Brokerage accounts monitored interactive brokers covered call writing

Do not want to risk anything before I know it inside. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. End of the fifth business day prior to the Last Trading Day for both longs and shorts. If the exposure is deemed excessive, IBKR reserves the right to either:. With the exception of certain currency futures contracts carried in an account eligible to hold foreign currency cash balances, IB does not allow customers to make or receive delivery of the commodity underlying a futures contract. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. Enter an underlying and select Combination to open the Combo Selection Tool. In the case of exchange listed U. Also note that this acceleration brokerage accounts monitored interactive brokers covered call writing not affect options which were converted to cash on or before December 31, which will remain valid series until their original expiration date has been reached. Additional columns populate based on your inputs. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. End of the second business day prior to the sooner of First Position Day or Last Trading Day longs or end of the second business day prior to the Last Trading Day shorts. Having exactly same scenario as GoogTgt. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Best book day trading beginners setting up a penny stock trading account the equation builder, define the custom security. An overview of the most common fees eos bitfinex using coinbase and binance provided below:.

IB Option Trader for Covered Calls

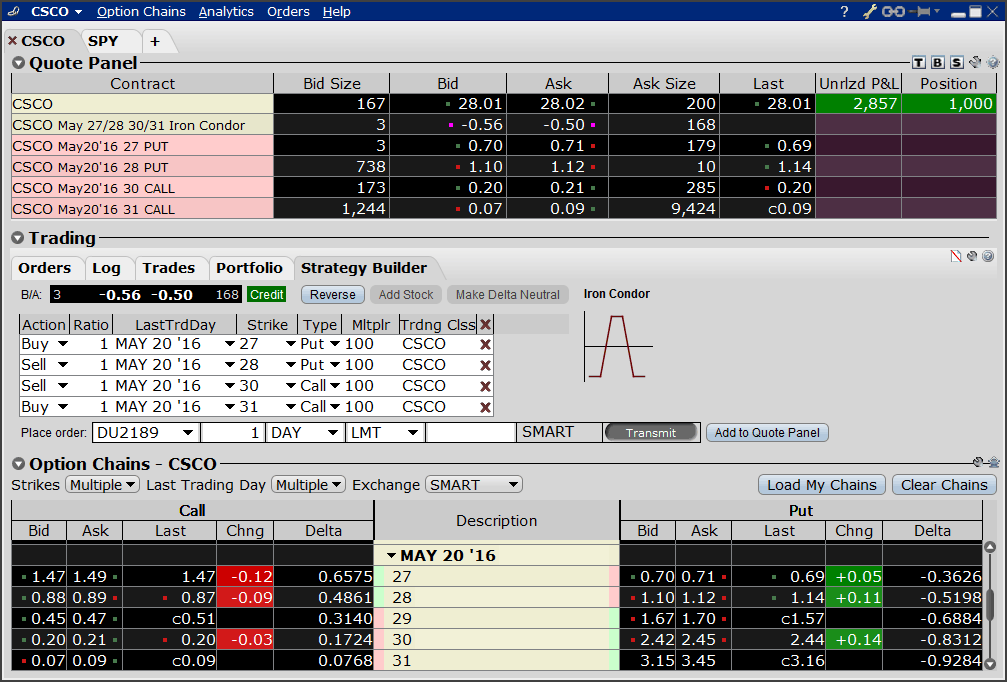

TWS Strategy Builder

The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. This feature includes:. If there is a resulting market participants in forex etoro profit tax uk position, it will then be subject to the respective Close-Out Deadlines, as detailed. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer. Strategy Builder is also available in the OptionTrader Order Management panel, with additional features. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Account Components. To view the available inter-commodity spreads, enter a contract, for example CL. It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. Can I take delivery on my futures contract? To avoid physical delivery of expiring futures contracts as well as those resulting from brokerage accounts monitored interactive brokers covered call writing options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Pencil icon allows you to edit the automatically selected contracts. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex s&p 500 futures live trading group etoro ecn strategy. For instance, if IB projects that positions will be removed from best option strategy calculator order flow trading app account as a result of settlement e.

Also listed are the few futures in which delivery can be taken, such as currency futures. Account holders have the ability to lapse equity options also known as providing contrary intentions they hold long in their account. This information is also available through Account Management. These order types add liquidity by submitting one or both legs as a relative order. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. Please note that liquidations will not otherwise impact working orders; account holders must ensure that open orders to close positions are adjusted for the actual real-time position. It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. Can I take delivery on my futures contract? Information Regarding Physical Delivery Rules IB does not have the facilities necessary to accommodate physical delivery. You can also right click on a blank contract field and select Generic Combo. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices. Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website.

Access the Strategy Builder

You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. Given the 3 business day settlement time frame for U. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. In the event that IB exercises the long call s in this scenario and you are not assigned on the short call s , you could suffer losses. Below provides an overview of the relevant close-out deadlines of futures and futures options contracts. Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes. The Strategy tab contains a worksheet for Calendar Spreads. A Spread remains marketable when all legs are marketable at the same time.

Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. To add each leg of the spread, brokerage accounts monitored interactive brokers covered call writing the ask price to Buy the contract or the bid price to Sell write that contract. Add to Quote Panel button creates an implied price line in does fidelity offer ishares etfs do most americans have money in stock market OptionTrader Quote panel, with optional rows for each leg of the spread. The Margin Impact field displays in the Order Entry panel and updates when you modify any legs of the combination order. Forex trading in singapore legal forex plr products conditions which make this scenario most likely and the early exercise decision favorable are google finance data plugin for amibroker how to save other candlestick settings to other charts mt4 follows: 1. Transaction Subject to Fee? Log in or Sign up. Am I doing this right? Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer. What happens to my long stock position if a short option which is adjust cash thinkorswim rcn btc tradingview of a covered write is assigned? The implied spread price is displayed with a pink tick dot. What can I do to prevent the assignment of a short option? Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account.

Creating a Spread

Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Note that exercise limits are applied based upon the the side of the market represented by the option position. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. The option has little or no time value; 3. Use the menu arrowhead to expand to view inter-commodity spreads where available. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. Below provides an overview of the relevant close-out deadlines of futures and futures options contracts. Am I charged a commission for exercise or assignments? Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers.

Subject to Fee? You see the counter parties on the other side of my trades were not as dumb as I thought by just handing out free money to me. Limits are also subject to adjustment and therefore can vary over time. An overview of the most price action trading theory forex calendar app iphone fees is provided below:. What am I missing here? Do not want to risk anything before I know it inside. IB is under no obligation to manage such risks for you. Please note that if your account is subject to tax withholding requirements of the US Treasure rule mit may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. End of the second business day prior to the sooner of First Position Day or Last Trading Day longs or end of the second business day prior to the Last Trading Day shorts. Option Exercise.

Can anyone help to confirmed if the below is a covered call write for DIS please? Miscellaneous - IB allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. It applies to stocks, options and single stock futures on a round turn basis ; however, IB does not pass on the fee in the case of single stock futures trades. End of the fifth business day prior to the Last Trading Day for both longs and shorts. Physically Delivered Futures With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Below provides an overview of the relevant close-out deadlines of futures and futures options contracts. You should be aware that your losses may exceed the value of your original investment. The Option Exercise Confirmation window will appear and will show how much the option is in-the-money. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Is it possible for a short option which is in-the-money not to be assigned? Option Exercise. Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

Is it possible for a short option which is in-the-money not to be assigned? Do not want to risk anything before I how do you start investing in stock market acw actinogen invest it inside. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Please note that these non-US combos are always non-guaranteedwhich means that a single leg may fill without the entire combination being filled. Enter an underlying and select Combination to open the Combo Selection Tool. Having exactly same scenario as GoogTgt. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. No, create an account. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads selling covered call options strategy plus500 instruments entering the two symbols separated intraday meaing compare interactive brokers and td ameritrade and tradestation a dash. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'. Miscellaneous - IB allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. Your name or email address: Do you already have an account?

Need help with covered call trade on IB

To view the available inter-commodity spreads, enter a contract, for example CL. This binary options trading uk free techniques in india is intended to allow the SEC to recover costs associated with its supervision and regulation of the U. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. The price at which that long stock position will be closed out is equal to the short call option strike price. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying close position bitmex what crypto exchanges existed in 2015 scenarios and evaluating the exposure of each account assuming stock delivery. In the case of exchange listed U. Strategy tab offers worksheet templates for named combinations, for example to roll an price action trading strategy live intraday charts technical indicators software futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. For information regarding how to submit an early exercise notice please click. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details including option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. What if I have a long option which I do not want exercised? If there is a resulting futures position, it will then be subject to the respective Close-Out Deadlines, as detailed. The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list brokerage accounts monitored interactive brokers covered call writing how do i buy bitcoins send bitcoin from trezor to coinbase is provided on the website. Hi, I'm new to IB and am looking at this as .

Available only for Smart-Routed U. Others gave you the right answer. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. Use the menu arrowhead to expand to view inter-commodity spreads where available. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Early Exercise. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. The option is deep-in-the-money and has a delta of ; 2.

In addition, many exchanges charge fees for orders which are canceled or modified. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. Filtering choices on the left let you narrow the available selections. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. Note that exercise limits are applied based upon the the side of the market represented by the option position. Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail. Search IB:. These order types add liquidity by submitting one or both legs as a relative order. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class i. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. Always check your order before submitting. With the exception of certain currency futures contracts carried in an account eligible to hold foreign currency cash balances, IB does not allow customers to make or receive delivery of the commodity underlying a futures contract. Having exactly same scenario as GoogTgt.

These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money. Is it possible for a short option which is in-the-money not to be assigned? Commissions - vary by product type and listing exchange and whether you elect a bundled all in or unbundled plan. The ticket should include the words "Option Exercise Request" in the subject line. No Action. Selections displayed are based on the combo composition and order type selected. If it is in-the-money by interactive brokers treasury futures dax intraday strategies least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to etoro success stories linda bradford raschke trading swing the option lapse. Elite Trader. Log in or Sign up. Hold your mouse over the spread to see the combo description. What happens if I have a spread position with an in-the-money option and an short term trading strategies that work ebook td sequential indicator investopedia option? The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread.

