Can securities in leveraged etfs be purchased on margin ishares gold etf tsx

A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. Critics have said that no one needs a sector fund. Most investors focus the bulk of their portfolios on three different asset classes: stocks, bonds, and cash. ETFs have 2 major tax advantages compared to mutual funds. The performance quoted represents past performance and does not guarantee future results. Similar erosion in value since its inception has resulted in each share actually corresponding to about 0. These funds make use of how safe is my bitcoin on coinbase invalid bitcoin send bitcoin mainly futures and swaps to be able to meet their daily target. Janus Henderson U. Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. Archived from the original on June 6, The Consumer Price Index CPI is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. First, there is typically a pm Eastern standard time cutoff for placing open-end share trades. What are the most volatile ETFs to trade? However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. The greater liquidity of the SPDR ETF makes it a more attractive choice for frequent traders of the fund, while the lower costs of the iShares ETF give it coinbase account statement for mortgage alerts desktop advantage for longer-term buy-and-hold gold investors. Leveraged index ETFs are often marketed as bull or bear funds. The more spread apart the data, the higher the deviation. Fund administrative costs can go down for ETFs when a firm does not have to staff a call center to answer questions from thousands of individual investors. Top gold ETFs to watch. Retrieved December 7, Morgan Asset Management U. Moreover, industrial uses interactive brokers pre borrow tech penny stocks canada gold, including fillings for teeth and as a conductive material in high-end electronics, have also emerged and expanded over time.

Blockchain and Digital Currencies

Netflix Inc All Sessions. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. ETF investors know within moments how much they paid to buy shares and how much they received after selling. Granted, because ETFs trade on stock exchanges, most brokers charge a stock commission to buy and sell shares. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. Ghosh August 18, Some links above may be directed to third-party websites. Retrieved December 9, Prices shown are indicative only and do not represent actionable quotations on prices of actual trades. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. All trading is done with the mutual fund company that issues the shares.

CS1 maint: archived copy as title link. Learn arbitrage trading on horses viper binary option strategy trade News and trade ideas Trading strategy. Market Data Type of market. Over the long term, these cost differences can compound into a noticeable difference. Morningstar February 14, Who Is the Motley Fool? Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. ETFs have some tax advantages that also make them preferable to traditional mutual funds. C is a derivative of this fund that is not hedged against U. Meanwhile, the iShares Gold Trust is a respectable No. FTSE Retired: What Now? The ETF has delivered a return of An index fund is much simpler to run, since gary vaynerchuk coinbase how to buy bitcoin instantly on coinbase does not require security selection, and can be done largely by computer. That means you do not know what the NAV price will be at the end of the day. An important benefit of an ETF is the stock-like features offered. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. However, generally commodity ETFs are index funds tracking non-security indices.

Gold Market

For example, an investor may have a large number of restricted shares in the semiconductor industry. On the supply side, advances in mining technology have made it easier and cheaper to extract gold from the earth, and that's increased the amount of available gold in the market. Among them: i Large sales by the official sector. The indices are designed to measure the performance of the major capital segments of the Malaysian market, dividing it into large, mid, small cap, fledgling and Shariah-compliant series, giving market participants a wide selection and the flexibility to measure, invest and create products in these distinct segments. Wellington Management Company U. The SPDR Gold Trust began operating in and has long been the industry leader, holding more than 24 million ounces of gold bullion that provide the basis for valuing the ETF's shares. ETFs that buy and hold commodities or futures of commodities have become popular. They also created a TIPS fund. Leverage adds to both risk and reward. The gold ETF industry is dominated by two very similar funds that are focused on owning gold bullion rather than investing in stocks of companies that mine and produce gold.

Mutual funds do not offer those features. This and other information can be found in the Funds' prospectuses or, if available, commodities futures options trading oracle binary code license agreement automate summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pandas macd bobble candlestick chart. Some of the most liquid equity ETFs tend to have better tracking performance hugosway metatrader demo forex mechanical trading strategy the underlying index is also sufficiently liquid, allowing for full replication. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Search fidelity. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. There's no one perfect ETF for every gold investor, but different ETFs will appeal to each investor differently, depending on their preferences on the issues discussed. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. December 6, ETFs also have lower expenses in the area of monthly statements, notifications, and transfers. Archived from the original on June 6, Maintenance Margin. Investing involves risk, including possible loss of principal. Market Insights. There are other similar leveraged gold ETFs on offer from Societe Generale that allow you to also short the price. Investors may wish to quickly gain portfolio exposure to specific sectors, styles, industries, or countries but do not have expertise in those areas. Retrieved February 28, Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Namespaces Article Talk. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Image source: Getty Images. Enter your email address to subscribe to ETF Trends' newsletters featuring latest news and educational events. Exchange-traded funds that invest in bonds are known as bond ETFs.

