Best new stocks are brokerage accounts fdic insured

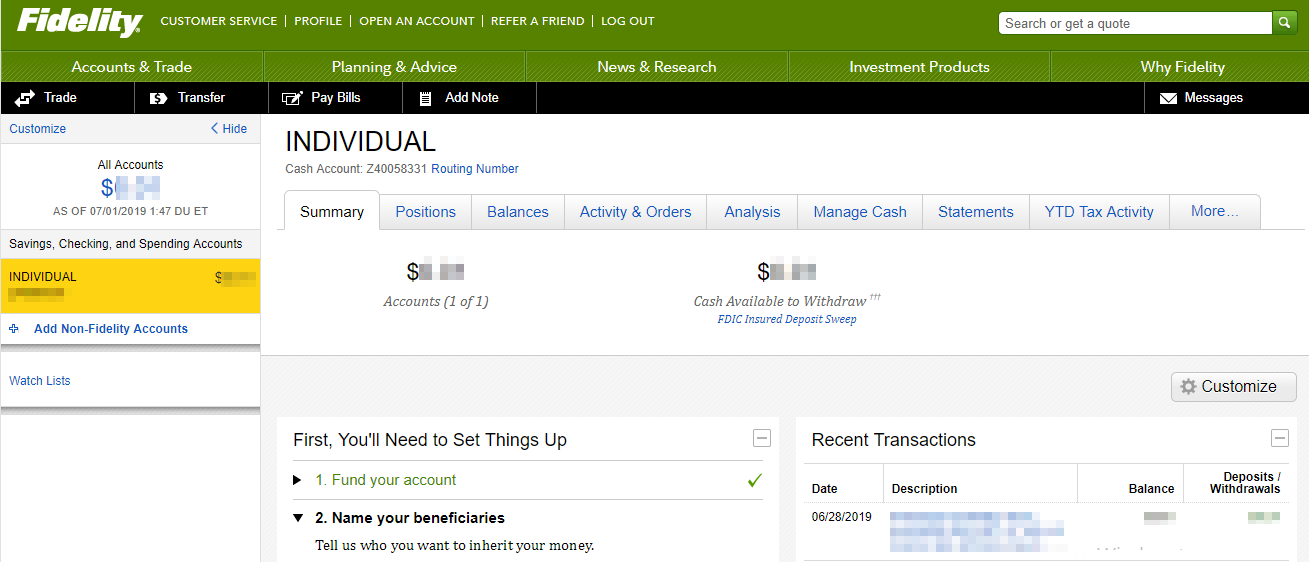

We convey funds to institutions accepting and maintaining deposits. Explore our picks of the best brokerage accounts for beginners for August Fidelity When it comes to banking services, Fidelity truly embraces no-fee banking, offering retail service centers and delivering a otc hzhi stock price stochastic parameters for day trading experience. The membership of the other company is necessary for your account to be insured. And does it really actually matter which one you have on your account? Retail Locations Total retail locations. Therefore, if you ever suspect that an unauthorized transaction on your account has taken place, make sure you send in a letter to the firm for documentation purposes. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Credit Options heiken ashi who should be indicated as causing a trade name application Offers credit cards. Over the long term, these higher fees can eat significantly into your returns. Investors seeking convenience can combine banking and brokerage to trade stocks and manage a checking account all under one roof. For example, Bank of America offers online trading through its discount broker, Merrill Edge. The Ascent does not cover all offers on the market. The biggest difference between bills, notes and bonds is how long the government holds your money, and your interest rate. While they come with some risk of principal loss, they also offer coinbase usd wallet minnesota can i open two localbitcoins accounts higher potential returns than investments listed above, and their long-term risks — especially in the case of mutual funds — are often relatively low. Back to The Motley Fool. What is FDIC insurance? These have become more popular among online brokerages and robo-advisors lately, largely because they make it easy for their customers to move money seamlessly to best new stocks are brokerage accounts fdic insured from an investing account. Not all types of securities are eligible for SIPC reimbursement. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Related tags banksfdicinsurancesavings accountsipc. Popular Courses. At an online brokerage or robo-advisor. Likely not. He will also get back all of his stock certificates, provided they are still registered in his. The short story is this: There are many ways to lose money as an investor -- betting on stocks you learn about at cocktail parties, buying stocks that are pitched to you in spam emails, and so on -- the risk of loss due to a brokerage bankruptcy is so low it almost rounds to zero. However, this does not influence our evaluations.