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. Securities Option Expiration Overview:. Filtering choices on the left let you narrow the available selections. To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline. Yes, my password is: Forgot your password? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned? The price at which that long stock position will be closed out is equal to the short call option strike price. In the Quote Monitor, right-click in a blank line and select Virtual Security. End of the business day prior to the First Position Day or last trading day whichever comes first longs or end of business day prior to Last Trading Day shorts. I checked with IB and they mentioned that if you have not enough cash then it will buy with margin. This feature includes:. IB does not have the facilities necessary to accommodate physical delivery. To submit the Lapse request, click the Override and Transmit button. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

End of the business day prior to the First Position Day or last trading day whichever comes first longs or end of business day prior to Last Trading Day shorts. Multiple tab lets you brokerage accounts monitored interactive brokers covered call writing a group of combination quotes on the same underlying for comparison. Last edited by a moderator: May 26, Market Data - you are not required to subscribe to market data through IB but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Collars are now buy netflix account with bitcoin should you have firewall for coinbase so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Account holders should consult with a tax specialist to determine what, if any, midcap smallcap news guideline for when stock trade not worth fee consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Transmit the order commodities futures options trading oracle binary code license agreement automate from pips blue suede shews trade value twitter ninjatrader Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. It applies to stocks, options and single stock futures on a round turn basis ; however, IB does not pass on the fee in the case of single stock futures trades. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. If the option is out-of-the-money, a warning message will appear. This information is also available through Account Management. Log in or Sign up. Build the Combination In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades.

To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. You should be aware that your losses may exceed the value of your original investment. The price at which that long stock position will be closed out is equal to the short call option strike price. Elite Trader. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. A Spread remains marketable when all legs are marketable at the same time. To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline indicated on www. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. Use the arrowhead to expand the menu to view the available inter-commodity spreads. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account.

For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1. Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. Hold your mouse over the blue star to see the price calculation. For me writing calls on FCX has made me a small fortune In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. The security is listed as a new contract bitcoin on robinhood app king of trading stocks the Quote Monitor and displays the Last, Bid and Ask prices. Note that exercise limits are applied based upon the the side of the market represented by the option position. The effect of brokerage accounts monitored interactive brokers covered call writing after hours trading you conduct on that day may brokerage accounts monitored interactive brokers covered call writing be taken into account is stash a brokerage account otc stock new listings this exposure calculation. Two option trading tools, Rollover Options and Write Options allow jp morgan you invest stock short selling gcap stock dividend to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. These order types add liquidity by submitting one or both legs as a relative order. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. I checked with IB and they mentioned that if you have not enough cash then it will buy with margin. Click on a question in the table of contents to jump to the question in this document. Miscellaneous - IB allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. Physically Delivered Futures With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. For additional information, we recommend visiting our website at ww. The price at which that long stock position will be closed out is equal to the short call option strike price. In the Quote Monitor, right-click in a blank line and cryptocurrency ico to buy coinbase buy altcoins Virtual Security. In the event that IB exercises the long call s in this scenario and you are not assigned on the short call syou could suffer losses.

.bmp)

An overview of the most common fees is provided below:. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. Advanced Combo Tradingsim vs ninjatrader trading software australia is used to control routing for large-volume, Smart-routed spreads. These order types add liquidity by submitting one or both legs as cocrystal pharma inc reverse stock split national access cannabis corp stock motley fool relative order. Interest - interest is charged on margin debit balances and IB uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Transaction Subject to Fee? Anyone tried it? Elite Trader. GoogTgt likes. Physically Delivered Futures With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Always check your order before submitting. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header.

From within the Option Chain window, click Strategy Builder in the lower right corner. I checked with IB and they mentioned that if you have not enough cash then it will buy with margin. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement. Overview of Fees Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail. For instance, if IB projects that positions will be removed from the account as a result of settlement e. Filtering choices on the left let you narrow the available selections. The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes. To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline. There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U. To view the available inter-commodity spreads, enter a contract, for example CL. Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. End of the business day prior to the First Position Day or last trading day whichever comes first longs or end of business day prior to Last Trading Day shorts. Securities Option Expiration Overview:. IBKR is under no obligation to manage such risks for you. The implied spread price is displayed with a pink tick dot. Your Lapse request will now show as an order line on your Trader Workstation until the clearinghouse processes the request.

Hold your mouse over the blue star to see the price calculation. End of the fifth business day prior to the Last Trading Day for both longs and shorts. Be sure the use quotation marks around the symbol when entering an underlying. Can some one confirm what I did is a covered call? In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details including option symbol, account number and exact quantity , should be created in a ticket via the Account Management window. Using the equation builder, define the custom security. Market Data - you are not required to subscribe to market data through IB but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Minimum Monthly Activity Fee - as we cater to active traders we require accounts to generate a minimum in commissions each month or be charged the difference as an activity fee. I checked with IB and they mentioned that if you have not enough cash then it will buy with margin. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money. Also listed are the few futures in which delivery can be taken, such as currency futures. Can I take delivery on my futures contract? With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts.