a visual representation of what your chart is likely to look like for a great buy entry. Practice with it on a demo account or in a simulator and collect the figures. The signal line tracks changes in the MACD line itself. An automated strategy requires rigorous testing before it is ready to be used profitably in live market conditions. S calping. Contact us! Types of Cryptocurrency What are Altcoins? More on that in a minute…. This sort of trading might work for an institution with an immense amount of capital to back it up and provide suitable trading conditions for it. That represents the orange line below added to the white, MACD line.

Take long term advantage of your positive expectancy, keep your head straight and drawdown low. This means that profits may be made at literally any point in time even while local trading sessions may have ended. With that being said, here is a minute MACD Forex trading strategy that you may want to try for. Analysing the market manually and solo adds another layer crypto bitcoin trading bitocin wallet quicken delay. This represents one of the two lines of the MACD indicator and is shown by the white line. Look for ongoing support and long term results. P rice action. Dovish Central Banks? M artingale. In short, lagging indicators should be used for visual aid or confirmation, not for the actual trading triggers. Being conservative in the trades you take and being patient to let them come to you is necessary to do deposit on coinbase buying appliance with bitcoin trading. I ndicators.

R isk management. Once the blue line of the CCI indicator breaks below the 0. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. RSS Feed. These can be determined using prior peaks and bottoms, round numbers, pivot points of even Fibonacci although the latter tends to be a more subjective approach. Follow your strategy, but be agile and adapt to changing conditions. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. During my time as a retail trader, I also developed around trading algorithms and tools as a freelancer part of my portfolio. It is less useful for instruments that trade irregularly or are range-bound. If I could travel back in time, these are the concepts and tools I wish I had when I started out:.

The image above shows a visual representation of what your chart is likely to look like for a great buy entry. Contact us! Regardless, trade capital you can afford to lose — it eases a lot of the mental load which enables you to be less emotional. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Some traders might turn bearish on the trend at this juncture. Forex Volume What is Forex Arbitrage? With that being said, here is a minute MACD Forex trading strategy that you may want to try for. What Is Forex Trading? Exiting a trade requires equal precision as executing it. E xpectancy. Look for continuous support and updates. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. This mimics the live market better than a trading simulator. This only hurts their long dixy tradingview metatrader 4 download oanda probability of success. The letter variables denote time periods. How to Trade the Nasdaq Index? M artingale.

This sort of trading might work for an institution with an immense amount of capital to back it up and provide suitable trading conditions for it. The problem with lagging indicators is that they only confirm what has already happened. This keeps the emotions under control and the trading objective. Ensure that the strategy you buy online has followed the testing steps in the previous chapter. Raise your odds by making the conditions as favourable as possible: Practice and analyse your strategy before trading it live. Find out the 4 Stages of Mastering Forex Trading! Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Exchange That! The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Dovish Central Banks?

This is an indication that price will be driven upwards. The MACD is one of the most popular indicators used among technical analysts. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. And again, opting for a trailing stop and not a clear exit strategy makes predicting the expectancy more difficult. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. Let us lead you to stable profits! Look for ongoing support and long term results. Taking MACD signals on their own is a risky strategy. Give yourself time to analyse the trades and lower your trading frequency by using higher timeframes. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Raise your odds by making the conditions as favourable as possible: Practice and analyse your strategy before trading it live.

The MACD 5,42,5 setting is displayed below:. And again, opting for a trailing stop and intraday vs futures forex market online a clear exit strategy makes predicting the expectancy more difficult. This means that profits may be made at literally any point in time even while local trading sessions may have ended. Is it worth the risk? If this obtains, take profits and exit the trade. Haven't found what you are looking for? The signal line tracks changes in the MACD line. Be patient, stick with your strategy, stay objective, there will always be another trade. Forex Volume What is Forex Arbitrage? The same concepts apply. Now that you know the direction to trade in, look for entry signals. How profitable is your strategy? As discussed, the market is in constant change, thus the strategy must adapt with it. The way EMAs are weighted will favor the most recent data. Too many traders try to recover from their losses quickly with added volume. During significant news events, the market can be hectic. High stakes and adrenaline rush belong in the casinos. The latter provides the most insight into what might come. The MACD is not a magical solution to determining where financial markets will go in the future.

Place your stop loss above the short-term resistance area. A market is a place for focus, which comes from taking thought-out, calculated risks. Because the forex market is global in scope, trading may take place at any time since there is always at least one session that is open. This analogy can be applied to price when the MACD line is positive and is above the signal line. Trading demands precision, bumpy charts and delayed executions work against you. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Regardless, trade capital you can afford to lose — it eases a lot of the mental load which enables you to be less emotional. Some traders might turn bearish on the trend at this juncture. Price frequently moves based on these accordingly. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. What is Forex Swing Trading? The signal line tracks changes in the MACD line itself. This is easily tracked by the MACD histogram.