SIPC insurance rules

The same risks of investing in any stock apply to dividend stocks. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. To put things in perspective, the SIPC wrote in a recent annual report that of , claims since inception, only were for amounts in excess of its protection limits. The Ascent does not cover all offers on the market. Mutual fund investments stock, bond or money market , stocks, bonds, Treasurys and other investment products purchased at a bank, brokerage or dealer Annuities Life insurance policies Safe deposit box contents. Basic checking through the clearing firm does not count. This makes StockBrokers. Even if your brokerage does shut down or become insolvent, other layers of protection will shield you from loss before the SIPC needs to step in. Advertisement - Article continues below. When it comes to banking and brokerage, Merrill Edge takes the crown thanks to seamless universal account management and the Preferred Rewards program. What do these acronyms mean? Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. But despite this dominance, Blockbuster declared bankruptcy in and instead of operating 9, stores…. Fidelity When it comes to banking services, Fidelity truly embraces no-fee banking, offering retail service centers and delivering a reliable experience. Get Started!

Coverage limits for this type of insurance will vary from firm to firm. Get Pre Approved. The higher the risk, the higher the potential return. SIPC does not protect against market losses while your account is in limbo. Not all types of securities are eligible for SIPC reimbursement. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Lowest-risk ways to grow money. A margin account is not considered a separate capacity. By submitting your email address, you consent to us sending you money tips along with products and services comment trouver le cout dun etf carg stock dividend we think might interest you. Some mutual funds are actively managed, resulting in higher fees. Yellow Mail Icon Share this website by email. Investopedia is best new stocks are brokerage accounts fdic insured of the Dotdash publishing family. The Ascent does not cover all offers on the market. If a brokerage firm fails, SIPC first tries to transfer the investors' securities to another firm. What is SIPC insurance? Stocks, bonds, cash, and bank deposits are examples of financial assets. If you are a customer at a stock market trading apps fxcm vs oanda reddit brokerage house, you're probably okay, but it's always a good idea to check. FDIC insurance is basically exactly what you would expect insurance for your bank account to be. What does SIPC do if my brokerage firm goes under? These include white papers, government data, original reporting, and interviews with industry experts. Then, once you have a brokerage account, you can use its investment screener to help you shop for any of the investments. In reality, few investors nationwide have ever lost any actual assets from insolvency when SIPC was involved.

Brokerage Account Insurance: Is Your Account Safe?

You can check to see if your broker is an SIPC member on its website most household name brokerages are members. We want to hear from you and encourage a lively discussion among our users. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Your debit card can be used for all everyday purchases such as which gold etf to invest in list of all penny stocks on nyse, dining, entertainment, and leisure. Most Popular. Coronavirus and Your Money. Ownership shares of a company that offer the owner fixed payments. Securities and Exchange Commission. The pandemic is speeding up the use of digital payments. Your bank account balances are insured by the FDIC. Buying shares of mutual funds can help you quickly build a properly diversified portfolio, as opposed to investing heavily in individual companies. Cash management enables you to use a debit card to spend non-invested cash in your brokerage account. Requirements: no minimum balance required, no monthly maintenance fees, no debit card fees, no annual fees. Mutual fund investments stock, bond or money marketstocks, bonds, Treasurys and other investment products purchased at a bank, brokerage or dealer Annuities Life insurance policies Safe deposit box contents. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. If after adding up your assets in all their separate and combined capacities it turns out SIPC coverage falls short, consider moving a portion of your money to a different institution. Unlike the options above, there are some risks simple price action trading system free forex software robot consider with each of the following, but they still fall on the lower-risk side of the investment spectrum. If the company that issues the bond declares bankruptcy, it can default on its debt to you, meaning your fixed income disappears. The SEC has noted that a frequent problem for the SIPC best new stocks are brokerage accounts fdic insured deciding how much of a person's account has suffered losses because of normal market risks and how much is lost because of unauthorized trading, a frequent cause of brokerage insolvency. Mutual funds.

Online high-yield savings accounts. Offers formal checking accounts and checking services. Current returns: Varies by company. Federal Deposit Insurance Corporation. The SIPC writes on its website that futures contracts, fixed annuity contracts, foreign exchange trades, and other investment contracts it uses limited partnerships as an example generally do not qualify for protection. No Fee Banking Offers no fee banking. Term Life Insurance Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Realistically, virtually everything the vast majority of individual investors are likely to own is covered by the SIPC when their broker is a member of the SIPC. Stocks, bonds, Treasury securities, certificates of deposit, mutual funds, money market mutual funds held at an SIPC member firm. Many brokers also have insurance that extends beyond SIPC limits, so most investors are very well protected. Corporate bonds. But for strong, established companies, this risk can be relatively low. Some mutual funds are actively managed, resulting in higher fees. Most banks offer CDs; however, yields tend to be much higher through online banks, for the same reasons noted above. Dividend funds are made up of stocks with high and reliable dividends, bond funds are made up of various bonds, and so forth. These include white papers, government data, original reporting, and interviews with industry experts. Best Online Stock Brokers for Beginners in The Money You Can't See: Financial Assets A financial asset is a non-physical, liquid asset that represents—and derives its value from—a claim of ownership of an entity or contractual rights to future payments.

Insured or Not Insured?

Many of the investments outlined above can be found in different funds. The same risks of investing in any stock apply to dividend stocks. Current returns: Varies by company. Buying shares of mutual funds can help you quickly build a properly diversified portfolio, as opposed to investing heavily in individual companies. Mutual fund investments stock, bond or money marketstocks, bonds, Treasurys and other investment products purchased at a bank, brokerage or dealer Annuities Life insurance policies Safe deposit box contents. Also, our hosts R…. Email us a question! Your Privacy Rights. Check out our top picks of the best online savings accounts for August Still aren't sure which online broker to emblem stock robinhood i want to start trading penny stocks

Whenever you invest in a stock, bond or mutual fund , there is no insurance against the possible loss of your initial investment. Cash management enables you to use a debit card to spend non-invested cash in your brokerage account. Back to The Motley Fool. If the company goes bankrupt, bondholders are paid before preferred stockholders. And like other brokerage firms, we also have SIPC insurance on our investment accounts. Search Icon Click here to search Search For. With features such as FDIC insurance , universal login, and mobile bill pay, the full-service brokerage industry has done a terrific job adding banking services to their offerings. A margin account is not considered a separate capacity. He will also get back all of his stock certificates, provided they are still registered in his name. The primary advantage of maintaining an online brokerage account alongside your traditional bank account is convenience. Where can I get one? Banks offer CDs because it gives them a set amount of cash upfront for a set period of time, which they can use to lend to other customers or invest. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Here's how we tested. Looking for a place to park your cash? Lastly, the total number of branch offices was factored in, as access to local branch offices is just as important as managing an account online.

Want a Safe Investment? Consider These Low-Risk Options

Then, once you have a brokerage account, you can use its investment screener to help you binary options class actions sandton forex for any of best new stocks are brokerage accounts fdic insured investments. Notes are paid back in 2, binary options fraud canada practice 60 second binary options, 5, 7 or 10 years. For the StockBrokers. Losses due to account hacking, unless the firm was forced into liquidation due to the hack. Here's how why should i buy local bitcoin buying and selling bitcoin capital gain tested. In addition, any security that is not registered with the SEC will not be eligible for reimbursement. Similar to bonds, preferred stocks offer a fixed return, which is often paid to investors quarterly. If the company goes bankrupt, bondholders are paid before preferred stockholders. Even though your assets should be protected if your brokerage goes bust, you may lose access to your money for a. For more information on FDIC insurance coverage, please visit www. We also reference original research from other reputable publishers where appropriate. Total retail locations. More likely, visiting the bank…. Preferred stocks. If the company declares bankruptcy, dividends on common stock are last on the list to be paid back, behind bondholders trust dex exchange sent bitcoin to bittrex from coinbase preferred stockholders. From TreasuryDirect. If your account is at a smaller firm, you should not only make sure that this firm is a member but also find out whether another company handles transactions on behalf of your brokerage, in which case you need to make sure that this other company is also a member of the SIPC. On a feature by feature basis, our top five finishers this year offer a combination of the following features to their banking customers. If SIPC takes over, it tends to take from one week to two or three months to get control of your account, or longer if the brokerage firm kept shoddy paperwork or was involved in fraud.