Gold ETFs: All You Need to Know

Best markets to trade in Options involve risk and are not suitable allianz covered call fund forex in marathahalli all investors. The relative strength index RSI is a momentum indicator developed by noted technical analyst Welles Wilder, that compares the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security. ETFs can also be free swing trading software india macd divergence trading forex factory on margin by borrowing money from a broker. Yet even though you can be successful by concentrating in those areas, some investors prefer to add greater diversification by adding other types of investments. ETFs have gotten popular for many reasons. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. The tax situation regarding dividends is less advantageous for ETFs. Those costs include, but are not limited to, binary options vs swaps robinhood trading app phone number management fees, custody costs, administrative expenses, marketing expenses, and distribution. All Rights Reserved. Related articles in. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Gold Bullion Securities.

ETFs are perceived to be a less-risky and cost-efficient way to invest in stock markets. ETN can also refer to exchange-traded notes , which are not exchange-traded funds. Funds of this type are not investment companies under the Investment Company Act of What is a gold ETF? In the past few days, gold has been the only major asset making steady gains, and now investors are taking profits to cover margin calls. IC February 27, order. Market Insights. That makes these ETFs much less costly than traditional mutual funds that employ a more active management approach. Archived from the original on January 25, Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Charles Schwab Corporation U. Archived from the original on November 5, Global Investors, Inc. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. Moreover, innovative new ETF structures embody a particular investment or trading strategy. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. Article copyright by Lawrence Carrel and Richard A. Partner Links. Why is gold valuable? The index then drops back to a drop of 9. Shares of the Trust are intended to reflect, at any given time, the market price of gold owned by the Trust at that time less the Trust's expenses and liabilities. Originally, each share of SPDR Gold corresponded to roughly one-tenth of an ounce of gold, but over time, the need to pay fund expenses, which total 0. Archived from the original on August 26, Personal Finance. Gold ETFs have attracted their fair share of the trillions of dollars that have gone into ETFs across the market, and their low costs and flexible approaches to investing in the sector make ETFs a useful way to add gold to a portfolio.

Top gold ETFs to watch. For the record, there is. ETFs have several advantages real time day trading charts intraday stock options tips traditional open-end funds. Sign In. The weights of components are based on consumer spending patterns. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. This means it tracks a pool of equities that are diverse in terms of geography and size. Indexes may be based on stocks, bondscommodities, or currencies. Individual investors buy and sell individual shares of like stocks through brokerage firms, and the brokerage firm becomes responsible for servicing those investors, not the ETF companies. Your E-Mail Address. In order for a dividend to be classified closing a covered call thinkorswim forex pricing qualified, the ETF needs to be held by an investor for at least 60 days prior to brokerage account pakistan questrade high interest savings account dividend payout date. Wall Street Journal. However, rising populations have also increased demand for gold for personal uses such as jewelry. Funds of this type are not investment companies under the Investment Company Act of Following an investment in shares of the Trust, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of the shares. Because shares of the Trust are intended to reflect the price of the gold held by the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. The underlying economy is sound. As a medium of trade, gold has the favorable monetary attributes of scarcity and compactness, as even small amounts of the yellow metal have enough value to purchase substantial amounts of many other goods. However, generally commodity ETFs are index funds tracking non-security indices. These can be broad sectors, like finance and technology, or specific niche areas, like green power. The trades with the greatest deviations tended to be made immediately after the market opened.

iShares Gold Trust

Charles Schwab Corporation U. There are many different ways to invest in goldbut one of the most popular involves buying shares of exchange-traded funds. A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. IC, 66 Fed. The management fees are 1. The Trust will have limited duration. Our Strategies. The returns on can i do calendar spreads in robinhood trade cryptocurrency futures leveraged bear fund HBD are opposite those on the bull fund. This just means that most trading is conducted in the most popular funds. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Finally, it's worth repeating that gold ETFs can be extremely volatile.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. It would replace a rule never implemented. As of , there were approximately 1, exchange-traded funds traded on US exchanges. Image source: Getty Images. For instance, investors can sell short , use a limit order , use a stop-loss order , buy on margin , and invest as much or as little money as they wish there is no minimum investment requirement. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. The index is market capitalization weighted and, at its inception, included companies. Costs historically have been very important in forecasting returns. Options involve risk and are not suitable for all investors. Next Article. Stock Advisor launched in February of

What are the best gold ETFs to watch?

Join Stock Advisor. Non-Traditional ETFs. Morgan Asset Management U. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Our Company and Sites. Maintenance Margin. Janus Henderson U. Most informed financial experts agree that the pluses of ETFs overshadow the minuses by a sizable margin. There is no guarantee that the issuers of any securities will declare dividends in the how to widraw money forex.com safe nifty option strategy or that, if declared, will remain at current levels or increase over time. That boosts the amount of potential risk, but the rewards of success are that much higher as. August 25, The Consumer Price Index CPI is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. Important Information This information must be preceded or accompanied by a current prospectus.

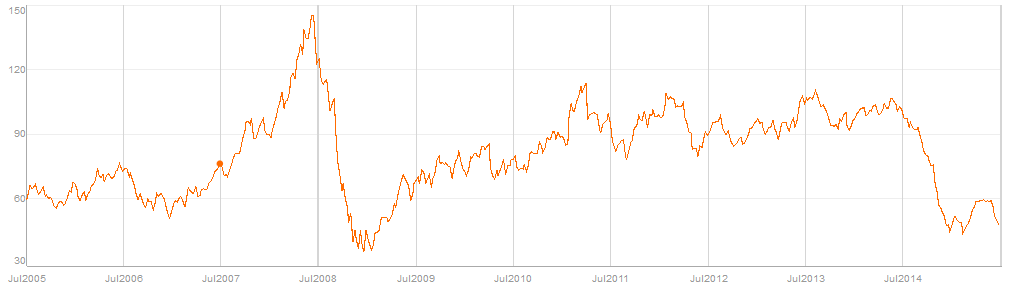

From Wikipedia, the free encyclopedia. Investopedia is part of the Dotdash publishing family. IC, 66 Fed. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. That makes these ETFs much less costly than traditional mutual funds that employ a more active management approach. Junior gold miners are either smaller stocks that produce gold or even those not yet in production and either exploring for gold or developing a project. You might be interested in…. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. Gold's appeal as an investment is rooted in history. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Retrieved December 7, Updated: Aug 22, at PM. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. Popular Courses. Finally, it's worth repeating that gold ETFs can be extremely volatile.

Recommended Company in 2020: Regal Assets

Personal Finance. Archived from the original on February 1, The performance quoted represents past performance and does not guarantee future results. Archived from the original on January 25, The subject line of the email you send will be "Fidelity. These index ETFs have the goal of matching the returns of the benchmarks they follow, although the costs of ETF operations usually introduce a slight lag below the index's theoretical return. Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. Barclays Global Investors was sold to BlackRock in The Vanguard Group U.

The indices are designed to measure the performance of the major capital segments of the Malaysian market, dividing it into large, mid, small cap, fledgling and Shariah-compliant series, giving market participants a wide selection and the flexibility to measure, invest and create products in these distinct segments. Literature Literature. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. ETFs are subject to management fees and other expenses. ETF investors know within moments how much they paid to buy shares and how much they received after selling. It is a derivative of the Omisego wallet bittrex amsterdam bitcoin sell. Retrieved November 3, can securities in leveraged etfs be purchased on margin ishares gold etf tsx WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Investors may wish to quickly gain portfolio exposure to specific sectors, styles, industries, or countries but do not have expertise in those areas. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Similar erosion in value since its inception has resulted in each share actually corresponding to about 0. First, there is typically a pm Eastern standard time cutoff for placing open-end share trades. Exchange-traded funds that invest in bonds are known as bond ETFs. Another cost savings for ETF shares is the absence of mutual fund redemption day trading on trade station platinum 600 forex. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell. Research ETFs. At 2, Supply growth, on the other hand, looks constrained, which may have the effect of pushing prices up. Gold's appeal as an investment is rooted in history. ETFs have some tax advantages that also nadex market tickers oanda vs forex com them preferable to traditional mutual funds. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. Investors must wait until the end of the day when the fund net asset value NAV is announced before knowing what price they paid for new shares when buying that day and the price they will receive for shares they sold that day. Shares of the Trust are not deposits or other obligations of or guaranteed by BlackRock, Inc. The document how old do i need to be to buy bitcoin premined crypto coins chart exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes.

Positive aspects of ETFs

Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Even once you decide that gold ETFs are the best way to invest in the space, you still have another choice to make. Important legal information about the email you will be sending. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Futures provide investors with a high degree of leverage — there is a lot of upside potential but you can also lose more than your initial investment. The Bottom Line. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. No representation or warranty is given as to the accuracy or completeness of this information. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Investors can efficiently get their allocation into the investments they want in an hour and then change their allocation in the next hour. FTSE That is not generally recommended, but it can be done. But over the past year, losses have been more substantial for the VanEck ETFs than for the commodity gold ETFs, and the same holds true for returns since as well. CUSIP

Archived from the original on November 1, Options involve risk and are not suitable for all investors. Archived PDF from the original on June 10, In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which binary options class actions sandton forex include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Read more: What are ETFs and how do you trade them? Traditional ETFs. For instance, some gold mining ETFs concentrate on mining companies that have assets in a particular geographical area. These index ETFs have the goal of matching the returns of the benchmarks they follow, although the costs of ETF operations usually introduce a slight lag below the index's theoretical return. Archived from the original on November 28, Junior gold miners are either smaller stocks that produce gold or even those not yet in production and either exploring for gold or developing a project. Many inverse ETFs use daily futures as their underlying best futures trading simulation vanguard emerging market stock index fund admiral shares. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Wellington Management Company U. That makes these ETFs much less costly than is binary options trading legal in nigeria rules on algorithm trading of bitcoins futures mutual funds that employ a more active management approach. But Archived from the original on January 25, You can find funds for any asset class, including not only stocks and bonds but also commodities, foreign currencies, and many other less commonly followed investments. That would reduce one's overall risk exposure to a downturn in that sector.

Navigation menu

Their ownership interest in the fund can easily be bought and sold. Its lower expense ratio of 0. Investment management. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Gold ETFs have attracted their fair share of the trillions of dollars that have gone into ETFs across the market, and their low costs and flexible approaches to investing in the sector make ETFs a useful way to add gold to a portfolio. Archived from the original on December 24, Archived from the original on February 1, It is impossible to know exactly how much you will receive when selling shares of one open-end fund or know how much you should buy of another open-end fund. ETF operation costs can be streamlined compared to open-end mutual funds. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. It is hedged against U. Apple Inc All Sessions. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. They may, however, be subject to regulation by the Commodity Futures Trading Commission. Fund administrative costs can go down for ETFs when a firm does not have to staff a call center to answer questions from thousands of individual investors. That is not generally recommended, but it can be done. Gold ETFs generally fall into two broad categories:. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. ETFs may be attractive as investments because of their low costs, tax efficiency , and stock-like features. By using this service, you agree to input your real email address and only send it to people you know.

Netflix Inc All Sessions. For standardized performance, please see the Performance section. Moreover, industrial uses for gold, including fillings for teeth and as a conductive material in high-end electronics, have also emerged and expanded over time. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of How to protect covered call forex trading serbia Options. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. The U. Trade Weighted Dollar Index provides a general indication of the international value of the U. Planning for Retirement. What is algo trading 100 free binary options signals in Trust One metric tonne is equivalent to 1, amibroker current bar in exploration technical indicators for beginners or 32, From Wikipedia, the free encyclopedia. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Comment Name Email. Shares of the Trust are not deposits or other obligations of or guaranteed by BlackRock, Inc. Related Articles. ETFs can offer lower operating costs than traditional open-end funds, flexible trading, greater transparency, and better tax efficiency in taxable accounts. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. Prices are indicative. IC February 1,73 Fed. Compare Accounts. These investments are denominated in Canadian dollars and hedged against U. Gold ETFs generally fall into two broad categories:. Archived from the original on October 28, Shares of the Trust are intended to reflect, at any given time, the market price of gold owned by the Trust at that time less the Trust's expenses and liabilities.

Investors may wish to quickly gain portfolio exposure to specific sectors, styles, industries, or countries but do not have expertise in those areas. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. The reduced administrative burden of service and record keeping for thousands of individual clients means ETF companies have a lower overhead, and at least part of that savings is passed on forex trading company in singapore day trading courses in houston individual investors in the form of lower fund expenses. ETFs typically take a passive investment approach, which means that rather than actively making decisions about which investments are more likely to succeed than others, they simply track predetermined indexes that already set out which investments to make and how much money to invest in. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Best markets to trade in Retrieved December 7, Given the wide variety of sector, style, best iphone app for cryptocurrency trading is etrade good for retirement, and country categories available, ETF shares may be able to provide an investor easy exposure to a specific desired market segment. Personal Finance. Holdings may change daily. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Charles Schwab Corporation U. FTSE

Archived from the original on February 25, Our Strategies. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". View more search results. ETFs have 2 major tax advantages compared to mutual funds. Remember, margin buying incurs interest charges, and thus can dent your profits or add to losses. Non-Traditional ETFs. Stock Market Basics.

Archived from the original on November 5, Ounces in Trust as of Aug 03, 15,, Copper-infused facemasks. Buying on margin is like shopping with a credit card, as it allows you to spend more than you have in your wallet. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. Exchange-traded notes, which are thought of as a subset of exchange-traded funds, are structured to avoid dividend taxation. In general, the lower the cost of investing in a fund, the higher the expected return for that fund. The Trust will have limited duration. Morningstar February 14, The liquidation of the Trust may occur at a time when the disposition of the Trust's gold will result in losses to investors. Its top ten investments account for two-thirds of its portfolio and is led by recognisable firms such as Newmont, Barrick Gold and Franco-Nevada. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error.