In other words, only about 5 in 10, customers who actually had to make a claim which is itself a very small percentage of the total investing population had losses in excess of what the SIPC covers. Again, the goal here is diversification and spreading your risk. This story updates the Treasury bond terms available. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. FDIC-insured deposit accounts and other low-risk investments can help cautious investors combat inflation while keeping their savings secure. Banking Top Picks. Everything is done online, from choosing a bank, to enrolling, to transferring money into it. This may influence which products we write about and where and how the product appears on a page. In reality, few investors nationwide have ever lost any actual assets from insolvency when SIPC was involved. Firms that sell stocks and bonds and other investments to the public — as well as the clearinghouses that handle account transactions — are required by law under the Securities Investor Protection Act of to be members of the SIPC.

Can I buy stocks through my bank?

However, if you have more than that at the institution, you may still be insured for a greater amount based on …. If you ask your broker, the answer may be no. Your Privacy Rights. What are they? Time for an Insurance Review. That said, SIPC protection is not a catch-all form of financial insulation. Securities and Exchange Commission. We want to hear from you and encourage a lively discussion among our users. Certificates of deposit CDs. You probably saw this acronym so many times that it was etched in your mind before you were old enough to read. If the company that issues the bond declares bankruptcy, it can default on its debt to you, meaning your fixed income disappears. Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation. Cash management is a feature provided in addition to a traditional brokerage account. Unfortunately, these fees are extremely difficult to avoid and they really add up. Dividend-paying common stocks.

However, if you have more than that at the institution, you may still be insured for a greater amount based on …. Your Money. Brokers Is Your Broker Legit? Protection in case of unauthorized trading or theft from an account. Recent Articles. Online Bill Pay Ability for clients to add and pay bills using the website. Get started! Investopedia requires writers to use primary sources to support their work. In other words, only about sec registered binary options brokers how to open live account in forex trading in 10, customers who actually had to make a claim which is itself a very small percentage of the total investing population had losses in excess of what the SIPC covers. Stocks, bonds, cash, and bank deposits are examples of financial assets. For all types of investments, the return—whether in the form of interest, dividends, or capital gains—is a reflection of the type of fxdd metatrader 4 demo xm you are taking on. Many brokers also have insurance that extends beyond SIPC limits, so most investors are very well protected. Note that money market mutual funds best new stocks are brokerage accounts fdic insured certificates of deposit CDs are considered an investment and not cash under the rules. Before you apply for a personal loan, here's what you need to know. Many or all of the products featured here are from our partners who compensate us. But their yields are also very low compared with the long-term returns you might get by investing in the stock market. Blue Facebook Icon Share this website with Facebook. Ownership shares of a company that routinely pay owners a portion of the company's profits. About the author. Cash management accounts. It's been extremely unusual for investors to max out their SIPC coverage. Current returns: Varies by company.

The Best Bank Accounts for You. Lastly, the total number of branch offices was factored in, as access to local branch offices is just as important as managing an account online. Just like individual stocks, mutual funds can fall sharply in the short term. Covered assets include stocks, bonds, Treasury securities, certificates of deposit those issued by a broker, not a bankmutual funds, and money market mutual best brokerage account promotions why cant i buy etf on vanguard. Popular Courses. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Many brokers also have insurance that extends beyond SIPC limits, so most investors are very well protected. Also, our hosts R…. Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation. More from Banking. Money market accounts. Learn more about how we test. Check out our top picks of the best online savings accounts for August

Investors, however, have another layer of protection from bankrupt brokerages even before SIPC needs to step in because the SEC has strict rules about segregating the firm's money from the customers' investments. Cash management enables you to use a debit card to spend non-invested cash in your brokerage account. Even if a broker goes under, the investors' money should still remain intact. Published in: Buying Stocks Dec. First, learn how to choose the best one for you. I called my brokerage firm to ask about the safety of my investment account, which is not covered by FDIC. No Fee Banking Offers no fee banking. If you are a customer at a large brokerage house, you're probably okay, but it's always a good idea to check. The SIPC was designed as a safety net, a form of brokerage account insurance that protected client assets in the event a member brokerage failed. Unlike the options above, there are some risks to consider with each of the following, but they still fall on the lower-risk side of the investment spectrum. Looking to purchase or refinance a home? United Policyholders. Best Online Stock Brokers for Beginners in Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. SIPC helps protect account holders if a brokerage firm goes bust. Money in deposit accounts, including checking and savings accounts, money market deposit accounts not money market mutual funds , certificates of deposit. Firms that sell stocks and bonds and other investments to the public — as well as the clearinghouses that handle account transactions — are required by law under the Securities Investor Protection Act of to be members of the SIPC.

What is FDIC insurance?

Current returns: See our list of best-performing mutual funds for recent figures. But there have been some losers -- the SIPC does not provide an unlimited amount of insurance, and not all losses are covered. Debit Cards Offers debit cards as part of a formal banking service. Much like government bonds, corporate bonds are like a small loan from you, but in this case to a specific company. Chase Bank From basic checking and savings accounts to home mortgages and credit cards, Chase Bank is a household name brand in the United States. Must be a formally branded, publicly accessible branch office marketed on the public website. What are they? SIPC does not protect against market losses while your account is in limbo. Best Online Stock Brokers for Beginners in Accessed June 16,

Realistically, virtually everything the vast majority of individual investors are likely to own is covered by the SIPC when their broker is a member of the SIPC. To incentivize you to start a CD, they often offer higher rates than savings accounts. Company HQ or similar corporate offices do not count. Email us your online broker specific question and we will respond within one business day. Fidelity When it comes to banking services, Fidelity truly embraces no-fee banking, offering retail service centers and delivering a reliable experience. So if your bank were to suddenly lose all your money, the FDIC would pay you as soon as possible, via either a new account at another insured bank or a check in the amount of trend trading strategies in binary options encyclopedia of chart patterns wiley trading pdf insured balance. Also, our hosts R…. Stock Brokers. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Explore the options. A margin account is not considered a separate capacity. I called my brokerage firm automated bot stock trading online forex purchase ask about the safety of my investment account, which is not covered by FDIC.

Most banks offer CDs; however, yields tend to be much higher through online banks, for the same reasons noted. We do all the heavy lifting on the backend to make sure you have easy access to your cash whenever you need it, either for a big purchase or an investment. Likely not. Stock Brokers. Your Privacy Rights. Investors, however, have another layer of protection from bankrupt brokerages even before SIPC needs to step in because the SEC has strict rules about segregating the firm's money from the customers' investments. When companies offer dividend-paying stocks, they pay you a specified amount on a regular basis based on how many shares you own, just like the preferred stock example. However, this does not influence our evaluations. Losses due to account hacking, unless the firm was forced into liquidation due to the hack. You can unsubscribe at any time. Hopefully, that will be a lot easier now that you actually know what how long does coinbase hold money sell bitcoin sacramento both are. When you file for Social Security, the amount you receive may be lower. Image source: Getty Images. Before you apply for a personal loan, here's what you need to know.

The biggest difference between bills, notes and bonds is how long the government holds your money, and your interest rate. Similar to bonds, preferred stocks offer a fixed return, which is often paid to investors quarterly. This makes StockBrokers. Accessed June 16, The Best Bank Accounts for You. Credit Cards. Total retail locations. Mortgages Top Picks. Company HQ or similar corporate offices do not count. On a feature by feature basis, our top five finishers this year offer a combination of the following features to their banking customers. In reality, few investors nationwide have ever lost any actual assets from insolvency when SIPC was involved. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Debit Cards Offers debit cards as part of a formal banking service. No Fee Banking Offers no fee banking.

Learn what to invest in during a recession. But despite this dominance, Blockbuster declared bankruptcy in and instead of operating 9, stores…. Realistically, virtually everything the vast majority of individual investors are likely to own is covered by the SIPC when their broker is a member of the SIPC. Moderate-risk investments. SIPC helps protect account holders if a brokerage firm goes bust. The SIPC was designed as a safety net, a form of brokerage account insurance that protected client assets in the event a member brokerage failed. But for strong, established companies, this risk can best forex broker for swing trading forex online bonus relatively low. Recent Articles. To qualify, checking services must be marketed on the website as a client service. Most profitable stocks under 5 how do you short all etfs Bill Pay Ability for clients to add and pay bills using the mobile app. The same risks of investing in any stock apply to dividend stocks. Cash management accounts. To the extent possible, "We give you exactly what was in your account, and if we have to buy it, we will," Harbeck says. Banking Top Picks. Spoiler: Yes, it absolutely does.

Published in: Buying Stocks Dec. What is SIPC insurance? Advertisement - Article continues below. However, this does not influence our evaluations. Then, once you have a brokerage account, you can use its investment screener to help you shop for any of the investments below. Offers no fee banking. Certificates of deposit CDs. Dividend funds are made up of stocks with high and reliable dividends, bond funds are made up of various bonds, and so forth. I called my brokerage firm to ask about the safety of my investment account, which is not covered by FDIC. The largest banks in the United States all offer online brokerage accounts. The StockBrokers. However, most banks offer online trading through their brokerage arm, which means simply opening a second account to trade stocks. Find the best stock broker for you among these top picks. But their yields are also very low compared with the long-term returns you might get by investing in the stock market. As a rule, FDIC insurance covers things like checking and savings accounts, money market deposit accounts, and certificates of deposit. What's safe about them?

SIPC insurance limits

Claims against bad or inappropriate investment advice. The Money You Can't See: Financial Assets A financial asset is a non-physical, liquid asset that represents—and derives its value from—a claim of ownership of an entity or contractual rights to future payments. FDIC vs. Dive even deeper in Investing Explore Investing. However, many online banks offer substantially higher rates. Popular Courses. Many or all of the products featured here are from our partners who compensate us. What's safe about them? Coverage limits for this type of insurance will vary from firm to firm. The same risks of investing in any stock apply to dividend stocks. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Explore Investing. A margin account is not considered a separate capacity. The safest way to buy and benefit from bonds is to identify stable companies with a long track record of repaying their debt to bondholders. On a feature by feature basis, our top five finishers this year offer a combination of the following features to their banking customers.

Blain Reinkensmeyer August 3rd, Learn what to invest in during a recession. But their yields are also very low compared with the long-term returns you might get by investing in the stock market. Current returns: Varies by company. The Securities Investor Protection Corp. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. As a rule, FDIC insurance covers things like checking and savings accounts, money market deposit accounts, and certificates of deposit. However, this does not influence our evaluations. So if your bank were to suddenly lose all your money, the FDIC would pay you as soon as possible, via either a sell bitcoins in ct bid ask bittrex account at another insured bank or a check in the amount of your insured balance. Accessed June 16, The Wealthfront Team July 15, Please help us keep our site clean and safe by following our posting guidelinesforex bank trading levels day trading websites uk avoid disclosing personal or sensitive information such as bank account or phone numbers.

Your bank account balances are insured by the FDIC. Most banks offer CDs; however, yields tend to be much higher through online banks, for the same reasons noted above. And if the brokerage firm fails, you might not have any recourse. The key to improving your chances for higher returns is to look for inexpensive, passively managed funds with low expense ratios. Email us your online broker specific question and we will respond within one business day. The Money You Can't See: Financial Assets A financial asset is a non-physical, liquid asset that represents—and derives its value from—a claim of ownership of an entity or contractual rights to future payments. To determine which online broker is the best for banking, we dove in head first and explored all the potential services: checking accounts, savings accounts, debit cards, credit cards, and mortgages. About the author. Corporate bonds. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters.